0001176334False00011763342025-02-112025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): February 11, 2025

MARTIN MIDSTREAM PARTNERS L.P.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 000-50056

| | 05-0527861

|

(State of incorporation or organization) | (Commission file number) | (I.R.S. employer identification number) |

| 4200 Stone Road | | |

| | |

Kilgore, Texas 75662

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (903) 983-6200

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

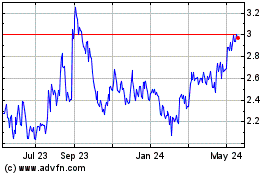

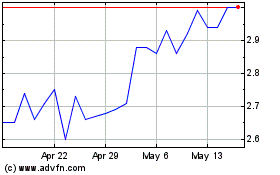

| Common Units representing limited partnership interests | MMLP | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act. o

| | | | | | | | |

| Item 1.01 | | Entry into a Material Definitive Agreement. |

On February 13, 2025, Martin Operating Partnership L.P. (the “Operating Partnership”), a wholly owned subsidiary of Martin Midstream Partners L.P. (the “Partnership”), the Partnership and certain of the Partnership’s other subsidiaries entered into a First Amendment to Fourth Amended and Restated Credit Agreement (the “First Amendment”) with Royal Bank of Canada, as administrative agent and collateral agent, and the lenders party thereto, which amends the Fourth Amended and Restated Credit Agreement, dated effective as of February 8, 2023 (the “Credit Agreement”).

The First Amendment amended the Credit Agreement to require the Operating Partnership to maintain, among other things:

•a minimum Interest Coverage Ratio (as defined in the Credit Agreement) of at least 2.00:1.00 for the fiscal quarter ended December 31, 2024, stepping down to 1.75:1.00 for the fiscal quarters ending March 31, 2025, June 30, 2025 and September 30, 2025, and stepping back up to 2.00:1.00 for the fiscal quarter ending December 31, 2025 and each fiscal quarter thereafter; and

•a maximum First Lien Leverage Ratio (as defined in the Credit Agreement) of not more than 1.50:1.00 for the fiscal quarter ended December 31, 2024, stepping down to 1.25:1.00 for the fiscal quarters ending March 31, 2025, June 30, 2025 and September 30, 2025, and stepping back up to 1.50:1.00 for the fiscal quarter ending December 31, 2025 and each fiscal quarter thereafter.

The foregoing description of the First Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the First Amendment, a copy of which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

| | | | | | | | |

| Item 2.03 | | Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth above in Item 1.01 regarding the First Amendment is incorporated by reference into this Item 2.03.

| | | | | | | | |

| Item 5.02 | | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On February 11, 2025, the board of directors and the compensation committee of the board of directors of Martin Midstream GP LLC, the general partner of the Partnership, approved the Martin Midstream Partners L.P. 2025 Phantom Unit Plan (the “Plan”), effective as of the same date. The Plan permits the awards of phantom units and phantom unit appreciation rights to any employee or non-employee director of the Partnership, including its executive officers. The awards may be time-based or performance-based and will be paid, if at all, in cash.

The award of a phantom unit entitles the participant to a cash payment equal to the value of the phantom unit on the vesting date or dates, which value is the fair market value of a common unit of the Partnership (a “Unit”) on such vesting date or dates. The award of a phantom unit appreciation right entitles the recipient to a cash payment equal to the difference between the value of a phantom unit on the vesting date or dates in excess of the value assigned by the Compensation Committee to the phantom unit as of the grant date. Phantom units and phantom unit appreciation rights granted to participants do not confer upon participants any right to a Unit.

On February 11, 2025, the Compensation Committee approved forms of time-based award agreements for phantom units and phantom unit appreciation rights, both of which awards vest in full on July 21, 2027. The grant date value of a phantom unit under a phantom unit appreciation right award is equal to the average of the closing price for a Unit during the 20 trading days immediately preceding the grant date of the award.

Generally, vesting of an award is subject to a participant remaining continuously employed with the Partnership through the vesting date. However, if prior to the vesting date (i) a participant is terminated without cause (as defined in the time-based award agreements) or terminates employment after the participant has attained age 65 and ten years of employment (“retirement-eligible”), a prorated portion of the award will vest and be paid in cash no later than the 30th day following such termination date (subject to a six-month delay in payment for certain retirement-eligible participants) or (ii) there is a change in control of the Partnership (as defined in the Plan), the award will vest in full and be paid in cash no later than the 30th day following the date of the change of control; provided, however, the participant has been in continuous employment through the termination or change in control date, as applicable.

On February 11, 2025, 1,210,000 phantom units and 425,000 phantom unit appreciation rights were granted to employees of the general partner and its affiliates who perform services for the Partnership.

The foregoing summary of the Plan is qualified in its entirety by reference to the complete text of the Plan, the form of award agreement for phantom units and the form of award agreement for phantom unit appreciation rights, copies of which are filed as Exhibits 10.2, 10.3 and 10.4 to this Current Report on Form 8-K and are incorporated herein by reference.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

(d) Exhibits

In accordance with General Instruction B.2 of Form 8-K, the information set forth in the attached Exhibit 99.1 and Exhibit 99.2 are deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act.

| | | | | | | | |

Exhibit

Number | | Description |

| 10.1 | | |

| 10.2 | | |

| 10.3 | | |

| 10.4 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document (contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | MARTIN MIDSTREAM PARTNERS L.P. By: Martin Midstream GP LLC, Its General Partner |

| Date: February 18, 2025 | | By: /s/ Sharon L. Taylor |

| | Sharon L. Taylor |

| | | Executive Vice President and Chief Financial Officer |

FIRST AMENDMENT TO FOURTH AMENDED

AND RESTATED CREDIT AGREEMENT

This FIRST AMENDMENT TO FOURTH AMENDED AND RESTATED CREDIT AGREEMENT (this “First Amendment”), dated effective as of February 13, 2025 (the “First Amendment Effective Date”), is among MARTIN OPERATING PARTNERSHIP L.P., a Delaware limited partnership (the “Borrower”), MARTIN MIDSTREAM PARTNERS L.P., a Delaware limited partnership (the “MLP”), the other guarantors party hereto (such guarantors, together with the Borrower and the MLP, the “Loan Parties”), the Lenders (as defined below) party hereto, and ROYAL BANK OF CANADA, a Canadian chartered bank under and governed by the provisions of the Bank Act, being S.C. 1991, c.46, as Administrative Agent (in such capacity, the “Administrative Agent”) and as Collateral Agent (in such capacity, the “Collateral Agent”) under the Credit Agreement referred to below.

WHEREAS, the Borrower, the MLP, the guarantors party thereto, the Administrative Agent, the Collateral Agent, the L/C Issuers party thereto and the lenders party thereto are parties to that certain Amendment and Restatement Agreement dated as of January 30, 2023, which established, and resulted in the effectiveness of, that certain Fourth Amended and Restated Credit Agreement dated effective as of February 8, 2023 (as amended, restated, supplemented or otherwise modified prior to the date hereof, the “Existing Credit Agreement”, and the Existing Credit Agreement, as the same may be further amended, restated, supplemented or otherwise modified from time to time, including by and after giving effect to this First Amendment, the “Credit Agreement”), among the Borrower, the MLP, the lenders from time to time party thereto (the “Lenders”), the Administrative Agent and the Collateral Agent, pursuant to which the Lenders have, subject to the terms and conditions set forth therein, made certain credit available to and on behalf of the Borrower;

WHEREAS, effective as of the First Amendment Effective Date, the parties hereto are entering into this First Amendment to, among other things, on the terms and subject to the conditions set forth herein, (a) amend certain of the financial covenants set forth therein and (b) amend certain terms of the Existing Credit Agreement as provided for in Section 2 hereof;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

Section 1.Definitions. Unless otherwise defined herein, all capitalized terms used herein that are defined in the Credit Agreement shall have the meanings given such terms in the Credit Agreement. The interpretive provisions set forth in Section 1.02 of the Existing Credit Agreement shall apply to this First Amendment mutatis mutandis.

