false000146874800014687482024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 15, 2024 |

Kodiak Sciences Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38682 |

27-0476525 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1200 Page Mill Rd |

|

Palo Alto, California |

|

94304 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 650 281-0850 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.0001 |

|

KOD |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 15, 2024, Kodiak Sciences Inc. (the “Company”) published a press release reporting the Company’s financial results for the quarter ended March 31, 2024 and business highlights. A copy of the Company’s press release is attached hereto as Exhibit 99.1.

In accordance with General Instruction B.2. of Form 8-K, the information contained or incorporated herein, including the press release filed as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

KODIAK SCIENCES INC. |

|

|

|

|

Date: |

May 15, 2024 |

By: |

/s/ Victor Perlroth |

|

|

|

Victor Perlroth, M.D.

Chief Executive Officer |

Exhibit 99.1

Kodiak Sciences Announces Recent Business Highlights and First Quarter 2024 Financial Results

Palo Alto, CA — May 15, 2024 – Kodiak Sciences Inc. (Nasdaq: KOD), today reported business highlights and financial results for the quarter ended March 31, 2024.

“We continue to make excellent operational progress with our three clinical programs of tarcocimab, KSI-501 and KSI-101, as well as on our duet and triplet research programs,” said Victor Perlroth, M.D., Chief Executive Officer of Kodiak Sciences. “We are enrolling well in GLOW2 and remain on track to activate mid-year our next Phase 3 study DAYBREAK in wet AMD which is designed to investigate the efficacy, durability and safety of tarcocimab and KSI-501 in parallel against aflibercept. We also expect to initiate Phase 1b enrollment in June for the APEX study of KSI-101, our anti-IL-6, VEGF-trap bispecific protein, in patients with macular edema associated with inflammation.”

“We were pleased to share the advancement on our growing repertoire of novel small molecules and biologics for the duet and triplet platforms at the ARVO 2024 Annual Meeting recently. The duets and triplets are designed as a modular platform that embeds diverse active pharmaceutical ingredients (“API”) including small molecules, proteins, peptides, macrocycles, and oligonucleotides in the biopolymer backbone to enable high drug antibody ratio (“DAR”) medicines with targeted, multi-specific, tailored modulation of biological pathways for ophthalmic and systemic diseases.”

“We look forward to sharing ongoing progress of our late- and early-phase retina pipeline programs later this year, as we refine our planning and continue to accelerate our execution,” concluded Dr. Perlroth.

Recent Business Highlights

•Recent scientific presentations: We presented a breadth of data on our early- and late-phase retina pipeline at the Association for Research in Vision and Ophthalmology (“ARVO”) 2024 Annual Meeting. Our presentations included clinical and non-clinical data on our ABC Platform investigational medicines tarcocimab and KSI-501, and we highlighted progress on our duet and triplet platform including discovery and characterization of novel small molecules and biologics.

•Tarcocimab pivotal program: We announced in the first quarter of 2024 that we intend to conduct two additional Phase 3 clinical studies with tarcocimab. The GLOW2 Phase 3 study in diabetic retinopathy (“DR”) has a similar design to the successful GLOW1 Phase 3 study with the benefit of an additional, third monthly loading dose (weeks 0, 4, and 8). We recently announced that the first patients were treated in the GLOW2 study and that our goal is to complete enrollment before the end of this year.

We also announced our intention to study tarcocimab as a second investigational arm in the KSI-501 Phase 3 DAYBREAK study to evaluate its durability, strengthen its competitive position in wet AMD and bolster its ex-US regulatory dossier. We are operationalizing towards DAYBREAK study activation in mid-2024.

Both GLOW2 and DAYBREAK will be run using our go-to-market formulation of tarcocimab, which we believe improves the manufacturability in a prefilled syringe and may also enhance the utility of the product.

•Tarcocimab commercial scale manufacturing: We released tarcocimab drug product based on the go-to-market formulation in March 2024, which is ready for use in the GLOW2 and DAYBREAK Phase 3 studies.

•KSI-501 clinical program: In the first quarter of 2024 we shared the Phase 1 study results of KSI-501 in patients with diabetic macular edema (“DME”) at the Angiogenesis, Exudation, and Degeneration 2024 Virtual Meeting. The Phase 1 study demonstrated that repeated monthly dosing of KSI-501 was safe and well tolerated and achieved clinically meaningful and sustained visual acuity gains and fluid reduction in patients.

We also announced our intention of advancing KSI-501 into the Phase 3 DAYBREAK study to evaluate its efficacy, durability, and safety in wet AMD. The DAYBREAK study is intended to be a non-inferiority study evaluating KSI-501 dosed every 4 to 24 weeks, compared to aflibercept. The study will use an enhanced formulation of KSI-501 informed from tarcocimab commercial manufacturing scale-up. We are on track for study activation in mid-2024.

