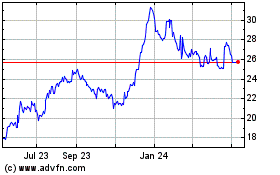

Summit Financial Group, Inc. (“Company” or “Summit”) (NASDAQ: SMMF)

today reported continued strong financial results for the fourth

quarter of 2021, including growth in earnings, net interest income,

revenue, and commercial and total loans to new record levels, while

maintaining sustained asset quality strength and expense

discipline.

The Company, which serves commercial and individual clients

across West Virginia, the Washington metropolitan area, Virginia

and Kentucky through Summit Community Bank, Inc., grew fourth

quarter 2021 net income applicable to common shares to $12.4

million, or $0.95 per diluted share. Earnings increased 2.8 percent

from $12.0 million, or $0.92 per diluted share, in the third

quarter of 2021 and 20.5 percent from $10.3 million, or $0.79 per

share, in the fourth quarter of 2020. For the year ended December

31, 2021, Summit grew earnings by 44.1 percent to $45.1 million, or

$3.47 per share, from $31.3 million, or $2.41 per share in

2020.

“We believe we have some of the best bankers in the markets we

serve, which has been key to our ability to accelerate organic loan

growth through the fourth quarter and position us well with

significant commercial new business pipelines heading into 2022,”

said H. Charles Maddy, III, President and Chief Executive Officer.

“We also continued to manage the balance sheet to maximize

profitability while maintaining our low operating expense advantage

relative to peers.”

Highlights for Q4 2021

- Total loans,

excluding mortgage warehouse lines of credit and Paycheck

Protection Program (“PPP”) lending, increased 6.4 percent, or 25.7

percent annualized, during the quarter and 20.9 percent during the

year.

- Commercial loans

excluding PPP lending increased 8.6 percent (34.4 percent

annualized) during the quarter and 34.3 percent during 2021.

- Net interest income

increased 2.8 percent from the linked quarter and 10.0 percent from

the year-ago period, primarily due to loan growth and lower funding

costs.

- Net interest margin

(“NIM”) increased 2 basis points to 3.49 percent from the linked

quarter, as yield on interest earning assets increased 3 basis

points while the cost of funds increased 1 basis point. Summit

remains strategically well positioned for a rising rate

environment.

- Revenue from net

interest income and noninterest income, excluding gains and losses

on debt securities and equity investments, grew 6.2 percent from

the linked quarter and 11.7 percent from the year-ago quarter.

- Incurred $1.5

million provision for credit losses in the quarter compared to none

in the linked quarter and $3.0 million in the year-ago quarter;

period-end allowance for loan credit losses equaled $32.3 million,

or 1.17 percent of total loans and 254.4 percent of nonperforming

loans.

- Grew pre-tax,

pre-provision earnings 10.5 percent from the linked quarter and 9.6

percent from the year-ago quarter.

- Achieved an

efficiency ratio of 49.04 percent and annualized non-interest

expense of 2.02 percent of average assets.

- Reduced property

held for sale by 20.8 percent during the quarter and 36.8 percent

from December 31, 2020.

- Reduced

nonperforming assets (“NPAs”) to 0.63 percent of total assets,

excluding restructured assets, down 4 basis points during the

quarter and 53 basis points from December 31, 2020.

- Issued $75 million

of growth capital through the private placement of 3.25%

Fixed-to-Floating Rate Subordinated Notes due 2031.

Results from Operations

Net interest income grew to $28.8 million in the fourth quarter

of 2021, an increase of 2.8 percent from the linked quarter and

10.0 percent from the prior-year fourth quarter. NIM for fourth

quarter of 2021 was 3.49 percent compared to 3.47 percent for the

linked quarter and 3.76 percent for the year-ago quarter. Excluding

the impact of accretion and amortization of fair value acquisition

accounting adjustments, Summit’s net interest margin would have

been 3.45 percent for the fourth quarter of 2021, 3.41 percent for

the linked quarter and 3.70 percent for the year-ago period.

Noninterest income, consisting primarily of service fee income

from community banking activities and trust and wealth management

fees, for fourth quarter 2021 was $6.0 million compared to $4.6

million for the linked quarter and $5.8 million for the comparable

period of 2020. The Company recorded realized securities losses on

debt securities of $109,000 and $68,000 in the fourth quarter and

linked quarter of 2021, respectively, and gains of $912,000 in the

year-ago quarter. In addition, we recognized a gain on equity

investments of $202,000 in Q4 2021.

Mortgage origination revenue was $1.4 million in the fourth

quarter of 2021, including an $879,000 increase in the fair value

of mortgage servicing rights, compared to $742,000 for the linked

quarter and $1.2 million for the year-ago period, including a

positive $284,000 mortgage servicing rights fair value adjustment.

Year-to-date, mortgage origination revenue grew to $4.0 million,

increasing 42.9 percent from 2020.

Excluding gains and losses on debt securities and equity

investments and mortgage servicing rights fair value adjustments,

noninterest income was $5.0 million in fourth quarter 2021 compared

to $4.6 million in the linked quarter and $4.6 million in the

year-ago quarter.

Revenue from net interest income and noninterest income,

excluding gains and losses on debt securities and equity

investments and mortgage servicing rights fair value adjustments,

grew to $33.8 million, up 3.5 percent from $32.7 million in the

linked quarter and 9.8 percent from $30.8 million in the year-ago

quarter. Revenue, excluding gains and losses on debt securities and

equity investments and mortgage servicing rights fair value

adjustments, for the full year 2021, grew to $128.6 million, up

15.0 percent from 2020 and outpacing the 10.3 percent noninterest

expense increase.

Total noninterest expense increased to $17.9 million in the

fourth quarter of 2021, up 3.3 percent from $17.3 million in the

linked quarter and 8.0 percent from $16.6 million for the

prior-year fourth quarter, reflecting acquisition-related expenses

primarily from Summit’s recently completed branch acquisitions, as

well as ongoing operating costs for its December 2020 purchase of

Kentucky’s WinFirst Bank.

Salary and benefit expenses of $9.0 million in the fourth

quarter of 2021 increased from $8.7 million in the linked quarter,

while acquisitions closed in December 2020 and July 2021

contributed to an increase from $8.3 million in the year-ago

period.

Additionally, other significant factors contributing to the

changes in total noninterest expense in the fourth quarter of 2021

were: equipment expense of $1.9 million compared to

$1.9 million for the linked quarter and $1.5 million for the

year-ago period, foreclosed properties expense of $403,000 compared

to $370,000 in the linked quarter and $676,000 in the year-ago

period, as well as other expenses of $3.3 million compared to $2.7

million for the linked quarter and $3.1 million in the year-ago

period. The changes in these other expenses include:

- Fraud and robbery

losses of $190,000 during Q4 2021 compared to $36,000 and $86,000

in the linked and year-ago quarters, respectively;

- Virginia franchise

tax of $228,000 during Q4 2021 compared to $137,000 and $95,000 in

the linked and year-ago quarters, respectively;

- Debit card

processing expenses of $340,000 during Q4 2021 compared to $343,000

and $259,000 in the linked and year-ago quarters, respectively;

and

- Internet banking

expenses of $322,000 during Q4 2021 compared to $306,000 and

$279,000 in the linked and year-ago quarters, respectively.