Section 2.Amendments to Existing Credit Agreement. In reliance on the representations, warranties, covenants and agreements contained in this First Amendment, but subject to the satisfaction or waiver of each condition precedent set forth in Section 3 hereof, the Existing Credit Agreement shall be amended effective as of the First Amendment Effective Date in the manner provided in this Section 2.

(a)Amendment to Definition of “Loan Documents”. Section 1.01 of the Existing Credit Agreement shall be amended to amend and restate the definition of “Loan Documents” in its entirety to read in full as follows:

“Loan Documents” means this Agreement, the First Amendment, the Intercreditor Agreement, each Note (including any amended and restated Note), the Master Consent to Assignment, each of the Collateral Documents, the Agent/Arranger Fee Letters, the Engagement Letter, each Borrowing Notice, each Compliance Certificate, the Guaranties, each Letter of Credit Application and each other agreement, document or instrument executed and delivered by a Loan Party from time to time in connection with this Agreement and the Notes.

(b)New Definitions. Section 1.01 of the Existing Credit Agreement shall be further amended to add thereto, in alphabetical order, the following definition that shall read in full as follows:

“First Amendment” means that certain First Amendment to Fourth Amended and Restated Credit Agreement dated as of February 13, 2025, by and among the Borrower, the MLP, the other Loan Parties party thereto, the Lenders party thereto, the Administrative Agent and the Collateral Agent.

(c)Amendment to Section 7.14(a) of the Existing Credit Agreement. Section 7.14(a) of the Existing Credit Agreement shall be amended and restated in its entirety to read in full as follows:

(a) Interest Coverage Ratio. Permit the Interest Coverage Ratio as of the end of any fiscal quarter to be less than:

(i) with respect to each fiscal quarter from and after the Restatement Effective Date through and including the fiscal quarter ended December 31, 2024, 2.00 to 1.00;

(ii) with respect to each of the fiscal quarters ending March 31, 2025, June 30, 2025 and September 30, 2025, 1.75 to 1.00; and

(iii) with respect to each fiscal quarter ending thereafter, 2.00 to 1.00.

(d)Amendment to Section 7.14(c) of the Existing Credit Agreement. Section 7.14(c) of the Existing Credit Agreement shall be amended and restated in its entirety to read in full as follows:

(c) First Lien Leverage Ratio. Permit the First Lien Leverage Ratio as of the end of any fiscal quarter to be greater than:

(i) with respect to each fiscal quarter from and after the Restatement Effective Date through and including the fiscal quarter ended December 31, 2024, 1.50 to 1.00;

(ii) with respect to each of the fiscal quarters ending March 31, 2025, June 30, 2025 and September 30, 2025, 1.25 to 1.00; and

(iii) with respect to each fiscal quarter ending thereafter, 1.50 to 1.00.

(e)Replacement of Exhibit C to the Existing Credit Agreement. Exhibit C to the Existing Credit Agreement is hereby replaced in its entirety with Exhibit C attached hereto, and Exhibit C attached hereto is hereby deemed to be attached as Exhibit C to the Credit Agreement.

Section 3.Conditions Precedent. This First Amendment (including the amendments contained in Section 2 hereof) is subject to the satisfaction or waiver of the conditions set forth below in this Section 3.

(a)Counterparts. The Administrative Agent shall have received counterparts of this First Amendment (which may be by electronic transmission) duly executed by the Borrower, the MLP, each of the other Loan Parties, the Administrative Agent, the Collateral Agent and the Required Lenders.

(b)Responsible Officer’s Certificate. The Administrative Agent shall have received a certificate signed by a Responsible Officer of the Borrower certifying that (i) the representations and warranties contained in Article V of the Credit Agreement are true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations or warranties that already are qualified or modified as to “materiality” or “Material Adverse Effect” in the text thereof, which representations and warranties shall be true and correct in all respects subject to such qualification) on and as of the First Amendment Effective Date (unless such representations and warranties specifically refer to an earlier date, in which case such representations and warranties shall be true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations or warranties that already are qualified or modified as to “materiality” or “Material Adverse Effect” in the text thereof, which representations and warranties shall be true and correct in all respects subject to such qualification) as of such earlier date), (ii) no Default or Event of Default shall have occurred that is continuing immediately prior to and after giving effect to this First Amendment, (iii) since December 31, 2024, there has occurred no material adverse change in the business, assets, liabilities (actual or contingent), operations or condition (financial or otherwise) of the MLP, the Borrower General Partner or the Borrower and its Restricted Subsidiaries, taken as a whole, (iv) there is no litigation, investigation or proceeding known to and affecting the Borrower or any affiliate for which the Borrower is required to give notice under the Credit Agreement and as to which notice has not been given, and (v) no action, suit, investigation or proceeding is pending or, to the knowledge of such officer, threatened in any court or before any arbitrator or Governmental Authority by or against the Borrower, any Guarantor, the MLP’s general partner, or any of their respective properties that could reasonably be expected to have a Material Adverse Effect.

(c)Expenses. The Administrative Agent and the Lenders, as applicable, shall have received all amounts due and payable on or prior to the First Amendment Effective Date, including, without limitation, to the extent invoiced at least one (1) Business Day prior to the First Amendment Effective Date, reimbursement or payment of all out-of-pocket expenses required to be reimbursed or paid by the Borrower hereunder (including, to the extent invoiced at least one (1) Business Day prior to the First Amendment Effective Date, the fees and expenses of Paul Hastings LLP, counsel to the Administrative Agent).

Each Lender, by delivering its signature page to this First Amendment, shall be deemed to have acknowledged receipt of, and consented to and approved, this First Amendment and each other document, agreement and/or instrument or other matter required to be approved by the Lenders on the First Amendment Effective Date. All documents executed or submitted pursuant to this Section 3 by and on behalf of any of the Loan Parties shall be in form and substance reasonably satisfactory to the Administrative Agent and its counsel. The Administrative Agent agrees that it will, upon the satisfaction of the conditions contained in this Section 3, promptly provide notice to the Borrower and the Lenders of the occurrence of the First Amendment Effective Date. Such notice shall be final, conclusive and binding upon the Lenders and all parties to this First Amendment for all purposes.

Section 4.Representations and Warranties. In order to induce the Administrative Agent and the Lenders to enter into this First Amendment, each Loan Party represents and warrants to the Administrative Agent and to each Lender that:

(a)This First Amendment, the Existing Credit Agreement as amended hereby, and each other Loan Document have been duly authorized, executed, and delivered by the applicable Loan Parties and constitute their legal, valid, and binding obligations enforceable in accordance with their respective terms (subject, as to the enforcement of remedies, to applicable bankruptcy, reorganization, insolvency, moratorium, and similar laws affecting creditors’ rights generally and to general principles of equity);

(b)The representations and warranties set forth in Article V of the Credit Agreement and in the Collateral Documents are true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations or warranties that already are qualified or modified as to “materiality” or “Material Adverse Effect” in the text thereof, which representations and warranties shall be true and correct in all respects subject to such qualification) on and as of the First Amendment Effective Date, after giving effect to this First Amendment, as if made on and as of the First Amendment Effective Date, except to the extent such representations and warranties relate solely to an earlier date (in which case such representations and warranties shall be true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations or warranties that already are qualified or modified as to “materiality” or “Material Adverse Effect” in the text thereof, which representations and warranties shall be true and correct in all respects subject to such qualification) as of such earlier date);

(c)As of the date hereof, after giving effect to this First Amendment, no Default or Event of Default has occurred and is continuing or would result immediately after giving effect to this First Amendment and the transactions contemplated hereby; and

(d)No Loan Party has any defense to payment, counterclaim or rights of set-off with respect to the Obligations on the date hereof, either immediately before or immediately after giving effect to this First Amendment.

