– Net product revenues for the third quarter 2024 totaled

$429.8 million, a 39% increase over the same quarter of the prior

year

– ELEVIDYS net product revenue for the quarter totaled $181.0

million; Royalty revenue from the sales of ELEVIDYS by Roche for

the quarter totaled $9.5 million

– Achieved GAAP and non-GAAP net income of $33.6 million and

$67.0 million for the third quarter 2024, respectively

Sarepta Therapeutics, Inc. (NASDAQ:SRPT), the leader in

precision genetic medicine for rare diseases, today reported

financial results for the third quarter 2024.

“I am pleased to report another strong quarter of performance,

as we posted $429.8 million in net product revenue for the third

quarter, a 39% increase over the same quarter of the prior year.

Reflecting our detailed preparation and track record of commercial

execution, the launch of ELEVIDYS is proceeding to plan. ELEVIDYS

net product revenue was $181.0 million in the quarter, exceeding

prior guidance. If one includes royalty revenue generated on

Roche’s ex-US sales of ELEVIDYS, total ELEVIDYS performance was

$190.5 million for the quarter. Likewise, net product revenue for

our three PMOs -- EXONDYS 51, VYONDYS 53, and AMONDYS 45 –

performed well, achieving approximately $248.8 million in the

quarter and, as anticipated, reflecting a lack of near-term

cannibalization from the launch of ELEVIDYS,” said Doug Ingram,

president and chief executive officer, Sarepta Therapeutics. “At

the same time, we have made important decisions regarding portfolio

prioritization and have made great progress on our pipeline in the

quarter. As examples, by mid-2025 we will have submitted a

Biologics License Application for one and will be in clinical

trials for two others of our Limb-girdle muscular dystrophy

programs. Assuming success, these three therapeutic candidates will

deliver our next wave of approved therapies as our multi-program

platform advances productively.”

Third Quarter 2024 and Recent Developments:

- Sarepta has made the decision to discontinue the SRP-5051

(vesleteplirsen) development program. This decision was informed by

information available to date, including the risk-benefit of the

program, feedback from the FDA, and the evolving therapeutic

landscape for Duchenne.

- Presented new data from its neuromuscular portfolio at 2024

World Muscle Society Congress (WMS 2024): Among the multiple

presentations from Sarepta at WMS 2024 were new safety and efficacy

results from several studies in the SRP-9001 clinical development

program. These data included:

- Skeletal muscle MRI data from Study 9001-301 EMBARK where

multiple muscles from a subset of patients (n=39) were evaluated

using MRI/MRS and MRI T2 signal prior to treatment and at 52 weeks

post treatment. Across all measures, patients treated with SRP-9001

showed improvement over the placebo group with less accumulation of

fat and fibrosis. The finding correlates with the functional

outcomes in Part 1 of EMBARK which showed stabilization or slowing

of disease progression in patients treated with SRP-9001 compared

to placebo.

- Cardiac MRI data from EMBARK where an assessment of a subgroup

of patients (n=19), found no negative effects on cardiac safety

compared to placebo at 52 weeks and no differences in cardiac

measures in SRP-9001-treated patients compared to the placebo group

at one year. Sarepta plans for future longitudinal cardiac MRI

studies to evaluate the long-term protection of cardiac

muscle.

- Five-year functional results from Study SRP-9001-101, the

longest-term data to date for a gene therapy in Duchenne. These

patients, with an average age of 10 years at the time of the

assessment, were stable or showed a slowing of disease progression

with an increase in divergence from natural history over time as

shown by an external control analysis. Notably this evaluation was

conducted at an age when many Duchenne patients are entering the

steep decline phase of the disease. The five-year results showed:

- A 9.8 point (p=0.0127) increase in change from baseline in the

North Star Ambulatory Assessment (NSAA) total score to five

years.

- At year five the sustained increase in NSAA total score was

statistically significant and clinically meaningful when compared

to an external control cohort.