•KSI-101 clinical program: KSI-101 is a novel, potent and high-strength bispecific protein targeting IL-6 and VEGF. In the first quarter of 2024 we announced our intention to develop KSI-101 for patients who have retinal fluid and inflammation. With KSI-101, we are seeking to develop an intravitreal biologic therapy whose commercial opportunity sits outside of today’s anti-VEGF retina market. We have recently obtained supportive FDA feedback on the pivotal study program for KSI-101. Two pivotal clinical studies will be required, both with 16-week primary endpoints. We are on track to initiate enrollment for a dose-finding Phase 1b APEX study in June 2024 to evaluate the safety and tolerability and to identify two dose levels to progress into dual Phase 2b/3 studies (PEAK and PINNACLE) which we hope to initiate later in 2024.

•KSI-501 and KSI-101 manufacturing: We have been progressing the manufacturing of KSI-501 and KSI-101 in preparation for their anticipated clinical studies. Clinical material for both KSI-501 (50 mg/mL strength in our enhanced formulation) and KSI-101 (100 mg/mL strength) have been successfully manufactured and released.

First Quarter 2024 Financial Results

Cash Position

Kodiak ended the first quarter of 2024 with $245.9 million of cash and cash equivalents. We believe that our current cash will support our current and planned operations into 2026.

Net Loss

The net loss for the first quarter of 2024 was $43.0 million, or $0.82 per share on both a basic and diluted basis, as compared to a net loss of $70.8 million, or $1.35 per share on both a basic and diluted basis, for the first quarter of 2023. The net loss for the quarter ended March 31, 2024 included non-cash stock-based compensation of $18.4 million, as compared to $26.0 million for the quarter ended March 31, 2023.

R&D Expenses

Research and development (R&D) expenses were $29.9 million for the first quarter of 2024, as compared to $56.5 million for the first quarter of 2023. The R&D expenses for the first quarter of 2024 included non-cash stock-based compensation of $8.7 million, as compared to $14.7 million for the first quarter of 2023. The decrease in R&D expenses for the first quarter of 2024, as compared to the same period in 2023, was primarily driven by reduced clinical activities for tarcocimab, as well as forfeitures related to stock-based compensation expense.

G&A Expenses

General and administrative (G&A) expenses were $16.1 million for the first quarter of 2024, as compared to $18.1 million for the first quarter of 2023. The G&A expenses for the first quarter of 2024 included non-cash stock-based compensation of $9.7 million, as compared to $11.3 million for the first quarter of 2023.

About tarcocimab tedromer (tarcocimab, KSI-301)

Tarcocimab is an investigational anti-VEGF therapy built on Kodiak’s proprietary Antibody Biopolymer Conjugate (“ABC”) Platform and is designed to maintain potent and effective drug levels in ocular tissues for longer than existing available agents. Kodiak’s immediate objective with tarcocimab is to finish the clinical development program to enable marketing authorization application for the retinal vascular diseases of diabetic retinopathy, retinal vein occlusion and wet AMD. We believe tarcocimab can fill an important unmet need in the marketplace for a medicine that can be administered to treatment naïve and/or treatment experienced patients on a monthly through every 6-month interval, and with the majority of patients able to do well on every 6-month dosing.

To date, tarcocimab has completed three successful Phase 3 pivotal clinical studies: the Phase 3 GLOW1 study in diabetic retinopathy (“DR”), the Phase 3 BEACON study in retinal vein occlusion (“RVO”) and the Phase 3 DAYLIGHT study in wet AMD. In the GLOW1 study, 100% of tarcocimab treated patients were extended to 6-month dosing. In the BEACON study, in the first 6 months tarcocimab-treated patients were dosed on an every 8-week interval (as opposed to an every 4-week interval for aflibercept) and in the second 6-months nearly half of patients did not require treatment at all, and with both groups achieving overlapping vision outcomes at one year.

Kodiak is initiating two additional BLA-facing Phase 3 studies: the GLOW2 study in diabetic retinopathy, and the DAYBREAK study in wet AMD. The GLOW2 study has a similar design as GLOW1 with the benefit of an additional, third monthly loading dose (weeks 0, 4 and 8) to explore even further benefits with tarcocimab in diabetic retinopathy patients. The DAYBREAK study will include investigational arms for tarcocimab and KSI-501, Kodiak’s bispecific conjugate, to evaluate their efficacy, safety and durability versus aflibercept. DAYBREAK is designed to strengthen the competitive position of tarcocimab in wet AMD and bolster the ex-US regulatory dossier for the program. Both GLOW2 and DAYBREAK will use a go-to-market formulation of tarcocimab which we believe improves the manufacturability in a prefilled syringe and may also enhance the utility of the product. GLOW2 is actively enrolling patients, and we are operationalizing towards DAYBREAK study activation in mid-2024.

