UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

STRYVE

FOODS, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

PLEASE

TAKE NOTICE that a Special Meeting of Stockholders of Stryve Foods, Inc. (the “Special Meeting”) will be held virtually on

[__________], [ __________], 2025 at 9:00 AM, Central Time. You will be able to participate in the Special Meeting online, vote your

shares electronically and submit your questions prior to and during the meeting. You must register to attend the Special Meeting online

and/or participate at www.proxydocs.com/SNAX. There is no physical location for the Special Meeting. At the meeting, the holders of outstanding

common stock will act on the following matters:

| |

(1) |

To approve the issuance of

7,341,722 shares of Class A common stock upon the exercise of warrants at an exercise price of $0.79 per share (the “November

Warrants”) in accordance with Nasdaq Listing Rules (Proposal 1). |

| |

|

|

| |

(2) |

To approve the issuance of

529,412 shares of Class A common stock upon the exercise of amended warrants at a reduced exercise price of $0.79 per share (the “Amended

Warrants”) in accordance with Nasdaq Listing Rules (Proposal 2). |

| |

|

|

| |

(3) |

To approve the adjournment of the meeting, if necessary

or advisable, to solicit additional proxies in favor of Proposal 1 and/or 2 (Proposal 3) |

Stockholders

of record at the close of business on [_________], 2024 are entitled to notice of and to vote at the Special Meeting and any postponements

or adjournments thereof.

We

hope you will be able to attend the meeting virtually, but in any event, we would appreciate your submitting your proxy as promptly as

possible. You may vote by telephone or the internet as instructed in the accompanying proxy. If you received a copy of the proxy card

by mail, you may also submit your vote by mail. We encourage you to vote by telephone or the internet. These methods are convenient and

save the Company significant postage and processing charges.

| By

Order of the Board of Directors, |

| |

|

| |

|

/s/

Kevin Vivian |

| |

|

Kevin

Vivian

|

| |

|

Chairman

of the Board |

Dated:

[_____], 2024

TABLE

OF CONTENTS

STRYVE

FOODS, INC.

Post

Office Box 864

Frisco,

TX 75034

SPECIAL

MEETING OF STOCKHOLDERS

To

Be Held [______], 2025

PROXY

STATEMENT

The

Board of Directors (the “Board”) of Stryve Foods, Inc. (the “Company,” “we,” “us,” “our,”

and “ours”) is soliciting proxies from its stockholders to be used at the Special Meeting of Stockholders to be held virtually

on [______], 2025 at 9:00 AM, Central Time. You will be able to participate in the Special Meeting online, vote your shares electronically

and submit your questions prior to and during the meeting. You must register to attend the Special Meeting online and/or participate

at www.proxydocs.com/SNAX. There is no physical location for the Special Meeting. This proxy statement contains information related to

the Special Meeting.

ABOUT

THE SPECIAL MEETING

Why

did I receive these materials?

Our

Board is soliciting proxies for the Special Meeting. You are receiving a proxy statement because you owned shares of our common stock

on [____], 2024 and that entitles you to vote at the meeting. By use of a proxy, you can vote whether or not you attend the meeting

virtually. This proxy statement describes the matters on which we would like you to vote and provides information on those matters so

that you can make an informed decision.

What

information is contained in this proxy statement?

This

proxy statement includes information related to the proposals to be voted on at the Special Meeting, the voting process and other information

that the Securities and Exchange Commission requires us to provide to our stockholders.

Who

is entitled to vote at the meeting?

Holders

of shares of our Class A and Class V common stock vote together as a single class on all matters submitted to stockholders. Holders of

Class A and Class V common stock as of the close of business on the record date, [_____], 2024, will receive notice of, and be

eligible to vote at, the Special Meeting and at any adjournment or postponement thereof. At the close of business on the record date,

we had outstanding and entitled to vote [_______] shares of Class A common stock and [______] shares of Class V common

stock, for a total of [____] shares of common stock as of the record date.

How

many votes do I have?

Each

outstanding share of our common stock you owned as of the record date will be entitled to one vote for each matter considered at the

meeting. There is no cumulative voting.

Who

can attend the meeting virtually?

You

will be able to participate in the Special Meeting online, vote your shares electronically and submit your questions prior to and during

the meeting. You must register to attend the Special Meeting online and/or participate at www.proxydocs.com/SNAX. There is no physical

location for the Special Meeting.

What

constitutes a quorum?

