false

0001093691

0001093691

2024-07-29

2024-07-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): July 29, 2024

Plug Power Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-34392 |

|

22-3672377 |

| (State

or other jurisdiction |

|

(Commission

File |

|

(IRS

Employer |

| of

incorporation) |

|

Number) |

|

Identification

No.) |

| |

|

|

|

|

125 Vista Boulevard,

Slingerlands, New York |

|

12159 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(518) 782-7700

Registrant’s telephone

number, including area code:

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common

Stock, par value $0.01 per share |

|

PLUG |

|

The

Nasdaq Capital

Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Chief Operating Officer

On July 29, 2024, Dean C. Fullerton was appointed

as the Chief Operating Officer of Plug Power Inc. (the “Company”).

Mr. Fullerton,

age 56, has more than 30 years of experience in the supply chain and logistics engineering industry. Prior to joining the Company,

he worked at Amazon.com, Inc., where his career spanned 14 years and included many areas of responsibility, including most recently

as Vice President of Global Engineering and Security Services from January 2020 to March 2024 and Vice President of Noth America

Engineering Services from January 2017 to January 2020. Previously, Mr. Fullerton was Senior Director of North America

Engineering and Maintenance at The Gap, Inc. from March 2008 to June 2010, Principal/Director at Tompkins Associates, a

supply chain and logistics engineering consulting firm, from January 2000 to February 2008, and Industrial Engineering Manager

at United Parcel Service, Inc. from March 1986 to January 2000. Mr. Fullerton received his M.B.A from the University

of Redlands and his B.S. in Business Management from San Diego State University.

In connection with Mr. Fullerton’s

appointment as Chief Operating Officer, the Company and Mr. Fullerton entered into an executive employment agreement (the “Employment

Agreement”). Pursuant to the Employment Agreement, Mr. Fullerton will be entitled to an annual base salary of $550,000, subject

to upward increases as may be determined upon annual review by the Compensation Committee of the Board of Directors (the “Compensation

Committee”), and any cash incentive compensation as determined by the Compensation Committee from time to time. In addition, pursuant

to an offer letter between the Company and Mr. Fullerton (the “Offer Letter”), Mr. Fullerton is entitled to an one-time

sign-on bonus of $275,000, subject to certain repayment obligations, and was granted 1,000,000 options to purchase 1,000,000 shares of

the Company’s common stock pursuant to the Company’s 2021 Stock Option Incentive Plan, as amended. The options have an exercise

price of $2.47, equal to the closing price of the Company’s common stock on the Nasdaq Capital Market on July 31, 2024, the

date of grant, and will vest in three equal annual installments following the grant date, subject to Mr. Fullerton’s continued

service on each such vesting date; provided, however, that 500,000 shares underlying such options will vest only if the daily volume weighted

average price of the Company’s common stock during any thirty (30) consecutive trading day period equals or exceeds $7.50 prior

to April 30, 2025. During Mr. Fullerton’s employment, he will be eligible to participate in the Company’s annual

bonus program, which currently provides for a target payment equivalent to 100% of his annual base salary subject to achievement of Company

performance goals, and equity compensation plans and employee benefit plans available to other employees of the Company. Mr. Fullerton’s

annual bonus equal to his current base salary of $550,000 is guaranteed for 2024.

Pursuant

to the Employment Agreement, in the event Mr. Fullerton is terminated by the Company without “Cause” (as such term is

defined in the Employment Agreement), subject to Mr. Fullerton signing a general release of claims and complying with a confidentiality

agreement, Mr. Fullerton will be entitled to: (i) an amount equal to one (1) time his then current base salary, (ii) exercise

all vested stock options held by him for twelve months from the date of termination, and (iii) a lump sum payment equal to

twelve (12) times the Company’s share of the monthly health insurance premium for the health insurance plan in force on the date

of termination, less applicable withholdings and deductions, or a monthly subsidy for a period of twelve (12) months and equivalent to

the Company’s share of the monthly health insurance premium for the health insurance plan in force on the date of termination.

In

the event Mr. Fullerton is terminated by the Company without “Cause” or he terminates his employment for “Good

Reason,” in each case within 12 months following a “Change in Control” (as such terms are defined in the Employment

Agreement), subject to Mr. Fullerton signing a general release of claims and complying with a confidentiality agreement, he will

be entitled to: (i) an amount equal to (x) one-hundred percent (100%) his average annual base salary over the three (3) fiscal

years immediately prior to the termination date (or his annual base salary in effect immediately prior to the Change in Control, if higher)

and (y) one-hundred percent (100%) of his average annual bonus over the three (3) fiscal years immediately prior to the Change

in Control (or his annual bonus for the last fiscal year immediately prior to the Change in Control, if higher) with such amounts to be

paid out either in a lump sum or in installments, per the discretion of the Company; (ii) the vesting in such portion of his stock

options and other stock-based awards as he would have vested in if he had remained employed by the Company for twelve (12) months following

the termination date; and (iii) a lump sum payment equal to twelve (12) times the Company’s share of the monthly health

insurance premium for the health insurance plan in force on the date of termination, less applicable withholdings and deductions, or a

monthly subsidy for a period of twelve (12) months and equivalent to the Company’s share of the monthly health insurance premium

for the health insurance plan in force on the date of termination.

The foregoing description does not purport to

be complete and is qualified in its entirety by reference to the complete text of the Offer Letter and the Employment Agreement, copies

of which are filed herewith as Exhibit 10.1 and Exhibit 10.2, respectively, to this Current Report on Form 8-K and incorporated

herein by reference herein.

