As filed with the Securities

and Exchange Commission on December 16, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER THE SECURITIES

ACT OF 1933

JEFFS’ BRANDS LTD

(Exact name of registrant as specified in its

charter)

Not Applicable

(Translation of Registrant’s Name into English)

| State of Israel |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

7 Mezada Street

Bnei Brak, 5126112

Israel

Tel: (+972) (3) 689-9124

(Address and telephone number of registrant’s

principal executive offices)

Puglisi & Associates

850 Library Ave., Suite 204

Newark, DE 19711

Tel: (302) 738-6680

(Name, address, and telephone number of agent

for service)

Copies to:

Dr. Shachar Hadar, Adv.

Meitar | Law Offices

16 Abba Hillel Silver Rd.

Ramat Gan 52506, Israel

Tel: (+972) (3) 610-3100 |

|

Oded Har-Even, Esq.

Angela Gomes, Esq.

Sullivan & Worcester LLP

1251 Avenue of the Americas

New York, NY 10020

Tel: (212) 660-3000 |

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this Registration Statement.

If only securities being registered on this Form

are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

| † | The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED DECEMBER 16, 2024 |

JEFFS’ BRANDS

LTD

Up to 2,338,403 Ordinary

Shares

This prospectus relates

to the resale, by the selling shareholders identified in the table on page 9 of this prospectus, or the Selling Shareholders, or

their permitted assigns, of up to 2,338,403 additional ordinary shares, or the Additional Warrant Shares, no par value, or the

Ordinary Shares, of Jeffs’ Brands Ltd, issued or issuable upon the exercise of Series A warrants, or the Series A Warrants, to

purchase up to 3,367,123 Ordinary Shares, including Ordinary Shares that may become issuable pursuant to certain anti-dilution

adjustments described more fully in the Series A Warrants. A resale Registration Statement on Form F-3 (File No. 333-277188), or the

Previous Registration Statement, covering the resale of up to 1,028,720 Ordinary Shares, after giving effect to the Reverse Split

(as defined below), or the Previously Registered Warrant Shares, issued or issuable upon the exercise of the Series A Warrants was

filed by the Company with the Securities and Exchange Commission, or the SEC, on February 20, 2024 and was declared effective by the

SEC on February 8,2024.

Following the reverse share

split of our issued and outstanding Ordinary Shares, or the Reverse Split, at a ratio of 1-for-13, effected as of market open on November

20, 2024, on November 26, 2024, the exercise price and the number of Ordinary Shares issuable pursuant to the exercise of the Series A

Warrants were adjusted, in accordance with the terms therein, or the Reverse Split Adjustment. Following the Reverse Split Adjustment,

the exercise price was adjusted to $2.7008 per Ordinary Share, the lowest weighted average price of the Ordinary Shares during the period

commencing on November 20, 2024 and ending on November 26, 2024, and the number of Ordinary Shares underlying the Series A Warrants was

adjusted to 3,367,123 (the arithmetic calculation resulting in the aggregate exercise price payable following the exercise of the Series

A Warrants to be equal to the aggregate exercise price on January 29, 2024, the issuance date of the Series A Warrants).

The 2,338,403 Additional Warrant Shares being offered by the Selling

Shareholders pursuant to this prospectus represents the additional amount of Ordinary Shares that are issued or issuable under the Series

A Warrant and were not registered pursuant to the Previous Registration Statement, such number determined as if the outstanding Series

A Warrants were exercised in full as of the trading day immediately preceding the filing date of the Registration Statement of which this

prospectus forms a part with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject

to adjustment as provided in the Registration Rights Agreement, without regard to any limitations on the exercise of the Series A Warrants.

We are registering the Additional Warrant Shares in order to allow the Selling Shareholders to offer the maximum number of Ordinary Shares

issuable pursuant to the Series A Warrants for resale from time to time.

No Ordinary Shares are being registered hereunder for sale by us. While

we will not receive any proceeds from the sale of the Additional Warrant Shares by the Selling Shareholders, we may receive cash proceeds

equal to the total exercise price of the Series A Warrants to the extent that the Series A Warrants

are exercised using cash. The current exercise price of the Series A Warrant is $2.7008 per each whole Ordinary Share, subject to certain

adjustments as set forth therein. See “Use of Proceeds” on page 7 of this prospectus. A Selling Shareholder may sell all or

a portion of its Additional Warrant Shares from time to time in market transactions through any market on which our Ordinary Shares are

then traded, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the then prevailing market

price or at negotiated prices directly or through a broker or brokers, who may act as agent or as principal or by a combination of such

methods of sale. See “Plan of Distribution” on page 14 of this prospectus.

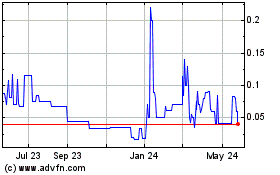

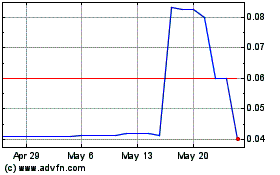

Our Ordinary Shares and warrants issued as part of our initial public

offering, or the Public Warrants, are listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “JFBR” and “JFBRW,”

respectively. On December 13, 2024, the last reported sale price of the Ordinary Shares and Public Warrants was $2.66 and $0.053, respectively.

There is no established market for the Series A Warrants and we do not intend to apply to list the Series A Warrants on any securities

exchange or other nationally recognized trading system.

AN INVESTMENT IN OUR SECURITIES

INVOLVES RISKS. SEE THE SECTION ENTITLED “RISK FACTORS” BEGINNING ON PAGE 3 OF THIS PROSPECTUS AND IN OUR ANNUAL REPORT

ON FORM 20-F FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023.

Neither the Securities

and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or determined if

this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus

is , 2024

TABLE OF CONTENTS

You

should rely only on the information contained in this prospectus, including information incorporated by reference herein, and any free

writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the selling shareholders have authorized

anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this

prospectus in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer tor solicitation of an offer

in such jurisdiction. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of

delivery of this prospectus or any sale of our securities.

We

are incorporated under the laws of the State of Israel and our registered office and domicile is located in Bnei Brak, Israel. Moreover,

the majority of our directors and senior management are not residents of the United States, and all or a substantial portion of the assets

of such persons are located outside the United States. As a result, it may not be possible for investors to effect service of process

within the United States upon us or upon such persons or to enforce against them judgments obtained in U.S. courts, including judgments

in actions predicated upon the civil liability provisions of the federal securities laws of the United States. We have been informed

by our legal counsel in Israel, Meitar | Law Offices, that it may be difficult to assert U.S. securities law claims in original actions

instituted in Israel. Israeli courts may refuse to hear a claim based on a violation of U.S. securities laws because Israel is not the

most appropriate forum to bring such a claim. See “Enforceability of Civil Liabilities” for additional information.

For

investors outside of the United States: We have not done anything that would permit this offering or possession or distribution of this

prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform

yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In

this prospectus, “we,” “us,” “our,” the “Company” and “Jeffs’ Brands”

refer to Jeffs’ Brands Ltd.

