Gen AI and Automation Enhancements Help Banks Accelerate Payment Disputes and Claims with New Edition of Pega Smart Dispute

12 December 2024 - 1:00AM

Business Wire

New version of market-leading solution further

simplifies time-consuming process and supports more payment

types

Pegasystems Inc. (NASDAQ: PEGA), the Enterprise Transformation

Company™, today introduced the next generation version of its

market-leading Pega Smart Dispute™ offering, including new

generative AI and automation features that helps banks accelerate

resolution of disputes and fraud claims for any type of payment.

With the new Pega Smart Dispute Enterprise Edition, banks can now

resolve complex disputes and claims even faster across a wider

range of payment types, all through a single, powerful, and

time-tested Pega solution.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241211846627/en/

This screenshot of Pega Smart Dispute

Enterprise Edition highlights how new Pega GenAI capabilities help

the service representative accelerate a credit card transaction

dispute. (Photo: Business Wire)

Banks worldwide are facing a massive surge in chargeback

requests, which are costly and time-consuming to process. Research

firm Datos Insights found customers disputed $11 billion worth of

charges in the U.S. last year alone, with this figure expected to

rise 40% by 2026. The adoption of alternative payment methods

beyond Visa and Mastercard has surged in recent years with

significant growth in mobile wallet payments, peer-to-peer

payments, buy now pay later (BNPL), and real/near-real time payment

systems. Banks must navigate this ever-growing array of global and

regional payment types while working across a complex web of

evolving chargeback policies, often across siloed systems.

Any payment type, unified under one solution Trusted for

decades by dozens of the top global banks to handle card payment

disputes, Pega Smart Dispute Enterprise Edition can now process any

possible payment type more efficiently and effectively with gen AI

and expanded automation capabilities.

By tapping into Pega GenAI Blueprint™ – the workflow design

platform launched earlier this year – users can extend Pega Smart

Dispute Enterprise Edition to support new payment types in just

seconds using natural language prompts. This means banks can easily

support emerging, regional, or niche payment types as quickly as

they come to market. Pega leverages its 20 years of extensive

chargeback experience and the power of gen AI to automate new

payment workflow creation. This complements existing out-of-the-box

support for more established payment types, such as Visa,

Mastercard, American Express, Zelle, and others, all under one

centralized disputes platform.

Even more automation & guidance In addition, Pega has

added a suite of AI agents that infuse even more automation and

guidance through every step, including:

- Intelligent guidance: Pega GenAI Coach™ gives employees

an always-on mentor within Pega Smart Dispute Enterprise Edition to

help optimize their work and overcome roadblocks.

- Fast and accurate data retrieval: Pega Knowledge Buddy™

gives employees quick and accurate answers to dispute processing

questions using Retrieval Augmented Generation-based gen AI.

- Other gen-AI agent assistance: Additional gen AI agents

help employees process disputes smarter and faster, including

instant summaries of customer calls via Pega Voice AI™ or instant

summaries of client claims and dispute histories with Pega

GenAI™.

Additional enhancements

- Pega has enhanced the underlying architecture of Pega Smart

Dispute in the new Enterprise Edition to accelerate new

deployments, provide greater flexibility, streamline design of new

payment types, and enable increased use of AI and automations.

- A new user interface provides a more responsive, accessible,

and modern look and feel as well as a streamlined user experience

for faster processing of customer disputes and fraud.

- Enhanced integrations with Pega’s DX API capabilities make it

easier to extend chargeback request functionality to any channel,

including self-service over mobile or web, as well as phone and

chat agents.

- Pega Smart Dispute Enterprise Edition now comes integrated with

market-leading Pega Customer Service™, enabling agents to leverage

Pega’s customer service capabilities to seamlessly provide

additional service actions tied to disputes and fraud.

- Pega will continue to make timely updates to the solution with

the latest compliance rules for Visa, American Express, and

Mastercard.

Longtime market leader Pega Smart Dispute manages all aspects of

the payment dispute and exception processes in a unified solution.

It both guides employees and automates processes to increase

efficiency, customer satisfaction, and compliance. Built on Pega’s

leading low-code platform, Pega Smart Dispute enables clients to

rapidly adapt to changing conditions and handle new payment

types.

Pega Smart Dispute Enterprise Edition is available today. Some

AI features may require additional licensing. For more information,

visit:

www.pega.com/industries/financial-services/smart-dispute.

Quotes & Commentary: “With the rapid growth in

chargeback disputes, banks must be increasingly quick and nimble to

keep up with customer demands,” said Steve Morgan, global banking

industry lead, Pega. “By infusing new powerful gen AI and

automation capabilities across our market-leading payment dispute

solution, Pega is helping banks increase efficiency and bring

faster resolutions to customers.”

Supporting Resources:

- More information: Pega Smart Dispute background

- Video overview: Delivering moments that matter

- Data Sheet: Pega Smart Dispute

- Analyst recognition: Pega named Leader in The Forrester

Wave: Task-Centric Automation Software report Q4 2024

About Pegasystems Pega is The Enterprise Transformation

Company that helps organizations Build for Change® with enterprise

AI decisioning and workflow automation. Many of the world’s most

influential businesses rely on our platform to solve their most

pressing challenges, from personalizing engagement to automating

service to streamlining operations. Since 1983, we’ve built our

scalable and flexible architecture to help enterprises meet today’s

customer demands while continuously transforming for tomorrow. For

more information on Pega (NASDAQ: PEGA), visit www.pega.com

All trademarks are the property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211846627/en/

Press: Sean Audet Pegasystems sean.audet@pega.com

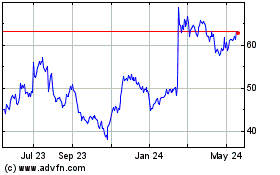

Pegasystems (NASDAQ:PEGA)

Historical Stock Chart

From Nov 2024 to Dec 2024

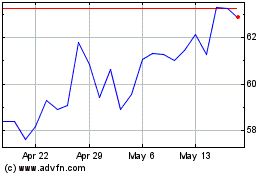

Pegasystems (NASDAQ:PEGA)

Historical Stock Chart

From Dec 2023 to Dec 2024