There is no arrangement or understanding between

either Mr. Fullerton and any other person pursuant to which he was appointed as Chief Operating Officer. There are no family relationships

between Mr. Fullerton and any of the Company’s directors, executive officers or persons nominated or chosen by the Company

to become a director or executive officer. Mr. Fullerton is not a participant in, nor is he to be a participant in, any related-person

transaction or proposed related-person transaction required to be disclosed by Item 404(a) of Regulation S-K under the Securities

Exchange Act of 1934, as amended, in connection with his appointment.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Plug Power Inc. |

| |

|

|

| Date: August 2, 2024 |

By: |

/s/ Paul Middleton |

| |

|

Name: Paul Middleton |

| |

|

Title: Chief Financial Officer |

Exhibit 10.1

July 27, 2024

Dean Fullerton

Dear Dean,

It is my pleasure to confirm Plug Power Inc.’s

(the “Company”) offer of employment for the position of Chief Operating Officer - reporting to Andy Marsh (President

and Chief Executive Officer). If you accept this offer, the official start date of your employment is July 29th, 2024.

The key elements of this package include:

| 1) | A weekly base salary in the gross amount of $10,576.92 to be subject to applicable withholdings

and deductions and paid concurrent with the payroll schedule of the Company. Annualized, this salary rate is equivalent to $550,000.00

and subject to upward increases upon annual review. Since this is an exempt (salaried) role per FLSA guidelines, you will not

be eligible for overtime compensation. |

| 2) | Upon starting employment with the Company, you will also be eligible for a sign-on bonus in the gross

amount of $275,000 USD. This amount will be paid to you within your first month of service. Although the sign-on bonus will be

paid to you within your first month of service, you will have a repayment obligation to the Company if you resign from your position,

or you are terminated for Cause (as defined in your employment agreement) or a reason other than reduction in force. If employed with

the Company for one (1) year or less, you would be obliged to replay the full amount of the sign-on bonus. If employed with the Company

for more than one (1) year but less than two (2) years, you would owe a prorated portion of the sign-on bonus back to the Company. |

| 3) | You will be eligible to participate in the Company’s 2021 Stock Options and Incentive Plan (the

“Plan"). Pursuant to the Plan, as an inducement to accept our offer of employment, you will be granted an inducement grant

of 1,000,000 options to purchase shares of the Company’s common stock. The exercise price of the options will be equal to

NASDAQ’s closing price of the Plug Power stock on the date that your grant is ratified and approved by the Compensation Committee.

This ratification and approval date will fall concurrent with the next Compensation Committee meeting subsequent to your hire date. The

vesting of this grant is as follows: ½ of the shares are time based vested over a 3-year period; and ½ of the grant is both

time based and dependent on a $7.50 Stock Price Achievement by April 30, 2025. |

| 4) | In connection with your employment with Plug Power Inc. we are offering relocation assistance as needed

for agreed upon relocation expenses (example: furnished temporary housing for up to 12 months, (1) home finding trip for you and

your spouse/partner), to offset some of the costs associated with relocating to Capital Region, New York area. |

Initials: _________

The Relocation Assistance will be paid

to you in accordance with the terms and conditions of the Relocation Policy. Moving an employee requires a substantial financial commitment

by the Company. Therefore, if you elect to voluntarily terminate your employment with the Company or are terminated for Cause (as defined

in your Employment Agreement) during the 24-month period immediately following your start date in your new location, you will be required

to repay the Company all or a portion of the costs associated with your relocation according to the following repayment schedule:

· 1-12 months: Employee pays back

100%

· 13-24 months: Employee pays back

50%

| 5) | You will be eligible to participate in the Company’s annual bonus program that currently provides

for a target payment equivalent to 100% of your annual base salary as guided by the achievement of annual Company performance goals. Company

goals also have threshold (lower end) and stretch (higher end) targets which allow for the possibility to earn both lower and higher levels

of annual bonus payments. The Company bonus program is discretionary, and all aspects of the program remain subject to the approval of

both the CEO and Board of Directors. Given the discretionary nature of the Company’s annual bonus program, bonus payments are not

guaranteed from year to year. Your 2024 bonus will be guaranteed at 100% target, and subsequent years will follow the discretionary language

as noted above and will require subsequent approvals as noted above. |

| 6) | On a monthly basis, you will accrue vacation up to an annual total of four (4) weeks (160 hours).

Although vacation time accrues monthly, with supervisory approval, you may use vacation time prior to accruing it. At the end of the calendar

year, up to 120 hours of accrued but unused vacation time may be rolled over to the next year. |

In the event of termination of employment,

any vacation hours accrued but not used will be paid to you at your equivalent base hourly rate, subject to policy requirements. Conversely,

if, at termination of employment, you have used vacation time that you have yet to accrue, you would be required to repay the Company

for the un-accrued vacation time.

| 7) | Each year you are employed with the Company you will receive certain additional time-off benefits offered

to regular full-time employees, including: seven (7) paid Company holidays, five (5) floating holidays, two (2) personal

days, and five (5) sick days. This paid time off is not eligible for rollover nor is unused time paid out at year end or upon termination

of employment. The above categories of PTO are also subject to proration based upon your hire date. |

| 8) | You will also be eligible to participate in a full suite of benefits package options, including: health,

dental, vision, flexible spending accounts, and life insurance coverage. You are eligible to participate in most of these plans effective

on your hire date. As a part of the onboarding process, a member of the Human Resources team will review all plan options with you in

detail so that you can make informed decisions about your elections. Benefits package options are reviewed by the Company on an annual

basis and are subject to change at the discretion of the Company in order to ensure the most competitive and cost-effective options are

in place for employees. |

| 9) | The Company is also proud to encourage you to participate in our 401(k) retirement plan effective

on the 1st of the month following your date of hire. As you defer a portion of your pay into the retirement plan, you will

be able to enjoy the benefit of the Company matching contribution, subject to the plan’s vesting schedule. |

Initials: _________

You will also have the ability to choose

from a wide-range of investment options that suit your preferences and can help you in working towards meeting your retirement savings

goals. A member of the HR team will review the relevant plan details with you during the onboarding process so that you fully understand

plan functionality.

| 10) | We look forward to having you join the Company. However, we recognize that you retain the option, as does

the Company, of ending your employment with us at any time, with or without notice or cause. As such, your employment is considered at-will

and neither this letter nor any other oral or written representations may be considered a contract for a specific period of time. Your

at-will employment status can only be changed or amended by a written agreement signed by the President/CEO that expressly alters the

at-will nature of your employment. |

| 11) | This offer is contingent upon the following: |

|

· | completion of a background check package which may include any combination of the following items: criminal

history, drug screening, employment references, educational verification, driving record/license verification, a credit history check,

and a social media account review.