Summit’s efficiency ratio was 49.04 percent in the fourth

quarter of 2021 compared to 49.53 percent in the linked quarter and

48.93 percent for the year-ago period. Non-interest expense was

2.02 percent of average assets in the fourth quarter of 2021,

compared to 2.01 percent during the linked quarter and 2.22 percent

in the year-ago period.

Balance Sheet

At December 31, 2021, total assets were $3.58 billion, an

increase of $67.8 million, or 1.9 percent, during the fourth

quarter and $470.3 million, or 15.1 percent since December 31,

2020.

Total loans net of unearned fees grew to $2.76 billion on

December 31, 2021, increasing 8.1 percent during the fourth quarter

and 14.5 percent year-to-date. Excluding PPP and mortgage warehouse

lending, total loans grew to $2.52 billion on December 31, 2021,

increasing 6.4 percent during the fourth quarter and 20.9 percent

year-to-date.

Total commercial loans, including commercial and industrial

(C&I) and commercial real estate (CRE) and excluding PPP

lending, grew to $1.7 billion on December 31, 2021, increasing 8.6

percent during the fourth quarter and 34.3 percent year-to-date.

Residential real estate and consumer lending totaled $567.9 million

on December 31, 2021, down 0.5 percent during the fourth quarter

and 7.7 percent year-to-date.

PPP balances paid down to $12.8 million on December 31, 2021

from a peak of $98.5 million on September 30, 2020. Mortgage

warehouse lines of credit, sourced solely from a participation

arrangement with a large regional bank, were $227.9 million on

December 31, 2021 compared to a peak of $252.5 million on June 30,

2020.

As Summit deployed excess liquidity to enhance profitability and

fund continued loan growth, it lowered total deposits to $2.94

billion on December 31, 2021, down 0.4 percent during the fourth

quarter. Total deposits grew 13.4 percent year-to-date.

Core deposits decreased to $2.85 billion on December 31, 2021

compared to the linked quarter, decreasing 0.4 percent during the

fourth quarter and grew 15.9 percent year-to-date.

Total shareholders’ equity was $327.5 million as of December 31,

2021 compared to $323.3 million at September 30, 2021 and $281.6

million at December 31, 2020. During the fourth quarter of 2021,

Summit raised $75 million of growth capital through the private

placement of 3.25% Fixed-to-Floating Rate Subordinated Notes due

2031.

Tangible book value per common share increased to $19.54 as of

December 31, 2021 compared to $18.83 at September 30, 2021 and

$17.50 at December 31, 2020. Summit had 12,743,125 outstanding

common shares at the end of the fourth quarter of 2021 compared to

12,976,693 at the end of the linked quarter and 12,942,004 at

year-end 2020.

As announced in the first quarter of 2020, the Board of

Directors authorized the open market repurchase of up to 750,000

shares of the issued and outstanding shares of Summit's common

stock. The timing and quantity of stock purchases under this

repurchase plan are at the discretion of management. During the

fourth quarter of 2021, 248,244 shares of Summit’s common stock

were repurchased under the Plan at an average price of $26.95 per

share.

Asset Quality

Net loan charge-offs (“NCOs”) were $193,000, or 0.03 percent of

average loans annualized, in the fourth quarter of 2021. NCOs of

$370,000 represented 0.06 percent of average loans annualized in

the linked quarter, and $239,000 or 0.04 percent of average loans

annualized for fourth quarter 2020.

Summit recorded $1.5 million provision for credit losses in the

fourth quarter of 2021, reflecting reserve build to support our

substantial growth in both loans and unfunded loan commitments,

partially offset by reserve reductions due to improving forecasted

economic factors. The provision for credit losses was zero and $3.0

million for the linked and year-ago quarters, respectively.

Summit’s allowance for loan credit losses and allowance for

credit losses on unfunded loan commitments were $32.3 million and

$7.28 million, respectively, as of December 31, 2021, compared to

$32.4 million and $5.86 million, respectively, at the end of the

linked quarter. The allowance for loan credit losses declined just

slightly in Q4 2021 as the impact of improving forecasted economic

factors served to offset fully the additional provisions for credit

losses resulting from the significant volumes of new loans. The

allowance for credit losses on unfunded loan commitments increased

$1.42 million during the most recent quarter, principally as result

of the recent strong volumes of construction loan commitments

having a higher historical loss ratio than do our other loans as a

whole.

The allowance for loan credit losses stood at 1.17 percent of

total loans at year-end 2021 compared to1.27 percent at September

30, 2021 and 1.34 percent at December 31, 2020.

As of December 31, 2021, NPAs consisting of nonperforming loans,

foreclosed properties and repossessed assets, totaled $22.6

million, or 0.63 percent of assets, compared to $23.6 million, or

0.67 percent of assets at the linked quarter-end and $35.9 million,

or 1.16 percent of assets at the end 2020. During January 2022, we

closed on the sale of a foreclosed residential land development

project carried on the balance sheet at $2.00 million in property

held for sale at year-end 2021 and realized a gain of $201,000 as a

result of the sale.

About the Company

Summit Financial Group, Inc. is the $3.58 billion financial

holding company for Summit Community Bank, Inc. Its talented

bankers serve commercial and individual clients throughout West

Virginia, the Washington, D.C. metropolitan area, Virginia, and

Kentucky. Summit’s focus on in-market commercial lending and

providing other business banking services in dynamic markets is

designed to leverage its highly efficient operations and core

deposits in strong legacy locations. Residential and consumer

lending, trust and wealth management, and other retail financial

services are offered through convenient digital and mobile banking

platforms, including MySummit.Bank, and 45 full-service branch

locations. More information on Summit Financial Group, Inc.

(NASDAQ: SMMF), headquartered in West Virginia’s Eastern Panhandle

in Moorefield, is available at SummitFGI.com.

FORWARD-LOOKING STATEMENTS

This press release contains comments or information that

constitute forward-looking statements (within the meaning of the

Private Securities Litigation Act of 1995) that are based on

current expectations that involve a number of risks and

uncertainties. Words such as “expects”, “anticipates”, “believes”,

“estimates” and other similar expressions or future or conditional

verbs such as “will”, “should”, “would” and “could” are intended to

identify such forward-looking statements.

Although we believe the expectations reflected in such

forward-looking statements are reasonable, actual results may

differ materially. Factors that might cause such a difference

include: the effect of the COVID-19 pandemic, including the

negative impacts and disruptions on the communities we serve, and

the domestic and global economy, which may have an adverse effect

on our business; current and future economic and market conditions,

including the effects of declines in housing prices, high

unemployment rates, U.S. fiscal debt, budget and tax matters,

geopolitical matters, and any slowdown in global economic growth;

fiscal and monetary policies of the Federal Reserve; future

provisions for credit losses on loans and debt securities; changes

in nonperforming assets; changes in interest rates and interest

rate relationships; demand for products and services; the degree of

competition by traditional and non-traditional competitors; the

successful integration of operations of our acquisitions; changes

in banking laws and regulations; changes in tax laws; the impact of

technological advances; the outcomes of contingencies; trends in

customer behavior as well as their ability to repay loans; and

changes in the national and local economies. We undertake no

obligation to revise these statements following the date of this

press release.

