false

0001367083

0001367083

2024-08-19

2024-08-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported) August 19,

2024

SONOMA

PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-33216 |

|

68-0423298 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

5445

Conestoga Court, Suite

150

Boulder, CO 80301

(Address of principal executive offices)

(Zip Code)

(800) 759-9305

(Registrant’s telephone number, including

area code)

Not applicable.

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common

Stock |

SNOA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or

Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Effective August 19, 2024,

we entered into a distribution agreement with Medline Industries, LP, for the marketing and distribution of our wound care products. The

agreement is for an initial term of five years, subject to automatic one-year renewal periods.

The foregoing description

of the agreement is not complete and is qualified in its entirety by reference to the full text of the agreement, a redacted copy of which

is filed herewith as Exhibit 10.1.

This report contains forward-looking

statements. Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations,

strategies, predictions or any other statements related to our future activities, or future events or conditions. These statements are

based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements

are not guarantees of future performances and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual

outcomes and results may differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors,

including those risks discussed in our Annual Report on Form 10-K and in other documents that we file from time to time with the SEC.

Any forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any

forward-looking statement to reflect events or circumstances after the date of this report, except as required by law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

___________________

| † |

Certain portions of the agreement have been omitted to preserve the confidentiality of such information. The Company will furnish copies of any such information to the SEC upon request. |

| * |

Some exhibits or schedules to the agreement have been omitted from this filing pursuant to Item 601(a)(5) of Regulation S-K. The Company will furnish copies of any such schedule or exhibit to the SEC upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SONOMA PHARMACEUTICALS, INC. |

| |

|

| |

|

| Date: August 21, 2024 |

By: |

/s/ Amy Trombly |

| |

Name:

Title: |

Amy Trombly

Chief Executive Officer |

Exhibit 10.1

[Certain identified information has been excluded

from the exhibit because it both (i) is not material and (ii) is the type that the company treats as private or confidential.]

DISTRIBUTION AGREEMENT

This Distribution Agreement,

effective on August 19th, 2024 (the “Effective Date”), is between Medline Industries, LP, an Illinois limited partnership with

its principal offices located at 3 Lakes Drive, Northfield, IL 60093 together with its subsidiaries and affiliates, who may place orders

pursuant to this Agreement (collectively, “Medline”), and Sonoma Pharmaceuticals, Inc., with offices at 5445 Conestoga Court

Suite 150, Boulder, CO 80301 (“Supplier” and, together with Medline, the “Parties” and each a “Party”).

This Agreement supersedes all other existing distribution, supply, or corporate program agreements with respect to the subject matter

herein between Supplier and Medline.

BACKGROUND

Supplier manufactures and/or

markets certain wound cleansers [________] and other products. Supplier desires to appoint Medline as a distributor of the Products and

Medline desires to accept such appointment on the terms and subject to the conditions described in this Agreement.

1.

Products Covered by this Agreement. The products covered by this Agreement are those products manufactured by Supplier

listed on Exhibit A (each, a “Product,” and, collectively, the “Products”). Products may be added to or deleted

from this Agreement by mutual written consent of the Parties. Additional products may be ordered separately from this Agreement at mutually

agreed prices and terms.

2.

Appointment.

| a. | Supplier hereby authorizes Medline to distribute the Products [_________________________] in the

United States pursuant to the terms and conditions set forth in this Agreement, and Medline hereby accepts such appointment. |

| | | |

| b. | Supplier

warrants that it has not made any covenants or agreements in violation of this Agreement. |

3.

Term and Renewal. This Agreement shall begin on the Effective Date and shall continue in effect for five (5) years

(the “Initial Term”), and shall automatically renew for successive one (1) year periods (each a “Renewal Term”

and together with the Initial Term, the “Term”) unless either Party provides written notice of non-renewal at least [______]

([______]) days before the end of the then-current term.

4.

Pricing and Payment Terms.

| a. | The prices for Products Medline shall pay to Supplier shall be as set forth on Exhibit A (the

“Prices”), subject to the minimum amount per order set forth on Exhibit A and other terms and conditions herein. All

Prices are listed in U.S. dollars. Beginning [______] ([______]) months after the Effective Date, Supplier may increase prices

annually commensurate with [______]. Supplier shall provide Medline no less than [______] ([______]) days written notice of any

price changes. New prices shall be effective on the first day of the month following the expiration of the [______]-day notice

period. |

| | | |

| c. | Terms

of payment are net [______] ([______]) days from receipt of invoice. |

| | | |

| e. | All

shipments shall be provided [______]. |

5.

