Premier, Inc. (NASDAQ: PINC), a leading technology-driven

healthcare improvement company, today reported financial results

for the fiscal-year 2025 first quarter ended September 30,

2024.

On October 1, 2024, the company announced that it had divested

the S2S Global direct sourcing business. As such, and unless stated

otherwise, all results presented in the following release reflect

those of continuing operations. In addition, as the divestiture

process for the Contigo Health business remains ongoing, results

presented in this release will continue to include contributions

from that business. Refer to supplemental financial tables below

for a reconciliation of the impact of the Contigo Health business

on certain financial measures in the quarter.

"I am pleased to report that our first quarter results slightly

exceeded our expectations for revenue and profitability," said

Michael J. Alkire, Premier's President and CEO. "As a result, we

are reaffirming our previously released fiscal 2025 financial

guidance ranges. In addition, we continued to return capital to

stockholders during the quarter through our quarterly cash dividend

and the repurchase of additional shares under our $1 billion share

repurchase authorization."

Consolidated Financial Highlights of

Continuing Operations

Three Months Ended September

30,

(in thousands, except per share data)

2024

2023

% Change

Net revenue:

Supply Chain Services:

Net administrative fees

$

132,625

$

149,886

(12

%)

Software licenses, other services and

support

18,763

13,390

40

%

Total Supply Chain Services

151,388

163,276

(7

%)

Performance Services

96,754

105,750

(9

%)

Net revenue

$

248,142

$

269,026

(8

%)

Net income from continuing operations

$

72,940

$

41,769

75

%

Net income from continuing operations

attributable to stockholders

$

72,388

$

44,120

64

%

Diluted earnings per share from continuing

operations attributable to stockholders

$

0.72

$

0.37

95

%

Consolidated Non-GAAP Financial

Highlights of Continuing Operations

Three Months Ended September

30,

(in thousands, except per share data)

2024

2023

% Change

NON-GAAP FINANCIAL MEASURES*:

Adjusted EBITDA:

Supply Chain Services

$

77,511

$

101,387

(24

%)

Performance Services

14,949

22,930

(35

%)

Total segment adjusted EBITDA

92,460

124,317

(26

%)

Corporate

(30,032

)

(31,009

)

3

%

Adjusted EBITDA

$

62,428

$

93,308

(33

%)

Adjusted net income

$

34,739

$

56,165

(38

%)

Adjusted earnings per share

(EPS)

$

0.34

$

0.47

(28

%)

* Refer to "Premier's Use and Definition

of Non-GAAP Measures" below and the supplemental financial

information at the end of this release for information on the

company's use of non-GAAP measures and a reconciliation of reported

GAAP results to non-GAAP results.

Fiscal 2025 Guidance

Certain statements in this release, including without

limitation, those in this section, are forward-looking statements.

For additional information regarding the use and limitations of

such statements, refer to "Cautionary Note Regarding

Forward-Looking Statements" below.

Based on results for the first quarter of fiscal 2025 and its

current outlook for the remainder of the fiscal year, the company

is reaffirming the following:

Guidance Metric

Fiscal 2025 Guidance Range [1] [2] (as

of November 5, 2024)

Segment Net Revenue:

Supply Chain Services

$560 million to $610 million

Performance Services Excluding Contigo

Health

$370 million to $410 million

Total Net Revenue Excluding Contigo

Health

$930 million to $1.02 billion

Adjusted EBITDA

$235 million to $255 million

Adjusted EPS

$1.16 to $1.28

Fiscal 2025 guidance is based on the

realization of the following key assumptions:

- Net administrative fees revenue of $495 million to $525

million, which includes $60 million to $75 million in revenue

related to non-healthcare member purchasing

- Supply Chain Services segment software licenses, other services

and support revenue of $65 million to $85 million

- Capital expenditures of $90 million to $100 million

- Effective income tax rate in the range of 25% to 27%

- Cash income tax rate of less than 5%

- Free cash flow of 45% to 55% of adjusted EBITDA

- Does not include the impact of any significant acquisitions or

share repurchases subsequent to the completion of the $400 million

accelerated share repurchase transaction ("ASR") in July 2024

[1] Adjusted EBITDA, adjusted EPS and free cash flow presented in

this financial guidance are forward-looking non-GAAP measures.

Refer to "Premier's Use and Definitions of Non-GAAP Measures" below

for information on the company's use of non-GAAP measures. Premier,

Inc. does not provide forward-looking guidance on a GAAP basis as

certain financial information, the probable significance of which

cannot be determined, is not available and cannot be reasonably

estimated. Total Net Revenue Excluding Contigo Health is also a

forward-looking non-GAAP measure. Refer to "Premier's Use of

Forward-Looking Non-GAAP Measures" below for additional

explanation.

[2] As a result of the company's

previously announced plan to divest a majority interest in the

Contigo Health business, guidance is being presented excluding

financial contributions from this business.

