false

0000788920

0000788920

2024-09-05

2024-09-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 5, 2024

PRO-DEX, INC.

(Exact name of registrant as specified in charter)

| Colorado |

0-14942 |

84-1261240 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

2361 McGaw Avenue

Irvine, California 92614

(Address of principal executive offices, zip

code)

(949) 769-3200

(Registrant’s telephone number including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

PDEX |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ☐ |

|

If an emerging growth company, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

The

information in this Item 2.02 of this Form 8-K, as well as Exhibit 99.1 attached hereto, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such a filing.

On

September 5, 2024, Pro-Dex, Inc. (the “Company”) is issuing a press release announcing its financial performance for the

fourth fiscal quarter and fiscal year ended June 30, 2024. A copy of the press release is attached to this Form 8-K as Exhibit 99.1,

which is incorporated herein by this reference.

| |

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: September 5, 2024 |

Pro-Dex, Inc. |

| |

|

| |

|

|

| |

By: |

/s/ Alisha K. Charlton |

| |

|

Alisha K. Charlton |

| |

|

Chief Financial Officer |

Exhibit 99.1

Contact: Richard L. Van Kirk,

Chief Executive Officer

(949) 769-3200

For Immediate Release

PRO-DEX, INC. ANNOUNCES FISCAL 2024

FOURTH QUARTER AND FULL-YEAR RESULTS

IRVINE,

CA, September 5, 2024 - PRO-DEX, INC. (NasdaqCM: PDEX) today announced financial results for its

fiscal 2024 fourth quarter and full-year ended June 30, 2024.

Quarter Ended June 30, 2024

Net

sales for the three months ended June 30, 2024 increased $4.4 million, or 41%, to $15.0 million from $10.6 million for the three

months ended June 30, 2023, due primarily to increased revenue in the amount of $3.4 million from

our largest customer. Specifically, the increase relates to a $1.4 million increase in repair revenue related to the enhanced repair program

we began last fiscal year to refurbish the orthopedic handpiece we sell to our largest customer, as well as an increase of $2.0 million

in sales of new units to that same customer. Gross profit for the three months ended June 30, 2024 increased $729,000, or 22%. Although

gross profit increased, our gross margin decreased from 32% for the three months ended June 30, 2023, to 27% for the three months ended

June 30, 2024, due to continued price pressures and increased indirect labor in our operations group to manage our growth.

Operating expenses (which include

selling, general and administrative, and research and development expenses) for the quarter ended June 30, 2024, remained relatively flat

at $1.7 million, compared to $1.8 million for the prior fiscal year’s corresponding quarter. While these total operating expense

amounts have remained flat, we reduced general and administrative expenses by $182,000 and increased engineering expenses by $141,000

for the quarter ended June 30, 2024, compared to the corresponding quarter in 2023. The decrease in general and administrative expenses

is a result of reduced equity compensation expenses due to employee forfeitures and the increase in engineering relates to a higher proportion

of sustaining engineering expenses as opposed to billable customer contract expenses.

Our operating income for the quarter

ended June 30, 2024, increased $742,000, or 46%, to $2.4 million compared to $1.6 million for the prior fiscal year’s corresponding

quarter. The increase reflects our increased sales and gross profit, as described above.

Net income for the quarter ended

June 30, 2024, increased slightly by $86,000 to $1.6 million, or $0.46 per diluted share, compared to $1.5 million, or $0.42 per diluted

share, in the corresponding quarter in 2023. The difference in the growth rate of net income and operating income is primarily due to

unrealized gains and losses of investments. In the current quarter, operating income increased 46% over the corresponding quarter of the

prior fiscal year compared to the slight increase in net income for the same period.

Year Ended June 30, 2024

Net

sales for the fiscal year ended June 30, 2024 increased $7.8 million, or 17%, to $53.8 million from $46.0 million for the fiscal year

ended June 30, 2023, due primarily to increases in revenue from our largest customer. Specifically, the increase relates to a $3.6 million

increase in repair revenue as well as an increase of $3.5 million in sales of new units to that same customer.

Gross

profit for the fiscal year ended June 30, 2024,

increased $1.8 million, or 14%, to $14.5 million compared to $12.7 million for fiscal 2023.

Operating expenses (which include

selling, general and administrative, and research and development expenses) for the fiscal year ended June 30, 2024, increased 6% to $7.4

million from $7.0 million in the prior fiscal year. The increase relates primarily to an increase in research and development costs because

in fiscal 2024 our expenditures related primarily to sustaining engineering activities rather than billable customer projects which are

reclassified to cost of sales.

Our operating income for the year

ended June 30, 2024, increased $1.4 million, or 25%, to $7.2 million compared to $5.8 million for the prior fiscal year’s corresponding

quarter. The increase reflects our increased sales and gross profit, as described above.

Net income for the fiscal year

ended June 30, 2024, was $2.1 million, or $0.60 per diluted share, compared to $7.1 million, or $1.95 per diluted share, for fiscal 2023.