|

|

|

|

|

SUMMIT FINANCIAL GROUP, INC. (NASDAQ: SMMF) |

|

|

|

Quarterly Performance Summary (unaudited) |

|

|

|

|

Q4 2021 vs Q4 2020 |

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

Percent |

|

Dollars in thousands |

12/31/2021 |

12/31/2020 |

Change |

|

Statements of Income |

|

|

|

|

|

Interest income |

|

|

|

|

|

Loans, including fees |

$ |

28,979 |

|

$ |

27,897 |

3.9 |

% |

|

|

Securities |

|

2,763 |

|

|

2,228 |

24.0 |

% |

|

|

Other |

|

75 |

|

|

51 |

47.1 |

% |

|

|

Total interest income |

|

31,817 |

|

|

30,176 |

5.4 |

% |

|

|

Interest expense |

|

|

|

|

|

Deposits |

|

1,718 |

|

|

2,956 |

-41.9 |

% |

|

|

Borrowings |

|

1,267 |

|

|

1,014 |

25.0 |

% |

|

|

Total interest expense |

|

2,985 |

|

|

3,970 |

-24.8 |

% |

|

|

Net interest income |

|

28,832 |

|

|

26,206 |

10.0 |

% |

|

|

Provision for credit losses |

|

1,500 |

|

|

3,000 |

n/m |

|

|

Net interest income after provision |

|

|

|

|

|

for credit losses |

|

27,332 |

|

|

23,206 |

17.8 |

% |

|

|

|

|

|

|

|

|

Noninterest income |

|

|

|

|

|

Trust and wealth management fees |

|

847 |

|

|

626 |

35.3 |

% |

|

|

Mortgage origination revenue |

|

1,361 |

|

|

1,163 |

17.0 |

% |

|

|

Service charges on deposit accounts |

|

1,501 |

|

|

1,305 |

15.0 |

% |

|

|

Bank card revenue |

|

1,528 |

|

|

1,237 |

23.5 |

% |

|

|

Gains on equity investments |

|

202 |

|

|

- |

n/a |

|

|

Realized gains/(losses) on debt securities, net |

|

(109 |

) |

|

912 |

-112.0 |

% |

|

|

Bank owned life insurance and annuity income |

|

293 |

|

|

233 |

25.8 |

% |

|

|

Other income |

|

330 |

|

|

301 |

9.6 |

% |

|

|

Total noninterest income |

|

5,953 |

|

|

5,777 |

3.0 |

% |

|

|

Noninterest expense |

|

|

|

|

|

Salaries and employee benefits |

|

8,977 |

|

|

8,250 |

8.8 |

% |

|

|

Net occupancy expense |

|

1,265 |

|

|

1,046 |

20.9 |

% |

|

|

Equipment expense |

|

1,902 |

|

|

1,502 |

26.6 |

% |

|

|

Professional fees |

|

438 |

|

|

370 |

18.4 |

% |

|

|

Advertising and public relations |

|

216 |

|

|

207 |

4.3 |

% |

|

|

Amortization of intangibles |

|

387 |

|

|

409 |

-5.4 |

% |

|

|

FDIC premiums |

|

330 |

|

|

261 |

26.4 |

% |

|

|

Bank card expense |

|

703 |

|

|

573 |

22.7 |

% |

|

|

Foreclosed properties expense, net |

|

403 |

|

|

676 |

-40.4 |

% |

|

|

Acquisition-related expense |

|

57 |

|

|

218 |

-73.9 |

% |

|

|

Other expenses |

|

3,250 |

|

|

3,094 |

5.0 |

% |

|

|

Total noninterest expense |

|

17,928 |

|

|

16,606 |

8.0 |

% |

|

|

Income before income taxes |

|

15,357 |

|

|

12,377 |

24.1 |

% |

|

|

Income taxes |

|

2,777 |

|

|

2,126 |

30.6 |

% |

|

|

Net income |

|

12,580 |

|

|

10,251 |

22.7 |

% |

|

|

Preferred stock dividends |

|

225 |

|

|

- |

n/a |

| |

|

|

|

|

| |

Net income applicable to common shares |

$ |

12,355 |

|

$ |

10,251 |

20.5 |

% |

| |

|

|

|

|

|

|

|

|

|

SUMMIT FINANCIAL GROUP, INC. (NASDAQ: SMMF) |

|

|

|

Quarterly Performance Summary (unaudited) |

|

|

|

|

Q4 2021 vs Q4 2020 |

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

Percent |

|

|

|

12/31/2021 |

12/31/2020 |

Change |

|

Per Share Data |

|

|

|

|

|

Earnings per common share |

|

|

|

|

|

Basic |

$ |

0.96 |

|

$ |

0.79 |

|

21.5 |

% |

|

|

Diluted |

$ |

0.95 |

|

$ |

0.79 |

|

20.3 |

% |

|

|

|

|

|

|

|

|

Cash dividends per common share |

$ |

0.18 |

|

$ |

0.17 |

|

5.9 |

% |

|

|

Common stock dividend payout ratio |

|

18.3% |

|

|

21.5% |

|

-15.1 |

% |

|

|

|

|

|

|

|

|

Average common shares outstanding |

|

|

|

|

|

Basic |

|

12,916,555 |

|

|

12,932,768 |

|

-0.1 |

% |

|

|

Diluted |

|

12,976,181 |

|

|

12,980,041 |

|

-0.0 |

% |

|

|

|

|

|

|

|

|

Common shares outstanding at period end |

|

12,743,125 |

|

|

12,942,004 |

|

-1.5 |

% |

|

|

|

|

|

|

|

Performance Ratios |

|

|

|

|

|

Return on average equity |

|

15.48% |

|

|

14.90% |

|

3.9 |

% |

|

|

Return on average tangible equity (C) |

|

19.72% |

|

|

18.70% |

|

5.5 |

% |

|

|

Return on average tangible common equity (D) |

|

20.91% |

|

|

18.70% |

|

11.8 |

% |

|

|

Return on average assets |

|

1.42% |

|

|

1.37% |

|

3.6 |

% |

|

|

Net interest margin (A) |

|

3.49% |

|

|

3.76% |

|

-7.2 |

% |

|

|

Efficiency ratio (B) |

|

49.04% |

|

|

48.93% |

|

0.2 |

% |

|

|

|

|

|

|

NOTES

(A) – Presented on a tax-equivalent basis assuming

a federal tax rate of 21%.

(B) – Computed on a tax equivalent basis excluding

acquisition-related expenses, gains/losses on sales of assets,

write-downs of OREO properties to fair value and amortization of

intangibles.

(C) – Return on average tangible equity = (Net income –

Amortization of intangibles [after-tax]) / (Average shareholders’

equity – Average intangible assets).