Section 5.Effect of Amendment.

(a)This First Amendment (i) except as expressly provided herein, shall not be deemed to be a consent to the modification or waiver of any other term or condition of the Existing Credit Agreement or of any of the instruments or agreements referred to therein, and (ii) shall not prejudice any right or rights which the Administrative Agent, the Collateral Agent, or the Lenders may now or hereafter have under or in connection with the Existing Credit Agreement, as amended hereby. Except as otherwise expressly provided by this First

Amendment, all of the terms, conditions and provisions of the Existing Credit Agreement shall remain the same. It is declared and agreed by each of the parties hereto that the Existing Credit Agreement, as amended hereby, shall continue in full force and effect, and that this First Amendment and such Credit Agreement shall be read and construed as one instrument.

(b)Each of the undersigned Guarantors is executing this First Amendment in order to evidence that it hereby consents to and accepts the terms and conditions of this First Amendment and the transactions contemplated hereby, agrees to be bound by the terms and conditions hereof, and ratifies and confirms that each Guaranty and each of the other Loan Documents to which it is a party is, and shall remain, in full force and effect after giving effect to this First Amendment. Each of the Borrower and each of the other Loan Parties hereby confirms and agrees that all Liens and other security now or hereafter held by the Collateral Agent for the benefit of the Lenders as security for payment of the Obligations are the legal, valid, and binding obligations of the Borrower and the other Loan Parties, remain in full force and effect, are unimpaired by this First Amendment, and are hereby ratified and confirmed as security for payment of the Obligations.

(c)No failure or delay on the part of the Administrative Agent or the Lenders to exercise any right or remedy under the Credit Agreement, any other Loan Document or applicable law shall operate as a waiver thereof, nor shall any single partial exercise of any right or remedy preclude any other or further exercise of any right or remedy, all of which are cumulative and may be exercised without notice except to the extent notice is expressly required (and has not been waived) under the Credit Agreement, the other Loan Documents and applicable law.

(d)Upon and after the execution of this First Amendment by each of the parties hereto, each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof” or words of like import referring to the Credit Agreement, and each reference in the other Loan Documents to “the Credit Agreement”, “thereunder”, “thereof” or words of like import referring to the Credit Agreement, shall mean and be a reference to the Credit Agreement as modified hereby.

Section 6.Governing Law; Submission to Process. THIS FIRST AMENDMENT AND ANY CLAIMS, CONTROVERSY, DISPUTE OR CAUSE OF ACTION (WHETHER IN CONTRACT OR TORT OR OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO THIS FIRST AMENDMENT AND THE TRANSACTIONS CONTEMPLATED HEREBY AND THEREBY SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. Section 10.15(b) of the Credit Agreement shall apply to this First Amendment, mutatis mutandis.

Section 7.Waiver of Jury Trial. EACH PARTY HERETO HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, (A) ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS FIRST AMENDMENT OR ANY OTHER LOAN DOCUMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY (WHETHER BASED ON CONTRACT, TORT, OR ANY OTHER THEORY), AND (B) ANY RIGHT IT MAY HAVE TO CLAIM OR RECOVER IN ANY SUCH LEGAL PROCEEDING ANY “SPECIAL DAMAGES”, AS DEFINED BELOW. EACH PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT, OR ATTORNEY OF ANY OTHER PERSON HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PERSON WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THIS FIRST AMENDMENT AND THE OTHER LOAN

DOCUMENTS BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION. AS USED IN THIS SECTION, “SPECIAL DAMAGES” INCLUDES ALL SPECIAL, CONSEQUENTIAL, EXEMPLARY, OR PUNITIVE DAMAGES (REGARDLESS OF HOW NAMED), BUT DOES NOT INCLUDE ANY PAYMENTS OR FUNDS THAT ANY PARTY HERETO AS EXPRESSLY PROMISED TO PAY OR DELIVER TO ANY OTHER PARTY HERETO.

Section 8.Miscellaneous. The captions in this First Amendment are for convenience of reference only and shall not define or limit the provisions hereof. This First Amendment may be executed in separate counterparts, each of which when so executed and delivered shall be an original, but all of which together shall constitute one instrument. In proving this First Amendment, it shall not be necessary to produce or account for more than one such counterpart. Delivery of an executed counterpart of this First Amendment by telecopier or other electronic means shall be effective as delivery of a manually executed counterpart of this First Amendment.

Section 9.Entire Agreement. THIS FIRST AMENDMENT, THE EXISTING CREDIT AGREEMENT (AS AMENDED HEREBY) AND THE OTHER LOAN DOCUMENTS REPRESENT THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES.

Remainder of Page Intentionally Blank.

Signature Pages to Follow.

IN WITNESS WHEREOF, the parties hereto have caused this First Amendment to be duly executed and delivered by their proper and duly authorized officers as of the date and year first above written.

MARTIN OPERATING PARTNERSHIP L.P.,

a Delaware limited partnership

By: MARTIN OPERATING GP LLC,

its General Partner

By: MARTIN MIDSTREAM PARTNERS L.P.,

its Sole Member

By: MARTIN MIDSTREAM GP LLC,

its General Partner

By: /s/ Sharon L. Taylor_____________

Name: Sharon L. Taylor

Title: Executive Vice President and Chief Financial Officer

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

MARTIN MIDSTREAM PARTNERS L.P.,

a Delaware limited partnership,

as a Guarantor

By: MARTIN MIDSTREAM GP LLC,

its General Partner

By: /s/ Sharon L. Taylor_____________

Name: Sharon L. Taylor

Title: Executive Vice President and Chief Financial Officer

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

MARTIN OPERATING GP LLC,

a Delaware limited liability company,

as a Guarantor

By: MARTIN MIDSTREAM PARTNERS L.P.,

its Sole Member

By: MARTIN MIDSTREAM GP LLC,

its General Partner

By: /s/ Sharon L. Taylor_____________

Name: Sharon L. Taylor

Title: Executive Vice President and Chief Financial Officer

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

MARTIN MIDSTREAM FINANCE CORP.,

a Delaware corporation,

as a Guarantor

By: /s/ Sharon L. Taylor_____________

Name: Sharon L. Taylor

Title: Executive Vice President and Chief Financial Officer

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

TALEN’S MARINE & FUEL, LLC,

a Louisiana limited liability company,

as a Guarantor

By: /s/ Sharon L. Taylor_____________

Name: Sharon L. Taylor

Title: Executive Vice President and Chief Financial Officer

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

MARTIN TRANSPORT, INC.,

a Texas corporation,

as a Guarantor

By: /s/ Sharon L. Taylor_____________

Name: Sharon L. Taylor

Title: Executive Vice President and Chief Financial Officer

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

ROYAL BANK OF CANADA,

as Administrative Agent and Collateral Agent

By: /s/ Sabrina Wang_______________

Name: Sabrina Wang

Title: Manager, Agency

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

ROYAL BANK OF CANADA,

as a Lender

By: /s/ Michael Sharp_______________

Name: Michael Sharp

Title: Authorized Signatory

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

WELLS FARGO BANK, N.A.,

as Syndication Agent, a Lender and an L/C Issuer

By: /s/ Brandon Kast________________

Name: Brandon Kast

Title: Executive Director

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

CADENCE BANK,

as a Lender

By: /s/ Ifeanyi Uzowihe______________

Name: Ifeanyi Uzowihe

Title: Assistant Vice President

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

COMERICA BANK,

as a Lender

By: /s/ Kylie Moreland_____________

Name: Kylie Moreland

Title: Vice President

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

THIRD COAST BANK, SSB,

as a Lender

By: /s/ Trey Romero_____________

Name: Trey Romero

Title: Executive Vice President

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

BOKF NA, DBA BANK OF TEXAS,

as a Lender

By: /s/ Frank Carvelli_____________

Name: Frank Carvelli

Title: Senior Vice President

[Signature Page to First Amendment to Fourth Amended and Restated Credit Agreement –

Martin Operating Partnership L.P.]