- An 8.8 second decrease (p=0.0198) in time to rise from floor,

change from baseline to five years. The improvement was

statistically significant and clinically meaningful when compared

to an external control cohort.

- Patients maintained their 10-meter walk test time throughout

the five years.

- No new safety signals.

- Results from EMBARK study of delandistrogene moxeparvovec

published in Nature Medicine: In early October, efficacy and

safety results from Part 1 of the EMBARK study of delandistrogene

moxeparvovec-rokl for the treatment of Duchenne muscular dystrophy

were published in Nature Medicine. These published results

demonstrate a treatment benefit with delandistrogene moxeparvovec

that is clinically meaningful and similar regardless of age and a

favorable risk-benefit profile. EMBARK, also known as Study

SRP-9001-301, is a global, randomized, double-blind,

placebo-controlled, Phase 3 clinical study of delandistrogene

moxeparvovec in patients with Duchenne muscular dystrophy between

the ages of 4 through 7 years.

Conference Call

The event will be webcast live under the investor relations

section of Sarepta's website at

https://investorrelations.sarepta.com/events-presentations

and following the event a replay will be archived there for one

year. Interested parties participating by phone will need to

register using this online form. After registering

for dial-in details, all phone participants will receive an

auto-generated e-mail containing a link to the dial-in number along

with a personal PIN number to use to access the event by phone.

Q3 2024 Financial Highlights1

For the Three Months Ended

September 30,

2024

2023

QTD Change

(in millions, except for per

share amounts)

$

%

Total Revenues

$

467.2

$

331.8

135.4

41

%

Operating income (loss):

GAAP

$

22.2

$

(20.8

)

43.0

NM*

Non-GAAP

$

74.9

$

37.7

37.2

99

%

Net income (loss):

GAAP

$

33.6

$

(40.9

)

74.5

NM*

Non-GAAP

$

67.0

$

31.5

35.5

113

%

Diluted earnings (loss) per share:

GAAP

$

0.34

$

(0.46

)

0.80

NM*

Non-GAAP

$

0.62

$

0.31

0.31

99

%

For the Nine Months Ended

September 30,

2024

2023

YTD Change

(in millions, except for per

share amounts)

$

%

Total Revenues

$

1,243.6

$

846.6

397.0

47

%

Operating income (loss):

GAAP

$

56.4

$

(292.4

)

348.8

NM*

Non-GAAP

$

216.5

$

(123.5

)

340.0

NM*

Net income (loss):

GAAP

$

76.2

$

(581.6

)

657.8

NM*

Non-GAAP

$

191.9

$

(146.1

)

338.0

NM*

Diluted earnings (loss) per share:

GAAP

$

0.78

$

(6.56

)

7.34

NM*

Non-GAAP

$

1.78

$

(1.65

)

3.43

NM*

*NM: not meaningful

[1] For an explanation of our use of

non-GAAP financial measures, please refer to the “Use of Non-GAAP

Financial Measures” section later in this press release and for a

reconciliation of each non-GAAP financial measure to the most

comparable GAAP measures, see the tables at the end of this press

release.

As of September 30,

2024

As of December 31,

2023

(in millions)

Cash, cash equivalents, restricted cash

and investments

$

1,395.8

$

1,691.8

Revenues

Total revenues increased by $135.4 million for the three months

ended September 30, 2024, compared to the same period of 2023. The

increase primarily reflects the initial product launch of ELEVIDYS

in June 2023 and expanded label in June 2024, partially offset by a

$22.5 million decrease in the amortization of the single, combined

performance obligation under our collaboration agreement with F.

Hoffman-La Roche Ltd. (“Roche”), which was fully amortized as of

December 31, 2023.

Total revenues increased by $397.0 million for the nine months

ended September 30, 2024, compared to the same period of 2023. The

increase primarily reflects the initial product launch of ELEVIDYS

in June 2023 and expanded label in June 2024, as well as the $48.0

million of collaboration revenue recognized related to an option

declined by Roche to acquire the ex-US rights to a certain

external, early stage Duchenne-specific program, partially offset

by a $66.8 million decrease in the amortization of the single,

combined performance obligation under our collaboration agreement

with Roche, which was fully amortized as of December 31, 2023.

