Real’s December Agent Survey: Growing Optimism for Market Recovery

22 January 2025 - 11:30PM

Business Wire

Survey Highlights Expectations for Continued

Commission Rate Stability in 2025

The Real Brokerage Inc. (NASDAQ: REAX, “Real”), a technology

platform reshaping real estate for agents, home buyers, and

sellers, today released results from its December 2024 Agent

Survey. The survey highlights growing agent confidence as 2025

begins, with the Agent Optimism Index reaching a new high. Despite

continued affordability challenges and constrained inventory,

agents are signaling expectations for a market recovery in

2025.

"Our agents’ outlook for 2025 signals a turning point for the

industry," said Tamir Poleg, Chairman and CEO of Real. "Even in an

elevated rate environment, agents are preparing for recovery as the

housing market emerges from two years of historically low

transaction activity."

“As we enter 2025, agents’ insights point to a market regaining

balance and positioning itself for sustained recovery,” said

Sharran Srivatsaa, President of Real. “At the same time, our data

continues to show stability in commission rates, underscoring the

critical role agents play in navigating buyers and sellers through

today’s dynamic market.”

Key Survey Findings: Commission Rate Trends

- Buy-Side Commission Rates Showed Stability Despite Market

Challenges in 2024: Over half (55%) of U.S. agents reported no

significant changes in buy-side commission rates compared to 2023,

reflecting relative stability despite a challenging market.

However, 16% of agents reported slight decreases (less than 0.25%

of the total transaction value), while 8% reported more significant

declines. Meanwhile, 9% of respondents noted increases in buy-side

commission rates. In Canada, stability was even more pronounced,

with 82% of agents reporting no meaningful change.

- 2025 Buy-Side Commission Rates Expected to Stay Largely

Steady: Looking ahead, 52% of U.S. agents expect no meaningful

change in buy-side commission rates in 2025. While 20% anticipate

slight decreases and 5% foresee more significant reductions, 13%

predict increases, indicating that the net impact may be limited

overall.

- Listing-Side Commission Rates Reflected Even Greater

Stability in 2024: Sixty-four percent (64%) of U.S. agents

reported no meaningful changes in listing-side commission rates in

2024, while 13% observed declines and 15% noted increases. In

Canada, stability was even stronger, with 78% of agents indicating

no changes in listing-side commission rates.

- Agents Expect Minimal Change to Listing-Side Commissions in

2025: For 2025, 60% of U.S. agents expect listing-side

commission rates to remain unchanged. Among the remainder, 18%

foresee increases, while 13% anticipate decreases. Compared to the

buy-side, agents expressed somewhat greater confidence in the

relative stability of listing-side commission rates, indicating

less expectation for change across most markets.

Key Survey Findings: Market Trends and Insights

- Agent Optimism Index Closes Out 2024 at a New High: The

Agent Optimism Index, which measures agents’ sentiment about their

local market outlook over the next 12 months, rose to 76.4 in

December, up from 73.1 in November. This marks the highest reading

of the year, with a score above 50 signaling a net positive

outlook. In December, 52% of agents reported feeling more

optimistic compared to the previous month, and an additional 29%

felt significantly more optimistic. Only 4% of agents felt more

pessimistic, while 15% were neutral.

- Market Conditions Reflect Balance as Year Ends: Thirty

percent (30%) of agents described their market as a buyer’s market

in December, down slightly from 32% in November. Seller-dominated

markets also held relatively steady at 30%, up from 29% in

November. Forty percent (40%) of agents cited balanced market

conditions, showing a slight increase from 38% the prior

month.

- Affordability Remains a Key Concern: Affordability was

identified as the biggest hurdle for prospective homebuyers by 59%

of agents in December, down slightly from 62% in November.

Inventory constraints rose to 23% from 19% the prior month, while

economic uncertainty eased to 10% of respondents from 13%. Buyer

competition remained low, with 4% of agents citing it as a key

challenge.

- Transaction Growth Index Shows Modest Contraction: The

Transaction Growth Index, which tracks year-over-year changes in

home sales activity, dipped slightly to 47.7 in December from 48.3

in November. A score below 50 indicates a year-over-year

contraction in transaction activity. Canada continued to show

modest expansion, with an index score of 56.7, despite a slight dip

from November’s 61.0. The U.S. index edged down to 46.8 from 46.9,

signaling a narrow decline as agents prepare for recovery.

A summary presentation of these results can be found on Real’s

investor relations website at the link here.

About the Survey The Real Brokerage December 2024 Agent

Survey included responses from over 500 real estate agents across

the United States and Canada and was conducted between December 31,

2024 and January 7, 2025. Responses to questions regarding

transaction growth and agent optimism were calibrated on a 0-100

point index scale, with readings above 50 indicating an improving

trend, whereas readings below 50 indicate a declining trend.

Responses are meant to capture industry-level information and are

not meant to serve as an indication of Real’s company-specific

growth trends. Additionally, given the smaller sample size, there

can be greater variability in Canada index results on a

month-to-month basis.

About Real Real (NASDAQ: REAX) is a real estate

experience company working to make life’s most complex transaction

simple. The fast-growing company combines essential real estate,

mortgage and closing services with powerful technology to deliver a

single seamless end-to-end consumer experience, guided by trusted

agents. With a presence in all 50 states throughout the U.S. and

Canada, Real supports over 24,000 agents who use its digital

brokerage platform and tight-knit professional community to power

their own forward-thinking businesses.

Forward-Looking Information This press release contains

forward-looking information within the meaning of applicable

Canadian securities laws. Forward-looking information is often, but

not always, identified by the use of words such as “seek”,

“anticipate”, “believe”, “plan”, “estimate”, “expect”, “likely” and

“intend” and statements that an event or result “may”, “will”,

“should”, “could” or “might” occur or be achieved and other similar

expressions. These statements reflect management’s current beliefs

and are based on information currently available to management as

of the date hereof. Forward-looking information in this press

release includes, without limiting the foregoing, expectations

regarding the residential real estate market in the U.S. and

Canada.

Forward-looking information is based on assumptions that may

prove to be incorrect, including but not limited to expectations

regarding 2025 market conditions. Real considers these assumptions

to be reasonable in the circumstances. However, forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that could cause actual results, performance or

achievements to differ materially from those expressed or implied

in the forward-looking information. Important factors that could

cause such differences include, but are not limited to, slowdowns

in real estate markets and economic and industry downturns. These

factors should be carefully considered and readers should not place

undue reliance on the forward-looking statements. Although the

forward-looking statements contained in this press release are

based upon what management believes to be reasonable assumptions,

Real cannot assure readers that actual results will be consistent

with these forward-looking statements. These forward-looking

statements are made as of the date of this press release, and Real

assumes no obligation to update or revise them to reflect new

events or circumstances, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122189976/en/

Investor inquiries, please contact: Ravi Jani Vice President,

Investor Relations and Financial Planning & Analysis

investors@therealbrokerage.com 908.280.2515

For media inquiries, please contact: Elisabeth Warrick Senior

Director, Marketing, Communications & Brand

press@therealbrokerage.com 201.564.4221

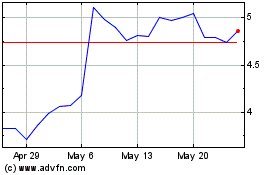

Real Brokerage (NASDAQ:REAX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Real Brokerage (NASDAQ:REAX)

Historical Stock Chart

From Jan 2024 to Jan 2025