QuantaSing Group Limited (NASDAQ: QSG) (“QuantaSing” or the

“Company”), a leading online learning service provider in China,

today announced its unaudited financial results for the third

quarter of the fiscal year ending June 30, 2024 (the “third quarter

of FY 2024”, which refers to the quarter from January 1, 2024 to

March 31, 2024).

Highlights for the Third Quarter of FY

2024

- Revenues for the

third quarter of FY 2024 were RMB945.6 million (US$131.0 million),

representing a change of 3.6% from the second quarter of the fiscal

year ending June 30, 2024 (the “second quarter of FY 2024”) and an

increase of 17.1% from the third quarter of the fiscal year ended

June 30, 2023 (the “third quarter of FY 2023”).

- Gross billings of

individual online learning services1 for

the third quarter of FY 2024 were RMB981.5million (US$135.9

million), representing an increase of 3.9% from the second quarter

of FY 2024 and an increase of 22.1% from the third quarter of FY

2023.

- Net income for the

third quarter of FY 2024 was RMB14.6 million (US$2.0 million),

compared with RMB107.6 million in the second quarter of FY 2024,

and a net loss of RMB22.7 million in the third quarter of FY

2023.

- Adjusted net

income2 for the third quarter of FY 2024

was RMB31.9 million (US$4.4 million), compared with RMB103.9

million in the second quarter of FY 2024, and RMB21.7 million in

the third quarter of FY 2023.

- Total registered

users increased by 40.3% to approximately 121.0 million as

of March 31, 2024, from 86.3 million as of March 31, 2023.

- Paying learners

increased by 48.4% year over year to approximately 0.5 million in

the third quarter of FY 2024.

Mr. Peng Li, Chairman and Chief Executive

Officer of QuantaSing, commented, “We are pleased to see the

positive reception that our expanded course offerings have received

from our middle-aged and elderly users. By focusing on their unique

interests and needs, such as Traditional Chinese Medicine and

recreational exercises like Ba Duan Jin, we are enriching their

lives and fostering a vibrant community of lifelong learners. Our

recent initiatives, including the educational tour program and the

launch of mini-lectures, have received enthusiastic feedback,

highlighting robust demand for active aging and continuous

learning. During May 2024, our overseas development initiatives

made solid progress, as Kelly’s Education opened its first offline

school in Hong Kong. Importantly, this quarter's growth in gross

billings and user engagement has further solidified our business

fundamentals. As we continue to develop and market consumer

products tailored to our middle-aged and elderly users, we are

excited about the opportunities ahead to enhance their well-being

and extend our reach in the silver economy.”

Mr. Dong Xie, Chief Financial Officer of

QuantaSing, added, “During the third quarter of fiscal year 2024,

we achieved total revenues of RMB945.6 million, a 17.1%

year-over-year increase driven by robust demand for our skills

upgrading courses. We strategically allocated cash flow into new

initiatives using our "test-and-scale" approach while closely

monitoring our learning business to preserve profitability. Moving

forward, our commitment to sustainable and profitable growth will

continue to guide our strategic trajectory.”

Financial Results for the Third Quarter

of FY 2024

Revenues

Revenues increased by 17.1% year over year to

RMB945.6 million (US$131.0 million) in the third quarter of FY

2024, primarily driven by the growth in revenues from skills

upgrading courses, which primarily consist of courses aiming to

improve the soft skills of individuals3.

-

Revenues from individual online learning services increased by

14.3% year over year to RMB828.1 million (US$114.7 million) in the

third quarter of FY 2024, up from RMB724.7 million in the third

quarter of FY 2023. This growth was primarily due to 1) revenues

from skills upgrading courses3 increased to RMB464.4 million

(US$64.3 million) in the third quarter of FY 2024 from RMB205.9

million in the third quarter of FY 2023, and 2) revenues from

recreation and leisure courses3 increased to RMB95.3 million

(US$13.2 million) in the third quarter of FY 2024 from RMB32.1

million in the third quarter of FY 2023, partially offset by the

decline of RMB218.2 million (US$30.2 million) in revenues from

financial literacy courses.

