0001620459false00016204592023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported): | November 8, 2023 |

| | |

JAMES RIVER GROUP HOLDINGS, LTD. |

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Bermuda | 001-36777 | 98-0585280 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

Wellesley House, 2nd Floor, 90 Pitts Bay Road, Pembroke HM08, Bermuda

(Address of principal executive offices)

(Zip Code)

(441) 278-4580

(Registrant's telephone number, including area code)

| | |

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8‑K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a‑12 under the Exchange Act (17 CFR 240.14a‑12)

☐ Pre-commencement communications pursuant to Rule 14d‑2(b) under the Exchange Act (17 CFR 240.14d‑2(b))

☐ Pre-commencement communications pursuant to Rule 13e‑4(c) under the Exchange Act (17 CFR 240.13e‑4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, par value $0.0002 per share | JRVR | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On November 8, 2023 James River Group Holdings, Ltd. (the "Company") issued a press release announcing that it has entered into a definitive agreement to sell JRG Reinsurance Company, Ltd., its third-party casualty reinsurance business, to Fleming Intermediate Holdings LLC. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this "Form 8-K").

The information in this Item 7.01 and in Exhibit 99.1 furnished herewith shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act unless specifically stated by the Company.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

The following Exhibit is furnished as part of this Form 8-K:

| | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| JAMES RIVER GROUP HOLDINGS, LTD. |

| |

Dated: November 8, 2023 | By: /s/ Sarah C. Doran |

| Sarah C. Doran |

| Chief Financial Officer |

James River Announces Agreement to Sell Casualty Reinsurance Business to Fleming Holdings

Accelerates Strategy to Pure Play E&S and Fronting Operations

Full Exit from Reinsurance Business

PEMBROKE, Bermuda, November 8, 2023 -- James River Group Holdings, Ltd. (“James River” or the “Company”) (NASDAQ: JRVR) today announced that it has entered into a definitive agreement to sell JRG Reinsurance Company, Ltd. (“JRG Re”), its third-party casualty reinsurance business, to Fleming Intermediate Holdings (“Fleming”). The total estimated transaction value is $277 million, inclusive of a $139 million pre closing dividend and a $138 million cash payment from Fleming at close. Under the terms of the transaction, valued as of September 30, 2023, James River would receive 0.75x the book value of JRG Re at closing.

The transaction includes the full insurance entity supporting the Company’s Casualty Reinsurance segment, including the remaining assets and liabilities, as well as the staff supporting the business. The segment produced $85.2 million of gross written premiums in 2022.

Frank D’Orazio, the Company’s Chief Executive Officer, commented, “Today’s announcement represents a key milestone for James River and is strategically significant for both our Company and Fleming. The transaction aligns with James River’s strategy to focus our resources on core businesses where we have meaningful scale, including our E&S and fronting businesses. We are excited about the new partnership with Fleming, which we believe will be a great new home for the staff of JRG Re.”

Eric Haller, CEO of Fleming, commented, “Fleming’s acquisition of JRG Re is highly strategic in providing complementary infrastructure and significant scale that will enable us to better serve our existing and prospective cedents. We have tremendous respect for the entire James River organization and look forward to welcoming the JRG Re team and continuing to be great partners to all of JRG Re’s existing counterparties following the close of the transaction.”

Fleming is a portfolio company of Altamont Capital Partners (“Altamont”), a private equity firm with over $4 billion of capital under management and significant experience investing in the insurance sector.

The transaction has been unanimously approved by the Board of Directors of both companies. It is subject to customary closing conditions including receipt of required regulatory approvals. It is expected to close during the first quarter of 2024.

Citi and Howden Tiger Capital Markets & Advisory acted as financial advisors and Debevoise & Plimpton LLP acted as legal counsel for James River.

Forward-Looking Statements

This press release contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. In some cases, such forward-looking statements may be identified by terms such as believe, expect, seek, may, will, should, intend, project, anticipate, plan, estimate, guidance or similar words. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Although it is not possible to identify all of these risks and uncertainties, they include, among others, the following: the failure to complete the transaction on anticipated terms and timing, or at all; the failure to satisfy closing conditions, including receipt of required regulatory approvals; the inherent uncertainty of estimating reserves and the possibility that incurred losses may be greater than our loss and loss adjustment expense reserves; inaccurate estimates and judgments in our risk management may expose us to greater risks than intended; downgrades in the financial strength rating of our regulated insurance subsidiaries impacting our ability to attract and retain insurance and reinsurance business that our subsidiaries write, our

