FY

2024

--10-31

false

0000740664

0

3

1

0

0

0

333,333

666,666

0

0.25

4

0.25

4

0.25

4

2

2

1

0

0

0

2

1

5

0

0

0

0

5

3

false

false

false

false

R F INDUSTRIES LTD

00007406642023-11-012024-10-31

thunderdome:item

iso4217:USD

00007406642024-10-31

xbrli:pure

00007406642023-10-31

utr:M

00007406642022-11-012023-10-31

0000740664rfil:KAndKUnlimitedMember2024-10-31

utr:Y

0000740664srt:MaximumMember2024-10-31

0000740664srt:MinimumMember2024-10-31

0000740664rfil:RoyaltyPaymentsMemberrfil:ElmecMember2023-11-012024-10-31

0000740664rfil:RoyaltyPaymentsMemberrfil:ElmecMember2022-11-012023-10-31

0000740664rfil:KAndKUnlimitedMember2022-11-012023-10-31

0000740664rfil:KAndKUnlimitedMember2023-11-012024-10-31

0000740664rfil:KAndKUnlimitedMember2024-05-30

0000740664rfil:EBCCreditAgreementMember2024-10-31

0000740664us-gaap:OtherAssetsMemberrfil:EBCCreditAgreementMember2024-03-15

0000740664rfil:EBCCreditAgreementMember2024-03-152024-03-15

0000740664rfil:EBCCreditAgreementMember2024-03-15

0000740664rfil:EBCCreditAgreementMembersrt:MinimumMember2024-03-15

0000740664rfil:EBCRevolvingLoanFacilityMember2024-03-152024-03-15

0000740664rfil:EBCAdditionalLineMember2024-03-15

0000740664rfil:EBCAdditionalLineMemberrfil:AdjustedTermSOFRMember2024-03-152024-03-15

0000740664rfil:EBCRevolvingLoanFacilityMemberrfil:AdjustedTermSOFRMember2024-03-152024-03-15

0000740664rfil:EBCRevolvingLoanFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-03-152024-03-15

0000740664rfil:EBCAdditionalLineMember2024-08-31

0000740664rfil:EBCAdditionalLineMember2024-07-13

0000740664rfil:EBCAdditionalLineMember2024-06-14

0000740664rfil:SwingLineLoanMember2024-03-15

0000740664rfil:EBCRevolvingLoanFacilityMember2024-03-15

0000740664rfil:BankOfAmericaNaMember2024-02-29

0000740664rfil:BankOfAmericaNaMembersrt:MaximumMember2024-02-29

0000740664rfil:BankOfAmericaNaMember2024-03-01

0000740664rfil:BankOfAmericaNaMember2024-10-31

0000740664rfil:BankOfAmericaNaMember2024-01-26

0000740664rfil:BankOfAmericaNaMember2024-01-262024-01-26

0000740664rfil:BankOfAmericaNaMember2023-09-22

0000740664rfil:BankOfAmericaNaMember2022-02-28

0000740664rfil:BankOfAmericaNaMember2024-07-31

0000740664rfil:BankOfAmericaNaMember2024-04-30

0000740664rfil:BankOfAmericaNaMember2024-01-31

0000740664rfil:BankOfAmericaNaMember2023-10-31

0000740664rfil:BankOfAmericaNaMember2023-09-21

0000740664rfil:BankOfAmericaNaMember2022-02-012022-02-28

0000740664us-gaap:RevolvingCreditFacilityMember2022-02-012022-02-28

0000740664us-gaap:RestrictedStockMember2023-11-012024-10-31

0000740664rfil:IncentiveStockOptionsMember2023-11-012024-10-31

0000740664us-gaap:RestrictedStockMember2024-10-31

0000740664rfil:IncentiveStockOptionsMember2024-10-31

iso4217:USDxbrli:shares

xbrli:shares

00007406642022-10-31

0000740664rfil:IncentiveStockOptionsMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2023-11-012024-10-31

0000740664rfil:IncentiveStockOptionsMemberrfil:ThreeManagersMemberrfil:VestingOnApril162025Member2024-04-162024-04-16

0000740664rfil:IncentiveStockOptionsMemberrfil:ThreeManagersMember2024-04-162024-04-16

0000740664rfil:IncentiveStockOptionsMemberrfil:ThreeOfficersMemberrfil:VestingOnJanuary112025Member2024-01-112024-01-11

0000740664rfil:IncentiveStockOptionsMemberrfil:ThreeOfficersMember2024-01-112024-01-11

0000740664rfil:IncentiveStockOptionsMembersrt:ChiefOperatingOfficerMember2024-01-112024-01-11

0000740664rfil:IncentiveStockOptionsMembersrt:ChiefFinancialOfficerMember2024-01-112024-01-11

0000740664rfil:IncentiveStockOptionsMembersrt:ChiefExecutiveOfficerMember2024-01-112024-01-11

0000740664rfil:IncentiveStockOptionsMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2023-08-292023-08-29

0000740664rfil:RestrictedStockAndIncentiveStockOptionsMemberrfil:AnotherManagerMember2021-01-122021-01-12

0000740664rfil:IncentiveStockOptionsMemberrfil:AnotherManagerMember2023-01-122023-10-31

0000740664rfil:IncentiveStockOptionsMemberrfil:AnotherManagerMember2023-01-112023-01-11

0000740664rfil:RestrictedStockAndIncentiveStockOptionsMemberrfil:OneManagerAndThreeOfficersMemberrfil:VestingOnJanuary102024Member2023-01-112023-01-11

0000740664rfil:RestrictedStockAndIncentiveStockOptionsMemberrfil:OneManagerAndThreeOfficersMember2023-01-112023-01-11

0000740664rfil:IncentiveStockOptionsMemberrfil:OneManagerAndThreeOfficersMember2023-01-112023-01-11

0000740664us-gaap:RestrictedStockMemberrfil:OneManagerAndThreeOfficersMember2023-01-112023-01-11

0000740664rfil:The2020PlanMember2024-10-31

0000740664rfil:The2020PlanMember2024-09-052024-09-05

0000740664rfil:The2020PlanMember2020-07-22

0000740664us-gaap:StateAndLocalJurisdictionMemberus-gaap:ResearchMemberrfil:ExpiringMember2024-10-31

0000740664us-gaap:StateAndLocalJurisdictionMemberus-gaap:ResearchMember2024-10-31

0000740664us-gaap:DomesticCountryMemberus-gaap:ResearchMember2024-10-31

0000740664us-gaap:GeneralBusinessMember2024-10-31

0000740664us-gaap:StateAndLocalJurisdictionMember2024-10-31

0000740664us-gaap:DomesticCountryMember2024-10-31

0000740664us-gaap:CorporateNonSegmentMember2022-11-012023-10-31

0000740664us-gaap:OperatingSegmentsMemberrfil:CustomCablingManufacturingAndAssemblyMember2022-11-012023-10-31

0000740664us-gaap:OperatingSegmentsMemberrfil:RfConnectorAndCableAssemblyMember2022-11-012023-10-31

0000740664us-gaap:CorporateNonSegmentMember2023-10-31

0000740664us-gaap:OperatingSegmentsMemberrfil:CustomCablingManufacturingAndAssemblyMember2023-10-31

0000740664us-gaap:OperatingSegmentsMemberrfil:RfConnectorAndCableAssemblyMember2023-10-31

0000740664us-gaap:CorporateNonSegmentMember2023-11-012024-10-31

0000740664us-gaap:OperatingSegmentsMemberrfil:CustomCablingManufacturingAndAssemblyMember2023-11-012024-10-31

0000740664us-gaap:OperatingSegmentsMemberrfil:RfConnectorAndCableAssemblyMember2023-11-012024-10-31