The

presence at the meeting, virtually or by proxy, of the holders of a majority of all the outstanding shares of common stock representing

a majority of the voting power of all outstanding shares constitutes a quorum, permitting the conduct of business at the meeting. Proxies

received but marked as abstentions or broker non-votes, if any, will be included in the calculation of the number of votes considered

to be present at the meeting for purposes of a quorum.

How

do I vote if I am a stockholder of record?

If

you are a stockholder of record (that is, you own your shares in your own name with our transfer agent and not through a broker, bank

or other nominee that holds shares for your account in a “street name” capacity), you can vote via a virtual meeting or by

proxy, which will be conducted solely online via live webcast. You will be able to participate in the Special Meeting online, vote your

shares electronically and submit your questions prior to and during the meeting. You must register to attend the Special Meeting online

and/or participate at www.proxydocs.com/SNAX. There is no physical location for the Special Meeting. We urge you to vote by proxy even

if you plan to attend the Special Meeting virtually so that we will know as soon as possible that enough votes will be present for us

to hold the meeting. If you attend the meeting virtually, you may vote at the meeting and your proxy will not be counted. Our Board has

designated R. Alex Hawkins and Will Pugh or their respective designees, as proxies to vote the shares of common stock solicited on its

behalf. You can vote by proxy by any of the following methods.

Voting

by Telephone or Internet. If you are a stockholder of record, you may vote by proxy by telephone or internet. Proxies submitted by

telephone or through the internet must be received by 9:00 a.m. CDT on [____], [____], 2025. Please see the proxy card

for instructions on how to vote by telephone or internet.

Voting

by Proxy Card. Each stockholder electing to receive stockholder materials by mail may vote by proxy using the accompanying proxy

card. When you return a proxy card that is properly signed and completed, the shares represented by your proxy will be voted as you specify

on the proxy card.

How

do I vote if I hold my shares in “street name”?

If

you hold your shares in “street name,” we have supplied copies of our proxy materials for the Special Meeting to the broker,

trust, bank or other nominee holding your shares of record and they have the responsibility to send these proxy materials to you. You

must either direct the broker, trust, bank or other nominee as to how to vote your shares, or obtain a proxy from the bank, broker or

other nominee to vote at the meeting. Please refer to the voter instruction cards used by your broker, trust, bank or other nominee for

specific instructions on methods of voting, including by telephone or using the internet. You must register to attend the Special Meeting

online and/or participate at www.proxydocs.com/SNAX.

Can

I change my vote?

Yes.

If you are a stockholder of record, you may revoke or change your vote at any time before the proxy is exercised by filing a notice of

revocation with the Secretary of the Company or mailing a proxy bearing a later date, submitting your proxy again by telephone or over

the internet or by attending the Special Meeting virtually and voting. For shares you hold beneficially in “street name,”

you may change your vote by submitting new voting instructions to your broker, trust, bank or other nominee or, if you have obtained

a legal proxy from your broker, trust, bank or other nominee giving you the right to vote your shares, by attending the meeting virtually

and voting. In either case, the powers of the proxy holders will be suspended if you attend the meeting virtually and so request, although

attendance at the meeting will not by itself revoke a previously granted proxy.

How

is the Company soliciting this proxy?

We

are soliciting this proxy on behalf of our Board and will pay all expenses associated with this solicitation. In addition to mailing

these proxy materials, certain of our officers and other employees may, without compensation other than their regular compensation, solicit

proxies through further mailing or personal conversations, or by telephone, facsimile or other electronic means. We will also, upon request,

reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket expenses

for forwarding proxy materials to the beneficial owners of our stock and to obtain proxies.

What

vote is required to approve each item?

Each

proposal requires a majority of the votes cast by the stockholders present in person or represented by proxy at the meeting and entitled

to vote thereon.

How

are votes counted?

You

may vote “FOR,” “AGAINST” or “ABSTAIN.” An abstention is not considered a vote “cast”

and therefore will not impact any of the proposals.

If

you hold your shares in “street name,” we have supplied copies of our proxy materials for our Special Meeting to the broker,

trust, bank or other nominee holding your shares of record and they have the responsibility to send these proxy materials to you. Your

broker, trust, bank or other nominee that has not received voting instructions from you may not vote on any proposal.

These

so-called “broker non-votes” will be included in the calculation of the number of votes considered to be present at the meeting

for purposes of determining a quorum, but will not be considered in determining the number of votes necessary for approval of any of

the proposals and will have no effect on the outcome of any of the proposals.

Other

than the items in the proxy statement, what other items of business will be addressed at the Special Meeting?

