SHF Holdings, Inc., d/b/a/

Safe Harbor

Financial (“Safe Harbor” or the “Company”)

(

NASDAQ: SHFS), a leader in facilitating banking,

payments and financial services to the regulated cannabis industry,

announced that it has submitted comments to the Justice Department,

following its recent proposed rule to reclassify cannabis from

Schedule I to Schedule III of the Controlled Substances Act

(“CSA”), consistent with the view of the Department of Health and

Human Services (“HHS”) that cannabis has a currently accepted

medical use as well as HHS’s views about marijuana’s abuse

potential and level of physical or psychological dependence.

For the past 54 years,

cannabis has been categorized as a Schedule I controlled substance

under the Controlled Substances Act. Schedule I drugs, substances

or chemicals are defined as drugs with no currently accepted

medical use and a high potential for abuse.

The publication of

this proposed rule initiates a public comment period that will

remain open until July 22, 2024. Comments can be submitted

electronically via the Federal eRulemaking Portal using the

reference: ‘Docket No. DEA-1362.’

Safe Harbor Financial Chief Legal

Officer Donnie Emmi:Safe Harbor Financial welcomes the

proposed rule to reclassify marijuana from Schedule I to Schedule

III of the Controlled Substances Act. This reclassification

represents significant progress in aligning federal policy with the

growing recognition of the medical benefits of cannabis. However,

it is important to clarify what this potential change does and does

not mean for our industry.

First and foremost, the reclassification does

not make marijuana legal, as it remains an illegal substance under

federal law. From a banking perspective, the compliance

requirements under the Bank Secrecy Act (BSA) and Anti-Money

Laundering (AML) regulations remain unchanged. Banks must continue

to adhere to these stringent regulations to avoid significant fines

and penalties.

The reclassification to Schedule III is expected

to have several positive impacts on the cannabis industry. Most

notably, it will alleviate some of the severe tax burdens imposed

by Section 280E of the Internal Revenue Code. Currently, cannabis

businesses cannot deduct many of their operating expenses, leading

to inflated tax liabilities. The change to Schedule III will allow

these businesses to deduct expenses more akin to standard business

operations, potentially adding significant amounts to their balance

sheets. For example, some large operators could see more than $100

million added to their balance sheets, enabling them to reinvest in

and expand their operations and create jobs.

Overall, the rescheduling of cannabis will

create a more favorable business environment for Safe Harbor

Financial and the businesses we serve – enabling each to expand its

services, reduce operational risks and capitalize on new market

opportunities. While this does not change the illegality of

cannabis or change compliance requirements under the Bank Secrecy

Act, the move to Schedule III represents progress.

For Safe Harbor, this reclassification

underscores our continued relevance and importance in the cannabis

financial services sector. Despite fears that regulatory changes

might diminish our role, the reality is quite the opposite, as the

expectation is that the industry will grow considerably, increasing

the need for our unique service platform. The reclassification is

likely to lead to increased banking and transaction activity among

our clients, benefiting Safe Harbor through higher transaction

volumes and enhanced financial stability.

In addition, the cannabis industry remains

cash-intensive, similar to other sectors like liquor stores,

tobacco and adult entertainment venues, due to restrictions on

credit card processing and other financial services. As the

regulatory landscape evolves, Safe Harbor will remain a crucial

partner for cannabis and other high risk banking businesses.

In conclusion, Safe Harbor remains committed to

supporting the regulated cannabis industry through these changes.

Our first-mover status and deep industry expertise position us

uniquely to continue providing essential financial services,

ensuring the growth and success of our clients.

About Safe

HarborSafe Harbor is among the first service providers to

offer compliance, monitoring and validation services to financial

institutions, providing traditional banking services to cannabis,

hemp, CBD, and ancillary operators, making communities safer,

driving growth in local economies, and fostering long-term

partnerships. Safe Harbor, through its financial institution

clients, implements high standards of accountability, transparency,

monitoring, reporting and risk mitigation measures while meeting

Bank Secrecy Act obligations in line with FinCEN guidance on

cannabis-related businesses. Over the past nine years, Safe Harbor

has facilitated more than $21 billion in deposit transactions for

businesses with operations spanning over 41 states and US

territories with regulated cannabis markets. For more information,

visit www.shfinancial.org.

Forward-Looking StatementsCertain statements

contained in this press release constitute "forward-looking

statements" within the meaning of federal securities laws.

Forward-looking statements may include, but are not limited to,

statements with respect to trends in the cannabis industry,

including proposed changes in U.S. and state laws, rules,

regulations and guidance relating to Safe Harbor's services; Safe

Harbor's growth prospects and Safe Harbor's market size; Safe

Harbor's projected financial and operational performance, including

relative to its competitors and loan performance; new product and

service offerings Safe Harbor may introduce in the future; the

impact of recent volatility in the capital markets, which may

adversely affect the price of the Company's securities; Safe

Harbor's ability to make the same or similar loans in the future;

the outcome of any legal proceedings that may be instituted against

Safe Harbor; other statements regarding Safe Harbor's expectations,

hopes, beliefs, intentions or strategies regarding the future; and

the other risk factors discussed in Safe Harbor's filings from time

to time with the Securities and Exchange Commission. In addition,

any statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking statements. The words

"anticipate," "believe," "continue," "could," "estimate," "expect,"

"intends," "outlook," "may," "might," "plan," "possible,"

"potential," "predict," "project," "should," "would," and similar

expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject, are subject to risks and uncertainties. These

forward-looking statements involve a number of risks and

uncertainties (some of which are beyond the control of Safe

Harbor), and other assumptions, that may cause the actual results

or performance to be materially different from those expressed or

implied by these forward-looking statements.

Media Contact

InformationSafe Harbor MediaEllen

Mellody570-209-2947safeharbor@kcsa.com

Investor Relations Contact

InformationSafe Harbor Investor

Relationsir@SHFinancial.org

KCSA Strategic CommunicationsPhil

Carlsonsafeharbor@kcsa.com

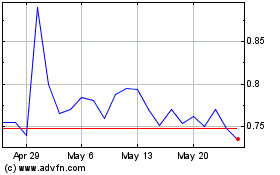

SHF (NASDAQ:SHFS)

Historical Stock Chart

From Nov 2024 to Dec 2024

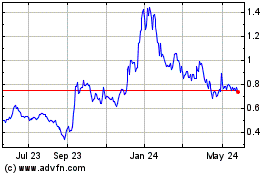

SHF (NASDAQ:SHFS)

Historical Stock Chart

From Dec 2023 to Dec 2024