0000740664us-gaap:CorporateNonSegmentMember2024-10-31

0000740664us-gaap:OperatingSegmentsMemberrfil:CustomCablingManufacturingAndAssemblyMember2024-10-31

0000740664us-gaap:OperatingSegmentsMemberrfil:RfConnectorAndCableAssemblyMember2024-10-31

0000740664us-gaap:NonUsMember2022-11-012023-10-31

0000740664us-gaap:NonUsMember2023-11-012024-10-31

0000740664rfil:AllOtherForeignCountriesMember2022-11-012023-10-31

0000740664rfil:AllOtherForeignCountriesMember2023-11-012024-10-31

0000740664country:GB2022-11-012023-10-31

0000740664country:GB2023-11-012024-10-31

0000740664country:CN2022-11-012023-10-31

0000740664country:CN2023-11-012024-10-31

0000740664country:IT2022-11-012023-10-31

0000740664country:IT2023-11-012024-10-31

0000740664country:CA2022-11-012023-10-31

0000740664country:CA2023-11-012024-10-31

0000740664country:US2022-11-012023-10-31

0000740664country:US2023-11-012024-10-31

0000740664rfil:InventoryPurchasesMemberus-gaap:SupplierConcentrationRiskMemberrfil:OneVendorMember2022-11-012023-10-31

0000740664rfil:InventoryPurchasesMemberus-gaap:SupplierConcentrationRiskMemberrfil:VendorsMember2023-11-012024-10-31

0000740664rfil:InventoryPurchasesMemberus-gaap:SupplierConcentrationRiskMember2024-10-312024-10-31

0000740664us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberrfil:DistributorTwoMember2022-11-012023-10-31

0000740664us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberrfil:DistributorTwoMember2022-11-012023-10-31

0000740664us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberrfil:DistributorOneMember2021-11-012022-10-31

0000740664us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberrfil:DistributorOneMembersrt:MaximumMember2023-11-012024-10-31

0000740664us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberrfil:WirelessCarrierMember2022-11-012023-10-31

0000740664us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberrfil:OneDistributorMember2023-11-012024-10-31

0000740664us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberrfil:WirelessCarrierMember2023-11-012024-10-31

0000740664us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberrfil:OneDistributorMember2023-11-012024-10-31

0000740664us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberrfil:WirelessCarrierMember2023-11-012024-10-31

0000740664us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberrfil:DistributorAMember2022-11-012023-10-31

0000740664us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberrfil:WirelessProviderMember2022-11-012023-10-31

0000740664us-gaap:TrademarksMember2022-11-012023-10-31

0000740664us-gaap:TrademarksMember2023-11-012024-10-31

0000740664srt:WeightedAverageMember2024-10-31

0000740664us-gaap:TrademarksMember2023-10-31

0000740664us-gaap:TrademarksMember2024-10-31

0000740664us-gaap:PatentedTechnologyMember2023-10-31

0000740664us-gaap:PatentedTechnologyMember2024-10-31

0000740664us-gaap:TradeNamesMember2023-10-31

0000740664us-gaap:TradeNamesMember2024-10-31

0000740664us-gaap:PatentsMember2023-10-31

0000740664us-gaap:PatentsMember2024-10-31

0000740664us-gaap:PatentsMembersrt:MaximumMember2024-10-31

0000740664us-gaap:PatentsMembersrt:MinimumMember2024-10-31

0000740664us-gaap:OrderOrProductionBacklogMember2023-10-31

0000740664us-gaap:OrderOrProductionBacklogMember2024-10-31

0000740664us-gaap:OrderOrProductionBacklogMembersrt:MaximumMember2024-10-31

0000740664us-gaap:OrderOrProductionBacklogMembersrt:MinimumMember2024-10-31

0000740664us-gaap:CustomerRelationshipsMember2023-10-31

0000740664us-gaap:CustomerRelationshipsMember2024-10-31

0000740664us-gaap:CustomerRelationshipsMembersrt:MaximumMember2024-10-31

0000740664us-gaap:CustomerRelationshipsMembersrt:MinimumMember2024-10-31

0000740664us-gaap:NoncompeteAgreementsMember2023-10-31

0000740664us-gaap:NoncompeteAgreementsMember2024-10-31

0000740664rfil:MicrolabFXRLLCMember2024-10-31

0000740664rfil:MicrolabFXRLLCMemberrfil:RFConnectorSegmentMember2024-10-31

0000740664rfil:RfConnectorAndCableAssemblyMemberrfil:RFConnectorSegmentMember2024-10-31

0000740664rfil:SchrofftechMemberrfil:CustomCablingManufacturingAndAssemblyMember2024-10-31

0000740664rfil:ReltechElectronicsMemberrfil:CustomCablingManufacturingAndAssemblyMember2024-10-31

0000740664rfil:CablesUnlimitedMemberrfil:CustomCablingManufacturingAndAssemblyMember2024-10-31

0000740664us-gaap:RetainedEarningsMember2024-10-31

0000740664us-gaap:AdditionalPaidInCapitalMember2024-10-31

0000740664us-gaap:CommonStockMember2024-10-31

0000740664us-gaap:RetainedEarningsMember2023-11-012024-10-31

0000740664us-gaap:AdditionalPaidInCapitalMember2023-11-012024-10-31

0000740664us-gaap:CommonStockMember2023-11-012024-10-31

0000740664us-gaap:RetainedEarningsMember2023-10-31

0000740664us-gaap:AdditionalPaidInCapitalMember2023-10-31

0000740664us-gaap:CommonStockMember2023-10-31

0000740664us-gaap:RetainedEarningsMember2022-11-012023-10-31

0000740664us-gaap:AdditionalPaidInCapitalMember2022-11-012023-10-31

0000740664us-gaap:CommonStockMember2022-11-012023-10-31

0000740664us-gaap:RetainedEarningsMember2022-10-31

0000740664us-gaap:AdditionalPaidInCapitalMember2022-10-31

0000740664us-gaap:CommonStockMember2022-10-31

00007406642021-11-012022-10-31

00007406642025-01-10

00007406642024-04-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended October 31, 2024

or

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ______________ to ________________.

Commission File Number 0-13301

RF INDUSTRIES, LTD.

(Name of registrant as specified in its charter)

|

Nevada

|

88-0168936

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

| |

|

|

16868 Via Del Campo Court, Suite 200

San Diego, California

|

92127

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(858) 549-6340

|

|

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

| |

|

|

|

Common Stock, $0.01 par value per share

|

RFIL

|

NASDAQ Global Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☐

|

Accelerated Filer ☐

|

|

Non-accelerated Filer ☒

|

Smaller reporting company ☒

|

|

Emerging Growth Company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $25.9 million.

On January 10, 2025, the Registrant had 10,544,431 outstanding shares of Common Stock, $.01 par value.

Forward-Looking Statements:

Certain statements in this Annual Report on Form 10-K (this “Annual Report”), and other oral and written statements made by the Company from time to time are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, including those that discuss strategies, goals, outlook or other non-historical matters, or projected revenues, income, returns or other financial measures. In some cases forward-looking statements can be identified by terminology such as “may,” “will,” “should,” “except,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of such terms or other comparable terminology. These forward-looking statements are subject to numerous risks and uncertainties that may cause actual results to differ materially from those contained in such statements. Among the most important of these risks and uncertainties are the ability of the Company to meet customer demand through pricing and product offerings and efficient inventory and distribution channel management, to continue to source our raw materials and products from our suppliers and manufacturers, particularly those in Asia, the market demand for our products, which market demand is dependent in large part on the state of the telecommunications industry, the Company’s ability to continue as a going concern, the Company’s ability to remain in compliance with its existing capital loan terms and financial covenants and whether plans to develop 4G and 5G networks accelerate as expected, as well as our ability to meet any such demand, the effect of future business acquisitions and dispositions, the incurrence of impairment charges, and competition.