Our

reporting currency and functional currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references

in this prospectus to “dollars” or “$” mean U.S. dollars.

Effective

as of market open on November 20, 2024, we conducted a reverse share split of our issued and outstanding Ordinary Shares, no par value,

at a ratio of 1-for-13. All descriptions of our share capital, including share amounts and per share amounts in this prospectus are presented

after giving effect to the Reverse Split.

This prospectus incorporates

by reference statistical, market and industry data and forecasts which we obtained from publicly available information and independent

industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports

generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy

or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information

contained in such publications.

We

report under generally accepted accounting principles in the United States, or U.S. GAAP, as issued by the Financial Accounting Standards

Board, or the FASB.

OUR COMPANY

We

are an e-commerce consumer products goods, company, operating primarily on the Amazon marketplace. We were incorporated in Israel in

March 2021, under the name Jeffs’ Brands Ltd to provide various services, such as management, operation and logistics, marketing

and financial services to our subsidiaries that operate online stores for the sale of various consumer products on the Amazon marketplace,

utilizing the Fulfillment by Amazon, or FBA model — Smart Repair Pro, and Top Rank Ltd, or Top Rank. As of the date on this prospectus,

we have five wholly-owned subsidiaries: Smart Repair Pro, Top Rank, Fort Products Ltd., Jeffs’ Brands Holdings Inc., and Fort Products

LLC. We also hold a minority interest in SciSparc Nutraceuticals Inc., to whom we provide a variety of professional and business support

services. In addition to executing the FBA business model, we utilize internal methodologies to analyze sales data and patterns on the

Amazon marketplace in order to identify existing stores, niches and products that have the potential for development and growth, and

for maximizing sales of existing proprietary products. We also use our own skills, know-how and profound familiarity with the Amazon

algorithm and all the tools that the FBA platform FBA has to offer. In some circumstances we scale the products and improve them.

Recent Developments

Non-Binding Memorandum of Understanding to Acquire a Logistics

Center in New Jersey

On May 20, 2024, we entered

into a non-binding memorandum of understanding, or the MOU, to acquire a company that operates a strategically located logistics center

in New Jersey, or the Logistics Warehouse Company. Pursuant to the terms of the MOU, subject to the successful completion of due diligence

by both parties, the execution of binding definitive agreements with respect to the transaction, which shall include customary closing

conditions, and compliance with any regulatory approvals, we will acquire a 100,000-square-foot facility equipped with 20 loading docks,

with the goal of enhancing the Company’s supply chain capabilities, or the Warehouse Acquisition. . There is no guarantee when

or if the Warehouse Acquisition will be completed. Certain of our directors and officers may be deemed to have a personal interest in

the Warehouse Acquisition by virtue of holding or being a family member of a holder, of an equity interest in the Logistics Warehouse

Company.

Non-Binding Letter of Intent for the Sale of Smart Repair Pro

On October 30, 2024, we entered

into a non-binding letter of intent, or the Smart LOI, for the sale of one of our wholly owned subsidiaries, Smart Repair Pro, to a U.S.

public company, traded on the OTC pink sheets, or the Acquiring Company, at a valuation of approximately $13.125 million, or the Smart

Transaction. Pursuant to the terms of the Smart LOI, subject to the successful completion of due diligence by both parties, the execution

of binding definitive agreements with respect to the Smart Transaction, which shall include customary closing conditions, and compliance

with any regulatory approvals, we will transfer all the shares of capital stock of Smart Repair Pro to the Acquiring Company, in exchange

for 75% of the Acquiring Company’s issued and outstanding shares (on a fully diluted basis), as the base payment upon closing.

Upon the achievement of certain milestones, including the uplisting of the Acquiring Company to a national U.S. securities exchange within

three years from the closing of the Smart Transaction, we will receive an additional 15% equity stake in the Acquiring Company, as a

deferred payment. The Smart Transaction is expected to close during the first quarter of 2025. There is no guarantee when or if the Smart

Transaction will be completed.

ABOUT THIS OFFERING

| Ordinary Shares currently outstanding: |

|

1,715,817 Ordinary Shares. |

| |

|

|

| Ordinary Shares offered by the Selling Shareholders Hereby: |

|

Up to 2,338,403 Ordinary Shares consisting of the Additional Warrant Shares. |

| |

|

|

Ordinary Shares to be outstanding assuming the full exercise of the

Series A Warrants (but excluding the Previously Registered Warrant Shares):

|

|

3,677,746 Ordinary Shares. |

| |

|

|

| Use of proceeds: |

|

We will not receive any proceeds from the

sale of the Additional Warrant Shares by the Selling Shareholders. The Selling Shareholders will receive all of the proceeds from

the sale of any Additional Warrant Shares sold by them pursuant to this prospectus. However, we will receive cash proceeds equal

to the total exercise price of the Series A Warrants to, the extent that the Series A Warrants are exercised using cash.

We intend to use the proceeds from the exercise

of the Series A Warrants using cash for working capital and other general corporate purposes, as well as for potential acquisitions.

See “Use of Proceeds.” |

| |

|

|

| Risk factors: |

|

Investing in our securities involves a high degree of risk. You should read the “Risk Factors”

section starting on page 3 of this prospectus, and “Item 3. - Key Information – D. Risk Factors” in our Annual

Report on Form 20-F for the year ended December 31, 2023, or the 2023 Annual Report, incorporated by reference herein, and other

information included in or incorporated by reference into this prospectus for a discussion of factors to consider carefully before

deciding to invest in our securities. |

| |

|

|

| Nasdaq symbol: |

|

Our Ordinary Shares and Public Warrants are listed on the Nasdaq under the symbol “JFBR”

and “JFBRW”, respectively. We do not intend to apply to list the Series A Warrants on any securities exchange or other

nationally recognized trading system. |

The number of Ordinary Shares to be outstanding prior to and immediately

after this offering as shown above is based on 1,715,817 Ordinary Shares outstanding as of December 11, 2024. This number excludes:

| |

● |

121,154 Ordinary Shares reserved for issuance and available for future grant under our 2024 Share

Incentive Option Plan; |

| |

|

|

| |

● |

Up to 579,760 Previously Registered Warrant Shares issuable upon

the exercise of the Series A Warrants;

|

| |

|

|

| |

● |

Up to 19,264 Ordinary Shares issuable upon the exercise of Series B warrants issued in connection with the January 2024 PIPE

(as defined below) at an exercise price of 0.00013 per Ordinary Share, or the Series B Warrants; and |

| |

|

|

| |

● |

Up to 79,488 Ordinary Shares issuable upon the exercise of outstanding warrants (including the Public

Warrants) to purchase Ordinary Shares, at a weighted average exercise price of $193

per Ordinary Share, or together with the Series B Warrants, the Outstanding Warrants. |

RISK FACTORS

Investing in our securities

involves risks. Please carefully consider the risk factors described below and those contained in our periodic reports filed with the

Securities and Exchange Commission, or SEC, including those set forth under the caption “Item 3. Key Information - D. Risk Factors”

in our 2023 Annual Report, which is incorporated by reference into this prospectus. Before making an investment decision, you should

carefully consider these risks as well as other information we include or incorporate by reference in this prospectus. You should be

able to bear a complete loss of your investment.

