Current Report Filing (8-k)

28 June 2023 - 6:32AM

Edgar (US Regulatory)

0001847440

false

0001847440

2023-06-21

2023-06-21

0001847440

dei:FormerAddressMember

2023-06-21

2023-06-21

0001847440

mita:UnitseachconsistingofoneclassAordinaryshareandonethirdofwarrantMember

2023-06-21

2023-06-21

0001847440

mita:ClassAordinarysharesMember

2023-06-21

2023-06-21

0001847440

mita:RedeemablewarrantseachwholewarrantexercisableforoneClassAordinaryshareMember

2023-06-21

2023-06-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 21, 2023

Coliseum Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-40514 |

|

98-1583230 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1180 North Town Center Drive, Suite 100

Las Vegas, NV 89144

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (702) 781-4313

80 Pine Street, Suite 3202

New York, New York

10005

(Former name or former address,

if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each

exchange on which

registered |

| |

|

|

|

|

| Units, each consisting of one Class A ordinary share, par value $0.001 per share, and one-third of one redeemable warrant |

|

MITAU |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Class A ordinary shares, par value $0.001 per share |

|

MITA |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

MITAW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Introductory Note

As previously disclosed, on

June 15, 2023, Coliseum Acquisition Corp., a Cayman islands exempted company (the “Company”), Coliseum Acquisition Sponsor

LLC (“Sponsor”) and Berto LLC, an affiliate of Harry L. You (the “Acquirer”), entered into a Purchase Agreement

(the “Purchase Agreement”) pursuant to which Sponsor agreed to sell to Acquirer, and Acquirer agreed to purchase from Sponsor

an aggregate of (i) 2,625,000 Class B ordinary shares, $0.001 par value per share, of the Company (the “Class B ordinary

shares”) and (ii) 2,257,500 private placement warrants of the Company (the “Private Placement Warrants”) held by

Sponsor (collectively, the “Transferred Securities”) for an aggregate purchase price (the “Purchase Price”) of

$1.00 plus Acquirer’s agreement to advance funds to the Company in connection with the shareholder vote to approve the Extension

(as defined below) (the “Transaction”).

On June 26, 2023 (the

“Closing Date”), Mr. You paid the Purchase Price for the Transferred Securities and the Transaction was completed (the “Closing”).

The

foregoing description of the Transaction does not purport to be complete and is qualified in its entirety by the full text of the Purchase

Agreement, which was attached as Exhibit 10.1 to the Current Report on Form 8-K filed by the Company on June 15, 2023,

and which is incorporated herein by reference.

Item 1.01 Entry into a Material Definitive

Agreement.

Amendment to the Investment

Management Trust Agreement

On

June 21, 2023, the Company entered into Amendment No. 1 (the “Amendment”) to the Investment Management Trust Agreement

(the “IMTA”) with Continental Stock Transfer & Trust Company, as trustee (the “Trustee”). Pursuant to

the Amendment, Section 1(c) of the IMTA was amended to provide that the Trustee may, at the direction of the Company (i) hold

funds uninvested, (ii) hold funds in an interest-bearing bank demand deposit account, or (iii) invest and reinvest the Property

in solely United States government securities within the meaning of Section 2(a)(16) of the Investment Company Act of 1940, as amended,

having a maturity of 185 days or less, or in money market funds meeting the conditions of paragraphs (d)(1), (d)(2), (d)(3) and (d)(4) of

Rule 2a-7 promulgated under the Investment Company Act of 1940, as amended (or any successor rule), which invest only in direct U.S.

government treasury obligations.

Promissory Note

As

disclosed in the definitive proxy statement dated June 7, 2023 (as supplemented by the proxy supplement dated June 14, 2023,

the “Proxy Statement”), relating to the Company’s extraordinary general meeting, Sponsor agreed that if the proposal

to amend the Company’s amended and restated memorandum and articles of association (“Articles”) to extend (the “Extension”)

the date by which the Company has to consummate a business combination up to twelve (12) times for an additional one (1) month each

time (each, an “Extension Period”) from June 25, 2023 up to June 25, 2024 was approved, Sponsor or its designee

would deposit (the “Contribution”) into the trust account established in connection with the Company’s initial public

offering (the “Trust Account”) as a loan, an amount equal to the lesser of (x) $100,000 or (y) $0.04 per public

share multiplied by the number of public shares of the Company that were not redeemed in connection with the shareholder vote to approve

the Extension, for each month of the Extension Period elected by the Company’s board of directors.