Important factors which may cause actual results to differ materially from the forward-looking statements are described in the Section entitled “Risk Factors” in this Form 10-K, and other risks identified from time to time in the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update these forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in Part I, Item 1A titled “Risk Factors.” These risks include, but are not limited to, the following:

Risks Related to Our Business

• We are heavily dependent upon wireless and broadband communications providers.

• The acquisition of Microlab will affect both the Company’s liquidity and its capital resources in the near future.

• We entered into a new credit facility, which replaced a Loan Agreement we previously entered into to fund our acquisition of Microlab, which may expose us to additional risks, including risks associated with the inability to repay the loan on a timely basis.

• Due to the nature of our business, we need continued access to capital, which if not available to us or if not available on favorable terms, could harm our ability to operate or expand our business.

• If our third-party contract manufacturers are unable to manufacture and deliver a sufficient quantity of high-quality products on a timely and cost-efficient basis, our net revenue and profitability would be harmed and our reputation may suffer.

• Our business strategy to expand through acquisitions of other businesses could increase operating costs and expose us to additional risks.

• Global economic conditions and any related impact on our supply chain and the markets where we do business could adversely affect our results of operations.

• Our business, financial condition and results of operations could be harmed by the effects of outbreaks of COVID-19 or similar public health crises.

• Our dependence on third-party manufacturers increases the risk that we will not have an adequate supply of products or that our product costs will be higher than expected.

• An impairment in the carrying value of goodwill, trade names and other long-lived assets could negatively affect our consolidated results of operations and net worth.

• Changes in technology may reduce the demand for some of our products.

• If the manufacturers of our coaxial connectors or other products discontinue the manufacturing processes needed to meet our demands or fail to upgrade their technologies, we may face production delays.

• Our dependence upon independent distributors to sell and market our products exposes us to the risk that such distributors may decrease their sales of our products or terminate their relationship with us.

• A material portion of our sales is dependent upon a few principal customers, the loss of whom could materially negatively affect our total sales.

• Difficult conditions in the global economy may adversely affect our business and results of operations.

• Because the markets in which we compete are highly competitive, a failure to effectively compete could result in an immediate and substantial loss of market share.

• If the industries into which we sell our products experience recession or other cyclical effects impacting the budgets of our customers, our operating results could be negatively impacted.

• Because we sell our products to foreign customers, we are exposed to all of the risks associated with international sales, including foreign currency exposure.

• The inability to hire or retain certain key professionals, management and staff could adversely affect our business, financial condition and results of operations.

• We have few patent rights in the technology employed in our products, which may limit our ability to compete.

• Claims by other companies that we infringe their intellectual property could adversely affect our business

• A cyber incident could result in information theft, data corruption, operational disruption, and/or financial loss.

Risks Related to Our Common Stock

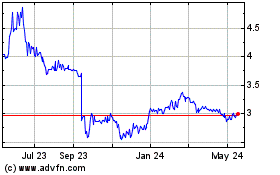

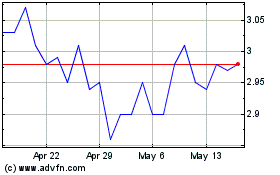

• Volatility of trading prices of our stock could result in a loss on an investment in our stock.

• Failure to maintain an effective system of internal control over financial reporting or to remediate weaknesses could materially harm our revenues, erode stockholder confidence in our ability to pursue business and report our financial results/condition, and negatively affect the trading price of our common stock.

• While we have in the past paid dividends, no assurance can be given that we will declare or pay cash dividends in the future.

• Future sales of our common stock in the public market could cause our stock price to fall.

• Provisions of our certificate of incorporation and bylaws and Nevada law may make a takeover more difficult.

• We are a “smaller reporting company” and we have elected to comply with certain reduced reporting and disclosure requirements which could make our common stock less attractive to investors.

PART I

General

RF Industries, Ltd. (together with subsidiaries, the “Company”, “we”, “us”, or “our”) is a national manufacturer and marketer of interconnect products and systems, including high-performance components such as RF connectors and adapters, dividers, directional couplers and filters, coaxial cables, data cables, wire harnesses, fiber optic cables, custom cabling, energy-efficient cooling systems and integrated small cell enclosures. Through our manufacturing and production facilities, we provide a wide selection of interconnect products and solutions primarily to telecommunications carriers and equipment manufacturers, wireless and network infrastructure carriers and manufacturers and to various original equipment manufacturers (“OEMs”) in several market segments. We also design, engineer, manufacture and sell energy-efficient cooling systems and integrated small cell solutions and related components.

We operate through two reporting segments: (i) the RF Connector and Cable Assembly (“RF Connector”) segment, and (ii) the Custom Cabling Manufacturing and Assembly (“Custom Cabling”) segment. The RF Connector segment primarily designs, manufactures, markets and distributes a broad range of RF connector, adapter, coupler, divider, and cable products, including coaxial passives and cable assemblies that are used in telecommunications and information technology, OEM markets and other end markets. The Custom Cabling segment designs, manufactures, markets and distributes custom copper and fiber cable assemblies, complex hybrid fiber optic and power solution cables, electromechanical wiring harnesses, wiring harnesses for a broad range of applications in a diverse set of end markets, energy-efficient cooling systems for wireless base stations and remote equipment shelters and custom designed, pole-ready 5G small cell integrated enclosures.

Recent Events

In February 2022, we entered into a loan agreement (the “BofA Loan Agreement”) providing for a revolving line of credit (the “BofA Revolving Credit Facility”) in the amount of $3.0 million and a $17.0 million term loan (the “BofA Term Loan”, and together with the BofA Revolving Credit Facility, the “BofA Credit Facility”) with Bank of America, N.A. (“BofA”). Amounts outstanding under the BofA Revolving Credit Facility bore interest at a rate of 2.0% plus the Bloomberg Short-Term Bank Yield Index Rate. All amounts outstanding pursuant to the BofA Credit Facility were repaid by us and the BofA Loan Agreement was terminated in connection with us entering into a new loan and security agreement (the “EBC Credit Agreement”) with Eclipse Business Capital, as administrative agent (“EBC”) on March 15, 2024. Borrowings under the BofA Credit Facility were secured by a security interest in certain assets of the Company and were subject to certain loan covenants. The BofA Credit Facility required the maintenance of certain financial covenants, including: (i) consolidated debt to EBITDA ratio not to exceed 3.00 to 1.00 (the “Debt Test”); (ii) consolidated fixed charge coverage ratio of at least 1.25 to 1.00 (the “FCCR Test”); and (iii) consolidated minimum EBITDA of at least $600,000 for the discrete quarter ended January 31, 2022. In addition, the BofA Credit Facility contained customary affirmative and negative covenants.

On September 12, 2023, we entered into Amendment No. 1 and Waiver to the BofA Loan Agreement (“Loan Amendment No. 1”) with BofA, which, among other matters, provided for a one-time waiver of our failure to comply with (i) the Debt Test for the period ended July 31, 2023 and (ii) the FCCR Test for the period ended July 31, 2023. Loan Amendment No. 1 also waived testing for compliance with the Debt Test and FCCR Test for the quarterly periods ending October 31, 2023, January 31, 2024, April 30, 2024 and July 31, 2024. Further, pursuant to Loan Amendment No. 1, we were required to maintain (i) (a) until September 21, 2023, minimum liquidity (week-end cash balance plus availability from the BofA Revolving Credit Facility) of $4.0 million, and (b) from September 22, 2023 and thereafter, liquidity equal to the greater of (1) $4.0 million or (2) 80% of the liquidity that had been forecast for this date at the fourth week of the forecast and (ii) minimum EBITDA of ($400,000), $500,000, $1.0 million, and $1.0 million for the quarters ending October 31, 2023, January 31, 2024, April 30, 2024, and July 31, 2024, respectively.