-

Revenues from enterprise services were RMB65.1 million (US$9.0

million) in the third quarter of FY 2024, compared to RMB81.1

million in the third quarter of FY 2023, representing a

year-over-year change of 19.8%, primarily due to a change in

revenue streams from transactions involving related party and

external entities, partially offset by an increase in revenue due

to higher demand from existing and new customers for marketing

services.

-

Revenues from others increased to RMB52.4 million (US$7.3 million)

in the third quarter of FY 2024 from RMB1.4 million in the third

quarter of FY 2023, mainly driven by the increase in revenues from

the Company's newest business endeavor, live e-commerce, which is

aligned with its commitment to diversified revenue streams.

Cost of revenues

Cost of revenues was RMB145.8 million (US$20.2

million) in the third quarter of FY 2024, compared to RMB101.1

million in the third quarter of FY 2023, representing a change of

44.3%. The change was primarily due to increased labor outsourcing

costs of RMB23.3 million (US$3.2 million) and higher procurement

costs of RMB27.1 million (US$3.7 million), and was partially offset

by a RMB15.7 million (US$2.2 million) decrease in staff costs.

Sales and marketing

expenses

Sales and marketing expenses were RMB729.6

million (US$101.1 million) in the third quarter of FY 2024,

compared to RMB631.4 million in the third quarter of FY 2023,

representing a change of 15.6%. The change was mainly due to

increases in labor outsourcing costs of RMB84.9 million (US$11.8

million) and marketing and promotion expenses of RMB89.4 million

(US$12.4 million), partially offset by a decrease in staff costs of

RMB73.7 million (US$10.2 million), which includes a decrease in

share-based compensation expenses of RMB9.5 million (US$1.3

million).

Research and development

expenses

Research and development expenses were RMB38.8

million (US$5.4 million) in the third quarter of FY 2024, compared

to RMB49.6 million in the third quarter of FY 2023, representing a

decrease of 21.7%. The decrease was primarily due to a decline in

staff costs of RMB11.5 million (US$1.6 million), which includes a

decrease in share-based compensation expenses of RMB5.2 million

(US$0.7 million).

General and administrative

expenses

General and administrative expenses were RMB36.4

million (US$5.0 million) in the third quarter of FY 2024, compared

to RMB48.3 million in the third quarter of FY 2023, representing a

decrease of 24.7%. The decrease was primarily due to a decline in

share-based compensation expenses and office expenses.

Net income and adjusted net

income

Net income was RMB14.6 million (US$2.0 million)

in the third quarter of FY 2024, compared with a net loss of

RMB22.7 million in the third quarter of FY 2023. Adjusted net

income was RMB31.9 million (US$4.4 million) in the third quarter of

FY 2024, compared with RMB21.7 million in the third quarter of FY

2023.

Earnings per share and adjusted earnings

per share4

Basic and diluted net income per share were

RMB0.09 (US$0.01) in the third quarter of FY 2024, compared with

basic and diluted net loss per share of RMB0.19 in the third

quarter of FY 2023. Basic and diluted adjusted net income per share

were RMB0.19 (US$0.03) in the third quarter of FY 2024, compared

with basic and diluted adjusted net income per share of RMB0.11 in

the third quarter of FY 2023.

Balance Sheet

As of March 31, 2024, the Company had cash and

cash equivalents and short-term investments of RMB1,149.9 million

(US$159.3 million), compared with RMB930.6 million as of June 30,

2023.

Financial Outlook

Based on currently available information, for

the fourth quarter of FY 2024 (which refers to the quarter from

April 1, 2024 to June 30, 2024), the Company expects its revenues

to be in the range of RMB900.0 million to RMB930.0 million,

representing a year-over-year increase of 8.7% to 12.3%. The

forecasts reflect the Company’s current and preliminary views on

the market and its operating conditions, which are subject to

change.