As

previously disclosed, the Company’s shareholders approved the Extension on June 22, 2023 and an aggregate of 9,121,799 public

shares were validly tendered for redemption, leaving an aggregate of 5,878,201 public shares outstanding. The Company’s board of

directors has elected to effect the first Extension Period, extending the Company’s liquidation date to July 25, 2023. Accordingly,

the Sponsor or its designee must deposit $100,000 into the Trust Account for the first Extension Period. Pursuant to the Purchase Agreement,

the Sponsor designated Acquirer as its designee to make the Contribution, and Acquirer agreed to make the Contribution subject to consummation

of the Transaction.

On

June 23, 2023, Acquirer advanced $100,000 to the Company for the first Extension Period.

In connection with the Contribution

and advances Acquirer may make in the future to the Company for working capital expenses, on June 22, 2023, the Company issued a

convertible promissory note to Acquirer with a principal amount up to $1.5 million (the “Note”). The Note bears no interest

and is repayable in full upon the earlier of (a) the date of the consummation of the Company’s initial business combination,

or (b) the date of the Company’s liquidation. If the Company does not consummate an initial business combination by the end

of the Extension Period, the Note will be repaid only from funds held outside of the Trust Account or will be forfeited, eliminated or

otherwise forgiven. Upon the consummation of the Company’s initial business combination, the outstanding principal of the Note may

be converted into warrants, at a price of $1.50 per warrant, at the option of Acquirer. Such warrants will have terms identical to the

warrants issued to the Sponsor in a private placement that closed simultaneously with the Company’s initial public offering.

The

foregoing descriptions of the Amendment and the Note are qualified in their entirety by reference to the text of the Amendment and the

Note, copies of which are attached as Exhibit 10.1 and 10.2 hereto and are incorporated herein by reference.

Item 1.02 Termination of a Material Definitive

Agreement.

In connection with the Closing,

on June 26, 2023, the Company entered into a termination agreement (the “Termination Agreement”), pursuant to which the

Company terminated the Administrative Services Agreement with SC Management LLC dated June 22, 2021 and SC Management LLC forgave

and fully discharged all outstanding fees thereunder as of the date of the Closing.

The foregoing description

of the Termination Agreement is not complete and is qualified in its entirety by reference to the text of the Termination Agreement, which

is filed hereto as Exhibit 10.3 and which is incorporated herein by reference.

Item 2.03 Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

disclosure contained in Item 1.01 of this Current Report on Form 8-K with respect to the Note is incorporated by reference in this

Item 2.03.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Pursuant to the Purchase Agreement,

effective June 26, 2023, (i) Jason Stein and Daniel Haimovic resigned as Co-Chief Executive Officers of the Company, (ii) Jason

Beren resigned as the Company’s Chief Financial Officer, and (iii) Andrew Fishkoff resigned as the Company’s Chief Operating

Officer and General Counsel. Effective June 26, 2023, Harry L. You was appointed Chief Executive Officer and Chief Financial Officer

of the Company.

Additionally, pursuant to

the Purchase Agreement, the Company’s current independent directors, Andrew Heyer, Ezra Kucharz, Jim Lanzone, Rich Paul, and Romita

Mally, have tendered their resignations from the board of directors as well as from each committee of the board of directors on which

he or she currently serves, to be effective as of the later of (i) ten days after the Closing Date, or (ii) the Company’s

acceptance of such resignation.

In

connection with the Closing, Mr. You entered into an indemnification agreement with the Company on substantially the same terms as

the forms of indemnification agreement previously entered into by and between the Company and each of its other officers and directors

in connection with the Company’s initial public offering. The form of the Company’s standard indemnification agreement is

included as Exhibit 10.7 to the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission

on June 28, 2021.