On January 26, 2024, we entered into Amendment No. 2 to the BofA Loan Agreement (“Loan Amendment No. 2”) with BofA, which, among other matters, eliminated the requirement to maintain minimum EBITDA of $500,000 for the quarter ending January 31, 2024. Under Loan Amendment No. 2, the line of credit available to the Company under the BofA Revolving Credit Facility was lowered from $3.0 million to $500,000. Further, Loan Amendment No. 2 required that we maintain from September 22, 2023 and thereafter, liquidity of at least $2.0 million, rather than the greater of $4.0 million or 80% of the forecast liquidity as was required under Loan Amendment No. 1. Under Loan Amendment No. 2, the Company would have been required to pay an additional fee equal to 1% of the collective outstanding principal balances of the BofA Revolving Credit Facility and BofA Term Loan if the BofA Credit Facility was not repaid in full on or before March 1, 2024. This additional fee, if applicable, would have been due on March 2, 2024. Further, Loan Amendment No. 2 required that the Company make an additional principal payment of $1.0 million on the BofA Term Loan on March 1, 2024, in addition to the existing monthly payments due on the BofA Term Loan. In connection with Loan Amendment No. 2, we paid BofA a $500,000 paydown on the BofA Revolving Credit Facility, thereby reducing the outstanding balance from $1.0 million to $500,000. Loan Amendment No. 2 was considered a modification under Accounting Standards Codification (“ASC”) 470, Debt.

On February 29, 2024, we entered into Amendment No. 3 to the BofA Loan Agreement (“Loan Amendment No. 3”) with BofA, which, among other matters, deferred the requirement that the Company make an additional principal payment of $1.0 million on the BofA Term Loan, from March 1, 2024, as was required under Loan Amendment No. 2, to April 1, 2024. Further, Loan Amendment No. 3 reduced the additional fee the Company was required to pay BofA on March 2, 2024 from 1% of the collective outstanding principal balances of the BofA Revolving Credit Facility and BofA Term Loan as of March 1, 2024 as required under Loan Amendment No. 2, to 0.50% of the collective outstanding principal balances of the BofA Revolving Credit Facility and BofA Term Loan as of March 1, 2024. Additionally, Loan Amendment No. 3 required the Company to pay BofA a fee equal to 0.50% of the collective outstanding principal balances of the BofA Revolving Credit Facility and BofA Term Loan as of March 1, 2024, if the BofA Credit Facility was not repaid in full on or before April 2, 2024 (the “April 2024 Fee”). The April 2024 Fee, if applicable, would have been due on April 2, 2024. We were not required to pay the April 2024 Fee based on our repayment of the BofA Credit Facility prior to April 2, 2024. Under Loan Amendment No. 3, the Company was required to maintain liquidity of at least $2.0 million and pay the remaining outstanding balance of $500,000 on the BofA Revolving Credit Facility by March 1, 2024, as required under Loan Amendment No. 2. Loan Amendment No. 3 was considered a modification under ASC 470, Debt.

On March 15, 2024, we entered into the EBC Credit Agreement and used proceeds from the initial drawings under the EBC Credit Facilities (as defined below) to repay in full outstanding obligations under the BofA Loan Agreement and to pay fees, premiums, costs and expenses, including fees payable in connection with the EBC Credit Agreement. The BofA Loan Agreement was terminated upon entry into the EBC Credit Agreement and is no longer in effect.

The EBC Credit Agreement provides for (i) a senior secured revolving loan facility of up to $15.0 million (the “EBC Revolving Loan Facility”) and (ii) a senior secured revolving credit facility of up to $1.0 million (the “EBC Additional Line” and, together with the EBC Revolving Loan Facility, the “EBC Credit Facilities”) (with a $3.0 million swingline loan sublimit). On June 14, 2024, the parties entered into a First Amendment to the EBC Credit Agreement (the “First Amendment”) providing for a modified EBC Additional Line of $1.0 million through July 12, 2024, $666,666.67 from July 13, 2024 through August 11, 2024 and $333,333.34 from August 12, 2024 through September 10, 2024. Availability of borrowings under the EBC Credit Facilities will be based upon a borrowing base formula and periodic borrowing base certifications valuing certain of our accounts receivable and inventories, as reduced by certain reserves, if any.

In the absence of an Event of Default (as defined in the EBC Credit Agreement) or certain other events (including the inability of EBC to determine the secured overnight financing rate “SOFR”), borrowings under (a) the EBC Revolving Loan Facility accrue interest at a rate of the one-month term SOFR reference rate plus an adjustment of 0.11448% (“Adjusted Term SOFR”) plus 5.00%, and (b) the EBC Additional Line accrues interest at a rate of Adjusted Term SOFR plus 6.50%, in each case subject to a floor of 2.00% for Adjusted Term SOFR. We will be required to pay a commitment fee of 0.50% per annum for the unused portion of the EBC Revolving Loan Facility. In addition to the foregoing unused commitment fee, we are required to pay certain other administrative fees pursuant to the terms of the EBC Credit Agreement.

Borrowings under the EBC Credit Agreement are secured by a security interest in certain assets of the Company and are subject to certain loan covenants. The EBC Credit Facilities require the maintenance of certain financial covenants, including (i) Excess Availability (as defined in the EBC Credit Agreement) of at least, as of any date of determination, an amount equal to the greater of (a) $1.0 million and (b) 10% of the Adjusted Borrowing Base (as defined in the EBC Credit Agreement), unless as of the last day of the most recent month for which the monthly financial statements and the related compliance certificate have been or are required to have been delivered to EBC, the Fixed Charge Coverage Ratio (as defined in the EBC Credit Agreement) for the 12 consecutive calendar month period then ended is greater than 1.10 to 1.00; and (ii) a capital expenditure limitation limiting the aggregate cost of all Capital Expenditure (as defined in the EBC Credit Agreement) to $2.5 million during any fiscal year. In addition, the EBC Credit Facilities contain customary affirmative and negative covenants.

Strategy

Our overall strategy is to provide our customers with a broad selection of products, rapid and high-quality service, and custom design capabilities, all at competitive prices. Specifically, our strategy is the following:

Provide rapid and flexible design and manufacturing services. Over the past few years we have focused our organization on providing a standardized portfolio, allowing for quick-turn readily available products, while having the capabilities, flexible design and manufacturing services to customize our offering to address customer specific requirements or applications.

Competitive pricing. Our manufacturing and distribution arrangements have been designed to lower costs and enable us to offer prices on both our standard and custom manufactured products that are competitive with the marketplace, all while keeping quality as a priority.

Leverage our manufacturing and distribution capabilities and facilities. Our strategy is to operate our manufacturing and distribution locations to best provide our customers with a competitively priced, high-quality product offering delivered with a fast turnaround time. As part of this strategy, we utilize a “one-company” approach to production and distribution locations and allocate our resources based on each location’s production specialization capabilities, its proximity to the shipment destination, and other factors. Using this “one-company” approach, our goal is to leverage available capacity and shorten delivery times, while potentially providing lower shipping costs. We operate manufacturing and distribution locations in California, and in the Northeastern United States.

Integrate marketing and selling efforts. Our strategy is to integrate and cross-sell our various historical and acquired product lines. We have been integrating our marketing and sales efforts, thereby expanding the number and type of products we can offer to our existing client base, while also using this cross-sell approach to win new customers.

Broad range of immediately available products. Our strategy is to provide a high level of availability where we stock a large selection of standard products that are available for immediate delivery, including availability from multiple distributors. Additionally, we augment this “on-the-shelf” availability of several cable assembly and interconnect products with fast-turn production and assembly providing better lead times for our customers.