Recent Developments

On June 9, 2023, the Company announced that its

board of directors had approved a share repurchase program of up to

US$20.0 million of the Company’s Class A ordinary shares in the

form of American Depositary Shares (“ADSs”) for a 12-month period

beginning on June 9, 2023 (the “Share Repurchase Program”). As of

March 31, 2024, the Company had cumulatively repurchased an

aggregate of approximately 2.6 million ADSs for approximately

US$11.5 million under the Share Repurchase Program.

On March 20, 2024, as part of its initiative to

expand the e-commerce business and the AI and technology business,

the Company, through one of its wholly-owned PRC subsidiaries,

entered into a partnership agreement to form a PRC limited

partnership enterprise for future equity investment (the

“Partnership”), in which the Company served as a limited partner

and committed to subscribing for 43.29% of the interests in the

Partnership for an aggregate capital contribution of RMB100.0

million. Up to the date of this press release, the Company has

fulfilled its initial capital contribution of RMB3.0 million.

Conference Call Information

The Company's management team will hold a

conference call at 7:00 A.M. Eastern Time on Thursday, June 6, 2024

(7:00 P.M. Beijing Time on the same day) to discuss the financial

results. Listeners may access the call by dialing the following

numbers:

|

International: |

1-412-902-4272 |

| United States Toll Free: |

1-888-346-8982 |

| Mainland China Toll Free: |

4001-201203 |

| Hong Kong Toll Free: |

800-905945 |

| Conference ID: |

QuantaSing Group Limited |

| |

|

The replay will be accessible through June 13,

2024 by dialing the following numbers:

|

International: |

1-412-317-0088 |

| United States Toll Free: |

1-877-344-7529 |

| Access Code: |

7529094 |

| |

|

A live and archived webcast of the conference

call will be available at the Company's investor relations website

at https://ir.quantasing.com.

Non-GAAP Financial Measures

To supplement the Company’s consolidated

financial statements, which are prepared and presented in

accordance with U.S. GAAP, the Company uses gross billings of

individual online learning services, adjusted net income/(loss) and

basic and diluted adjusted net income/(loss) per ordinary share as

its non-GAAP financial measures. Gross billings of individual

online learning services for a specific period represents revenues

of the Company’s individual online learning services net of the

changes in deferred revenues in such period, further adjusted by

value-added tax in such period. Adjusted net income/(loss)

represents net (loss)/income excluding share-based compensation

expense. Basic and diluted adjusted net income/(loss) per ordinary

share represents adjusted net income/(loss) attributable to

ordinary shareholders of QuantaSing Group Limited divided by

weighted average number of ordinary shares outstanding during the

periods used in computing adjusted net income/(loss) per ordinary

share, basic and diluted. The Company believes that the non-GAAP

financial measures provide useful information about the Company's

results of operations, enhance the overall understanding of the

Company's past performance and future prospects and allow for

greater visibility with respect to key metrics used by the

Company's management in its financial and operational

decision-making.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP.

The non-GAAP financial measures have limitations as analytical

tools, and when assessing the Company's operating performance,

investors should not consider them in isolation, or as a substitute

for revenue, net (loss)/income, net (loss)/income per ordinary

share, basic and diluted or other consolidated statements of

operations data prepared in accordance with U.S. GAAP. The

Company's definition of non-GAAP financial measures may differ from

those of industry peers and may not be comparable with their

non-GAAP financial measures.

The Company mitigates these limitations by

reconciling the non-GAAP financial measures to the most comparable

U.S. GAAP performance measures, all of which should be considered

when evaluating the Company's performance. For more information on

these non-GAAP financial measures, please see the table captioned

“QuantaSing Group Limited Unaudited Reconciliation of GAAP and

Non-GAAP Results” near the end of this release.

