Liberty Broadband Corporation (“Liberty Broadband”) (Nasdaq:

LBRDA, LBRDK, LBRDP) today reported first quarter 2024 results.

Headlines include(1):

- Fair value of Charter investment was $13.4 billion as of March

31st

- Liberty Broadband did not sell Charter shares to Charter from

February 1, 2024 through April 30, 2024 as its fully diluted equity

interest in Charter remained below 26%(2)

- From February 1, 2024 through April 30, 2024, Liberty Broadband

repurchased 103 thousand LBRDK shares at an average price per share

of $79.88 for total cash consideration of $8.2 million

- In the first quarter, GCI(3) revenue was flat at $245 million,

generated $37 million in operating income and Adjusted OIBDA(4) was

flat at $90 million

Share Repurchases

From February 1, 2024 through April 30, 2024, Liberty Broadband

repurchased 103 thousand shares of Series C Liberty Broadband

common stock (Nasdaq: LBRDK) at an average cost per share of $79.88

for total cash consideration of $8.2 million. The total remaining

repurchase authorization for Liberty Broadband as of April 30, 2024

is approximately $1.7 billion.

Charter Ownership

Under the terms of Liberty Broadband and Charter’s stockholder

agreement, Liberty Broadband has sold and will continue to sell to

Charter a number of shares of Charter Class A common stock as is

necessary to maintain Liberty Broadband’s percentage equity

interest at 26%(2) on a fully diluted basis. Such sales are

executed by Liberty Broadband monthly based on Charter’s repurchase

activity in the month prior.

From February 1, 2024 through April 30, 2024, Liberty Broadband

did not sell Charter shares to Charter as its fully diluted equity

interest in Charter remained below 26%(2).

Balance Sheet

The following presentation is provided to separately identify

cash and liquid investments, debt and public holdings of Liberty

Broadband as of December 31, 2023 and March 31, 2024.

(amounts in millions)

12/31/2023

3/31/2024

Cash and Cash Equivalents:

GCI Holdings

$

79

$

70

Corporate and Other

79

38

Total Liberty Broadband Consolidated

Cash

$

158

$

108

Fair Value of Public Holdings in

Charter(a)

$

17,984

$

13,385

Debt:

Senior Notes(b)

$

600

$

600

Senior Credit Facility

394

334

Tower Obligations and Other(c)

91

90

Total GCI Holdings Debt

$

1,085

$

1,024

GCI Leverage(d)

2.9x

2.8x

Charter Margin Loan

$

1,460

$

1,480

3.125% Exchangeable Senior Debentures due

2053(e)

1,265

1,265

Total Corporate Level Debt

$

2,725

$

2,745

Total Liberty Broadband Debt

$

3,810

$

3,769

Fair market value adjustment and deferred

loan costs

12

(45

)

Tower obligations and finance leases

(excluded from GAAP Debt)

(86

)

(85

)

Total Liberty Broadband Debt

(GAAP)

$

3,736

$

3,639

Other Financial Obligations:

Preferred Stock(f)

180

180

_________________________

a)

Represents fair value of the investment in

Charter as of December 31, 2023 and March 31, 2024.

b)

Principal amount of Senior Notes.

c)

Includes the Wells Fargo Note Payable and

current and long-term obligations under tower obligations and

finance leases.

d)

As defined in GCI's credit agreement.

e)

Principal amount of Exchangeable Senior

Debentures exclusive of fair market value adjustments.

f)

Liquidation value of preferred stock.

Preferred stock has a 7% coupon, $25 per share liquidation

preference plus accrued and unpaid dividends and 1/3 vote per

share. The redemption date is the first business day following

March 8, 2039. The preferred stock is considered a liability for

GAAP purposes.

Liberty Broadband cash decreased $50 million in the first

quarter primarily due to proceeds from Charter share sales and

borrowing under the Charter margin loan being more than offset by

share repurchases and other investing activities. GCI cash

decreased $9 million in the first quarter as cash from operations

was more than offset by debt repayment and capital expenditures

(net of grant proceeds) during the period.

Liberty Broadband debt decreased $41 million in the first

quarter as GCI repaid $60 million under its senior credit facility,

partially offset by additional borrowing under the Charter margin

loan. There is $820 million of available capacity under the Charter

margin loan. GCI’s credit facility has undrawn capacity of $457

million (net of letters of credit), and GCI’s leverage as defined

in its credit agreement is 2.8x.