Targeted focus of product lines. Our strategy is to focus on passive products rather than manufacturing and selling operating or active components or products. Our product line focus remains on supporting and leveraging our distribution channels with our core passive interconnect and cable assemblies offering, while in parallel we continue to expand our portfolio of integrated solutions to address key end customer and market applications. As we have grown in recent years, we have placed a specific emphasis on expanding our product lines to offer more of the bill of materials required to deploy specific connectivity systems and applications in key markets, such as wireless and public safety communications.

Increase long-term relationships with customers. Our goal is to establish long-term relationships with the customers who have used us for specialized projects by having our solutions built into the customer’s product specifications and bills of materials. As we remain focused on maintaining and expanding our national distributor relationships through our dedicated sales and account management teams, we have invested in targeted business development efforts to assist in getting more closely aligned with the requirements of strategic end customers.

Grow through strategic and targeted acquisitions. We will continue to consider strategic acquisitions of companies or technologies that can increase our customer penetration and/or diversify our customer base, supplement our management team, expand our product offerings, and/or expand our footprint in relevant market segments.

Operations

We currently conduct operations through our six divisions with our product areas divided into two reporting segments.

RF Connector and Cable Assembly Segment

Our RF Connector segment consists of the RF Connector and Cable Assembly division (“RF Connector division”) that is based at our headquarters in San Diego, California with expansion in New Jersey through our acquisition of Microlab. The RF Connector division is primarily engaged in the design, manufacture and distribution of coaxial connector solutions for companies that design, build, operate, maintain and use a variety of connectivity/communication applications. Coaxial connector products consist primarily of connectors which, when attached to a coaxial cable, facilitate the transmission of analog and digital signals in various frequencies. Although most of the connectors are designed to fit standard cable products, the RF Connector division also sells custom connectors specifically designed and manufactured to suit its customers’ requirements. Additionally, during fiscal year 2023 the Company integrated the former C Enterprises division into the RF Connector division and San Diego headquarters. The business and assets of C Enterprises, L.P. were acquired on March 15, 2019, bringing to the Company the Corning Cable Systems CAH ConnectionsSM Gold Program member as an authorized manufacturer of fiber optic products that are backed by Corning Cable Systems’ extended warranty. This acquisition added the capabilities to design, develop and manufacture connectivity solutions including custom copper and fiber cable assemblies sold to telecommunications and data communications distributors.

The Microlab division is included in the RF Connector segment. Microlab was acquired in March 2022, and is based in Parsippany, New Jersey. Microlab designs and manufactures high-performance RF and Microwave products enabling signal distribution and deployment of in-building DAS (distributed antenna systems), wireless base stations and small cell networks. Manufacturing operations are performed at Microlab’s facilities in New Jersey.

The RF Connector division typically carries over 1,500 different types of connectors, adapters, tools, and test and measurements kits. This division’s connectors are used in thousands of different devices, products and types of equipment. Since the RF Connector division’s standard connectors can be used in a number of different products and devices, the discontinuation of one product typically does not make our connectors obsolete. Accordingly, most connectors that we carry can be marketed for a number of years. Furthermore, because our connector products are not dependent on any single line of products or any market segment, our overall sales of connectors tend to fluctuate less when there are material changes or disruption to a single product line or market segment.

Cable assembly products manufactured and sold by the RF Connector division consist of various types of coaxial cables that are attached to connectors (usually our connectors) for use in a variety of communications applications. Cable assemblies manufactured for the RF Connector division are primarily manufactured at our San Diego, California facilities using state-of-the-art automation equipment and are sold through distributors or directly to major OEM accounts. Our cable assembly portfolio consists of both standard and custom cable assemblies designed for specific customer requirements. We offer a line of cable assemblies with over 100,000 cable product combinations.

We design our connectors at our headquarters in San Diego, California, and Microlab designs and manufactures a wide selection of components and integrated subsystems for signal conditioning and distribution in the wireless infrastructure markets as well as for use in medical devices. However, most of the connectors are manufactured for us by third-party foreign manufacturers located in Asia.

Custom Cabling Manufacturing and Assembly Segment

The Custom Cabling segment currently consists of three wholly-owned subsidiaries located in the Northeastern United States. Our plan is to integrate certain aspects of the manufacturing, sales and marketing functions of these divisions so as to better address overlapping market opportunities and to more efficiently manufacture, market, and ship products to our customers.

The three divisions that comprise the current Custom Cabling segment consist of the following:

Cables Unlimited, Inc. Cables Unlimited, Inc. (“Cables Unlimited”) is a custom cable manufacturer located in Yaphank, New York, that we acquired in 2011. Cables Unlimited is a Corning Cable Systems CAH ConnectionsSM Gold Program member, authorized to manufacture fiber optic products that are backed by Corning Cable Systems’ extended warranty. Cables Unlimited designs, develops and manufactures custom connectivity solutions for the industrial, defense, telecommunications and wireless markets. The products sold by Cables Unlimited include custom and standard copper and fiber optic cable assemblies, adapters and electromechanical wiring harnesses for communications, computer, LAN, automotive fiber optic and medical equipment.

Rel-Tech Electronics, Inc. Rel-Tech Electronics, Inc. (“Rel-Tech”) was acquired in June 2015. Rel-Tech’s offices and manufacturing facilities are located in Milford, Connecticut. Rel-Tech is a designer and manufacturer of cable assemblies and wiring harnesses for blue chip industrial, oilfield, instrumentation, medical and military customers. Wire and cable assembly products include custom wire harnesses, ribbon cable, electromechanical and kitted assemblies, and networking and communications cabling.

Schroff Technologies International, Inc. Schroff Technologies International, Inc. (“Schrofftech”) was acquired in November 2019. Schrofftech is a Rhode Island based manufacturer and marketer of intelligent thermal cooling control systems, along with pole-ready wireless small cell shrouds and enclosures, custom designed for plug-and-play installation. These products are typically used by telecommunications companies across the U.S. and Canada.

Product Description

We produce a large variety of interconnect products and assemblies that are used in telecommunications and a range of other industries. The products that we offer and sell consist of the following:

Connector and Cable Products

We design, manufacture and market a broad range of coaxial connectors, adapters and cable assemblies fornumerous applications in commercial, industrial, automotive, transportation, scientific, aerospace and military markets.

There are numerous applications for these connectors, some of which include digital applications, 2.5G, 3G, 4G, 5G, LTE, Wi-Fi and other broadband wireless infrastructure, GPS, mobile radio products, aircraft, video surveillance systems, cable assemblies and test equipment. Users of our connectors include telecommunications companies, circuit board manufacturers, OEMs, consumer electronics manufacturers, audio and video product manufacturers and installers, and satellite companies. We market over 1,500 types of connectors, adapters, tools, assembly, test and measurement kits, which range in price from under $1 to over $1,000 per unit. The kits satisfy a variety of applications including, but not limited to, lab operations, site requirements and adapter needs.

We also design and sell a variety of connector tools and hand tools that are assembled into kits used by lab and field technicians, research and development technicians and engineers. These tools are manufactured for us by outside contractors. Tool products are carried as an accommodation to our customers and have not materially contributed to our revenues.

We market and manufacture cable assemblies in a variety of sizes and combinations of RF coaxial connectors and coaxial cabling. Cabling is purchased from a variety of major unaffiliated suppliers and is assembled predominately with our connectors as complete cable assemblies. Coaxial cable assemblies have numerous applications including low PIM, Wi-Fi and wireless local area networks, wide area networks, internet systems, cellular systems including 2.5G, 3G, 4G, 5G, LTE, DAS and Small Cell installations, TV/dish network systems, test equipment, military/aerospace (mil-standard and COTS (Commercial Off–The-Shelf)) and entertainment systems. Cable assemblies are manufactured to customer requirements.

