Returned 54% of 2024 Free Cash Flow through

share repurchases

onsemi (the “Company”) (Nasdaq: ON) today announced its

fourth quarter and fiscal year 2024 results with the following

highlights:

- Fourth quarter revenue of $1,722.5 million

- Fourth quarter GAAP gross margin and non-GAAP gross margin of

45.2% and 45.3%, respectively

- Fourth quarter GAAP operating margin and non-GAAP operating

margin of 23.7% and 26.7%, respectively

- Fourth quarter GAAP diluted earnings per share of $0.88 and

non-GAAP diluted earnings per share of $0.95, respectively

- Full year 2024 free cash flow of $1.2 billion, a 3X increase

year-over-year

“As we continue to navigate this market downturn, our actions

over the last four years have proven we are a structurally

different company that is well-equipped to navigate prolonged

volatility,” said Hassane El-Khoury, president and CEO, onsemi.

“While 2025 remains uncertain, we remain committed to our long-term

strategy. We will maintain our financial discipline, streamline our

operations and continue to deliver high-value, differentiated

intelligent power and sensing solutions that position onsemi to

emerge even stronger.”

Selected financial results for the quarter are shown below

with comparable periods:

GAAP

Non-GAAP

Three Months Ended

Three Months Ended

(Revenue and Net Income in millions)

Q4 2024

Q3 2024

Q4 2023

Q4 2024

Q3 2024

Q4 2023

Revenue

$1,722.5

$1,761.9

$2,018.1

$1,722.5

$1,761.9

$2,018.1

Gross Margin

45.2 %

45.4 %

46.7 %

45.3 %

45.5 %

46.7 %

Operating Margin

23.7 %

25.3 %

30.3 %

26.7 %

28.2 %

31.6 %

Net Income attributable to onsemi

$379.9

$401.7

$562.7

$404.2

$423.8

$540.9

Diluted Earnings Per Share

$0.88

$0.93

$1.28

$0.95

$0.99

$1.25

Selected financial results for 2024 and 2023 are shown

below:

GAAP

Non-GAAP

Year Ended

Year Ended

(Revenue and Net Income in millions)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Revenue

$7,082.3

$8,253.0

$7,082.3

$8,253.0

Gross Margin

45.4 %

47.1 %

45.5 %

47.1 %

Operating Margin

25.0 %

30.8 %

27.9 %

32.3 %

Net Income attributable to onsemi

$1,572.8

$2,183.7

$1,704.6

$2,256.2

Diluted Earnings Per Share

$3.63

$4.89

$3.98

$5.16

Revenue Summary

($ in millions)

(Unaudited)

Three Months Ended

Business Segment (1)

Q4 2024

Q3 2024

Q4 2023

Sequential Change

Year-over- Year Change

PSG

$

809.4

$

829.4

$

965.6

(2)%

(16)%

AMG

610.6

653.7

744.8

(7)%

(18)%

ISG

302.5

278.8

307.7

9 %

(2)%

Total

$

1,722.5

$

1,761.9

$

2,018.1

(2)%

(15)%

Year Ended

Business Segment (1)

December 31, 2024

December 31, 2023

Year-over- Year Change

PSG

$

3,348.2

$

3,880.4

(14)%

AMG

2,609.1

3,057.1

(15)%

ISG

1,125.0

1,315.5

(14)%

Total

$

7,082.3

$

8,253.0

(14)%

(1)

During the first quarter of 2024, the

Company reorganized certain reporting units and its segment

reporting structure. As a result of the reorganization of divisions

within PSG and AMG, the prior-period amounts have been reclassified

to conform to current-period presentation.

FIRST QUARTER 2025 OUTLOOK

The following table outlines onsemi's projected first quarter of

2025 GAAP and non-GAAP outlook.

Total onsemi

GAAP

Special

Items **

Total onsemi

Non-GAAP ***

Revenue

$1,350 to $1,450 million

—

$1,350 to $1,450 million

Gross Margin

38.9% to 40.9%

0.1%

39.0% to 41.0%

Operating Expenses

$329 to $344 million

$16 million

$313 to $328 million

Other Income and Expense (including

interest expense), net

($14 million)

—

($14 million)

