false

0001000694

0001000694

2025-03-10

2025-03-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 10, 2025

NOVAVAX, INC.

(Exact name of registrant as specified

in charter)

| Delaware |

|

0-26770 |

|

22-2816046 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

700 Quince Orchard Road

Gaithersburg, Maryland 20878

(Address of Principal Executive Offices,

including Zip Code)

(240) 268-2000

(Registrant’s telephone number,

including area code)

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, Par Value $0.01 per share |

|

NVAX |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors

or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of James F. Young

On March 10, 2025, James F. Young, Ph.D. resigned

from the Board of Directors (the “Board”) of Novavax, Inc. (the “Company”), effective as of March 10, 2025. Dr.

Young’s resignation from the Board is not the result of any disagreement with the Company on any matter relating to the Company’s

operations, policies or practices.

Margaret G. McGlynn was appointed to serve as the Chairperson of the

Board to succeed Dr. Young and Richard H. Douglas, Ph.D. was appointed to serve as the Chairperson of the Board’s Research and Development

Committee.

Appointment of Director John W. Shiver

On March 10, 2025, the Board appointed John W.

Shiver, Ph.D. to the Company’s Board, effective on such date, to fill the vacancy created by Dr. Young’s resignation and to

serve as a Class III director for a term expiring at the Company’s 2025 annual meeting of stockholders and until his successor is

duly elected and qualified or until his earlier death, resignation or removal. Dr. Shiver was also appointed to serve as a member of the

Board’s Research and Development Committee.

Dr. Shiver is eligible to receive compensation

in respect of his Board service under the Company’s Non-Employee Director Compensation Program, consisting of (i) cash compensation

as described in the Company’s Definitive Proxy Statement on Schedule 14A, filed with the Securities and Exchange Commission on April

29, 2024, (ii) beginning on the date of the 2026 second quarter meeting of the Board, and on each annual second quarter meeting of the

Board thereafter, an annual equity grant, consisting of an option to purchase shares of the Company’s common stock and/or restricted

stock units with an aggregate grant date fair value approximately equal to $350,000 as determined by the Board or the Compensation Committee

thereof, and (iii) an initial equity grant upon election or appointment to the Board, consisting of an option to purchase shares of the

Company’s common stock and/or restricted stock units with an aggregate grant date fair value approximately equal to $525,000 as

determined by the Board or the Compensation Committee thereof. Under the Company’s Non-Employee Director Compensation Program, annual

equity grants vest in full on the first anniversary of the grant date and initial equity grants vest in three equal annual installments

on the first three anniversaries of the grant date, in each case subject to the non-employee director’s continued service to the

Board through the applicable vesting date. On March 10, 2025, Dr. Shiver was granted an initial equity grant, consisting of an option

to purchase 35,770 shares of the Company’s common stock and 23,480 restricted stock units under the Company’s Amended and

Restated 2015 Stock Incentive Plan, as amended.

There is no arrangement or understanding between

Dr. Shiver and any other person pursuant to which Dr. Shiver was selected as a director. The Board has affirmatively determined that Dr.

Shiver qualifies as independent under Nasdaq listing standards and has no material direct or indirect interest in a related party transaction

that requires disclosure under Item 404(a) of Regulation S-K.

Dr. Shiver and the Company expect to enter into

the Company’s standard indemnification agreement (the “Indemnification Agreement”), a form of which is filed as Exhibit

10.19 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2009, filed on March 16, 2010 and incorporated

herein by reference, which will provide indemnification protection for Dr. Shiver in connection with his service as a director of the

Company.

Item 7.01. Regulation FD Disclosure.

