Singing Machine Announces Results of Operations for First Quarter of Fiscal 2024

19 August 2023 - 6:05AM

The Singing Machine Company, Inc.

(“Singing Machine” or the

“Company”) (NASDAQ:

MICS) -- the

worldwide leader in consumer karaoke products -- today released its

results of operations for the three months ended June 30, 2023.

Financial highlights are as follows:

- Revenues for the three months ended

June 30, 2023 were $2.6 million, as compared to $11.7 million for

the same period in the prior year. The $9.1 million decrease was

largely due to the distortive effects of $6.7 million in purchase

orders from Walmart and Sam’s Club in the first quarter of the

prior year.

- These orders were in part due to

the launch of Singing Machine products in the Walmart Consumer

Electronics department in mid-2022, and a direct import shipment

that accelerated revenues normally booked in the second quarter

into the tail end of our first quarter of fiscal 2022. Overall,

first quarter of fiscal 2024 sales were consistent with the

Company’s historical record for customer purchases.

- Gross margins improved to 32.3% for

the first quarter of fiscal 2024, as compared to 27.2% for the same

period in the prior year. The improvement was largely the result of

more sales of higher margin products and efficiencies in shipping

that resulted in slightly lower overall shipping expenses.

- Operating expenses were $3.3

million for the three months ended June 30, 2023, as compared to

$3.0 million for the same period in the prior year. The increase

was almost entirely due to a $0.3 million one-time expense relating

to the closure of the Company’s logistics facility in Ontario, CA.

The Company has migrated to an outsourced third-party logistics

warehouse that is expected to covert fixed annual overhead expenses

to variable expenses and help insulate the Company from rising

occupancy and labor costs in the southern California market.

- The Company maintained a strong

balance sheet with $8.6 million in working capital as of June 30,

2023. Cash on hand was $1.9 million, and additional $2.0 million

was available under a revolving credit agreement as of June 30,

2023.

Management Commentary:

Gary Atkinson, Singing Machine’s Chief Executive

Officer, commented, “During this first quarter we saw our

supply-chain normalizing back to pre-pandemic levels. Due to the

improvement in production and transportation lead-times we are

seeing a timing shift from our retail partners back to just-in-time

ordering. We believe this will produce more accurate buying

commitments from our retail partners which we anticipate will lower

the need to provide markdown incentives or other frictional costs

that detract from sales and gross margins.”

“In contrast, during the same period last year,

supply chain interruptions resulted in extended lead-times, forcing

retailers to accelerate their order timing to ship earlier during

our first quarter. Additionally, during the same quarter last year,

we celebrated opening a new major department within Walmart stores

which resulted in a heavy front loading of inventory to set all of

the stores.”

Atkinson continued, “Despite the timing of

shipments returning to the traditional second fiscal quarter, our

view on the upcoming holiday retail season remains optimistic. All

of our existing retail customers have committed to karaoke programs

for this holiday season and we will be launching at least five new,

innovative karaoke products this fall. We are generally pleased

with the purchase orders received and the timing and schedule of

delivery for product shipments.”

Earnings Call Information:

The Company will host a conference call today,

Friday, August 18, 2023, beginning at 5:00 PM Eastern time to

discuss these results and answer questions. If you would like to

participate on the call, please dial (800) 225-9448 and use

conference ID: MICS.

About The Singing Machine

The Singing Machine Company, Inc. (NASDAQ: MICS)

is the worldwide leader in consumer karaoke products. Based in Fort

Lauderdale, Florida, and founded over forty years ago, the Company

designs and distributes the industry's widest assortment of at-home

and in-car karaoke entertainment products. Their portfolio is

marketed under both proprietary brands and popular licenses,

including Carpool Karaoke and Sesame Street. Singing Machine

products incorporate the latest technology and provide access to

over 100,000 songs for streaming through its mobile app and select

WiFi-capable products and is also developing the world’s first

globally available, fully integrated in-car karaoke system. The

Company also has a new philanthropic initiative, CARE-eoke by

Singing Machine, to focus on the social impact of karaoke for

children and adults of all ages who would benefit from singing.

Their products are sold in over 25,000 locations worldwide,

including Amazon, Costco, Sam’s Club, Target, and Walmart. To learn

more, go to www.singingmachine.com.

Investor Relations

Contact:investors@singingmachine.comwww.singingmachine.comwww.singingmachine.com/investors

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Words such as "may", "could", "expects", "projects,"

"intends", "plans", "believes", "predicts", "anticipates", "hopes",

"estimates" and variations of such words and similar expressions

are intended to identify forward-looking statements. These

statements involve known and unknown risks and are based upon

several assumptions and estimates, which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the Company's control. Actual results may differ materially

from those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially

include, but are not limited to, the risk factors described in the

Company's filings with the Securities and Exchange Commission. The

forward-looking statements are applicable only as of the date on

which they are made, and the Company does not assume any obligation

to update any forward-looking statements.