Martin Midstream Partners L.P.

2025 Phantom Unit Plan

1.Purpose. Martin Midstream Partners L.P., a Delaware limited partnership (the “Partnership”), has adopted this Martin Midstream Partners L.P. 2025 Phantom Unit Plan (the “Plan”), effective as of February 11, 2025 (the “Effective Date”). The Plan is intended to attract, retain, reward and motivate certain employees and directors of Martin Midstream GP, LLC, a Delaware limited liability partnership (the “Company”), Martin Resource Management Corporation, a Texas corporation (“MRMC”) and their respective Affiliates (collectively, the “Martin Group”) and to strengthen the mutuality of interests between those service providers and other unitholders of the Partnership.

2.Definitions. Unless otherwise defined in the Plan, the following terms will have the meanings indicated, unless the context clearly indicates otherwise, with all definitions equally applicable to the singular and plural forms of the terms defined.

“Affiliate” of any particular Person means any other Person controlling, controlled by, or under common control with such particular Person, where “control” means the possession, directly or indirectly, of the power to direct the management and policies of a Person, whether through the ownership of voting securities, by contract, or otherwise.

“Award” means the grant of one or more Phantom Units and, if applicable, DERs under the Plan.

“Award Agreement” means an agreement entered into between the Participant and the Partnership evidencing the number and terms and conditions of Phantom Units awarded to the Participant under the Plan.

“Board” means the Board of Directors of the Company.

“Change in Control” means any one of the following:

(a)any sale, lease, exchange, or other transfer (in one or a series of related transactions) of all or substantially all of the assets of the Partnership and its subsidiaries to any Person or its Affiliates, other than to the Partnership, its subsidiaries, the Company, or any Affiliates of the foregoing;

(b)any merger, reorganization, consolidation, or other transaction pursuant to which more than 50% of the combined voting power of the general partnership interests in the Partnership ceases to be owned by Persons who own such interests as of the Date of Grant;

(c)any merger, reorganization, consolidation, or other transaction pursuant to which more than 50% of the combined voting power of the equity interests in MRMC ceases to be owned by Persons who own such interests as of the Date of Grant; or

(d)any transaction that results in the Company no longer being controlled by MRMC or its Affiliates.

(e)Notwithstanding the foregoing, with respect to an Award that is subject to Code Section 409A and to which a Change in Control will accelerate payment, “Change in Control” shall mean a “change of control event” as defined in the regulations and guidance issued under Code Section 409A.

“Code” means the Internal Revenue Code of 1986, as amended, or any successor statute, and the Treasury Regulations and other authoritative guidance issued thereunder.

“Committee” means the Compensation Committee of the Board or other committee of the Board or subcommittee of the Compensation Committee designated by the Board.

“Date of Grant” means the date an Award is granted to a Participant.

“DER” means a right to receive an amount in cash equal to the cash distributions made by the Partnership with respect to a Unit during a specified period.

“Director” means a non-employee member of the Board.

“Employee” means any employee of the Partnership or a Martin Group entity.

“Fair Market Value” of a Unit means the closing sales price of a Unit on the principal national securities exchange or other market in which trading in Units occurs on the applicable date (or if there is no trading in the Units on such date, on the prior day on which there was trading) as reported in The Wall Street Journal (or other reporting service approved by the Committee). In the event Units are not traded on a national securities exchange or other market at the time a determination of fair market value is required to be made hereunder, the determination of fair market value shall be made in good faith by the Committee and in compliance with Code Section 409A.

“Participant” means an Employee or Director who has been granted an Award and has timely executed and returned to the Committee (or its delegate) the Award Agreement.

“Person” means a natural person, company, limited partnership, general partnership, limited liability company or partnership, joint venture, association, trust, bank, trust company, land trust, business trust or other organization, whether or not a legal entity, and a government or agency or political subdivision thereof.

“Phantom Unit” means a phantom (notional) unit granted under the Plan which entitles the Participant to receive an amount of cash equal to (i) the Fair Market Value of a Unit or (ii) if the Award is a Phantom Unit Appreciation Right, the Fair Market Value of a Unit less the Unit’s Date of Grant value, subject to the terms and conditions of the Award.

“Phantom Unit Appreciation Right” has the meaning provided in Section 5.2 of the Plan.

“Plan” means the Martin Midstream Partners L.P. 2025 Phantom Unit Plan, as may be amended from time to time.

“Unit” means a common unit of the Partnership traded under the symbol MMLP.

3.Eligibility. Any Employee or Director shall be eligible to be designated a Participant and receive an Award under the Plan.

4.Phantom Units Available for Grant. The total number of Phantom Units available for grant under the Plan is 5,000,000. Phantom Units that are canceled, forfeited or expired will revert and again become available for grant under the Plan.

5.Awards.

5.1Awards and Award Agreements. The Committee, in its sole discretion, shall select Employees and Directors to be granted Awards under the Plan. The grant of an Award shall be evidenced by a written Award Agreement, which shall include such limitations, restrictions, restrictive covenants

and other provisions, as the Committee may from time to time determine. Upon timely execution and return of the Award Agreement to the Committee (or its delegate), the grantee shall be a Participant. For the avoidance of doubt, the Award shall not be effective until and unless the Employee or Director timely executes and returns the Award Agreement to the Committee (or its delegate). The Phantom Units granted to a Participant shall be reflected in a bookkeeping (notional) account for such Participant maintained by the Partnership. An Award does not confer upon a Participant the right to future grants of Phantom Units.

5.2Phantom Units. The Committee shall have the authority to determine the Employees and Directors to whom Phantom Units shall be granted, the number of Phantom Units to be granted, the time or conditions under which the Phantom Units may become vested or forfeited, which may include, without limitation, the accelerated vesting upon the achievement of specified performance goals, and such other terms and conditions as the Committee may establish with respect to such Awards. The foregoing notwithstanding, the Committee may provide in the Award Agreement that the payment of the Phantom Units upon vesting shall be reduced by the Date of Grant value of the Phantom Unit, as determined by the Committee, such that the Participant shall be eligible for payment of the appreciation of the Phantom Unit since the Date of Grant (a “Phantom Unit Appreciation Right”).

6.Terms of Awards.

6.1No Voting Rights or Membership Interests. A Phantom Unit has no voting rights or rights to participate in any distributions of profits or losses or other distributions paid to holders of membership interests or other equity interests of the Partnership other than DERs (as provided in Section 8 below). A Phantom Unit does not represent actual membership interests or equity in the Partnership. Phantom Units do not constitute issued and outstanding Units for any purposes.

