Kandi Technologies Reports Second Quarter 2024 Financial Results

16 August 2024 - 9:00PM

Kandi Technologies Group, Inc. (the “Company”, “we” or “Kandi”)

(NASDAQ GS: KNDI), today announced its financial results for the

second quarter of 2024.

Second Quarter Highlights

- Total revenues increased to $39.1 million, up from $36.0

million in the same period of 2023.

- Off-road vehicles and associated parts were the primary driver

of revenue, increasing by 11.3% y/y to $34.7 million, compared to

$31.3 million in the same period of 2023.

- Net income was $1.6 million, or $0.02 income per fully diluted

share, compared to net income of $4.4 million, or $0.06 income per

fully diluted share for the same period of 2023.

- Solid financial standing with $220 million in cash and cash

equivalents, restricted cash, short term investment, and

certificate of deposit as of June 30, 2024.

- During the second quarter, the Company repurchased 673,896

shares of its common stock at an average price of $2.25.

- Continued to expand the Company’s fully electric off-road

vehicle lineup in the U.S. with the launch of new products that

have injected fresh energy into the market, including the

officially licensed NFL-branded golf cart. These offerings provide

off-road enthusiasts with advanced performance and sustainable

options.

- Released ultra-high capacity AA batteries in the U.S. market,

offering long-lasting and quick charging solutions.

- Expanded global presence by achieving EEC certification for the

10K all-electric UTV, paving the way for entry into the EU market.

Simultaneously, as well as expanded the market for Kandi products

in Asia, further increasing its international market share.

Dr. Xueqin Dong, CEO of Kandi commented, “Our

second quarter results showcase the continued strength and growth

of our company. We achieved a notable increase in total revenues,

driven by strong sales in our off-road vehicle segment. This

reflects the market's positive reception to our innovative and

sustainable product offerings.”

Dong continued, “We remain financially robust,

with a solid cash position and share repurchases highlighting our

confidence in the company's future. Our focus on the U.S. market,

our primary market, has proven particularly rewarding. The

successful launch of our new off-road vehicle offerings and

ultra-high capacity AA batteries demonstrates our commitment to

meeting the needs of American consumers with advanced and

sustainable solutions. Additionally, our new partnership with

Lowe's to introduce a limited-edition golf cart collection

featuring logos and designs for all 32 NFL teams underscores our

innovative approach to combining sports enthusiasm with sustainable

technology. These golf carts, set to launch in the U.S. market at

the end of August, offer fans an exciting and eco-friendly way to

show their team pride. Our global expansion efforts, including

entry into the EU market and expanded distribution in Asia, further

support our long-term growth strategy.”

Share Repurchase

As of June 30, 2024, the Company had repurchased

a total of 1,422,764 common shares at an average price of $2.50 per

share under the repurchase plan, including a total of 673,896

common shares at an average price of $2.25 per share repurchased in

the second quarter of 2024.

Q2 2024 Key Financial Results

Net Revenues and Gross Profit (in USD millions)

|

|

Q2 2024 |

Q2 2023 |

Y-o-Y% |

|

Net Revenues |

$39.1 |

|

$36.0 |

|

8.9 |

% |

|

Gross Profit |

$11.9 |

|

$13.7 |

|

-13.8 |

% |

|

Gross Margin% |

|

30.3 |

% |

|

38.2 |

% |

- |

|

- Total revenues in the second

quarter of 2024 were $39.1 million compared to $36.0 million in the

same period of 2023, representing an increase of 8.9%, mainly due

to an increase in sales of off-road vehicles and EV products

compared to the prior period.

- Cost of goods sold in the second

quarter of 2024 was $27.3 million compared to $22.2 million in the

same period of 2023, representing an increase of 22.9%. The

increase was primarily due to the corresponding increase in

sales.

- Gross profit in the second quarter

of 2024 was $11.9 million, compared to $13.7 million in the same

period of 2023, representing a decrease of 13.8%. The overall gross

margin for the second quarter was 30.3%, down from 38.2% in the

same period of 2023, reflecting the impact of the product mix and

the regional revenue shift.

