Completed Initial Public Offering Raising $75

Million in Gross Proceeds

Ovid Therapeutics Inc. (NASDAQ:OVID), a biopharmaceutical company

committed to developing medicines for patients with rare

neurological disorders, today announced financial results for the

first quarter ended March 31, 2017 and provided an overview of the

company’s recent progress.

“Ovid has a clear strategy and business plan to build a

neurology company focused on rare disorders of the brain. Earlier

this year we initiated two clinical trials for OV101, a Phase 2

(“STARS”) trial in adults with Angelman syndrome and a Phase 1

trial in adolescents with either Angelman syndrome or Fragile X

syndrome,” said Jeremy Levin, DPhil, MB BChir, chairman and chief

executive officer of Ovid Therapeutics. “In addition, we entered

into a collaboration with Takeda Pharmaceutical Company Limited to

develop and commercialize TAK-935/OV935 for rare epileptic

encephalopathies. Building on the momentum in the company we

successfully closed our initial public offering in May. We look

forward to continued progress throughout 2017 and beyond.”

Recent Highlights and Upcoming Milestones

- Successfully completed the company’s initial public offering

(IPO), raising $75.0 million in gross proceeds.

- Initiated the Phase 2 STARS clinical trial of OV101 in adults

with Angelman syndrome, a rare genetic disorder with no

FDA-approved therapies.

- The trial is expected to enroll approximately 75 adults aged 18

to 49 years in the United States and Israel with a confirmed

diagnosis of Angelman syndrome.

- The primary endpoint of the trial is to assess the safety and

tolerability of OV101. Exploratory endpoints include evaluating

measures of gross and fine motor skills, maladaptive behavior,

sleep, clinical global impression and health-related quality of

life questionnaires.

- The company expects topline data from the STARS trial to be

available in 2018.

- Initiated a Phase 1 clinical trial to evaluate OV101 in

adolescents diagnosed with Angelman syndrome or Fragile X syndrome

aged 13 to 17 years.

- The Phase 1 single dose, single-arm, open-label clinical trial

will measure pharmacokinetics (PK), safety and tolerability of

OV101.

- The company expects topline data to be available in the second

half of 2017.

- Ovid also is planning to initiate clinical development in a

younger pediatric population pending completion of a pediatric PK

trial and juvenile animal toxicity studies.

- Launched a biomarker strategy to identify molecular markers of

treatment responders in neurodevelopmental disorders.

- Ovid entered into a services agreement with NeuroPointDX. The

relationship will focus on identifying novel biomarkers of Angelman

syndrome by analyzing metabolomic profile data generated in the

STARS trial.

- Expanded the pipeline by entering into a global collaboration

with Takeda Pharmaceutical Company Limited focused on the clinical

development and commercialization of TAK-935/OV935, a potent and

highly selective CH24H inhibitor, in rare epileptic

encephalopathies.

- The companies share in the development and commercialization

costs on a 50/50 basis and, if successful, the companies will share

in the profits on a 50/50 basis.

- Ovid will lead clinical development activities and

commercialization of OV935 in the United States, Europe, Canada and

Israel.

- The companies plan to initiate a Phase 1b/2a trial in 2017 in

patients with rare epileptic encephalopathies, including Dravet

syndrome, Lennox-Gastaut syndrome and Tuberous Sclerosis

Complex.

- Presented preclinical data for OV935 at an oral presentation at

the Antiepileptic Drug and Device (AEDD) Trials XIV Conference in

May 2017.

- Strengthened the company’s Scientific Advisory Board with the

appointment of Jacqueline A. French, M.D., a world-renowned expert

in the treatment of epilepsy.

First Quarter 2017 Financial Results

- As of March 31, 2017, cash and cash equivalents totaled $44.2

million. On May 10, 2017, the company completed its IPO of

5,000,000 shares of common stock at a public offering price of

$15.00 per share, raising gross proceeds of $75 million, prior to

deducting the underwriting discount and estimated expenses of the

offering.

