Form 424B3 - Prospectus [Rule 424(b)(3)]

15 October 2024 - 11:40PM

Edgar (US Regulatory)

Filed

pursuant to 424(b)(3)

Registration

Statement No. 333-280113

PROSPECTUS

SUPPLEMENT NO. 7

(To

Prospectus dated July 3, 2024)

Microbot

Medical Inc.

3,211,671

Shares of Common Stock

This

prospectus supplement (this “Prospectus Supplement”) is being filed to update and supplement our prospectus dated July 3,

2024, as supplemented (the “Prospectus”), relating to the resale or other disposition of up to 3,211,671 shares of our common

stock, $0.01 par value per share, by the selling stockholders named in the Prospectus, including their transferees, pledgees, donees

or successors, that may be issued upon the exercise of outstanding preferred investment options held by the selling stockholders.

Specifically,

this Prospectus Supplement is being filed to update and supplement the information included in the Prospectus with certain information

reported by us with the Securities and Exchange Commission. Accordingly, we have included such information in this Prospectus Supplement

below. Any statement contained in the Prospectus shall be deemed to be modified or superseded to the extent that information in this

Prospectus Supplement modifies or supersedes such statement.

Capitalized

terms used but not defined herein have the meanings ascribed to them in the Prospectus.

This

Prospectus Supplement is not complete without, and may not be utilized except in connection with, the Prospectus, including any supplements

and amendments thereto.

We

may further amend or supplement the Prospectus and this Prospectus Supplement from time to time by filing amendments or supplements as

required. You should read the entire Prospectus, this Prospectus Supplement and any amendments or supplements carefully before you make

your investment decision.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “MBOT”. On October 11, 2024, the closing price of our

common stock was $0.9836.

Investing

in our common stock involves significant risks. You should read the section entitled “Risk Factors” beginning on page 11

of the Prospectus for a discussion of certain risk factors that you should consider before investing in our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this Prospectus Supplement is October 15, 2024

Status

of ACCESS-PVI Human Clinical Trial

The

Company has successfully completed enrollment and follow up for all patients in its ACCESS-PVI human clinical trial. The Company remains

on track to file its 510(k) submission with the U.S. Food and Drug Administration (FDA) by of the end of 2024.

The

Company also is accelerating its go-to-market strategy. It expects to begin building out the commercial infrastructure, including the

hiring of a seasoned healthcare executive to lead its sales efforts, upon the FDA clearance, which is expected during the second quarter

of 2025.

Nasdaq

Letter

On

October 9, 2024, we received a deficiency letter from the Nasdaq Listing Qualifications department (the “Staff”) of The Nasdaq

Stock Market, LLC (“Nasdaq”), notifying us that we are not in compliance with Nasdaq Listing Rule 5550(a)(2) (the “Minimum

Bid Price Requirement”) for continued listing on the Nasdaq Capital Market, as the minimum bid price of our common stock on the

Nasdaq Capital Market was below $1.00 for 30 consecutive business days, from August 26, 2024 to October 7, 2024.

In

accordance with Nasdaq Listing Rule 5810(c)(3)(A) (the “Compliance Period Rule”), we have a period of 180 calendar days,

or until April 7, 2025 (the “Compliance Date”), to regain compliance with the Minimum Bid Price Requirement. If, at any time

before the Compliance Date, the closing bid price of our common stock is at least $1.00 for a minimum of ten consecutive business days,

the Staff will provide a written confirmation to us that we have regained compliance with the Minimum Bid Price Requirement.

If

we do not regain compliance with the Minimum Bid Price Requirement by the Compliance Date, we may be eligible for additional time. To

qualify, we will be required to meet the continued listing requirement for market value of publicly held shares and all other initial

listing standards for The Nasdaq Capital Market, with the exception of the Minimum Bid Price Requirement, and will need to provide written

notice of our intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary.

If we meet these requirements, Nasdaq will inform us that we have been granted an additional 180 calendar days. However, if it appears

to Nasdaq that we will not be able to cure the deficiency, or if we are otherwise not eligible, Nasdaq will provide notice that our securities

will be subject to delisting. At that time, we may appeal the Staff’s delisting determination to a Nasdaq Listing Qualifications

Panel (the “Panel”) pursuant to the procedures set forth in the applicable Nasdaq Listing Rules. However, there can be no

assurance that, if we receive a delisting notice and appeals the delisting determination by the Staff to the Panel, such appeal would

be successful.

Additionally,

there can be no assurance that we will be able to regain compliance with the Minimum Bid Price Requirement, or will otherwise be compliant

with other Nasdaq Listing Rules.

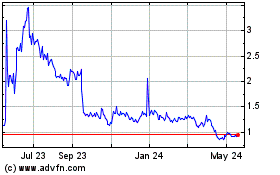

Microbot Medical (NASDAQ:MBOT)

Historical Stock Chart

From Nov 2024 to Dec 2024

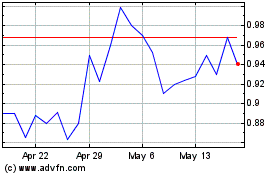

Microbot Medical (NASDAQ:MBOT)

Historical Stock Chart

From Dec 2023 to Dec 2024