On March 11, 2025, the Company issued a press

release announcing Dr. Young’s resignation and Dr. Shiver’s appointment to the Board. A copy of the press release is attached

as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information in Item 7.01, including the information

contained in Exhibit 99.1 of this Current Report on Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except

as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Novavax, Inc. |

| |

|

|

| |

|

|

| Date: March 11, 2025 |

By: |

/s/ Mark Casey |

| |

Name: |

Mark Casey |

| |

Title: |

Executive Vice President, Chief Legal Officer and Corporate Secretary |

Exhibit 99.1

| Press Release |  |

Novavax Announces

Changes to Board of Directors

| · | James

Young, PhD retires as Chair of the Board, Margaret McGlynn, RPh, appointed |

| · | John

Shiver, PhD appointed to board of directors |

GAITHERSBURG,

Md., March 11, 2025 – Novavax, Inc. (Nasdaq: NVAX) today announced that James Young, PhD, is

retiring as Chair of the Board and Margaret McGlynn, RPh, has been appointed as his successor. The Company also appointed John

Shiver, PhD, to its board as an independent director.

Dr. Young

made the decision to resign from the board effective March 10, 2025. He has served

on Novavax’s board since 2010 and as Chair since 2011. During his tenure, the Company acquired Isconova and the Matrix-M™

adjuvant, now a key component of its technology platform. Novavax also earned global approvals for and commercialized its first vaccine

ever for COVID-19, ramping up quickly to meet the demands of the global pandemic. Dr. Young helped to guide the Company through

the partnership with Sanofi in 2024 and the subsequent transformative focus on a new corporate growth strategy to maximize the impact

of Novavax’s cutting-edge technology by focusing on strategic partnerships for its research and development

(R&D) assets and its Matrix-M™ adjuvant.

“We’ll

forever be grateful for Jim’s leadership during such critical moments for Novavax over the past 15 years,” said John

C. Jacobs, President and Chief Executive Officer, Novavax. “With the solid foundation he helped build, we look forward to advancing

our corporate growth strategy with Margie at the helm of the board, and now with John’s guidance as well. Both Margie and John

bring a wealth of experience and under the collective leadership of all of our board members, we are well-positioned to deliver for our

shareholders."

Ms. McGlynn has served on Novavax’s

board of directors since 2020. She previously served as President, Merck Vaccines and Infectious Disease, and after 26 years at Merck,

served as CEO of the International AIDS Vaccine Initiative. She also serves on the board of directors of Amicus Therapeutics and University

at Buffalo Foundation.

“Thanks to Jim’s leadership, Novavax

is primed to deliver against an exciting new pipeline through strategic collaborations,” said Ms. McGlynn. “I look forward

to working with this immensely talented board and executive leadership team to support Novavax as it moves into a position of strength

over the coming years.”

Dr. Shiver has more than 30 years of vaccine,

biologics and RNA therapeutics experience in pharmaceutical research and development. He has led teams of scientists to develop novel

vaccine and monoclonal antibody candidates to prevent or treat more than 40 infectious and non-infectious diseases. Dr. Shiver has

also created a machine learning/artificial intelligence group to help design new vaccine candidates. He has served on multiple scientific

advisory boards and committees including the International AIDS Vaccine Initiative Board of Directors and the Board of Directors for

Icosavax, Auravax and Calder Biosciences. Dr. Shiver is a Special Advisor to F Prime Capital and serves as Head of R&D and an

Observer of the board of directors at Vibrant Biomedicines. His past experience includes roles at IGM ID, Sanofi Pasteur, Merck and the

National Cancer Institute. Dr. Shiver holds a Bachelor of Science degree in Chemistry and Mathematics from Wofford College and a

Doctor of Philosophy in Physical Chemistry from the University of Florida.

Forward-Looking Statements

Statements herein

other than statements of historical fact, including statements relating to the Company’s corporate growth strategy, the composition

of its Board of Directors, and expectations regarding its clinical pipeline through strategic collaborations, are forward-looking statements.