You will be notified regarding the

specific background package applicable to your position and your consent will be obtained prior to any checks being run. The Company maintains

sole and exclusive discretion to determine if the results of the background package are satisfactory; |

|

· | execution of and compliance with the Company’s Employee Patent, Confidentiality, Non-Compete and

Non-Solicitation Agreement (“Agreement”) a copy of which is enclosed; |

|

· | full and complete disclosure of any obligations or agreements with prior employers – including,

but not limited to non-compete agreements – that might conflict or interfere with, limit in any way, or prohibit your employment

with or work for the Company; |

|

· | your compliance with U.S. Immigration Law that requires you to complete the U.S. Government Employment

Eligibility Verification Form (I-9) and provide documents that verify your identity and employment eligibility. |

To indicate your acceptance of this offer please

sign below and initial all other pages of the letter. Upon doing so, kindly return a copy to me which will begin your onboarding

process.

If you have any questions, please do not hesitate

to contact me at .

| Sincerely, |

|

| |

|

| /s/ Andrew Marsh |

|

| Andrew Marsh |

|

| Chief Executive Officer |

|

I have read this letter and acknowledge

and accept this offer of employment with Plug Power Inc.

| /s/ Dean Fullerton |

|

| Dean Fullerton |

|

Date: 7/29/24

Exhibit 10.2

EXECUTIVE EMPLOYMENT AGREEMENT

This Employment Agreement

(“Agreement”) is made as of July 29, 2024 (the “Commencement Date”), between Plug Power Inc., a Delaware

corporation (the “Company”), and Dean Fullerton (the “Executive”).

WHEREAS, the Executive and

the Company have determined to enter into an agreement related to the employment of Executive by the Company;

NOW, THEREFORE, in consideration

of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which

is hereby acknowledged, the parties agree as follows:

1. Employment.

The term of this Agreement shall extend from the Commencement Date until the first anniversary of the Commencement Date; provided, however,

that the term of this Agreement shall automatically be extended for one additional year on the anniversary of the Commencement Date and

on each anniversary thereafter unless, not less than ninety (90) days prior to each such date, either party shall have given notice to

the other that it does not wish to extend this Agreement; provided, further, that if a Change in Control occurs during the original or

extended term of this Agreement, the term of this Agreement shall continue in effect for a period of not less than twelve (12) months

beyond the month in which the Change in Control occurred. The term of this Agreement shall also terminate upon any Date of Termination

(as defined in Section 4) and may be referred to herein as the “Term”.

2. Position

and Duties. During the Term, the Executive shall serve as the Executive Chief Operating Officer, and shall have responsibilities and

duties consistent with his position and such other responsibilities and duties as may from time to time be prescribed by the Chairman

of the Board of Directors of the Company (the “Board”), the Chief Executive Officer of the Company (the “CEO”)

or other authorized executives, provided that such responsibilities and duties are consistent with the Executive’s position or other

positions that he may hold from time to time. The Executive shall devote his full working time and efforts to the business and affairs

of the Company. Notwithstanding the foregoing, the Executive may serve on other boards of directors with the approval of the Board, or

engage in religious, charitable or other community activities as long as such services and activities are disclosed to the Board and do

not materially interfere with the Executive’s performance of his duties to the Company as provided in this Agreement.

3. Policies.

Except as provided herein, the Executive shall be covered by and agrees to comply with all of the Company’s policies and procedures,

including but not limited to the Company’s Employee Handbook, on the same terms as are applicable to other executives of the Company.

4. Compensation

and Related Matters.

(a) Base

Salary. The Executive’s initial annual base salary shall be $550,000.00. The Executive’s base salary shall be subject

to upward increases as may be determined upon annual review by the Compensation Committee of the Board. The base salary in effect at any

given time is referred to herein as “Base Salary”. The Base Salary shall be payable in substantially equal installments based

upon the payroll cycle of the Company and will be subject to applicable withholdings and deductions.

(b) Incentive

Compensation. The Executive shall be eligible to receive cash incentive compensation as determined by Compensation Committee of the

Board from time to time.

(c) Expenses.

The Executive shall be entitled to receive prompt reimbursement for all reasonable expenses incurred by him in performing services hereunder

during the Term, in accordance with the policies and procedures then in effect and established by the Company for its senior executive

officers.

(d) Other

Benefits. During the Term, the Executive shall be entitled to continue to participate in or receive benefits under all of the Company’s

Employee Benefit Plans in accordance with the terms of such plans in effect on the date hereof, or under plans or arrangements that provide

the Executive with benefits at least substantially equivalent to those provided under such Employee Benefit Plans. As used herein, the

term “Employee Benefit Plans” includes, without limitation, each retirement plan; stock option plan; life insurance plan;

medical insurance plan; disability plan; and health and accident plan or arrangement established and maintained by the Company on the

date hereof for employees of the same status within the hierarchy of the Company. During the Term, the Executive shall be entitled to

participate in or receive benefits under any employee benefit plan or arrangement which may, in the future, be made available by the Company

to its executives and key management employees, subject to and on a basis consistent with the terms, conditions and overall administration

of such plan or arrangement. Any payments or benefits payable to the Executive under a plan or arrangement referred to in this Section 3(d) in

respect of any calendar year during which the Executive is employed by the Company for less than the whole of such year shall, unless

otherwise provided in the applicable plan or arrangement, be prorated in accordance with the number of days in such calendar year during

which he is so employed. Should any such payments or benefits accrue on a fiscal (rather than calendar) year, then the proration in the

preceding sentence shall be on the basis of a fiscal year rather than calendar year.

(e) Vacations.

The Executive shall be entitled to 160 hours of paid vacation in each calendar year, which shall be accrued monthly during the calendar

year and shall be subject to the Company’s vacation policy. The Executive shall also be entitled to all paid holidays given by the

Company to its executives.

5. Termination.

The Executive’s employment hereunder may be terminated without any breach of this Agreement under the following circumstances:

(a) Death.