Diluted Earnings Per Share

$0.42 to $0.52

$0.03

$0.45 to $0.55

Diluted Shares Outstanding *

426 million

1 million

425 million

*

Diluted shares outstanding can vary as a

result of, among other things, the vesting of restricted stock

units, the incremental dilutive shares from the Company's

convertible senior subordinated notes, and the repurchase or the

issuance of stock or convertible notes or the sale of treasury

shares. In periods when the quarterly average stock price per share

exceeds $52.97 for the 0% Notes, and $103.87 for the 0.50% Notes,

the non-GAAP diluted share count and non-GAAP net income per share

include the anti-dilutive impact of the Company’s hedge

transactions issued concurrently with the 0% Notes and the 0.50%

Notes, respectively. At an average stock price per share between

$52.97 and $74.34 for the 0% Notes and $103.87 and $156.78 for the

0.50% Notes, the hedging activity offsets the potentially dilutive

effect of the 0% Notes and 0.50% Notes, respectively. In periods

when the quarterly average stock price exceeds $74.34 for the 0%

Notes, and $156.78 for the 0.50% Notes, the dilutive impact of the

warrants issued concurrently with such notes are included in the

diluted shares outstanding. GAAP and non-GAAP diluted share counts

are based on the average stock price for the month subsequent to

the end of the previous quarter.

**

Special items may include: amortization of acquisition-related

intangibles; expensing of appraised inventory fair market value

step-up; purchased in-process research and development expenses;

restructuring, asset impairments and other, net; goodwill and

intangible asset impairment charges; gains and losses on debt

prepayment; non-cash interest expense; actuarial (gains) losses on

pension plans and other pension benefits; and certain other special

items, as necessary. These special items are out of our control and

could change significantly from period to period. As a result, we

are not able to reasonably estimate and separately present the

individual impact or probable significance of these special items,

and we are similarly unable to provide a reconciliation of the

non-GAAP measures. The reconciliation that is unavailable would

include a forward-looking income statement, balance sheet and

statement of cash flows in accordance with GAAP. For this reason,

we use a projected range of the aggregate amount of special items

in order to calculate our projected non-GAAP operating expense

outlook.

***

We believe these non-GAAP measures provide important supplemental

information to investors. We use these measures, together with GAAP

measures, for internal managerial purposes and as a means to

evaluate period-to-period comparisons. However, we do not, and you

should not, rely on non-GAAP financial measures alone as measures

of our performance. We believe that non-GAAP financial measures

reflect an additional way of viewing aspects of our operations

that, when taken together with GAAP results and the reconciliations

to corresponding GAAP financial measures that we also provide in

our releases, provide a more complete understanding of factors and

trends affecting our business. Because non-GAAP financial measures

are not standardized, it may not be possible to compare these

financial measures with other companies' non-GAAP financial

measures, even if they have similar names.

TELECONFERENCE

onsemi will host a conference call for the financial community

at 9 a.m. Eastern Time (EST) on Feb. 10, 2025 to discuss this

announcement and onsemi’s results for the fourth quarter of 2024

and fiscal year 2024. The Company will also provide a real-time

audio webcast of the teleconference on the Investor Relations page

of its website at http://www.onsemi.com. The webcast replay will be

available at this site approximately one hour following the live

broadcast and will continue to be available for approximately 30

days following the conference call. Investors and interested

parties can also access the conference call by pre-registering

here.

About onsemi

onsemi (Nasdaq: ON) is driving disruptive innovations to

help build a better future. With a focus on automotive and

industrial end-markets, the company is accelerating change in

megatrends such as vehicle electrification and safety, sustainable

energy grids, industrial automation, and 5G and cloud

infrastructure. onsemi offers a highly differentiated and

innovative product portfolio, delivering intelligent power and

sensing technologies that solve the world’s most complex challenges

and leads the way to creating a safer, cleaner, and smarter world.

onsemi is recognized as a Fortune 500® company and included

in the Nasdaq-100 Index® and S&P 500® index. Learn more about

onsemi at www.onsemi.com.

onsemi and the onsemi logo are trademarks of Semiconductor

Components Industries, LLC. All other brand and product names

appearing in this document are registered trademarks or trademarks

of their respective holders. Although the Company references its

website in this news release, information on the website is not to

be incorporated herein.