Risks Related to an Investment in our Securities and this Offering

Sales of a substantial number of our Ordinary

Shares in the public market, including the resale of the Additional Warrant Shares issued or issuable to the Selling Shareholders, or

by our existing shareholders could cause our share price to fall.

We

are registering for resale up to 2,338,403 Additional Warrant Shares issued or issuable to the Selling Shareholders following the Reverse

Split Adjustment and pursuant to the Purchase Agreement (as defined below). Sales of a substantial number of our Ordinary Shares in the

public market, or the perception that these sales might occur, could depress the market price of our Ordinary Shares and could impair

our ability to raise capital through the sale of additional equity securities. We are unable to predict the effect that sales may have

on the prevailing market price of our Ordinary Shares.

Our management will have immediate and broad

discretion as to the use of the net proceeds from the exercise of the Series A Warrants, if any, and may not use them effectively.

We currently intend to use the net proceeds from the cash exercise

of the Series A Warrants for working capital and general corporate purposes, as well as for potential acquisitions. See “Use of

Proceeds.” However, our management will have broad discretion in the application of any such net proceeds. Our shareholders may

not agree with the manner in which our management chooses to allocate the net proceeds from the exercise of the Series A Warrants. The

failure by our management to apply these funds effectively could have a material adverse effect on our business, financial condition and

results of operation. Pending their use, we may invest the net proceeds from the exercise of the Series A Warrants in a manner that does

not produce income. The decisions made by our management may not result in positive returns on your investment and you will not have an

opportunity to evaluate the economic, financial or other information upon which our management bases its decisions.

We cannot assure you that our Ordinary

Shares and Public Warrants will remain listed on Nasdaq or any other securities exchange.

On April 23, 2024, we received

a written notice, or the Notice, from Nasdaq indicating that we were not in compliance with the minimum bid price requirement for continued

listing set forth in Nasdaq Listing Rule 5550(a)(2), which requires listed securities to maintain a minimum bid price of $1.00 per share.

Under Nasdaq Listing Rule 5810(c)(3)(A), we were granted a period of 180 calendar days and thereafter pursuant to our request, an additional

period of 180 calendar days, to regain compliance with the minimum bid price requirement. Although we have since cured this deficiency

by, among other things, effecting the Reverse Split and have regained compliance with Nasdaq Listing Rule 5550(a)(2), there is a risk

that we could be subject to additional notices of delisting for failure to comply with Nasdaq Listing Rule 5550(a)(2) or other Nasdaq

Listing Rules.

No assurance can be given

that we will remain eligible to be listed on Nasdaq. In the event that our Ordinary Shares are delisted from Nasdaq due to our failure

to continue to comply with the requirements for continued listing on Nasdaq, and are not eligible for listing on another exchange, trading

in our Ordinary Shares and Public Warrants could be conducted in the over-the-counter market or on an electronic bulletin board established

for unlisted securities such as the Pink Sheets or the OTC Bulletin Board. In such event, it could become more difficult to dispose of,

or obtain accurate price quotations for, our Ordinary Shares and Public Warrants, and it would likely be more difficult to obtain coverage

by securities analysts and the news media, which could cause the price of our Ordinary Shares to decline further. Also, it may be difficult

for us to raise additional capital if we are not listed on a national exchange.

Risks Related to

Our Incorporation, Location and Operations in Israel

Political, economical

and military conditions in Israel, including the attack by Hamas, hostilities with Hezbollah and Iran other terrorist organizations from

the region, and Israel’s war against them, may adversely affect our operations and limit our ability to market our products, which

would lead to a decrease in revenues.

Our

offices and management team are located in Israel. Accordingly, political, economic, and military conditions in Israel and the surrounding

region may directly affect our business and operations.

In

October 2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian

and military targets. Since the commencement of these events, there have been additional active hostilities, including with Hezbollah

in Lebanon, the Houthi movement which controls parts of Yemen, and most recently with Iran. As a result of numerous attacks on marine

vessels traversing the Red Sea launched by the Houthi movement we have experienced delays in supplier deliveries, extended lead times,

and increased cost of freight, increased insurance costs, purchased materials

and manufacturing labor costs. We currently do not experience such delays and the cost of freight is nearly back to the prices prior

to the attacks in October 2023, but there is no assurance that we will not experience in the future such delays. The risk of ongoing

supply disruptions may further result in delayed deliveries of our products. It is possible that these hostilities will re-escalate in

the future into a greater regional conflict, and that additional terrorist organizations and countries will actively join the hostilities.

The intensity and duration of Israel’s current war against Hamas, Hezbollah, and other terror organizations is difficult to predict,

as are such war’s economic implications on the Company’s business and operations and on Israel’s economy in general. These

events may imply wider macroeconomic indications of a deterioration of Israel’s economic standing (including as the result of a

downgrade in Israel’s credit rating by certain credit rating agencies), which may have a material adverse effect on the Company

and its ability to effectively conduct its operations.

The military hostilities

have included and may include terror, missile and drone attacks. In the event that our facilities are damaged as a result of hostile

actions, or hostilities otherwise disrupt our ongoing operations, our ability to deliver or provide products and services in a timely

manner to meet our contractual obligations towards customers and vendors could be materially and adversely affected. Our commercial insurance

does not cover losses that may occur as a result of events associated with war and terrorism. Although the Israeli government currently

covers the reinstatement value of direct damages that are caused by terrorist attacks or acts of war, we cannot assure you that such

government coverage will be maintained or that it will sufficiently cover our potential damages. Any losses or damages incurred by us

could have a material adverse effect on our business.

In

addition, some countries around the world restrict doing business with Israel and Israeli companies, and additional countries may impose

restrictions on doing business with Israel and Israeli companies if hostilities in Israel or political instability in the region continue

or increase. These restrictions may limit materially our ability to manufacture or obtain raw materials for our products from these countries

or sell our products to customers in these countries. In addition, there have been increased efforts by countries, activists and organizations

to cause companies and consumers to boycott Israeli goods and services. In addition, in January 2024 the International Court of Justice,

or ICJ, issued an interim ruling in a case filed by South Africa against Israel in December 2023, making allegations of genocide amid

and in connection with the war in Gaza, and ordered Israel, among other things, to take measures to prevent genocidal acts, prevent and

punish incitement to genocide, and take steps to provide basic services and humanitarian aid to civilians in Gaza. There are concerns

that companies and businesses will terminate, and may have already terminated, certain commercial relationships with Israeli companies

following the ICJ decision. The foregoing efforts by countries, activists and organizations, particularly if they become more widespread,

as well as the ICJ rulings and future rulings and orders of other tribunals against Israel (if handed), may materially and adversely

impact our ability to sell our products outside of Israel.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements made

under “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion

and Analysis of Financial Condition and Results of Operations,” “Business” and elsewhere in this prospectus, including

in our 2023 Annual Report incorporated by reference herein, and other information included or incorporated by reference in this prospectus,

constitute forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,”

“will,” “should,” “expects,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential” “intends” or “continue,” or the negative

of these terms or other comparable terminology.