Additionally, included in total revenues for the three and nine

months ended September 30, 2024, is $37.4 million and $45.8

million, respectively, of contract manufacturing and other revenues

associated with commercial ELEVIDYS supply delivered to Roche and

royalty revenue received from Roche, with no similar activity for

the same periods of 2023.

Cost of sales (excluding amortization of in-licensed

rights)

Cost of sales (excluding amortization of in-license rights)

increased by $54.7 million and $80.6 million for the three and nine

months ended September 30, 2024, respectively, compared with the

same periods of 2023. The increases in both periods primarily

reflect the initial product launch of ELEVIDYS in June 2023 and

expanded label in June 2024. For the three and nine months ended

September 30, 2024, we recognized $13.7 million and $15.4 million

of cost of sales related to products sold to Roche under our

collaboration agreement, with no similar activity for the same

periods of 2023.

Operating expenses and others

Research and development expenses increased by $30.2 million for

the three months ended September 30, 2024, compared with the same

period of 2023. The increase in research and development expense

primarily reflects $55.4 million of costs associated with the

termination of the development, commercial manufacturing and supply

agreement (the “Thermo Agreement”) related to Brammer Bio MA, LLC,

an affiliate of Thermo Fisher Scientific, Inc. in August 2024, net

of the reimbursable termination costs by Roche, partially offset by

a decrease in clinical and manufacturing activity for our PPMO

platform and Eteplirsen program.

Research and development expenses decreased by $77.3 million for

the nine months ended September 30, 2024, compared with the same

period of 2023. The decrease in research and development expense

primarily reflects capitalization of commercial batches of ELEVIDYS

manufactured after its approval in June 2023, partially offset by

$55.4 million of costs associated with the termination of the

Thermo Agreement, net of the reimbursable termination costs by

Roche.

Non-GAAP research and development expenses increased by $35.9

million for the three months ended September 30, 2024, compared

with the same period of 2023. Non-GAAP research and development

expenses decreased by $65.0 million for the nine months ended

September 30, 2024, compared with the same period of 2023.

Selling, general and administrative expenses increased by $7.3

million and $43.8 million for the three and nine months ended

September 30, 2024, compared with the same periods of 2023. The

increase in selling, general and administrative expenses for both

periods is primarily driven by professional services used to

support the continued efforts to commercialize ELEVIDYS and ongoing

litigation matters, the timing of charitable contributions,

compensation due to changes in headcount, as well as the

achievement of performance conditions related to certain

Performance Stock Units. Non-GAAP selling, general and

administrative expenses increased by $7.4 million and $40.3 million

for the three and nine months ended September 30, 2024,

respectively, compared with the same periods of 2023.

For the three months ended September 30, 2024, other income

(loss), net increased by $24.1 million, compared with the same

period of 2023, which primarily reflects an impairment of a

strategic investment during the three months ended September 30,

2023, with no similar activity in 2024. For the nine months ended

September 30, 2024, other income (loss), net increased by $300.6

million compared with the same period of 2023, which primarily

reflects a $387.3 million loss on debt extinguishment offset by a

$102.0 million gain on the sale of a Priority Review Voucher

(“PRV”) during the nine months ended September 30, 2023, with no

similar activities in 2024.

Income tax expense for the three months ended September 30, 2024

and 2023, was approximately $0.4 million and $7.8 million,

respectively. Income tax expense for the nine months ended

September 30, 2024 and 2023, was approximately $12.8 million and

$21.2 million, respectively. Income tax expense for all periods

presented primarily relates to state, federal and foreign income

taxes for which available tax losses or credits were not available

to offset.

Use of Non-GAAP Measures

In addition to the GAAP financial measures set forth in this

press release, we have included the following non-GAAP

measurements:

- Non-GAAP income (loss) is defined by us as GAAP net income

(loss) excluding interest income, net, depreciation and

amortization expense, stock-based compensation expense, the

estimated income tax impact of each pre-tax non-GAAP adjustment and

other items.