Exchange Rate Information

This announcement contains translations of

certain Renminbi (“RMB”) amounts into U.S. dollars (“US$”) at

specified rates solely for the convenience of the reader. Unless

otherwise stated, all translations from Renminbi to U.S. dollars

were made at the rate of RMB7.2203 to US$1.00, the exchange rate on

March 29, 2024, set forth in the H.10 statistical release of the

Federal Reserve Board. The Company makes no representation that the

Renminbi or U.S. dollars amounts referred to could be converted

into U.S. dollars or Renminbi, as the case may be, at any

particular rate or at all.

Safe Harbor Statements

This announcement contains forward-looking

statements within the meaning of Section 27A of Securities Act of

1933, as amended and Section 21E of the Securities Exchange Act of

1934, as amended and the Private Securities Litigation Reform Act

of 1955. All statements other than statements of historical or

current fact included in this press release are forward-looking

statements, including but not limited to statements regarding

QuantaSing’s financial outlook, beliefs and expectations. These

statements can be identified by terminology such as “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates,” “potential,” “continue,” “ongoing,” “targets,”

“guidance” and similar statements. Among other things, the

Financial Outlook in this announcement contains forward-looking

statements. The Company may also make written or oral

forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission (the “SEC”), in its annual

report to shareholders, in press releases, and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to the

following: the Company’s growth strategies; its future business

development, results of operations and financial condition; its

ability to attract and retain new users and learners and to

increase the spending and revenues generated from users and

learners; its ability to maintain and enhance the recognition and

reputation of its brand; its expectations regarding demand for and

market acceptance of its services and products; trends and

competition in China’s adult learning market; changes in its

revenues and certain cost or expense items; the expected growth of

China’s adult learning market; PRC governmental policies and

regulations relating to the Company’s business and industry,

general economic and political conditions in China and globally,

and assumptions underlying or related to any of the foregoing.

Further information regarding these and other risks, uncertainties,

or factors is included in the Company’s filings with the SEC,

including, without limitation, the final prospectus related to the

IPO filed with the SEC dated January 24, 2023. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date this press release. All

forward-looking statements are qualified in their entirety by this

cautionary statement, and the Company undertakes no obligation to

revise or update any forward-looking statements to reflect events

or circumstances after the date hereof.

About QuantaSing Group Limited

QuantaSing is a leading online service provider

in China dedicated to improving people’s quality of life and

well-being by providing lifelong personal learning and development

opportunities. The Company is the largest service provider in

China’s online adult learning market and China’s adult personal

interest learning market in terms of revenue, according to a report

by Frost & Sullivan based on data from 2022. By leveraging its

proprietary tools and technology, QuantaSing offers

easy-to-understand, affordable, and accessible online courses to

adult learners, empowering users to pursue personal development.

Leveraging its extensive experience in individual online learning

services and its robust technology infrastructure, the Company has

expanded its services to corporate clients, and diversified its

operations into its e-commerce business and its AI and technology

business.

For more information, please visit:

https://ir.quantasing.com.

Contact

Investor Relations Leah Guo QuantaSing Group Limited Email:

ir@quantasing.com Tel: +86 (10) 6493-7857

Robin Yang, Partner ICR, LLC Email:

QuantaSing.IR@icrinc.com Phone: +1 (212) 537-0429

________________________________

1 Gross billings of individual online learning

services is a non-GAAP financial measure. For a reconciliation of

revenues of individual online learning services to gross billings

of individual online learning services, see the “Non-GAAP Financial

Measures” section and the table captioned “QuantaSing Group Limited

Unaudited Reconciliation of GAAP and Non-GAAP Results”