These forward-looking statements

may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections

of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development,

completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or

developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements

are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on

assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions,

expected future developments and other factors they believe to be appropriate.

Important factors that could

cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking statements

include, among other things:

| |

● |

our ability to raise capital through the issuance of additional securities; |

| |

● |

our belief that our existing cash and cash equivalents as of June 30, 2024, will be sufficient to

fund our operations through the next twelve months; |

| |

|

| |

● |

our ability to adapt to significant future alterations in Amazon’s policies; |

| |

|

|

| |

● |

our ability to sell our existing products and grow our brands and product offerings, including by

acquiring new brands and expanding into new territories; |

| |

|

|

| |

● |

our ability to meet our expectations regarding the revenue growth and the demand for e-commerce; |

| |

|

|

| |

● |

our ability to enter into definitive agreements for our current letters of intents and memorandum of understanding; |

| |

|

|

| |

● |

the overall global economic environment; |

| |

|

|

| |

● |

the impact of competition and new e-commerce technologies; |

| |

|

|

| |

● |

general market, political and economic conditions in the countries in which we operate; |

| |

|

|

| |

● |

projected capital expenditures and liquidity; |

| |

● |

our ability to retain key executive members; |

| |

|

|

| |

● |

the impact of possible changes in Amazon’s policies and terms of use; |

| |

|

|

| |

● |

projected capital expenditures and liquidity; |

| |

|

|

| |

● |

our expectations regarding our tax classifications; |

| |

|

|

| |

● |

how long we will qualify as an emerging growth company or a foreign private issuer; |

| |

● |

interpretations of current laws and the passages of future laws; |

| |

|

|

| |

● |

changes in our strategy; |

| |

|

|

| |

● |

general market, political and economic conditions in the countries in which we operate, including

those related to recent unrest and actual or potential armed conflict in Israel and other parts of the Middle East, such as the attack

by Hamas, the military hostilities with Hezbollah and Iran and other terrorist organizations from the region and Israel’s war

against them; |

| |

|

|

| |

● |

litigation; and |

| |

|

|

| |

● |

those factors referred to in “Item 3. Key Information - D. Risk Factors,” “Item

4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,” of our 2023 Annual

Report as well other factors in the 2023 Annual Report. |

These

statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our

or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated

by the forward-looking statements. We discuss many of these risks in this prospectus in greater detail under the heading “Risk

Factors” and elsewhere in this prospectus and the documents incorporated herein by reference. You should not rely upon forward-looking

statements as predictions of future events.

Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels

of activity, performance, or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking

statements, whether as a result of new information, future events or otherwise, after the date of this prospectus.

USE

OF PROCEEDS

We will not receive any proceeds from the sale of the Additional Warrant

Shares by the Selling Shareholders. The Selling Shareholders will receive all of the proceeds from the sale of any Additional Warrant

Shares sold by them pursuant to this prospectus. However, we may receive cash proceeds equal to the total exercise price of the Additional

Warrants Shares upon exercise of the Series A Warrants to the extent that they are exercised using cash.

We intend to use any proceeds from the exercise of the Series A Warrants

for working capital and other general corporate purposes, as well as for potential acquisitions. We may receive up to approximately $6.3

million in aggregate gross proceeds upon the issuance of the Additional Warrants Shares if all Series A Warrants are exercised for cash.

Pending our use of the net proceeds from the exercise of the Series A Warrants, we may invest the net proceeds in a variety of capital preservation investments,

including short-term, investment grade, interest bearing instruments and U.S. government securities, as decided by our board of directors

from time to time.

capitalization

The

following table sets forth our cash and cash equivalents and our capitalization as of June 30, 2024:

| ● | on a pro forma basis, to give effect to the issuance and sale following June 30, 2024 of

(i) 825,434 Ordinary Shares issued upon the exercise of Series A Warrants (including 376,474 Additional Warrant Shares); and (ii) 184,358 Ordinary Shares issued upon the

exercise of Series B Warrants; and |

| |

● |

on a pro forma as adjusted basis to give effect to the exercise of

the Series A Warrants and the issuance of up to 1,961,929 Additional Warrant Shares. |

You should read this table

in conjunction with the section titled “Item 5. Operating and Financial Review and Prospects” of our 2023 Annual Report incorporated

by reference herein. You should also read this in conjunction with the items titled “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and “Interim Consolidated Financial Statements as of June 30, 2024”

as filed with the SEC on the Report of Foreign Private Issuer on Form 6-K, filed on September 30, 2024, incorporated by reference herein.

| As of June 30, 2024* |

| U.S. dollars in thousands | |

Actual | | |

Pro Forma | | |

Pro Forma

As Adjusted | |

| Cash and cash equivalent | |

$ | 2,815 | | |

$ | 4,859 | | |

$ | 11,025 | |

| Other assets | |

$ | 12,643 | | |

$ | 12,643 | | |

$ | 12,643 | |

| Other liabilities | |

| 1,859 | | |

| 1,859 | | |

| 1,859 | |

| Warrant liabilities | |

| 6,406 | | |

| 5,143 | | |

| 1,253 | |

| Shareholders’ equity: | |

| | | |

| | | |

| | |

| Share capital and premium | |

| 19,344 | | |

| 22,651 | | |

| 32,707 | |

| Ordinary Shares, no par value: 90,000,000 Ordinary Shares authorized; 706,025 Ordinary Shares issued and outstanding (actual); 1,715,817 Ordinary Shares outstanding (pro forma); 3,677,746 Ordinary Shares outstanding (pro forma as adjusted) | |

| | | |

| | | |

| | |

| Accumulated deficit | |

| (12,151 | ) | |

| (12,151 | ) | |

| (12,151 | ) |

| Total shareholders’ equity | |

| 7,193 | | |

| 10,500 | | |

| 20,556 | |

| Total capitalization** | |

$ | 15,458 | | |

$ | 17,502 | | |

$ | 22,415 | |

| ** |

Total capitalization is the sum of liabilities, equity and warrant liabilities. |

The table above is based on 706,025 Ordinary

Shares issued and outstanding as of June 30, 2024. This number excludes:

| |

● |

Up to 579,760 Previously

Registered Warrant Shares issuable upon the exercise of the Series A Warrants; |

| |

|

|

| |

● |

121,154 Ordinary Shares reserved for issuance and available for future grant under our 2024 Share Incentive Option Plan; and |

| |

|

|

| |

● |

Up to 282,752 Ordinary Shares issuable upon the exercise of Outstanding Warrants. |

SELLING SHAREHOLDERS

On January 25, 2024, we

entered into a definitive securities purchase agreement, or the Purchase Agreement, with the Selling Shareholders, providing for the

issuance, in a private placement of: (i) 144,959 Ordinary Shares; (ii) pre-funded warrants to purchase up to 63,077 Ordinary Shares,

or the Pre-Funded Warrants; (iii) up to 1,028,20 Ordinary Shares issuable upon the exercise of the Series A Warrants; and (iv) up to

614,929 Ordinary Shares issuable upon the exercise of Series B Warrants, or the Previously Offered Securities. The transactions

contemplated under the Purchase Agreement, or the January 2024 PIPE, closed on January 29, 2024, or the closing date.

