Nano Dimension Ltd. (Nasdaq: NNDM) (“Nano Dimension” or the

“Company”), a leading supplier of Additively Manufactured

Electronics (“AME”) and multi-dimensional polymer, metal &

ceramic Additive Manufacturing (“AM”) 3D printing solutions, today

sent a letter to shareholders in connection with the Company’s

upcoming 2024 Annual General Meeting of Shareholders (the “Annual

Meeting”).

The letter details the progress Nano Dimension

has made in executing its focused value creation strategy under the

guidance of Nano Dimension’s Board of Directors (the “Board”) and

the leadership of its management team. Key highlights of the past

12 months include:

| |

● |

Two transformational M&A agreements that accelerate Nano

Dimension’s plans to become a leader in digital manufacturing; |

|

|

● |

Improvements in financial and operational performance; and |

|

|

● |

Significant governance enhancements. |

The letter also highlights the value destructive

and deeply concerning proposed Annual Meeting agenda items received

from Murchinson Ltd. (“Murchinson”). Despite shareholders’ clear

rebuke last year, Murchinson is once again attempting to gain

control of Nano Dimension through a series of proposals that would

paralyze the Company’s strategy, while facilitating its path to

gain control of the Board, obtain Nano Dimension’s cash, and

prevent the maximization of long-term value for all

shareholders.

The Board urges shareholders to protect their

investment and the future of the Company by voting today

“FOR” ALL of Nano

Dimension’s proposals. The Annual

Meeting will be held on Friday, December 6th, 2024, at 7:00 A.M.

ET. Shareholders of record as of the close of business on

October 22nd, 2024, are entitled to vote at the Annual Meeting.

Votes must be received by 11:59 P.M. ET on Sunday, December 1st,

2024.

The Company’s definitive proxy statement and

other important information and resources related to the Annual

Meeting can be found at www.ProtectingNanoValue.com or the investor

relations page of the Company’s website.

The full text of the letter can be found

below.

Nano Dimension Shareholders: Once Again,

You Must VOTE to Protect Your Investment in Nano!

Dear Fellow Shareholder,

At last year’s Annual General Meeting (“AGM”) of Nano Dimension

(“Nano” or the “Company”), you made the choice to protect your

Company and your investment — your decisive votes prevented the

self-interested actors at Murchinson Ltd. (“Murchinson”) from

seizing control of Nano.

In the year since our last AGM, your Board of Directors

(“Board”) and management team have been delivering on the

promises we made to you, leading Nano’s successful

expansion strategy to become a digital manufacturing leader.

We are executing on our multi-pronged growth

strategy, comprised of transformational M&A, and driving

improvements in financial and operational performance, while we

have also instituted significant governance enhancements.

Despite our progress in executing our strategy, Murchinson is

once again seeking to derail our approach for its own

self-interested gains.

As a result, at the upcoming AGM to be held on December 6, 2024,

shareholders must again vote to protect their investment.

The answer is clear:

| |

✔ |

Vote FOR ALL of

Nano’s proposals, allowing our Board to continue executing on our

strategic plan to build significant long-term value for all Nano

shareholders; |

– AND –

| |

× |

Vote AGAINST

Murchinson’s efforts to derail our progress. All of their proposals

will destroy value. |

Nano Is Executing a Focused Value

Creation Strategy

Delivering Results and Driving Future Value

Creation

Over the past year, your Board and management team have driven

Nano’s transformation into a broad, digital manufacturing leader

with expanded 3D printing and additive manufacturing (“AM”)

capabilities.

Our strategy is delivering

results. Nano’s strong organic growth

from development and innovation in leading technologies, combined

with a disciplined and focused M&A strategy and publicly stated

plans to return capital to shareholders, are expected to continue

to drive future value for shareholders:

Transformational

M&A. The agreements to acquire

Desktop Metal, Inc. (“Desktop Metal”) and Markforged Holding

Corporation (“Markforged”), which are expected to close in the

fourth quarter of 2024 and first quarter of 2025, respectively, are

a realization of Nano’s ambitious and prudent M&A strategy to

create the market leader in AM. The future combined company,

including both Desktop Metal and Markforged, is expected to have

approximately $340 million in revenue based on fiscal year 2023 and

is expected to have approximately $475 million in cash, cash

equivalents, and marketable securities at the time of expected

closing of both transactions. The addition of both companies at

compelling valuations is expected to accelerate Nano’s path

to becoming a leading force in Industry 4.0 and digital

manufacturing, further strengthening the Company’s value

proposition for shareholders, customers and employees, as well as

provide Nano with a clear path to

profitability.