Results of Operations for the Three Months Ended September

30, 2024 (As compared with the three months ended September 30,

2023)

GAAP net revenue of $248.1 million decreased 8% from $269.0

million in the prior-year period. Refer to "Supply Chain Services"

and "Performance Services" sections below for further discussion on

the factors that impacted each segment during the quarter.

GAAP net income from continuing operations of $72.9 million

increased 75% from $41.8 million in the prior-year period primarily

due to a $57.0 million non-operating gain on the payment received

as a result of the derivative lawsuit settlement in the

current-year period, partially offset by lower revenue compared to

the prior-year period.

GAAP diluted EPS from continuing operations of $0.72 increased

95% from $0.37 in the prior-year period due to the aforementioned

drivers affecting GAAP net income and completion of the ASR.

Adjusted EBITDA of $62.4 million decreased 33% from $93.3

million in the prior-year period. Refer to "Supply Chain Services"

and "Performance Services" sections below for further discussion on

the factors that impacted the adjusted EBITDA of each segment

during the quarter.

Adjusted net income of $34.7 million decreased 38% from $56.2

million in the prior-year period primarily as a result of the same

factors that impacted adjusted EBITDA partially offset by a

decrease in our effective income tax rate in the current-year

period. Adjusted EPS of $0.34 decreased 28% from $0.47 in the

prior-year period primarily due to the aforementioned drivers

affecting adjusted net income partially offset by the ASR.

Segment Results (For the fiscal first quarter of 2025 as

compared with the fiscal first quarter of 2024)

Commencing in fiscal 2025, the company is reporting the Remitra

business as part of the Supply Chain Services segment. On August

20, 2024, the company announced that it determined to make this

change in conjunction with the evolution of the company’s digital

supply chain strategy to more tightly align the Remitra business’

strategic and operational capabilities with the group purchasing

organization (“GPO”). In addition, prior-year results have been

restated to conform to the current-year presentation.

Supply Chain Services

Supply Chain Services segment net revenue of $151.4 million

decreased 7% from $163.3 million in the prior-year period primarily

reflecting lower net administrative fees revenue partially offset

by higher software license, other services and support revenue.

Net administrative fees revenue of $132.6 million decreased 12%

from $149.9 million in the prior-year period primarily driven by an

expected increase in the aggregate blended member fee share to the

low-60% range in the quarter partially offset by continued growth

in member purchasing as a result of further penetration of existing

member spend.

Software license, other services and support revenue of $18.8

million increased 40% from $13.4 million in the prior-year period

primarily driven by new agreements for supply chain co-management

that were signed in the second half of fiscal 2024.

Segment adjusted EBITDA of $77.5 million decreased 24% from

$101.4 million in the prior-year period primarily due to the

decrease in net administrative fees revenue and additional

investments in the supply chain co-management business to support

ongoing growth.

Performance Services

Performance Services segment net revenue of $96.8 million

decreased 9% from $105.8 million in the prior-year period primarily

due to lower demand in the consulting business compared to the

prior-year period, continued pressure in the Contigo Health

business and timing of engagements in the applied sciences

business.

Segment adjusted EBITDA of $14.9 million decreased 35% from

$22.9 million in the prior-year period mainly due to the decrease

in net revenue in the consulting and applied sciences

businesses.

Cash Flows and Liquidity

Net cash provided by operating activities from continuing

operations ("operating cash flow") for the three months ended

September 30, 2024 of $80.0 million increased from $62.7 million in

the prior-year period primarily due to cash received from the

derivative lawsuit settlement of $57.0 million in the current-year

period partially offset by higher performance-related compensation

payments resulting from better fiscal 2024 performance against

expectations than in the prior-year period where performance was

lower than expectations.

Net cash used in investing activities for the three months ended

September 30, 2024 of $17.7 million decreased from the prior-year

period primarily due to a decrease in internally developed

software. Net cash used in financing activities for the three

months ended September 30, 2024 of $88.1 million decreased from the

prior-year period primarily driven by net proceeds from the sale of

the company's non-healthcare GPO operations of $553.3 million in

the prior-year period and the use of $56.4 million for market

repurchases of Class A common stock ("Common Stock") in the

current-year period under the company's $1 billion share repurchase

authorization announced in February 2024 ("Share Repurchase

Authorization"). These uses of cash were partially offset by

payments of $215.0 million on the revolving credit facility in the

prior-year period. As of September 30, 2024, cash and cash

equivalents were $87.0 million compared with $125.1 million as of

June 30, 2024, and the company's five-year, $1.0 billion revolving

credit facility had no outstanding balance.

Free cash flow for the three months ended September 30, 2024 was

$16.2 million compared with $12.3 million in the prior-year period.

The increase was primarily due to the same factors that impacted

operating cash flow and the decrease in purchases of property and

equipment. These were partially offset by a full quarter of cash

payments in the current-year period to OMNIA related to the sale of

future revenue compared to a partial quarter in the prior-year

period due to the timing of the sale of the non-healthcare GPO

operations. Refer to "Premier's Use and Definition of Non-GAAP

Measures" below and the supplemental financial information at the

end of this release for information on the company's use of this

and other non-GAAP financial measures and a reconciliation of

reported GAAP results to non-GAAP results.

