SpringBig Holdings, Inc. (“springbig,” “we,” “our” or the

“Company”) (OTCQX: SBIG), a leading provider of vertical SaaS-based

marketing solutions, consumer mobile app experiences, and

omnichannel loyalty programs, today announced that it has secured

$8.0 million of debt financing with a syndicate of lenders

consisting of $6.4 million 8% Secured Convertible Note (the

“Convertible Note”) due 2026 and $1.6 million 12% Secured Term Loan

(the “Term Loan”) due 2026. Proceeds from the Convertible Note and

Term Loan will be used to repurchase entirely the outstanding

existing Senior Secured Convertible Note due 2025 (the “Existing

Note”) for a discounted amount of approximately $2.9 million and

for general corporate purposes. The net proceeds after repurchasing

the Existing Note and transaction costs is estimated to be $4.6

million.

“Springbig now has a much stronger and cleaner

balance sheet with the capital that will enable the Company to

continue to expand and deliver shareholder value,” said Paul Sykes,

CFO. “During 2023 we have significantly improved our financial

profile, significantly reducing SG&A while being able to

maintain revenue growth in a challenging climate and concluded the

year achieving our stated objective of positive Adjusted EBITDA* in

December. We have re-sized our expense base and anticipate 2024

operating expenses will be approximately 25% lower than in 2023,

and that we expect to generate Adjusted EBITDA* margins of 12%-15%

in 2024.”

Jeffrey Harris, CEO and Chairman of springbig, said, “The

Company is in an excellent position. We have a sound strategy and I

remain confident that we are making the right investments to both

add value to our clients while at the same time capturing the

long-term opportunity in front of us. Springbig has a rich menu of

innovative solutions to enable our clients to retain and grow their

customer bases and we are particularly encouraged by our recent

launches of ‘subscriptions by springbig’, offering our clients

robust capabilities to launch and power their own

subscription-based VIP loyalty programs and ‘gift cards by

springbig’, offering a secure, user-friendly, and efficient payment

solution. With the closing of the Convertible Note and Term Loan

financing we now have a stronger balance sheet and the capital to

support our future growth. Springbig is fresh off a positive

Adjusted EBITDA* month in December, and I am proud to be heading

into 2024 which we believe will be a year of meaningful market

success.”

The Convertible Note will mature two years after

the date of issuance and is convertible into common stock at the

option of the holders at any time prior to the last business day

immediately preceding the maturity date at a conversion price of

$0.15. Interest at 8% per annum is payable by adding such interest

to the outstanding amount owing under the Convertible Note until

the earlier of the date of maturity or conversion.

The Term Loan will rank pari passu with the

Convertible Note and will also mature in January 2026. Interest at

12% per annum is payable in cash each six months in arrears.

The Convertible Note and Term Loan and related guarantees were

offered only to accredited investors in reliance on Section 4(a)(2)

of the Securities Act of 1933, as amended (the “Securities Act”)

and/or Rule 506(b) of Regulation D promulgated thereunder. This

press release does not constitute an offer to sell or the

solicitation of an offer to buy the Convertible Note and Term Loan

and related guarantees or the common stock into which the

Convertible Note is convertible. These securities have not been

registered under the Securities Act, or the securities laws of any

other jurisdiction, and may not be offered or sold in the United

States absent registration or an applicable exemption from

registration requirements.

Financial Outlook

For the year ended December 31, 2023, springbig

currently expects revenue and Adjusted EBITDA* to be in line with

guidance previously provided at the announcement of our

third-quarter earnings, namely revenue in the range $28.0 - $28.5

million and Adjusted EBITDA* loss of approximately $(3.4) million,

compared with an Adjusted EBITDA* loss in the prior year of $(12.6)

million.

For the year ending December 31, 2024, the

Company expects revenue to be in the range $29.5 - $32.5 million,

representing approximately 10% at the midpoint, and Adjusted

EBITDA* profit in the range $3.5 - $5.0 million.

* Adjusted EBITDA is a non-GAAP financial

measure provided in this “Financial Outlook” section on a

forward-looking basis. We calculate Adjusted EBITDA as net income

before interest, taxes, depreciation and amortization, and further

adjustments to exclude unusual and/or infrequent costs. The Company

does not provide a reconciliation of such forward-looking measure

to the most directly comparable financial measure calculated and

presented in accordance with GAAP because to do so would be

potentially misleading and not practical given the difficulty of

projecting event-driven transactional and other non-core operating

items in any future period. The magnitude of these items, however,

may be significant.