The Executive’s employment hereunder shall automatically terminate upon his death.

(b) Disability.

The Company may terminate the Executive’s employment if he is disabled and unable to perform the essential functions of the Executive’s

then existing position or positions under this Agreement with or without reasonable accommodation for a period of 180 days (which

need not be consecutive) in any 12-month period. If any question shall arise as to whether during any period the Executive is disabled

so as to be unable to perform the essential functions of the Executive’s then existing position or positions with or without reasonable

accommodation, the Executive may, and at the request of the Company shall, submit to the Company a certification in reasonable detail

by a physician selected by the Company to whom the Executive or the Executive’s guardian has no reasonable objection as to whether

the Executive is so disabled or how long such disability is expected to continue, and such certification shall for the purposes of this

Agreement be conclusive of the issue. The Executive shall cooperate with any reasonable request of the physician in connection with such

certification. If such question shall arise and the Executive shall fail to submit such certification, the Company’s determination

of such issue shall be binding on the Executive. Nothing in this Section 4(b) shall be construed to waive the Executive’s

rights, if any, under existing law including, without limitation, the Family and Medical Leave Act of 1993, 29 U.S.C. §2601 et

seq. and the Americans with Disabilities Act, 42 U.S.C. §12101 et seq.

(c) Termination

by the Company for Cause. At any time during the Term, the Company may terminate the Executive’s employment hereunder for Cause.

For purposes of this Agreement, “Cause” shall mean: (i) willful conduct by the Executive constituting a material act

of gross misconduct in connection with the performance of the Executive’s duties, including, without limitation, deliberate misappropriation

of funds or property of the Company or any of its subsidiaries or affiliates other than the occasional, customary and de minimis use of

Company property for personal purposes; (ii) the commission by the Executive of (A) any felony; or (B) a misdemeanor involving

moral turpitude, deceit, dishonesty or fraud; (iii) any conduct by the Executive that would reasonably be expected to result in material

injury or reputational harm to the Company or any of its subsidiaries and affiliates if the Executive were retained in the Executive’s

position; (iv) continued and substantial non-performance by the Executive of the Executive’s primary responsibilities hereunder

(other than by reason of the Executive’s physical or mental illness, incapacity or disability) which has continued for more than

thirty (30) days following written notice of such non-performance from the Board and Executive’s failure to substantially cure such

non-performance within thirty (30) days following such written notice; (v) a material breach by the Executive of the Employee Patent,

Confidentiality, and Non-Solicitation/Non-Compete Agreement between the Executive and the Company (the “Confidentiality Agreement”);

(vi) a material violation by the Executive of any of the Company’s written employment policies; (vii) failure to cooperate

with a bona fide internal investigation or an investigation by regulatory or law enforcement authorities, after being instructed by the

Company to cooperate, or the willful destruction or failure to preserve documents or other materials known to be relevant to such investigation

or the inducement of others to fail to cooperate or to produce documents or other materials in connection with such investigation; or

(viii) the Executive’s willful failure to honor his fiduciary duties to the Company.

(d) Termination

Without Cause. At any time during the Term, the Company may terminate the Executive’s employment hereunder without Cause. Any

termination by the Company of the Executive’s employment under this Agreement which does not constitute a termination for Cause

under Section 5(c) or result from the death or disability of the Executive under Section 5(a) or (b) shall be

deemed a termination without Cause.

(e) Termination

by the Executive. At any time during the Term, the Executive may terminate his employment hereunder for any reason, including but

not limited to Good Reason. If the Executive provides notice to the Company under Section 1 that he elects to discontinue the extensions,

such action shall be deemed a voluntary termination by the Executive and one without Good Reason. For purposes of this Agreement, “Good

Reason” shall mean that the Executive has complied with the “Good Reason Process” (hereinafter defined) following the

occurrence of any of the following events after a Change in Control: (i) a material diminution in the Executive’s responsibilities,

authority or duties; (ii) a diminution in the Executive’s Base Salary; (iii) a material change in the geographic location

at which the Executive provides services to the Company; or (iv) the material breach of this Agreement by the Company. “Good

Reason Process” shall mean that (i) the Executive reasonably determines in good faith that a “Good Reason” condition

has occurred; (ii) the Executive notifies the Company in writing of the occurrence of the Good Reason condition within sixty (60)

days of the occurrence of such condition; (iii) the Executive cooperates in good faith with the Company’s efforts, for a period

not less than 30 days following such notice (the “Cure Period”), to remedy the condition; (iv) notwithstanding such efforts,

the Good Reason condition continues to exist; and (v) the Executive terminates his employment within sixty (60) days after the end

of the Cure Period. If the Company cures the Good Reason condition during the Cure Period, Good Reason shall be deemed not to have occurred.

(f) Notice

of Termination. Except for termination as specified in Section 5(a), any termination of the Executive’s employment by the

Company or any such termination by the Executive shall be communicated by written Notice of Termination to the other party hereto. For

purposes of this Agreement, a “Notice of Termination” shall mean a notice which shall indicate the specific termination provision

in this Agreement relied upon.

(g) Date

of Termination. “Date of Termination” shall mean: (i) if the Executive’s employment is terminated by his death,

the date of his death; (ii) if the Executive’s employment is terminated by the Company for Cause under Section 5(c), the

date on which Notice of Termination is given; (iii) if the Executive’s employment is terminated by the Company under Section 5(b) or

5(d), thirty (30) days after the date on which a Notice of Termination is given; (iv) if the Executive’s employment is terminated

by the Executive under Section 5(e) without Good Reason, thirty (30) days after the date on which a Notice of Termination is

given, and (v) if the Executive’s employment is terminated by the Executive under Section 5(e) with Good Reason,

the date on which a Notice of Termination is given after the end of the Cure Period. Notwithstanding the foregoing, in the event that

the Executive gives a Notice of Termination to the Company, the Company may unilaterally accelerate the Date of Termination and such acceleration

shall not constitute a termination by the Company for purposes of this Agreement.

6. Compensation

Upon Termination.

