Redfin Reports 65% of Home Listings Have Been Sitting on the Market Longer Than a Month, Up From 60% a Year Ago

24 July 2024 - 10:00PM

Business Wire

More listings are growing stale because high

housing costs are dampening demand, while the supply of homes for

sale is growing

(NASDAQ: RDFN) — Nearly two-thirds (64.7%) of homes that were on

the market in June had been listed for at least 30 days without

going under contract, according to a new report from Redfin

(redfin.com), the technology-powered real estate brokerage. That’s

up from 59.6% a year earlier, marking the biggest annual increase

in a year, and the highest share of any June since 2020.

June was the fourth straight month in which the portion of homes

sitting on the market for at least one month ticked up on a

year-over-year basis. Less-desirable listings are sitting on the

market, causing unsold inventory to pile up.

More homes are sitting on the market without finding a buyer

because record high home prices and elevated mortgage rates are

giving buyers cold feet. And while demand is slow, supply is

relatively high. The total number of homes for sale posted its

biggest year-over-year gain on record in June because even though

new listings are losing steam, many listings are sitting on the

market, causing inventory to pile up.

“Overall, the market is fairly stagnant,” said Shay Stein, a

Redfin Premier agent in Las Vegas. “There are more listings hitting

the market, but a lot of them aren’t in good condition or they’re

not in a desirable neighborhood—and sellers are pricing

unrealistically high. A lot of sellers are willing to let their

home sit on the market until they get the price they want, and a

lot of buyers aren’t willing to pay sky-high prices when mortgage

rates are still high. My advice to serious sellers is to price

fairly and make cosmetic repairs before listing.”

Stein noted that move-in ready, relatively affordable homes in

popular neighborhoods, along with luxury homes that are priced

fairly and don’t need work, are still getting multiple offers and

selling quickly.

Stale inventory is growing fastest in Texas and

Florida

In Dallas, 63% of listings sat on the market for at least 30

days in June, up from 52% a year earlier, the biggest uptick of all

the major U.S. metros. It’s followed by four Florida metros: Tampa,

where 70% of homes on the market in June had been listed at least

30 days without going under contract, up from 60%, Fort Lauderdale

(77%, up from 68%), Jacksonville (70%, up from 61%) and Orlando

(69%, up from 60%).

There are a few reasons Florida and Texas are seeing the biggest

increase in unsold inventory. Those states are building more new

homes than other parts of the country, adding to overall home

supply at a time when demand is fairly slow due to high housing

costs, including skyrocketing insurance and HOA prices.

The share of stale home listings increased year over year in 44

of the 50 most populous U.S. metros, and declined in just

five—though the decreases were small.

In Nassau County, NY, 57% of listings sat on the market for at

least 30 days without going under contract, down from just over 58%

a year earlier. Next come New York (70%, down from 72%), Las Vegas

(59%, down from 60%), Newark, NJ (53.5%, down from 54.1%) and

Warren, MI (50.6%, down from 51%). The share was essentially flat

in Philadelphia (66.4%).

Over 40% of U.S. home listings sat on the market for at least

60 days in June

Nationwide, more than two in five (42.6%) homes that were on the

market in June had been listed for at least 60 days without going

under contract, up from 38.4% a year earlier—the biggest annual

increase in nearly a year. June is the third straight month in

which the share of homes sitting on the market for at least two

months has risen.

To view the full report, including charts, methodology and more

metro-level data, please visit:

https://www.redfin.com/news/stale-inventory-june-2024

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate

company. We help people find a place to live with brokerage,

rentals, lending, title insurance, and renovations services. We run

the country's #1 real estate brokerage site. Our customers can save

thousands in fees while working with a top agent. Our home-buying

customers see homes first with on-demand tours, and our lending and

title services help them close quickly. Customers selling a home

can have our renovations crew fix it up to sell for top dollar. Our

rentals business empowers millions nationwide to find apartments

and houses for rent. Since launching in 2006, we've saved customers

more than $1.6 billion in commissions. We serve more than 100

markets across the U.S. and Canada and employ over 4,000

people.

Redfin’s subsidiaries and affiliated brands include: Bay Equity

Home Loans®, Rent.™, Apartment Guide®, Title Forward® and

WalkScore®.

For more information or to contact a local Redfin real estate

agent, visit www.redfin.com. To learn about housing market trends

and download data, visit the Redfin Data Center. To be added to

Redfin's press release distribution list, email press@redfin.com.

To view Redfin's press center, click here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724266984/en/

Redfin Journalist Services: Kenneth Applewhaite

press@redfin.com

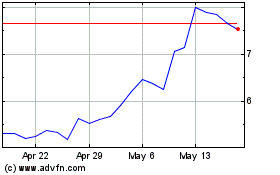

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Nov 2023 to Nov 2024