Return of Capital to Stockholders

In February 2024, the company announced that its Board of

Directors ("Board") approved the Share Repurchase Authorization and

that it entered into the ASR. Under the ASR, in February 2024, the

company received initial deliveries of an aggregate of 15.0 million

shares of Common Stock. On July 11, 2024, as final settlement, the

company received an additional 4.8 million shares of Common Stock,

resulting in a total of 19.9 million shares repurchased under the

ASR.

On August 20, 2024, the Board approved execution of another

$200.0 million of repurchases under the Share Repurchase

Authorization. As of September 30, 2024, the Company had

repurchased 2.9 million shares of Common Stock for $58.0 million in

market transactions in addition to the ASR repurchases.

During the first quarter of fiscal 2025, the company paid

aggregate dividends of $21.3 million to holders of its Common

Stock. On October 24, 2024, the Board declared a quarterly cash

dividend of $0.21 per share, payable on December 15, 2024 to

stockholders of record on December 1, 2024.

Conference Call and Webcast

Premier will host a conference call to provide additional detail

around the company's performance and outlook today at 8:00 a.m. ET.

The call will be webcast live from the company's website and, along

with the accompanying presentation, will be available at the

following link: Premier Events. The webcast should be accessed 10

minutes prior to the conference call start time. A replay of the

webcast will be available for one year following the conclusion of

the live broadcast and will be accessible on the company's website

at https://investors.premierinc.com.

For those parties who do not have internet access, the

conference call may be accessed by calling one of the below

telephone numbers and asking to join the Premier, Inc. call:

Domestic participant dial-in number

(toll-free):

(833) 953-2438

International participant dial-in

number:

(412) 317-5767

About Premier, Inc.

Premier, Inc. (NASDAQ: PINC) is a leading healthcare improvement

company, uniting an alliance of more than 4,350 U.S. hospitals and

health systems and approximately 325,000 other providers and

organizations to transform healthcare. With integrated data and

analytics, collaboratives, supply chain solutions, consulting and

other services, Premier enables better care and outcomes at a lower

cost. Premier plays a critical role in the rapidly evolving

healthcare industry, collaborating with members, suppliers and

other stakeholders to co-develop long-term innovations that

reinvent and improve the way care is delivered to patients

nationwide. Please visit Premier’s news and investor sites on

www.premierinc.com, as well as X, Facebook, LinkedIn, YouTube,

Instagram and Premier’s blog for more information about the

company.

Premier’s Use and Definition of Non-GAAP Measures

Premier uses EBITDA, adjusted EBITDA, segment adjusted EBITDA,

adjusted net income, adjusted earnings per share, and free cash

flow. These are non-GAAP financial measures that are not in

accordance with, or an alternative to, GAAP, and may be different

from non-GAAP financial measures used by other companies. We

include these non-GAAP financial measures to facilitate a

comparison of the company’s operating performance on a consistent

basis from period to period and to provide measures that, when

viewed in combination with its results prepared in accordance with

GAAP, we believe allow for a more complete understanding of factors

and trends affecting the company’s business than GAAP measures

alone.

Management believes EBITDA, adjusted EBITDA and segment adjusted

EBITDA assist the company’s board of directors, management and

investors in comparing the company’s operating performance on a

consistent basis from period to period by removing the impact of

the company’s earnings elements attributable to the company's asset

base (primarily depreciation and amortization), certain items

outside the control of management, e.g., taxes, other non-cash

items (such as impairment of intangible assets, purchase accounting

adjustments and stock-based compensation), non-recurring items

(such as strategic initiative and financial restructuring-related

expenses) and income and expense that have been classified as

discontinued operations, from operating results.

Management believes adjusted net income and adjusted earnings

per share assist the company's board of directors, management and

investors in comparing our net income and earnings per share on a

consistent basis from period to period because these measures

remove non-cash items (such as impairment of intangible assets,

purchase accounting adjustments and stock-based compensation) and

non-recurring items (such as strategic initiative and financial

restructuring-related expenses), and eliminate the variability of

non-controlling interest and equity in net income of unconsolidated

affiliates.

Management believes free cash flow is an important measure

because it represents the cash that the company generates after

payments to certain former limited partners that elected to execute

a Unit Exchange and Tax Receivable Agreement (“Unit Exchange

Agreement") in connection with our August 2020 restructuring,

capital investment to maintain existing products and services and

ongoing business operations, as well as development of new and

upgraded products and services to support future growth, and cash

payments to OMNIA for the sale of future revenues and tax payments

on proceeds received from the sale of future revenues. Free cash

flow is important because it enables the company to seek

enhancement of stockholder value through acquisitions,

partnerships, joint ventures, investments in related or

complimentary businesses and/or debt reduction.