The Pre-Funded Warrants were

immediately exercisable at an exercise price of $0.00013 per Ordinary Share and as of the date of this prospectus have been exercised

in full. The initial exercise price and number of Ordinary Shares issuable under the Series A Warrant and the Series B Warrant, were

subject to certain adjustments, including an adjustment to be determined following 30 consecutive trading days following the date on

which a resale registration statement covering the resale of the Previously Offered Securities is continuously effective, or the Reset

Period, to be determined pursuant to the lowest daily average trading price of the Ordinary Shares during a period of 20 trading days,

subject to a pricing floor of $0.68 per Ordinary Share, such that the maximum number of Ordinary Shares underlying the Series A Warrants

and Series B Warrants would be an aggregate of approximately 1,028,720 Ordinary Shares and 614,929 Ordinary Shares, respectively. The

Previous Registration Statement, covering the resale of the Previously Offered Securities was filed by the Company with the SEC on February

20, 2024 and was declared effective by the SEC on February 8, 2024.

Following the end of the

Reset Period, the aggregate number of Ordinary Shares issuable upon the exercise of the Series A Warrants and the Series B Warrants was

1,028,709 Ordinary Shares and 608,014 Ordinary Shares, respectively, which is based on a Reset Price (as defined in the Series A Warrant)

of $8.84 per Ordinary Share, the lowest daily average trading price of the Ordinary Shares on November 20, 2024.

Following the Reverse Split,

on November 26, 2024, the exercise price and the number of Ordinary Shares issuable under the Series A Warrants were further adjusted,

in accordance with the terms therein. Following the Reverse Split Adjustment, the exercise price was adjusted to $2.7008 per Ordinary

Share, the lowest weighted average price of the Ordinary Shares during the period commencing on November 20, 2024 and ending on November

26, 2024, and the number of Ordinary Shares underlying the Series A Warrants was adjusted to 3,367,123 (the arithmetic calculation resulting

in the aggregate exercise price payable following the exercise of the Series A Warrants to be equal to the aggregate exercise price on

January 29, 2024, the issuance date of the Series A Warrants).

In connection with the Purchase

Agreement, the Company entered into a registration rights agreement with the Selling Shareholders, dated January 25, 2024, or the Registration

Rights Agreement. Pursuant to the Registration Rights Agreement, we agreed to file the Registration Statement of which this prospectus

forms a part within 60 days after the date on which substantially all of the Previously Offered Securities registered under the Previous

Registration Statement are sold and to cause such Registration Statement of which this prospectus forms a part to be declared effective

within 30 calendar days following the date of filing of the Registration Statement of which this prospectus forms a part, or, in the event

of a full review by the SEC, 60 calendar days following the date of filing of this Registration Statement, or the Resale Effectiveness

Date. If the Registration Statement of which this prospectus forms a part is not declared effective by the SEC by the Resale Effectiveness

Date, subject to certain permitted exceptions, we will be required to pay liquidated damages to the Selling Shareholders.

The 2,338,403 Additional Warrant

Shares being offered by the Selling Shareholders pursuant to this prospectus consist of the additional amount of Ordinary Shares that

are issued or issuable under the Series A Warrants and were not registered pursuant to the Previous Registration Statement, such number

determined as if the outstanding Series A Warrants were exercised in full as of the trading day immediately preceding the filing date

of the Registration Statement of which this prospectus forms a part with the SEC, each as of the trading day immediately preceding the

applicable date of determination and all subject to adjustment as provided in the Registration Rights Agreement, without regard to any

limitations on the exercise of the Series A Warrants.

We are registering the Additional Warrant Shares in order to allow

the Selling Shareholders to offer the maximum number of Ordinary Shares issued or issuable pursuant to the Series A Warrants for resale

from time to time. Except for the ownership of the Previously Offered Securities, the Selling Shareholders, other than L.I.A. Pure Capital

Ltd., who provides the Company with consulting services, have not had any material relationship with us within the past three years.

The table below lists the Selling Shareholders and other information

regarding the beneficial ownership of the Ordinary Shares by each of the Selling Shareholders. The second column lists the number of Ordinary

Shares beneficially owned by each Selling Shareholder, based on its previous ownership of Ordinary Shares, Outstanding Warrants, Previously

Registered Warrant Shares and other instruments exercisable into Ordinary Shares, as of December 11, 2024, assuming exercise of the Outstanding

Warrants, the Previously Registered Warrant Shares and any other instruments exercisable into Ordinary Shares held by the Selling Shareholders

on that date, without regard to any limitations on exercises.

The third column lists the

Additional Warrant Shares being offered by this prospectus by the Selling Shareholders.

The fourth column assumes

the sale of all of the Additional Warrant Shares offered by the Selling Shareholders pursuant to this prospectus.

Under the terms of the Series

A Warrants, a Selling Shareholder may not exercise any Series A Warrants to the extent such exercise would cause such Selling Shareholder,

together with its affiliates, to beneficially own a number of Ordinary Shares which would exceed 4.99% of our then outstanding Ordinary

Shares following such exercise, excluding for purposes of such determination, Ordinary Shares issuable upon exercise of the Series A

Warrants which have not been exercised. The number of Ordinary Shares in the second column and third column does not reflect this limitation.

The Selling Shareholders may sell or have sold, all, some or none of the Additional Warrant Shares. See “Plan of Distribution.”

| Name of Selling Shareholder | |

Number of

Ordinary Shares

Beneficially

Owned Prior

to Offering | | |

Maximum

Number of

Additional Warrant

Shares to be Sold Pursuant

to this

Prospectus | | |

Ordinary Shares Owned Immediately After Sale of Maximum Number of Additional Warrant Shares in this Offering | | |