About KSI-501

KSI-501 is an anti-IL-6, VEGF-trap bispecific antibody biopolymer conjugate built on the ABC platform and is being developed for high prevalence retinal vascular diseases to address the leading unmet needs of extended durability and targeting multiple disease biologies. A completed Phase 1 multiple ascending dose study demonstrated that repeated monthly dosing of KSI-501 was safe and well tolerated and achieved clinically meaningful and sustained improvement in visual acuity and fluid reduction in patients with diabetic macular edema.

Kodiak intends to advance KSI-501 into a Phase 3 study DAYBREAK in 2024 to evaluate its efficacy, durability, and safety in wet AMD. The DAYBREAK study is intended to be a non-inferiority study evaluating KSI-501 dosed every 4 to 24 weeks, compared to aflibercept dosed per label. The DAYBREAK study will use an enhanced formulation of KSI-501 educated from tarcocimab’s commercial manufacturing scale-up. We are operationalizing towards DAYBREAK study activation in mid-2024.

About KSI-101

KSI-101 is the unconjugated protein portion of KSI-501 and is a novel, potent and high strength bispecific protein targeting IL-6 and VEGF. We intend to develop KSI-101 for patients who have retinal fluid and inflammation. Currently there are no available intravitreal biologic therapies addressing the spectrum of inflammatory conditions of the retina. We believe that retinal inflammatory conditions represent a new market segment separate from the established anti-VEGF market. KSI-101 is a clinical prospect with opportunities and risks uncoupled from the ABC Platform, and as such is an important part of our late-phase portfolio. We intend to initiate a dose-finding Phase 1b study APEX in the second quarter of 2024 to evaluate its safety and tolerability and to identify two dose levels to progress into dual Phase 2b/3 studies PEAK and PINNACLE, both with a 16-week primary endpoint, later in 2024.

About Kodiak Sciences Inc.

Kodiak Sciences (Nasdaq: KOD) is a biopharmaceutical company committed to researching, developing, and commercializing transformative therapeutics to treat a broad spectrum of retinal diseases. We are focused on bringing new science to the design and manufacture of next generation retinal medicines to prevent and treat the leading causes of blindness globally. Our ABC Platform™ uses molecular engineering to merge the fields of protein-based and chemistry-based therapies and has been at the core of Kodiak's discovery engine. We are developing a portfolio of three clinical programs, two of which are late-stage today and derived from our ABC Platform and one which is platform-independent and which we believe can progress rapidly into pivotal studies.

Kodiak's lead investigational medicine, tarcocimab, is a novel anti-VEGF antibody biopolymer conjugate under development for the treatment of high prevalence retinal vascular diseases including diabetic retinopathy, the leading cause of blindness in working-age patients in the developed world, and wet age-related macular degeneration, the leading cause of blindness in elderly patients in the developed world.

KSI-501 is our second investigational medicine, a first-in-class anti-IL-6, VEGF-trap bispecific antibody biopolymer conjugate designed to inhibit both IL-6 mediated inflammation and VEGF-mediated angiogenesis and vascular permeability. KSI-501 is being developed for the treatment of high prevalence retinal vascular diseases to address the unmet needs of extended durability and targeting multiple disease biologies for differentiated efficacy. Phase 1b data for KSI-501 was presented in February 2024, and the Phase 3 DAYBREAK study of KSI-501 in wet AMD is scheduled to be actively screening patients in mid-2024.

Additionally, Kodiak is developing a third product candidate, KSI-101, a novel anti-IL-6, VEGF-trap bispecific protein, the unconjugated protein portion of KSI-501. Kodiak intends to develop KSI-101 for the treatment of retinal inflammatory diseases, as currently there are no available intravitreal biologic therapies addressing the spectrum of inflammatory conditions of the retina.

Kodiak has expanded its early research pipeline of duet and triplet inhibitors that embed small molecules and other active pharmaceutical ingredients (“API”) in the biopolymer backbone to enable targeted, high drug-antibody ratio ("DAR") medicines. The diverse API’s are designed to be released over time to achieve targeted, multi-specific and tailored modulation of targeted biological pathways. The unique combination of high DAR and tailored therapeutic benefit offers potential for broad application to multifactorial ophthalmic and systemic diseases.

For more information, please visit www.kodiak.com.

Kodiak®, Kodiak Sciences®, ABC™, ABC Platform™ and the Kodiak logo are registered trademarks or trademarks of Kodiak Sciences Inc. in various global jurisdictions.