This document includes “forward-looking statements,” as that

term is defined in Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical facts,

included or incorporated in this document could be deemed

forward-looking statements, particularly statements about the

future financial performance of onsemi, including financial

guidance for the first fiscal quarter of 2025. Forward-looking

statements are often characterized by the use of words such as

“believes,” “estimates,” “expects,” “projects,” “may,” “will,”

“intends,” “plans,” “anticipates,” “should” or similar expressions

or by discussions of strategy, plans or intentions. All

forward-looking statements in this document are made based on our

current expectations, forecasts, estimates and assumptions and

involve risks, uncertainties, and other factors that could cause

results or events to differ materially from those expressed in the

forward-looking statements. Certain factors that could affect our

future results or events are described under Part I, Item 1A “Risk

Factors” in our 2024 Annual Report on Form 10-K filed with the

Securities and Exchange Commission (“SEC”) on February 10, 2025

(our “2024 Form 10-K”), and from time-to-time in our other SEC

reports (including in our 2024 Form 10-K). Readers are cautioned

not to place undue reliance on forward-looking statements. We

assume no obligation to update such information, except as may be

required by law. Investing in our securities involves a high degree

of risk and uncertainty, and you should carefully consider the

trends, risks, and uncertainties described in this document, our

2024 Form 10-K and other reports filed with or furnished to the SEC

before making any investment decision with respect to our

securities. If any of these trends, risks, or uncertainties

actually occurs or continues, our business, financial condition or

operating results could be materially adversely affected, the

trading prices of our securities could decline, and you could lose

all or part of your investment. All forward-looking statements

attributable to us or persons acting on our behalf are expressly

qualified in their entirety by this cautionary statement.

ON SEMICONDUCTOR

CORPORATION

UNAUDITED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in millions, except per share

and percentage data)

Quarter Ended

Year Ended

December 31, 2024

September 27, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Revenue

$

1,722.5

$

1,761.9

$

2,018.1

$

7,082.3

$

8,253.0

Cost of revenue

943.4

962.5

1,076.2

3,866.2

4,369.5

Gross profit

779.1

799.4

941.9

3,216.1

3,883.5

Gross margin

45.2

%

45.4

%

46.7

%

45.4

%

47.1

%

Operating expenses:

Research and development

155.2

151.0

150.2

612.7

577.3

Selling and marketing

70.4

65.4

67.5

273.5

279.1

General and administrative

100.5

95.5

88.6

376.3

362.4

Amortization of acquisition-related

intangible assets

13.5

13.0

12.1

52.0

51.1

Restructuring, asset impairments and other

charges, net

30.9

29.1

11.4

133.9

74.9

Total operating expenses

370.5

354.0

329.8

1,448.4

1,344.8

Operating income

408.6

445.4

612.1

1,767.7

2,538.7

Other income (expense), net:

Interest expense

(15.3

)

(15.7

)

(15.8

)

(62.3

)

(74.8

)

Interest income

27.8

28.6

26.3

111.4

93.1

Loss on debt refinancing and

prepayment

—

—

—

—

(13.3

)

Loss on divestiture of business

—

—

—

—

(0.7

)

Other income (expense)

21.4

(3.7

)

(11.7

)

20.6

(7.2

)

Other income (expense), net

33.9

9.2

(1.2

)

69.7

(2.9

)

Income before income taxes

442.5

454.6

610.9

1,837.4

2,535.8

Income tax provision

(62.7

)

(51.9

)

(47.5

)

(262.8

)

(350.2

)

Net income

379.8

402.7

563.4

1,574.6

2,185.6

Less: Net (income) loss attributable to

non-controlling interest

0.1

(1.0

)

(0.7

)

(1.8

)

(1.9

)

Net income attributable to ON

Semiconductor Corporation

$

379.9

$

401.7

$

562.7

$

1,572.8

$

2,183.7

Net income for diluted earnings per share

of common stock

$

379.9

$

401.7

$

562.8

$

1,572.8

$

2,185.0

Net income per share of common stock

attributable to ON Semiconductor Corporation:

Basic

$

0.89

$

0.94

$

1.31

$

3.68

$

5.07

Diluted

$

0.88

$

0.93

$

1.28

$

3.63

$

4.89

Weighted average common shares

outstanding:

Basic

425.4

427.0

428.1

427.4

430.7

Diluted

429.6

431.7

439.5

432.7

446.8

ON SEMICONDUCTOR

CORPORATION

UNAUDITED CONSOLIDATED BALANCE

SHEETS

(in millions)