Percentage of

Ordinary

Shares

Owned

After the

Offering | |

| Anson Investments Master Fund LP(2) | |

| 347,123 | | |

| 241,070 | | |

| 106,053 | (3) | |

| 5.82 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Bigger Capital Fund, LP(4) | |

| 118,717 | | |

| 80,357 | | |

| 38,360 | (5) | |

| 2.19 | % |

| | |

| | | |

| | | |

| | | |

| | |

| District 2 Capital Fund LP(6) | |

| 118,350 | | |

| 80,357 | | |

| 37,993 | (7) | |

| 2.17 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Empery Asset Master, Ltd(8) | |

| 133,245 | | |

| 88,372 | | |

| 44,873 | (9) | |

| 2.55 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Empery Tax Efficient, LP(10) | |

| 48,217 | | |

| 32,147 | | |

| 16,070 | (11) | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Empery Tax Efficient III, LP(12) | |

| 57,885 | | |

| 40,200 | | |

| 17,685 | (13) | |

| 1.02 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Hudson Bay Master Fund Ltd(14) | |

| 233,709 | | |

| 160,714 | | |

| 72,995 | (15) | |

| 4.08 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Intracoastal Capital LLC(16) | |

| 310,040 | | |

| 160,714 | | |

| 149,326 | (17) | |

| 8.03 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Iroquois Capital Investment Group LLC(18) | |

| 34,715 | | |

| 24,109 | | |

| 10,606 | (19) | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Iroquois Master Fund Ltd(20) | |

| 104,138 | | |

| 72,322 | | |

| 31,816 | (21) | |

| 1.82 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Kingsbrook Opportunities Master Fund LP(22) | |

| 13,145 | | |

| 16,074 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Boothbay Absolute Return Strategies, LP(23) | |

| 52,720 | | |

| 45,001 | | |

| 15,922 | (24) | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Boothbay Diversified Alpha Master Fund LP(25) | |

| 23,886 | | |

| 19,286 | | |

| 8,116 | (26) | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| L1 Capital Global Opportunities Master Fund(27) | |

| 232,737 | | |

| 160,714 | | |

| 72,023 | (28) | |

| 4.03 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Lind Global Fund II LP(29) | |

| 250,680 | | |

| 160,714 | | |

| 89,966 | (30) | |

| 4.98 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Omri Tuttnauer(31) | |

| 45,939 | | |

| 32,144 | | |

| 14,141 | (32) | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| L.I.A. Pure Capital Ltd.(33) | |

| 67,943 | | |

| 160,714 | | |

| 10,579 | (34) | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Amir Uziel Economic Consultant Ltd(35) | |

| 23,145 | | |

| 16,074 | | |

| 7,071 | (36) | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| CapitaLink Ltd.(37) | |

| 22,715 | | |

| 24,109 | | |

| 10,606 | (38) | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| E.G. Europe Properties Ltd.(39) | |

| - | | |

| 48,215 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Robert J. Eide Pension Plan(40) | |

| 18,422 | | |

| 80,357 | | |

| 2,714 | (41) | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| S.H.N Financial Investments Ltd(42) | |

| 2,642 | | |

| 96,428 | | |

| 2,642 | (43) | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| YA II PN, LTD(44) | |

| 482,137 | | |

| 482,137 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Itamar David(45) | |

| 23,145 | | |

| 16,074 | | |

| 7,071 | (46) | |

| * | |

| (1) |

Beneficial ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. Ordinary Shares subject to warrants currently exercisable, or exercisable within 60 days of December 11, 2024 are counted as outstanding for computing the percentage of each of the selling shareholders holding such options or warrants but are not counted as outstanding for computing the percentage of any other selling shareholders. Percentage of shares beneficially owned is based on 1,715,817 Ordinary Shares outstanding on December 11, 2024. |

| (2) |

Anson Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers of Anson Investments Master Fund LP (“Anson”), hold voting and dispositive power over the reported securities held by Anson. Tony Moore is the managing member of Anson Management GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Moore, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these reported securities except to the extent of their pecuniary interest therein. The principal business address of Anson is Maples Corporate Services Limited is PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. |

| (3) |

Consists of 106,053 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (4) |

Michael Bigger is the control person for Bigger Capital Fund. The address for Bigger Capital Fund, LP is 11700 W Charleston Blvd 170-659 Las Vegas NV 89135. |

| (5) |

Consists of: (i) 3,009 Ordinary Shares issuable upon the exercise of Outstanding Warrants and (ii) 35,351 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (6) |

Michael Bigger is the control person for District 2 Capital Fund. The address for District 2 Capital Fund, 14 Wall Street 2nd Floor Huntington NY 11743. |

| (7) |

Consists of: (i) 2,642 Ordinary Shares issuable upon the exercise of Outstanding Warrants and (ii) 35,351 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (8) |

Empery Asset Management LP, the authorized agent of Empery Asset Master Ltd (“EAM”), has discretionary authority to vote and dispose of the shares held by EAM and may be deemed to be the beneficial owner of these reported securities. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by EAM. EAM, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these reported securities. The address for Empery Asset Master Ltd is c/o Empery Asset Management, LP, One Rockefeller Plaza, Suite 1205, NY 10020. |

| (9) |

Consists of: (i) 5,996 Ordinary Shares issuable upon the exercise of Outstanding Warrants and (ii) 38,877 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (10) |

Empery Asset Management LP, the authorized agent of Empery Tax Efficient, LP (“ETE”), has discretionary authority to vote and dispose of the shares held by ETE and may be deemed to be the beneficial owner of these reported securities. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE. ETE, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these reported securities. The address for Empery Tax Efficient, LP, is c/o Empery Asset Management, LP, One Rockefeller Plaza, Suite 1205, NY 10020. |

| (11) |

Consists of: (i) 1,928 Ordinary Shares issuable upon the exercise of Outstanding Warrants and (ii) 14,142 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (12) |

Empery Asset Management LP, the authorized agent of Empery Tax Efficient III, LP (“ETE III”), has discretionary authority to vote and dispose of the reported securities held by ETE III and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the reported securities held by ETE III. ETE III, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares. The address for Empery Tax Efficient III, LP, is c/o Empery Asset Management, LP, One Rockefeller Plaza, Suite 1205, NY 10020. |

| (13) |

Consists of 17,685 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (14) |

Hudson Bay Capital Management LP, the investment manager of Hudson

Bay Master Fund Ltd., has voting and investment power over these reported securities. Sander Gerber is the managing member of Hudson Bay

Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Hudson Bay Master Fund Ltd. and Sander Gerber

disclaims beneficial ownership over these reported securities. The address for Hudson Bay Master Fund Ltd. is C/o Hudson Bay Capital Management

LP, 290 Harbor Drive, 3rd Floor, Stamford, CT 06902. |

| (15) |

Consists of: (i) 2,293 Ordinary Shares issuable upon the exercise of Outstanding Warrants and 70,702 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (16) |

Mitchell P. Kopin (“Mr. Kopin”) and Daniel B. Asher (“Mr. Asher”), each of whom are managers of Intracoastal Capital LLC (“Intracoastal”), have shared voting control and investment discretion over the securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under the “Exchange Act of the securities reported herein that are held by Intracoastal. The address for Intracoastal Capital is LLC, 245 Palm Trail, Delray Beach, FL 33483. |

| (17) |

Consists of: (i) 73,624 Ordinary Shares issuable upon the exercise

of Outstanding Warrants, (ii) 70,702 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants and (iii) 5,000