- Research and development expenses were $31.3 million for the

first quarter of 2017, as compared to $1.1 million for the same

period in 2016. The increase was primarily due to the issuance of

stock to Takeda as an upfront payment upon signing the

collaboration agreement for OV935. Of the $27.5 million in

collaboration agreement expenses, $25.9 million related to the

issuance of common stock to Takeda and $1.6 million in Takeda

alliance costs. Additional higher expenses relating to the STARS

Phase 2 trial for OV101 accounted for the rest of the increase in

2017.

- General and administrative expenses were $3.0 million for first

quarter of 2017, as compared to $2.6 million for the same period in

2016. The increase was primarily due to the increase in payroll and

payroll-related expenses as a result of increased headcount as we

expand our operations.

The Company reported net losses of $34.2 million, or basic and

diluted net loss per share attributable to common stockholders

of $3.48, for the first quarter of 2017, as compared to a loss

of $3.7 million, or basic and diluted net loss per share

attributable to common stockholders of $0.37, for the same

period in 2016.

About OV101OV101 (gaboxadol) is believed to be

the only delta (δ)-selective GABAA receptor agonist in development

and the first investigational drug to specifically target the

disruption of tonic inhibition that is thought to be the underlying

cause of certain neurodevelopmental disorders. OV101 has been

demonstrated in laboratory studies and animal models to selectively

activate the δ-subunit of GABAA receptors, which are found in the

extrasynaptic space (outside of the synapse), and thereby impact

neuronal activity through tonic inhibition.

Ovid is developing OV101 for the treatment of Angelman syndrome

and Fragile X syndrome to potentially restore tonic inhibition and

relieve several of the symptoms of these disorders. In preclinical

studies, it was observed that OV101 improved symptoms of Angelman

syndrome and Fragile X syndrome.

In September 2016, the FDA granted orphan drug designation for

OV101 for the treatment of Angelman syndrome. The United States

Patent and Trademark Office has granted Ovid two patents directed

to methods of treating Angelman syndrome using THIP (OV101). The

issued patents expire in 2035, without regulatory extensions.

About TAK-935TAK-935, which is being studied in

rare pediatric epilepsies, is a potent, highly-selective,

first-in-class inhibitor of the enzyme cholesterol 24-hydroxylase

(CH24H). CH24H is predominantly expressed in the brain, where it

plays a central role in cholesterol homeostasis. CH24H converts

cholesterol to 24-S-hydroxycholesterol (24HC) which then exits the

brain into the blood plasma circulation.i Glutamate is one of

the main neurotransmitters in the brain and has been shown to play

a role in the initiation and spread of seizure

activity.ii Recent literature indicates CH24H is involved in

over-activation of the glutamatergic pathway through modulation of

the NMDA channel,iii implying its potential role in CNS

diseases such as epilepsy. To Ovid’s knowledge, TAK-935 is the only

molecule with this mechanism of action in clinical development.

TAK-935 has been tested in preclinical models to provide data to

support the advancement of the drug into human clinical studies in

patients suffering from rare epilepsy syndromes. A novel

proprietary PET ligand, developed by Takeda and Molecular

Neuroimaging, LLC (MNI), has been used to determine target

occupancy of TAK-935 in the brain.iv In addition, TAK-935’s

effect on CH24H enzyme activity in the brain has been assessed by

following measurable reductions in the plasma concentration

of 24HC.

TAK-935 has completed four Phase 1 clinical

studiesv,vi,vii,viii which have assessed tolerability and

target engagement at doses which are believed to be therapeutically

relevant. TAK-935 is being co-developed by Ovid and Takeda

Pharmaceutical Company Limited.