GCI Operating and Financial

Results

1Q23

1Q24

% Change

(amounts in millions, except operating

metrics)

GCI Consolidated Financial

Metrics

Revenue

Consumer

$

118

$

117

(1)

%

Business

128

128

—

%

Total revenue

$

246

$

245

—

%

Operating income

$

29

$

37

28

%

Operating income margin (%)

11.8%

15.1%

330

bps

Adjusted OIBDA(a)

$

90

$

90

—

%

Adjusted OIBDA margin(a) (%)

36.6%

36.7%

10

bps

GCI Consumer

Financial Metrics

Revenue

Data

$

59

$

60

2

%

Wireless

47

47

—

%

Other

12

10

(17)

%

Total revenue

$

118

$

117

(1)

%

Operating Metrics

Data:

Cable modem subscribers(b)

159,100

159,800

—

%

Wireless:

Lines in service(c)

193,700

199,000

3

%

GCI Business

Financial Metrics

Revenue

Data

$

106

$

108

2

%

Wireless

13

12

(8)

%

Other

9

8

(11)

%

Total revenue

$

128

$

128

—

%

__________________________

a)

See reconciling schedule 1.

b)

A cable modem subscriber is defined by the

purchase of cable modem service regardless of the level of service

purchased. If one entity purchases multiple cable modem service

access points, each access point is counted as a subscriber. Data

cable modem subscribers as of March 31, 2024, include 900

subscribers that were reclassified from GCI Business to GCI

Consumer subscribers in the first quarter of 2024 and are not new

additions.

c)

A wireless line in service is defined as a

wireless device with a monthly fee for services. Wireless lines in

service as of March 31, 2024, include 1,800 lines that were

reclassified from GCI Business to GCI Consumer lines in the first

quarter of 2024 and are not new additions.

Unless otherwise noted, the following discussion compares

financial information for the three months ended March 31, 2024 to

the same period in 2023.

GCI revenue was flat in the first quarter. Consumer revenue was

down 1% driven by declines in video revenue, partially offset by

demand for consumer data. Business revenue was flat as growth in

data was offset by declines in wireless and other revenues.

Operating income increased by $8 million in the first quarter

driven by lower depreciation expense as certain assets became fully

depreciated during 2023. Adjusted OIBDA was flat in line with

revenue.

In the first quarter, GCI spent $46 million, net, on capital

expenditures. Capital expenditure spending was related primarily to

improvements to the wireless and data networks in rural Alaska.

GCI's net capital expenditures for the full year 2024 are expected

to be approximately $200 million related to additional

high-returning investments in middle and last mile connectivity,

with continued network expansion in GCI’s most important markets in

rural Alaska including the Bethel and AU-Aleutians fiber

projects.

FOOTNOTES

1)

Liberty Broadband will discuss

these highlights and other matters on Liberty Broadband's earnings

conference call that will begin at 11:15 a.m. (E.T.) on May 8,

2024. For information regarding how to access the call, please see

“Important Notice” later in this document.

2)

Calculated pursuant to the

stockholder agreement between Liberty Broadband and Charter

Communications, Inc. ("Charter").

3)

Liberty Broadband’s principal

operating asset is GCI Holdings, LLC (“GCI” or “GCI Holdings”),

Alaska's largest communications provider. Liberty Broadband also

holds an interest in Charter.

4)

For a definition of Adjusted

OIBDA and Adjusted OIBDA margin and applicable reconciliations, see

the accompanying schedules.

NOTES

LIBERTY BROADBAND FINANCIAL

METRICS

(amounts in millions)

1Q23

1Q24

Revenue

GCI Holdings

$

246

$

245

Corporate and other

—

—

Total Liberty Broadband Revenue

$

246

$

245

Operating Income

GCI Holdings

$

29

$

37

Corporate and other

(13

)

(9

)

Total Liberty Broadband Operating

Income

$

16

$

28

Adjusted OIBDA

GCI Holdings

$

90

$

90

Corporate and other

(8

)

(5

)

Total Liberty Broadband Adjusted

OIBDA

$

82

$

85

Important Notice: Liberty Broadband (Nasdaq: LBRDA,

LBRDK, LBRDP) will discuss Liberty Broadband’s earnings release on

a conference call which will begin at 11:15 a.m. (E.T.) on May 8,

2024. The call can be accessed by dialing (877) 407-3944 or (412)

902-0038, passcode 13742820, at least 10 minutes prior to the start

time. The call will also be broadcast live across the Internet and

archived on our website. To access the webcast go to

https://www.libertybroadband.com/investors/news-events/ir-calendar.

Links to this press release and replays of the call will also be

available on Liberty Broadband’s website.

This press release includes certain forward-looking statements

under the Private Securities Litigation Reform Act of 1995,

including statements about business strategies, market potential,

future financial prospects, capital expenditures, matters relating

to Liberty Broadband’s equity interest in Charter and Charter’s

buyback of common stock, Liberty Broadband’s participation in

Charter’s buyback of common stock, the continuation of our stock

repurchase program and other matters that are not historical facts.