(D) – Return on average tangible common equity = (Net income –

Amortization of intangibles [after-tax]) / (Average common

shareholders’ equity – Average intangible assets).

|

|

|

|

|

SUMMIT FINANCIAL GROUP, INC. (NASDAQ: SMMF) |

|

|

|

Annual Performance Summary (unaudited) |

|

|

|

|

2021 vs 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended |

Percent |

|

Dollars in thousands |

12/31/2021 |

12/31/2020 |

Change |

|

Statements of Income |

|

|

|

|

|

Interest income |

|

|

|

|

|

Loans, including fees |

$ |

112,630 |

|

$ |

105,564 |

|

6.7 |

% |

|

|

Securities |

|

9,470 |

|

|

9,173 |

|

3.2 |

% |

|

|

Other |

|

316 |

|

|

266 |

|

18.8 |

% |

|

|

Total interest income |

|

122,416 |

|

|

115,003 |

|

6.4 |

% |

|

|

Interest expense |

|

|

|

|

|

Deposits |

|

8,182 |

|

|

16,044 |

|

-49.0 |

% |

|

|

Borrowings |

|

4,302 |

|

|

3,477 |

|

23.7 |

% |

|

|

Total interest expense |

|

12,484 |

|

|

19,521 |

|

-36.0 |

% |

|

|

Net interest income |

|

109,932 |

|

|

95,482 |

|

15.1 |

% |

|

|

Provision for credit losses |

|

4,000 |

|

|

14,500 |

|

n/m |

|

|

Net interest income after provision |

|

|

|

|

|

for credit losses |

|

105,932 |

|

|

80,982 |

|

30.8 |

% |

|

|

|

|

|

|

|

|

Noninterest income |

|

|

|

|

|

Trust and wealth management fees |

|

2,886 |

|

|

2,495 |

|

15.7 |

% |

|

|

Mortgage origination revenue |

|

3,999 |

|

|

2,799 |

|

42.9 |

% |

|

|

Service charges on deposit accounts |

|

5,032 |

|

|

4,588 |

|

9.7 |

% |

|

|

Bank card revenue |

|

5,896 |

|

|

4,494 |

|

31.2 |

% |

|

|

Gains on equity investments |

|

202 |

|

|

- |

|

n/a |

|

|

Realized gains on debt securities, net |

|

425 |

|

|

3,472 |

|

-87.8 |

% |

|

|

Bank owned life insurance and annuity income |

|

1,026 |

|

|

1,567 |

|

-34.5 |

% |

|

|

Other income |

|

742 |

|

|

668 |

|

11.1 |

% |

|

|

Total noninterest income |

|

20,208 |

|

|

20,083 |

|

0.6 |

% |

|

|

Noninterest expense |

|

|

|

|

|

Salaries and employee benefits |

|

34,386 |

|

|

32,211 |

|

6.8 |

% |

|

|

Net occupancy expense |

|

4,824 |

|

|

3,963 |

|

21.7 |

% |

|

|

Equipment expense |

|

6,990 |

|

|

5,765 |

|

21.2 |

% |

|

|

Professional fees |

|

1,578 |

|

|

1,538 |

|

2.6 |

% |

|

|

Advertising and public relations |

|

697 |

|

|

596 |

|

16.9 |

% |

|

|

Amortization of intangibles |

|

1,563 |

|

|

1,659 |

|

-5.8 |

% |

|

|

FDIC premiums |

|

1,449 |

|

|

856 |

|

69.3 |

% |

|

|

Bank card expense |

|

2,668 |

|

|

2,225 |

|

19.9 |

% |

|

|

Foreclosed properties expense, net |

|

1,745 |

|

|

2,490 |

|

-29.9 |

% |

|

|

Acquisition-related expense |

|

1,224 |

|

|

1,671 |

|

-26.8 |

% |

|

|

Other expenses |

|

11,615 |

|

|

9,337 |

|

24.4 |

% |

|

|

Total noninterest expense |

|

68,739 |

|

|

62,311 |

|

10.3 |

% |

|

|

Income before income taxes |

|

57,401 |

|

|

38,754 |

|

48.1 |

% |

|

|

Income taxes |

|

11,663 |

|

|

7,428 |

|

57.0 |

% |

|

|

Net income |

|

45,738 |

|

|

31,326 |

|

46.0 |

% |

|

|

Preferred stock dividends |

|

589 |

|

|

- |

|

n/a |

| |

|

|

|

|

| |

Net income applicable to common shares |

$ |

45,149 |

|

$ |

31,326 |

|

44.1 |

% |

|

SUMMIT FINANCIAL GROUP, INC. (NASDAQ: SMMF) |

|

|

|

Annual Performance Summary (unaudited) |

|

|

|

|

2021 vs 2020 |

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended |

Percent |

|

|

|

12/31/2021 |

12/31/20020 |

Change |

|

Per Share Data |

|

|

|

|

|

Earnings per common share |

|

|

|

|

|

Basic |

$ |

3.49 |

|

$ |

2.42 |

|

44.2 |

% |

|

|

Diluted |

$ |

3.47 |

|

$ |

2.41 |

|

44.0 |

% |

|

|

|

|

|

|

|

|

Cash dividends per common share |

$ |

0.70 |

|

$ |

0.68 |

|

2.9 |

% |

|

|

Common stock dividend payout ratio |

|

19.9% |

|

|

28.2% |

|

-29.6 |

% |

|

|

|

|

|

|

|

|

Average common shares outstanding |

|

|

|

|

|

Basic |

|

12,943,883 |

|

|

12,935,430 |

|

0.1 |

% |

|

|

Diluted |

|

13,003,428 |

|

|

12,975,385 |

|

0.2 |

% |

|

|

|

|

|

|

|

|

Common shares outstanding at period end |

|

12,743,125 |

|

|

12,942,004 |

|

-1.5 |

% |

|

|

|

|

|

|

|

Performance Ratios |

|

|

|

|

|

Return on average equity |

|

14.76% |

|

|

11.80% |

|

25.1 |

% |

|

|

Return on average tangible equity (C) |

|

18.71% |

|

|

14.73% |

|

27.0 |

% |

|

|

Return on average tangible common equity (D) |

|

19.51% |

|

|

14.73% |

|

32.5 |

% |

|

|

Return on average assets |

|

1.36% |

|

|

1.13% |

|

20.4 |

% |

|

|

Net interest margin (A) |

|

3.54% |

|

|

3.71% |

|

-4.6 |

% |

|

|

Efficiency ratio (B) |

|

49.22% |

|

|

50.00% |

|

-1.6 |

% |

|

|

|

|

|

|

NOTES

(A) – Presented on a tax-equivalent basis assuming

a federal tax rate of 21%.

(B) – Computed on a tax equivalent basis excluding

acquisition-related expenses, gains/losses on sales of assets,

write-downs of OREO properties to fair value and amortization of

intangibles.

(C) – Return on average tangible equity = (Net income –

Amortization of intangibles [after-tax]) / (Average shareholders’

equity – Average intangible assets).

