UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 14)1

Nano Dimension Ltd.

(Name

of Issuer)

Ordinary Shares par value NIS 5.00 per share

(Title of Class of Securities)

63008G203

(CUSIP Number)

MURCHINSON LTD.

145 Adelaide Street West, Fourth Floor

Toronto, Ontario Canada A6 M5H 4E5

(416) 845-0666

ANDREW FREEDMAN, ESQ.

MEAGAN REDA, ESQ.

OLSHAN

FROME WOLOSKY LLP

1325

Avenue of the Americas

New

York, New York 10019

(212)

451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

October 22, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Murchinson Ltd. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Canada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

7,775,000# |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,775,000* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,775,000# |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,775,000* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

15,550,000#* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

7.1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

# Includes (i) 7,500,000 Ordinary

Shares and (ii) 275,000 American Depositary Shares (“ADSs”) (each ADS represents one Ordinary Share).

* Includes (i) 4,000,000 Ordinary Shares and (ii) 3,775,000 American Depositary

Shares (“ADSs”) (each ADS represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Nomis Bay Ltd |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Bermuda |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

4,665,000* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

4,665,000* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

4,665,000* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

2.1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

* Includes (i) 3,600,000 Ordinary Shares and (ii) 1,065,000 American Depositary

Shares (“ADSs”) (each ADS represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

BPY Limited |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Bermuda |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

3,110,000* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

3,110,000* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

3,110,000* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

1.4% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

* Includes (i) 400,000 Ordinary Shares and (ii) 2,710,000 American Depositary

Shares (“ADSs”) (each ADS represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

EOM Management Ltd. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Bermuda |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,775,000* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,775,000* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

7,775,000* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

3.5% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

* Includes (i) 4,000,000 Ordinary Shares and (ii) 3,775,000 American Depositary

Shares (“ADSs”) (each ADS represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

James Keyes |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

United Kingdom |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,775,000* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,775,000* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

7,775,000* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

3.5% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

* Includes (i) 4,000,000 Ordinary Shares and (ii) 3,775,000 American Depositary

Shares (“ADSs”) (each ADS represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Jason Jagessar |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Republic of Trinidad and Tobago |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,775,000* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,775,000* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

7,775,000* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

3.5% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

* Includes (i) 4,000,000 Ordinary Shares and (ii) 3,775,000 American Depositary

Shares (“ADSs”) (each ADS represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Chaja Carlebach |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Switzerland |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,775,000* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,775,000* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

7,775,000* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

3.5% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

* Includes (i) 4,000,000 Ordinary Shares and (ii) 3,775,000 American Depositary

Shares (“ADSs”) (each ADS represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Marc J. Bistricer |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Canada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

7,775,000# |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,775,000* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,775,000# |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,775,000* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

15,550,000#* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

7.1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

# Includes (i) 7,500,000 Ordinary

Shares and (ii) 275,000 American Depositary Shares (“ADSs”) (each ADS represents one Ordinary Share).

* Includes (i) 4,000,000 Ordinary Shares and (ii) 3,775,000 American Depositary

Shares (“ADSs”) (each ADS represents one Ordinary Share).

The following constitutes

Amendment No. 14 to the Schedule 13D filed by the undersigned (the “Amendment No. 14”). This Amendment No. 14 amends the Schedule

13D as specifically set forth herein.

| Item 3. | Source and Amount of Funds or Other Consideration. |

Item 3 is hereby amended

to add the following:

In connection with the ADS

Conversion (as defined below), (i) Nomis Bay paid $30,017.50 in fees to the Bank of New York Mellon, the depositary (“BNYM”),