The

Board and management do not intend to present any matters at this time at the Special Meeting other than those outlined in the notice

of the Special Meeting. Should any other matter requiring a vote of stockholders arise, stockholders returning the proxy card confer

upon the individuals designated as proxies discretionary authority to vote the shares represented by such proxy on any such other matter

in accordance with their best judgment.

What

should I do if I receive more than one set of voting materials?

You

may receive more than one set of voting materials, including multiple copies of this proxy statement, proxy cards or voting instruction

cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for

each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name,

you will receive more than one proxy card. Please vote your shares applicable to each proxy card and voting instruction card that you

receive.

Where

can I find the voting results of the Special Meeting?

We

will announce the preliminary voting results at the Special Meeting and release the final results in a Form 8-K within four business

days following the Special Meeting.

PRINCIPAL

STOCKHOLDERS

The

following table sets forth information regarding the beneficial ownership of the Company as of [____], 2024 by:

| |

● |

each person known to be the beneficial owner of more

than 5% of the shares of the Company’s Class A common stock; |

| |

|

|

| |

● |

each of the Company’s named executive officers

and directors; and |

| |

|

|

| |

● |

all current executive officers and directors as a group. |

Beneficial

ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security

if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently

exercisable or exercisable within 60 days. The information below is based on an aggregate of [______] shares of Class A Common

Stock and [___] shares of Class V Common Stock issued and outstanding as of [_____], 2024.

Unless

otherwise indicated, the Company believes that all persons named in the table have sole voting and investment power with respect to all

shares beneficially owned by them.

| Name

and Address of Beneficial Owner (1) | |

Shares

of Class A Common Stock | | |

%

of Class A Common Stock | | |

Holdings

Class B/V Units(2) | | |

%

of Total Voting Power(3) | |

| Directors

and Name Executive Officers | |

| | | |

| | | |

| | | |

| | |

| Christopher

Boever | |

| | (4)

(9) | |

| | % | |

| — | | |

| | % |

| R.

Alex Hawkins | |

| | (4)

(5) (6) | |

| | * | |

| 8,114 | | |

| | % |

| Kevin

Vivian | |

| | | |

| | * | |

| 5,812 | | |

| | * |

| B.

Luke Weil | |

| | (7) | |

| | % | |

| — | | |

| | % |

| Mauricio

Orellana | |

| | (8) | |

| | * | |

| — | | |

| | * |

| Robert

“Bo” D. Ramsey III | |

| | (9) | |

| | * | |

| — | | |

| | * |

| Chris

Whitehair | |

| | (9) | |

| | * | |

| — | | |

| | * |

| All

Directors and Executive Officers as a Group (seven persons): | |

| | | |

| | % | |

| 13,926 | | |

| | % |

| Greater

than Five Percent Holders (excluding officers and directors): | |

| | | |

| | | |

| | | |

| | |

| Laurence

W. Lytton (10) | |

| 194,780 | | |

| | % | |

| — | | |

| | % |

*

Less than one percent.

(1)

Unless otherwise noted, the principal business address of all the individuals listed under “Directors and Named Executive Officers”

in the table above is c/o Post Office Box 864, Frisco, TX 75034.

(2)

Holders of Class A Common Stock are entitled to one vote for each share of Class A common stock held by them. Subject to the terms of

an exchange agreement, a set of one Class B Unit and one share of Class V common stock is exchangeable for one share of Class A common

stock.

(3)

Represents percentage of voting power of the holders of Class A common stock and Class V common stock of the Company voting together

as a single class. Class V common stock votes together with Class A common stock on all matters.

(4)

Ownership of Class A common stock excludes the following shares of restricted Class A common stock awarded under the Stryve Foods, Inc.

2021 Omnibus Incentive Plan (the “Incentive Plan”):

| Name |

|

Excludes |

| Christopher

Boever |

|

● |

[______] |

| Alex

Hawkins |

|

● |

[______] |

(5)

Includes [____] restricted stock awards representing shares of Class A common stock that will become exercisable or settle within 60

days after [_____], 2024.

(6)

Includes 1,000 Warrants to purchase 67 shares of Class A common stock.

(7)

Includes 72,955 Warrants to purchase 4,864 shares of Class A common stock. In addition, includes 5,000 shares of Class A common stock

owned by Andina Equity LLC of which Mr. Weil is the managing member and 15,833 shares of Class A common stock owned by LWEH3 LLC which

Mr. Weil controls. B. Luke Weil disclaims beneficial ownership of the securities held by Andina Equity LLC and LWEH3 LLC except to the

extent of his pecuniary interest therein.