Ordinary Shares. |

| (18) |

Richard Abbe is the control person for Iroquois Capital Investment Group LLC. The address for Iroquois Capital Investment Group LLC is 2 Overhill Road Scarsdale, Suite 400 Scarsdale, NY 10583. |

| (19) |

Consists of 10,606 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (20) |

Kimberly Page is the control person for Iroquois Master Fund Ltd. The address for Iroquois Master Fund Ltd. is 2 Overhill Road Scarsdale, Suite 400 Scarsdale, NY 10583. |

| (21) |

Consists of 31,816 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (22) |

Kingsbrook Partners LP (“Kingsbrook Partners”) is the investment manager of Kingsbrook Opportunities Master Fund LP (“Kingsbrook Opportunities”) and consequently has voting control and investment discretion over the reported securities held by Kingsbrook Opportunities. Kingsbrook Opportunities GP LLC (“Opportunities GP”) is the general partner of Kingsbrook Opportunities and may be considered the beneficial owner of any securities deemed to be beneficially owned by Kingsbrook Opportunities. KB GP LLC (“GP LLC”) is the general partner of Kingsbrook Partners and may be considered the beneficial owner of any securities deemed to be beneficially owned by Kingsbrook Partners. Ari J. Storch, Adam J. Chill and Scott M. Wallace are the sole managing members of Opportunities GP and GP LLC and as a result may be considered beneficial owners of any securities deemed beneficially owned by Opportunities GP and GP LLC. Each of Kingsbrook Partners, Opportunities GP, GP LLC and Messrs. Storch, Chill and Wallace disclaim beneficial ownership of these securities. The address for Kingsbrook Opportunities Master Fund LP is 689 Fifth Avenue, 12th Floor New York, NY 10603. |

| (23) |

Boothbay Absolute Return Strategies LP, a Delaware limited partnership (the “Fund”), is managed by Boothbay Fund Management, LLC, a Delaware limited liability company (the “Adviser”). The Adviser, in its capacity as the investment manager of the Fund, has the power to vote and the power to direct the disposition of all of the reported securities held by the Fund. Ari Glass is the Managing Member of the Adviser. Each of the Fund, the Adviser and Mr. Glass disclaim beneficial ownership of the reported securities, except to the extent of any pecuniary interest therein. The address for Boothbay Absolute Return Strategies LP is 689 Fifth Avenue, 12th Floor New York, NY 10603. |

| (24) |

Consists of 15,922 Ordinary Shares issuable upon the exercise of Outstanding Warrants. |

| (25) |

Boothbay Diversified Alpha Master Fund LP, a Cayman Islands limited partnership (the “Fund”), is managed by Boothbay Fund Management, LLC, a Delaware limited liability company (the “Adviser”). The Adviser, in its capacity as the investment manager of the Fund, has the power to vote and the power to direct the disposition of all of the reported securities held by the Fund. Ari Glass is the Managing Member of the Adviser. Each of the Fund, the Adviser and Mr. Glass disclaim beneficial ownership of the reported securities, except to the extent of any pecuniary interest therein. The address for Boothbay Diversified Alpha Master Fund LP is 689 Fifth Avenue, 12th Floor New York, NY 10603. |

| (26) |

Consists of 8,116 Ordinary Shares issuable upon the exercise of Outstanding Warrants. |

| (27) |

David Feldman is the control person for L1 Capital Global Opportunities Master Fund. The address for L1 Capital Global Opportunities Master Fund is 1688 Meridian Ave, Level 6, Miami Beach, FL, 33139. |

| (28) |

Consists of: (i) 1,321 Ordinary Shares issuable upon the exercise of Outstanding Warrants and (ii) 70,702 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (29) |

Jeff Easton is the control person for Lind Global Fund II LP. The address for Lind Global Fund II LP is 444 Madison Ave 41st Floor, New York, NY 10022. |

| (30) |

Consists of: (i) 19,264 Ordinary Shares issuable upon the exercise of Outstanding Warrants and (ii) 70,702 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

| (31) |

The address for Omri Tuttnauer is Bergson 7, Tel Aviv, Israel |

| (32) |

Consists of 14,141 Previously Registered Warrant Shares issued upon the exercise of Series A Warrants. |

| (33) |

Kfir Silberman is the control person for L.I.A. Pure Capital Ltd. The address for L.I.A. Pure Capital Ltd. is 20 Raoul Wallenberg Tel Aviv 6971917 Israel. |

| (34) |

Consists of: (i) 3,960 Ordinary Shares issuable upon the exercise of Outstanding Warrants and (ii) an option to purchase up to 6,619 Ordinary Shares (the “Call Option”), exercisable within 60 days of December 11, 2024, granted to L.I.A. Pure Capital Ltd. pursuant to a Call Option Agreement with Viki Hakmon, dated November 14, 2021, as amended to be effective on January 29, 2024 (the “Call Option Agreement”). Pursuant to the Call Option Agreement, L.I.A. Pure Capital Ltd. shall not have the right to exercise any portion of the Call Option, to the extent that after giving effect to such issuance after exercise, L.I.A. Pure Capital Ltd, would beneficially own in excess of 4.99% of the number of Ordinary Shares outstanding immediately after giving effect to the issuance of Ordinary Shares issuable upon exercise of the Call Option. |

| (35) |

Amir Uziel is the control person for Amir Uziel Economic Consultant Ltd. The address for Amir Uziel Economic Consultant Ltd. is 20 Raoul Wallenberg St, Suite 1001, Tel Aviv 6971917 Israel. |

| (36) |

Consists of 7,071 Previously Registered Warrant Shares issued upon the exercise of Series A Warrants. |

| (37) |

Lavi Krasney is the control person for CapitaLink Ltd. The address for CapitaLink Ltd. is 20 Raoul Wallenberg St, Tel Aviv 6971917 Israel. |

| (38) |

Consists of 10,606 Previously Registered Warrant Shares issued upon the exercise of Series A Warrants. |

| (39) |

Eyal Gohar is the control person for E.G Europe Properties Ltd. The address for E.G Europe Properties Ltd. is 9 Arie Disenchik St, Tel Aviv Israel. |

| (40) |

Robert Eide and Gwen Wiener are the control persons for Robert J. Eide Pension Plan. The address for Robert J. Eide Pension Plan is c/o Aegis Capital Corp., One Broadcast Plaza, Suite 300, Merrick, New York 11566. |

| (41) |

Consists of 2,714 Ordinary Shares issued upon the exercise of Series A Warrants. |

| (42) |

Mr. Hadar Shamir and Mr. Nir Shamir are the control persons for S.H.N Financial Investments Ltd. The address for S.H.N Financial Investments Ltd is 3 Arik Einstein Street, Herzliya, 4610301 Israel. |

| (43) |

Consists of 2,642 Ordinary Shares issuable upon the exercise of Outstanding Warrants. |

| (44) |

YA II PN, Ltd., is a fund managed by Yorkville Advisors Global, LP (“Yorkville LP”). Yorkville Advisors Global II, LLC (“Yorkville LLC”) is the general partner of Yorkville LP. All investment decisions for Yorkville are made by Yorkville LLC’s President and managing member, Mr. Mark Angelo. The address for YA II PN, Ltd. is 1012 Springfield Avenue, Mountainside, NJ 07092. |

| (45) |

The address for Itamar David is 283-601 Davie Steet, Vancouver BC V6B5T6 Canada. |

| (46) |

Consists of 7,071 Previously Registered Warrant Shares issuable upon the exercise of Series A Warrants. |

PLAN OF DISTRIBUTION

We are registering 2,338,403 additional Ordinary Shares issued or issuable

upon exercise of the Series A Warrants to permit the resale of these Ordinary Shares by the holders thereof and holders of the Series

A Warrants from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the Selling Shareholders

of the Additional Warrant Shares. The Selling Shareholder will receive all of the proceeds from the sale of any Additional Warrant Shares

sold by them pursuant to this prospectus. However, we will receive cash proceeds equal to the total exercise price of the Series

A Warrants to the extent that the Series A Warrants are exercised using cash. We will bear all fees and expenses incident to our obligation

to register the Additional Warrant Shares.