Also, adjusted EBITDA and free cash flow are supplemental

financial measures used by the company and by external users of our

financial statements and are considered to be indicators of the

operational strength and performance of our business. Adjusted

EBITDA and free cash flow measures allow us to assess our

performance without regard to financing methods and capital

structure and without the impact of other matters that we do not

consider indicative of the operating performance of our business.

More specifically, segment adjusted EBITDA is the primary earnings

measure we use to evaluate the performance of our business

segments.

Non-recurring items are income or expenses and other

items that have not been earned or incurred within the prior two

years and are not expected to recur within the next two years. Such

items include acquisition- and disposition-related expenses,

strategic initiative- and financial restructuring-related expenses,

loss on disposal of long-live assets, income and expense that has

been classified as discontinued operations and other expense.

Non-cash items include stock-based compensation expense

and asset impairments.

Non-operating items include gains or losses on the

disposal of assets, interest and investment income or expense,

equity in income of unconsolidated affiliates and operating income

from revenues sold to OMNIA in connection with the sale of

non-healthcare GPO member contracts, less royalty payments

retained.

EBITDA is defined as net income before income or loss

from discontinued operations, net of tax, interest and investment

income or expense, net, income tax expense, depreciation and

amortization and amortization of purchased intangible assets.

Adjusted EBITDA is defined as EBITDA before merger and

acquisition-related expenses and non-recurring, non-cash or

non-operating items.

Segment adjusted EBITDA is defined as the segment’s net

revenue less cost of revenue and operating expenses directly

attributable to the segment excluding depreciation and

amortization, amortization of purchased intangible assets, merger

and acquisition-related expenses and non-recurring or non-cash

items. Operating expenses directly attributable to the segment

include expenses associated with sales and marketing, general and

administrative, and product development activities specific to the

operation of each segment. General and administrative corporate

expenses that are not specific to a particular segment are not

included in the calculation of Segment Adjusted EBITDA. Segment

Adjusted EBITDA also excludes any income and expense that has been

classified as discontinued operations and operating income from

revenues sold to OMNIA in connection with the sale of

non-healthcare GPO member contracts, less royalty payments

retained.

Adjusted net income is defined as net income attributable

to Premier (i) excluding income or loss from discontinued

operations, net, (ii) excluding income tax expense, (iii) excluding

the effect of non-recurring or non-cash items, including certain

strategic initiative- and financial restructuring-related expenses,

(iv) reflecting an adjustment for income tax expense on Non-GAAP

net income before income taxes at our estimated annual effective

income tax rate, adjusted for unusual or infrequent items, (v)

excluding the equity in net income of unconsolidated affiliates and

(vi) excluding operating income from revenues sold to OMNIA in

connection with the sale of non-healthcare GPO member contracts,

less royalty payments retained, imputed interest expense and

associated income tax expense.

Adjusted earnings per share is Adjusted Net Income

divided by diluted weighted average shares.

Free cash flow is defined as net cash provided by

operating activities from continuing operations less (i) early

termination payments to certain former limited partners that

elected to execute a Unit Exchange Agreement in connection with our

August 2020 restructuring, (ii) purchases of property and equipment

and (iii) cash payments to OMNIA for the sale of future revenues

and tax payments on proceeds received from the sale of future

revenues. Free Cash Flow does not represent discretionary cash

available for spending as it excludes certain contractual

obligations such as debt repayments.

To properly and prudently evaluate our business, readers are

urged to review the reconciliation of these non-GAAP financial

measures, as well as the other financial tables, included at the

end of this release. Readers should not rely on any single

financial measure to evaluate the company’s business. In addition,

the non-GAAP financial measures used in this release are

susceptible to varying calculations and may differ from, and may

therefore not be comparable to, similarly titled measures used by

other companies.

The Company has revised the definitions for Adjusted EBITDA,

Segment Adjusted EBITDA, Adjusted Net Income and Free Cash Flow

from the definitions reported in the 2024 Annual Report. Adjusted

EBITDA and Segment Adjusted EBITDA definitions were revised to

exclude operating income from revenues sold to OMNIA in connection

with the sale of non-healthcare GPO member contracts, less royalty

payments retained. The Adjusted Net Income definition was revised

to exclude operating income from revenues sold to OMNIA in

connection with the sale of non-healthcare GPO member contracts,

less royalty payments retained, imputed interest expense and

associated income tax expense. Free Cash Flow was revised to

exclude the cash payments to OMNIA for the sale of future revenues

and tax payments on proceeds received from the sale of future

revenues. For comparability purposes, prior year non-GAAP financial

measures are presented based on the current definitions in the

above section.