Medline’s Duties.

Medline shall:

| a. | Submit its order for Products via EDI transaction on its standard purchase order form the terms and conditions

of which are incorporated herein by reference thereto to the extent such terms and conditions do not conflict with the terms and conditions

of this Agreement, unless Supplier is incapable of processing orders submitted via EDI. To the extent there is such a conflict, the terms

and conditions of this Agreement shall control. |

| | | |

| b. | Pay for such orders in accordance with the payment terms specified in Section 4 above. Failure to make

undisputed payments in accordance with such terms shall constitute a material breach of the Agreement, provided that Supplier shall notify

Medline in writing of any outstanding payment(s) and give Medline [______] ([______]) days thereafter to satisfy the undisputed, outstanding

balance. |

| | | |

| c. | Maintain complete and accurate records for such periods as may be required by applicable law, of all the

Products sold by it. |

| | | |

| d. | Develop and deliver to Supplier any and all branding and trade dress for Product. [______]. |

6.

Supplier’s Duties.

Supplier shall:

| a. | Provide the Products to Medline in accordance with the specifications. |

| | | |

| b. | [_________________________]. Medline shall not modify, alter, remove, or add to any labeling of any Product without the prior written consent

of Supplier. [_________________________]. |

| | | |

| c. | Deliver Products to Medline as set forth herein within [______] ([______]) weeks of receipt of

Medline’s purchase order (the “Lead Time”). If Supplier fails to meet the Lead Time, Medline shall be entitled to

a discount equal to [______] ([______]%) of the total price of the delayed delivery for each week or part of a week of delay, not to

exceed [______] ([______]%). Supplier will not be liable for failing to meet Lead Time requirements if the delays are due to

Medline’s actions or lack thereof as required under the Agreement. Furthermore, Supplier will have no obligation to ship

Product if Medline is delinquent in undisputed payments pursuant to this contract, provided that in order for such right to apply,

Supplier shall first notify Medline in writing of any such outstanding balance and give [______] days from the date of such notice

of delinquent payment (the “Grace Period”) to pay the outstanding amount. In the event that Medline fails to pay the

outstanding, undisputed balance by the end of the Grace Period, then the rights granted to Supplier in this subsection 6.c shall

apply and Supplier will accrue no damages for its refusal to ship Products. |

| | | |

| d. | Use best efforts to maintain [______] percent ([______]%) fill rate on all orders for Products. Fill Rate

is defined as complete line items shipped on the scheduled monthly ship date. |

| | | |

| e. | Adequately label, package and deliver the Products. [_________________________]. |

| | | |

| f. | Notify Medline immediately in writing should Supplier become aware of any defect or condition which may

render any of the Products in violation of the Food, Drug and Cosmetic Act or any other applicable law. |

| g. | Participate with Medline in business reviews, as mutually agreed to by the parties. |

| | | |

| h. | Notify the appropriate federal, state and local authorities of any customer complaints or other occurrences

regarding the Products which are required to be so reported. Medline and Supplier shall provide each other with any information it receives

regarding such occurrences. Supplier shall be responsible for evaluating all complaints and for responding to Medline in writing. The

parties will cooperate fully with each other in effecting any recall of the Products, including communications with any purchasers or

users. |

| | | |

| i. | Use commercially reasonable efforts to comply with the Universal Product Number (UPN) standard within

180 days of the Effective Date. The UPN is a number that uniquely identifies a healthcare product at each salable unit of measure. |

7.

Representations and Warranties.

| a. | Supplier represents and warrants that: |

| i. | Supplier has the right to enter this Agreement and make the promises and grants contained herein; |

| | | |

| ii. | the Products shall strictly comply with the specifications and all written representations and warranties

published or distributed by Supplier, including any representations or warranties in Supplier’s marketing materials; and |

| | | |

| iii. | the Products will not infringe on any intellectual property right of any third party. |

| b. | Medline represents and warrants that: |

| i. | Medline has the right to enter this Agreement and make the promises contained herein; and |

| | | |

| ii. | [_________________________]. |

8.

