Form 8-K - Current report

01 March 2025 - 8:05AM

Edgar (US Regulatory)

false

0000788611

0000788611

2025-02-28

2025-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 28, 2025

NextTrip,

Inc.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-38015 |

|

27-1865814 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

3900

Paseo del Sol

Santa Fe, New Mexico |

|

87507 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (505) 438-2576

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

NTRP |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

As

previously disclosed on that certain Current Report on Form 8-K as filed with the Securities and Exchange Commission (the “SEC”)

on September 20, 2024 (the “Original 8-K”), on September 18, 2024, NextTrip, Inc. (the “Company”) received a

notification letter (the “Notice”) from the Nasdaq Listing Qualifications Staff (the “Staff”) of The Nasdaq Stock

Market LLC (“Nasdaq”) notifying the Company that its amount of stockholders’ equity had fallen below the $2,500,000

required minimum for continued listing set forth in Nasdaq Listing Rule 5550(b)(1). The Notice also noted that the Company does not meet

the alternatives of market value of listed securities or net income from continuing operations, and therefore, the Company no longer

complied with Nasdaq’s Listing Rules.

As

noted in the Original 8-K, the Company had until November 4, 2024 to provide Nasdaq with a specific plan to achieve and sustain compliance,

which the Company has done. The Company is filing this Current Report on Form 8-K (this “Report”) to provide an update

to its compliance with continued listing requirements as set forth in Nasdaq Listing Rule 5550(b)(1).

As

a result of various transactions entered into by the Company since November 30, 2024, including without limitation various equity offerings,

debt conversions and strategic transactions, the Company believes it has regained compliance with the minimum $2.5 million stockholders’

equity requirement for continued listing, and satisfies the minimum $5 million equity requirement for initial listing on The Nasdaq

Capital Market. In that regard, the Company believes that as of the date of this Report, stockholders’ equity exceeds $5 million.

Nasdaq will continue to monitor the Company’s ongoing compliance with the stockholders’ equity requirement and, if at the

time of its next periodic report the Company does not evidence compliance, it may be subject to delisting.

The

unaudited pro forma condensed balance sheet attached as Exhibit 99.1 to this Report has been prepared to illustrate the impact of a number

of events that followed the close of the Company’s third fiscal quarter ended November 30, 2024, including without limitation various

equity offerings, debt conversions and strategic transactions (as disclosed in various Current Reports on Form 8-K filed by the Company

with the SEC), and the Company’s resulting compliance with the minimum $5 million stockholders’ equity requirement for initial

listing on The Nasdaq Capital Market.

The

unaudited pro forma condensed balance sheet is based on the Company’s unaudited balance sheet as of November 30, 2024, as contained

in the Company’s Quarterly Report on Form 10-Q for the quarter ended November 30, 2024, filed with the SEC on January 14, 2025,

adjusted to reflect the subsequent events after the balance sheet date of November 30, 2024 through the date of filing of this Current

Report, as if such events occurred on November 30, 2024.

The

unaudited pro forma condensed balance sheet is being provided for informational purposes only, and should be read in conjunction with

the more detailed unaudited condensed consolidated financial statements and related notes thereto included in the Company’s Form

10-Q for the quarter ended November 30, 2024 and Company’s subsequent filings with the SEC.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

|

NEXTTRIP,

INC. |

| |

|

|

|

|

| Date: |

February

28, 2025 |

|

By: |

/s/

William Kerby |

| |

|

|

Name: |

William

Kerby |

| |

|

|

Title: |

Chief

Executive Officer |

Exhibit

99.1

Unaudited

Pro Forma Condense Balance Sheet of NextTrip, Inc.

| | |

November 30, 2024 | | |

Pro Forma Adjustments | | |

Note Reference | |

As Adjusted November 30, 2024 | |

| Cash and Cash Equivalents | |

$ | 15,385 | | |

$ | 3,326,995 | | |

(1) (4) (6) (9) (10) (13) (14) (17) (22) | |

$ | 3,342,380 | |

| Total Other Current Assets | |

$ | 1,509,126 | | |

$ | 450,220 | | |

(2) (4) (7) (11) (16) (21) | |

$ | 1,959,346 | |

| Total Non-Current Assets | |

$ | 3,454,240 | | |

$ | 4,287,250 | | |

(13) (16) (20) | |

$ | 7,741,490 | |

| Total Assets | |

$ | 4,978,751 | | |

$ | 8,064,465 | | |

| |

$ | 13,043,216 | |

| Total Current Liabilities | |

$ | 6,394,097 | | |

$ | (3,518,189 | ) | |

(3) (4) (5) (8) (14) (15) (18) (19) | |

$ | 2,875,908 | |

| Total Liabilities | |

$ | 6,394,097 | | |

$ | (3,518,189 | ) | |

(3) (4) (5) (8) (14) (15) (18) (19) | |

$ | 2,875,908 | |

| Stockholders’ Equity (Deficit): | |

| | | |

| | | |

| |

| | |

| Preferred Stock; par value $0.001, 10 000,000 authorized, 225,520 issued and outstanding as of November 30, 2024 | |