In addition to the foregoing, the reconciliations of our

non-GAAP financial measures included at the end of this release

include the presentation of additional fiscal year 2025 non-GAAP

financial measures including net revenue excluding Contigo Health

and Adjusted EBITDA excluding Contigo Health. The company

previously announced a plan to divest a majority interest in the

Contigo Health business; however, as of September 30, 2024, the

divestiture process for the Contigo Health business remains ongoing

and our GAAP financial results for the first quarter of fiscal year

2025 presented in this release include contributions from that

business. As the company expects that the Contigo Health business

will be divested and moved into discontinued operations in fiscal

2025, guidance presented in this release excludes financial

contributions from this business. Accordingly, we believe that

providing supplemental non-GAAP financial measures that align with

our fiscal 2025 guidance allow for a better understanding of that

guidance.

Further information on Premier’s use of non-GAAP financial

measures is available in the “Our Use of Non-GAAP Financial

Measures” section of Premier’s Form 10-Q for the quarter ended

September 30, 2024, expected to be filed with the SEC shortly after

this release, and which will also be made available on Premier's

website at investors.premierinc.com.

Premier's Use of Forward-Looking Non-GAAP Measures

The company does not meaningfully reconcile guidance for

non-GAAP adjusted EBITDA and non-GAAP adjusted earnings per share

to net income attributable to stockholders or earnings per share

attributable to stockholders because the company cannot provide

guidance for the more significant reconciling items between net

income attributable to stockholders and adjusted EBITDA and between

earnings per share attributable to stockholders and non-GAAP

adjusted earnings per share without unreasonable effort. This is

due to the fact that future period non-GAAP guidance includes

adjustments for items not indicative of our core operations, which

may include, without limitation, items included in the supplemental

financial information for reconciliation of reported GAAP results

to non-GAAP results. Such items include, but are not limited to,

strategic and acquisition related expenses for professional fees;

mark to market adjustments for put options and contingent

liabilities; gains and losses on stock-based performance shares;

adjustments to its income tax provision (such as valuation

allowance adjustments and settlements of income tax claims); items

related to corporate and facility restructurings; and certain other

items the company believes to be non-indicative of its ongoing

operations. Such adjustments may be affected by changes in ongoing

assumptions, judgements, as well as nonrecurring, unusual or

unanticipated charges, expenses or gains/losses or other items that

may not directly correlate to the underlying performance of our

business operations. The exact amount of these adjustments is not

currently determinable but may be significant.

As noted above, as result of the company's previously announced

plan to divest a majority interest in the Contigo Health business,

the forward-looking guidance presented in this release (including

Total Net Revenue Excluding Contigo Health, Adjusted EBITDA,

Adjusted EPS, and free cash flow), excludes the financial

contribution of this business, in addition to any applicable

adjustments for non-GAAP financial measures described above under

"Premier's Use and Definitions of Non-GAAP Measures."

Cautionary Note Regarding Forward-Looking Statements

Statements made in this release that are not statements of

historical or current facts, including, but not limited to those

related to our ability to advance our long-term strategies and

develop innovations for, transform and improve healthcare, our

ability to find a partner for our Contigo Health business and the

potential benefits thereof, our ability to fund and conduct share

repurchases pursuant to the outstanding share repurchase

authorization and the potential benefits thereof, the payment of

dividends at current levels or at all, guidance on expected future

financial performance and assumptions underlying that guidance, and

our expected effective income tax rate, are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements may involve known

and unknown risks, uncertainties and other factors that may cause

the actual results, performance or achievements of Premier to be

materially different from historical results or from any future

results or projections expressed or implied by such forward-looking

statements. Accordingly, readers should not place undue reliance on

any forward-looking statements. In addition to statements that

explicitly describe such risks and uncertainties, readers are urged

to consider statements in the conditional or future tenses or that

include terms such as “believes,” “belief,” “expects,” “estimates,”

“intends,” “anticipates” or “plans” to be uncertain and

forward-looking. Forward-looking statements may include comments as

to Premier’s beliefs and expectations as to future events and

trends affecting its business and are necessarily subject to risks

and uncertainties, many of which are outside Premier’s control.

More information on risks and uncertainties that could affect

Premier’s business, achievements, performance, financial condition,

and financial results is included from time to time in the

“Cautionary Note Regarding Forward-Looking Statements,” “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” sections of Premier’s periodic

and current filings with the SEC, including the information in

those sections of Premier’s Form 10-K for the year ended June 30,

2024, and subsequent Quarterly Reports on Form 10-Q, including the

Form 10-Q for the quarter ended September 30, 2024, expected to be

filed with the SEC shortly after the date of this release.

Premier's periodic and current filings with the SEC are made

available on Premier’s website at investors.premierinc.com.

Forward-looking statements speak only as of the date they are made,

and Premier undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information or future events that occur after that date, or

otherwise.