We carry thousands of separate types of connectors, most of which are available in standard sizes and configurations and that are also offered by other companies. However, we also have some proprietary products, including the CompPro product line, OptiFlex cables, and the Schrofftech telecom shelter cooling and control system products. CompPro is a patented compression technology that offers advantages for a water-tight, ruggedized connection, providing easier installation, and improved system reliability on braided cables. CompPro is used by wireless network operators, installers and distributors in North America and other parts of the world. OptiFlex is a hybrid fiber optic and DC power cabling solution that we designed and manufactured, and the Schrofftech products are energy efficient cooling/temperature control and filtration systems for use in telecom shelters, outdoor enclosures and battery/power rooms.

Passive RF Products

We design and manufacture high-performance RF and microwave high-performance components such as dividers, directional couplers and filters enabling signal distribution and deployment of in-building DAS (distributed antenna systems), wireless base stations and small cell networks.

Fiber Optic Products

Cables Unlimited is a Corning Cable Systems CAH Connections SM Gold Program member that is authorized to manufacture fiber optic products that are backed by Corning Cable Systems’ extended warranty. Through our Cables Unlimited division, we offer a broad range of interconnect products and systems that have the ability to combine radio frequency and fiber optic interconnect components, with various connectors and power cables through customized solutions for these customers. Cables Unlimited also manufactures OptiFlex, a custom designed hybrid fiber optic and DC power cabling solution manufactured for wireless service providers engaged in upgrading their cell towers. The custom hybrid cable is significantly lighter and possesses greater flexibility than cables previously used for wireless service.

The former C Enterprises, now integrated into the RF Connector division, is a Corning Cable Systems CAH Connections SM Gold Program member, authorized to manufacture fiber optic products that are backed by Corning Cable Systems’ extended warranty. C Enterprises designs, develops and manufactures connectivity solutions to telecommunications and data communications distributors.

Other Cabling Products

We design, manufacture, and sell cable assemblies and wiring harnesses for industrial, oilfield, instrumentation, medical, and military customers. Wire and cable assembly products include custom wire harnesses, ribbon cable, electromechanical and kitted assemblies, networking and communications cabling. DIN and Mini DIN connector assemblies include power cord, coaxial, Mil-spec and testing.

Telecommunications Thermal Control Systems and Shrouds

We engineer, design, manufacture and sell intelligent thermal control systems for outdoor telecommunications equipment. The thermal control systems, which can be controlled offsite using networked software at the telecommunication company’s own data center, maintain the interior temperature of telecommunications and other networking equipment. We also design and sell integrated shrouds and enclosures for small cell deployments that reduce installation time and improve aesthetics by eliminating the exterior cabling used with current configurations.

Foreign Sales

Net sales to foreign customers accounted for $6,014,000 (or approximately 9%) of our net sales, and $6,387,000 (or approximately 9%) of our net sales for the fiscal years ended October 31, 2024 and 2023, respectively. The majority of the export sales during these periods were to Canada.

We do not own, or directly operate any manufacturing operations or sales offices in foreign countries.

Distribution and Marketing

We currently sell our products through independent warehousing distributors and through our in-house marketing and sales team. Sales through independent distributors accounted for approximately 35% of our net sales for the fiscal year ended October 31, 2024. Our agreements with most of the distributors are nonexclusive and generally may be terminated by either party upon 30-60 days’ written notice. The Company directly sells certain of its products to large, national telecommunication equipment and solution providers who include the Company’s products in their own product offerings.

Manufacturing

We contract with outside third parties for the manufacture of a significant portion of our coaxial connectors. However, virtually all of the RF cable assemblies sold during the fiscal year ended October 31, 2024 were assembled at the International Organization for Standardization (“ISO”) approved factories in San Diego, California and Parsippany, New Jersey. We procure our raw cable from manufacturers with ISO-approved factories in the United States, China, and Taiwan. The Company primarily relies on several third-party partners for the manufacture of its coaxial connectors, tools and other passive components and receives bulk cable from multiple manufacturing plants. Although we do not have manufacturing contracts with these manufacturers for our connectors and cable products, we do have long-term purchasing relationships. There are certain risks associated with our dependence on third-party manufacturers for some of our products. See “Risk Factors” below. We have in-house design engineers who create the engineering drawings for fabrication and assembly of connectors and cable assemblies. Accordingly, the third-party manufacturers are not primarily responsible for design work related to the manufacture of our connectors and cable assemblies. Although our current facilities are set up to manufacture certain lines of products, manufacturing of certain products is often shifted to other facilities to alleviate capacity limitations or to address a customer’s product manufacturing schedule requirements.

We manufacture custom cable assemblies, adapters and electromechanical wiring harnesses and other products through Cables Unlimited at its Yaphank, New York manufacturing facility. The Yaphank facility is an ISO-approved factory. Cables Unlimited is a Corning Cable Systems CAH Connections SM Gold Program member, authorized to manufacture fiber optic products and assemblies that are backed by Corning Cable Systems’ extended warranty.

The Milford, Connecticut facility of Rel-Tech is an ISO-approved manufacturing facility that is primarily used to manufacture cable assemblies, electromechanical assemblies, wiring harnesses and other similar products.

The products sold by Schrofftech are designed and manufactured at its ISO-approved manufacturing facility in North Kingstown, Rhode Island. Schrofftech’s products are manufactured and tested in accordance with the ETL Listing standards.

Microlab designs and manufactures a wide selection of RF components and integrated subsystems in our design and manufacturing facility in Parsippany, New Jersey.

Raw Materials

Connector materials are typically made of commodity metals such as copper, brass and zinc and include small applications of precious materials, including silver and gold. The RF Connector division purchases most of its connector products from contract manufacturers located in Asia and the United States. We believe that the raw materials used in our products are readily available and that we are not currently dependent on any supplier for our raw materials. We do not currently have any long-term purchase or supply agreements with our connector suppliers. The Custom Cabling divisions obtain coaxial connectors from the RF Connector division. We believe there are numerous domestic and international suppliers of other coaxial connectors that we may utilize for any of our cabling products.

The Cables Unlimited, Rel-Tech, Schrofftech, and former C Enterprises divisions purchase largely all of the raw materials used in their products from sources located in the United States. Fiber optic cables are available from various manufacturers located throughout the United States, however, Cables Unlimited purchases most of its fiber optic cables from Corning Cables Systems LLC. The Company believes that the raw materials used by Cables Unlimited in its products are readily available and that Cables Unlimited is not currently dependent on any supplier for its raw materials except where Corning Extended Warranty certification is required. Neither Cables Unlimited nor Rel-Tech Electronics currently have any long-term purchase or supply agreements with their connector and cable suppliers.

Backlog

As of October 31, 2024, our estimated backlog of unfilled firm orders was approximately $19.5 million compared with backlog of approximately $16.1 million as of October 31, 2023. Orders typically fluctuate from quarter to quarter based on customer demand and general business conditions and, in particular, for project-based orders from wireless carrier customers for custom cable assemblies at our Cables Unlimited division. Since purchase orders are submitted from customers based on the estimated timing of their requirements, our ability to predict orders in future periods or trends in future periods is limited. Furthermore, purchase orders may be subject to shipment delays and to cancellation from customers, although we have not historically experienced material cancellations of purchase orders.

It is expected that a substantial portion of the backlog will be filled within the next 12 months. Most of the orders that we receive, particularly in the RF Connector segment, generally have short lead times. Therefore, backlog may not be indicative of future demand.