(D) – Return on average tangible common equity = (Net income –

Amortization of intangibles [after-tax]) / (Average common

shareholders’ equity – Average intangible assets).

|

|

|

|

|

|

|

SUMMIT FINANCIAL GROUP, INC. (NASDAQ: SMMF) |

|

|

|

|

|

Five Quarter Performance Summary (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

Dollars in thousands |

12/31/2021 |

9/30/2021 |

6/30/2021 |

3/31/2021 |

12/31/2020 |

|

Statements of Income |

|

|

|

|

|

|

|

Interest income |

|

|

|

|

|

|

|

Loans, including fees |

$ |

28,979 |

|

$ |

28,416 |

|

$ |

27,697 |

|

$ |

27,538 |

|

$ |

27,897 |

|

|

Securities |

|

2,763 |

|

|

2,348 |

|

|

2,202 |

|

|

2,157 |

|

|

2,228 |

|

|

Other |

|

75 |

|

|

118 |

|

|

56 |

|

|

67 |

|

|

51 |

|

|

Total interest income |

|

31,817 |

|

|

30,882 |

|

|

29,955 |

|

|

29,762 |

|

|

30,176 |

|

|

Interest expense |

|

|

|

|

|

|

|

Deposits |

|

1,718 |

|

|

1,832 |

|

|

2,136 |

|

|

2,496 |

|

|

2,956 |

|

|

Borrowings |

|

1,267 |

|

|

1,013 |

|

|

1,008 |

|

|

1,014 |

|

|

1,014 |

|

|

Total interest expense |

|

2,985 |

|

|

2,845 |

|

|

3,144 |

|

|

3,510 |

|

|

3,970 |

|

|

Net interest income |

|

28,832 |

|

|

28,037 |

|

|

26,811 |

|

|

26,252 |

|

|

26,206 |

|

|

Provision for credit losses |

|

1,500 |

|

|

- |

|

|

1,000 |

|

|

1,500 |

|

|

3,000 |

|

|

Net interest income after provision |

|

|

|

|

|

|

|

for credit losses |

|

27,332 |

|

|

28,037 |

|

|

25,811 |

|

|

24,752 |

|

|

23,206 |

|

|

Noninterest income |

|

|

|

|

|

|

|

Trust and wealth management fees |

|

847 |

|

|

718 |

|

|

683 |

|

|

638 |

|

|

626 |

|

|

Mortgage origination revenue |

|

1,361 |

|

|

742 |

|

|

898 |

|

|

998 |

|

|

1,163 |

|

|

Service charges on deposit accounts |

|

1,501 |

|

|

1,338 |

|

|

1,093 |

|

|

1,100 |

|

|

1,305 |

|

|

Bank card revenue |

|

1,528 |

|

|

1,509 |

|

|

1,519 |

|

|

1,341 |

|

|

1,237 |

|

|

Gains on equity investments |

|

202 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

Realized gains/(losses) on debt securities, net |

|

(109 |

) |

|

(68 |

) |

|

127 |

|

|

476 |

|

|

912 |

|

|

Bank owned life insurance and annuity income |

|

293 |

|

|

160 |

|

|

275 |

|

|

298 |

|

|

233 |

|

|

Other income |

|

330 |

|

|

168 |

|

|

120 |

|

|

123 |

|

|

301 |

|

|

Total noninterest income |

|

5,953 |

|

|

4,567 |

|

|

4,715 |

|

|

4,974 |

|

|

5,777 |

|

|

Noninterest expense |

|

|

|

|

|

|

|

Salaries and employee benefits |

|

8,977 |

|

|

8,745 |

|

|

8,230 |

|

|

8,435 |

|

|

8,250 |

|

|

Net occupancy expense |

|

1,265 |

|

|

1,254 |

|

|

1,131 |

|

|

1,174 |

|

|

1,046 |

|

|

Equipment expense |

|

1,902 |

|

|

1,908 |

|

|

1,598 |

|

|

1,581 |

|

|

1,502 |

|

|

Professional fees |

|

438 |

|

|

374 |

|

|

428 |

|

|

338 |

|

|

370 |

|

|

Advertising and public relations |

|

216 |

|

|

254 |

|

|

138 |

|

|

90 |

|

|

207 |

|

|

Amortization of intangibles |

|

387 |

|

|

390 |

|

|

382 |

|

|

405 |

|

|

409 |

|

|

FDIC premiums |

|

330 |

|

|

354 |

|

|

488 |

|

|

277 |

|

|

261 |

|

|

Bank card expense |

|

703 |

|

|

705 |

|

|

685 |

|

|

573 |

|

|

573 |

|

|

Foreclosed properties expense, net |

|

403 |

|

|

370 |

|

|

746 |

|

|

227 |

|

|

676 |

|

|

Acquisition-related expenses |

|

57 |

|

|

273 |

|

|

454 |

|

|

440 |

|

|

218 |

|

|

Other expenses |

|

3,250 |

|

|

2,716 |

|

|

2,756 |

|

|

2,893 |

|

|

3,094 |

|

|

Total noninterest expense |

|

17,928 |

|

|

17,343 |

|

|

17,036 |

|

|

16,433 |

|

|

16,606 |

|

|

Income before income taxes |

|

15,357 |

|

|

15,261 |

|

|

13,490 |

|

|

13,293 |

|

|

12,377 |

|

|

Income tax expense |

|

2,777 |

|

|

3,023 |

|

|

2,930 |

|

|

2,933 |

|

|

2,126 |

|

|

Net income |

|

12,580 |

|

|

12,238 |

|

|

10,560 |

|

|

10,360 |

|

|

10,251 |

|

|

Preferred stock dividends |

|

225 |

|

|

225 |

|

|

139 |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

Net income applicable to common shares |

$ |

12,355 |

|

$ |

12,013 |

|

$ |

10,421 |

|

$ |

10,360 |

|

$ |

10,251 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMIT FINANCIAL GROUP, INC. (NASDAQ: SMMF) |

|

|

|

|

|

Five Quarter Performance Summary (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

|

12/31/2021 |

9/30/2021 |

6/30/2021 |

3/31/2021 |

12/31/2020 |

|

Per Share Data |

|

|

|

|

|

|

|

Earnings per common share |

|

|

|

|

|

|

|

Basic |

$ |

0.96 |

|

$ |

0.93 |

|

$ |

0.80 |

|

$ |

0.80 |

|

$ |

0.79 |

|

|

|

Diluted |

$ |

0.95 |

|

$ |

0.92 |

|

$ |

0.80 |

|

$ |

0.80 |

|

$ |

0.79 |

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per common share |

$ |

0.18 |

|

$ |

0.18 |

|

$ |

0.17 |

|

$ |

0.17 |

|

$ |

0.17 |

|

|

|

Common stock dividend payout ratio |

|

18.5% |

|

|

19.1% |

|

|

21.2% |

|

|

20.6% |

|

|

21.5% |

|

|

|

|

|

|

|

|

|

|

|

Average common shares outstanding |

|

|

|

|

|

|

|

Basic |

|

12,916,555 |

|

|

12,964,575 |

|

|

12,952,357 |

|

|

12,942,099 |

|

|

12,932,768 |

|

|

|

Diluted |

|

12,976,181 |

|

|

13,018,672 |

|

|

13,013,714 |

|

|

13,002,062 |

|

|

12,980,041 |

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding at period end |

|

12,743,125 |

|

|

12,976,693 |

|

|

12,963,057 |

|

|

12,950,714 |

|

|

12,942,004 |

|

|

|

|

|

|

|

|

|

|

Performance Ratios |

|

|

|

|

|

|

|

Return on average equity |

|

15.48% |

|

|

15.30% |

|

|

13.67% |

|

|

14.51% |

|

|

14.90% |

|

|

|

Return on average tangible equity (C) |

|

19.72% |

|

|

19.51% |

|

|

17.03% |

|

|

18.49% |

|

|

18.70% |

|

|

|

Return on average tangible common equity (D) |

|

20.91% |

|

|

20.71% |

|

|

17.59% |

|

|

18.49% |

|

|

18.70% |

|

|

|

Return on average assets |

|

1.42% |

|

|

1.42% |

|

|

1.29% |

|

|

1.31% |

|

|

1.37% |

|

|

|

Net interest margin (A) |

|

3.49% |

|

|

3.47% |

|

|

3.55% |

|

|

3.65% |

|

|

3.76% |

|

|

|

Efficiency ratio (B) |

|

49.04% |

|

|

49.53% |

|

|

48.82% |

|

|

49.50% |

|

|

48.93% |

|

NOTES

(A) – Presented on a tax-equivalent basis assuming

a federal tax rate of 21%.