Harry

L. You, 64, has served as Co-Chief Executive Officer of dMY Squared Technology

Group (“dMY Squared”) since March 2022. He was Chief Financial Officer from September 2016 to August 2019 and President in

May 2019 and from September 2016 to February 2019 of GTY Technology Holdings Inc. (“GTY”), a software as a service company

that offers cloud-based solutions for the public sector. He was Executive Vice President in the Office of the Chairman of EMC Corporation

(“EMC”) from 2008 to 2016. When Mr. You joined EMC in 2008, he oversaw corporate strategy and new business development, including

mergers and acquisitions, joint ventures and venture capital activity. He was Chief Executive Officer from 2005 to 2007 and Interim Chief

Financial Officer from 2005 to 2006 of BearingPoint Inc. He was Executive Vice President and Chief Financial Officer of Oracle Corporation

from 2004 to 2005. Prior to joining Oracle, he held several key positions in finance, including as Chief Financial Officer of Accenture

Ltd. and managing director in the Investment Banking Division of Morgan Stanley. He has also served as a trustee of the U.S. Olympic Committee

Foundation since 2016.

Mr.

You currently serves as a director of IonQ, Inc. Mr. You is also Chairman of the board of dMY Technology Group, Inc.

VI and dMY Squared, each a special purpose acquisition company.

Mr.

You served as Vice Chairman of the board of GTY from February 2019 to July 2022 and as director of Coupang, Inc. from January 2021

to June 2023, Genius Sports Limited from April 2021

to December 2022, Rush Street Interactive, Inc. from September 2019 to June 2022, dMY Technology Group, Inc. II (a special purpose acquisition

company) from June 2020 to April 2021, dMY Technology Group, Inc. IV (a special purpose acquisition company) from December 2020 to December

2021, and Korn/Ferry International from 2005 to 2016.

Item 8.01 Other Events.

Amendment to Articles

As

previously disclosed, on June 22, 2023, the Company’s shareholders approved a series of amendments to the Company’s Articles

to (i) extend the date by which the Company has to consummate a business combination up to twelve (12) times for an additional one

(1) month each time, from June 25, 2023 to June 25, 2024, (ii) remove the net tangible asset requirement from the

Articles in order to expand the methods that the Company may employ so as not to become subject to the “penny stock” rules of

the Securities and Exchange Commission, and (iii) provide for the right of a holder of Class B ordinary shares to convert such

shares into Class A ordinary shares on a one-for-one basis at any time and from time to time prior to the closing of a business combination

at the election of the holder (collectively, the “Articles Amendment”). The Company filed the Articles Amendment with the

Registrar of the Cayman Islands on June 22, 2023.

The

foregoing description of the Articles Amendment is qualified in its entirety by the full text of each of the Articles Amendment, which

is filed as Exhibit 3.1 hereto and is incorporated herein by reference.

Class B Share Conversion

Immediately

prior to and in connection with the Closing, the Sponsor elected to convert an aggregate of 3,749,999 Class B ordinary shares on

a one for one basis into Class A ordinary shares, par value $0.0001 per share of the Company (“Class A ordinary shares”).

Following such conversions, the Company had an aggregate of 9,628,200 Class A ordinary shares and 1 Class B ordinary share issued

and outstanding.

Joinder Agreements

Pursuant

to the Purchase Agreement, on June 26, 2023, Acquirer and Mr. You entered into joinders to the letter agreement and registration

rights agreement previously into by and between the Company and the Sponsor in connection with the Company’s initial public offering,

pursuant to which Acquirer and Mr. You will be bound by all terms, conditions, and covenants and be entitled to all of the rights, benefits,

and privileges of the letter agreement and registration right agreement as if Acquirer and Mr. You were original parties thereto. The

forms of the Company’s standard letter agreement and registration rights agreement are included as Exhibits 10.1 and 10.3, respectively,

to the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission on June 28, 2021.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are

being filed herewith:

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Coliseum Acquisition Corp. |

| |

|

|

| |

By: |

/s/ Harry L. You |

| |

|

Name: |

Harry L. You |

| |

|

Title: |

Chief Executive Officer and Chief Financial Officer |

| |

|

|

| Dated: June 27, 2023 |

|

|

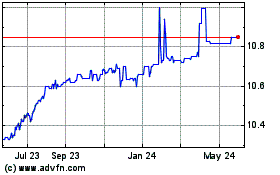

Coliseum Acquisition (NASDAQ:MITA)

Historical Stock Chart

From Jan 2025 to Feb 2025

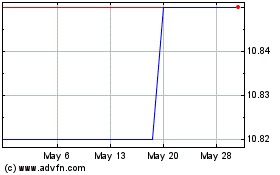

Coliseum Acquisition (NASDAQ:MITA)

Historical Stock Chart

From Feb 2024 to Feb 2025