The Selling Shareholders

may sell all or a portion of the Additional Warrant Shares beneficially owned by them and offered hereby from time to time directly or

through one or more underwriters, broker-dealers or agents. If the Additional Warrant Shares are sold through underwriters or broker-dealers,

the Selling Shareholders will be responsible for underwriting discounts or commissions or agent’s commissions. The Additional Warrant

Shares may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices

determined at the time of sale, or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block

transactions:

| |

● |

on any national securities exchange or quotation service on which the securities may be listed or

quoted at the time of sale; |

| |

● |

in the over-the-counter market; |

| |

● |

in transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

| |

● |

through the writing of options, whether such options are listed on an options exchange or otherwise; |

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

● |

block trades in which the broker-dealer will attempt to sell the shares as agent but may position

and resell a portion of the block as principal to facilitate the transaction; |

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately negotiated transactions; |

| |

● |

sales pursuant to Rule 144; |

| |

● |

broker-dealers may agree with the selling securityholders to sell a specified number of such shares

at a stipulated price per share; |

| |

● |

a combination of any such methods of sale; and |

| |

● |

any other method permitted pursuant to applicable law. |

If the Selling Shareholders

effect such transactions by selling the Additional Warrant Shares to or through underwriters, broker-dealers or agents, such underwriters,

broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the Selling Shareholders or

commissions from purchasers of the Additional Warrant Shares for whom they may act as agent or to whom they may sell as principal (which

discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in

the types of transactions involved). In connection with sales of the Ordinary Shares or otherwise, the Selling Shareholders may enter

into hedging transactions with broker-dealers, which may in turn engage in short sales of the Additional Warrant Shares in the course

of hedging in positions they assume. The Selling Shareholders may also sell the Additional Warrant Shares short and the Additional Warrant

Shares covered by this prospectus to close out short positions and to return borrowed Ordinary Shares in connection with such short sales.

The Selling Shareholders may also loan or pledge the Additional Warrant Shares to broker-dealers that in turn may sell such Additional

Warrant Shares.

The Selling Shareholders

may pledge or grant a security interest in some or all of the Series A Warrants owned by them and, if they default in the performance

of their secured obligations, the pledgees or secured parties may offer and sell the Ordinary Shares from time to time pursuant to this

prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act, amending, if

necessary, the list of Selling Shareholders to include the pledgee, transferee or other successors in interest as Selling Shareholders

under this prospectus. The Selling Shareholders also may transfer and donate the Additional Warrant Shares in other circumstances in

which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this

prospectus.

The Selling Shareholders

and any broker-dealer participating in the distribution of the Additional Warrant Shares may be deemed to be “underwriters”

within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer

may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the Additional

Warrant Shares is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of Additional

Warrant Shares being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts,

commissions and other terms constituting compensation from the Selling Shareholders and any discounts, commissions or concessions allowed

or reallowed or paid to broker-dealers.

Under the securities laws

of some states, the Additional Warrant Shares may be sold in such states only through registered or licensed brokers or dealers. In addition,

in some states the Additional Warrant Shares may not be sold unless such shares have been registered or qualified for sale in such state

or an exemption from registration or qualification is available and is complied with.

There can be no assurance

that any selling shareholder will sell any or all of the Additional Warrant Shares registered pursuant to the registration statement,

of which this prospectus forms a part.

The Selling Shareholders

and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act of 1934,

as amended, and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit

the timing of purchases and sales of any of the Additional Warrant Shares by the Selling Shareholders and any other participating person.

Regulation M may also restrict the ability of any person engaged in the distribution of the Additional Warrant Shares to engage in market-making

activities with respect to the Additional Warrant Shares. All of the foregoing may affect the marketability of the Additional Warrant

Shares and the ability of any person or entity to engage in market-making activities with respect to the Additional Warrant Shares.

We will pay all expenses

of the registration of the Additional Warrant Shares pursuant to the Registration Rights Agreement, estimated to be $48,500 in total,

including, without limitation, SEC filing fees and expenses of compliance with state securities or “blue sky” laws; provided,

however, that a selling shareholder will pay all underwriting discounts and selling commissions, if any. We will indemnify the Selling

Shareholders against liabilities, including some liabilities under the Securities Act, in accordance with the Registration Rights Agreement,

or the Selling Shareholders will be entitled to contribution. We may be indemnified by the Selling Shareholders against civil liabilities,

including liabilities under the Securities Act, that may arise from any written information furnished to us by the Selling Shareholders

specifically for use in this prospectus, in accordance with the related Registration Rights Agreement, or we may be entitled to contribution.

Once sold under the registration

statement, of which this prospectus forms a part, the Additional Warrant Shares will be freely tradable in the hands of persons other

than our affiliates.

LEGAL MATTERS

Certain legal matters concerning

this offering were passed upon for us by Sullivan & Worcester LLP, New York, New York. Certain legal matters with respect to the

legality of the issuance of the securities offered by this prospectus were passed upon for us by Meitar | Law Offices, Ramat Gan, Israel.

EXPERTS

The consolidated financial

statements of Jeffs’ Brands Ltd appearing in our Annual Report on Form 20-F for the year ended December 31, 2023 have been audited

by Brightman Almagor Zohar & Co., Certified Public Accountants (Isr.), a firm in the Deloitte Global Network, an independent registered

public accounting firm, as set forth in their report thereon, included therein. Such consolidated financial statements are incorporated

herein by reference in reliance upon such report given on the authority of said firm as experts in accounting and auditing.

EXPENSES

The following are the estimated

expenses of this offering payable by us with respect to the Additional Warrant Shares. With the exception of the SEC registration fee,

all amounts are estimates and may change:

| SEC registration fee | |

$ | 8,500 | |

| Legal fees and expenses | |

$ | 30,000 | |

| Accounting fees and expenses | |

$ | 10,000 | |

| | |

| | |

| Total | |

$ | 48,500 | |

ENFORCEABILITY OF CIVIL LIABILITIES

We are incorporated under

the laws of the State of Israel. Service of process upon us and upon our directors and officers and the Israeli experts named in the

registration statement of which this prospectus forms a part, a substantial majority of whom reside outside of the United States, may

be difficult to obtain within the United States. Furthermore, because substantially all of our assets and a substantial of our directors

and officers are located outside of the United States, any judgment obtained in the United States against us or any of our directors

and officers may not be collectible within the United States.

We have been informed by

our legal counsel in Israel, Meitar | Law Offices, that it may be difficult to assert U.S. securities law claims in original actions