Novavax cautions that these forward-looking statements are subject to numerous risks and uncertainties that could cause actual results

to differ materially from those expressed or implied by such statements. These risks and uncertainties include, without limitation, challenges

or delays in obtaining regulatory authorization or approval for its COVID-19 vaccine, in particular with respect to its BLA submission

to the FDA for approval of its COVID-19 vaccine, or its other product candidates, including for future COVID-19 variant strain changes,

its CIC vaccine candidate, its stand-alone influenza vaccine candidate or other product candidates; Novavax’s ability to successfully

and timely manufacture, market, distribute, or deliver its updated 2024-2025 formula COVID-19 vaccine and the impact of its not having

received a BLA from the FDA for the 2024-2025 vaccination season; challenges related to Novavax’s partnership with Sanofi and in

pursuing additional partnership opportunities; challenges satisfying, alone or together with partners, various safety, efficacy, and

product characterization requirements, including those related to process qualification, assay validation and stability testing, necessary

to satisfy applicable regulatory authorities; challenges or delays in conducting clinical trials or studies for its product candidates;

manufacturing, distribution or export delays or challenges; Novavax’s substantial dependence on SII and Serum Life Sciences Limited

for co-formulation and filling Novavax’s COVID-19 vaccine and the impact of any delays or disruptions in their operations; difficulty

obtaining scarce raw materials and supplies including for its proprietary adjuvant; resource constraints, including human capital and

manufacturing capacity; constraints on Novavax’s ability to pursue planned regulatory pathways, alone or with partners; challenges

in implementing its global restructuring and cost reduction plan; Novavax’s ability to timely deliver doses; challenges in obtaining

commercial adoption and market acceptance of its updated 2024-2025 formula COVID-19 vaccine or any COVID-19 variant strain containing

formulation, or for its CIC vaccine candidate and stand-alone influenza vaccine candidate or other product candidates; challenges meeting

contractual requirements under agreements with multiple commercial, governmental, and other entities, including requirements to deliver

doses that may require Novavax to refund portions of upfront and other payments previously received or result in reduced future payments

pursuant to such agreements and challenges in amending or terminating such agreements; challenges related to the seasonality of vaccinations

against COVID-19 or influenza; challenges related to the demand for vaccinations against COVID-19 or influenza; challenges in identifying

and successfully pursuing innovation expansion opportunities, including with respect to Novavax’s Matrix-MTM adjuvant; Novavax’s

expectations as to expenses and cash needs may prove not to be correct for reasons such as changes in plans or actual events being different

than its assumptions; and those other risk factors identified in the "Risk Factors" and "Management's Discussion and Analysis

of Financial Condition and Results of Operations" sections of Novavax's Annual Report on Form 10-K for the year ended December 31,

2024, and subsequent Quarterly Reports on Form 10-Q, as filed with the Securities and Exchange Commission (SEC). We caution investors

not to place considerable reliance on forward-looking statements contained in this press release. You are encouraged to read our filings

with the SEC, available at www.sec.gov and www.novavax.com, for a discussion of these and other risks and

uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and we undertake no obligation

to update or revise any of the statements. Our business is subject to substantial risks and uncertainties, including those referenced

above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

About Novavax

Novavax, Inc.

(Nasdaq: NVAX) tackles some of the world's most significant health challenges by leveraging its scientific expertise in vaccines and

its cutting-edge technology platform, including a protein-based nanoparticle and Matrix-M™ adjuvant. The Company's growth strategy

is focused on building new and diversified partnerships via the out-licensing of its technology platform and vaccine assets earlier in

the development process. These strategic collaborations are fueled by smart investments in a growing early-stage pipeline starting with

the Company's core expertise in infectious disease and potentially expanding into other disease areas. Please visit novavax.com and LinkedIn for

more information.

Contacts:

Investors

Luis Sanay, CFA

240-268-2022

ir@novavax.com

Media

Giovanna Chandler

202-709-5563

media@novavax.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

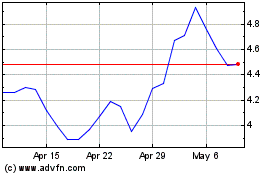

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

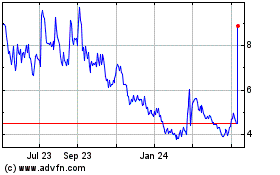

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Mar 2024 to Mar 2025