- Non-GAAP earnings (loss) per share is defined by us as non-GAAP

net income (loss), as defined previously, divided by the

weighted-average number of shares of common stock and dilutive

common stock equivalents outstanding. The non-GAAP earnings per

share is calculated using diluted shares whereas the non-GAAP net

loss per share is calculated using basic shares as all other

instruments are anti-dilutive.

- Non-GAAP operating income (loss) is defined by us as GAAP

operating income (loss) excluding depreciation and amortization

expense, stock-based compensation expense and other items.

- Non-GAAP research and development expenses are defined by us as

GAAP research and development expenses excluding depreciation and

amortization expense, stock-based compensation expense and other

items.

- Non-GAAP selling, general and administrative expenses are

defined by us as GAAP selling, general and administrative expenses

excluding depreciation expense, stock-based compensation expense

and other items.

The following components are used to adjust our GAAP financial

measures into the previously defined non-GAAP measurements:

- Interest, depreciation and amortization - Interest income, net

amounts can vary substantially from period to period due to changes

in cash and debt balances and interest rates driven by market

conditions outside of our operations. Depreciation expense can vary

substantially from period to period as the purchases of property

and equipment may vary significantly from period to period and

without any direct correlation to our operating performance.

Amortization expense primarily associated with patent costs are

amortized over a period of several years after acquisition or

patent application or renewal.

- Stock-based compensation expenses - Stock-based compensation

expenses represent non-cash charges related to equity awards we

have granted. Although these are recurring charges to operations,

we believe the measurement of these amounts can vary substantially

from period to period and depend significantly on factors that are

not a direct consequence of operating performance that is within

our control. Therefore, we believe that excluding these charges

facilitates comparisons of our operational performance in different

periods.

- Other items - We evaluate other items of expense and income on

an individual basis. We take into consideration quantitative and

qualitative characteristics of each item, including (a) nature, (b)

whether the items relate to our ongoing business operations, and

(c) whether we expect the items to continue or occur on a regular

basis. These other items include impairment of strategic

investments, change in fair value of derivatives, gain from sale of

the PRV and loss on debt extinguishment and may include other items

that fit the above characteristics in the future. We exclude from

our non-GAAP results:

- The impairment of any strategic investments as it is a non-cash

item and is not considered to be a normal operating expense due to

the variability of amount and lack of predictability as to the

occurrence and/or timing of such impairments.

- The loss on debt extinguishment, which is considered to be an

infrequent and non-cash event as it is associated with a distinct

financing decision and is not indicative of the performance of our

core operations, which accordingly, would make it difficult to

compare our results to peer companies that also provide non-GAAP

disclosures.

- The gain from sale of the PRV obtained as a result of the FDA

accelerated approval of ELEVIDYS in June 2023 as it is a

non-recurring event.

- The change in fair value of derivatives related to 1.)

regulatory-related contingent payments meeting the definition of a

derivative to Myonexus selling shareholders as well as to an

academic institution under a separate license agreement and 2.) the

derivative asset associated with capped call options for our $570.0

million aggregate principal amount of senior convertible notes due

on November 15, 2024, as these are non-cash items and are not

considered to be normal operating expenses due to the variability

of amounts and lack of predictability as to occurrence and/or

timing.

- Beginning in the fourth quarter of 2023, amortization of

in-licensed rights (formerly included within depreciation and

amortization expense) and income tax (benefit) expense are no

longer excluded from the non-GAAP results. We now include the

income tax effect of adjustments, which represents the estimated

income tax impact of each pre-tax non-GAAP adjustment based on the

applicable effective income tax rate. Non-GAAP financial results

for the for the three and nine months ended September 30, 2023 have

been updated to reflect this change for comparability.