(8)

Includes 4,999 Warrants to purchase 333 shares of Class A common stock.

(9)

Ownership of Class A common stock includes the following shares to be issued upon the conversion of warrants issued in connection with

the April 19, 2023 promissory notes:

| Name |

|

Excludes |

| Christopher

Boever |

|

97,390 |

| Robert

Ramsey |

|

1,299 |

| Chris

Whitehair |

|

19,478 |

(10)

Based on information included in Schedule 13-G/A filed on February 14, 2024. The address is 467 Central Park West, New York, NY 10025.

PROPOSAL

NO. 1

APPROVAL

OF THE ISSUANCE OF SHARES OF CLASS A COMMON STOCK UPON EXERCISE OF THE NOVEMBER WARRANTS IN ACCORDANCE WITH NASDAQ LISTING RULE 5635

General

On

November 8, 2024, we announced the pricing of a best efforts public offering of (i) 370,000 shares of Class A common stock; (ii) prefunded

warrants to purchase an aggregate of 3,300,886 shares of Class A common stock; and (iii) 7,341,722 common warrants to purchase up to

7,341,722 shares of Class A common stock (the “November Warrants”), at a combined public offering price of $0.79 per

share and warrants. The following is a summary description of the November Warrants:

Duration

and Exercise Price

Each

November Warrant has an initial exercise price per share equal to $0.79 and is exercisable for one share of Class A Common Stock. The

November Warrants are exercisable following stockholder approval and have a term of exercise equal to five years following date of the

stockholder approval. We have agreed to hold an annual or special meeting within 60 days of November 12, 2024 to have stockholders approve

the issuance of the shares of Class A Common Stock underlying the November Warrants pursuant to applicable Nasdaq rules. The exercise

price and number of shares issuable upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits,

reorganizations or similar events affecting our common stock and the exercise price.

Exercisability

The

November Warrants are exercisable, at the option of each holder, in whole or in part, by delivering to us a duly-executed exercise notice

accompanied by payment in full for the number of shares of our Class A Common Stock purchased upon such exercise (except in the case

of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s

warrants to the extent that the holder would own more than 4.99% (or 9.99%, at the holder’s election) of our outstanding Class

A Common Stock immediately after exercise, except that upon notice from the holder to us, the holder may decrease or increase the limitation

of ownership of outstanding shares of Class A Common Stock after exercising the holder’s warrants up to 9.99% of the number of

shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in

accordance with the terms of the warrants, provided that any increase in such limitation shall not be effective until 61 days following

notice to us. No fractional shares of Class A Common Stock will be issued in connection with the exercise of a November Warrant. In lieu

of fractional shares, we will either pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price

or round up to the next whole share.

Cashless

Exercise

If,

at the time a holder exercises its November Warrants, a registration statement registering the issuance or resale of the shares of Class

A Common Stock underlying the warrants under the Securities Act is not then effective or available for the issuance of such shares, then

in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price,

the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of Class A Common Stock

determined according to a formula set forth in the warrant.

Fundamental

Transactions

In

the event of any fundamental transaction, as described in the November Warrants and generally including any merger with or into another

entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of Class A

Common Stock, then upon any subsequent exercise of a warrant, the holder will have the right to receive as alternative consideration,

for each share of Class A Common Stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental

transaction, the same consideration receivable upon or as a result of such transaction by a holder of the number of shares of common

stock for which the warrant is exercisable immediately prior to such event. In addition, upon a fundamental transaction, the holder will

have the right to require us to repurchase its warrant at its fair value using the Black Scholes option pricing formula in the warrants;

provided, however, that, if the fundamental transaction is not within our control, including not approved by our board of directors,

then the holder shall only be entitled to receive the same type or form of consideration (and in the same proportion), at the Black Scholes

value of the unexercised portion of the warrant, that is being offered and paid to the holders of our Class A Common Stock in connection

with the fundamental transaction.

Transferability

Subject

to applicable laws, a November Warrant may be transferred at the option of the holder upon surrender of the warrant to us together with

the appropriate instruments of transfer.

Form

of Warrant

The

foregoing summary of the November Warrants does not purport to be complete and is subject to, and qualified in its entirety by, the forms

of such warrant attached as Exhibit 4.1 to our Current Report Form 8-K filed on November 12, 2024, which is incorporated herein by reference.

