Los Angeles, San Diego and New York have the

highest shares of renter households, while Worcester, MA, North

Port, FL and Albany, NY have the lowest

(NASDAQ: RDFN) — The number of renter households in America grew

1.9% year over year in the second quarter to a record 45.2 million,

according to a new report from Redfin (redfin.com), the

technology-powered real estate brokerage. That’s over three times

faster than the number of homeowner households, which grew 0.6% to

a record 86.3 million.

The number of renter households grew at the second-fastest pace

since 2021, while the number of homeowner households grew at the

slowest pace since 2019.

Growth in the number of renter households hit a peak of 2.8% in

the first quarter of 2024. That was the largest gain since

2015.

This is based on a Redfin analysis of U.S. Census Bureau data

going back to 1994. A renter household is defined as one where the

head of the household reports to the Census that they are renting

out the property, while a homeowner household is one where the head

of household reports they own the property. The number of homeowner

and renter households are both at record highs because the U.S.

population is at a record high.

Renter households have formed faster than homeowner households

for three straight quarters, partly because homebuying costs have

risen much faster than rents.

The median apartment asking rent increased less than 1% year

over year in June, while the median monthly mortgage payment jumped

roughly 5%. Asking rents were 23% above pre-pandemic (June 2019)

levels, while mortgage payments were 90% above pre-pandemic levels.

Mortgage payments climbed because home prices hit a record high,

and mortgage rates, while below their recent peak, were more than

double the all-time low hit during the pandemic. While homebuying

costs did come down a bit in July, that has yet to bring buyers off

of the sidelines.

“The cost of both renting and buying a home has skyrocketed in

recent years, but the affordability crunch isn’t quite as severe in

the rental market. That’s because America has been building a lot

of apartments to keep pace with robust demand from renters,” said

Redfin Senior Economist Sheharyar Bokhari. “The country’s leaders

should heed this lesson when considering how to improve

affordability in the homebuying market: When there’s more housing

to go around, prices don’t increase as fast.”

It’s important to note that while rents aren’t growing as

quickly as homebuying costs, finding an affordable place to live is

still a challenge for many renters. June’s $1,654 median U.S.

asking rent was the highest since October 2022 and only $46 below

the all-time high. Nearly two in five renters don’t think they’ll

ever own a home.

Renters may be able to find deals in Austin, TX and many parts

of Florida, where rents are falling, but Florida faces intensifying

risk from natural disasters and an insurance crisis.

America Has Been on a Multifamily Building Spree, But That

Could Come to an End Soon

America has added a lot of renter households over the past

year—855,000, to be exact. But it also has ramped up construction,

which has helped accommodate that rise in demand and limit rent

growth. The country is adding new multifamily housing units at an

annual rate of 563,000 (as of the second quarter)—the second

fastest pace in records dating back to 1994. The fastest pace was

in the first quarter of 2024.

America still faces a housing shortage, but the recent boom in

multifamily construction has helped narrow the gap. Multifamily

building completions are at historic highs because many projects

started during the pandemic housing frenzy are just now being

finished. But it’s worth noting that multifamily building permits

and starts have slowed significantly, which could cause asking

rents to jump again in the coming years.

Over Half of Households In Los Angeles Rent—the Highest Rate

in the U.S.

Nationwide, just over one-third (34.4%) of households in the

U.S. are renter households—a figure that has remained fairly steady

over time. The share is much higher in coastal metros where it’s

expensive to buy a home.

Los Angeles has a rentership rate of 53%—the highest among the

75 largest U.S. metropolitan areas. It’s followed by San Diego

(52.4%) New York (50.1%), Fresno, CA (49%) and Austin, TX (46.3%).

Fresno is the outlier in the group; it’s not nearly as expensive

as, say, Los Angeles or San Diego. But over 20% of residents in

Fresno County live below the poverty line—nearly double the

statewide share—making it challenging for many people to own a

home.

Rentership rates are lower than average in parts of the country

where it’s more affordable to buy a home. In Worcester, MA, 23.2%

of households are renter households—the lowest share among the

metros Redfin analyzed. It’s followed by North Port, FL (23.3%),

Albany, NY (25.6%), Rochester, NY (25.7%) and Syracuse, NY

(26.2%).

To view the full report, including charts, please visit:

https://www.redfin.com/news/renter-household-growth-2024

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate

company. We help people find a place to live with brokerage,

rentals, lending, title insurance, and renovations services. We run

the country's #1 real estate brokerage site. Our customers can save

thousands in fees while working with a top agent. Our home-buying

customers see homes first with on-demand tours, and our lending and

title services help them close quickly. Customers selling a home

can have our renovations crew fix it up to sell for top dollar. Our

rentals business empowers millions nationwide to find apartments

and houses for rent. Since launching in 2006, we've saved customers

more than $1.6 billion in commissions. We serve more than 100

markets across the U.S. and Canada and employ over 4,000

people.

Redfin’s subsidiaries and affiliated brands include: Bay Equity

Home Loans®, Rent.™, Apartment Guide®, Title Forward® and

WalkScore®.

For more information or to contact a local Redfin real estate

agent, visit www.redfin.com. To learn about housing market trends

and download data, visit the Redfin Data Center. To be added to

Redfin's press release distribution list, email press@redfin.com.

To view Redfin's press center, click here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240802527568/en/

Redfin Journalist Services: Kenneth Applewhaite

press@redfin.com

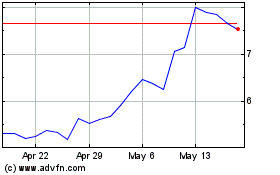

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Nov 2023 to Nov 2024