Human Capital

As of October 31, 2024, we employed 302 full-time employees, of whom 64 were in accounting, administration, sales and management, 225 were in manufacturing, distribution and assembly, and 13 were engineers engaged in design, engineering and research and development. The employees were based at our facilities in San Diego, California (144 employees), Yaphank, New York (60 employees), Milford, Connecticut (50 employees), Parsippany, New Jersey (42 employees), and North Kingstown, Rhode Island (6 employees). We also occasionally hire part-time employees. We believe that we have a good relationship with our employees.

Patents, Trademarks and Licenses

We own ten U.S. patents related to the CompPro Product Line that we acquired in May 2015. The CompPro Product Line utilizes a patented compression technology that offers revolutionary advantages for a water-tight connection, easier installation, and improved system reliability on braided cables. The CompPro Product Line is used by wireless network operators, installers and distributors in North America and other parts of the world.

Our Schrofftech subsidiary owns eight issued patents on its proprietary telecom shelter cooling and control system technology and its equipment room ventilation controls. Schrofftech has also filed one pending patent application related to ventilation and control equipment and controls.

The trademarks we own include the “CompPro” registered trademark associated with the compression cable product line and the “OptiFlex™” as a trademark for its hybrid cable wireless tower cable solution. Each of our subsidiaries also use various trademarks (and associated logos and trade names) in their operations, although none of these trademarks have been registered.

Because the RF Connector division carries thousands of separate types of connectors and other products, most of which are available in standard sizes and configurations and are also offered by our competitors, we do not believe that our cables and connector business or competitive position is dependent on patent protection.

Under agreements with Corning Cables Systems LLC, Cables Unlimited and C Enterprises are permitted to advertise that they are Corning Cables System CAH Connections SM Gold Program members.

With the acquisition of Microlab, three additional relevant patents were added to our portfolio regarding GPS signal repeaters, RF System Monitoring, and RF Tappers. Additional filings are also pending for RF system conditioning.

Warranties and Terms

We warrant our products to be free from defects in material and workmanship for varying warranty periods, depending upon the product. Products are generally warranted to the dealer for one year, with the dealer responsible for any additional warranty it may make. The RF Connector products are warranted for the useful life of the connectors. Although we have not experienced any significant warranty claims to date, there can be no assurance that we will not be subjected to such claims in the future.

We usually sell to customers on 30 to 60-day terms pursuant to invoices and do not generally grant extended payment terms. Generally, customers may delay, cancel, reduce, or return products after shipment subject to a restocking charge.

Under their agreements with Corning Cables Systems LLC, Cables Unlimited and C Enterprises are authorized to manufacture optic cable assemblies that are backed by Corning Cables Systems’ extended warranty (referred to as the “Gold Certified Warranty”).

Competition

The industries in which we operate are highly competitive, and we compete with thousands of companies that range from large multinational corporations, most of which have greater assets and financial resources, to local manufacturers. Competition is generally based on breadth of product offering, product innovation, price, quality, delivery, performance and customer service. In addition, rapid technological changes occurring in the communications industry could also lead to the entry of new competitors of all sizes against whom we may not be able to successfully compete. There can be no assurance that we will be able to compete successfully against existing or new competition, and the inability to do so may result in price reductions, reduced margins, or loss of market share, any of which could have an adverse effect on our business, financial condition and results of operations.

Government Regulations

Our products are designed to meet all known existing or proposed governmental regulations. We believe that we currently meet existing standards for approvals by government regulatory agencies for our principal products.

Our products are Restriction on Hazardous Substances (“RoHS”) compliant.

Environmental Regulations

We are subject to various laws and governmental regulations concerning environmental matters and employee safety and health matters in the United States. Compliance with these federal, state, and local laws and regulations related to protection of the environment and employee safety and health has had no material effect on our business. There were no material capital expenditures for environmental projects in fiscal year 2024, and there are no material expenditures planned for such purposes in fiscal year 2025.

Investor Information

Our principal executive office is currently located at 16868 Via Del Campo Court, Suite 200, San Diego, California. RF Industries, Ltd. was incorporated in the State of Nevada on November 1, 1979, completed its initial public offering in March 1984 under the name Celltronics, Inc., and changed its name to RF Industries, Ltd. in November 1990. Unless the context requires otherwise, references to the “Company” in this report include RF Industries, Ltd. and our six wholly-owned subsidiaries, Cables Unlimited, Inc., Rel-Tech Electronics, Inc., C Enterprises, Inc., Schroff Technologies International, Inc., and Microlab/FXR LLC.

The Company’s principal Internet website is located at http://www.rfindustries.com. The Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and other information related to the Company, are available, free of charge, on that website as soon as reasonably practicable after we electronically file those documents with, or otherwise furnish them to, the Securities and Exchange Commission (“SEC”). Reports filed with the SEC are also available on the SEC’s website at www.sec.gov. The Company’s Internet website and the information contained therein, or connected thereto, are not and are not intended to be incorporated into this Annual Report.

Investors should carefully consider the risks described below and all other information in this Form 10-K. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business and operations.

If any of the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected. In such case, the trading price of our common stock could decline and investors may lose all or part of their investment in our common stock.

Risks Related to Our Business

We are heavily dependent upon wireless and broadband communications providers.

Most of our revenues and profitability have in recent years been generated from products that we sell, directly or through our distributors, to the wireless and broadband communications industries. In addition, we also sell connectors, cables and other products to companies that incorporate these products into their own wireless and broadband communications products. As a result, our business is heavily dependent upon the wireless and broadband markets. Demand for our products in these markets depends primarily on capital spending by operators for constructing, rebuilding or upgrading their telecommunication systems. The amount of this capital spending and, therefore, our sales and profitability, will be affected by a variety of factors affecting the telecommunications companies, including general economic conditions, consolidation within the telecommunications industry and the financial condition of operators. Although we sell many products into many different markets other than the telecommunications marketplace, because a major portion of our revenues has historically been derived from direct and indirect sales to wireless and broadband communications companies, our financial condition and results of operations are heavily influenced by the health and growth of the wireless and broadband markets, all of which is beyond our control.

The acquisition of Microlab will affect both the Company’s liquidity and its capital resources in the near future.

On March 1, 2022, we purchased Microlab from Wireless Telecom Group, Inc. for $24,250,000, subject to certain post-closing adjustments. We funded $17 million of the cash purchase price from the funds obtained under the term loan obtained from Bank of America, N.A. (the “Credit Facility Lender”) and paid the remaining amount of the cash purchase price with $7.3 million cash on hand, thereby reducing the amount of cash available for future acquisitions, for investments in the expansion of our existing businesses and assets, or as a reserve for unanticipated financial requirements.

We entered into a new credit facility, which replaced a Loan Agreement we previously entered into to fund our acquisition of Microlab, which may expose us to additional risks, including risks associated with the inability to repay the loan on a timely basis.

On March 15, 2024, we entered into a new loan and security agreement (the “EBC Credit Agreement”), with Eclipse Business Capital as administrative agent (“EBC”) providing for (i) a senior secured revolving loan facility of up to $15.0 million (the “EBC Revolving Loan Facility”) and (ii) a senior secured revolving credit facility of up to $1.0 million (the “EBC Additional Line” and, together with the EBC Revolving Loan Facility, the “EBC Credit Facilities”) (with a $3.0 million swingline loan sublimit). Pursuant to the terms of the First Amendment to the EBC Credit Agreement entered into by the parties on June 14, 2024, the EBC Additional Line was modified to provide for $1.0 million through July 12, 2024, $666,666.67 from July 13, 2024 through August 11, 2024 and $333,333.34 from August 12, 2024 through September 10, 2024. Availability of borrowings under the EBC Credit Facilities will be based upon a borrowing base formula and periodic borrowing base certifications valuing certain of our accounts receivable and inventories, as reduced by certain reserves, if any. We used proceeds from the initial drawings under the EBC Credit Facilities to repay in full outstanding obligations under the loan agreement (the “BofA Loan Agreement”) previously entered into by us and Bank of America, N.A. (“BofA”) used to fund our acquisition of Microlab. Additional proceeds from the initial drawings under the EBC Credit Facilities were used to pay fees, premiums, costs and expenses, including fees payable in connection with the EBC Credit Agreement. The BofA Loan Agreement was terminated upon entry into the EBC Credit Agreement and is no longer in effect.