About Ovid TherapeuticsOvid Therapeutics

(NASDAQ:OVID) is a New York-based, biopharmaceutical company using

its BoldMedicineTM approach to develop therapies that transform the

lives of patients with rare neurological disorders. Ovid’s drug

candidate, OV101, is currently in development for the treatment of

Angelman syndrome and Fragile X syndrome. Ovid has initiated the

Phase 2 STARS trial of OV101 in adults with Angelman syndrome and a

Phase 1 trial in adolescents with Angelman syndrome or Fragile X

syndrome. Ovid is also developing OV935 in collaboration with

Takeda Pharmaceutical Company Limited for the treatment of rare

epileptic encephalopathies. Ovid expects to initiate a Phase 1b/2a

trial of OV935 to treat rare epileptic encephalopathies in

2017.

For more information on Ovid, please visit

http://www.ovidrx.com/.

Forward-Looking Statements

This press release includes certain disclosures which contain

“forward-looking statements,” including, without limitation,

statements regarding progress, timing, scope and results of

clinical trials for Ovid’s product candidates, the reporting of

clinical data regarding Ovid’s product candidates, and the

potential use of TAK-935/OV935 to treat epileptic encephalopathies.

You can identify forward-looking statements because they contain

words such as “will,” “believes” and “expects.” Forward-looking

statements are based on Ovid’s current expectations and

assumptions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that may differ materially from those

contemplated by the forward-looking statements, which are neither

statements of historical fact nor guarantees or assurances of

future performance. Important factors that could cause actual

results to differ materially from those in the forward-looking

statements are set forth in Ovid’s filings with the Securities and

Exchange Commission, including its registration statement on Form

S-1, as amended, under the caption “Risk Factors.” Ovid assumes no

obligation to update any forward-looking statements contained

herein to reflect any change in expectations, even as new

information becomes available.

| |

| OVID THERAPEUTICS INC. |

| Condensed Balance Sheets

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

44,225,807 |

|

|

$ |

51,939,661 |

|

| Prepaid

and other current assets |

|

|

389,360 |

|

|

|

221,507 |

|

| Due from

related parties |

|

|

- |

|

|

|

7,369 |

|

| Deferred

transaction costs |

|

|

1,926,017 |

|

|

|

242,673 |

|

| Total

current assets |

|

|

46,541,184 |

|

|

|

52,411,210 |

|

| |

|

|

|

|

|

|

|

|

| Security deposit |

|

|

415,260 |

|

|

|

407,785 |

|

| Property, plant and

equipment, net |

|

|

46,586 |

|

|

|

43,591 |

|

| Other assets |

|

|

200,281 |

|

|

|

165,301 |

|

| Total

assets |

|

$ |

47,203,311 |

|

|

$ |

53,027,887 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

1,579,789 |

|

|

$ |

857,169 |

|

| Accrued

expenses |

|

|

3,287,974 |

|

|

|

2,876,243 |

|

| Total

current liabilities |

|

|

4,867,763 |

|

|

|

3,733,412 |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders'