Operating Loss (in USD millions)

|

|

Q2 2024 |

Q2 2023 |

Y-o-Y% |

|

Operating Expenses |

($13.1 |

) |

($14.0 |

) |

-6.1 |

% |

|

Loss from Operations |

($1.3 |

) |

($0.2 |

) |

452.4 |

% |

|

Operating Margin% |

|

-3.2 |

% |

|

-0.6 |

% |

- |

|

- Research and development expenses

totaled $0.8 million for the second quarter of 2024, a decrease of

10.4% compared to $0.9 million for the same period in 2023. The

decrease was mainly due to fewer research and development projects

being carried out in the current period than in the same period in

2023.

- Selling and distribution expenses

totaled $4.0 million for the second quarter of 2024, an increase of

43.4% compared to $2.8 million for the same period in 2023. The

increase was mainly due to more freight expenses incurred from

shipping of the Company’s products to cover more retails stores of

its customers in the current period.

- General and administrative expenses

totaled $8.3 million for the second quarter of 2024, a decrease of

5.7% compared to $8.8 million for the same period in 2023.

Net Income (in USD millions)

|

|

Q2 2024 |

Q2 2023 |

Y-o-Y% |

|

Net Income |

$1.6 |

|

$4.4 |

|

-63.1 |

% |

|

Net Income per Share, Basic and Diluted |

$0.02 |

|

$0.06 |

|

- |

|

|

Net Income attributable to Kandi |

$1.7 |

|

$3.7 |

|

-55.1 |

% |

|

Net Income attributable to Kandi per Share, Basic and

Diluted |

$0.02 |

|

$0.05 |

|

- |

|

- Net income was $1.6 million for the

second quarter of 2024, a decrease of 63.1% compared to $4.4

million for the same period in 2023. The decrease was mainly due to

the $2.2 million change in the fair value of contingent

consideration recorded in the prior period compared to $0.7 million

recorded in the current period, as well as a decrease in gross

margin in the current period.

Balance Sheet (in USD millions)

- Working capital was $264.1 million

as of June 30, 2024.

Second Quarter 2024 Conference Call Details

The Company has scheduled a conference call and

live webcast to discuss its financial results at 8:00

A.M. Eastern Time (8:00 P.M. Beijing Time) on Friday,

August 16, 2024. Management will deliver prepared remarks to be

followed by a question and answer session.

The dial-in details for the conference call are as follows:

- Toll-free dial-in number: +1-877-407-3982

- International dial-in number: + 1-201-493-6780

- Webcast and

replay: https://viavid.webcasts.com/starthere.jsp?ei=1684400&tp_key=aa761f6044

The live audio webcast of the call can also be

accessed by visiting Kandi's Investor Relations page on

the Company's website at http://www.kandivehicle.com. An archive of

the webcast will be available on the Company's website following

the live call.

About Kandi Technologies Group, Inc.

Kandi Technologies Group, Inc. (KNDI),

headquartered in Jinhua New Energy Vehicle Town,Zhejiang Province,

is engaged in the research, development, manufacturing, and sales

of various vehicular products. Kandi conducts its primary business

operations through its wholly-owned subsidiary, Zhejiang Kandi

Technologies Group Co., Ltd. (“Zhejiang Kandi Technologies”),

formerly, Zhejiang Kandi Vehicles Co., Ltd. and its subsidiaries

including Kandi Electric Vehicles (Hainan) Co., Ltd. and SC

Autosports, LLC (d/b/a Kandi America), the wholly-owned subsidiary

of Kandi in the United States, and its wholly-owned subsidiary,

Kandi America Investment, LLC. Zhejiang Kandi Technologies has

established itself as one of China’s leading manufacturers of pure

electric vehicle parts and off-road vehicles.

Safe Harbor Statement

This press release contains certain statements

that may include “forward-looking statements.” All statements other

than statements of historical fact included herein are

“forward-looking statements.” These forward-looking statements are

often identified by the use of forward-looking terminology such as

“believes,” “expects” or similar expressions, involving known and

unknown risks and uncertainties. Although the Company believes that

the expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. You should not

place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. The Company’s

actual results could differ materially from those anticipated in

these forward-looking statements as a result of a variety of

factors, including the risk factors discussed in the Company’s

periodic reports that are filed with the Securities and Exchange

Commission and available on the SEC’s website (http://www.sec.gov).