Condensed Consolidated

Statements of Income

(Unaudited)

(In thousands, except per

share data)

Three Months Ended

September 30,

2024

2023

Net revenue:

Net administrative fees

$

132,625

$

149,886

Software licenses, other services and

support

115,517

119,140

Net revenue

248,142

269,026

Cost of revenue:

Services and software licenses

67,724

64,132

Cost of revenue

67,724

64,132

Gross profit

180,418

204,894

Operating expenses:

Selling, general and administrative

134,880

133,138

Research and development

586

863

Amortization of purchased intangible

assets

9,637

12,553

Operating expenses

145,103

146,554

Operating income

35,315

58,340

Equity in net income (loss) of

unconsolidated affiliates

1,833

(1,726

)

Interest expense, net

(1,756

)

(22

)

Other income (expense), net

60,259

(1,092

)

Other income (expense), net

60,336

(2,840

)

Income before income taxes

95,651

55,500

Income tax expense

22,711

13,731

Net income from continuing operations

72,940

41,769

Net (loss) income from discontinued

operations, net of tax

(1,604

)

641

Net income

71,336

42,410

Net (income) loss from continuing

operations attributable to non-controlling interest

(552

)

2,351

Net income attributable to

stockholders

$

70,784

$

44,761

Calculation of GAAP Earnings per

Share

Numerator for basic and diluted

earnings per share:

Net income from continuing operations

attributable to stockholders

$

72,388

$

44,120

Net (loss) income from discontinued

operations attributable to stockholders

(1,604

)

641

Net income attributable to

stockholders

$

70,784

$

44,761

Denominator for earnings per

share:

Basic weighted average shares

outstanding

100,380

119,344

Effect of dilutive securities:

Restricted stock units

611

534

Performance share awards

—

255

Diluted weighted average shares

100,991

120,133

Earnings per share attributable to

stockholders:

Basic earnings per share from continuing

operations

$

0.72

$

0.37

Basic (loss) earnings per share from

discontinued operations

(0.01

)

0.01

Basic earnings per share attributable to

stockholders

$

0.71

$

0.38

Diluted earnings per share from continuing

operations

$

0.72

$

0.37

Diluted loss per share from discontinued

operations

(0.02

)

—

Diluted earnings per share attributable to

stockholders

$

0.70

$

0.37

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands, except share

data)

September 30, 2024

June 30, 2024

Assets

Cash and cash equivalents

$

86,956

$

125,146

Accounts receivable (net of $2,431 and

$1,455 allowance for credit losses, respectively)

98,749

100,965

Contract assets (net of $1,174 and $1,248

allowance for credit losses, respectively)

341,016

335,831

Prepaid expenses and other current

assets

76,022

73,653

Current assets of discontinued

operations

104,893

116,462

Total current assets

707,636

752,057

Property and equipment (net of $760,993

and $742,063 accumulated depreciation, respectively)

203,957

205,711

Intangible assets (net of $303,970 and

$294,333 accumulated amortization, respectively)

259,622

269,259

Goodwill

995,852

995,852

Deferred income tax assets

748,048

776,202

Deferred compensation plan assets

47,380

54,422

Investments in unconsolidated

affiliates

230,395

228,562

Operating lease right-of-use assets

17,845

20,635

Other assets

102,863

98,749

Total assets

$

3,313,598

$

3,401,449

Liabilities and stockholders'

equity

Accounts payable

$

24,655

$

22,610

Accrued expenses

47,408

58,482

Revenue share obligations

318,910

292,792

Accrued compensation and benefits

45,072

100,395

Deferred revenue

17,901

19,642

Line of credit and current portion of

long-term debt

—

1,008

Current portion of notes payable to former

limited partners

76,317

101,523

Current portion of liability related to

the sale of future revenues

41,331

51,798

Other current liabilities

56,791

52,589

Current liabilities of discontinued

operations

20,163

45,724

Total current liabilities

648,548

746,563

Liability related to the sale of future

revenues, less current portion

631,266

599,423

Deferred compensation plan obligations

47,380

54,422

Operating lease liabilities, less current

portion

8,067

11,170

Other liabilities

24,154

27,640

Total liabilities

1,359,415

1,439,218

Commitments and contingencies

Stockholders' equity:

Class A common stock, $0.01 par value,

500,000,000 shares authorized; 97,794,635 shares issued and

outstanding at September 30, 2024 and 111,456,454 shares issued and

105,027,079 shares outstanding at June 30, 2024

978

1,115

Treasury stock, at cost; 6,429,375 shares

at June 30, 2024

—

(250,129

)

Additional paid-in capital

2,188,208

2,105,684

(Accumulated deficit) retained

earnings

(234,995

)

105,590

Accumulated other comprehensive loss

(8

)

(29

)

Total stockholders' equity

1,954,183

1,962,231

Total liabilities and stockholders'

equity

$

3,313,598

$

3,401,449

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

(In thousands)

Three Months Ended September

30,

2024

2023

Operating activities

Net income

$

71,336

$

42,410

Adjustments to reconcile net income to net

cash provided by operating activities:

Net loss (income) from discontinued

operations, net of tax

1,604

(641

)

Depreciation and amortization

29,288

32,881

Equity in net loss (income) of

unconsolidated affiliates

(1,833

)

1,726

Deferred income taxes

24,954

(143,435

)