below. 2 Adjusted net income/(loss) is a non-GAAP financial

measure. For a reconciliation of net (loss)/income to adjusted net

income/(loss), see the “Non-GAAP Financial Measures” section and

the table captioned “QuantaSing Group Limited Unaudited

Reconciliation of GAAP and Non-GAAP Results” below. 3 The

Company has adopted a new presentation of its revenues since the

second quarter of FY 2024, which split other personal interest

courses into skills upgrading courses and recreation and leisure

courses, to better align with its business strategies and provide

useful and updated information to investors. Skills upgrading

courses mainly include short-video production courses and memory

training courses. Recreation and leisure courses mainly include

personal well-being courses, electronic keyboard courses and

standing meditation courses. The historical revenues presentation

has been conformed to the current presentation. 4 Basic and

diluted adjusted net income/(loss) per ordinary share are non-GAAP

financial measures. For a reconciliation of basic and diluted net

(loss)/income per ordinary share to basic and diluted adjusted net

income/(loss) per ordinary share, see the “Non-GAAP Financial

Measures” section and the table captioned “QuantaSing Group Limited

Unaudited Reconciliation of GAAP and Non-GAAP Results” below.

|

QUANTASING GROUP LIMITEDUNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS(Amounts in

thousands, except for share and per share data) |

| |

| |

As of |

|

|

June 30,2023 |

|

March 31,2024 |

|

March 31,2024 |

| |

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

| ASSETS |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

764,281 |

|

971,575 |

|

134,562 |

|

Short-term investments |

166,303 |

|

178,367 |

|

24,704 |

|

Accounts receivable, net |

12,251 |

|

28,564 |

|

3,956 |

|

Amounts due from related parties |

29,116 |

|

2,291 |

|

317 |

|

Inventory, net |

- |

|

7,185 |

|

995 |

|

Prepayments and other current assets |

136,681 |

|

182,877 |

|

25,328 |

| Total current

assets |

1,108,632 |

|

1,370,859 |

|

189,862 |

| |

|

|

|

|

|

| Non-current

assets: |

|

|

|

|

|

|

Property and equipment, net |

7,409 |

|

6,700 |

|

928 |

|

Intangible assets, net |

- |

|

2,807 |

|

389 |

|

Operating lease right-of-use assets |

84,009 |

|

64,891 |

|

8,987 |

|

Deferred tax assets |

2,084 |

|

13,721 |

|

1,900 |

|

Goodwill |

- |

|

7,389 |

|

1,023 |

|

Other non-current assets |

21,296 |

|

21,365 |

|

2,959 |

| Total non-current

assets |

114,798 |

|

116,873 |

|

16,186 |

| TOTAL

ASSETS |

1,223,430 |

|

1,487,732 |

|

206,048 |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Accounts payables |

62,094 |

|

87,001 |

|

12,049 |

|

Accrued expenses and other current liabilities |

171,160 |

|

222,664 |

|

30,839 |

|

Income tax payable |

8,794 |

|

5,103 |

|

707 |

|

Contract liabilities, current portion |

517,213 |

|

527,948 |

|

73,120 |

|

Advance from customers |

144,397 |

|

201,124 |

|

27,855 |

|

Operating lease liabilities, current portion |

41,092 |

|

46,277 |

|

6,409 |

| Total current

liabilities |

944,750 |

|

1,090,117 |

|

150,979 |

|

|

|

|

|

|

|

| Non-current

liabilities: |

|

|

|

|

|

|

Contract liabilities, non-current portion |

7 |

|

- |

|

- |

|

Operating lease liabilities, non-current portion |

52,840 |

|

29,359 |

|

4,066 |

| Total non-current

liabilities |

52,847 |

|

29,359 |

|

4,066 |

| TOTAL

LIABILITIES |

997,597 |

|

1,119,476 |

|

155,045 |

|

QUANTASING GROUP LIMITEDUNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS -

continued(Amounts in thousands, except for share

and per share data) |

| |

| |

As of |

| |

June 30,2023 |

|

March 31,2024 |

|

March 31,2024 |

| |

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

| SHAREHOLDERS’