Reasons

for Stockholder Approval

In

the public offering, we agreed to use commercially reasonable efforts to hold an annual or a special meeting of stockholders within sixty

(60) days to obtain the stockholder approval.

In

addition, our Class A common stock is listed on the Nasdaq Capital Market under the symbol “SNAX,” and we are subject to

the Nasdaq listing standards and rules. Under Rule 5635(b) of the Nasdaq Stock Market, stockholder approval is required prior to the

issuance of securities when the issuance or potential issuance will result in a change of control of the Company. The November Warrants

could be deemed to effect a change of control of the Company, which would violate Rule 5635(b) without approval of our stockholders.

In addition, under Rule 5635(d) of the Nasdaq Stock Market, stockholder approval is required in connection with a transaction, other

than a public offering, at a price below the Minimum Price (as defined under Nasdaq rules) involving the sale, issuance or potential

issuance by the Company of common stock (or securities convertible into or exercisable for common stock), which equals 20% or more of

the common stock or 20% or more of the voting power outstanding before the issuance. The November Warrants would result in shares of

Class A common stock being potentially issued at a price below the Minimum Price if this offering were combined with other offerings,

it is possible that the November Warrants would violate Rule 5635(d) without approval of our stockholders.

Use

of Proceeds

The

Company intends to use the net proceeds from any November Warrants exercises for general corporate purposes.

Possible

Effects of the Proposal

If

the stockholders do not approve this Proposal 1, then the November Warrants will not become exercisable. However, we will also be obligated

to incur additional management resources and expenses to call and hold a meeting every 60 days thereafter to seek such stockholder approval

until the date stockholder approval is obtained. Additionally, the failure to obtain stockholder approval may discourage future investors

from engaging in future financings with us. If these consequences occur, we may have difficulty finding alternative sources of capital

to fund our operations in the future on terms favorable to us or at all. We can provide no assurance that we would be successful in raising

funds pursuant to additional equity or debt financings.

If

the stockholders approve this Proposal 1, the November Warrants shall become immediately exercisable.

Our

Board of Directors recommends that the stockholders vote “FOR” Proposal 1 to approve the issuance of shares upon exercise

of the November Warrants.

PROPOSAL

NO. 2

APPROVAL

OF THE ISSUANCE OF SHARES OF CLASS A COMMON STOCK UPON EXERCISE OF THE NOVEMBER WARRANTS IN ACCORDANCE WITH NASDAQ LISTING RULE 5635

General

On

November 8, 2024, we announced the pricing of a best efforts public offering of (i) 370,000 shares of Class A common stock; (ii) prefunded

warrants to purchase an aggregate of 3,300,886 shares of Class A common stock; and (iii) 7,341,722 November Warrants, at a combined public

offering price of $0.79 per share and warrants.

In

connection with the offering, we agreed to amend certain existing warrants originally issued on January 11, 2022 to purchase up to 529,412

shares of Class A common stock (the “Amended Warrants”) to (i) reduce the exercise price of the Amended Warrants from $54.00

to equal $0.79 (subject to adjustment therein) and (ii) extend the term of the Amended Warrants to November 12, 2029, which shall become

exercisable upon stockholder approval. Other than the reduced exercise price and the extended term, the Amended Warrants have not been

otherwise amended.

Reasons

for Stockholder Approval

In

the public offering, we agreed to use commercially reasonable efforts to hold an annual or a special meeting of stockholders within sixty

(60) days to obtain the stockholder approval.

In

addition, our Class A common stock is listed on the Nasdaq Capital Market under the symbol “SNAX,” and we are subject to

the Nasdaq listing standards and rules. Under Rule 5635(d) of the Nasdaq Stock Market, stockholder approval is required in connection

with a transaction, other than a public offering, at a price below the Minimum Price (as defined under Nasdaq rules) involving the sale,

issuance or potential issuance by the Company of common stock (or securities convertible into or exercisable for common stock), which

equals 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance. The Amended Warrants would

result in shares of Class A common stock being potentially issued at a price below the Minimum Price if this offering were combined with

other offerings, it is possible that the Amended Warrants would violate Rule 5635(d) without approval of our stockholders.

Use

of Proceeds

The

Company intends to use the net proceeds from any Amended Warrants exercises for general corporate purposes.

Possible

Effects of the Proposal

If

the stockholders do not approve this Proposal 2, then the Amended Warrants will not become exercisable. However, we will also be obligated

to incur additional management resources and expenses to call and hold a meeting every 60 days thereafter to seek such stockholder approval

until the date stockholder approval is obtained. Additionally, the failure to obtain stockholder approval may discourage future investors

from engaging in future financings with us. If these consequences occur, we may have difficulty finding alternative sources of capital

to fund our operations in the future on terms favorable to us or at all. We can provide no assurance that we would be successful in raising

funds pursuant to additional equity or debt financings.