December 31, 2024

September 27, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

2,691.3

$

2,470.2

$

2,483.0

Short-term investments

300.0

300.0

—

Receivables, net

1,160.1

1,070.6

935.4

Inventories

2,242.0

2,242.8

2,111.8

Other current assets

358.6

461.1

382.1

Total current assets

6,752.0

6,544.7

5,912.3

Property, plant and equipment, net

4,361.4

4,383.7

4,401.5

Goodwill

1,587.9

1,587.9

1,577.6

Intangible assets, net

257.9

273.1

299.3

Deferred tax assets

729.9

725.8

600.8

ROU financing lease assets

40.5

41.1

42.4

Other assets

360.2

367.3

381.3

Total assets

$

14,089.8

$

13,923.6

$

13,215.2

Liabilities, Non-Controlling Interest

and Stockholders’ Equity

Accounts payable

$

574.5

$

597.5

$

725.6

Accrued expenses and other current

liabilities

760.0

734.3

663.2

Current portion of financing lease

liabilities

0.3

0.4

0.8

Current portion of long-term debt

—

796.4

794.0

Total current liabilities

1,334.8

2,128.6

2,183.6

Long-term debt

3,345.9

2,547.2

2,542.6

Deferred tax liabilities

37.6

42.8

38.7

Long-term financing lease liabilities

20.7

22.4

22.4

Other long-term liabilities

536.3

578.6

627.3

Total liabilities

5,275.3

5,319.6

5,414.6

ON Semiconductor Corporation stockholders’

equity:

Common stock

6.2

6.2

6.2

Additional paid-in capital

5,372.2

5,321.9

5,210.9

Accumulated other comprehensive loss

(62.4

)

(49.1

)

(45.2

)

Accumulated earnings

8,120.9

7,741.0

6,548.1

Less: Treasury stock, at cost

(4,640.5

)

(4,435.9

)

(3,937.4

)

Total ON Semiconductor Corporation

stockholders’ equity

8,796.4

8,584.1

7,782.6

Non-controlling interest

18.1

19.9

18.0

Total stockholders' equity

8,814.5

8,604.0

7,800.6

Total liabilities and stockholders'

equity

$

14,089.8

$

13,923.6

$

13,215.2

ON SEMICONDUCTOR

CORPORATION

UNAUDITED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in millions)

Quarter Ended

Year Ended

December 31, 2024

September 27, 2024

December 31, 2023

December 31,

2024

December 31,

2023

Cash flows from operating activities:

Net income

$

379.8

$

402.7

$

563.4

$

1,574.6

$

2,185.6

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

166.6

161.8

160.3

642.9

609.5

Loss on sale or disposal of fixed

assets

0.4

4.1

4.3

5.5

11.6

Loss on divestiture of businesses

—

—

—

—

0.7

Loss on debt refinancing and

prepayment

—

—

—

—

13.3

Amortization of debt discount and issuance

costs

1.9

3.6

2.6

11.1

11.3

Share-based compensation

38.1

32.7

30.7

136.1

121.1

Non-cash asset impairment charges

22.1

—

6.8

37.8

19.5

Change in deferred tax balances

(7.5

)

(45.6

)

(18.7

)

(129.6

)

(127.7

)

Other

3.0

1.7

(6.2

)

10.0

(4.7

)

Changes in assets and liabilities

(24.7

)

(95.2

)

(132.0

)

(382.0

)

(862.7

)

Net cash provided by operating

activities

579.7

465.8

611.2

1,906.4

1,977.5

Cash flows from investing activities:

Payments for acquisition of property,

plant and equipment

(157.3

)

(161.7

)

(386.4

)

(694.0

)

(1,539.1

)

Proceeds from sale of property, plant and

equipment

5.6

0.3

1.2

6.2

4.0

Payments related to acquisition of

business

—

(20.5

)

—

(20.5

)

(236.3

)

Purchase of short-term investments

(300.0

)

(300.0

)

—

(1,050.0

)

—

Proceeds from maturity of short-term

investments and available-for-sale securities

300.0

450.0

—

750.0

33.5

Other

—

—

—

(1.5

)

—

Net cash used in investing activities

(151.7

)

(31.9

)

(385.2

)

(1,009.8

)

(1,737.9

)

Cash flows from financing activities:

Proceeds for the issuance of common stock

under the ESPP

5.6

6.5

5.9

25.2

25.8

Payment of tax withholding for RSUs

(2.7

)

(3.1

)

(4.4

)

(51.0

)

(66.8

)

Repurchase of common stock

(204.1

)

(200.0

)

(300.2

)

(654.1

)

(564.2

)

Issuance and borrowings under debt

agreements

—

—

—

—

1,845.0

Repayment of borrowings under debt

agreements

—

—

(119.6

)

—

(1,723.4

)

Payment on principal portion of finance

lease obligations

(0.4

)

(0.4

)

(5.0

)

(2.2

)

(15.3

)

Payment for purchase of bond hedges

—

—

—

—

(414.0

)

Proceeds from issuance of warrants

—

—

—

—

242.5

Other

(1.7

)

—

(8.9

)

(1.7

)

(16.1

)

Net cash used in financing activities

(203.3

)

(197.0

)

(432.2

)

