Liquidia Corporation (NASDAQ: LQDA) (the “Company” or “Liquidia”),

a biopharmaceutical company developing innovative therapies for

patients with rare cardiopulmonary diseases, announced today the

pricing of an underwritten public offering and a concurrent private

placement, with anticipated total gross proceeds of approximately

$67.5 million, before deducting underwriting discounts and

commissions, and expenses.

The Company offered 6,460,674 shares of common stock in the

public offering at a price of $8.90 per share. In addition,

Liquidia entered into a common stock purchase agreement with funds

managed by Caligan Partners LP for the sale of 1,123,595 shares of

common stock at a purchase price of $8.90 per share in a private

placement exempt from the registration requirements of the

Securities Act of 1933, as amended (the “Securities Act”). The

closing of the public offering is not conditioned upon the closing

of the private placement, but the closing of the private placement

is conditioned upon the closing of the public offering. The public

offering and concurrent private placement are expected to close on

September 12, 2024, subject to other customary closing

conditions.

BofA Securities acted as the sole book-running manager for the

public offering, LifeSci Capital acted as lead manager for the

public offering and Needham & Company as co-manager for the

public offering.

Liquidia also announced today that the Company has entered into

a fifth amendment to the Revenue Interest Financing Agreement

(“RIFA”) with HealthCare Royalty (“HCRx”) to fund an additional

$32.5 million (the “Fifth Amendment”), subject to certain closing

conditions including the funding condition discussed further below.

With this amendment, HCRx will have invested the full $100 million

in non-dilutive capital as originally contemplated under the RIFA

entered in January 2023.

The Fifth Amendment proceeds, together with the public offering

and concurrent private placement proceeds aggregate to total gross

proceeds of approximately $100 million before deducting applicable

underwriting discounts, commissions, and expenses. Net proceeds

from the public offering, the concurrent private placement and the

Fifth Amendment are expected to fund ongoing commercial development

of YUTREPIA™ (treprostinil) inhalation powder for the potential

treatment of pulmonary arterial hypertension (PAH) and pulmonary

hypertension associated with interstitial lung disease (PH-ILD),

continued development of YUTREPIA in other clinical trials,

including but not limited to trials for pediatric patients and

trials further evaluating the use of YUTREPIA in WHO Group 1 and

WHO Group 3 patients, clinical development of L606 and for general

corporate purposes.

Michael Kaseta, Chief Financial Officer and Chief Operating

Officer of Liquidia, stated: “We are excited by HealthCare

Royalty’s continued commitment and confidence in our ability to

bring new treatment options to market for patients with rare

cardiopulmonary diseases. We believe we are financially

well-positioned to continue ongoing commercial development of

YUTREPIA in anticipation of potential final regulatory approval, to

progress development of YUTREPIA in other clinical trials like

ASCENT for PH-ILD, and to advance L606 (liposomal treprostinil)

inhalation suspension into a global pivotal study.”

Clarke Futch, Chairman and Chief Executive Officer of HCRx

added: “We view the recent grant of tentative approval of YUTREPIA

to treat both PAH and PH-ILD as a significant milestone for the

company. More importantly, we are confident in Liquidia’s potential

to address the needs of patients suffering from rare

cardiopulmonary diseases. We are excited to see how YUTREPIA may

help change the lives of patients upon final approval and launch

potentially in 2025.”

The Fifth Amendment to the RIFA moves the additional $32.5

million that was funded from the third and fourth tranches to the

second tranche such that, following the closing of the Fifth

Amendment and the funding of the remaining $32.5 million, HCRx will

have funded a total of $67.5 million under the second tranche and

each of the third and fourth tranches will be eliminated. As a

result, the Company will continue to pay HCRx on a fixed payment

schedule and will not change to a tiered royalty on the Company’s

annual net revenue after the first commercial sale of YUTREPIA. As

consideration for the additional invested amount, Liquidia has

agreed to a modified fixed payment schedule that extends expected

termination of the RIFA from 2029 to 2031. HCRx also agreed to

defer a one-time fixed payment of $23.8 million that was originally

due on July 30, 2025 into two equal payments due in January 2026

and July 2026. The aggregate payments to HCRx are capped at 175% of

the total amounts advanced by HCRx, but also include a potential

true-up payment to be made by Liquidia if HCRx’s internal rate of

return is less than a threshold value on the date the cap is

reached. The threshold value for the newly advanced funds is 16% as

compared to the 18% for the previously advanced funds. Funding of

the additional $32.5 million under the second tranche is

conditioned upon Liquidia receiving not less than $50.0 million in

aggregate gross proceeds from the sale of the Company’s common

stock in one or more transactions. Upon closing of the public

offering and concurrent private placement, this funding condition

will be satisfied. The closing of the public offering and

concurrent private placement are each subject to customary closing

conditions.