competitive position, and our financial condition; the potential loss of key members of our management team or key employees and our ability to attract and retain personnel; adverse economic factors resulting in the sale of fewer policies than expected or an increase in the frequency or severity of claims, or both; the impact of a persistent high inflationary environment on our reserves, the values of our investments and investment returns, and our compensation expenses; exposure to credit risk, interest rate risk and other market risk in our investment portfolio; reliance on a select group of brokers and agents for a significant portion of our business and the impact of our potential failure to maintain such relationships; reliance on a select group of customers for a significant portion of our business and the impact of our potential failure to maintain, or decision to terminate, such relationships; our ability to obtain reinsurance coverage at prices and on terms that allow us to transfer risk, adequately protect our company against financial loss and that supports our growth plans; losses resulting from reinsurance counterparties failing to pay us on reinsurance claims, insurance companies with whom we have a fronting arrangement failing to pay us for claims, or a former customer with whom we have an indemnification arrangement failing to perform its reimbursement obligations, and our potential inability to demand or maintain adequate collateral to mitigate such risks; inadequacy of premiums we charge to compensate us for our losses incurred; changes in laws or government regulation, including tax or insurance law and regulations; changes in U.S. tax laws and the interpretation of certain provisions of Public Law No. 115-97, informally titled the 2017 Tax Cuts and Jobs Act (including associated regulations), which may be retroactive and could have a significant effect on us including, among other things, by potentially increasing our tax rate, as well as on our shareholders; in the event we do not qualify for the insurance company exception to the passive foreign investment company (“PFIC”) rules and are therefore considered a PFIC, there could be material adverse tax consequences to an investor that is subject to U.S. federal income taxation; the Company or any of its foreign subsidiaries becoming subject to U.S. federal income taxation; a failure of any of the loss limitations or exclusions we utilize to shield us from unanticipated financial losses or legal exposures, or other liabilities; losses from catastrophic events, such as natural disasters and terrorist acts, which substantially exceed our expectations and/or exceed the amount of reinsurance we have purchased to protect us from such events; potential effects on our business of emerging claim and coverage issues; the potential impact of internal or external fraud, operational errors, systems malfunctions or cyber security incidents; our ability to manage our growth effectively; failure to maintain effective internal controls in accordance with the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley”); changes in our financial condition, regulations or other factors that may restrict our subsidiaries; ability to pay us dividends; and an adverse result in any litigation or legal proceedings we are or may become subject to. Additional information about these risks and uncertainties, as well as others that may cause actual results to differ materially from those in the forward-looking statements, is contained in our filings with the U.S. Securities and Exchange Commission (“SEC”), including our most recently filed Annual Report on Form 10-K. These forward-looking statements speak only as of the date of this release and the Company does not undertake any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

About James River Group Holdings, Ltd.

James River Group Holdings, Ltd. is a Bermuda-based insurance holding company that owns and operates a group of specialty insurance and reinsurance companies. The Company operates in three specialty property-casualty insurance and reinsurance segments: Excess and Surplus Lines, Specialty Admitted Insurance and Casualty Reinsurance. Each of the Company’s regulated insurance subsidiaries are rated “A-” (Excellent) by A.M. Best Company. Visit James River Group Holdings, Ltd. on the web at www.jrvrgroup.com.

James River Investor Contact:

Brett Shirreffs

SVP, Finance, Investments and Investor Relations

(919) 980-0524

Investors@jrvrgroup.com

v3.23.3

Document and Entity Information

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity Registrant Name |

JAMES RIVER GROUP HOLDINGS, LTD.

|

| Entity Central Index Key |

0001620459

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

D0

|

| Entity File Number |

001-36777

|

| Entity Tax Identification Number |

98-0585280

|

| Entity Address, Address Line One |

90 Pitts Bay Road

|

| Entity Address, Address Line Two |

2nd Floor

|

| Entity Address, Address Line Three |

Wellesley House

|

| Entity Address, City or Town |

Pembroke

|

| Entity Address, Postal Zip Code |

HM08

|

| Entity Address, Country |

BM

|

| City Area Code |

441

|

| Local Phone Number |

278-4580

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, par value $0.0002 per share

|

| Trading Symbol |

JRVR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

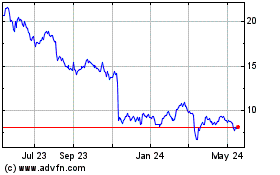

James River (NASDAQ:JRVR)

Historical Stock Chart

From Oct 2024 to Nov 2024

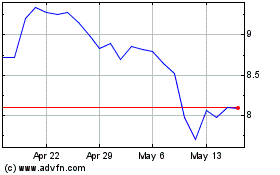

James River (NASDAQ:JRVR)

Historical Stock Chart

From Nov 2023 to Nov 2024