(a) Termination

Generally. If the Executive’s employment with the Company is terminated for any reason during the Term, the Company shall pay

or provide to the Executive (or to his authorized representative or estate) any earned but unpaid base salary, incentive compensation

determined by the Board to be earned but not yet paid, unpaid expense reimbursements, accrued but unused vacation and any vested benefits

the Executive may have under the Company’s Employee Benefit Plans through the Date of Termination (the “Accrued Benefit”).

The Executive shall not be entitled to receive any other termination payments or benefits from the Company except as specifically provided

in Section 6(b) or Section 7.

(b) Termination

by the Company Without Cause. Except as provided in Section 7, if the Executive’s employment is terminated by the Company

without Cause as provided in Section 5(d), then the Company shall, through the Date of Termination, pay the Executive his Accrued

Benefit. Except as provided in Section 7, if (i) the Executive’s employment is terminated by the Company without Cause

as provided in Section 5(d), (ii) the Executive signs a general release of claims in a form and manner satisfactory to the Company

(the “Release”) within 21 days of the receipt of the Release and does not revoke such Release during the seven-day revocation

period (if applicable), and (iii) the Executive complies with the Confidentiality Agreement, then

A. The

Company shall pay the Executive an amount equal to the sum of one (1) times the Executive’s then current Base Salary. Such

amount shall be paid out either in a lump sum or in installments, per the discretion of the Company, and commencing on the first payroll

date after the Date of Termination or expiration of the seven-day revocation period for the Release, whichever is later.

B. As

of the Date of Termination, all vested stock options held by the Executive shall be exercisable for twelve (12) months following the Date

of Termination; and any unvested stock options, restricted stock or other stock-based equity award will be immediately forfeited upon

the Date of Termination.

C. Executive’s

coverage under the Company’s group health insurance will extend through the end of the month in which the Date of Termination occurs.

Executive may elect COBRA continuation coverage for the group health plans. Notification of conditions and premiums costs to continue

health insurance will be provided to Executive following termination. Executive will be responsible for payment of premiums for health

insurance coverage secured after the end of the month in which the Date of Termination occurs. In consideration of the loss of various

benefits provided by the Company, the Company shall choose to either provide a lump sum payment to Executive equal to twelve (12) times

the Company’s share of the monthly health insurance premium for the health insurance plan in force on the Date of Termination, less

applicable withholdings and deductions OR provide a monthly subsidy for a period of twelve (12) months and equivalent to the Company’s

share of the monthly health insurance premium for the health insurance plan in force on the Date of Termination to offset the Executive’s

COBRA cost.

D. The

Company shall have no obligation to make any further payments (salary, bonus or otherwise) or provide any further benefits to Executive

except as otherwise provided under the applicable terms of this Agreement or the Company’s Employee Benefit Plans.

7. Change

in Control Payment. The provisions of this Section 7 set forth certain terms regarding the Executive’s rights and obligations

upon the occurrence of a Change in Control of the Company. These provisions are intended to assure and encourage in advance the Executive’s

continued attention and dedication to his assigned duties and his objectivity during the pendency and after the occurrence of any such

event. These provisions shall apply in lieu of, and expressly supersede, the provisions of Section 6(b) regarding severance

pay and benefits upon a termination of employment, if such termination of employment occurs within 12 months after the occurrence of the

first event constituting a Change in Control, provided that such first event occurs during the Term. These provisions shall terminate

and be of no further force or effect beginning 12 months after the occurrence of a Change in Control.

(a) Change

in Control. If (i) within twelve (12) months after a Change in Control, the Executive’s employment is terminated by the

Company without Cause as provided in Section 5(d) or the Executive terminates his employment for Good Reason as provided in

Section 5(e), (ii) the Executive signs the Release within twenty-one (21) days of the receipt of the Release and does not revoke

the Release during the seven-day revocation period (if applicable), and (iii) the Executive complies with the Confidentiality Agreement,

then

A. The

Company shall pay to the Executive an amount equal to (i) one-hundred percent (100%) the Executive’s average annual base salary

over the three (3) fiscal years immediately prior to the Termination Date (or the Executive’s annual base salary in effect

immediately prior to the Change in Control, if higher) and (ii) one-hundred percent (100%) of the Executive’s average annual

bonus over the three (3) fiscal years immediately prior to the Change in Control (or the Executive’s annual bonus for the last

fiscal year immediately prior to the Change in Control, if higher). Such amounts shall be paid out either in a lump sum or in installments,

per the discretion of the Company, and commencing on the first payroll date after the Date of Termination or expiration of the seven-day

revocation period for the Release, whichever is later, subject to Section 7(b) regarding additional limitations and Section 8

regarding IRC Section 409A.

B. Notwithstanding

anything to the contrary in any applicable option agreement or stock-based award agreement, on the Termination Date the Executive shall

vest in such portion of his stock options and other stock-based awards as he would have vested in if he had remained employed by the Company

for twelve (12) months following the Termination Date.

C. Executive’s

coverage under the Company’s group health insurance will extend through the end of the month in which the Date of Termination occurs.

Executive may elect COBRA continuation coverage for the group health plans. Notification of conditions and premiums costs to continue

health insurance will be provided to Executive following termination. Executive will be responsible for payment of premiums for health

insurance coverage secured after the end of the month in which the Date of Termination occurs. In consideration of the loss of various

benefits provided by the Company, the Company shall choose to either provide a lump sum payment to Executive equal to twelve (12) times

the Company’s share of the monthly health insurance premium for the health insurance plan in force on the Date of Termination, less

applicable withholdings and deductions OR provide a monthly subsidy for a period of twelve (12) months and equivalent to the Company’s

share of the monthly health insurance premium for the health insurance plan in force on the Date of Termination to offset the Executive’s

COBRA cost.

D. The

Company shall pay to the Executive all reasonable legal and arbitration fees and expenses incurred by the Executive in obtaining or enforcing

any right or benefit provided by this Agreement, except in cases involving frivolous or bad faith litigation.