Stock-based compensation

6,931

6,692

Other, net

1,672

3,458

Changes in operating assets and

liabilities, net of the effects of acquisitions:

Accounts receivable

2,216

4,203

Contract assets

(10,566

)

(16,838

)

Prepaid expenses and other assets

8,730

10,241

Accounts payable

397

(6,023

)

Revenue share obligations

26,118

3,544

Accrued expenses, deferred revenue and

other liabilities

(80,804

)

124,432

Net cash provided by operating activities

from continuing operations

80,043

62,650

Net cash (used in) provided by operating

activities from discontinued operations

(12,396

)

19,226

Net cash provided by operating

activities

$

67,647

$

81,876

Investing activities

Purchases of property and equipment

$

(17,718

)

$

(21,270

)

Net cash used in investing

activities

$

(17,718

)

$

(21,270

)

Financing activities

Payments on notes payable

$

(26,214

)

$

(25,823

)

Payments on credit facility

—

(215,000

)

Proceeds from sale of future revenues

42,325

578,983

Payments on liability related to the sale

of future revenues

(20,949

)

(4,322

)

Cash dividends paid

(21,323

)

(25,827

)

Repurchase of Class A common stock

(56,440

)

—

Other, net

(5,539

)

(5,146

)

Net cash used in financing

activities

$

(88,140

)

$

302,865

Effect of exchange rate changes on cash

flows

21

(3

)

Net increase in cash and cash

equivalents

(38,190

)

363,468

Cash and cash equivalents at beginning of

year

125,146

89,793

Cash and cash equivalents at end of

period

$

86,956

$

453,261

Supplemental Financial

Information

Reconciliation of Net Cash

Provided by Operating Activities from Continuing Operations to Free

Cash Flow

(Unaudited)

(In thousands)

Three Months Ended

September 30,

2024

2023

Net cash provided by operating activities

from continuing operations

$

80,043

$

62,650

Early termination payments to certain

former limited partners that elected to execute a Unit Exchange

Agreement (a)

(25,206

)

(24,742

)

Purchases of property and equipment

(17,718

)

(21,270

)

Cash payments to OMNIA for the sale of

future revenues (b)

(20,949

)

(4,322

)

Free Cash Flow

$

16,170

$

12,316

_________________________________

(a)

Early termination payments to certain

former limited partners that elected to execute a Unit Exchange

Agreement in connection with Premier's August 2020 restructuring

are presented in the Consolidated Statements of Cash Flows under

“Payments made on notes payable." During the three months ended

September 30, 2024, the company paid $25.7 million to members

including imputed interest of $0.5 million which is included in net

cash provided by operating activities from continuing operations.

During the three months ended September 30, 2023, the company paid

$25.7 million to members, including imputed interest of $0.9

million which is included in net cash provided by operating

activities from continuing operations.

(b)

Cash payments to OMNIA for the sale of

future revenues in connection with our sale of non-healthcare

contracts to OMNIA are presented in the Consolidated Statements of

Cash Flows under "Payments on liability related to the sale of

future revenues." During the three months ended September 30, 2024,

the company paid $25.3 million to OMNIA including imputed interest

of $4.4 million which is included in net cash provided by operating

activities from continuing operations. During the three months

ended September 30, 2023, the company paid $6.9 million to OMNIA

including imputed interest of $2.5 million which is included in net

cash provided by operating activities from continuing

operations.

Supplemental Financial

Information

Reconciliation of Net Income

from Continuing Operations to Adjusted EBITDA

Reconciliation of Operating

Income to Segment Adjusted EBITDA

Reconciliation of Net Income

Attributable to Stockholders to Adjusted Net Income

(Unaudited)

(In thousands)

Three Months Ended

September 30,

2024

2023

Net income from continuing

operations

$

72,940

$

41,769

Interest expense, net

1,756

22

Income tax expense

22,711

13,731

Depreciation and amortization

19,651

20,328

Amortization of purchased intangible

assets

9,637

12,553

EBITDA

126,695

88,403

Stock-based compensation

7,140

6,893

Acquisition- and disposition-related

expenses

2,884

6,205

Strategic initiative and financial

restructuring-related expenses

110

1,746

Operating income from revenues sold to

OMNIA

(15,710

)

(11,666

)

Equity in net (income) loss of

unconsolidated affiliates

(1,833

)

1,726

Other non-operating gain

(57,244

)

—

Other reconciling items, net

386

1

Adjusted EBITDA

$

62,428

$

93,308

Less: Contigo Health

2,227

Adjusted EBITDA excluding Contigo

Health

$

64,655

Income before income taxes

$

95,651

$

55,500

Equity in net (income) loss of

unconsolidated affiliates

(1,833

)

1,726

Interest expense, net

1,756

22

Other (income) expense, net

(60,259

)