Our net income for the year ended June 30, 2024, contains unrealized losses on our marketable equity investments of $4.1 million while

our net income for the year ended June 30, 2023, contains unrealized gains on our marketable equity investments of $3.9 million. The difference

in the growth rate of net income and operating income is primarily due to unrealized gains and losses of investments. In the current fiscal

year operating income increased 25% over the prior fiscal year, compared to the 70% decrease in net income for the same period. All of

our investments are recorded at estimated fair value, and the valuation can be highly volatile.

CEO Comments

“We are very pleased with

our performance including increasing sales and an increase of $1.4 million in operating income.” said the Company’s President

and Chief Executive Officer Richard L. (“Rick”) Van Kirk. “While this fiscal year included the challenges of transitioning

to a multiple-facility operation, we continued to grow the business. I remain grateful to the entire Pro-Dex team for their ongoing efforts

and teamwork.” Mr. Van Kirk continued, “Additionally, we are excited to announce that we hired a new Director of Operations

in the first quarter of fiscal 2025, Mr. Jawahar Garg, who has extensive manufacturing operations and supply chain experience to assist

our team to continue on our growth trajectory.”

About Pro-Dex, Inc.:

Pro-Dex, Inc.

specializes in the design, development, and manufacture of autoclavable, battery-powered, and electric multi-function surgical drivers

and shavers used primarily in the orthopedic, thoracic, and maxocranial facial markets. We have patented adoptive torque-limiting

software and proprietary sealing solutions which appeal to our customers, primarily medical device distributors. Pro-Dex also sells rotary

air motors. Pro-Dex's products are found in hospitals and medical engineering labs around the world. For more information, visit the Company's

website at www.pro-dex.com.

Statements herein

concerning the Company's plans, growth and strategies may include “forward-looking statements” within the context of the federal

securities laws. Statements regarding the Company's future events, developments and future performance (including, but not limited to,

prospects for future growth) as well as management's expectations, beliefs, plans, estimates, or projections relating to the future, are

forward-looking statements within the meaning of these laws. The Company's actual results may differ materially from those suggested as

a result of various factors. Interested parties should refer to the disclosure concerning the operational and business risks of the Company

set forth in the Company's filings with the Securities and Exchange Commission.

(tables follow)

PRO-DEX, INC. AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data

| | |

June

30, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,631 | | |

$ | 2,936 | |

| Investments | |

| 4,217 | | |

| 1,134 | |

| Accounts receivable | |

| 13,887 | | |

| 9,952 | |

| Deferred costs | |

| 262 | | |

| 494 | |

| Inventory | |

| 15,269 | | |

| 16,167 | |

| Prepaid expenses | |

| 345 | | |

| 296 | |

| Total current assets | |

| 36,611 | | |

| 30,979 | |

| Land and building, net | |

| 6,155 | | |

| 6,249 | |

| Equipment and improvements, net | |

| 5,024 | | |

| 5,079 | |

| Right of use asset, net | |

| 1,473 | | |

| 1,872 | |

| Intangibles, net | |

| 54 | | |

| 81 | |

| Deferred income taxes, net | |

| 1,555 | | |

| — | |

| Investments | |

| 1,563 | | |

| 7,521 | |

| Other assets | |

| 42 | | |

| 42 | |

| Total assets | |

$ | 52,477 | | |

$ | 51,823 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 4,513 | | |

$ | 2,261 | |

| Accrued liabilities | |

| 3,359 | | |

| 3,135 | |

| Income taxes payable | |

| 632 | | |

| 453 | |

| Deferred revenue | |

| 14 | | |

| — | |

| Notes payable | |

| 4,374 | | |

| 3,827 | |

| Total current liabilities | |

| 12,892 | | |

| 9,676 | |

| Non-current liabilities: | |

| | | |

| | |

| Lease liability, net of current portion | |

| 1,182 | | |

| 1,638 | |

| Deferred income taxes, net | |

| — | | |

| 8 | |

| Notes payable, net of current portion | |

| 7,536 | | |

| 8,911 | |

| Total non-current liabilities | |

| 8,718 | | |

| 10,557 | |

| Total liabilities | |

| 21,610 | | |

| 20,233 | |

| | |

| | | |

| | |

| Commitments and Contingencies: | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | |

| Common stock, no par value, 50,000,000 shares authorized; 3,363,412 and 3,545,309 shares issued and outstanding at June 30, 2024 and 2023, respectively | |

| 3,917 | | |

| 6,767 | |

| Retained earnings | |

| 26,950 | | |

| 24,823 | |

| Total shareholders’ equity | |

| 30,867 | | |

| 31,590 | |

| Total liabilities and shareholders’ equity | |

$ | 52,477 | | |

$ | 51,823 | |

PRO-DEX, INC. AND SUBSIDIARY

CONSOLIDATED INCOME STATEMENTS

(In thousands, except per share data)