(B) – Computed on a tax equivalent basis excluding

acquisition-related expenses, gains/losses on sales of assets,

write-downs of OREO properties to fair value and amortization of

intangibles.

(C) – Return on average tangible equity = (Net income –

Amortization of intangibles [after-tax]) / (Average shareholders’

equity – Average intangible assets).

(D) – Return on average tangible common equity = (Net income –

Amortization of intangibles [after-tax]) / (Average common

shareholders’ equity – Average intangible assets).

|

|

|

|

|

|

|

|

SUMMIT FINANCIAL GROUP, INC. (NASDAQ: SMMF) |

|

|

|

|

|

|

Selected Balance Sheet Data (unaudited) |

|

|

|

|

|

|

Dollars in thousands, except per share amounts |

12/31/2021 |

9/30/2021 |

6/30/2021 |

3/31/2021 |

12/31/2020 |

|

Assets |

|

|

|

|

|

|

|

Cash and due from banks |

$ |

21,006 |

|

$ |

21,247 |

|

$ |

18,707 |

|

$ |

20,732 |

|

$ |

19,522 |

|

|

|

Interest bearing deposits other banks |

|

57,452 |

|

|

189,862 |

|

|

176,282 |

|

|

155,865 |

|

|

80,265 |

|

|

|

Debt securities, available for sale |

|

401,103 |

|

|

424,741 |

|

|

345,742 |

|

|

311,384 |

|

|

286,127 |

|

|

|

Debt securities, held to maturity |

|

98,060 |

|

|

98,528 |

|

|

98,995 |

|

|

99,457 |

|

|

99,914 |

|

|

|

Equity investments |

|

20,202 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

Other investments |

|

11,304 |

|

|

10,649 |

|

|

10,661 |

|

|

10,776 |

|

|

14,185 |

|

|

|

Loans, net |

|

2,729,093 |

|

|

2,521,704 |

|

|

2,395,885 |

|

|

2,418,029 |

|

|

2,379,907 |

|

|

|

Property held for sale |

|

9,858 |

|

|

12,450 |

|

|

13,170 |

|

|

13,918 |

|

|

15,588 |

|

|

|

Premises and equipment, net |

|

56,371 |

|

|

56,818 |

|

|

53,104 |

|

|

53,289 |

|

|

52,537 |

|

|

|

Goodwill and other intangible assets |

|

63,590 |

|

|

63,977 |

|

|

53,858 |

|

|

54,239 |

|

|

55,123 |

|

|

|

Cash surrender value of life insurance policies and annuities |

|

60,613 |

|

|

60,241 |

|

|

60,087 |

|

|

59,740 |

|

|

59,438 |

|

|

|

Other assets |

|

48,067 |

|

|

48,734 |

|

|

46,042 |

|

|

50,706 |

|

|

43,778 |

|

|

|

Total assets |

$ |

3,576,719 |

|

$ |

3,508,951 |

|

$ |

3,272,533 |

|

$ |

3,248,135 |

|

$ |

3,106,384 |

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

|

Deposits |

$ |

2,943,089 |

|

$ |

2,955,940 |

|

$ |

2,729,205 |

|

$ |

2,725,010 |

|

$ |

2,595,651 |

|

|

|

Short-term borrowings |

|

140,146 |

|

|

140,146 |

|

|

140,146 |

|

|

140,145 |

|

|

140,146 |

|

|

|

Long-term borrowings and |

|

|

|

|

|

|

|

subordinated debentures |

|

123,159 |

|

|

49,739 |

|

|

49,710 |

|

|

49,681 |

|

|

49,652 |

|

|

|

Other liabilities |

|

42,852 |

|

|

39,837 |

|

|

38,265 |

|

|

39,854 |

|

|

39,355 |

|

|

|

Shareholders' equity - preferred |

|

14,920 |

|

|

14,920 |

|

|

14,920 |

|

|

- |

|

|

- |

|

|

|

Shareholders' equity - common |

|

312,553 |

|

|

308,369 |

|

|

300,287 |

|

|

293,445 |

|

|

281,580 |

|

|

|

Total liabilities and shareholders' equity |

$ |

3,576,719 |

|

$ |

3,508,951 |

|

$ |

3,272,533 |

|

$ |

3,248,135 |

|

$ |

3,106,384 |

|

|

|

|

|

|

|

|

|

|

|

Book value per common share |

$ |

24.53 |

|

$ |

23.76 |

|

$ |

23.16 |

|

$ |

22.66 |

|

$ |

21.76 |

|

|

|

Tangible book value per common share (A) |

$ |

19.54 |

|

$ |

18.83 |

|

$ |

19.01 |

|

$ |

18.47 |

|

$ |

17.50 |

|

|

|

Tangible common equity to tangible assets (B) |

|

7.1% |

|

|

7.1% |

|

|

7.7% |

|

|

7.5% |

|

|

7.4% |

|

|

|

|

|

|

|

|

|

NOTES(A) – Tangible book value per share = (Common

shareholders’ equity – Intangible assets) / Common shares

outstanding.(B) – Tangible common equity to tangible assets =

(Common shareholders’ equity – Intangible assets) / (Total assets –

Intangible assets).

|

|

|

|

|

|

SUMMIT FINANCIAL GROUP INC. (NASDAQ: SMMF) |

|

|

|

|

Regulatory Capital Ratios (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12/31/2021 |

9/30/2021 |

6/30/2021 |

3/31/2021 |

12/31/2020 |

|

Summit Financial Group, Inc. |

|

|

|

|

|

|

|

CET1 Risk-based Capital |

8.4 |

% |

9.0 |

% |

9.6 |

% |

9.3 |

% |

9.3 |

% |

|

|

Tier 1 Risk-based Capital |

9.5 |

% |

10.2 |

% |

10.9 |

% |

10.1 |

% |

10.0 |

% |

|

|

Total Risk-based Capital |

13.8 |

% |

12.1 |

% |

13.0 |

% |

12.1 |

% |

12.1 |

% |

|

|

Tier 1 Leverage |

8.3 |

% |

8.4 |

% |

8.9 |

% |

8.5 |

% |

8.6 |

% |

|

|

|

|

|

|

|

|

|

Summit Community Bank, Inc. |

|

|

|

|

|

|

|

CET1 Risk-based Capital |

11.9 |

% |

11.2 |

% |

11.9 |

% |

11.1 |

% |

11.1 |

% |

|

|

Tier 1 Risk-based Capital |

11.9 |

% |

11.2 |

% |

11.9 |

% |

11.1 |

% |

11.1 |

% |

|

|

Total Risk-based Capital |

12.8 |

% |

12.1 |

% |

12.9 |

% |

12.0 |

% |

12.0 |

% |

|

|

Tier 1 Leverage |

10.4 |

% |

9.2 |

% |

9.7 |

% |

9.3 |

% |

9.5 |

% |

|

|

|

|

|

|

|

|

|

SUMMIT FINANCIAL GROUP INC. (NASDAQ: SMMF) |

|

|

|

|

|

Loan Composition (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dollars in thousands |