E. The

Company shall have no obligation to make any further payments (salary, bonus or otherwise) or provide any further benefits to Executive

except as otherwise provided under the applicable terms of this Agreement or the Company’s Employee Benefit Plans.

(b) Additional

Limitation.

(i) Anything

in this Agreement to the contrary notwithstanding, in the event that any compensation, payment or distribution by the Company to or for

the benefit of the Executive, whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise

(the “Severance Payments”), would be subject to the excise tax imposed by Section 4999 of the Code, the following provisions

shall apply:

A. If

the Severance Payments, reduced by the sum of (1) the Excise Tax and (2) the total of the Federal, state, and local income and

employment taxes payable by the Executive on the amount of the Severance Payments which are in excess of the Threshold Amount, are greater

than or equal to the Threshold Amount, the Executive shall be entitled to the full benefits payable under this Agreement.

B. If

the Threshold Amount is less than (x) the Severance Payments, but greater than (y) the Severance Payments reduced by the sum

of (1) the Excise Tax and (2) the total of the federal, state, and local income and employment taxes on the amount of the Severance

Payments which are in excess of the Threshold Amount, then the benefits payable under this Agreement shall be reduced (but not below zero)

to the extent necessary so that the maximum Severance Payments shall not exceed the Threshold Amount.

(ii) For

the purposes of this Section 7(b), “Threshold Amount” shall mean three times the Executive’s “base amount”

within the meaning of Section 280G(b)(3) of the Code and the regulations promulgated thereunder less one dollar ($1.00); and

“Excise Tax” shall mean the excise tax imposed by Section 4999 of the Code, and any interest or penalties incurred by

the Executive with respect to such excise tax.

(iii) The

determination as to which of the alternative provisions of Section 7(b)(i) shall apply to the Executive shall be made by a nationally

recognized accounting firm selected by the Company (the “Accounting Firm”), which shall provide detailed supporting calculations

both to the Company and the Executive within fifteen (15) business days of the Date of Termination, if applicable, or at such earlier

time as is reasonably requested by the Company or the Executive. For purposes of determining which of the alternative provisions of Section 7(b)(i) shall

apply, the Executive shall be deemed to pay federal income taxes at the highest marginal rate of federal income taxation applicable to

individuals for the calendar year in which the determination is to be made, and state and local income taxes at the highest marginal rates

of individual taxation in the state and locality of the Executive’s residence on the Date of Termination, net of the maximum reduction

in federal income taxes which could be obtained from deduction of such state and local taxes. Any determination by the Accounting Firm

shall be binding upon the Company and the Executive.

(c) Definitions.

For purposes of this Section 7, the following terms shall have the following meanings:

“Change in Control”

shall be deemed to have occurred in any one of the following events:

(i) any

“person,” as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), (other than the Company, any of its subsidiaries, any trustee, fiduciary or other person or entity holding

securities under any employee benefit plan or trust of the Company or any of its subsidiaries, together with all Affiliates and Associates

(as such terms are hereinafter defined) of such person), shall become the “beneficial owner” (as such term is defined in Rule 13d-3

of the Exchange Act), directly or indirectly, of securities of the Company representing 25% or more of the then outstanding shares of

common stock of the Company (the “Stock”) (other than as a result of an acquisition of securities directly from the Company);

or

(ii) persons

who, as of the effective date of this Agreement (the “Effective Date”), constitute the Company’s Board of Directors

(the “Incumbent Directors”) cease for any reason, including, without limitation, as a result of a tender offer, proxy contest,

merger or similar transaction, to constitute at least a majority of the Board, provided that any person becoming a director of the Company

subsequent to the Effective Date shall be considered an Incumbent Director if such person’s election was approved by or such person

was nominated for election by either (A) a vote of at least a majority of the Incumbent Directors or (B) a vote of at least

a majority of the Incumbent Directors who are members of a nominating committee comprised, in the majority, of Incumbent Directors; but

provided further, that any such person whose initial assumption of office is in connection with an actual or threatened election contest

relating to the election of members of the Board of Directors or other actual or threatened solicitation of proxies or consents by or

on behalf of a Person other than the Board, including by reason of agreement intended to avoid or settle any such actual or threatened

contest or solicitation, shall not be considered an Incumbent Director; or

(iii) Upon

(A) the consummation of any consolidation or merger of the Company where the shareholders of the Company, immediately prior to the

consolidation or merger, did not, immediately after the consolidation or merger, beneficially own (as such term is defined in Rule 13d-3

of the Exchange Act), directly or indirectly, shares representing in the aggregate more than 50% of the voting shares of the corporation

issuing cash or securities in the consolidation or merger (or of its ultimate parent corporation, if any), (B) the consummation of

any sale, lease, exchange or other transfer (in one transaction or a series of transactions contemplated or arranged by any party as a

single plan) of all or substantially all of the assets of the Company or (C) the completion of a liquidation or dissolution that

has been approved by the stockholders of the Company; or

(iv) For

purposes of this Agreement, “Affiliate” and “Associate” shall have the respective meanings ascribed to such terms

in Rule 12b-2 of the Exchange Act, as in effect on the date of this Agreement; provided, however, that no person who

is a director or officer of the Company shall be deemed an Affiliate or an Associate of any other director or officer of the Company solely

as a result of his position as director or officer of the Company.

Notwithstanding the foregoing,

a “Change in Control” shall not be deemed to have occurred for purposes of the foregoing clause (i) solely as the result

of an acquisition of securities by the Company which, by reducing the number of shares of Stock outstanding, increases the proportionate

number of shares of Stock beneficially owned by any person to 25% or more of the shares of Stock then outstanding; provided, however,

that if any such person shall at any time following such acquisition of securities by the Company become the beneficial owner of any additional

shares of Stock (other than pursuant to a stock split, stock dividend, or similar transaction) and such person immediately thereafter

is the beneficial owner of 25% or more of the shares of Stock then outstanding, then a “Change in Control” shall be deemed

to have occurred for purposes of the foregoing clause (i), as applicable.