EQUITY |

|

|

|

|

|

|

Class A ordinary shares |

78 |

|

|

81 |

|

|

11 |

|

|

Class B ordinary shares |

34 |

|

|

34 |

|

|

5 |

|

| Treasury stock |

- |

|

|

(75,189 |

) |

|

(10,414 |

) |

| Additional paid-in

capital |

1,171,092 |

|

|

1,206,870 |

|

|

167,150 |

|

| Accumulated other

comprehensive income |

22,182 |

|

|

17,228 |

|

|

2,386 |

|

| Accumulative deficit |

(969,688 |

) |

|

(780,768 |

) |

|

(108,135 |

) |

| TOTAL QUANTASING GROUP

LIMITED SHAREHOLDERS’ EQUITY |

223,698 |

|

|

368,256 |

|

|

51,003 |

|

| Non-controlling interests |

2,135 |

|

|

- |

|

|

- |

|

| TOTAL SHAREHOLDERS’

EQUITY |

225,833 |

|

|

368,256 |

|

|

51,003 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

1,223,430 |

|

|

1,487,732 |

|

|

206,048 |

|

|

QUANTASING GROUP LIMITEDUNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME/(LOSS)(Amounts in thousands, except for

shares and per share data) |

|

|

|

|

For the Three MonthsEnded March

31, |

|

For the Nine MonthsEnded March

31, |

|

|

2023 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2024 |

|

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

807,243 |

|

|

945,570 |

|

|

130,960 |

|

|

2,253,034 |

|

|

2,795,248 |

|

|

387,137 |

|

| Cost of revenues |

(101,057 |

) |

|

(145,848 |

) |

|

(20,200 |

) |

|

(275,372 |

) |

|

(409,058 |

) |

|

(56,654 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

706,186 |

|

|

799,722 |

|

|

110,760 |

|

|

1,977,662 |

|

|

2,386,190 |

|

|

330,483 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

(631,380 |

) |

|

(729,620 |

) |

|

(101,051 |

) |

|

(1,835,439 |

) |

|

(2,006,884 |

) |

|

(277,950 |

) |

|

Research and development expenses |

(49,601 |

) |

|

(38,840 |

) |

|

(5,379 |

) |

|

(166,171 |

) |

|

(123,655 |

) |

|

(17,126 |

) |

|

General and administrative expenses |

(48,309 |

) |

|

(36,390 |

) |

|

(5,040 |

) |

|

(137,225 |

) |

|

(114,211 |

) |

|

(15,818 |

) |

|

Total operating expenses |

(729,290 |

) |

|

(804,850 |

) |

|

(111,470 |

) |

|

(2,138,835 |

) |

|

(2,244,750 |

) |

|

(310,894 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss)/Income from

operations |

(23,104 |

) |

|

(5,128 |

) |

|

(710 |

) |

|

(161,173 |

) |

|

141,440 |

|

|

19,589 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other

income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

1,811 |

|

|

2,513 |

|

|

348 |

|

|

2,659 |

|

|

8,369 |

|

|

1,159 |

|

|

Others, net |

5,206 |

|

|

7,685 |

|

|

1,064 |

|

|

15,158 |

|

|

22,163 |

|

|

3,070 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(Loss)/Income before income tax |

(16,087 |

) |

|

5,070 |

|

|

702 |

|

|

(143,356 |

) |

|

171,972 |

|

|

23,818 |

|

|

Income tax (expense)/benefit |

(6,576 |

) |

|

9,560 |

|

|

1,324 |

|

|

(17,986 |

) |

|

16,948 |

|

|

2,347 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/

income |

(22,663 |

) |

|

14,630 |

|

|

2,026 |

|

|

(161,342 |

) |

|

188,920 |

|

|

26,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income/(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments, net of nil tax |