6.2Vesting. A Participant shall become vested in the Phantom Units awarded to the Participant in accordance with the vesting schedule included in the Participant’s Award Agreement. Unless the Committee provides otherwise in the applicable Award Agreement, vesting of an Award will be based on (i) the Participant remaining continuously employed by the Partnership or a Martin Group entity from the Date of Grant of the Phantom Units until the date of vesting, (ii) the achievement of performance goals or criteria selected by the Committee, or (iii) a combination thereof, as specified in the Award Agreement.

6.3Forfeitures. Unless the Committee provides otherwise in the applicable Award Agreement, all of a Participant’s unvested Phantom Units shall be forfeited if the Participant’s termination of employment or service for any reason.

7.Adjustments. In the event that any distribution (whether in the form of cash, Units, other securities, or other property), recapitalization, split, reverse split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of Units or other securities of the Partnership, issuance of warrants or other rights to purchase Units or other securities of the Partnership, or other similar transaction or event affects the Units, then the Committee shall, in such manner as it may deem equitable, adjust any or all of (i) the number of Phantom Units with respect to which Awards may be granted, (ii) the number of Phantom Units subject to outstanding Awards, and (iii) the grant or exercise price with respect to any Award or, make provision for a cash payment to the holder of an outstanding Award; provided, however, that the number of Phantom Units subject to any Award shall always be a whole number. No adjustment pursuant to this Section 7 shall be made in a manner that results in noncompliance with the requirements of Code Section 409A, to the extent applicable.

8.DERs. DERs will only be paid to the Participant if the applicable Award Agreement provides for the payment of such and then such payment shall be in accordance with the terms of the Award Agreement.

9.Change in Control. Notwithstanding any other provisions of the Plan, and unless otherwise expressly addressed in the Award Agreement, (i) any Award that is subject to performance vesting shall be deemed to satisfy the performance criteria at the target payment level and shall become fully (100%) vested as of the date the Change in Control occurs and (ii) any Award that is subject to vesting upon

continued employment or service with the Partnership or a Martin Group entity through a designated vesting date shall become fully (100%) vested as of the date of the Change in Control.

10.Payment of Awards. Unless the Committee provides otherwise in the applicable Award Agreement, a Phantom Unit or Phantom Unit Appreciation Right shall be settled in a cash payment no later than the 30th day following its date of vesting. The value of each vested Phantom Unit to be paid to a Participant on the payment date shall be based on the Fair Market Value of a Phantom Unit as of the date of vesting or, if a Phantom Unit Appreciation Right, based on the Fair Market Value of a Phantom Unit as of the date of vesting less the Date of Grant value of the Phantom Unit. A Participant shall not be entitled to any increases in value thereafter.

11.Plan Administration.

11.1Administration by Committee. The Plan shall be administered by the Committee. The Committee has plenary authority to administer the Plan, including granting Awards under the Plan and entering into Award Agreements with, or providing notices to, Participants as to the terms of the Plan and any Awards granted under it, including, but not limited to, the right, power and authority to:

(a)Determine when and to whom Awards will be granted under the Plan;

(b)Determine the terms, provisions, and conditions of Awards (including the number of Phantom Units subject to an Award), which need not be identical and need not match any default terms set forth in the Plan, and amend or modify any outstanding Awards;

(c)Correct any defect, supply any omission, or reconcile any inconsistency in the Plan or any Award in the manner and to the extent it deems necessary or desirable to further the Plan’s objectives;

(d)Establish, amend, and rescind any rules or regulations relating to the administration of the Plan that it determines to be appropriate;

(e)Resolve all questions of interpretation or application of the Plan or Awards; and

(f)Make any other determination that it believes necessary or advisable for the proper administration of the Plan.

11.2Non-Uniform Treatment. The Committee’s determinations under the Plan need not be uniform and any such determinations may be made selectively among Participants.

11.3Committee Decisions Final. Committee decisions in matters relating to the Plan will be final, binding, and conclusive on all Persons, including, but not limited to, the Partnership, its unitholders, each Martin Group entity, and each Participant and his or her heirs and beneficiaries.

11.4Delegation of Authority. The Board or the Committee may authorize a committee of one or more members of the Board to grant individual Awards to Employees pursuant to such conditions or limitations as the Board or the Committee may establish. The Committee may also delegate to the Chief Executive Officer and to other employees of the Company (i) the authority to grant individual Awards to Employees who are not subject to Section 16(b) of the Securities Exchange Act of 1934, as amended, and (ii) other administrative duties under this Plan pursuant to such conditions or limitations as the Committee may establish. The Committee may engage or authorize the engagement of a third party administrator to carry out administrative functions under the Plan.

11.5Indemnification. No member of the Committee or any designee shall be liable for any action, failure to act, determination or interpretation made in good faith with respect to the Plan except for any liability arising from his or her own willful malfeasance, gross negligence or reckless disregard of his or her duties.

12.Amendment and Termination. The Board may, at any time, and in its sole discretion, alter, amend, modify, suspend or terminate the Plan or any portion thereof for any purpose which may at the time be permitted by Applicable Laws (including, without limitation, increasing the maximum number of Phantom Units available for grant under the Plan), and may at any time terminate the Plan as to any future grants of Awards; provided, however, that no such amendment, modification, suspension or termination shall, without the consent of a Participant, materially adversely affect such Participant’s rights under the Plan and provided, further, that, no payment of benefits shall occur upon termination of the Plan unless, if applicable, the requirements of Code Section 409A have been met.

13.Forfeiture and Clawback in Certain Circumstances. The Committee may, at its sole discretion, terminate any Award if it determines that the recipient of the Award has engaged in material misconduct. For purposes of this provision, material misconduct includes conduct adversely affecting the Partnership’s financial condition, results of operations, or conduct which constitutes fraud or theft of Partnership assets, any of which require the Partnership to make a restatement of its reported financial statements. The Committee may also specify other conduct requiring the Partnership to make a restatement of its publicly reported financial statements as constituting material misconduct in future Award Agreements. If any material misconduct results in any error in financial information used in the determination of compensation paid to the recipient of an Award and the effect of such error is to increase the payment amount pursuant to an Award, the Committee may also require the recipient to reimburse the Partnership for all or a portion of such increase in compensation provided in connection with any such Award. In addition, if there is a material restatement of the Partnership’s financial statements that affects the financial information used to determine the compensation paid to the recipient of the Award, then the Committee may take whatever action it deems appropriate to adjust such compensation.

14.Miscellaneous.

14.1No Employment or Other Service Rights. Nothing in the Plan, Award Agreement or any instrument executed pursuant thereto, or the grant of an Award, shall confer upon any Employee, Director or Participant any right to continued employment or service with the Partnership or any Martin Group entity or interfere in any way with the right of the Partnership or any Martin Group entity to terminate the Participant’s employment or service at any time with or without notice and with or without cause. The loss of existing or potential profit in Awards will not constitute an element of damages in the event of termination of employment or service for any reason, even if such termination is in violation of an obligation of the Partnership or any Martin Group entity to the Participant.

14.2Other Benefits. Amounts paid under the Plan shall not be considered part of a Participant’s salary or compensation for purposes of determining or calculating other benefits under any other employee benefit plan or program of the Partnership or the Company, except as required by the terms of such plans. Additionally, the adoption of this Plan will not affect any other compensation or incentive plans in effect for the Partnership or any Martin Group entity.

14.3Tax Withholding. The Partnership and any Martin Group entity shall have the right to deduct from any amounts otherwise payable under the Plan any federal, state, local, or other applicable taxes required to be withheld, or to take such other action as may be necessary in the opinion of the Partnership or any Martin Group entity to satisfy all obligations for withholding of such taxes.