The Singing Machine Company,

Inc. and

SubsidiariesCONDENSED CONSOLIDATED BALANCE

SHEETS

|

|

|

June 30, 2023 |

|

|

March 31, 2023 |

|

|

|

|

(unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

1,890,014 |

|

|

$ |

2,894,574 |

|

|

Accounts receivable, net of allowances of $146,315 and $165,986,

respectively |

|

|

713,152 |

|

|

|

2,075,086 |

|

|

Accounts receivable related party - Stingray Group, Inc. |

|

|

174,853 |

|

|

|

218,328 |

|

|

Accounts receivable related party - Ault Alliance, Inc. |

|

|

20,750 |

|

|

|

20,750 |

|

|

|

|

|

|

|

|

|

|

|

|

Inventories, net |

|

|

10,607,610 |

|

|

|

9,639,992 |

|

|

Prepaid expenses and other current assets |

|

|

473,277 |

|

|

|

266,068 |

|

|

Deferred financing costs |

|

|

84,667 |

|

|

|

84,667 |

|

|

Total Current Assets |

|

|

13,964,323 |

|

|

|

15,199,465 |

|

| |

|

|

|

|

|

|

|

|

| Property and

equipment, net |

|

|

492,253 |

|

|

|

633,207 |

|

| Deferred financing

costs, net of current portion |

|

|

109,361 |

|

|

|

130,528 |

|

| Operating leases -

right of use assets |

|

|

331,878 |

|

|

|

561,185 |

|

| Other non-current

assets |

|

|

124,201 |

|

|

|

124,212 |

|

|

Total Assets |

|

$ |

15,022,016 |

|

|

$ |

16,648,597 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,644,691 |

|

|

$ |

1,769,348 |

|

|

Accrued expenses |

|

|

1,294,794 |

|

|

|

2,265,424 |

|

|

Refunds due to customers |

|

|

670,699 |

|

|

|

583,323 |

|

|

Reserve for sales returns |

|

|

331,754 |

|

|

|

900,000 |

|

|

Current portion of finance leases |

|

|

18,531 |

|

|

|

18,162 |

|

|

Current portion of installment notes |

|

|

82,506 |

|

|

|

80,795 |

|

|

Current portion of operating lease liabilities |

|

|

277,733 |

|

|

|

508,515 |

|

|

Total Current Liabilities |

|

|

5,320,708 |

|

|

|

6,125,567 |

|

| |

|

|

|

|

|

|

|

|

| Finance leases, net of

current portion |

|

|

41,369 |

|

|

|

46,142 |

|

| Installment notes, net

of current portion |

|

|

36,575 |

|

|

|

57,855 |

|

| Operating lease

liabilities, net of current portion |

|

|

78,809 |

|

|

|

87,988 |

|

|

Total Liabilities |

|

|

5,477,461 |

|

|

|

6,317,552 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders’

Equity |

|

|

|

|

|

|

|

|

|

Preferred stock, $1.00 par value; 1,000,000 shares authorized; no

shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock $0.01 par value; 100,000,000 shares authorized;

4,220,259 and 3,184,439 shares issued, 4,220,259 and 3,167,489

shares outstanding, respectively |

|

|

42,203 |

|

|

|

31,675 |

|

|

Additional paid-in capital |

|

|

31,478,977 |

|

|

|

29,822,205 |

|

|

Subscriptions receivable |

|

|

- |

|

|

|

(5,891 |

) |

|

Accumulated deficit |

|

|

(21,976,625 |

) |

|

|

(19,516,944 |

) |

|

Total Shareholders’ Equity |

|

|

9,544,555 |

|

|

|

10,331,045 |

|

|

Total Liabilities and Shareholders’ Equity |

|

$ |

15,022,016 |

|

|

$ |

16,648,597 |

|

See notes to the condensed consolidated

financial statements

The Singing Machine Company,

Inc. and

SubsidiariesCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)

