Form 8-K - Current report

01 October 2024 - 10:52PM

Edgar (US Regulatory)

FALSE000174972300017497232024-10-012024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 1, 2024

New Fortress Energy Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38790 | 83-1482060 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

111 W. 19th Street, 8th Floor New York, NY | | 10011 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (516) 268-7400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, par value $0.01 per share

| “NFE”

| NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 8.01. Other Events

On October 1, 2024, New Fortress Energy Inc. (the “Company”) announced that it priced its underwritten public offering of 46,349,942 shares of its Class A common stock, par value $0.01 per share at a public offering price of $8.63 per share. Wesley R. Edens, chairman of the Board of Directors, the Chief Executive Officer and shareholder of the Company, has agreed to purchase 5,793,742 shares in this offering at the public offering price per share and on the same terms as the other purchasers in this offering. The underwriters will not receive any underwriting discount on these shares as they will on any other shares sold to the public in this offering.

The offering is expected to close on October 2, 2024, subject to customary closing conditions. The Company intends to use the net proceeds from the offering for general corporate purposes.

Morgan Stanley & Co. LLC is acting as joint book-running manager for the offering together with other members of the syndicate.

A copy of the press release is attached hereto as exhibit 99.1, and is incorporated into this Item 8.01 by reference.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| | Press release, dated October 1, 2024. |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

Cautionary Statement Regarding Forward-Looking Statements

This report contains certain statements and information that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this communication other than historical information are forward-looking statements that involve known and unknown risks and relate to future events, the Company’s future financial performance or the Company’s projected business results. You can identify these forward-looking statements by the use of forward-looking words such as “expects,” “may,” “will,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of those words or other comparable words. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition or the stock prices of the Company. These forward-looking statements represent the Company’s expectations or beliefs concerning future events, and it is possible that the results described herein will not be achieved. These forward-looking statements are necessarily estimates based upon current information and are subject to risks, uncertainties and other factors, many of which are outside of the Company’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, the Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for the Company to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in the Company’s annual report, quarterly and other reports filed with the SEC, which could cause its actual results to differ materially from those contained in any forward-looking statement. The Company undertakes no duty to update these forward-looking statements, even though its situation may change in the future.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | NEW FORTRESS ENERGY INC. |

| | |

| Date: October 1, 2024 | By: | /s/ Christopher S. Guinta |

| | Name: | Christopher S. Guinta |

| | Title: | Chief Financial Officer |

New Fortress Energy Announces Completion of $400 Million Offering of Class A Common Stock NEW YORK—October 1, 2024-- New Fortress Energy Inc. (Nasdaq: NFE) (“NFE” or the “Company”) announced today that it priced its underwritten public offering of 46,349,942 shares of its Class A common stock, par value $0.01 per share at a public offering price of $8.63 per share. Wesley R. Edens, chairman of the Board of Directors, the Chief Executive Officer and shareholder of the Company, has agreed to purchase 5,793,742 shares in this offering at the public offering price per share and on the same terms as the other purchasers in this offering. The underwriters will not receive any underwriting discount on these shares as they will on any other shares sold to the public in this offering. The offering is expected to close on October 2, 2024, subject to customary closing conditions. The Company intends to use the net proceeds from this offering for general corporate purposes. Morgan Stanley & Co. LLC is acting as joint book-running manager for the offering together with other members of the syndicate. The offering is being made pursuant to the Company’s effective shelf registration statement filed with the Securities and Exchange Commission (the “SEC”). The offering is being made only by means of a prospectus. Prospective investors should read the prospectus in that registration statement and other documents the Company has filed or will file with the SEC for more complete information about the Company and the offering. You may obtain these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, copies of the prospectus may be obtained from Morgan Stanley & Co. LLC, Attn: Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY 10014. This press release does not constitute an offer to sell or the solicitation of an offer to buy shares of common stock, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. About New Fortress Energy Inc. New Fortress Energy Inc. (NASDAQ: NFE) is a global energy infrastructure company founded to address energy poverty and accelerate the world’s transition to reliable, affordable, and clean energy. The Company owns and operates natural gas and liquefied natural gas (LNG) infrastructure and an integrated fleet of ships and logistics assets to rapidly deliver turnkey energy solutions to global markets. Collectively, the Company’s assets and operations reinforce global energy security, enable economic growth, enhance environmental stewardship and transform local industries and communities around the world. Cautionary Language Regarding Forward-Looking Statements This press release contains certain statements and information that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this communication other than historical information are forward-looking statements that involve known and unknown risks and relate to future events, our future financial performance or our projected business results. You can identify these forward-looking statements by the use of forward- looking words such as “expects,” “may,” “will,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these terms or other comparable words. Forward looking statements include, but 111 W 19th Street, 8th Floor New York, NY 10011

are not limited to, statements related to the consummation of the offering or the Company’s anticipated use of the net proceeds from the offering. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks, uncertainties and other factors, many of which are outside of the Company’s control. Actual results or events may differ materially from the results anticipated in these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we undertake no duty to update or revise these forward-looking statements, even though our situation may change in the future. New factors emerge from time to time, and it is not possible for the Company to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements included in the Company’s annual and quarterly reports filed with the Securities and Exchange Commission, which could cause its actual results to differ materially from those contained in any forward-looking statement. # # # Investors ir@newfortressenergy.com Media press@newfortressenergy.com Source: New Fortress Energy Inc.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

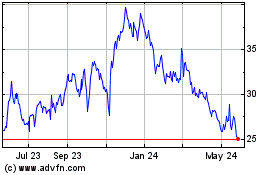

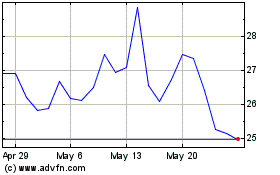

New Fortress Energy (NASDAQ:NFE)

Historical Stock Chart

From Nov 2024 to Dec 2024

New Fortress Energy (NASDAQ:NFE)

Historical Stock Chart

From Dec 2023 to Dec 2024