14.4Governing Law. To the extent not preempted by federal law, the Plan will be construed in accordance with and governed by the laws of the State of Delaware. Notwithstanding the foregoing, the Plan is intended to conform to the extent necessary with all provisions of all Applicable Laws and any and all regulations and rules promulgated under such provisions, to the extent the Partnership or any Participant is subject to the provisions thereof. The Plan will be administered, Awards will be granted, and the underlying Phantom Units may vest only in such a manner as to conform to such laws, rules, and regulations. To the extent permitted by Applicable Laws, the Plan and Awards granted under this Plan will be deemed amended to the extent necessary to conform to such laws, rules, and regulations.

14.5Section 409A.

(a)The Partnership intends that the Plan and Awards comply with, or be exempt from, the requirements of Code Section 409A and the accompanying regulations and guidance issued by the Internal Revenue Service (“Section 409A”) and shall be operated and interpreted consistent with that intent. Notwithstanding anything in this Plan to the contrary, the Committee will have the power to amend the Plan and any Agreements to the extent necessary to ensure that an Award will not trigger an excise tax to the Participant under Section 409A.

(b)If the Participant is identified by the Partnership as a “specified employee” within the meaning of Section 409A(a)(2)(B)(i) on the date on which the Participant has a “separation from service” (other than due to death) within the meaning of Treasury Regulation § 1.409A-1(h), any Award payable or settled on account of a separation from service that is deferred compensation subject to Section 409A shall be paid or settled on the earliest of (1) the first business day following the expiration of six months from the Participant’s separation from service, (2) the date of the Participant’s death, or (3) such earlier date as complies with the requirements of Section 409A.

(c)The Partnership, the Company and the Martin Group entities make no representation that the Plan complies with Section 409A and shall have no liability to any Participant for any failure to comply with Section 409A. Each Participant is fully responsible for any and all taxes or other amounts imposed by Section 409A.

14.6Unfunded Benefit. The Plan is unfunded. Although bookkeeping (notional) accounts may be established with respect to Participants, any such accounts shall be used merely as a convenience. Neither the Plan nor any Award will create or be construed to create a trust or separate fund of any kind or a fiduciary relationship between the Partnership or any participating Martin Group entity and a Participant or any other Person. All amounts provided under the Plan shall be paid from the general assets of the Partnership or the Company and no separate fund shall be established to secure payment. To the extent that any Participant or other Person acquires a right to receive payment from the Partnership under the Plan, such right shall be no greater than the right of any unsecured general creditor of the Partnership, the Company or the Martin Group entities.

14.7Beneficiary Designation. Each Participant under the Plan may from time to time name any beneficiary or beneficiaries to receive the Participant’s interest in the Plan in the event of the Participant’s death. Each designation will revoke all prior designations by the same Participant, shall be in a form reasonably prescribed by the Board and shall be effective only when filed by the Participant in writing with the Partnership or any Martin Group entity during the Participant’s lifetime. If a Participant fails to designate a beneficiary, then the Participant’s designated beneficiary shall be deemed to be the Participant’s surviving spouse to whom he or she is married as of the Participant’s date of death or, if the Participant is not married as of his or her date of death, the Participant’s estate.

14.8No Assignment. Neither a Participant nor any other person shall have any right to sell, assign, transfer, pledge, anticipate or otherwise encumber, transfer, hypothecate or convey any amounts payable hereunder prior to the date that such amounts are paid. Notwithstanding the foregoing, to the extent specifically provided by the Committee with respect to an Award, an Award may be transferred by a Participant without consideration to immediate family members or related family trusts, limited partnerships or similar entities on such terms and conditions as the Committee may from time to time establish.

14.9Successors. All obligations of the Partnership under the Plan with respect to Awards granted hereunder shall be binding on any successor to the Partnership, whether the existence of such successor is the result of a direct or indirect purchase, merger, consolidation, or otherwise, of all of the assets of the Partnership substantially as an entirety.

14.10Severability. If any provision of the Plan is held to be invalid, illegal or unenforceable, whether in whole or in part, such provision shall be deemed modified to the extent of such invalidity, illegality or unenforceability and the remaining provisions shall not be affected.

14.11Headings and Subheadings. Headings and subheadings in the Plan are for convenience only and are not to be considered in the construction of the provisions hereof.

MARTIN MIDSTREAM PARTNERS L.P. 2025 PHANTOM UNIT PLAN

PHANTOM UNIT AWARD AGREEMENT

This Award Agreement (this “Agreement”) is entered into between Martin Midstream Partners L.P., a Delaware limited partnership (the “Partnership”) and _________________ (the “Participant”), an employee of Martin Resource Management Corporation, a Martin Group entity (the “Employer”), effective [●] (the “Date of Grant”). Capitalized terms used but not defined in this Agreement have the respective meanings provided in the Martin Midstream Partners L.P. 2025 Phantom Unit Plan (the “Plan”).

1.Grant of Phantom Units. Effective on the Date of Grant, the Partnership hereby grants to the Participant [●] Phantom Units (this “Award”), subject to the terms, conditions, and restrictions set forth in the Plan and in this Agreement.

2.Vesting and Forfeiture.

(a) This Award will vest as provided in Exhibit A attached to this Agreement (with each such vesting date or dates a “Vesting Date”), provided that, except as provided below or in Exhibit A, the Participant remains continuously employed with a Martin Group entity (“Employment”) from the Date of Grant until the Vesting Date(s). Except as otherwise provided in the Plan or this Agreement, all outstanding Phantom Units granted under this Award that have not vested pursuant to the terms of this Agreement and Exhibit A shall be automatically and immediately forfeited and this Award shall be terminated without any payment and without any action required by the Partnership or the Participant.

(b) In the event that, prior to becoming fully vested as provided in Section 2(a), a Change in Control is consummated, this Award will be subject to the Plan terms applicable to such event.

(c) Notwithstanding the vesting and forfeiture provisions set forth in this Section 2, the Committee may, at any time and in its sole discretion, accelerate vesting of all or any part of this Award.

3.No Contract of Employment. Nothing in this Agreement will be construed as giving the Participant the right to continue employment with the Partnership or any Martin Group entity or in any way limit their right to terminate the Participant’s Service at any time.

4.Payment of Vested Phantom Units. The Phantom Unit Payment Value (as defined in Exhibit A) of each Phantom Unit subject to this Award that vests pursuant to this Agreement and Exhibit A (other than DER payments) shall be paid to the Participant in cash by the Partnership to the Participant (or to Participant’s estate in the case of death) as provided in Exhibit A.

5.Payment of DERs. Unless otherwise provided in Exhibit A, no DERs shall be paid with respect to the Phantom Units granted hereunder.

6.Non-Transferability. This Award, any Phantom Units subject to this Award, and any other rights or privileges provided for in this Agreement, may not be transferred, assigned, pledged, or hypothecated in any manner, by operation of law or otherwise, and will not be subject to execution, attachment, or similar process.

7.Taxes. The Partnership or the Employer is authorized to withhold from any payment relating to the Phantom Units granted hereby, or any payroll or other payment to Participant, amounts of withholding and other taxes due or potentially payable in connection with the Phantom Units granted hereby, and to take such other action as the Committee may deem advisable to enable the Partnership or the Employer and Participant to satisfy obligations for the payment of withholding taxes and other tax obligations relating to the Phantom Units granted hereby.

8.Amendment. The Committee may amend, modify, or terminate this Award at any time prior to vesting in any manner not inconsistent with the terms of the Plan. Notwithstanding the foregoing, except as expressly provided in the Plan, no such amendment, modification, or termination of this Award may materially impair the rights of the Participant under this Agreement without the written consent of the Participant.