Products Warranties, Indemnification and Insurance.

| a. | Supplier specifically warrants to Medline that the Products will be manufactured in accordance with Good

Manufacturing Practices and when supplied will comply with the label claims for such Products and shall be. free from defects in design,

workmanship and materials and are in compliance with the specifications and claims made by Supplier for them. |

| | | |

| b. | Indemnification by Medline. Subject to Section 8(d) and (e), Medline shall

defend, indemnify and hold harmless Supplier, its officers, directors, employees and agents from and against any and all third-party liabilities,

claims, lawsuits, losses, damages, expenses (including reasonable attorneys’ fees) and costs (hereinafter “Claims”)

to the extent such Claims result from or arise out of [______]. |

| | | |

| c. | Indemnification by Supplier. Subject to Section 8(d) and (e), Supplier

agrees to defend, indemnify, and hold harmless Medline, its affiliates, officers, directors, employees, and agents, from and against any

and all third party Claims arising from [______]. |

| | | |

| d. | Indemnification Procedures. The indemnified party shall provide the indemnifying

party with: (i) prompt written notice of any Claim, provided, however, that any failure by such indemnified party to notify the indemnifying

party shall not relieve the indemnifying party from its obligations hereunder except to the extent the indemnifying party is actually

prejudiced thereby; (ii) all requested information in the indemnified party’s possession concerning any Claim; (iii) reasonable

cooperation and assistance in the defense and/or settlement of any Claim; and (iv) authority to defend and/or settle any Claim, subject

to the approval of the indemnified party, such approval not to be unreasonably withheld, conditioned or delayed. In all events, the indemnified

party shall have the right to participate in the defense of any such suit or proceeding, with counsel of its own choice and at its own

sole expense unless the indemnifying party has agreed in writing to pay such fees and expenses of separate counsel. The indemnifying party

agrees to reimburse each indemnified party promptly for all such Claims as they are incurred by such indemnified party in connection with

the investigation of, preparation for or defense as requested by the indemnifying party of any pending or threatened Claim or any action

or proceeding arising therefrom. |

| | | |

| e. | Notwithstanding the foregoing, the indemnifying party shall not be entitled

to control the investigation, trial and defense of any Claim and any appeal arising therefrom and shall pay the fees and expenses of one

counsel retained by the indemnified party if (i) the Claim relates to or arises in connection with any criminal proceeding, action, or

indictment, (ii) the nature of the Claim creates a conflict or otherwise makes it inadvisable for the same counsel to represent the indemnified

party and the indemnifying party, (iii) the Claim seeks an injunction or equitable relief against the indemnified party or any of its

affiliates or (iv) the indemnifying party has failed or is failing to prosecute or defend vigorously the Claim. |

| | | |

| f. | Supplier agrees to procure and maintain commercial general liability and

products liability (including completed operations) insurance covering bodily injury and property damage, in the amount not less than

[______] ($[______]) per occurrence with endorsements for blanket contractual liability and additional insured vendor’s liability.

Supplier shall maintain an umbrella policy providing excess limits over the primary policies described herein, in an amount not less than

[______] ($[______]). Supplier shall, on or before the delivery of any Product, furnish a certificate of insurance evidencing the foregoing

coverage and limits in this section. Certificate shall also state that the insurer shall give Medline [______] ([______]) days prior written

notice of any cancellation or non-renewal in coverage, list Medline as additional insured and certificate holder, and note that coverage

provided is primary and non-contributory to any insurance Medline may have. Supplier’s Certificate of Insurance is attached as Exhibit

B. Supplier shall notify Medline in writing of any changes to the Certificate of Insurance; however, such changes shall not modify or

violate the terms of this sub-section (f). |

9.

Termination.

| |

a. |

Either Party shall have the right to terminate this Agreement on written notice if the other Party (i) commits or suffers any act of bankruptcy or insolvency or ceases to do business, or otherwise terminates its business operations, or (ii) commits a material breach of this Agreement and fails to cure such breach within [______] ([______]) days after receiving written notice of such breach. |

| |

|

|

| |

b. |

Medline shall have the right to terminate this Agreement upon [______] ([______]) days’ written notice to Supplier if Supplier, in Medline’s reasonable discretion, fails to meet Product quality obligations, or if Supplier fails to meet a [______] percent ([______]%) fill rate in any [______]-month period. |

| |

|

|

| |

c. |

In the event of any breach or missed obligation described in

sub-section (b) of this Section 9, upon receipt of notice from Medline as set forth above, the Parties will discuss ways to remedy

the breach or missed obligation. If the Parties are able to determine a remedy to Medline’s satisfaction, Supplier shall have

[______] ([______]) days to remedy such breach or missed obligation. If Supplier cannot remedy such breach or missed obligations

during such time period, Medline may in its sole discretion immediately terminate the agreement. |

| |

|

|

| |

d. |

If either Party terminates this Agreement pursuant to this Section

9, [______]. |

10.