12/31/2021 |

9/30/2021 |

6/30/2021 |

3/31/2021 |

12/31/2020 |

|

|

|

|

|

|

|

|

|

|

|

Commercial |

|

$ |

365,301 |

|

$ |

317,855 |

|

$ |

326,468 |

|

$ |

348,022 |

|

$ |

306,885 |

|

|

Mortgage warehouse lines |

|

227,869 |

|

|

161,628 |

|

|

105,288 |

|

|

187,995 |

|

|

251,810 |

|

|

Commercial real estate |

|

|

|

|

|

|

|

Owner occupied |

|

484,708 |

|

|

439,202 |

|

|

392,164 |

|

|

358,200 |

|

|

351,860 |

|

|

Non-owner occupied |

|

866,031 |

|

|

835,071 |

|

|

784,415 |

|

|

735,594 |

|

|

685,565 |

|

|

Construction and development |

|

|

|

|

|

|

|

Land and development |

|

100,805 |

|

|

99,718 |

|

|

102,670 |

|

|

106,312 |

|

|

107,342 |

|

|

Construction |

|

146,038 |

|

|

127,432 |

|

|

140,788 |

|

|

126,011 |

|

|

91,100 |

|

|

Residential real estate |

|

|

|

|

|

|

|

Conventional |

|

384,794 |

|

|

394,889 |

|

|

398,239 |

|

|

411,103 |

|

|

425,519 |

|

|

Jumbo |

|

|

79,108 |

|

|

71,977 |

|

|

71,694 |

|

|

65,851 |

|

|

74,185 |

|

|

Home equity |

|

72,112 |

|

|

71,496 |

|

|

72,956 |

|

|

77,684 |

|

|

81,588 |

|

|

Consumer |

|

|

31,923 |

|

|

32,284 |

|

|

32,732 |

|

|

32,924 |

|

|

33,906 |

|

|

Other |

|

|

2,702 |

|

|

2,558 |

|

|

2,356 |

|

|

2,375 |

|

|

2,393 |

|

|

Total loans, net of unearned fees |

|

2,761,391 |

|

|

2,554,110 |

|

|

2,429,770 |

|

|

2,452,071 |

|

|

2,412,153 |

|

|

Less allowance for credit losses |

|

32,298 |

|

|

32,406 |

|

|

33,885 |

|

|

34,042 |

|

|

32,246 |

|

|

Loans, net |

$ |

2,729,093 |

|

$ |

2,521,704 |

|

$ |

2,395,885 |

|

$ |

2,418,029 |

|

$ |

2,379,907 |

|

|

|

|

|

|

|

|

|

|

|

Unfunded loan commitments |

$ |

688,493 |

|

$ |

627,461 |

|

$ |

535,587 |

|

$ |

556,910 |

|

$ |

534,256 |

|

|

|

|

|

|

|

|

|

|

|

SUMMIT FINANCIAL GROUP INC. (NASDAQ: SMMF) |

|

|

|

|

|

Deposit Composition (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dollars in thousands |