| | |

Three

Months Ended

June 30,

(Unaudited) | | |

Years

Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net sales | |

$ | 15,025 | | |

$ | 10,639 | | |

$ | 53,844 | | |

$ | 46,087 | |

| Cost of sales | |

| 10,936 | | |

| 7,279 | | |

| 39,293 | | |

| 33,338 | |

| Gross profit | |

| 4,089 | | |

| 3,360 | | |

| 14,551 | | |

| 12,749 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| 37 | | |

| 9 | | |

| 117 | | |

| 155 | |

| Selling expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| 864 | | |

| 1,046 | | |

| 4,072 | | |

| 4,028 | |

| Research and development costs | |

| 836 | | |

| 695 | | |

| 3,189 | | |

| 2,804 | |

| Total operating expenses | |

| 1,737 | | |

| 1,750 | | |

| 7,378 | | |

| 6,987 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| 2,352 | | |

| 1,610 | | |

| 7,173 | | |

| 5,762 | |

| Interest expense | |

| (150 | ) | |

| (145 | ) | |

| (558 | ) | |

| (533 | ) |

| Unrealized gain (loss) on investments | |

| (340 | ) | |

| 492 | | |

| (4,125 | ) | |

| 3,899 | |

| Gain on sale of investments | |

| — | | |

| — | | |

| — | | |

| 6 | |

| Interest and dividend income | |

| 68 | | |

| 58 | | |

| 144 | | |

| 294 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 1,930 | | |

| 2,015 | | |

| 2,634 | | |

| 9,428 | |

| Income tax expense | |

| 343 | | |

| 514 | | |

| 507 | | |

| 2,354 | |

| Net income | |

$ | 1,587 | | |

$ | 1,501 | | |

$ | 2,127 | | |

$ | 7,074 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic & Diluted income per share: | |

| | | |

| | | |

| | | |

| | |

| Basic net income per share | |

$ | 0.47 | | |

$ | 0.42 | | |

$ | 0.61 | | |

$ | 1.98 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted net income per share | |

$ | 0.46 | | |

$ | 0.42 | | |

$ | 0.60 | | |

$ | 1.95 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 3,400,767 | | |

| 3,545,309 | | |

| 3,498,807 | | |

| 3,571,044 | |

| Diluted | |

| 3,473,167 | | |

| 3,610,109 | | |

| 3,571,207 | | |

| 3,636,944 | |

PRO-DEX, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | |

Years

Ended June 30, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net income | |

$ | 2,127 | | |

$ | 7,074 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,160 | | |

| 857 | |

| Unrealized (gain) loss on marketable equity investments | |

| 4,125 | | |

| (3,899 | ) |

| Gain on sale of investments | |

| — | | |

| (6 | ) |

| Non-cash lease recovery | |

| (17 | ) | |

| (2 | ) |

| Amortization of loan fees, net | |

| (13 | ) | |

| 12 | |

| Share-based compensation | |

| 605 | | |

| 766 | |

| Deferred income taxes | |

| (1,563 | ) | |

| 264 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (3,935 | ) | |

| 5,432 | |

| Deferred costs | |

| 232 | | |

| 216 | |

| Inventory | |

| 898 | | |

| (3,489 | ) |

| Prepaid expenses | |

| (49 | ) | |

| 494 | |

| Accounts payable and accrued expenses | |

| 2,436 | | |

| (1,153 | ) |

| Deferred revenue | |

| 14 | | |

| (1,013 | ) |

| Income taxes payable | |

| 179 | | |

| (91 | ) |

| Net cash provided by operating activities | |

| 6,199 | | |

| 5,462 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchases of equipment and improvements | |

| (983 | ) | |

| (974 | ) |

| Proceeds from sale of investments | |

| — | | |

| 89 | |

| Investment in Monogram | |

| (1,250 | ) | |

| — | |

| Net cash used in investing activities | |

| (2,233 | ) | |

| (885 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Principal payments on notes payable | |

| (4,816 | ) | |

| (6,093 | ) |

| Borrowing from Minnesota Bank & Trust, net of loan origination fees | |

| 4,000 | | |

| 5,284 | |

| Repurchases of common stock | |

| (3,505 | ) | |

| (1,547 | ) |

| Payments of employee taxes on net issuance of common stock | |

| — | | |

| (223 | ) |

| Proceeds from exercise of stock options and ESPP contributions | |

| 50 | | |

| 89 | |

| Net cash used in financing activities | |

| (4,271 | ) | |

| (2,490 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash and cash equivalents | |

| (305 | ) | |

| 2,087 | |

| Cash and cash equivalents, beginning of year | |

| 2,936 | | |

| 849 | |

| Cash and cash equivalents, end of year | |

$ | 2,631 | | |

$ | 2,936 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

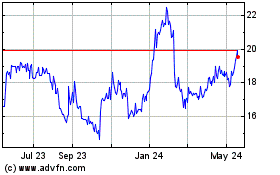

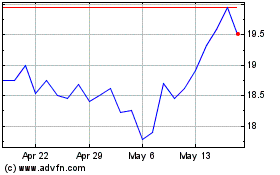

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Aug 2024 to Sep 2024

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Sep 2023 to Sep 2024