(ii) BPY paid $20,017.50 in fees to BNYM, and (iii) Murchinson, on behalf of the Managed Positions, paid $375,035 in fees to BNYM.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On October 22, 2024, Murchinson

and certain funds it advises and/or sub-advises (collectively, the “Proposing Shareholders”), delivered a letter to the Issuer

pursuant to Section 66(b) of the Israeli Companies Law, 1999 (the “AGM Demand”), demanding that the Issuer add to the agenda

of the Annual General Meeting of Shareholders scheduled to be held on December 6, 2024 (the “Meeting”) various resolutions

proposed by the Proposing Shareholders (the “Murchinson Proposed Resolutions”) to substantially improve the Issuer’s

corporate governance and overhaul the Issuer’s Board of Directors (the “Board”), including resolutions to (i) elect

two experienced and independent director nominees, Mr. Robert (Bob) Pons and Mr. Ofir Baharav (the “Murchinson Director Nominees”),

as Class I directors, and (ii) amend certain provisions of the Issuer’s Amended and Restated Articles of Association (as amended,

the “Articles”), including amendments to declassify the Board and require shareholder approval of major acquisition transactions.

The Murchinson Proposed Resolutions, which were included as Exhibit B to the AGM Demand, are attached hereto as Exhibit 99.1 and are incorporated

herein by reference.

Given the Issuer’s

history of concerning actions and apparent attempts to disenfranchise shareholders, including with respect to the 2023 Annual General

Meeting of Shareholders (the “2023 AGM”), the Proposing Shareholders urge the Board to refrain from employing similar tactics

at this year’s Meeting and properly include all of the Murchinson Proposed Resolutions on the agenda for the Meeting and in its

revied proxy materials in accordance with the law.

As previously disclosed in

Amendment No. 13 to the Schedule 13D, the Reporting Persons were in the process of converting a portion of the ADSs held by Nomis Bay,

BPY and the Managed Positions into Ordinary Shares (the “ADS Conversion”). As part of the ADS Conversion, Nomis Bay, BPY and

Murchinson on behalf of the Managed Positions surrendered and withdrew certain of their ADSs to BNYM and requested delivery of the underlying

Ordinary Shares. The ADS Conversion has been completed and as such, (i) Nomis Bay currently holds 1,065,000 ADSs and 3,600,000 Ordinary

Shares, (ii) BPY currently holds 2,710,000 ADSs and 400,000 Ordinary Shares, and (iii) the Managed Positions currently hold 275,000 ADSs

and 7,500,000 Ordinary Shares.

| Item 5. | Interest in the Securities of the Issuer. |

Item 5(c) is hereby amended

to add the following:

Other than the ADS Conversion

defined and described in Item 4 above, there have been no transactions in the Shares by the Reporting Persons since the filing of Amendment

No. 13 to the Schedule 13D.

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended

to add the following:

Murchinson has signed separate

letter agreements (the “Indemnification Letter Agreements”) with each of the Murchinson Director Nominees pursuant to which

it has agreed to indemnify such nominees against claims arising from the AGM Demand. A form of the Indemnification Letter Agreement is

attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Murchinson has signed compensation

letter agreements (the “Compensation Letter Agreements”) with each of the Murchinson Director Nominees, pursuant to which

it has agreed to pay each of such nominees $50,000 in cash as a result of the submission by Murchinson of the AGM Demand. A form of the

Compensation Letter Agreement is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibits:

| 99.1 | Murchinson Proposed Resolutions. |

| 99.2 | Form of Indemnification Letter Agreement. |

| 99.3 | Form of Compensation Letter Agreement. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: October 23, 2024

| |

Nomis Bay Ltd |

| |

|

| |

By: |

/s/ James Keyes |

| |

|

Name: |

James Keyes |

| |

|

Title: |

Director |

| |

BPY Limited |

| |

|

| |

By: |

/s/ James Keyes |

| |

|

Name: |

James Keyes |

| |

|

Title: |

Director |

| |

EOM Management Ltd. |

| |

|

| |

By: |

/s/ Chaja Carlebach |

| |

|

Name: |

Chaja Carlebach |

| |

|

Title: |

Director |

| |

Murchinson Ltd. |

| |

|

| |

By: |

/s/ Marc J. Bistricer |

| |

|

Name: |

Marc J. Bistricer |

| |

|

Title: |

Chief Executive Officer |

| |

/s/ James Keyes |

| |

James Keyes |

| |

/s/ Jason Jagessar |

| |

Jason Jagessar |

| |

/s/ Chaja Carlebach |

| |

Chaja Carlebach |

| |

/s/ Marc J. Bistricer |

| |

Marc J. Bistricer |

Exhibit 99.2

MURCHINSON LTD.