Improved Financial and Operational

Performance. Nano’s focus on operational

excellence has enabled it to deliver strong organic growth

and meaningful efficiencies. This focus has enabled the

leadership team to scale Nano, drive improved business performance

and deliver results to the bottom line. Nano’s focus on sales wins

and new product development has led to 29% organic revenue growth

in 2023 compared to the prior year. Importantly, it is not just

about the top-line — Nano reported a 69% reduction in cash burn in

the first half of 2024 from the first half of 2023 and is

laser-focused on driving towards profitability.

Returning Capital to

Shareholders. Nano is executing a

balanced capital allocation approach that enables shareholder

returns, investment in R&D and further growth through M&A.

Nano has completed over $160 million in share repurchases over two

programs to buy back its shares at compelling valuations to drive

shareholder value since the first repurchase program was approved

in August 2022.

Under Our Current Strategy

Nano Has Enacted Corporate Governance

Enhancements

Nano has acted on feedback from shareholders and governance

experts over the past year and instituted important enhancements to

its corporate governance. These changes include:

Reducing the size of the Board from nine to

eight directors, seven of whom are independent;

Separating the Company’s Chairman and CEO roles

and appointing Dr. Nissan-Cohen as Chairman of the Board; and

Continuing efforts to refresh the Board,

including the appointments of three new directors: Ambassador

Georgette Mosbacher, Major General (Ret.) Eitan Ben-Eliahu and

4-Star General (Ret.) Michael Garrett.

Our accomplished Board consists of eight highly

qualified individuals – seven of whom are independent –

with diverse skills that align with and support our focus on

growth, while taking our portfolio of proprietary manufacturing

solutions to the next level.

The two Nano directors targeted by Murchinson, our CEO Yoav

Stern and 4-Star General (Ret.) Michael X. Garrett, are

critical to the Board’s oversight of our strategy

and continued success. During both their tenures, Nano has executed

eight M&A transactions, including the recent agreements with

Desktop Metal and Markforged, driven meaningful operational

efficiencies, while delivering strong organic revenue growth, and

made significant progress in innovation. With their deep expertise

and institutional knowledge, we have the right Board in

place to bolster our long-term strategy and deliver value for

shareholders.

Murchinson Is, Again, Threatening to

Derail Our Progress With Its Self-Interested Agenda

Items

Last year, shareholders recognized that Murchinson brought

NO plan for value creation, NO

executable ideas, and NO director candidates with

additive skills.

Despite shareholders’ clear rebuke last year, Murchinson is once

again attempting to take control of Nano through a series

of proposals that would paralyze Nano’s strategy, while

facilitating Murchinson’s path to gain control of the Board and

prevent us from maximizing long-term value for all

shareholders. Murchinson is attempting to do this by

removing two directors who are critical to our Board oversight in

favor of two unqualified nominees, while also de-staggering the

Board.

In addition, Murchinson has made a proposal, which Nano has

rejected on legal grounds, seeking to prevent us from executing on

any M&A transactions above $50 million,

including our already signed agreements with Desktop Metal and

Markforged. This absurd concept would effectively hold up

Nano’s growth strategy to allow Murchinson time to take

control of a de-staggered Board. Make no mistake, this approach is

not an attempt to protect your interests: it is a blatant

effort to freeze Nano in place as Murchinson seeks to gain

control.

You have before you two proposals from Murchinson and the choice

is clear:

Reject Murchinson’s Unqualified Director

Nominees.

| |

○ |

Ofir Baharav is Nano’s prior

Chairman of the Board. His career has been riddled with concerns

about questionable ethics and failed businesses. Importantly, his

oversight of Nano’s strategy led the Company to one of its most

dire periods. He currently serves as the CEO of PowerBreezer, a

fledgling ventilators manufacturer, which under Mr. Baharav’s

leadership has failed to meet all its goals since 2016, including

to complete an IPO. Prior to that, he was ousted from XJet, a

company he founded, after conflicts with at least two prominent

investors and the company’s co-founder. |

|

|

|

|

| |

○ |

Robert Pons has ZERO direct 3D printing

experience. |

|

|

|

|

|

|

○ |

These unqualified director

candidates have NO additive skills,

NO strategic plan, and NO

independence from Murchinson. |

Reject De-Staggering the Board. A staggered

Board ensures that only a portion of the directors are up for

election at any given time, providing stability and continuity in

leadership and allowing time for long-term strategic planning.

Importantly, it also reduces risk of attempts to undervalue the

Company in a takeover. Murchinson clearly recognizes that a

staggered Board would make it harder for it to gain control – this

proposal is a blatant attempt to make it easier to dismantle and

liquidate Nano.