Procedures on Termination. On the termination or expiration of this Agreement, for whatever reason, Supplier shall

continue to honor Medline’s orders for Products up to the effective date of termination, and Medline shall pay for such Products

on the terms and conditions of this Agreement. For avoidance of doubt, Supplier shall honor any and all Purchase Orders submitted by Medline

prior to the effective date of termination, including those Purchase Orders that may be delivered thereafter.

11.

Confidential Information.

| a. | Each Party acknowledges and agrees that pursuant to this Agreement valuable information of a confidential

nature, which includes but is not limited to marketing, sales and new Product development information may be disclosed by one party (the

“Disclosing Party”) to the other Party (the “Receiving Party”); that such information will be retained by the

Receiving Party in confidence; that the transmittal of such information to the Receiving Party by the Disclosing Party is upon the condition

that the information is to be used solely for the purpose of effectuating this Agreement; and that the Receiving Party shall not, either

during the Term of this Agreement or after its termination, use, publish or disclose or cause anyone else to use, publish or disclose

any information supplied to the Receiving Party by the Disclosing Party other than for the purposes described above, whether purchased

the Receiving Party or provided free of charge by the Disclosing Party. Notwithstanding anything in the foregoing, the above restrictions

on disclosure and use shall not apply to: (a) information (other than trace sales and rebate information submitted to Supplier by Medline,

which shall be considered Medline’s confidential information for purposes of this Agreement) which is not identified in writing

at the time of disclosure as “confidential” (or, if the information is disclosed orally, is identified at the time of disclosure

as “confidential” and is confirmed to be confidential in writing within 30 days after the date of disclosure); (b) information

which the Receiving Party can show by written evidence was known to it at the time of receipt thereof from the Disclosing Party; (c) information

which is subsequently obtained from sources other than the Disclosing Party who are not bound by a confidentiality agreement with the

Disclosing Party. The above restrictions shall not prohibit any disclosure which is required pursuant to a court order or administrative

proceeding or by law, including to comply with applicable requirements of any government department or regulatory authority; provided

that each Party shall promptly notify the other Party of the need for any such disclosure and shall give the other Party a reasonable

time to oppose such process. The above restrictions shall apply during the term of this Agreement and for a period of two years thereafter. |

12.

Recall.

| |

a. |

In the situation of a Product recall or other corrective

action (a “Recall”), each Party shall promptly notify the other Party and shall cooperate in good faith to investigate the

cause of such Recall. Supplier shall direct any such notification to Medline’s Quality Department immediately. Communication should

be directed to the following:

Medline Industries, LP

Quality Recall Coordinator

[__________________]

[__________________]

Tel: [__________________]

Fax: [__________________] |

| |

|

|

| |

b. |

Subject to sub-section 12(c), Medline shall be entitled to return all Recalled

Product(s), regardless of unit of measure, to Supplier [__________________]. Due to the additional expense incurred by Recalls, Medline

charges a fee to help offset the costs. The fee structure is as follows:

[__________________].

|

| |

|

|

| |

c. |

If a Recall is requested or ordered by a government authority due to off-label promotion, illegal marketing or misrepresentation of Product quality by Medline, the out-of-pocket costs and expenses incurred in connection with such Recall shall be [__________________]. |

13.

Force Majeure. In the event performance of any term or condition of this Agreement is delayed or prevented in whole

or in part because of or related to (a) compliance with any law, decree, request, or order of any governmental agency or authority, whether

local, state, provincial or federal, (b) pandemics, riots, war, acts of terrorism, public disturbances, strikes, lockouts, differences

with workmen, fires, explosions, storms, floods, acts of God, accidents of navigation, breakdown or failure of transportation, manufacturing,

distribution, storage or processing facilities, (c) for any other reason (whether or not of the same class or kind as herein set forth)

which is not within the reasonable control of the party whose performance is interfered with and which by the exercise of reasonable diligence

said party is unable to prevent (such occurrences referred to herein as “force majeure”), then the party so affected by the

force majeure may, at its option and upon written notice to the other party, suspend performance during the period so affected, and no

liability will attach against either party on account thereof.