In the absence of an Event of Default (as defined in the EBC Credit Agreement) or certain other events (including the inability of EBC to determine the secured overnight financing rate “SOFR”), borrowings under (a) the EBC Revolving Loan Facility accrue interest at a rate of the one-month term SOFR reference rate plus an adjustment of 0.11448% (“Adjusted Term SOFR”) plus 5.00%, and (b) the EBC Additional Line accrues interest at a rate of Adjusted term SOFR plus 6.50%, in each case subject to a floor of 2.00% for Adjusted Term SOFR. We will be required to pay a commitment fee of 0.50% per annum for the unused portion of the EBC Revolving Loan Facility. In addition to the foregoing unused commitment fee, we are required to pay certain other administrative fees pursuant to the terms of the EBC Credit Agreement.

Our failure to comply with the terms of the EBC Credit Agreement could result in a default under the agreement. EBC may accelerate the payment terms of the EBC Credit Agreement upon the occurrence of certain events of default set forth therein. Any event that could require us to repay debt prior to its due date could have a material adverse impact on our financial condition and results of operations and may affect our ability to continue as a going concern. Further, any renegotiation, refinancing or additional indebtedness that we incur in the future may subject us to further covenants.

Our ability to comply with terms contained in the EBC Credit Agreement may be affected by events beyond our control, including prevailing economic, financial and industry conditions. Even if we are able to comply with all of the applicable covenants and terms, the restrictions on our ability to manage our business in our sole discretion could adversely affect our business by, among other things, limiting our ability to take advantage of financings, mergers, acquisitions and other corporate opportunities that we believe would be beneficial to us. In addition, our obligations under the EBC Credit Agreement are secured, on a first-priority basis, and such security interests could be enforced by EBC in the event of default by us.

Due to the nature of our business, we need continued access to capital, which if not available to us or if not available on favorable terms, could harm our ability to operate or expand our business.

Our business requires capital that is not financed by trade creditors when our business is expanding. If cash from available sources is insufficient or cash is used for unanticipated needs, we may require additional capital sooner than anticipated.

We believe that our existing sources of liquidity, including cash resources and cash provided by operating activities will provide sufficient resources to meet our working capital and cash requirements for at least the next twelve months; however, there can be no assurance that our cash resources will fund our operating plan for the period anticipated by us, especially if there is a material adverse impact on our business from unforeseen events or a desire to reduce our outstanding indebtedness. Any such events could have an effect on our liquidity and our ability to continue as a going concern in the future, and result in a need to raise additional capital. Alternatively, we could decide to liquidate assets, raise capital or incur additional indebtedness to fund strategic initiatives or operating activities, particularly if we pursue additional acquisitions. In the event we are required, or elect, to raise additional funds, we may be unable to do so on favorable terms, or at all, and may incur expenses in raising the additional funds and increase our interest rate exposure, and any future indebtedness could adversely affect our operating results and severely limit our ability to plan for, or react to, changes in our business or industry. Further, under the EBC Credit Agreement, we are limited by financial and other negative covenants in our credit arrangements. If we cannot raise funds on acceptable terms, we may be unable to continue as a going concern and may not be able to take advantage of future opportunities or respond to competitive pressures or unanticipated requirements. Any inability to raise additional capital when required could have an adverse effect on our business and operating results.

In the event that we are unable to pay our obligations on the EBC Credit Facilities on a timely basis, maintain the financial covenants under the EBC Credit Agreement, as amended, including the Excess Availability requirements and capital expenditure limitation, or otherwise default on our obligations under the EBC Credit Agreement, EBC will have a right to foreclose on personal property of the Company and certain of its subsidiaries.

We depend on third-party contract manufacturers for a majority of our connector manufacturing needs. If they are unable to manufacture and deliver a sufficient quantity of high-quality products on a timely and cost-efficient basis, our net revenue and profitability would be harmed and our reputation may suffer.

Substantially all of the RF Connector division’s connector products are manufactured by third-party contract manufacturers. We rely on them to procure components for RF connectors and in certain cases to design, assemble and test the products on a timely and cost-efficient basis. If our contract manufacturers are unable to complete design work on a timely basis, we will experience delays in product development and our ability to compete may be harmed. In addition, because some of our manufacturers have manufacturing facilities in Taiwan and China, their ability to provide us with adequate supplies of high-quality products on a timely and cost-efficient basis is subject to a number of additional risks and uncertainties, including political, social and economic instability and factors that could impact the shipment of supplies. Further, health crises, including epidemics or pandemics, such as the COVID-19 pandemic, and government and business responses thereto, could affect our manufacturers, including by resulting in quarantines and/or closures, which could result in potential closures and disruptions to our manufacturing needs. If our manufacturers are unable to provide us with adequate supplies of high-quality products on a timely and cost-efficient basis, our operations would be disrupted and our net revenue and profitability would suffer. Moreover, if our third-party contract manufacturers cannot consistently produce high-quality products that are free of defects, we may experience a higher rate of product returns, which would also reduce our profitability and may harm our reputation and brand.

Our third-party contract manufacturers are based in Asia. Recently, our third-party contract manufacturers have been subject to various supply chain disruptions. These supply chain disruptions have slowed the delivery of products to us and have increased the price of certain materials due to the significant increase in costs of raw materials and shipping costs. Our ability to produce and timely deliver our products may be materially impacted in the future if these supply chain disruptions continue or worsen. In addition, because of the rising cost, we may be forced to increase the price of our products to our customers, or we may have to reduce our gross margins on the products that we sell. Because some of our custom manufacturing contracts call for deliveries over a longer period of time, cost increases during the term of these agreements at times cannot be passed through to our customers and therefore will have to be borne by us.

We do not currently have any long-term supply agreements with any of our contract manufacturers, and such manufacturers could stop manufacturing products for us at any time. Although we believe that we could locate alternate contract manufacturers if any of our manufacturers terminated our business, our operations could be impacted until alternate manufacturers are found.

Our business strategy to expand through acquisitions of other businesses could increase operating costs and expose us to additional risks.

As part of our plan to operate businesses that are profitable and that reflect the changing market, we from time to time sell unprofitable divisions and purchase new businesses. Such recent transactions include the purchase of our new C Enterprises and Schrofftech subsidiaries in 2019 and Microlab in 2022. In addition, we have previously disclosed that, as part of our growth strategy, we intend to make additional acquisitions of businesses in the future. While we believe that restructuring our operations and acquiring other businesses will benefit us in the longer term, these acquisitions have in the short term caused us to incur additional legal, accounting and administrative expenses, including the cost of integrating the various accounting systems of our new subsidiaries, upgrading our information systems, and the cost of managing various divisions in separate locations and states. We may in the future make additional acquisitions. Accordingly, we will be subject to numerous risks associated with the acquisition of additional businesses, including:

| |

●

|

diversion of management’s attention;

|

| |

●

|

the effect on our financial statements of the amortization of acquired intangible assets;

|

| |

●

|

the cost associated with acquisitions and the integration of acquired operations;

|

| |

●

|

we may not be able to secure capital to finance future acquisitions to the extent additional debt or equity is needed; and

|

| |

●

|

assumption of unknown liabilities, or other unanticipated events or circumstances.

|

Any of these risks could materially harm our business, financial condition and results of operations. There can be no assurance that any business that we acquire will achieve anticipated revenues or operating results.