These forward-looking statements involve many risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements, including,

without limitation, possible changes in market acceptance of new

products or services, competitive issues, regulatory matters

affecting our businesses, continued access to capital on terms

acceptable to Liberty Broadband, changes in law and government

regulations, the availability of investment opportunities, general

market conditions (including as a result of inflationary pressures)

and market conditions conducive to stock repurchases. These

forward-looking statements speak only as of the date of this press

release, and Liberty Broadband expressly disclaims any obligation

or undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein to reflect any change in

Liberty Broadband's expectations with regard thereto or any change

in events, conditions or circumstances on which any such statement

is based. Please refer to the publicly filed documents of Liberty

Broadband, including the most recent Forms 10-K and 10-Q, for

additional information about Liberty Broadband and about the risks

and uncertainties related to Liberty Broadband which may affect the

statements made in this press release.

NON-GAAP FINANCIAL MEASURES

To provide investors with additional information regarding our

financial results, this press release includes a presentation of

Adjusted OIBDA, which is a non-GAAP financial measure, for Liberty

Broadband (and certain of its subsidiaries) and GCI Holdings

together with a reconciliation to that entity or such businesses’

operating income, as determined under GAAP. Liberty Broadband

defines Adjusted OIBDA as operating income (loss) plus depreciation

and amortization, stock-based compensation, transaction costs,

separately reported litigation settlements, restructuring and

impairment charges. Further, this press release includes Adjusted

OIBDA margin which is also a non-GAAP financial measure. Liberty

Broadband defines Adjusted OIBDA margin as Adjusted OIBDA divided

by revenue.

Liberty Broadband believes Adjusted OIBDA is an important

indicator of the operational strength and performance of its

businesses by identifying those items that are not directly a

reflection of each business' performance or indicative of ongoing

business trends. In addition, this measure allows management to

view operating results and perform analytical comparisons and

benchmarking between businesses and identify strategies to improve

performance. Because Adjusted OIBDA is used as a measure of

operating performance, Liberty Broadband views operating income as

the most directly comparable GAAP measure. Adjusted OIBDA is not

meant to replace or supersede operating income or any other GAAP

measure, but rather to supplement such GAAP measures in order to

present investors with the same information that Liberty

Broadband’s management considers in assessing the results of

operations and performance of its assets. Please see the tables

below for applicable reconciliations.

SCHEDULE 1

The following table provides a reconciliation of GCI’s operating

income to its Adjusted OIBDA for the three months ended March 31,

2023 and March 31, 2024.

GCI HOLDINGS ADJUSTED OIBDA

RECONCILIATION

(amounts in millions)

1Q23

1Q24

GCI Holdings Operating Income

$

29

$

37

Depreciation and amortization

58

50

Stock-based compensation

3

3

GCI Holdings Adjusted OIBDA

$

90

$

90

SCHEDULE 2

The following table provides a reconciliation of operating

income (loss) calculated in accordance with GAAP to Adjusted OIBDA

for Liberty Broadband for the three months ended March 31, 2023 and

March 31, 2024.

LIBERTY BROADBAND ADJUSTED OIBDA

RECONCILIATION

(amounts in millions)

1Q23

1Q24

Liberty Broadband Operating

Income

$

16

$

28

Depreciation and amortization

58

50

Stock-based compensation

8

7

Liberty Broadband Adjusted

OIBDA

$

82

$

85

GCI Holdings

$

90

$

90

Corporate and other

(8

)

(5

)

LIBERTY BROADBAND

CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEET INFORMATION

(unaudited)

March 31,

December 31,

2024

2023

amounts in millions,

except share amounts

Assets

Current assets:

Cash and cash equivalents

$

108

158

Trade and other receivables, net of

allowance for credit losses of $5 and $5, respectively

186

178

Prepaid and other current assets

56

94

Total current assets

350

430

Investment in Charter, accounted for using

the equity method

12,281

12,116

Property and equipment, net

1,078

1,053

Intangible assets not subject to

amortization

Goodwill

755

755

Cable certificates

550

550

Other

40

40

Intangible assets subject to amortization,

net

449

461

Other assets, net

237

236

Total assets

$

15,740

15,641

Liabilities and Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

94

86

Deferred revenue

29

30

Current portion of debt

3

3

Other current liabilities

67

59

Total current liabilities

193

178

Long-term debt, net, including $1,200 and

$1,255 measured at fair value, respectively

3,636

3,733

Obligations under tower obligations and

finance leases, excluding current portion

81

83

Long-term deferred revenue

77

65

Deferred income tax liabilities

2,255

2,216

Preferred stock

201

202

Other liabilities

139

141

Total liabilities

6,582

6,618

Equity

Series A common stock, $.01 par value.