The shares of common stock in the public offering described

above were offered by Liquidia pursuant to its shelf registration

statement on Form S-3, including a base prospectus, that was

previously filed by Liquidia with the Securities and Exchange

Commission (the “SEC”) on December 22, 2023, and declared effective

by the SEC on January 3, 2024. The public offering was made by

means of a written prospectus and prospectus supplement that formed

part of the registration statement. A final prospectus supplement

and the accompanying prospectus relating to and describing the

terms of the public offering will be filed with the SEC and will be

available at the SEC’s website located at www.sec.gov. Copies of

the final prospectus supplement and the accompanying prospectus

relating to the offering may be obtained from BofA Securities,

Attention: Prospectus Department, NC1-022-02-25, 201 North Tryon

Street, Charlotte, North Carolina 28255, or via email:

dg.prospectus_requests@bofa.com.

The shares of common stock to be sold in the concurrent private

placement have not been registered under the Securities Act or

under any state securities laws and, unless so registered, may not

be offered or sold in the United States except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and applicable

state securities laws.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any offer, solicitation or sale of these securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.About

Liquidia CorporationLiquidia Corporation is a

biopharmaceutical company developing innovative therapies for

patients with rare cardiopulmonary diseases. The company’s current

focus spans the development and commercialization of products in

pulmonary hypertension and other applications of its proprietary

PRINT® Technology. PRINT enabled the creation of Liquidia’s lead

candidate, YUTREPIA™ (treprostinil) inhalation powder, an

investigational drug for the treatment of pulmonary arterial

hypertension (PAH) and pulmonary hypertension associated with

interstitial lung disease (PH-ILD). The company is also developing

L606, an investigational sustained-release formulation of

treprostinil administered twice-daily with a next-generation

nebulizer, and currently markets generic Treprostinil Injection for

the treatment of PAH.Tyvaso® and Tyvaso DPI® are registered

trademarks of United Therapeutics Corporation.About

YUTREPIA™(treprostinil) Inhalation PowderYUTREPIA is an

investigational, inhaled dry-powder formulation of treprostinil

delivered through a convenient, low-effort, palm-sized device.

YUTREPIA was designed using Liquidia’s PRINT® technology, which

enables the development of drug particles that are precise and

uniform in size, shape and composition, and that are engineered for

enhanced deposition in the lung following oral

inhalation. Liquidia has completed INSPIRE, or

Investigation of the Safety and Pharmacology of Dry Powder

Inhalation of Treprostinil, an open-label, multi-center phase 3

clinical study of YUTREPIA in patients diagnosed with PAH who are

naïve to inhaled treprostinil or who are transitioning from Tyvaso®

(nebulized treprostinil). YUTREPIA is currently being studied in

the ASCENT trial, an Open-Label Prospective Multicenter Study to

Evaluate Safety and Tolerability of Dry Powder Inhaled Treprostinil

in Pulmonary Hypertension, with the objective of informing

YUTREPIA’s dosing and tolerability profile in patients with PH-ILD.

YUTREPIA was previously referred to as LIQ861 in investigational

studies.Cautionary Statements Regarding Forward-Looking

StatementsThis press release may include forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements contained in this press release

other than statements of historical facts, including statements

regarding our future results of operations and financial position,

our strategic and financial initiatives, our business strategy and

plans and our objectives for future operations, are forward-looking

statements. Such forward-looking statements, include statements

regarding the closing of the public offering, the concurrent

private placement and the funding under the Fifth Amendment; the

intended use of proceeds from these transactions; our plans

regarding clinical trials, clinical studies and other clinical work

(including the funding therefor, anticipated patient enrollment,

safety data, study data, trial outcomes, timing or associated

costs), regulatory applications and related submission contents and

timelines, including the potential for final FDA approval of the

NDA for YUTREPIA; the potential for and timing of commercial launch

of YUTREPIA; the potential benefits of YUTREPIA for patients; and

our ability to execute on our strategic or financial initiatives;

involve significant risks and uncertainties and actual results

could differ materially from those expressed or implied herein. The

words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” “should,” “target,” “would,” and similar expressions are

intended to identify forward-looking statements. We have based

these forward-looking statements largely on our current

expectations and projections about future events and financial

trends that we believe may affect our financial condition, results

of operations, business strategy, short-term and long-term business

operations and objectives and financial needs. These

forward-looking statements are subject to a number of risks

discussed in our filings with the SEC, as well as a number of

uncertainties and assumptions. Moreover, we operate in a very

competitive and rapidly changing environment and our industry has

inherent risks. New risks emerge from time to time. It is not

possible for our management to predict all risks, nor can we assess

the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements we may make. In light of these risks, uncertainties and

assumptions, the future events discussed in this press release may

not occur and actual results could differ materially and adversely

from those anticipated or implied in the forward-looking

statements. Nothing in this press release should be regarded as a

representation by any person that these goals will be achieved, and

we undertake no duty to update our goals or to update or alter any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contact

Information Investors: Jason

Adair 919.328.4350 jason.adair@liquidia.com

Media: Patrick

Wallace 919.328.4383 patrick.wallace@liquidia.com

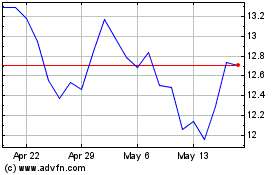

Liquidia (NASDAQ:LQDA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Liquidia (NASDAQ:LQDA)

Historical Stock Chart

From Feb 2024 to Feb 2025