|

|

|

For the Three Months Ended |

|

|

|

|

June 30, 2023 |

|

|

June 30, 2022 |

|

| |

|

|

|

|

|

|

| Net

Sales |

|

$ |

2,625,003 |

|

|

$ |

11,692,054 |

|

| |

|

|

|

|

|

|

|

|

| Cost of Goods

Sold |

|

|

1,776,153 |

|

|

|

8,511,524 |

|

| |

|

|

|

|

|

|

|

|

| Gross

Profit |

|

|

848,850 |

|

|

|

3,180,530 |

|

| |

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

445,274 |

|

|

|

605,197 |

|

|

General and administrative expenses |

|

|

2,650,858 |

|

|

|

2,370,424 |

|

|

Depreciation |

|

|

183,454 |

|

|

|

58,067 |

|

| Total Operating

Expenses |

|

|

3,279,586 |

|

|

|

3,033,688 |

|

| |

|

|

|

|

|

|

|

|

| (Loss) Income from

Operations |

|

|

(2,430,736 |

) |

|

|

146,842 |

|

| |

|

|

|

|

|

|

|

|

| Other

Expenses |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(7,778 |

) |

|

|

(160,113 |

) |

|

Finance costs |

|

|

(21,167 |

) |

|

|

(7,813 |

) |

| Total Other

Expenses |

|

|

(28,945 |

) |

|

|

(167,926 |

) |

| |

|

|

|

|

|

|

|

|

| Loss Before Income Tax

Benefit |

|

|

(2,459,681 |

) |

|

|

(21,084 |

) |

| |

|

|

|

|

|

|

|

|

| Income Tax

Benefit |

|

|

- |

|

|

|

5,081 |

|

| |

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(2,459,681 |

) |

|

$ |

(16,003 |

) |

| |

|

|

|

|

|

|

|

|

| Net Loss per Common

Share |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

$ |

(0.64 |

) |

|

$ |

(0.01 |

) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Weighted Average

Common and Common Equivalent Shares: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

3,872,447 |

|

|

|

1,911,485 |

|

|

|

|

|

|

|

|

|

|

|

See notes to the condensed consolidated

financial statements

The Singing Machine Company,

Inc. and

SubsidiariesCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(Unaudited)

|

|

|

For the Three Months Ended |

|

|

|

|

June 30, 2023 |

|

|

June 30, 2022 |

|

| |

|

|

|

|

|

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

|

Net Loss |

|

$ |

(2,459,681 |

) |

|

$ |

(16,003 |

) |

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

183,454 |

|

|

|

58,067 |

|

|

Amortization of deferred financing costs |

|

|

21,167 |

|

|

|

7,813 |

|

|

Change in inventory reserve |

|

|

132,386 |

|

|

|

- |

|

|

Change in allowance for bad debts |

|

|

(19,671 |

) |

|

|

138,237 |

|

|

Stock based compensation |

|

|

63,406 |

|

|

|

35,565 |

|

|

Change in net deferred tax assets |

|

|

- |

|

|

|

(5,081 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

1,381,605 |

|

|

|

(7,001,987 |

) |

|

Due from banks |

|

|

- |

|

|

|

(340,810 |

) |

|

Accounts receivable - related parties |

|

|

43,475 |

|

|

|

(90,043 |

) |

|

Inventories |

|

|

(1,100,004 |

) |

|

|

1,205,145 |

|

|

Prepaid expenses and other current assets |

|

|

(207,209 |

) |

|

|

113,473 |

|

|

Other non-current assets |

|

|

11 |

|

|

|

3,032 |

|

|

Accounts payable |

|

|

875,343 |

|

|

|

1,390,942 |

|

|

Accrued expenses |

|

|

(970,630 |

) |

|

|

447,566 |

|

|

Refunds due to customers |

|

|

87,376 |

|

|

|

16,034 |

|

|

Reserve for sales returns |

|

|

(568,246 |

) |

|

|

(108,341 |

) |

|

Operating lease liabilities, net of operating leases - right of use

assets |

|

|

(10,654 |

) |

|

|

(2,913 |

) |

|

Net cash used in operating activities |

|

|

(2,547,872 |

) |

|

|

(4,149,304 |

) |

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(42,500 |

) |

|

|

(21,801 |

) |

|

Net cash used in investing activities |

|

|

(42,500 |

) |

|

|

(21,801 |

) |

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of stock - net of transaction expenses |

|

|

1,603,894 |

|

|

|

3,362,750 |

|

|

Collection of subscriptions receivable |

|

|

5,891 |

|

|

|

- |

|

|

Payments on installment notes |

|

|

(19,569 |

) |

|

|

(17,995 |

) |

|

Proceeds from exercise of common stock warrants |

|

|

- |

|

|

|

647,422 |

|

|

Proceeds from exercise of pre-funded warrants |

|

|

- |

|

|

|

168,334 |

|

|

Payments on finance leases |

|

|

(4,404 |

) |

|

|

(1,832 |

) |

|

Net cash provided by financing activities |

|

|

1,585,812 |

|

|

|

4,158,679 |

|

| Net change in

cash |

|

|

(1,004,560 |

) |

|

|

(12,426 |

) |

| |

|

|

|

|

|

|

|

|

| Cash at beginning of

period |

|

|

2,894,574 |

|

|

|

2,290,483 |

|

| Cash at end of

period |

|

$ |

1,890,014 |

|

|

$ |

2,278,057 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

6,280 |

|

|

$ |

158,490 |

|

See notes to the condensed consolidated

financial statements

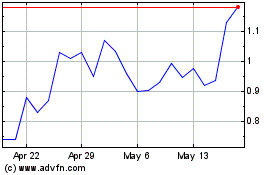

Singing Machine (NASDAQ:MICS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Singing Machine (NASDAQ:MICS)

Historical Stock Chart

From Feb 2024 to Feb 2025