false

0001629019

0001629019

2024-02-28

2024-02-28

0001629019

us-gaap:CommonStockMember

2024-02-28

2024-02-28

0001629019

us-gaap:SeriesAPreferredStockMember

2024-02-28

2024-02-28

0001629019

us-gaap:SeriesBPreferredStockMember

2024-02-28

2024-02-28

0001629019

us-gaap:SeriesCPreferredStockMember

2024-02-28

2024-02-28

0001629019

us-gaap:SeriesDPreferredStockMember

2024-02-28

2024-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United

States

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): February 28, 2024

Merchants Bancorp

(Exact Name of Registrant as Specified

in its Charter)

| Indiana |

|

001-38258 |

|

20-5747400 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

410 Monon Boulevard

Carmel, Indiana 46032

(Address of Principal Executive Offices) (Zip Code)

(317) 569-7420

(Registrant’s Telephone Number, Including

Area Code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, without par value |

MBIN |

NASDAQ |

| Series A Preferred Stock, without par value |

MBINP |

NASDAQ |

| Depositary Shares, each representing a 1/40th interest in a share of Series B Preferred Stock, without par value |

MBINO |

NASDAQ |

| Depositary

Shares, each representing a 1/40th interest in a share of Series C Preferred Stock, without par value |

MBINN |

NASDAQ |

| Depositary

Shares, each representing a 1/40th interest in a share of Series D Preferred Stock, without par value |

MBINM |

NASDAQ |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company |

¨ |

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

On February 28, 2024, Merchants Bancorp (“Merchants”)

issued a press release and provided notice to holders of its 7.00% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred

Stock (“Series A Preferred Stock”) that on April 1, 2024 Merchants will redeem all outstanding shares of Series A

Preferred Stock at the liquidation preference of $25.00 per share. A copy of the press release announcing the redemption is attached as

Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MERCHANTS BANCORP |

| |

|

|

| |

|

|

| Date: February 28, 2024 |

By: |

/s/ Terry Oznick |

| |

|

Name: Terry Oznick |

| |

|

Title: General Counsel and Secretary |

Exhibit 99.1

PRESS RELEASE

Merchants Bancorp

Announces Redemption of Its Series A Preferred Stock

For Release February 28, 2024

CARMEL, Ind. –

Merchants Bancorp (“Merchants”) (Nasdaq: MBIN) today announced that on April 1, 2024 it will redeem all outstanding shares

of its 7.00% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock (“Series A Preferred Stock”)

(Nasdaq: MBINP) at the liquidation preference of $25.00 per share.

Dividends on the Series A Preferred Stock of $0.4375 per share

that were declared and announced on February 14, 2024 will be paid separately on April 1, 2024. Accordingly, the redemption

price of the Series A Preferred Stock will not include any accrued and unpaid dividends. On and after the redemption date, all dividends

on the shares of Series A Preferred Stock will cease to accrue. Merchants will redeem the Series A Preferred Stock using cash

on hand.

Merchants has notified Nasdaq of its intention to voluntarily

delist the Series A Preferred Stock and a Notification of Removal from Listing on Form 25 will be

filed with the Securities and Exchange Commission on or prior to the redemption date. Merchants expects the delisting to become

effective on or about April 1, 2024, from which time the Series A Preferred Stock will no longer be traded on Nasdaq.

Merchants has received all necessary regulatory approvals to redeem

the Series A Preferred Stock. Payment of the redemption price for the Series A Preferred Stock will be sent to holders by the

Merchants’ transfer agent, Computershare Trust Company, N.A., on the redemption date.