We present Adjusted EBITDA because this metric

is a key measure used by our management to evaluate our operating

performance, generate future operating plans and make strategic

decisions regarding the allocation of investment capacity.

Accordingly, we believe that Adjusted EBITDA provides useful

information to investors and others in understanding and evaluating

our operating results in the same manner as our management.

Management also believes that these measures provide improved

comparability between fiscal periods.

Adjusted EBITDA has limitations as an analytical

tool, and you should not consider it in isolation or as a

substitute for analysis of our results as reported under GAAP. Some

of these limitations are as follows:

- Although

depreciation and amortization are non-cash charges, the assets

being depreciated and amortized may have to be replaced in the

future, and Adjusted EBITDA does not reflect cash capital

expenditure requirements for such replacements or for new capital

expenditure requirements;

- Adjusted EBITDA does not reflect

changes in, or cash requirements for, our working capital needs;

and

- Adjusted EBITDA does not reflect

tax payments that may represent a reduction in cash available to

us.

Because of these limitations, you should

consider Adjusted EBITDA alongside other financial performance

measures, including net income and our other GAAP results. Also,

these non-GAAP financial measures, as determined and presented by

the Company, may not be comparable to related or similarly titled

measures reported by other companies.

About springbig

springbig is a market-leading vertical software

platform providing customer loyalty and marketing automation

solutions to retailers and brands in the U.S. and Canada.

springbig’s platform connects consumers with retailers and brands,

primarily through SMS marketing, as well as emails, customer

feedback systems, and loyalty programs, to support retailers’ and

brands’ customer engagement and retention. springbig offers

marketing automation solutions that provide for consistency of

customer communication, thereby driving customer retention and

retail foot traffic. Additionally, springbig’s reporting and

analytics offerings deliver valuable insights that clients utilize

to better understand their customer bases, purchasing habits and

trends. For more information, visit https://springbig.com/.

Forward Looking Statements

Certain statements contained in this press

release constitute “forward-looking statements” within the meaning

of the “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“outlook,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “would,” and similar expressions

may identify forward-looking statements, but the absence of these

words does not mean that a statement is not forward-looking.

Forward-looking statements are predictions, projections and other

statements about future events and financial results that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. In particular, these include

but are not limited to statements relating to the Company’s

expected financial performance for the year ended December 31,

2023, and business strategy, future offerings and programs and

expected financial performance for the year ending December 31,

2024. Many factors could cause actual future events and financial

results to differ materially from the forward-looking statements in

this press release, including but not limited to the fact that we

have a relatively short operating history in a rapidly evolving

industry, which makes it difficult to evaluate our future prospects

and may increase the risk that we will not be successful; that if

we do not successfully develop and deploy new software, platform

features or services to address the needs of our clients, if we

fail to retain our existing clients or acquire new clients, and/or

if we fail to expand effectively into new markets, our revenue may

decrease and our business may be harmed; and the other risks and

uncertainties described under “Risk Factors” in the Company’s

Quarterly Reports on Form 10-Q for the quarters ended September 30,

2023 and June 30, 2023 filed with the Securities and Exchange

Commission (the “SEC”) on November 13, 2023 and August 10, 2023

respectively, the Company’s Annual Report on Form 10-K for the year

ended December 31, 2022 filed with the SEC on March 28, 2023 and in

the other documents we file from time to time with the SEC. These

forward-looking statements involve a number of risks and

uncertainties (some of which are beyond the control of springbig),

and other assumptions, which may cause the actual results or

performance to be materially different from those expressed or

implied by these forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and the Company assumes no obligation and does not intend to update

or revise these forward-looking statements other than as required

by applicable law. The Company does not give any assurance that it

will achieve its expectations.

|

Investor Relations Contact |

Media

Contact |

| Claire Bollettieri |

Paul Cohen |

| VP of Investor Relations |

paul@milkandhoneypr.com |

| ir@springbig.com |

|

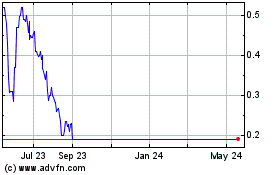

SpringBig (NASDAQ:SBIG)

Historical Stock Chart

From Dec 2024 to Jan 2025

SpringBig (NASDAQ:SBIG)

Historical Stock Chart

From Jan 2024 to Jan 2025