145 Adelaide Street West

Toronto, A6 M5H 4E5

October 22, 2024

Dear [Nominee]:

Thank you for agreeing

to serve as a nominee of Murchinson Ltd. (“Murchinson”) and certain other funds it advises and/or sub-advises (including their

respective affiliates, the “Murchinson Group”) for election or appointment to the Board of Directors of Nano Dimension Ltd.

(the “Company”) at the Company’s annual general meeting of shareholders of the Company, or any other meeting of shareholders

held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof (the “Murchinson Group Solicitation”).

Your outstanding qualifications, we believe, will prove a valuable asset to the Company and all of its shareholders. This letter (this

“Agreement”) will set forth the terms of our agreement.

The members of the Murchinson

Group agree to jointly and severally indemnify and hold you harmless against any and all claims of any nature, whenever brought, arising

from the Murchinson Group Solicitation, irrespective of the outcome; provided, however, that you will not be entitled to

indemnification for claims arising from your gross negligence, willful misconduct, intentional and material violations of law, criminal

actions or material breach of the terms of this Agreement; provided further, that upon your becoming a director or officer of the

Company, this indemnification shall not apply to any claims made against you in your capacity as a director or officer of the Company.

This indemnification will include losses, liabilities, damages, demands, claims, suits, actions, judgments, or causes of action, assessments,

costs and expenses, including, without limitation, interest, penalties, reasonable attorneys’ fees, and reasonable costs and expenses

incurred in investigating, preparing or defending against any litigation, commenced or threatened, any civil, criminal, administrative

or arbitration action, or any claim whatsoever, and amounts paid in settlement of any claim or litigation asserted against, resulting,

imposed upon, or incurred or suffered by you, directly or indirectly, as a result of or arising from the Murchinson Group Solicitation

and any related transactions (each, a “Loss”).

In the event of a claim

against you pursuant to the prior paragraph or the occurrence of a Loss, you shall give the Murchinson Group prompt written notice of

such claim or Loss (provided that failure to promptly notify the Murchinson Group shall not relieve us from any liability which we may

have on account of this Agreement, except to the extent we shall have been materially prejudiced by such failure). Upon receipt of such

written notice, the Murchinson Group will provide you with counsel to represent you. Such counsel shall be reasonably acceptable to you.

In addition, you will be reimbursed promptly for Losses suffered by you and as incurred as provided herein. The Murchinson Group may not

enter into any settlement of loss or claim without your consent unless such settlement includes a release of you from any and all liability

in respect of such claim.

You

hereby agree to keep confidential and not disclose to any party, without the prior written consent of the Murchinson Group,

any confidential, proprietary or non-public information (collectively, “Information”) of the Murchinson Group,

its affiliates or any members of any group formed by the Murchinson Group pursuant to Rule

13d-1(k)(1)(iii) under the Securities Exchange Act of 1934, as amended (“13D Group”) which you have heretofore obtained or

may obtain in connection with your service as a nominee hereunder. Notwithstanding the foregoing, Information shall not include

any information that is publicly disclosed by the Murchinson Group, its affiliates or any members of any 13D Group or any information

that you can demonstrate is now, or hereafter becomes, through no act or failure to act on your part, otherwise generally known to the

public.

Notwithstanding

the foregoing, if you are required by applicable law, rule, regulation or legal process to disclose any Information you may do

so provided that you first promptly notify the Murchinson Group so that the Murchinson Group or any member thereof may seek a protective

order or other appropriate remedy or, in the Murchinson Group’s sole discretion, waive compliance with the terms of this Agreement.