If

the stockholders approve this Proposal 2, the Amended Warrants shall become immediately exercisable.

Our

Board of Directors recommends that the stockholders vote “FOR” Proposal 2 to approve the issuance of shares upon exercise

of the Amended Warrants.

PROPOSAL

NO. 3

THE

ADJOURNMENT OF THE MEETING, IF NECESSARY OR ADVISABLE, TO SOLICIT ADDITIONAL PROXIES IN FAVOR OF PROPOSALS 1 OR 2.

We

are asking our stockholders to authorize us to adjourn the Special Meeting to another time and place, if necessary or advisable, to solicit

additional proxies in the event there are not sufficient votes to approve Proposals 1 or 2 described in this proxy statement at the Special

Meeting. If our stockholders approve this proposal, we could adjourn the Special Meeting to solicit additional proxies and/or to seek

to convince stockholders to change their votes in favor of such proposals.

If

it is necessary or advisable to adjourn the Special Meeting, no notice of any adjournment of less than thirty (30) days is required to

be given if the time and place of the adjourned meeting, and the means of remote communication, if any, by which stockholders and proxyholders

may be deemed to be present in person and vote at such adjourned meeting, are announced at the meeting at which adjournment is taken,

unless after the adjournment a new record date is fixed for the adjourned meeting. At the adjourned meeting, we may transact any business

which might have been transacted at the original meeting.

Our

Board of Directors recommends that the stockholders vote “FOR” Proposal 3, the adjournment of the meeting, if necessary or

advisable, to solicit additional proxies in the event there are not sufficient votes to approve Proposals 1 or 2.

STOCKHOLDER

PROPOSALS FOR THE 2025 ANNUAL MEETING

Our

bylaws provide that, for matters to be properly brought before an annual meeting, business must be either (i) specified in the notice

of annual meeting (or any supplement or amendment thereto) given by or at the direction of the Board, (ii) otherwise brought before the

annual meeting by or at the direction of the Board, or (iii) otherwise properly brought before the annual meeting by a stockholder. In

addition to any other applicable requirements, for business to be properly brought before an annual meeting by a stockholder, the stockholder

must be a stockholder of record entitled to vote at the annual meeting and have given timely notice thereof in writing to our Secretary

in the manner described in our bylaws.

Stockholder

proposals intended for inclusion in our proxy statement relating to the next annual meeting in 2025 must be received by us no later than

December 30, 2024. Any such proposal must comply with Rule 14a-8 of Regulation 14A of the proxy rules of the Securities and Exchange

Commission.

Notice

to us of a stockholder proposal submitted otherwise than pursuant to Rule 14a-8 also will be considered untimely if received at our principal

executive offices other than during the time period set forth below and will not be placed on the agenda for the meeting. In addition

to any other applicable requirements, for business to be properly brought before an annual meeting by a stockholder, the stockholder

must have given timely notice thereof in writing to our Secretary at Post Office Box 864, Frisco, TX 75034. To be timely, a stockholder’s

notice shall be delivered to, or made and received by, the Secretary at our principal executive offices not later than the close of business

on the ninetieth (90th) day nor earlier than the close of business on the one hundred and twentieth (120th) day prior to the annual meeting;

provided, however, that in the event that the annual meeting is more than 30 days before or more than 60 days after such anniversary

date, notice by the stockholder to be timely must be so delivered not earlier than the close of business on the 120th day before the

meeting and not later than the later of (A) the close of business on the 90th day before the meeting or (B) the close of business on

the 10th day following the day on which public announcement of the date of the annual meeting is first made by the Company.

OTHER

MATTERS

The

Board knows of no matter to be brought before the Special Meeting other than the matters identified in this proxy statement. However,

if any other matter properly comes before the Special Meeting or any adjournment of the meeting, it is the intention of the persons named

in the proxy solicited by the Board to vote the shares represented by them in accordance with their best judgment.

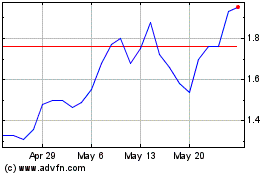

Stryve Foods (NASDAQ:SNAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Stryve Foods (NASDAQ:SNAX)

Historical Stock Chart

From Mar 2024 to Mar 2025