Pagaya Completes Acquisition of Theorem Technology, Inc.

28 October 2024 - 11:30PM

Business Wire

On a combined basis, the company now has access to more than $3

billion of fund capital to support strong investor demand

Pagaya Technologies LTD. (NASDAQ: PGY) ("Pagaya" or “the

Company”), a global technology company delivering AI-driven product

solutions for the financial ecosystem, today announced the

completion of its acquisition of Theorem Technology, Inc.

(“Theorem”), a machine-learning underwriting technology company

that has powered billions of dollars of credit across its network

since its founding in 2014.

With a combined credit fund platform exceeding $3 billion in

AUM, the transaction is expected to further strengthen Pagaya’s

market-leading capabilities, diversify its funding sources and

drive capital efficiency. Fund investors are expected to gain

access to credit assets generated by Pagaya’s network of 31 of the

top lenders in the U.S., creating more growth opportunities across

the lending ecosystem. The acquisition is expected to be accretive

in 2025.

“We are thrilled to welcome Theorem’s incredible team to our

company,” said Pagaya CEO Gal Krubiner. “Our combined capabilities

will enable us to better meet unprecedented institutional demand

for consumer credit, while also diversifying our funding sources

and improving our capital efficiency. Together we are well

positioned to drive accelerated profitable growth and deliver on

our mission.”

“We are excited to join the Pagaya team to create more

opportunities for our limited partners, employees, and

stockholders,” said Theorem Founder and Chief Investment Officer

Hugh Edmundson. “The combination of our technology platforms and

funding capabilities will allow us to deliver a truly unique

solution for the U.S. lending ecosystem at increased scale.”

About Pagaya Technologies

Pagaya (NASDAQ: PGY) is a global technology company making

life-changing financial products and services available to more

people nationwide, as it reshapes the financial services ecosystem.

By using machine learning, a vast data network and an AI-driven

approach, Pagaya provides consumer credit and other products for

its partners, their customers, and investors. Its proprietary API

and capital solutions integrate into its network of partners to

deliver seamless user experiences and greater access to the

mainstream economy. For more information, visit pagaya.com.

About Theorem

Founded in 2014, Theorem is a Silicon Valley-based institutional

asset manager focused exclusively on the consumer credit space,

managing assets for global institutional investors for more than a

decade. Theorem’s team of PhD researchers and technologists build

machine learning models for analyzing and pricing loans and

evaluating loan origination platforms to support its institutional

fund investment strategies, expressing its technology advantages

through active loan selection, primary and secondary loan pool

pricing, and proprietary custom joint ventures with originators.

Since its inception, Theorem has acquired over $10 billion of

consumer loans on behalf of its clients, $2.6 billion through

custom partner integrations, and today manages over $1.7 billion

for endowments, foundations, sovereign wealth funds, pensions,

healthcare organizations, insurance companies and family offices

worldwide.

Cautionary Note About Forward-Looking Statements

This document contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

that involve risks and uncertainties. These forward-looking

statements generally are identified by the words “anticipate,”

“believe,” “continue,” “can,” “could,” “estimate,” “expect,”

“intend,” “may,” “opportunity,” “future,” “strategy,” “might,”

“outlook,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “strive,” “will,” “would,” “will be,” “will continue,”

“will likely result,” and similar expressions. All statements other

than statements of historical fact are forward-looking statements,

including statements regarding: the Company’s strategy and future

operations and any expected results and benefits of the

transaction, including the potential growth of Pagaya’s fund

management business and the access of Theorem’s funds to Pagaya’s

network and corresponding results. The forward-looking statements

are made as of the date hereof, reflect the Company’s current

beliefs and are based on information currently available as of the

date they are made, and the Company assumes no obligation and does

not intend to update these forward-looking statements. These

forward-looking statements involve known and unknown risks,

uncertainties and other important factors that may cause the

Company's actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Certain of these risks are described in the Company’s

Form 10-K filed on April 25, 2024 and subsequent filings with the

U.S. Securities and Exchange Commission. Given these uncertainties,

investors should not place undue reliance on these forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028480924/en/

Investors & Analysts ir@pagaya.com

Media & Press press@pagaya.com

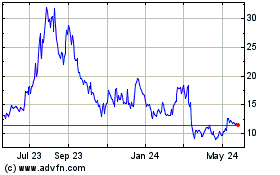

Pagaya Technologies (NASDAQ:PGY)

Historical Stock Chart

From Jan 2025 to Feb 2025

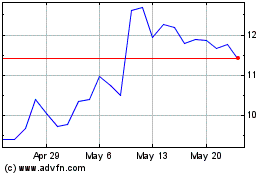

Pagaya Technologies (NASDAQ:PGY)

Historical Stock Chart

From Feb 2024 to Feb 2025