(683.8

)

(686.5

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(3.7

)

2.4

0.4

(4.4

)

(1.1

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

221.0

239.3

(205.8

)

208.4

(448.0

)

Beginning cash, cash equivalents and

restricted cash

2,472.4

2,233.1

2,690.8

2,485.0

2,933.0

Ending cash, cash equivalents and

restricted cash

$

2,693.4

$

2,472.4

$

2,485.0

$

2,693.4

$

2,485.0

ON SEMICONDUCTOR

CORPORATION

RECONCILIATION OF GAAP VERSUS

NON-GAAP DISCLOSURES

(in millions, except per share

and percentage data)

Quarter Ended

Year Ended

December 31, 2024

September 27, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Reconciliation of GAAP to non-GAAP

gross profit:

GAAP gross profit

$

779.1

$

799.4

$

941.9

$

3,216.1

$

3,883.5

Special items:

a)

Impact of business wind down

—

—

—

—

(3.9

)

b)

Amortization of acquisition-related

intangible assets

1.6

1.6

1.5

6.3

5.7

Total special items

1.6

1.6

1.5

6.3

1.8

Non-GAAP gross profit

$

780.7

$

801.0

$

943.4

$

3,222.4

$

3,885.3

Reconciliation of GAAP to non-GAAP

gross margin:

GAAP gross margin

45.2

%

45.4

%

46.7

%

45.4

%

47.1

%

Special items:

a)

Impact of business wind down

—

%

—

%

—

%

—

%

—

%

b)

Amortization of acquisition-related

intangible assets

0.1

%

0.1

%

0.1

%

0.1

%

0.1

%

Total special items

0.1

%

0.1

%

0.1

%

0.1

%

—

%

Non-GAAP gross margin

45.3

%

45.5

%

46.7

%

45.5

%

47.1

%

Reconciliation of GAAP to non-GAAP

operating expenses:

GAAP operating expenses

$

370.5

$

354.0

$

329.8

$

1,448.4

$

1,344.8

Special items:

a)

Amortization of acquisition-related

intangible assets

(13.5

)

(13.0

)

(12.1

)

(52.0

)

(51.1

)

b)

Restructuring, asset impairments and

other, net

(30.9

)

(29.1

)

(11.4

)

(133.9

)

(74.9

)

c)

Third party acquisition and divestiture

related costs

(4.8

)

(7.4

)

0.1

(14.0

)

1.3

Total special items

(49.2

)

(49.5

)

(23.4

)

(199.9

)

(124.7

)

Non-GAAP operating expenses

$

321.3

$

304.5

$

306.4

$

1,248.5

$

1,220.1

Reconciliation of GAAP to non-GAAP

operating income:

GAAP operating income

$

408.6

$

445.4

$

612.1

$

1,767.7

$

2,538.7

Special items:

a)

Amortization of acquisition-related

intangible assets

15.1

14.6

13.6

58.3

56.8

b)

Restructuring, asset impairments and

other, net

30.9

29.1

11.4

133.9

74.9

c)

Third party acquisition and divestiture

related costs

4.8

7.4

(0.1

)

14.0

(1.3

)

d)

Impact of business wind down

—

—

—

—

(3.9

)

Total special items

50.8

51.1

24.9

206.2

126.5

Non-GAAP operating income

$

459.4

$

496.5

$

637.0

$

1,973.9

$

2,665.2

Reconciliation of GAAP to non-GAAP

operating margin (operating income / revenue):

GAAP operating margin

23.7

%

25.3

%

30.3

%

25.0

%

30.8

%

Special items:

a)

Amortization of acquisition-related

intangible assets

0.9

%

0.8

%

0.7

%

0.8

%

0.7

%

b)

Restructuring, asset impairments and

other, net

1.8

%

1.7

%

0.6

%

1.9

%

0.9

%

c)

Third party acquisition and divestiture

related costs

0.3

%

0.4

%

—

%

0.2

%

—

%

d)

Impact of business wind down

—

%

—

%

—

%

—

%

—

%

Total special items

3.0

%

2.9

%

1.2

%

2.9

%

1.5

%

Non-GAAP operating margin

26.7

%

28.2

%

31.6

%

27.9

%

32.3

%

Reconciliation of GAAP to non-GAAP

income before income taxes:

GAAP income before income taxes

$

442.5

$

454.6

$

610.9

$

1,837.4

$

2,535.8

Special items:

a)

Amortization of acquisition-related

intangible assets

15.1

14.6

13.6

58.3

56.8

b)