9.Notices. All notices to the Partnership related to this Agreement should be sent to the Partnership’s principal executive offices as disclosed in its filings with the Securities and Exchange Commission, addressed to the Office of General Counsel. All notices to the Participant shall be delivered to the most recent address as provided by the Participant to the Employer’s human resources department.

10.Binding Effect. This Agreement is personal to the Participant and may not be assigned by the Participant. This Agreement shall inure to the benefit of and be binding upon each of the parties and any successors to the Partnership.

11.Governing Law. This Agreement will be governed by and construed in accordance with the laws of the State of Delaware, without regard to any conflicts of laws.

12.Severability. In the event that any provision in this Agreement shall be found to be invalid, illegal or unenforceable, the Participant and the Partnership intend for any court construing this Agreement to modify or limit such provision so as to render it valid and enforceable to the fullest extent allowed by law. Any such provision that is not susceptible of reformation shall be ignored and shall not affect the validity, legality and enforceability of the remaining provisions, which shall be valid and enforced to the fullest extent permitted by law.

13.Section 409A. It is intended that this Agreement and the Phantom Units granted comply with, or be exempt from, the requirements of Code Section 409A and the accompanying regulations and guidance issued by the Internal Revenue Service (“Section 409A”) and this Agreement shall be interpreted and administered accordingly. For purposes of this Agreement, if the Participant is a “specified employee” within the meaning of Section 409A(a)(2)(B)(i) on the date on which the Participant has a “separation from service” as defined in Treasury Regulation Section 1.409A-1(h), and any successor provision thereto (other than due to death), then any Phantom Units settled on account of a separation from service that are deferred compensation subject to Section 409A shall be paid or settled on the earliest of (1) the first business day following the expiration of six months from the Participant’s separation from service, (2) the date of the Participant’s death, or (3) such earlier date as complies with the requirements of Section 409A.

14.Entire Agreement. This Agreement, together with the Plan and the Partnership Agreement, constitutes the entire agreement between the parties with respect to the subject matter contained in this Agreement. Any oral or written agreements, representations, warranties, written inducements, or other communications with respect to the subject matter contained in this Agreement made prior to the execution of this Agreement shall be void and ineffective for all purposes.

By signature below, the Participant represents that he or she is familiar with the terms and provisions of the Plan, this Agreement, and the Partnership Agreement, and hereby accepts this Award subject to all of those terms and provisions. The Participant agrees to accept as binding, conclusive, and final all decisions or interpretations of the Committee upon any questions arising under the Plan or this Agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the Partnership and the Participant have executed this Agreement, effective as of the Date of Grant.

MARTIN MIDSTREAM PARTNERS L.P.

By: Martin Midstream GP LLC

By:

Name:

Title:

PARTICIPANT

By:

Name:

MARTIN MIDSTREAM PARTNERS L.P. 2025 PHANTOM UNIT PLAN

PHANTOM UNIT AWARD AGREEMENT

EXHIBIT A

Vesting Schedule and Terms

The Phantom Units granted under this Award shall vest and become payable as follows:

A.1. Definitions. For purposes of this Award, the “Phantom Unit Payment Value” is equal to the Fair Market Value of a Phantom Unit as of the Valuation Date. The “Valuation Date” for the foregoing means the applicable Vesting Date, for purposes of Section A.2, the Termination Date, for purposes of Sections A.3. and A.5., and the Change in Control date, for purposes of Section A.4.

A.2. Vesting. Except as provided in Sections A.3, A.4 and A.5 below, the Phantom Units granted under this Award shall vest in full (100%) on the third (3rd) anniversary of the Date of Grant (the “Vesting Date”), provided, however, that the Participant has been in continuous Employment at all times from the Date of Grant until and on the Vesting Date. Such vested Phantom Units shall be settled by a cash payment, equal to the Phantom Unit Payment Value of such vested Phantom Units, by the Partnership to the Participant (or to Participant’s estate in the case of death) no later than the 30th day following the Vesting Date (subject to tax withholding obligations).

A.3. Termination Without Cause. Section A.2 notwithstanding, if the Participant’s Employment is terminated by the Employer without Cause prior to the Vesting Date, then the Phantom Units granted under this Award shall vest pro-rata as of such termination of Employment date (the “Termination Date”) equal to the number (rounded up to the nearest whole Phantom Unit) determined by multiplying (i) the total number of Phantom Units granted under this Award by (ii) a fraction in which the numerator is the number of days that have elapsed from the Date of Grant to the Termination Date, and the denominator is the total number of days from the Date of Grant until the Vesting Date. All remaining unvested Phantom Units shall be forfeited as of the Participant’s Termination Date. Such vested Phantom Units shall be settled by a cash payment, equal to the Phantom Unit Payment Value of such vested Phantom Units, by the Partnership to the Participant (or to Participant’s estate in the case of death) no later than the 30th day following the Participant’s Termination Date (subject to tax withholding obligations). If the Participant’s Employment terminates for any other reason prior to the Vesting Date, all Phantom Units granted under this Award shall be forfeited as of the Participant’s Termination Date.

For purposes of this Agreement, “Cause” shall mean (i) the willful and continued failure by the Participant to substantially perform the Participant’s duties as an employee of the Employer or a member of the Martin Group entity, which failure is not cured to the satisfaction of the Employer’s senior officers within a reasonable period after written notice thereof to the Participant, (ii) the Participant being convicted of or a plea of nolo contendere to the charge of a felony which shall be final and non-appealable (other than a felony involving a traffic violation or as a result of vicarious liability) or any misdemeanor crime that involves fraud, embezzlement, moral turpitude or violation of federal or state securities law, (iii) the commission by the Participant of an act of dishonesty or breach of trust resulting or intending to result in personal benefit or enrichment to the Participant at the expense of the Partnership or the Employer or other Martin Group entity, or (iv) an unauthorized absence from Employment that is not cured within five (5) days after written notice thereof from the Partnership. For purposes of this definition of Cause, no act, or failure to act, on the Participant’s part shall be considered “willful” unless done, or omitted to be done, by him not in good faith and without reasonable belief that his action or omission was not in the best interest of the Partnership.

A.4. Change in Control. Section A.2 notwithstanding, if a Change in Control occurs prior to the Vesting Date, all Phantom Units granted under this Award shall vest in full (100%) on the date of the Change in Control, provided, however, that the Participant has been in continuous Employment at all times from the Date of Grant until and on the date of the Change in Control. Such vested Phantom Units shall be settled by a cash payment, equal to the Phantom Unit Payment Value of such vested Phantom Units, by the Partnership to the Participant (or to Participant’s estate in the case of death) no later than the 30th day following the date of the Change of Control (subject to tax withholding obligations).

A.5. Retirement. Section A.2 notwithstanding, if the Participant is eligible for Retirement and terminates Employment (including due to the Participant’s death) prior to the Vesting Date, then the Phantom Units granted under this Award shall vest pro-rata as of such termination of Employment date (the “Retirement Date”) equal to the number (rounded up to the nearest whole Phantom Unit) determined by multiplying (i) the total number of Phantom Units granted under this Award by (ii) a fraction in which the numerator is the number of days that have elapsed from the Date of Grant to the Retirement Date, and the denominator is the total number of days from the Date of Grant until the Vesting Date. All remaining unvested Phantom Units shall be forfeited as of the Participant’s Retirement Date. Such vested Phantom Units shall be settled by a cash payment, equal to the Phantom Unit Payment Value of such vested Phantom Units, by the Partnership to the Participant (or to Participant’s estate in the case of death) no later than the 30th day following the Retirement Date (subject to tax withholding obligations). The foregoing notwithstanding, a termination of the Participant’s Employment by the Employer with or without Cause shall not be a termination for Retirement under this Section A.5. For purposes of this Agreement, “Retirement” means the Participant has attained (i) age 65 and (ii) ten (10) years of Employment.