In the event that no such protective order or other remedy is obtained or the Murchinson Group does not waive compliance with the terms

of this Agreement, you may consult with counsel at the cost of the Murchinson Group and you may furnish only that portion of the Information

which you are advised by counsel is legally required to be so disclosed and you will request that the party(ies) receiving such Information

maintain it as confidential.

All

Information, all copies thereof, and any studies, notes, records, analysis, compilations or other documents prepared by you containing

such Information, shall be and remain the property of the Murchinson Group and, upon the

request of a representative of the Murchinson Group, all such Information shall be returned

or, at the Murchinson Group’s option, destroyed by you, with such destruction confirmed

by you to the Murchinson Group in writing.

This Agreement shall be

governed by the laws of the State of New York, without regard to the principles of the conflicts of laws thereof.

* * *

If you agree to the foregoing

terms, please sign below to indicate your acceptance.

| |

Very truly yours, |

| |

|

| |

MURCHINSON LTD. |

| |

|

| |

By: |

|

| |

|

Name: |

Marc Bistricer |

| |

|

Title: |

Chief Executive Officer |

| ACCEPTED AND AGREED: |

|

| |

|

|

|

|

| [Nominee] |

|

Exhibit 99.3

MURCHINSON LTD.

145 Adelaide Street West

Toronto, A6 M5H 4E5

October 22, 2024

Dear [Nominee]:

This letter sets forth

our mutual agreement with respect to compensation to be paid to you for your agreement to be named and serve as a nominee of a group of

investors (the “Murchinson Group”), including Murchinson Ltd. (“Murchinson”) and certain other funds it advises

and/or sub-advises, for election or appointment as a director of Nano Dimension Ltd. (the “Company”) at the Company’s

annual general meeting of shareholders of the Company, or any other meeting of shareholders held in lieu thereof, and any adjournments,

postponements, reschedulings or continuations thereof (the “AGM”).

In consideration of your

agreement to be named and serve as a nominee of the Murchinson Group for your proposed appointment as a director of the Company at the

AGM, the undersigned hereby agrees to pay you $50,000 in cash promptly following the execution of this letter agreement by Murchinson

and you and, for the sake of clarity, regardless of the outcome of the AGM.

The term of this letter

agreement shall commence on the date hereof and shall remain in effect until the earliest to occur of (i) the Company’s appointment

or nomination of you for election as a director of the Company, (ii) the date of any agreement with the Company in furtherance of your

nomination or appointment as a director of the Company, (iii) the Murchinson Group’s withdrawal of your nomination for appointment

as a director of the Company, and (iv) the date of the AGM.

The validity, interpretation,

construction and performance of this letter agreement shall be governed by the laws of the State of New York, without regard to its principles

of conflict of laws, and by applicable laws of the United States. The parties hereto consent to the jurisdiction of the New York State

and United States courts located in New York County, New York for the resolution of any disputes hereunder and agree that venue shall

be proper in any such court notwithstanding any principle of forum non conveniens and that service of process on the parties hereto in

any proceeding in any such court may be effected in the manner provided herein for the giving of notices. The parties hereto waive trial

by jury in respect of any such proceeding.

This letter agreement shall

bind and inure to the benefit of you and your heirs, successors and assigns.

This letter agreement

may be executed in counterparts, each of which shall be deemed an original, and all of which, taken together, shall constitute one and

the same instrument.

| |

MURCHINSON LTD. |

| |

|

| |

By: |

|

| |

|

Name: |

Marc Bistricer |

| |

|

Title: |

Chief Executive Officer |

| Accepted and Agreed to: |

|

| |

|

|

|

|

| [NOMINEE] |

|

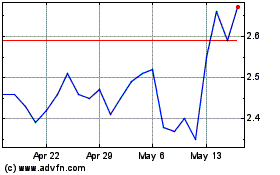

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Oct 2024 to Nov 2024

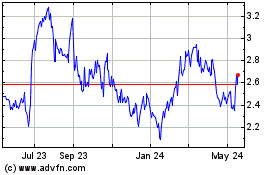

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Nov 2023 to Nov 2024