Murchinson Brings a History of Dubious,

Self-Interested Behavior and NO Plan to Create Value for Nano’s

Shareholders

As a reminder, Murchinson is a family hedge fund with a

long track record of problematic actions and poor judgment

– including stock manipulations, violations of law, and legal

proceedings with regulatory authorities. This record

extends to its founder, Marc Bistricer, who was required to pay the

Securities and Exchange Commission (“SEC”) $8 million in August

2021 for rules violations and has subsequently been accused by the

Ontario Security Commission of carrying out an abusive

short-selling scheme. In addition, Murchinson’s co-conspirators

Anson Funds and Anson Advisors were fined $2.25 million by the SEC

for misleading disclosures in June 2024, just a few months after

another October 2023 SEC fine.

Murchinson follows a simple playbook whereby the fund finds

promising companies such as Nano, furtively acquires a large

position and then seeks to dismantle the company and

distribute its cash for Murchinson’s own benefit. The fund

brings NO insight into the business,

NO plan for value creation and NO

executable ideas.

Murchinson’s own employees admit to these facts. Mr. Moshe

Sarfaty, a senior analyst and employee of Murchinson, directly

admitted to Murchinson’s lack of understanding of Nano’s business

activities and valuation in his July 2023 court testimony:

“I don't analyze the activity, because I don't

understand 3D printing…. we really have no idea what is good and

what is not good to do here.”

With no insight into the business, it is clear Murchinson does

not care about creating value for all of Nano’s shareholders – it

only cares about itself. Murchinson is ultimately seeking to gain

control of your Company without paying a premium. Allowing

Murchinson to pursue its self-interested agenda through its

proposals would deprive you of considerable upside as Nano

continues to execute on its strategy.

WE URGE YOU TO PROTECT YOUR INVESTMENT – VOTE

FOR NANO’S PROPOSALS AND AGAINST

MURCHINSON’S SELF-INTERESTED AGENDA ITEMS

Your vote is important. Throw away any proxy materials you may

receive from Murchinson. For most shareholders, the expected

deadline to vote electronically will be 11:59 pm ET on

December 1, 2024. Please vote as early as possible and

follow the instructions on your voting instruction form as your

broker may impose earlier voting cut-offs.

If you have questions about how to vote your shares, please

contact:

About Nano Dimension

Nano Dimension’s (Nasdaq: NNDM) vision is to

transform existing electronics and mechanical manufacturing into

Industry 4.0 environmentally friendly & economically efficient

precision additive electronics and manufacturing – by delivering

solutions that convert digital designs to electronic or mechanical

devices – on demand, anytime, anywhere.

Nano Dimension’s strategy is driven by the

application of deep learning-based AI to drive improvements in

manufacturing capabilities by using self-learning &

self-improving systems, along with the management of a distributed

manufacturing network via the cloud.

Nano Dimension has served over 2,000 customers

across vertical target markets such as aerospace and defense,

advanced automotive, high-tech industrial, specialty medical

technology, R&D, and academia. The Company designs and makes

Additive Electronics and Additive Manufacturing 3D printing

machines and consumable materials. Additive Electronics are

manufacturing machines that enable the design and development of

High-Performance-Electronic-Devices (Hi-PED®s). Additive

Manufacturing includes manufacturing solutions for production of

metal, ceramic, and specialty polymers-based applications - from

millimeters to several centimeters in size with micron

precision.

Through the integration of its portfolio of

products, Nano Dimension is offering the advantages of rapid

prototyping, high-mix-low-volume production, IP security, minimal

environmental footprint, and design-for-manufacturing capabilities,

which is all unleashed with the limitless possibilities of additive

manufacturing.

For more information, please visit www.nano-di.com.

Forward Looking Statements

This document contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include statements regarding

benefits and advantages of the proposed transactions with

Markforged and Desktop Metal, and the combined company; Nano

Dimension’s leadership in AM; the combined company’s revenues and

cash; other aspects of the expected transactions with Markforged

and Desktop Metal, including the timing of closing of the

acquisitions thereof, the potential benefits of a staggered board;

Nano Dimension’s strategy; Nano Dimension’s path to profitability,

future growth and value to shareholders; and all other statements

other than statements of historical fact that address activities,

events or developments that Nano Dimension intends, expects,

projects, believes or anticipates will or may occur in the future.