Authorized 500,000,000 shares; issued and outstanding 18,235,286

and 18,233,573 at March 31, 2024 and December 31, 2023,

respectively

—

—

Series B common stock, $.01 par value.

Authorized 18,750,000 shares; issued and outstanding 2,023,432 and

2,025,232 at March 31, 2024 and December 31, 2023, respectively

—

—

Series C common stock, $.01 par value.

Authorized 500,000,000 shares; issued and outstanding 122,589,251

and 123,704,814 at March 31, 2024 and December 31, 2023,

respectively

1

1

Additional paid-in capital

3,018

3,107

Accumulated other comprehensive earnings

(loss), net of taxes

35

52

Retained earnings

6,084

5,843

Total stockholders' equity

9,138

9,003

Non-controlling interests

20

20

Total equity

9,158

9,023

Commitments and contingencies

Total liabilities and equity

$

15,740

15,641

LIBERTY BROADBAND

CORPORATION

CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS INFORMATION

(unaudited)

Three months ended

March 31,

2024

2023

amounts in millions,

except per share

amounts

Revenue

$

245

246

Operating costs and expenses:

Operating expense (exclusive of

depreciation and amortization shown separately below)

62

62

Selling, general and administrative,

including stock-based compensation

105

110

Depreciation and amortization

50

58

217

230

Operating income (loss)

28

16

Other income (expense):

Interest expense (including amortization

of deferred loan fees)

(51

)

(45

)

Share of earnings (losses) of

affiliate

280

248

Gain (loss) on dilution of investment in

affiliate

(28

)

(27

)

Realized and unrealized gains (losses) on

financial instruments, net

76

(114

)

Other, net

4

14

Earnings (loss) before income taxes

309

92

Income tax benefit (expense)

(68

)

(23

)

Net earnings (loss)

241

69

Less net earnings (loss) attributable to

the non-controlling interests

—

—

Net earnings (loss) attributable to

Liberty Broadband shareholders

$

241

69

Basic net earnings (loss) attributable to

Series A, Series B and Series C Liberty Broadband shareholders per

common share

$

1.69

0.47

Diluted net earnings (loss) attributable

to Series A, Series B and Series C Liberty Broadband shareholders

per common share

$

1.69

0.47

LIBERTY BROADBAND

CORPORATION

CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS INFORMATION

(unaudited)

Three months ended

March 31,

2024

2023

amounts in millions

Cash flows from operating activities:

Net earnings (loss)

$

241

69

Adjustments to reconcile net earnings

(loss) to net cash from operating activities:

Depreciation and amortization

50

58

Stock-based compensation

7

8

Share of (earnings) losses of affiliate,

net

(280

)

(248

)

(Gain) loss on dilution of investment in

affiliate

28

27

Realized and unrealized (gains) losses on

financial instruments, net

(76

)

114

Deferred income tax expense (benefit)

44

22

Other, net

(1

)

(1

)

Change in operating assets and

liabilities:

Current and other assets

39

(6

)

Payables and other liabilities

—

(2

)

Net cash provided by (used in) operating

activities

52

41

Cash flows from investing activities:

Capital expenditures

(61

)

(54

)

Grant proceeds received for capital

expenditures

15

—

Cash received for Charter shares

repurchased by Charter

81

42

Other investing activities, net

(17

)

—

Net cash provided by (used in) investing

activities

18

(12

)

Cash flows from financing activities:

Borrowings of debt

20

1,248

Repayments of debt, tower obligations and

finance leases

(62

)

(1,416

)

Repurchases of Liberty Broadband common

stock

(89

)

(40

)

Indemnification payment to Qurate

Retail

—

(24

)

Other financing activities, net

(1

)

(3

)

Net cash provided by (used in) financing

activities

(132

)

(235

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(62

)

(206

)

Cash, cash equivalents and restricted

cash, beginning of period

176

400

Cash, cash equivalents and restricted

cash, end of period

$

114

194

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507783975/en/

Liberty Broadband Corporation Shane Kleinstein, 720-875-5432

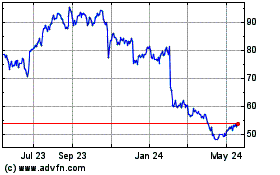

Liberty Broadband (NASDAQ:LBRDK)

Historical Stock Chart

From Oct 2024 to Nov 2024

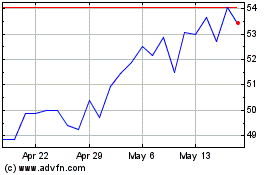

Liberty Broadband (NASDAQ:LBRDK)

Historical Stock Chart

From Nov 2023 to Nov 2024