Restructuring, asset impairments and

other, net

30.9

29.1

11.4

133.9

74.9

c)

Third party acquisition and divestiture

related costs

4.8

7.4

(0.1

)

14.0

(1.3

)

d)

Impact of business wind down

—

—

—

—

(3.9

)

e)

Actuarial (gains) losses on pension plans

and other pension benefits

(12.2

)

—

4.0

(12.2

)

4.0

f)

Loss on debt refinancing and

prepayment

—

—

—

—

13.3

g)

Loss on divestiture of businesses

—

—

—

—

0.7

Total special items

38.6

51.1

28.9

194.0

144.5

Non-GAAP income before income taxes

$

481.1

$

505.7

$

639.8

$

2,031.4

$

2,680.3

Reconciliation of GAAP to non-GAAP net

income attributable to ON Semiconductor Corporation:

GAAP net income attributable to ON

Semiconductor Corporation

$

379.9

$

401.7

$

562.7

$

1,572.8

$

2,183.7

Special items:

a)

Amortization of acquisition-related

intangible assets

15.1

14.6

13.6

58.3

56.8

b)

Restructuring, asset impairments and

other, net

30.9

29.1

11.4

133.9

74.9

c)

Third party acquisition and divestiture

related costs

4.8

7.4

(0.1

)

14.0

(1.3

)

d)

Impact of business wind down

—

—

—

—

(3.9

)

e)

Actuarial (gains) losses on pension plans

and other pension benefits

(12.2

)

—

4.0

(12.2

)

4.0

f)

Loss on debt refinancing and

prepayment

—

—

—

—

13.3

g)

Loss on divestiture of businesses

—

—

—

—

0.7

h)

Income taxes

(14.3

)

(29.0

)

(50.7

)

(62.2

)

(72.0

)

Total special items

24.3

22.1

(21.8

)

131.8

72.5

Non-GAAP net income attributable to ON

Semiconductor Corporation

$

404.2

$

423.8

$

540.9

$

1,704.6

$

2,256.2

GAAP net income for diluted earnings per

share

$

379.9

$

401.7

$

562.8

$

1,572.8

$

2,185.0

Non-GAAP net income for diluted earnings

per share

$

404.2

$

423.8

$

541.0

$

1,704.6

$

2,257.5

Reconciliation of GAAP to non-GAAP

diluted shares outstanding:

GAAP diluted shares outstanding

429.6

431.7

439.5

432.7

446.8

Special items:

a)

Less: dilutive shares attributable to

convertible notes

(3.5

)

(4.1

)

(5.6

)

(4.0

)

(9.1

)

Total special items

(3.5

)

(4.1

)

(5.6

)

(4.0

)

(9.1

)

Non-GAAP diluted shares outstanding

426.1

427.6

433.9

428.7

437.7

Non-GAAP diluted earnings per

share:

Non-GAAP net income attributable to ON

Semiconductor Corporation

$

404.2

$

423.8

$

541.0

$

1,704.6

$

2,257.5

Non-GAAP diluted shares outstanding

426.1

427.6

433.9

428.7

437.7

Non-GAAP diluted earnings per share

$

0.95

$

0.99

$

1.25

$

3.98

$

5.16

Reconciliation of net cash provided by

operating activities to free cash flow:

Net cash provided by operating

activities

$

579.7

$

465.8

$

611.2

$

1,906.4

$

1,977.5

Special items:

a)

Payments for acquisition of property,

plant and equipment

(157.3

)

(161.7

)

(386.4

)

(694.0

)

(1,539.1

)

Total special items

(157.3

)

(161.7

)

(386.4

)

(694.0

)

(1,539.1

)

Free cash flow

$

422.4

$

304.1

$

224.8

$

1,212.4

$

438.4

Certain of the amounts in the above tables may not total due to

rounding of individual amounts.

ON SEMICONDUCTOR CORPORATION

RECONCILIATION OF GAAP VERSUS NON-GAAP DISCLOSURES

(Continued) (in millions, except per share and percentage

data)

FREE CASH FLOW

Quarter Ended

March 29, 2024

June 28, 2024

September 27, 2024

December 31, 2024

Last Twelve Months

Net cash provided by operating

activities

$

498.7

$

362.2

$

465.8

$

579.7

$

1,906.4

Payments for acquisition of property,

plant and equipment

(233.9

)

(141.1

)

(161.7

)

(157.3

)

(694.0

)

Free cash flow

$

264.8

$

221.1

$

304.1

$

422.4

$

1,212.4

Revenue

$

1,862.7

$

1,735.2

$

1,761.9

$

1,722.5

$

7,082.3

SHARE-BASED COMPENSATION

Total share-based compensation related to restricted stock

units, stock grant awards and the employee stock purchase plan was

as follows:

Quarter Ended

Year Ended

December 31, 2024

September 27, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Cost of revenue

$

6.5

$

6.2

$

4.7

$

24.6

$

18.1

Research and development

6.5

6.1

5.5

24.7

20.5

Selling and marketing

5.9

4.8

4.8

21.3

18.6

General and administrative

19.2

15.6

15.7

65.5

63.9

Total share-based compensation

$

38.1

$

32.7

$

30.7

$

136.1

$

121.1

SUPPLEMENTAL FINANCIAL DATA

Quarter Ended

Year Ended

December 31, 2024

September 27, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Net cash provided by operating

activities

$

579.7

$

465.8

$

611.2

$

1,906.4

$

1,977.5

Free cash flow

$

422.4

$

304.1

$

224.8

$

1,212.4

$

438.4

Cash paid for income taxes

$

53.4

$

49.2

$

100.8

$

347.5

$

428.2

Depreciation and amortization

$

166.6

$

161.8

$

160.3

$

642.9

$

609.5

Less: Amortization of acquisition-related

intangible assets

15.1

14.6

13.6

58.3

56.8

Depreciation and amortization (excl.

amortization of acquisition-related intangible assets)

$

151.5

$

147.2

$

146.7

$

584.6

$

552.7

NON-GAAP MEASURES

To supplement the consolidated financial results prepared in

accordance with GAAP, onsemi uses certain non-GAAP measures, which

are adjusted from the most directly comparable GAAP measures to

exclude items related to the amortization of acquisition-related

intangibles, expensing of appraised inventory fair market value

step-up, inventory valuation adjustments, in-process research and

development expenses, restructuring, asset impairments and other,

net, goodwill and intangible asset impairment charges, gains and

losses on debt prepayment, non-cash interest expense, actuarial

(gains) losses on pension plans and other pension benefits, third

party acquisition and divestiture-related costs, tax impact of

these items, and certain other non-recurring items, as necessary.

Management does not consider the effects of these items in

evaluating the core operational activities of onsemi. Management

uses these non-GAAP measures internally to make strategic

decisions, forecast future results, and evaluate onsemi’s current

performance. In addition, the Company believes that most analysts

covering onsemi use the non-GAAP measures to evaluate onsemi’s

performance. Given management’s and other relevant parties' use of

these non-GAAP measures, onsemi believes these measures are

important to investors in understanding onsemi’s current and future

operating results as seen through the eyes of management. In

addition, management believes these non-GAAP measures are useful to

investors in enabling them to better assess changes in onsemi's

core business across different time periods. These non-GAAP

measures are not prepared in accordance with, and should not be

considered alternatives or necessarily superior to, GAAP financial

data and may be different from non-GAAP measures used by other

companies. Because non-GAAP financial measures are not

standardized, it may not be possible to compare these financial

measures with other companies’ non-GAAP financial measures, even if

they have similar names.

Non-GAAP Revenue

The use of non-GAAP revenue allows management to evaluate, among

other things, the revenue from the Company’s core businesses and

trends across different reporting periods on a consistent basis,

independent of special items. In addition, non-GAAP revenue is an

important component of management’s internal performance

measurement and incentive and reward process as it is used to

assess the current and historical financial results of the business

and for strategic decision making, preparing budgets, obtaining

targets and forecasting future results. Management presents this

non-GAAP financial measure to enable investors and analysts to

evaluate the Company's revenue generation performance relative to

the direct costs of operations of onsemi's core businesses.

Non-GAAP Gross Profit and Gross Margin

The use of non-GAAP gross profit and gross margin allows

management to evaluate, among other things, the gross margin and

gross profit of the Company’s core businesses and trends across

different reporting periods on a consistent basis, independent of

non-cash items including, generally speaking, amortization of

acquisition-related intangible assets, expensing of appraised

inventory fair market value step-up, impact of business wind-down

and non-recurring facility costs. In addition, it is an important

component of management’s internal performance measurement and

incentive and reward process as it is used to assess the current

and historical financial results of the business and for strategic

decision making, preparing budgets, obtaining targets, and

forecasting future results. Management presents this non-GAAP

financial measure to enable investors and analysts to evaluate our

operating performance independent of certain non-cash items and the

effects of certain variables unrelated to our overall operating

performance.