Such statements are based on management’s beliefs and assumptions

made based on information currently available to management. When

used in this communication, the words “outlook,” “guidance,”

“expects,” “believes,” “anticipates,” “should,” “estimates,” “may,”

“will,” “intends,” “projects,” “could,” “would,” “estimate,”

“potential,” “continue,” “plan,” “target,” or the negative of these

words or similar expressions are intended to identify

forward-looking statements, though not all forward-looking

statements contain these identifying words. These forward-looking

statements involve known and unknown risks and uncertainties, which

may cause the Company’s actual results and performance to be

materially different from those expressed or implied in the

forward-looking statements. Accordingly, we caution you that any

such forward-looking statements are not guarantees of future

performance and are subject to risks, assumptions, estimates and

uncertainties that are difficult to predict. Because such

statements deal with future events and are based on the current

expectations of Nano Dimension, Desktop Metal and Markforged, they

are subject to various risks and uncertainties. The acquisitions of

Markforged and Desktop Metal are subject to closing conditions,

some of which are beyond the control of Nano, Desktop Metal or

Markforged. Further, actual results, performance, or achievements

of Nano Dimension, Desktop Metal or Markforged could differ

materially from those described in or implied by the statements in

this communication. The forward-looking statements contained or

implied in this communication are subject to other risks and

uncertainties, including those discussed (i) under the heading

“Risk Factors” in Nano’s annual report on Form 20-F filed with the

Securities and Exchange Commission (the “SEC”) on March 21, 2024,

and in any subsequent filings with the SEC, (ii) under the heading

“Risk Factors” in Desktop Metal’s annual report on Form 10-K filed

with the SEC on March 15, 2024, and in any subsequent filings with

the SEC, and (iii) under the heading “Risk Factors” in Markforged’s

annual report on Form 10-K filed with the SEC on March 15, 2024,

and in any subsequent filings with the SEC. The combined company

financial information included in this communication has not been

audited or reviewed by Nano’s auditors and such information is

provided for illustrative purposes only. You should note that such

combined company information has not been prepared in accordance

with and does not purport to comply with Article 11 of Regulation

S-X under the Securities Act of 1933, as amended. Except as

otherwise required by law, Nano undertakes no obligation to

publicly release any revisions to these forward-looking statements

to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events. References and

links to websites have been provided as a convenience, and the

information contained on such websites is not incorporated by

reference into this communication. Nano is not responsible for the

contents of third-party websites.

No Offer or Solicitation

This communication is not intended to and shall not constitute

an offer to buy or sell or the solicitation of an offer to buy or

sell any securities, or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made, except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended.

Additional Information about the Transaction and Where

to Find It

In connection with the proposed transaction, Markforged intends

to file a proxy statement with the SEC. Markforged may also file

other relevant documents with the SEC regarding the proposed

transaction. This document is not a substitute for the proxy

statement or any other document that Markforged may file with the

SEC. The definitive proxy statement (if and when available) will be

mailed to shareholders of Markforged. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER

RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION. Investors and security holders will be able to obtain

free copies of the proxy statement (if and when available) and

other documents containing important information about Markforged

and the proposed transaction, once such documents are filed with

the SEC through the website maintained by the SEC

at http://www.sec.gov. Copies of the documents filed with the

SEC by the Company will be available free of charge on Markforged’s

website at https://investors.markforged.com/sec-filings.

Participants in the Solicitation

Nano Dimension, Markforged and certain of their respective

directors and executive officers may be deemed to be participants

in the solicitation of proxies from Markforged shareholders in

respect of the proposed transaction. Information about the

directors and executive officers of Nano Dimension, including a

description of their direct or indirect interests, by security

holdings or otherwise, is set forth in Nano Dimension’s Annual

Report on Form 20-F for the fiscal year ended December 31, 2023,

which was filed with the SEC on March 21, 2024. Information about

the directors and executive officers of Markforged, including a

description of their direct or indirect interests, by security

holdings or otherwise, is set forth in Markforged’s proxy statement

for its 2024 Annual Meeting of Stockholders, which was filed with

the SEC on April 26, 2024 and Markforged’s Annual Report on Form

10-K for the fiscal year ended December 31, 2023, which was filed

with the SEC on March 15, 2024. Other information regarding the

participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise,

will be contained in the proxy statement and other relevant

materials to be filed with the SEC regarding the proposed

transaction when such materials become available. Investors should

read the proxy statement carefully when it becomes available before

making any voting or investment decisions. You may obtain free

copies of these documents from Nano Dimension or Markforged using

the sources indicated above.

Nano Dimension Contacts

Investor:Julien Lederman, VP Corporate

Developmentir@nano-di.comMedia:Kal Goldberg / Bryan Locke / Kelsey

Markovich | NanoDimension@fgsglobal.com

To learn more, visit ProtectingNanoValue.com

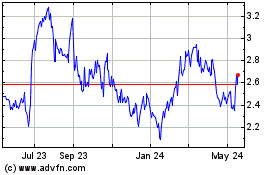

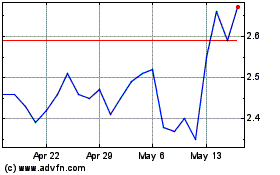

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Nov 2023 to Nov 2024