3,461 |

|

|

423 |

|

|

59 |

|

|

4,798 |

|

|

(4,954 |

) |

|

(686 |

) |

| Total other

comprehensive income/(loss) |

3,461 |

|

|

423 |

|

|

59 |

|

|

4,798 |

|

|

(4,954 |

) |

|

(686 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive

(loss)/income |

(19,202 |

) |

|

15,053 |

|

|

2,085 |

|

|

(156,544 |

) |

|

183,966 |

|

|

25,479 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

(loss)/Income |

(22,663 |

) |

|

14,630 |

|

|

2,026 |

|

|

(161,342 |

) |

|

188,920 |

|

|

26,165 |

|

|

Accretion of the Company’s preferred shares |

(2,867 |

) |

|

- |

|

|

- |

|

|

(22,379 |

) |

|

- |

|

|

- |

|

| Net (loss)/income

attributable to ordinary shareholders of QuantaSing Group

Limited |

(25,530 |

) |

|

14,630 |

|

|

2,026 |

|

|

(183,721 |

) |

|

188,920 |

|

|

26,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/income per

ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

- Basic |

(0.19 |

) |

|

0.09 |

|

|

0.01 |

|

|

(2.23 |

) |

|

1.14 |

|

|

0.16 |

|

|

- Diluted |

(0.19 |

) |

|

0.09 |

|

|

0.01 |

|

|

(2.23 |

) |

|

1.10 |

|

|

0.15 |

|

| Weighted average

number of ordinary shares used in computing net (loss)/income per

ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

- Basic |

135,768,739 |

|

|

164,753,256 |

|

|

164,753,256 |

|

|

82,295,042 |

|

|

166,399,349 |

|

|

166,399,349 |

|

|

- Diluted |

135,768,739 |

|

|

170,890,581 |

|

|

170,890,581 |

|

|

82,295,042 |

|

|

171,089,530 |

|

|

171,089,530 |

|

| Share-based

compensation expenses included in |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

(7,560 |

) |

|

(2,878 |

) |

|

(399 |

) |

|

(19,523 |

) |

|

(9,945 |

) |

|

(1,377 |

) |

|

Sales and marketing expenses |

(12,318 |

) |

|

(2,779 |

) |

|

(385 |

) |

|

(39,934 |

) |

|

8,678 |

|

|

1,202 |

|

|

Research and development expenses |

(8,762 |

) |

|

(3,599 |

) |

|

(498 |

) |

|

(41,269 |

) |

|

(10,611 |

) |

|

(1,470 |

) |

|

General and administrative expenses |

(15,719 |

) |

|

(8,039 |

) |

|

(1,113 |

) |

|

(53,167 |

) |

|

(28,961 |

) |

|

(4,011 |

) |

|

QUANTASING GROUP LIMITEDUNAUDITED

RECONCILIATION OF GAAP AND NON-GAAP

RESULTS(Amounts in thousands, except for shares

and per share data) |

| |

| The following

table below sets forth a reconciliation of revenues to gross

billings for the periods indicated: |

|

|

|

|

For the Three MonthsEnded March

31, |

|

For the Nine MonthsEnded March

31, |

|

|

2023 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2024 |

|

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues of individual online learning

services: |

724,716 |

|

|

828,127 |

|

|

114,694 |

|

|

2,013,784 |

|

|

2,457,588 |

|

|

340,372 |

|

| Add: value-added tax |

46,213 |

|

|

52,986 |

|

|

7,338 |

|

|

127,929 |

|

|

147,665 |

|

|

20,451 |

|

| Add: ending deferred

revenues(1) |

677,272 |

|

|

744,320 |

|

|

103,087 |

|

|

677,272 |

|

|

744,320 |

|

|

103,087 |

|

| Less: beginning deferred

revenues(1) |

(644,586 |

) |

|

(643,929 |

) |

|

(89,183 |

) |

|

(531,662 |

) |

|

(661,360 |

) |

|

(91,597 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Gross billings of

individual online learning services |

803,615 |

|

|

981,504 |

|

|

135,936 |

|

|

2,287,323 |

|

|

2,688,213 |

|

|

372,313 |

|

(1) Deferred revenues include contract liabilities, advance from

customers, and refund liability of individual online learning

services included in “accrued expenses and other current

liabilities.”