$ | 226 | | |

$ | 2,872 | | |

(1) (2) (3) (5) (9) (13) (15) (17) (18) (19) (20) (22) | |

$ | 3,098 | |

| Common Stock; par value $0.001, 250,000,000 authorized, 1,429,492 issued and outstanding as of November

30, 2024 | |

$ | 1,430 | | |

$ | 227 | | |

(6) (7) (10) (11) (12) (16) | |

$ | 1,657 | |

| Additional Paid in Capital | |

$ | 28,288,831 | | |

$ | 13,481,251 | | |

(1) (2) (3) (5) (6) (7) (8) (9) (10) (11) (12) (13) (15) (16) (17) (18) (19) (20) (22) | |

$ | 41,770,082 | |

| Accumulated Deficit | |

$ | (29,705,833 | ) | |

$ | (1,901,696 | ) | |

(12) (15) (21) | |

$ | (31,607,529 | ) |

| Total Stockholders’ Equity (Deficit) | |

$ | (1,415,346 | ) | |

$ | 11,582,654 | | |

| |

$ | 10,167,308 | |

Total Liabilities and Stockholders’ Equity (Deficit) | |

$ | 4,978,751 | | |

$ | 8,064,465 | | |

| |

$ | 13,043,216 | |

| |

(1) |

Issuance

of 231,788 shares of Series I preferred to an investor at $3.02 per share. |

| |

(2) |

Issuance

of 60,595 shares of Series K preferred for prepaid interest related to the sale of short-term promissory notes. |

| |

(3) |

Conversion

of related party short-term promissory notes into 579,469 Series L preferred shares at $3.02 per share. |

| |

(4) |

Sale

of short-term promissory notes to an investor for a principal amount of $402,500, including an original issue discount of $52,500. |

| |

(5) |

Issuance

of 133,278 shares of Series M preferred at $3.02 per share to an investor for the conversion of $402,500 in short-term promissory

notes. |

| |

(6) |

Issuance

of 85,235 common shares for the exercise of warrants by an investor. |

| |

(7) |

Issuance

of 28,281 common shares to a consulting firm for investor relations services. |

| |

(8) |

Issuance

of common warrants in connection with the sale of short-term promissory notes to investors. |

| |

(9) |

Issuance

of 17,000 shares of Series N preferred to an investor at $5.00 per share. |

| |

(10) |

Issuance

of 19,730 common shares for the exercise of warrants by an investor. |

| |

(11) |

Issuance

of 30,000 common shares to a consulting firm for investor relations services. |

| |

(12) |

Issuance

of 4,000 shares of common stock to a former employee pursuant to the terms of the Separation Agreement. |

| |

(13) |

Issuance

of 161,291 shares of Series O preferred in connection with the 49% acquisition of Five Star Alliance. |

| |

(14) |

Sale

of short-term promissory note to an investor for $1,000,000. |

| |

(15) |

Conversion

of $1,000,000 short-term promissory note into 250,000 shares of Series P preferred at $4.00 per share. |

| |

(16) |

Issuance

of 60,000 common shares and warrants to AOS Holdings, Inc. in connection with a two-year strategic consulting contract. |

| |

(17) |

Issuance

of 93,750 shares of Series P preferred to an investor at $4.00 per share. |

| |

(18) |

Conversion

of related party short-term promissory notes and deferred salary into 496,689 shares of Series L preferred at $3.02

per share. |

| |

(19) |

Conversion

of payable to a contractor into 33,113 shares of Series I preferred. |

| |

(20) |

Issuance

of 483,000 shares of Series N preferred in connection with a 10% minority interest investment in Blue Fysh Holdings, Inc. |

| |

(21) |

Write-off

of NextPlay promissory note deemed uncollectible. |

| |

(22) |

Issuance

of 331,125 shares of Series I preferred to an investor at $3.02 per share. |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

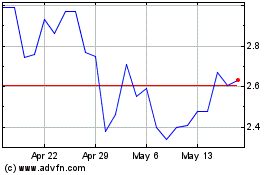

NextTrip (NASDAQ:NTRP)

Historical Stock Chart

From Feb 2025 to Mar 2025

NextTrip (NASDAQ:NTRP)

Historical Stock Chart

From Mar 2024 to Mar 2025