8. Section 409A.

(a) Anything

in this Agreement to the contrary notwithstanding, if at the time of the Executive’s “separation from service” within

the meaning of Section 409A of the Code, the Company determines that the Executive is a “specified employee” within the

meaning of Section 409A(a)(2)(B)(i) of the Code, and to the extent any payment or benefit that the Executive becomes entitled

to under this Agreement would be considered deferred compensation subject to the 20 percent additional tax imposed pursuant to Section 409A(a) of

the Code as a result of the application of Section 409A(a)(2)(B)(i) of the Code, then no such payment shall be payable and no

such benefit shall be provided prior to the date that is the earlier of (A) six months and one day after the Executive’s separation

from service, or (B) the Executive’s death.

(b) All

in-kind benefits provided and expenses eligible for reimbursement under this Agreement shall be provided by the Company or incurred by

the Executive during the time periods set forth in this Agreement. All reimbursements shall be paid as soon as administratively practicable,

but in no event shall any reimbursement be paid after the last day of the taxable year following the taxable year in which the expense

was incurred. The amount of in-kind benefits provided or reimbursable expenses incurred in one taxable year shall not affect the in-kind

benefits to be provided or the expenses eligible for reimbursement in any other taxable year. Such right to reimbursement or in-kind benefits

is not subject to liquidation or exchange for another benefit.

(c) To

the extent that any payment or benefit described in this Agreement constitutes “non-qualified deferred compensation” under

Section 409A of the Code, and to the extent that such payment or benefit is payable upon the Executive’s termination of employment,

then such payments or benefits shall be payable only upon the Executive’s “separation from service.” The determination

of whether and when a separation from service has occurred shall be made in accordance with the presumptions set forth in Treasury Regulation

Section 1.409A-1(h).

(d) The

parties intend that this Agreement will be administered in accordance with Section 409A of the Code. To the extent that any provision

of this Agreement is ambiguous as to its compliance with Section 409A of the Code, the provision shall be read in such a manner so

that all payments hereunder comply with Section 409A of the Code. The parties agree that this Agreement may be amended, as reasonably

requested by either party, and as may be necessary to fully comply with Section 409A of the Code and all related rules and regulations

in order to preserve the payments and benefits provided hereunder without additional cost to either party.

(e) The

Company makes no representation or warranty and shall have no liability to the Executive or any other person if any provisions of this

Agreement are determined to constitute deferred compensation subject to Section 409A of the Code but do not satisfy an exemption

from, or the conditions of, such Section.

9. Covenants.

(a) Confidentiality

Agreement. The Executive acknowledges and agrees that the Employee Patent, Confidentiality, and Non-Solicitation/Non-Compete Agreement

shall continue in effect as if set forth herein.

(b) Litigation

and Regulatory Cooperation. During and after the Term, the Executive shall cooperate fully with the Company and all of its subsidiaries

and affiliates (including its and their outside counsel) in connection with the contemplation, prosecution and defense of all phases of

existing, past and future claims or actions which relate to events or occurrences that transpired while the Executive was employed by

the Company. The Executive’s full cooperation in connection with such claims or actions shall include, but not be limited to, being

available to meet with counsel to prepare for discovery or trial and to act as a witness on behalf of the Company at mutually convenient

times. During and after the Term, the Executive also shall cooperate fully with the Company in connection with any investigation or review

of any federal, state or local regulatory authority as any such investigation or review relates to events or occurrences that transpired

while the Executive was employed by the Company. The Company shall reimburse the Executive for any pre-approved reasonable business travel

expenses that are incurred in connection with the Executive’s performance of obligations pursuant to this Section 8(a) after

receipt of appropriate documentation consistent with the Company’s business expense reimbursement policy.

(c) Disparagement.

During and after the Term, the Executive agrees not to make any disparaging statements concerning the Company or any of its subsidiaries,

affiliates or current or former officers, directors, shareholders, employees or agents (“Company Parties”). The Executive

further agrees not to take any actions or conduct himself in any way that would reasonably be expected to affect adversely the reputation

or good will of the Company or any of the Company Parties. The Executive further agrees that he shall not voluntarily provide information

to or otherwise cooperate with any individual or entity that is contemplating or pursuing litigation against the Company or any of the

Company Parties or that is undertaking any investigation or review of the Company’s or any of the Company Parties’ activities

or practices. Nothing in this Agreement prevents Executive from filing a charge with the Equal Employment Opportunity Commission (“EEOC”)

or participating in any investigation or proceeding conducted by the EEOC nor does it limit Executive’s ability to file a complaint

with the Securities and Exchange Commission (“SEC”) or communicate with the SEC or otherwise participate in any investigation

or proceeding that may be conducted by the SEC nor does it prevent Executive from disclosing information about unlawful acts in the workplace,

including, but not limited to, sexual harassment. These non-disparagement obligations shall not in any way affect the Executive’s

obligation to testify truthfully in any legal proceeding.

(d) Return

of Property. As soon as possible in connection with any termination of the Executive’s employment under this Agreement or when

otherwise requested by the Company, the Executive shall return to the Company all Company property, including, without limitation, computer

equipment, software, keys and access cards, credit cards, files and any documents (including computerized data and any copies made of

computer data or software) containing information concerning the Company, its business or its business relationships (in the latter two

cases, actual or prospective). The Executive shall also commit to deleting and finally purging any duplicates of files or documents that

may contain Company information from any computer or other device that remains his property after any Date of Termination. If requested

by the Company, Executive will provide a written acknowledgement and certification that all such Company property has been returned and

electronic data permanently deleted and that Executive has not shared or provided such information to any third parties. Executive acknowledges

and agrees that failure to surrender such property will cause irreparable damage to the Company.

(e) Injunction.

The Executive agrees that it would be difficult to measure any damages caused to the Company which might result from any breach by the

Executive of his obligations under this Agreement, and that in any event money damages would be an inadequate remedy for any such breach.

Accordingly, subject to Section 10 of this Agreement, the Executive agrees that if the Executive breaches, or proposes to breach,

any provision of this Agreement, the Company shall be entitled, in addition to all other remedies that it may have, to an injunction or

other appropriate equitable relief to restrain any such breach without showing or proving any actual damage to the Company.