All forward-looking statements attributable to the Company or

persons acting on its behalf are expressly qualified in their

entirety by these risk factors. Other than as required under the

applicable securities laws, the Company does not assume a duty to

update these forward-looking statements.

Follow us on Twitter: @ Kandi_Group

Contacts:

Kandi Technologies Group, Inc.Ms. Kewa Luo+1

(212) 551-3610IR@kandigroup.com

The Blueshirt GroupMr. Gary Dvorchak,

CFAgary@blueshirtgroup.co

- Tables Below -

|

KANDI TECHNOLOGIES GROUP, INC.AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED)(All amounts in

thousands) |

| |

|

|

|

June 30, 2024 |

|

December 31, 2023 |

| |

|

(Unaudited) |

|

|

| CURRENT

ASSETS |

|

|

|

|

| Cash and cash equivalents |

$ |

37,311 |

$ |

33,757 |

| Restricted cash |

|

100,957 |

|

59,873 |

| Short term investment |

|

124 |

|

- |

| Certificate of deposit |

|

81,210 |

|

33,947 |

| Accounts receivable |

|

31,553 |

|

18,952 |

| Inventories |

|

72,634 |

|

61,551 |

| Notes receivable |

|

63 |

|

124,473 |

| Other receivables |

|

20,574 |

|

6,477 |

| Prepayments and prepaid

expense |

|

3,959 |

|

1,909 |

| Advances to suppliers |

|

538 |

|

2,609 |

| TOTAL CURRENT

ASSETS |

|

348,923 |

|

343,548 |

| |

|

|

|

|

| NON-CURRENT

ASSETS |

|

|

|

|

| Property, plant and equipment,

net |

|

92,467 |

|

98,804 |

| Intangible assets, net |

|

5,410 |

|

6,396 |

| Land use rights, net |

|

2,639 |

|

2,754 |

| Deferred tax assets |

|

849 |

|

815 |

| Goodwill |

|

32,436 |

|

33,147 |

| Other long-term assets |

|

10,713 |

|

9,993 |

| TOTAL NON-CURRENT

ASSETS |

|

144,514 |

|

151,909 |

| |

|

|

|

|

| TOTAL

ASSETS |

$ |

493,437 |

$ |

495,457 |

| |

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

| Accounts payable |

$ |

34,987 |

$ |

28,745 |

| Other payables and accrued

expenses |

|

5,409 |

|

7,253 |

| Short-term loans |

|

13,225 |

|

9,072 |

| Notes payable |

|

23,503 |

|

24,071 |

| Income tax payable |

|

1,972 |

|

2,130 |

| Other current liabilities |

|

5,698 |

|

5,402 |

| TOTAL CURRENT

LIABILITIES |

|

84,794 |

|

76,673 |

| |

|

|

|

|

| NON-CURRENT

LIABILITIES |

|

|

|

|

| Long-term loans |

|

8,111 |

|

8,389 |

| Deferred taxes liability |

|

853 |

|

964 |

| Contingent consideration

liability |

|

1,757 |

|

2,693 |

| Other long-term

liabilities |

|

985 |

|

227 |

| TOTAL NON-CURRENT

LIABILITIES |

|

11,706 |

|

12,273 |

| |

|

|

|

|

| TOTAL

LIABILITIES |

|

96,500 |

|

88,946 |

| |

|

|

|

|

| STOCKHOLDER'S

EQUITY |

|

|

|

|

| Kandi technologies group, inc.

stockholders' equity |

|

394,491 |

|

404,126 |

| Non-controlling interests |

|

2,446 |

|

2,385 |

| TOTAL STOCKHOLDERS'