|

12/31/2021 |

9/30/2021 |

6/30/2021 |

3/31/2021 |

12/31/2020 |

|

|

Core deposits |

|

|

|

|

|

|

|

|

Non-interest bearing checking |

$ |

568,986 |

|

$ |

575,542 |

|

$ |

503,097 |

|

$ |

505,264 |

|

$ |

440,819 |

|

|

Interest bearing checking |

|

1,127,298 |

|

|

1,121,028 |

|

|

1,005,725 |

|

|

988,204 |

|

|

934,185 |

|

|

Savings |

|

|

698,156 |

|

|

693,686 |

|

|

677,000 |

|

|

656,514 |

|

|

621,168 |

|

|

Time deposits |

|

|

451,713 |

|

|

467,024 |

|

|

441,139 |

|

|

456,431 |

|

|

460,443 |

|

|

Total core deposits |

|

2,846,153 |

|

|

2,857,280 |

|

|

2,626,961 |

|

|

2,606,413 |

|

|

2,456,615 |

|

|

|

|

|

|

|

|

|

|

|

Brokered time deposits |

|

14,677 |

|

|

14,671 |

|

|

23,521 |

|

|

39,125 |

|

|

55,454 |

|

|

Other non-core time deposits |

|

82,259 |

|

|

83,989 |

|

|

78,723 |

|

|

79,472 |

|

|

83,582 |

|

|

Total deposits |

$ |

2,943,089 |

|

$ |

2,955,940 |

|

$ |

2,729,205 |

|

$ |

2,725,010 |

|

$ |

2,595,651 |

|

|

|

|

|

|

|

|

|

|

|

SUMMIT FINANCIAL GROUP, INC. (NASDAQ: SMMF) |

|

|

|

|

|

Asset Quality Information (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

Dollars in thousands |

12/31/2021 |

9/30/2021 |

6/30/2021 |

3/31/2021 |

12/31/2020 |

|

|

|

|

|

|

|

|

|

|

Gross loan charge-offs |

$ |

282 |

|

$ |

528 |

|

$ |

343 |

|

$ |

354 |

|

$ |

434 |

|

|

|

Gross loan recoveries |

|

(89 |

) |

|

(158 |

) |

|

(141 |

) |

|

(165 |

) |

|

(195 |

) |

|

|

Net loan charge-offs |

$ |

193 |

|

$ |

370 |

|

$ |

202 |

|

$ |

189 |

|

$ |

239 |

|

|

|

|

|

|

|

|

|

|

|

Net loan charge-offs to average loans (annualized) |

|

0.03% |

|

|

0.06% |

|

|

0.03% |

|

|

0.03% |

|

|

0.04% |

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan credit losses |

$ |

32,298 |

|

$ |

32,406 |

|

$ |

33,885 |

|

$ |

34,042 |

|

$ |

32,246 |

|

|

|

Allowance for loan credit losses as a percentage |

|

|

|

|

|

|

|

of period end loans |

|

1.17% |

|

|

1.27% |

|

|

1.39% |

|

|

1.39% |

|

|

1.34% |

|

|

|

|

|

|

|

|

|

| |

Allowance for credit losses on |

|

|

|

|

|

| |

unfunded loan commitments ("ULC") |

$ |

7,275 |

|

$ |

5,860 |

|

$ |

4,660 |

|

$ |

3,705 |

|

$ |

4,190 |

|

| |

Allowance for credit losses on ULC |

|

|

|

|

|

| |

as a percentage of peiod end ULC |

|

1.06% |

|

|

0.93% |

|

|

0.87% |

|

|

0.67% |

|

|

0.78% |

|

| |

|

|

|

|

|

|

| |

Nonperforming assets: |

|

|

|

|

|

| |

Nonperforming loans |

|

|

|

|

|

| |

Commercial |

$ |

740 |

|

$ |

459 |

|

$ |

968 |

|

$ |

848 |

|

$ |

525 |

|

| |

Commercial real estate |

|

4,603 |

|

|

4,643 |

|

|

14,430 |

|

|

17,137 |

|

|

14,237 |

|

| |

Residential construction and development |

|

1,560 |

|

|

448 |

|

|

621 |

|

|

626 |

|

|

235 |

|

| |

Residential real estate |

|

5,772 |

|

|

5,514 |

|

|

6,800 |

|

|

6,667 |

|

|

5,264 |

|

| |

Consumer |

|

21 |

|

|

48 |

|

|

38 |

|

|

54 |

|

|

74 |

|

| |

Other |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| |

Total nonperforming loans |

|

12,696 |

|

|

11,112 |

|

|

22,857 |

|

|

25,332 |

|

|

20,335 |

|

| |

Foreclosed properties |

|

|

|

|

|

| |

Commercial real estate |

|

1,389 |

|

|

2,192 |

|

|

2,281 |

|

|

2,281 |

|

|

2,581 |

|

| |

Commercial construction and development |

|

2,332 |

|

|

2,925 |

|

|

3,146 |

|

|

3,884 |

|

|

4,154 |

|

| |

Residential construction and development |

|

5,561 |

|

|

6,712 |

|

|

6,859 |

|

|

7,129 |

|

|

7,791 |

|

| |

Residential real estate |

|

576 |

|

|

621 |

|

|

884 |

|

|

624 |

|

|

1,062 |

|

| |

Total foreclosed properties |

|

9,858 |

|

|

12,450 |

|

|

13,170 |

|

|

13,918 |

|

|

15,588 |

|

| |

Other repossessed assets |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| |

Total nonperforming assets |

$ |

22,554 |

|

$ |

23,562 |

|

$ |

36,027 |

|

$ |

39,250 |

|

$ |

35,923 |

|

| |

|

|

|

|

|

|

| |

Nonperforming loans to period end loans |

|

0.46% |

|

|

0.44% |

|

|

0.94% |

|

|

1.03% |

|

|

0.84% |

|

| |

Nonperforming assets to period end assets |

|

0.63% |

|

|

0.67% |

|

|

1.10% |

|

|

1.21% |

|

|

1.16% |

|

| |

|

|

|

|

|

|

| |

Troubled debt restructurings |

|

|

|

|

|

| |

Performing |

$ |

18,887 |

|

$ |

20,535 |

|

$ |

20,799 |

|

$ |

20,462 |

|

$ |

21,375 |

|

| |

Nonperforming |

|

2,039 |

|

|

1,141 |

|

|

1,235 |

|

|

3,828 |

|

|

3,127 |

|

| |

Total troubled debt restructurings |

$ |

20,926 |

|

$ |

21,676 |

|

$ |

22,034 |

|

$ |

24,290 |

|

$ |

24,502 |

|

|

SUMMIT FINANCIAL GROUP, INC. (NASDAQ: SMMF) |

|

|

|

|

|

Loans Past Due 30-89 Days (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dollars in thousands |

12/31/2021 |

9/30/2021 |

6/30/2021 |

3/31/2021 |

12/31/2020 |

|

|

|

|

|

|

|

|

|

|

Commercial |

$ |

751 |

|

$ |

304 |

|

$ |

414 |

|

$ |

335 |

|

$ |

1 |

|

|

Commercial real estate |

|

683 |

|

|

281 |

|

|

733 |

|

|

508 |

|

|

274 |

|

|

Construction and development |

|

45 |

|

|

1,215 |

|

|

1,911 |

|

|

330 |

|

|

47 |

|

|

Residential real estate |

|

3,552 |

|

|

2,643 |

|

|

3,594 |

|

|

2,146 |

|

|

4,405 |

|

|

Consumer |

|

190 |

|

|

193 |

|

|

404 |

|

|

96 |

|

|

233 |

|

|

Other |

|

22 |

|

|

1 |

|

|

- |

|

|

3 |

|

|

5 |

|

|

Total |

$ |

5,243 |

|

$ |

4,637 |

|

$ |

7,056 |

|

$ |

3,418 |

|

$ |

4,965 |

|

|

|

|

|

|

|

|

|

SUMMIT FINANCIAL GROUP, INC. (NASDAQ: SMMF) |

|

|

|

|

|

|

|

|

|

|

Average Balance Sheet, Interest Earnings & Expenses and

Average Rates |

|

|

|

|

|

|

|

Q4 2021 vs Q3 2021 vs Q4 2020 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 2021 |

|

Q3 2021 |

|

Q4 2020 |

|

|

Average |

Earnings / |

Yield / |

|

Average |

Earnings / |

Yield / |

|

Average |

Earnings / |

Yield / |

|

Dollars in thousands |

Balances |

Expense |

Rate |

|

Balances |

Expense |

Rate |

|

Balances |

Expense |

Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

Interest earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

Loans, net of unearned interest (1) |

|

|

|

|

|

|

|

|

|

|

|

Taxable |

$ |

2,640,975 |

|

$ |

28,916 |

|

4.34 |

% |

|

$ |

2,495,880 |

|

$ |

28,340 |

|

4.50 |

% |

|

$ |

2,292,797 |

|

$ |

27,774 |

|

4.82 |

% |

|

Tax-exempt (2) |

|

6,888 |

|

|

81 |

|

4.67 |

% |

|

|

7,871 |

|

|

96 |

|

4.84 |

% |

|

|

13,062 |

|

|

156 |

|

4.75 |

% |

|

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

349,541 |

|

|

1,806 |

|

2.05 |

% |

|

|

315,082 |

|

|

1,432 |

|

1.80 |

% |

|

|

258,594 |

|

|

1,341 |

|

2.06 |

% |

|

Tax-exempt (2) |

|

177,757 |

|

|

1,212 |

|

2.71 |

% |

|

|

166,285 |

|

|

1,159 |

|

2.77 |

% |

|

|

147,979 |

|

|

1,122 |

|

3.02 |

% |

|

Interest bearing deposits other banks |

|

|

|

|

|

|

|

|

|

|

|

and Federal funds sold |

|

132,471 |

|

|

75 |

|

0.22 |

% |

|

|

248,315 |

|

|

118 |

|

0.19 |

% |

|

|

87,151 |

|

|

51 |

|

0.23 |

% |

|

Total interest earning assets |

|

3,307,632 |

|

|

32,090 |

|

3.85 |

% |

|

|

3,233,433 |

|

|

31,145 |

|

3.82 |

% |

|

|

2,799,583 |

|

|

30,444 |

|

4.33 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

Cash & due from banks |

|

21,037 |

|

|

|

|

|

20,077 |

|

|

|

|

|

16,846 |

|

|

|

|

Premises & equipment |

|

56,566 |

|

|

|

|

|

55,908 |

|

|

|

|

|

52,688 |

|

|

|

|

Other assets |

|

190,445 |

|

|

|

|

|

175,975 |

|

|

|

|

|

157,436 |

|

|

|

|

Allowance for credit losses |

|

(32,691 |

) |

|

|

|

|

(33,911 |

) |

|

|

|

|

(30,778 |

) |

|

|

|

Total assets |

$ |

3,542,989 |

|

|

|

|

$ |

3,451,482 |

|

|

|

|

$ |

2,995,775 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Interest bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Interest bearing |

|

|

|

|

|

|

|

|

|

|

|

|

demand deposits |

|

1,128,637 |

|

|

319 |

|

0.11 |

% |

|

$ |

1,092,392 |

|

$ |

325 |

|

0.12 |

% |

|

$ |

895,325 |

|

$ |

357 |

|

0.16 |

% |

|

Savings deposits |

|

692,893 |

|

|

590 |

|

0.34 |

% |

|

|

691,411 |

|

|

602 |

|