14.

Miscellaneous.

| a. | Notices. Any notice required or permitted under this Agreement shall be in writing and shall be

deemed to have been given upon receipt if forwarded by personal delivery, certified mail, email, or facsimile transmission (transmission

confirmed) properly addressed to the respective parties as set forth below until notice of a different address is supplied in accordance

with this Section: |

| |

If to Medline: |

Medline Industries, LP |

| |

|

Three Lakes Drive |

| |

|

Northfield, IL 60093 |

| |

|

Attn: [____________________] |

| |

|

[_________________________] |

| |

|

|

| |

If to Supplier: |

Sonoma Pharmaceuticals, Inc. |

| |

|

5445 Conestoga Court, Suite 150 |

| |

|

Boulder, Colorado 80301 |

| |

|

Attn: [____________________] |

| |

|

[_________________________] |

| |

b. |

Entire Agreement. This Agreement is the entire agreement between the Parties hereto with regard to the subject matter of this Agreement, there being no prior written or oral promises or representations not incorporated herein with respect to such matters. |

| |

|

|

| |

c. |

Applicable Law. This Agreement shall be governed by and construed in accordance with the laws of the State of [______], United States of America, without regard to (a) the conflict of laws provisions thereof to the extent such principles or rules would require or permit the application of the laws of any jurisdiction other than those of the State of [______] (USA), and (b) [______], which is explicitly excluded.. |

| |

|

|

| |

d. |

Dispute Resolution. Any controversy or claim arising out of or

relating to this Agreement, or the breach thereof, shall be determined [______] in accordance with

[______]. [______] |

| |

|

|

| |

e. |

Amendments. No amendment or modification of the terms of this Agreement shall be binding on either Party unless reduced to writing and signed by an authorized employee of the Party to be bound. |

| |

|

|

| |

f. |

Assignment. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their permitted successors and assigns. Medline may assign this Agreement to an affiliate or successor upon written notice to Supplier. Supplier shall not assign its interest in this Agreement without prior written authorization of Medline. |

| |

|

|

| |

g. |

Counterparts. For convenience of the parties hereto, this Agreement may be executed in one or more counterparts, each of which shall be deemed an original for all purposes. |

| |

|

|

| |

h. |

Survival. Sections 1 (Products Covered by this Agreement), 2 (Appointment), 7 (Representations and Warranties), 8(a)-(e) (Products Warranties, Indemnification and Insurance), 9(d) (Termination), 10 (Procedures on Termination), 11 (Confidential Information), 12 (Recall), 13 (Force Majeure) and 14 (Miscellaneous) shall survive termination or expiration of this Agreement. |

IN WITNESS WHEREOF, the parties

have by their duly authorized officers executed this Agreement as of the Effective Date.

| Sonoma Pharmaceuticals, Inc. |

|

MEDLINE INDUSTRIES, LP |

| |

|

|

| |

|

|

|

|

|

| By: |

/s/ Amy Trombly |

|

By: |

|

/s/ [____________________________] |

| |

|

|

|

|

|

|

| Name: |

Amy Trombly |

|

Name: |

[____________________________] |

| |

|

|

|

|

| Title: |

Chief Executive Officer |

|

Title: |

[____________________________]

General Manager – AWC Division |

| |

|

|

|

|

|

|

| Date: |

August 12, 2024 |

|

Date: |

8/19/2024 |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

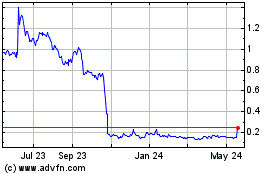

Sonoma Pharmaceuticals (NASDAQ:SNOA)

Historical Stock Chart

From Nov 2024 to Dec 2024

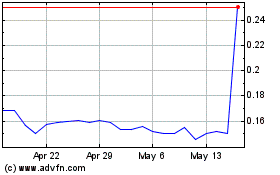

Sonoma Pharmaceuticals (NASDAQ:SNOA)

Historical Stock Chart

From Dec 2023 to Dec 2024