Forward-Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements are not based on historical fact and include statements regarding: the potential benefits of KSI-501, including that it may represent a new category of retinal medicines with greater therapeutic efficacy than existing therapies; the prospects of the candidates in our pipeline, including tarcocimab, KSI-501, and KSI-101; our ability to apply our clinical experience with tarcocimab to allow us to design and run an additional pivotal study, and the potential success of such study; the timing of activation and completion of our planned and ongoing studies, and our guidance on our cash runway. Forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as "may," "will," "should," "would," "could," "expect," "plan," "believe," "intend," "pursue," and other similar expressions among others. Any forward-looking statements are based on management's current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. The risks and uncertainties include, but are not limited to: the risk that cessation or delay of any of the on-going clinical studies and our development of tarcocimab or KSI-501 may occur; the risk that the BEACON and/or GLOW1 and/or GLOW2 and/or DAYLIGHT results may not provide the evidence, insights, or benefits as anticipated; the risk that safety, efficacy, and durability data observed in our product candidates in current or prior studies may not continue or persist; the risk that the results of the tarcocimab Phase 3 studies may not be sufficient to support a single Biologics License Application (BLA) submission for wet AMD, RVO and NPDR; the risk that a BLA may not be accepted by, or receive approval from, the FDA or foreign regulatory agencies when expected, or at all; future potential regulatory milestones of tarcocimab or KSI-501 or KSI-101, including those related to current and planned clinical studies, may be insufficient to support regulatory submissions or approval; the risk that a new formulation of tarcocimab, KSI-501 or other ABC Platform derived molecules may not provide the benefits expected; our research and development efforts and our ability to advance our product candidates into later stages of development may fail; the risk that KSI-501 may not inhibit VEGF and IL-6 or have an impact on the treatment of patients as expected; any one or more of our product candidates may not be successfully developed, approved or commercialized; our manufacturing facilities may not operate as expected; adverse conditions in the general domestic and global economic markets, which may significantly impact our business and operations, including our clinical trial sites, as well as the business or operations of our manufacturers, contract research organizations or other third parties with whom we conduct business; as well as the other risks Identified in our filings with the Securities and Exchange Commission. For a discussion of other risks and uncertainties, and other important factors, any of which could cause our actual results to differ from those contained in the forward-looking statements, see the section entitled "Risk Factors" in our most recent Form 10-K, as well as discussions of potential risks, uncertainties, and other important factors in our subsequent filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date hereof and Kodiak undertakes no obligation to update forward-looking statements, and readers are cautioned not to place undue reliance on such forward-looking statements. Kodiak®, Kodiak Sciences®, ABC™, ABC Platform™, and the Kodiak logo are registered trademarks or trademarks of Kodiak Sciences Inc. in various global jurisdictions.

Kodiak Sciences Inc.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Operating expenses |

|

|

|

|

|

|

Research and development |

|

$ |

29,931 |

|

|

$ |

56,520 |

|

General and administrative |

|

|

16,124 |

|

|

|

18,095 |

|

Total operating expenses |

|

|

46,055 |

|

|

|

74,615 |

|

Loss from operations |

|

|

(46,055 |

) |

|

|

(74,615 |

) |

Interest income |

|

|

3,353 |

|

|

|

3,617 |

|

Interest expense |

|

|

— |

|

|

|

(4 |

) |

Other income (expense), net |

|

|

(337 |

) |

|

|

222 |

|

Net loss |

|

$ |

(43,039 |

) |

|

$ |

(70,780 |

) |

Net loss per common share, basic and diluted |

|

$ |

(0.82 |

) |

|

$ |

(1.35 |

) |

Weighted-average shares of common stock

outstanding used in computing net loss per

common share, basic and diluted |

|

|

52,510,460 |

|

|

|

52,337,603 |

|

Kodiak Sciences Inc.

Condensed Consolidated Balance Sheet Data

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Cash and cash equivalents |

|

$ |

245,919 |

|

|

$ |

285,507 |

|

Working capital |

|

$ |

226,657 |

|

|

$ |

247,580 |

|

Total assets |

|

$ |

434,759 |

|

|

$ |

479,372 |

|

Accumulated deficit |

|

$ |

(1,195,570 |

) |

|

$ |

(1,152,531 |

) |

Total stockholders’ equity |

|

$ |

241,189 |

|

|

$ |

265,781 |

|

Kodiak Contact:

John Borgeson

Chief Financial Officer

Tel (650) 281-0850

ir@kodiak.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

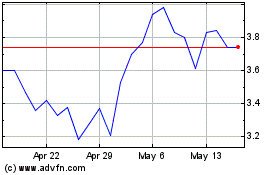

Kodiak Sciences (NASDAQ:KOD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kodiak Sciences (NASDAQ:KOD)

Historical Stock Chart

From Nov 2023 to Nov 2024