|

|

|

QUANTASING GROUP LIMITEDUNAUDITED

RECONCILIATION OF GAAP AND NON-GAAP RESULTS -

continued(Amounts in thousands, except for shares

and per share data) |

| |

| The following

table below sets forth a reconciliation of net (loss)/income to

adjusted net income/(loss) and basic and diluted net (loss)/income

per ordinary share to basic and diluted adjusted net income/(loss)

per ordinary share for the periods indicated: |

|

|

|

|

For the Three Months Ended March

31, |

|

For Nine Months Ended March

31, |

|

|

2023 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2024 |

|

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss)/income |

(22,663 |

) |

|

14,630 |

|

2,026 |

|

(161,342 |

) |

|

188,920 |

|

26,165 |

| Add: Share-based

compensation |

44,359 |

|

|

17,295 |

|

2,395 |

|

153,893 |

|

|

40,839 |

|

5,656 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net

income/(loss) |

21,696 |

|

|

31,925 |

|

4,421 |

|

(7,449 |

) |

|

229,759 |

|

31,821 |

|

Accretion of the Company’s preferred shares |

(2,867 |

) |

|

- |

|

- |

|

(22,379 |

) |

|

- |

|

- |

|

Income allocation to participating preferred shares |

(3,431 |

) |

|

- |

|

- |

|

- |

|

|

- |

|

- |

| Adjusted net

income/(loss) attributable to ordinary shareholders of QuantaSing

Group Limited |

15,398 |

|

|

31,925 |

|

4,421 |

|

(29,828 |

) |

|

229,759 |

|

31,821 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of ordinary shares used in computing net (loss)/income per

ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

- Basic |

135,768,739 |

|

|

164,753,256 |

|

164,753,256 |

|

82,295,042 |

|

|

166,399,349 |

|

166,399,349 |

|

- Diluted |

135,768,739 |

|

|

170,890,581 |

|

170,890,581 |

|

82,295,042 |

|

|

171,089,530 |

|

171,089,530 |

| Weighted average

number of ordinary shares used in computing adjusted net

income/(loss) per ordinary

share |

|

|

|

|

|

|

|

|

|

|

|

|

- Basic |

135,768,739 |

|

|

164,753,256 |

|

164,753,256 |

|

82,295,042 |

|

|

166,399,349 |

|

166,399,349 |

|

- Diluted |

142,354,949 |

|

|

170,890,581 |

|

170,890,581 |

|

82,295,042 |

|

|

171,089,530 |

|

171,089,530 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/income per

ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

- Basic |

(0.19 |

) |

|

0.09 |

|

0.01 |

|

(2.23 |

) |

|

1.14 |

|

0.16 |

|

- Diluted |

(0.19 |

) |

|

0.09 |

|

0.01 |

|

(2.23 |

) |

|

1.10 |

|

0.15 |

| Non-GAAP adjustments

to net (loss)/income per ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

- Basic |

0.30 |

|

|

0.10 |

|

0.02 |

|

1.87 |

|

|

0.24 |

|

0.03 |

|

- Diluted |

0.30 |

|

|

0.10 |

|

0.02 |

|

1.87 |

|

|

0.24 |

|

0.04 |

| Adjusted net

income/(loss) per ordinary

share |

|

|

|

|

|

|

|

|

|

|

|

|

- Basic |

0.11 |

|

|

0.19 |

|

0.03 |

|

(0.36 |

) |

|

1.38 |

|

0.19 |

|

- Diluted |

0.11 |

|

|

0.19 |

|

0.03 |

|

(0.36 |

) |

|

1.34 |

|

0.19 |

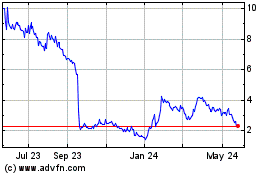

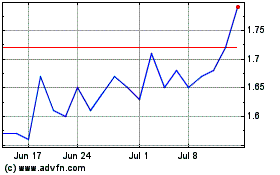

QuantaSing (NASDAQ:QSG)

Historical Stock Chart

From Oct 2024 to Nov 2024

QuantaSing (NASDAQ:QSG)

Historical Stock Chart

From Nov 2023 to Nov 2024