Equity: |

|

|

|

|

|

|

|

|

| Common

stock, $0.001 par value; 62,000,000 and 58,000,000 shares

authorized at March 31, 2017 and December 31, 2016, respectively,

9,838,590 shares issued and outstanding at March 31, 2017 and

December 31, 2016 |

|

|

9,839 |

|

|

|

9,839 |

|

| Preferred

Series A - 5,121,453 shares authorized at March 31, 2017 and

December 31, 2016, 2,382,069 issued and outstanding at March 31,

2017 and December 31, 2016 (liquidation preference $5,060,000) |

|

|

2,382 |

|

|

|

2,382 |

|

| Preferred

Series B - 12,038,506 shares authorized, 5,599,282 issued and

outstanding at March 31, 2017 and December 31, 2016 (liquidation

preference $74,999,883) |

|

|

5,599 |

|

|

|

5,599 |

|

| Preferred

Series B-1 - 3,831,923 and zero shares authorized at March 31, 2017

and December 31, 2016, respectively, 1,781,996 and zero issued and

outstanding at March 31, 2017 and December 31, 2016,

respectively |

|

|

1,782 |

|

|

|

- |

|

|

Additional paid-in-capital |

|

|

112,464,370 |

|

|

|

85,186,269 |

|

|

Accumulated deficit |

|

|

(70,148,424 |

) |

|

|

(35,909,614 |

) |

| Total

stockholders' equity |

|

|

42,335,548 |

|

|

|

49,294,475 |

|

| Total

liabilities and stockholders' equity |

|

$ |

47,203,311 |

|

|

$ |

53,027,887 |

|

|

|

|

|

|

|

|

|

|

|

| OVID THERAPEUTICS INC. |

| Condensed Statements of Operations and

Comprehensive Loss (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

Three Months Ended March 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

2016 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Research

and development |

|

$ |

31,284,429 |

|

|

$ |

1,126,602 |

|

| Selling,

general and administrative |

|

|

2,977,864 |

|

|

|

2,587,894 |

|

| Total

operating expenses |

|

|

34,262,293 |

|

|

|

3,714,496 |

|

| Interest income

(expense), net |

|

|

23,483 |

|

|

|

32,330 |

|

| Loss before income

tax |

|

|

(34,238,810 |

) |

|

|

(3,682,166 |

) |

| Income taxes |

|

|

- |

|

|

|

- |

|

| Net loss and

comprehensive loss |

|

$ |

(34,238,810 |

) |

|

$ |

(3,682,166 |

) |

| Net loss attributable

to common stockholders |

|

$ |

(34,238,810 |

) |

|

$ |

(3,682,166 |

) |

| Net loss per share

attributable to common stockholders, basic and diluted |

|

$ |

(3.48 |

) |

|

$ |

(0.37 |

) |

| Weighted-average common

shares outstanding basic and diluted |

|

|

9,838,590 |

|

|

|

9,838,590 |

|

| |

|

|

|

|

|

|

|

|

i Russell DW, Halford RW, Ramirez DMO, Shah R, Kotti T.

Cholesterol 24-Hydroxylase: An Enzyme of Cholesterol Turnover in

the Brain. Annu Rev Biochem. 2009; 78: 1017–1040.ii Mehta A,

Prabhakar M, Kumar P, Deshmukh R, Sharma PL. Excitotoxicity: bridge

to various triggers in neurodegenerative disorders. Eur J Pharmacol

2013;698(1-3):6-18.iii Paul SM, Doherty JJ, Robichaud AJ,

Belfort GM, Chow BY, Hammond RS, et al. The major brain cholesterol

metabolite 24(S)-hydroxycholesterol is a potent allosteric

modulator of N-methyl-D-aspartate receptors. J Neurosci

2013;33(44):17290-300.iv https://www.clinicaltrials.gov/ct2/show/NCT02497235?term=TAK-935&rank=1v https://www.clinicaltrials.gov/ct2/show/NCT02497235?term=TAK-935&rank=1vi https://www.clinicaltrials.gov/ct2/show/NCT02906813?term=TAK-935&rank=2vii https://www.clinicaltrials.gov/ct2/show/NCT02201056?term=TAK-935&rank=3viii https://www.clinicaltrials.gov/ct2/show/NCT02539134?term=TAK-935&rank=4

Ovid Contacts:

Investors:

Burns McClellan

Steve Klass, 212-213-0006

Sklass@burnsmc.com

Media:

Pure Communications, Inc.

Katie Engleman, 910-509-3977

katie@purecommunicationsinc.com

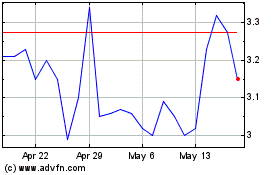

Ovid Therapeutics (NASDAQ:OVID)

Historical Stock Chart

From Mar 2024 to May 2024

Ovid Therapeutics (NASDAQ:OVID)

Historical Stock Chart

From May 2023 to May 2024