Non-GAAP Operating Income and Operating Margin

The use of non-GAAP operating income and operating margin allows

management to evaluate, among other things, the operating margin

and operating income of the Company’s core businesses and trends

across different reporting periods on a consistent basis,

independent of non-cash items including, generally speaking,

expensing of appraised inventory fair market value step-up, impact

of business wind-down, non-recurring facility costs, amortization

and impairments of intangible assets, goodwill and intangible asset

impairment charges, third party acquisition and divestiture related

costs, restructuring charges and certain other special items as

necessary. In addition, it is an important component of

management’s internal performance measurement and incentive and

reward process as it is used to assess the current and historical

financial results of the business and for strategic decision

making, preparing budgets, obtaining targets, and forecasting

future results. Management presents this non-GAAP financial measure

to enable investors and analysts to evaluate our operating

performance independent of certain non-cash items and the effects

of certain variables unrelated to our overall operating

performance.

Non-GAAP Net Income Attributable to onsemi and Non-GAAP Diluted

Earnings Per Share

The use of non-GAAP net income attributable to onsemi and

non-GAAP diluted earnings per share allows management to evaluate

the operating results of onsemi’s core businesses and trends across

different reporting periods on a consistent basis, independent of

non-cash items including, generally, the amortization and

impairments of intangible assets, goodwill and intangible asset

impairment charges, expensing of appraised inventory fair market

value step-up, impact of business wind down, non-recurring facility

costs, restructuring, gains and losses on debt prepayment, non-cash

interest expense, actuarial (gains) losses on pension plans and

other pension benefits, third party acquisition and

divestiture-related costs, discrete tax items and other non-GAAP

tax adjustments and certain other special items, as necessary. In

addition, these items are important components of management’s

internal performance measurement and incentive and reward process,

as they are used to assess the current and historical financial

results of the business and for strategic decision making,

preparing budgets, setting targets, and forecasting future results.

Management presents these non-GAAP financial measures to enable

investors and analysts to understand the results of operations of

onsemi’s core businesses and, to the extent comparable, to compare

our results of operations on a more consistent basis against those

of other companies in our industry.

Free Cash Flow

The use of free cash flow allows management to evaluate, among

other things, the ability of the Company to make interest or

principal payments on its debt. Free cash flow is defined as the

difference between cash flow from operating activities and capital

expenditures disclosed under investing activities in the

consolidated statement of cash flows. Free cash flow is not an

alternative to cash flow from operating activities as a measure of

liquidity. It is an important component of management’s internal

performance measurement and incentive and reward process as it is

used to assess the current and historical financial results of the

business and for strategic decision making, preparing budgets,

obtaining targets, and forecasting future results. Management

presents this non-GAAP financial measure to enable investors and

analysts to evaluate our financial performance independent of the

cash capital expenditures.

Non-GAAP Diluted Share Count

The use of non-GAAP diluted share count allows management to

evaluate, among other things, the potential dilution due to the

outstanding restricted stock units excluding the dilution from the

convertible notes that is covered by hedging activity up to a

certain threshold. In periods when the quarterly average stock

price per share exceeds $52.97 for the 0% Notes and $103.87 for the

0.50% Notes, the non-GAAP diluted share count includes the

anti-dilutive impact of the Company’s hedge transactions issued

concurrently with the 0% Notes and the 0.50% Notes, respectively.

At an average stock price per share between $52.97 and $74.34 for

the 0% Notes and $103.87 and $156.78 for the 0.50% Notes, the

hedging activity offsets the potentially dilutive effect of the 0%

Notes and the 0.50% Notes, respectively. In periods when the

quarterly average stock price per share exceeds $74.34 for the 0%

Notes and $156.78 for the 0.50% Notes, the dilutive impact of the

warrants issued concurrently with such notes are included in the

diluted shares outstanding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210128005/en/

Krystal Heaton Director, Head of Public Relations onsemi

(480) 242-6943 Krystal.Heaton@onsemi.com

Parag Agarwal Vice President - Investor Relations &

Corporate Development onsemi (602) 244-3437

investor@onsemi.com

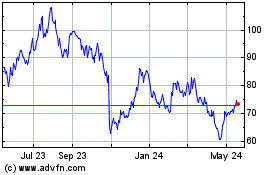

ON Semiconductor (NASDAQ:ON)

Historical Stock Chart

From Jan 2025 to Feb 2025

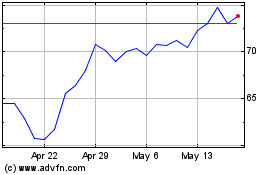

ON Semiconductor (NASDAQ:ON)

Historical Stock Chart

From Feb 2024 to Feb 2025