About Merchants Bancorp

Ranked as a

top performing U.S. public bank by S&P Global Market Intelligence, Merchants Bancorp is a diversified bank holding company headquartered

in Carmel, Indiana operating multiple segments, including Multi-family Mortgage Banking that offers multi-family housing and healthcare

facility financing and servicing; Mortgage Warehousing that offers mortgage warehouse financing; and Banking that offers retail and correspondent

residential mortgage banking, agricultural lending, and traditional community banking. Merchants Bancorp, with $17.0 billion in

assets and $14.1 billion in deposits as of December 31, 2023, conducts its business primarily through its direct and indirect subsidiaries,

Merchants Bank of Indiana, Merchants Capital Corp., Merchants Capital Investments, LLC, Merchants Capital Servicing, LLC, Merchants Asset

Management, LLC, and Merchants Mortgage, a division of Merchants Bank of Indiana. For more information and financial data, please visit

Merchants' Investor Relations page at investors.merchantsbancorp.com.

Forward-Looking Statements

This press release contains forward-looking

statements which reflect management’s current views with respect to, among other things, future events and financial performance.

These statements are often, but not always, made through the use of words or phrases such as "may," "might," "should,"

"could," "predict," "potential," "believe," "expect," "continue," "will,"

"anticipate," "seek," "estimate," "intend," "plan," "projection," "goal,"

"target," "outlook," "aim," "would," "annualized" and "outlook," or the negative

version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are

not historical facts, and are based on current expectations, estimates and projections about the industry, management's beliefs and certain

assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, management

cautions that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, estimates

and uncertainties that are difficult to predict. Although Merchants believes that the expectations reflected in these forward-looking

statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied

by the forward-looking statements. A number of important factors could cause actual results to differ materially from those indicated

in these forward-looking statements, including the impacts of factors identified in "Risk Factors" or "Management's Discussion

and Analysis of Financial Condition and Results of Operations" in Merchants’ Annual Report on Form 10-K and other periodic

filings with the Securities and Exchange Commission. Any forward-looking statements presented herein are made only as of the date of this

press release, and Merchants does not undertake any obligation to update or revise any forward-looking statements to reflect changes in

assumptions, the occurrence of unanticipated events, or otherwise.

Media Contact: Rebecca Marsh

Merchants Bancorp

Phone: (317) 805-4356

Email: rmarsh@merchantsbankofindiana.com

Investor Contact: Tami Durle

Merchants Bancorp

Phone: (317) 324-4556

Email: tdurle@merchantsbankofindiana.com

v3.24.0.1

Cover

|

Feb. 28, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity File Number |

001-38258

|

| Entity Registrant Name |

Merchants Bancorp

|

| Entity Central Index Key |

0001629019

|

| Entity Tax Identification Number |

20-5747400

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity Address, Address Line One |

410 Monon Boulevard

|

| Entity Address, City or Town |

Carmel

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46032

|

| City Area Code |

317

|

| Local Phone Number |

569-7420

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, without par value

|

| Trading Symbol |

MBIN

|

| Security Exchange Name |

NASDAQ

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series A Preferred Stock, without par value

|

| Trading Symbol |

MBINP

|

| Security Exchange Name |

NASDAQ

|

| Series B Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, each representing a 1/40th interest in a share of Series B Preferred Stock, without par value

|

| Trading Symbol |

MBINO

|

| Security Exchange Name |

NASDAQ

|

| Series C Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary

Shares, each representing a 1/40th interest in a share of Series C Preferred Stock, without par value

|

| Trading Symbol |

MBINN

|

| Security Exchange Name |

NASDAQ

|

| Series D Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary

Shares, each representing a 1/40th interest in a share of Series D Preferred Stock, without par value

|

| Trading Symbol |

MBINM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesCPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

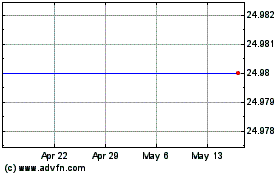

Merchants Bancorp (NASDAQ:MBINP)

Historical Stock Chart

From Apr 2024 to May 2024

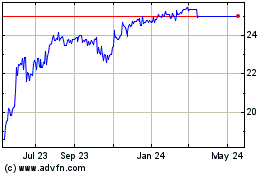

Merchants Bancorp (NASDAQ:MBINP)

Historical Stock Chart

From May 2023 to May 2024