A.6. DERs. [With respect to each vested Phantom Unit granted hereunder, the Partnership will pay the Participant cash amount equal to the amount of such cash distributions made by the Partnership on one Unit during the vesting period at the same time the vested Phantom Unit is settled in cash as provided in this Exhibit A. No DERs shall be paid with respect to Phantom Units that are forfeited.][No DERs shall be paid with respect to the Phantom Units granted hereunder.]

MARTIN MIDSTREAM PARTNERS L.P. 2025 PHANTOM UNIT PLAN

PHANTOM UNIT APPRECIATION RIGHT AWARD AGREEMENT

This Award Agreement (this “Agreement”) is entered into between Martin Midstream Partners L.P., a Delaware limited partnership (the “Partnership”) and _________________ (the “Participant”), an employee of Martin Resource Management Corporation, a Martin Group entity (the “Employer”), effective [●] (the “Date of Grant”). Capitalized terms used but not defined in this Agreement have the respective meanings provided in the Martin Midstream Partners L.P. 2025 Phantom Unit Plan (the “Plan”).

1.Grant of Phantom Units. Effective on the Date of Grant, the Partnership hereby grants to the Participant [●] Phantom Units payable as Phantom Unit Appreciation Rights (this “Award”), subject to the terms, conditions, and restrictions set forth in the Plan and in this Agreement.

2.Vesting and Forfeiture.

(a) This Award will vest as provided in Exhibit A attached to this Agreement (with each such vesting date or dates a “Vesting Date”), provided that, except as provided below or in Exhibit A, the Participant remains continuously employed with a Martin Group entity (“Employment”) from the Date of Grant until the Vesting Date(s). Except as otherwise provided in the Plan or this Agreement, all outstanding Phantom Units granted under this Award that have not vested pursuant to the terms of this Agreement and Exhibit A shall be automatically and immediately forfeited and this Award shall be terminated without any payment and without any action required by the Partnership or the Participant.

(b) In the event that, prior to becoming fully vested as provided in Section 2(a), a Change in Control is consummated, this Award will be subject to the Plan terms applicable to such event.

(c) Notwithstanding the vesting and forfeiture provisions set forth in this Section 2, the Committee may, at any time and in its sole discretion, accelerate vesting of all or any part of this Award.

3.No Contract of Employment. Nothing in this Agreement will be construed as giving the Participant the right to continue employment with the Partnership or any Martin Group entity or in any way limit their right to terminate the Participant’s Service at any time.

4.Payment of Vested Phantom Units. The Phantom Unit Payment Value (as defined in Exhibit A) of each Phantom Unit subject to this Award that vests pursuant to this Agreement and Exhibit A (other than DER payments) shall be paid to the Participant in cash by the Partnership to the Participant (or to Participant’s estate in the case of death) as provided in Exhibit A.

5.Payment of DERs. No DERs shall be paid with respect to the Phantom Units granted hereunder.

6.Non-Transferability. This Award, any Phantom Units subject to this Award, and any other rights or privileges provided for in this Agreement, may not be transferred, assigned, pledged, or hypothecated in any manner, by operation of law or otherwise, and will not be subject to execution, attachment, or similar process.

7.Taxes. The Partnership or the Employer is authorized to withhold from any payment relating to the Phantom Units granted hereby, or any payroll or other payment to Participant, amounts of

withholding and other taxes due or potentially payable in connection with the Phantom Units granted hereby, and to take such other action as the Committee may deem advisable to enable the Partnership or the Employer and Participant to satisfy obligations for the payment of withholding taxes and other tax obligations relating to the Phantom Units granted hereby.

8.Amendment. The Committee may amend, modify, or terminate this Award at any time prior to vesting in any manner not inconsistent with the terms of the Plan. Notwithstanding the foregoing, except as expressly provided in the Plan, no such amendment, modification, or termination of this Award may materially impair the rights of the Participant under this Agreement without the written consent of the Participant.

9.Notices. All notices to the Partnership related to this Agreement should be sent to the Partnership’s principal executive offices as disclosed in its filings with the Securities and Exchange Commission, addressed to the Office of General Counsel. All notices to the Participant shall be delivered to the most recent address as provided by the Participant to the Employer’s human resources department.

10.Binding Effect. This Agreement is personal to the Participant and may not be assigned by the Participant. This Agreement shall inure to the benefit of and be binding upon each of the parties and any successors to the Partnership.

11.Governing Law. This Agreement will be governed by and construed in accordance with the laws of the State of Delaware, without regard to any conflicts of laws.

12.Severability. In the event that any provision in this Agreement shall be found to be invalid, illegal or unenforceable, the Participant and the Partnership intend for any court construing this Agreement to modify or limit such provision so as to render it valid and enforceable to the fullest extent allowed by law. Any such provision that is not susceptible of reformation shall be ignored and shall not affect the validity, legality and enforceability of the remaining provisions, which shall be valid and enforced to the fullest extent permitted by law.

13.Section 409A. It is intended that this Agreement and the Phantom Units granted comply with, or be exempt from, the requirements of Code Section 409A and the accompanying regulations and guidance issued by the Internal Revenue Service (“Section 409A”) and this Agreement shall be interpreted and administered accordingly. For purposes of this Agreement, if the Participant is a “specified employee” within the meaning of Section 409A(a)(2)(B)(i) on the date on which the Participant has a “separation from service” as defined in Treasury Regulation Section 1.409A-1(h), and any successor provision thereto (other than due to death), then any Phantom Units settled on account of a separation from service that are deferred compensation subject to Section 409A shall be paid or settled on the earliest of (1) the first business day following the expiration of six months from the Participant’s separation from service, (2) the date of the Participant’s death, or (3) such earlier date as complies with the requirements of Section 409A.

14.Entire Agreement. This Agreement, together with the Plan and the Partnership Agreement, constitutes the entire agreement between the parties with respect to the subject matter contained in this Agreement. Any oral or written agreements, representations, warranties, written inducements, or other communications with respect to the subject matter contained in this Agreement made prior to the execution of this Agreement shall be void and ineffective for all purposes.

By signature below, the Participant represents that he or she is familiar with the terms and provisions of the Plan, this Agreement, and the Partnership Agreement, and hereby accepts this Award subject to all of those terms and provisions. The Participant agrees to accept as binding, conclusive, and final all decisions or interpretations of the Committee upon any questions arising under the Plan or this Agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the Partnership and the Participant have executed this Agreement, effective as of the Date of Grant.

MARTIN MIDSTREAM PARTNERS L.P.

By: Martin Midstream GP LLC

By:

Name:

Title:

PARTICIPANT

By:

Name:

MARTIN MIDSTREAM PARTNERS L.P. 2025 PHANTOM UNIT PLAN

PHANTOM UNIT APPRECIATION RIGHT AWARD AGREEMENT

EXHIBIT A

Vesting Schedule and Terms

The Phantom Units granted under this Award shall vest and become payable as follows:

A.1. Definitions. For purposes of this Award, the “Phantom Unit Payment Value” is equal to the (i) Fair Market Value of a Phantom Unit as of the Valuation Date less (ii) $_______ (the average of the closing price for a Unit during the twenty (20) trading days immediately preceding the Date of Grant of the Phantom Units). The “Valuation Date” for the foregoing means the applicable Vesting Date, for purposes of Section A.2, the Termination Date, for purposes of Sections A.3 and A.5. and the Change in Control date, for purposes of Section A.4.