1,092

Operating income

35,315

58,340

Depreciation and amortization

19,651

20,328

Amortization of purchased intangible

assets

9,637

12,553

Stock-based compensation

7,140

6,893

Acquisition- and disposition-related

expenses

2,884

6,205

Strategic initiative and financial

restructuring-related expenses

110

1,746

Operating income from revenues sold to

OMNIA

(15,710

)

(11,666

)

Deferred compensation plan expense

(income)

2,692

(1,125

)

Other reconciling items, net

709

34

Adjusted EBITDA

$

62,428

$

93,308

SEGMENT ADJUSTED EBITDA

Supply Chain Services

$

77,511

$

101,387

Performance Services

14,949

22,930

Corporate

(30,032

)

(31,009

)

Adjusted EBITDA

$

62,428

$

93,308

Net income attributable to

stockholders

$

70,784

$

44,761

Loss (income) from discontinued

operations, net of tax

1,604

(641

)

Income tax expense

22,711

13,731

Amortization of purchased intangible

assets

9,637

12,553

Stock-based compensation

7,140

6,893

Acquisition- and disposition-related

expenses

2,884

6,205

Strategic initiative and financial

restructuring-related expenses

110

1,746

Operating income from revenues sold to

OMNIA

(15,710

)

(11,666

)

Equity in net (income) loss of

unconsolidated affiliates

(1,833

)

1,726

Other non-operating gain

(57,244

)

—

Other reconciling items, net

6,236

1,630

Adjusted income before income taxes

46,319

76,938

Income tax expense on adjusted income

before income taxes

11,580

20,773

Adjusted net income

$

34,739

$

56,165

Supplemental Financial

Information

Reconciliation of GAAP EPS to

Adjusted EPS

(Unaudited)

(In thousands, except per

share data)

Three Months Ended

September 30,

2024

2023

Net income attributable to

stockholders

$

70,784

$

44,761

Loss (income) from discontinued

operations, net of tax

1,604

(641

)

Income tax expense

22,711

13,731

Amortization of purchased intangible

assets

9,637

12,553

Stock-based compensation

7,140

6,893

Acquisition- and disposition-related

expenses

2,884

6,205

Strategic initiative and financial

restructuring-related expenses

110

1,746

Operating income from revenues sold to

OMNIA

(15,710

)

(11,666

)

Equity in net (income) loss of

unconsolidated affiliates

(1,833

)

1,726

Other non-operating gain

(57,244

)

—

Other reconciling items, net

6,236

1,630

Adjusted income before income taxes

46,319

76,938

Income tax expense on adjusted income

before income taxes

11,580

20,773

Adjusted net income

$

34,739

$

56,165

Weighted average:

Basic weighted average shares

outstanding

100,380

119,344

Dilutive shares

611

789

Weighted average shares outstanding -

diluted

100,991

120,133

Basic earnings per share attributable

to stockholders

$

0.71

$

0.38

Loss (income) from discontinued

operations, net of tax

0.02

(0.01

)

Income tax expense

0.23

0.12

Amortization of purchased intangible

assets

0.10

0.11

Stock-based compensation

0.07

0.06

Acquisition- and disposition-related

expenses

0.03

0.05

Strategic initiative and financial

restructuring-related expenses

—

0.01

Operating income from revenues sold to

OMNIA

(0.16

)

(0.10

)

Equity in net (income) loss of

unconsolidated affiliates

(0.02

)

0.01

Other non-operating gain

(0.57

)

—

Other reconciling items, net

0.05

0.01

Impact of corporation taxes

(0.12

)

(0.17

)

Adjusted earnings per share

$

0.34

$

0.47

Supplemental Financial

Information

Fiscal 2025 First Quarter Walk

to Align to Fiscal 2025 Guidance Presentation

(Unaudited)

(In thousands)

Three Months Ended

September 30, 2024

Net revenue

$

248,142

Less: Contigo Health

(7,646

)

Net revenue excluding Contigo

Health

$

240,496

Adjusted EBITDA

$

62,428

Less: Contigo Health (a)

2,227

Adjusted EBITDA excluding Contigo

Health

$

64,655

_________________________________

(a)

Contigo Health Adjusted EBITDA for the

fiscal 2025 first quarter was a loss and therefore added back to

the total.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105183119/en/

Investor contact: Ben Krasinski Senior Director, Investor

Relations 704.816.5644 ben_krasinski@premierinc.com

Media contact: Amanda Forster Vice President, Integrated

Communications 202.879.8004 amanda_forster@premierinc.com

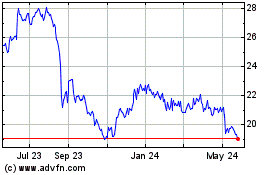

Premier (NASDAQ:PINC)

Historical Stock Chart

From Oct 2024 to Nov 2024

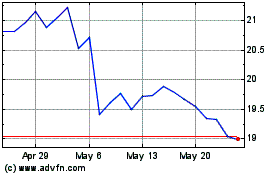

Premier (NASDAQ:PINC)

Historical Stock Chart

From Nov 2023 to Nov 2024