EQUITY |

|

396,937 |

|

406,511 |

| |

|

|

|

|

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

$ |

493,437 |

$ |

495,457 |

| |

|

KANDI TECHNOLOGIES GROUP, INC.AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS ANDCOMPREHENSIVE INCOME

(LOSS)(UNAUDITED)(All amounts in

thousands, except for share and per share/ADS data) |

| |

| |

|

Three Months Ended |

| |

|

June 30, 2024 |

|

June 30, 2023 |

| |

|

|

|

|

|

REVENUES, NET |

$ |

39,150 |

|

$ |

35,953 |

|

| |

|

|

|

|

| COST OF GOODS SOLD |

|

(27,307 |

) |

|

(22,219 |

) |

| |

|

|

|

|

| GROSS

PROFIT |

|

11,843 |

|

|

13,734 |

|

| |

|

|

|

|

| OPERATING

EXPENSE: |

|

|

|

|

| Research and development |

|

(783 |

) |

|

(875 |

) |

| Selling and marketing |

|

(3,988 |

) |

|

(2,781 |

) |

| General and

administrative |

|

(8,338 |

) |

|

(8,838 |

) |

| Impairment of goodwill |

|

- |

|

|

(508 |

) |

| Impairment of long-lived

assets |

|

- |

|

|

(963 |

) |

| TOTAL OPERATING

EXPENSE |

|

(13,109 |

) |

|

(13,965 |

) |

| |

|

|

|

|

| LOSS FROM

OPERATIONS |

|

(1,266 |

) |

|

(231 |

) |

| |

|

|

|

|

| OTHER INCOME

(EXPENSE): |

|

|

|

|

| Interest income |

|

1,555 |

|

|

1,955 |

|

| Interest expense |

|

(512 |

) |

|

(194 |

) |

| Change in fair value of

contingent consideration |

|

684 |

|

|

2,164 |

|

| Government grants |

|

834 |

|

|

190 |

|

| Other income, net |

|

634 |

|

|

807 |

|

| TOTAL OTHER INCOME,

NET |

|

3,195 |

|

|

4,922 |

|

| |

|

|

|

|

| INCOME BEFORE INCOME

TAXES |

|

1,929 |

|

|

4,691 |

|

| |

|

|

|

|

| INCOME TAX EXPENSE |

|

(311 |

) |

|

(305 |

) |

| |

|

|

|

|

| NET

INCOME |

|

1,618 |

|

|

4,386 |

|

| |

|

|

|

|

| LESS: NET (LOSS) INCOME

ATTRIBUTABLE TO NON-CONTROLLING INTERESTS |

|

(55 |

) |

|

659 |

|

| |

|

|

|

|

| NET INCOME

ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC.