10. Settlement

and Arbitration of Disputes. Any controversy or claim arising out of or relating to this Agreement or the breach thereof shall be

settled exclusively by arbitration in accordance with the laws of the State of New York by three arbitrators, one of whom shall be appointed

by the Company, one by the Executive and the third by the first two arbitrators. If the first two arbitrators cannot agree on the appointment

of a third arbitrator, then the third arbitrator shall be appointed by the American Arbitration Association. Such arbitration shall be

conducted in the City of Albany in accordance with the Employment Arbitration Rules of the American Arbitration Association, except

with respect to the selection of arbitrators which shall be as provided in this Section 10. Judgment upon the award rendered by the

arbitrators may be entered in any court having jurisdiction thereof. This Section 10 shall be specifically enforceable. Notwithstanding

the foregoing, this Section 10 shall not preclude either party from pursuing a court action for the sole purpose of obtaining a temporary

restraining order or a preliminary injunction in circumstances in which such relief is appropriate; provided that any other relief shall

be pursued through an arbitration proceeding pursuant to this Section 10.

11. Consent

to Jurisdiction. To the extent that any court action is permitted consistent with or to enforce Section 10 of this Agreement,

the parties hereby consent to the jurisdiction of the Supreme Courts of New York State and the United States District Court for the Northern

District of New York. Accordingly, with respect to any such court action, the Executive (a) submits to the personal jurisdiction

of such courts; (b) consents to service of process; and (c) waives any other requirement (whether imposed by statute, rule of

court, or otherwise) with respect to personal jurisdiction or service of process.

12. Integration.

This Agreement constitutes the entire agreement and understanding between the parties with respect to the subject matter hereof and supersedes

all prior agreements between the parties concerning such subject matter, except the Confidentiality Agreement, which remains in full force

and effect. To the extent there are any inconsistencies between this Agreement and the offer letter, this Agreement shall control.

13. Withholding.

All payments made by the Company to the Executive under this Agreement shall be net of any tax or other amounts required to be withheld

by the Company under applicable law.

14. Successor

to the Executive. This Agreement shall inure to the benefit of and be enforceable by the Executive’s personal representatives,

executors, administrators, heirs, distributees, devisees and legatees. In the event of the Executive’s death after his termination

of employment but prior to the completion by the Company of all payments due him under this Agreement, the Company shall continue such

payments to the Executive’s beneficiary designated in writing to the Company prior to his death (or to his estate, if the Executive

fails to make such designation).

15. Conditions

of Offer. The Company’s offer of employment is conditioned on Executive’s submission of satisfactory proof of legal authorization

to work in the United States and, if requested, Executive’s completion of a standard background check to the satisfaction of the

Company. This offer is also conditioned on Executive signing and returning the Company’s Employee Patent, Confidentiality, and Non-Solicitation/Non-Compete

Agreement.

16. Enforceability.

If any portion or provision of this Agreement (including, without limitation, any portion or provision of any section of this Agreement)

shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction, then the remainder of this Agreement, or

the application of such portion or provision in circumstances other than those as to which it is so declared illegal or unenforceable,

shall not be affected thereby, and each portion and provision of this Agreement shall be valid and enforceable to the fullest extent permitted

by law.

17. Waiver.

No waiver of any provision hereof shall be effective unless made in writing and signed by the waiving party. The failure of any party

to require the performance of any term or obligation of this Agreement, or the waiver by any party of any breach of this Agreement, shall

not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

18. Notices.

Any notices, requests, demands and other communications provided for by this Agreement shall be sufficient if in writing and delivered

in person or sent by a nationally recognized overnight courier service or by registered or certified mail, postage prepaid, return receipt

requested, to the Executive at the last address the Executive has filed in writing with the Company or, in the case of the Company, at

its main offices, attention of the Board.

19. Effect

on Other Plans. Nothing in this Agreement shall be construed to limit the rights of the Executive under the Company’s benefit

plans, programs or policies except (a) as otherwise provided herein, and (b) that the Executive shall have no rights to any

severance or similar benefits under any severance pay plan, policy or practice.

20. Amendment.

This Agreement may be amended or modified only by a written instrument signed by the Executive and by a duly authorized representative

of the Company.

21. Governing

Law. This is a California contract and shall be construed under and be governed in all respects by the laws of the State of California,

without giving effect to the conflict of laws principles of such State. With respect to any disputes concerning federal law, such disputes

shall be determined in accordance with the law as it would be interpreted and applied by the United States Court of Appeals for the

Ninth Circuit.

22. Counterparts.

This Agreement may be executed in any number of counterparts, each of which when so executed and delivered shall be taken to be an original;

but such counterparts shall together constitute one and the same document.

23. Successor

to Company. The Company shall require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise)

to all or substantially all of the business or assets of the Company expressly to assume and agree to perform this Agreement to the same

extent that the Company would be required to perform it if no succession had taken place. Failure of the Company to obtain an assumption

of this Agreement at or prior to the effectiveness of any succession shall be a breach of this Agreement and shall constitute Good Reason

if the Executive elects to terminate employment.

24. Gender

Neutral. Wherever used herein, a pronoun in the masculine gender shall be considered as including the feminine gender unless the context

clearly indicates otherwise.

25. Survival.

The provisions of this Agreement shall survive the termination of this Agreement and/or the termination of the Executive’s employment

to the extent necessary to effectuate the terms contained herein.

IN WITNESS WHEREOF, the parties

hereto have executed this Agreement effective on the date and year first above written.

| |

PLUG POWER INC. |

| |

|

| |

By: |

/s/ Andrew Marsh |

| |

Name: |

Andrew Marsh |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

Dean Fullerton |

| |

|

|

| |

By: |

/s/ Dean Fullerton |

| |

Name: |

Dean Fullerton |

| |

Title: |

Chief Operating Officer |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

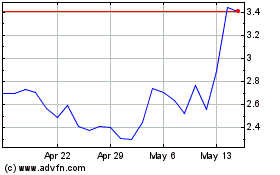

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Nov 2023 to Nov 2024