STOCKHOLDERS |

|

1,673 |

|

|

3,727 |

|

| |

|

|

|

|

| OTHER COMPREHENSIVE LOSS |

|

|

|

|

| Foreign currency translation

adjustment |

|

(2,306 |

) |

|

(19,279 |

) |

| |

|

|

|

|

| COMPREHENSIVE

LOSS |

$ |

(688 |

) |

$ |

(14,893 |

) |

| |

|

|

|

|

| WEIGHTED AVERAGE SHARES

OUTSTANDING BASIC |

|

86,325,182 |

|

|

74,378,083 |

|

| WEIGHTED AVERAGE SHARES

OUTSTANDING DILUTED |

|

86,522,152 |

|

|

76,315,953 |

|

| |

|

|

|

|

| NET INCOME PER SHARE,

BASIC |

$ |

0.02 |

|

$ |

0.06 |

|

| NET INCOME PER SHARE,

DILUTED |

$ |

0.02 |

|

$ |

0.06 |

|

| |

|

|

|

|

| NET INCOME ATTRIBUTABLE TO

KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS PER SHARE, BASIC |

$ |

0.02 |

|

$ |

0.05 |

|

| NET INCOME ATTRIBUTABLE TO

KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS PER SHARE, DILUTED |

$ |

0.02 |

|

$ |

0.05 |

|

| |

|

|

Six Months Ended |

| |

|

|

June 30, 2024 |

|

June 30, 2023 |

| |

|

|

|

|

|

|

REVENUES, NET |

|

$ |

59,825 |

|

$ |

58,815 |

|

| |

|

|

|

|

|

| COST OF GOODS SOLD |

|

|

(40,858 |

) |

|

(37,052 |

) |

| |

|

|

|

|

|

| GROSS

PROFIT |

|

|

18,967 |

|

|

21,763 |

|

| |

|

|

|

|

|

| OPERATING

EXPENSE: |

|

|

|

|

|

| Research and development |

|

|

(1,685 |

) |

|

(1,754 |

) |

| Selling and marketing |

|

|

(7,023 |

) |

|

(4,608 |

) |

| General and

administrative |

|

|

(14,612 |

) |

|

(16,398 |

) |

| Impairment of goodwill |

|

|

- |

|

|

(508 |

) |

| Impairment of long-lived

assets |

|

|

- |

|

|

(963 |

) |

| TOTAL OPERATING

EXPENSE |

|

|

(23,320 |

) |

|

(24,231 |

) |

| |

|

|

|

|

|

| LOSS FROM

OPERATIONS |

|

|

(4,353 |

) |

|

(2,468 |

) |

| |

|

|

|

|

|

| OTHER INCOME

(EXPENSE): |

|

|

|

|

|

| Interest income |

|

|

3,633 |

|

|

4,055 |

|

| Interest expense |

|

|

(965 |

) |

|

(368 |

) |

| Change in fair value of

contingent consideration |

|

|

936 |

|

|

1,803 |

|

| Government grants |

|

|

1,051 |

|

|

810 |

|

| Other income, net |

|

|

2,525 |

|

|

1,074 |

|

| TOTAL OTHER INCOME ,

NET |

|

|

7,180 |

|

|

7,374 |

|

| |

|

|

|

|

|

| INCOME BEFORE INCOME

TAXES |

|

|

2,827 |

|

|

4,906 |

|

| |

|

|

|

|

|

| INCOME TAX (EXPENSE)

BENEFIT |

|

|

(449 |

) |

|

74 |

|

| |

|

|

|

|

|

| NET

INCOME |

|

|

2,378 |

|

|

4,980 |

|

| |

|

|

|

|

|

| LESS: NET INCOME ATTRIBUTABLE

TO NON-CONTROLLING INTERESTS |

|

|

63 |

|

|

1,284 |

|

| |

|

|

|

|

|

| NET INCOME

ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC.

STOCKHOLDERS |

|

|

2,315 |

|

|

3,696 |

|

| |

|

|

|

|

|

| OTHER COMPREHENSIVE LOSS |

|

|

|

|

|

| Foreign currency translation

adjustment |

|

|

(9,823 |

) |

|

(17,696 |

) |

| |

|

|

|

|

|

| COMPREHENSIVE

LOSS |

|

$ |

(7,445 |

) |

$ |

(12,716 |

) |

| |

|

|

|

|

|

| WEIGHTED AVERAGE SHARES

OUTSTANDING BASIC |

|

|

86,663,100 |

|

|

74,282,823 |

|

| WEIGHTED AVERAGE SHARES

OUTSTANDING DILUTED |

|

|

87,097,274 |

|

|

75,786,201 |

|

| |

|

|

|

|

|

| NET INCOME PER SHARE,

BASIC |

|

$ |

0.03 |

|

$ |

0.07 |

|

| NET INCOME PER SHARE,

DILUTED |

|

$ |

0.03 |

|

$ |

0.07 |

|

| |

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO

KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS PER SHARE, BASIC |

|

$ |

0.03 |

|

$ |

0.05 |

|

| NET INCOME ATTRIBUTABLE TO

KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS PER SHARE, DILUTED |

|

$ |

0.03 |

|

$ |

0.05 |

|

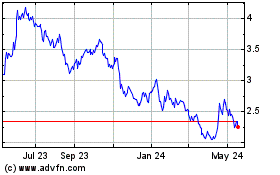

Kandi Technolgies (NASDAQ:KNDI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kandi Technolgies (NASDAQ:KNDI)

Historical Stock Chart

From Dec 2023 to Dec 2024