We use these non-GAAP measures as key performance measures for

the purpose of evaluating operational performance and cash

requirements internally. We also believe these non-GAAP measures

increase comparability of period-to-period results and are useful

to investors as they provide a similar basis for evaluating our

performance as is applied by management. These non-GAAP measures

are not intended to be considered in isolation or to replace the

presentation of our financial results in accordance with GAAP. Use

of the terms non-GAAP research and development expenses, non-GAAP

selling, general and administrative expenses, non-GAAP other income

and loss adjustments, non-GAAP operating income (loss), non-GAAP

net income (loss), and non-GAAP diluted net earnings (loss) per

share may differ from similar measures reported by other companies,

which may limit comparability, and are not based on any

comprehensive set of accounting rules or principles. All relevant

non-GAAP measures are reconciled from their respective GAAP

measures in the attached table “Reconciliation of GAAP Financial

Measures to Non-GAAP Financial Measures.”

About EXONDYS 51

EXONDYS 51 uses Sarepta’s proprietary phosphorodiamidate

morpholino oligomer (PMO) chemistry and exon-skipping technology to

bind to exon 51 of dystrophin pre-mRNA, resulting in exclusion, or

“skipping”, of this exon during mRNA processing in patients with

genetic mutations that are amenable to exon 51 skipping. Exon

skipping is intended to allow for production of an internally

truncated dystrophin protein.

EXONDYS 51 is indicated for the treatment of Duchenne muscular

dystrophy (DMD) in patients who have a confirmed mutation of the

DMD gene that is amenable to exon 51 skipping. This indication is

approved under accelerated approval based on an increase in

dystrophin in skeletal muscle observed in some patients treated

with EXONDYS 51. Continued approval for this indication may be

contingent upon verification of a clinical benefit in confirmatory

trials.

EXONDYS 51 has met the full statutory standards for safety and

effectiveness and as such is not considered investigational or

experimental.

Important Safety Information About EXONDYS 51

Hypersensitivity reactions, including bronchospasm, chest pain,

cough, tachycardia, and urticaria have occurred in patients who

were treated with EXONDYS 51. If a hypersensitivity reaction

occurs, institute appropriate medical treatment and consider

slowing the infusion or interrupting the EXONDYS 51 therapy.

Adverse reactions in DMD patients (N=8) treated with EXONDYS 51

30 mg or 50 mg/kg/week by intravenous (IV) infusion with an

incidence of at least 25% more than placebo (N=4) (Study 1, 24

weeks) were (EXONDYS 51, placebo): balance disorder (38%, 0%),

vomiting (38%, 0%) and contact dermatitis (25%, 0%). The most

common adverse reactions were balance disorder and vomiting.

Because of the small numbers of patients, these represent crude

frequencies that may not reflect the frequencies observed in

practice. The 50 mg/kg once weekly dosing regimen of EXONDYS 51 is

not recommended.

The most common adverse reactions from observational clinical

studies (N=163) seen in greater than 10% of patients were headache,

cough, rash, and vomiting.

Other adverse events may occur.

To report SUSPECTED ADVERSE REACTIONS, contact Sarepta

Therapeutics, Inc. at 1-888-SAREPTA (1-888-727-3782) or FDA at

1-800-FDA-1088 or www.fda.gov/medwatch.

For further information, please see the full Prescribing

Information.

About VYONDYS 53

VYONDYS 53 (golodirsen) uses Sarepta’s proprietary

phosphorodiamidate morpholino oligomer (PMO) chemistry and

exon-skipping technology to bind to exon 53 of dystrophin pre-mRNA,

resulting in exclusion, or “skipping,” of this exon during mRNA

processing in patients with genetic mutations that are amenable to

exon 53 skipping. Exon skipping is intended to allow for production

of an internally truncated dystrophin protein.

VYONDYS 53 is indicated for the treatment of Duchenne muscular

dystrophy (DMD) in patients who have a confirmed mutation of the

DMD gene that is amenable to exon 53 skipping. This indication is

approved under accelerated approval based on an increase in

dystrophin production in skeletal muscle observed in patients

treated with VYONDYS 53. Continued approval for this indication may

be contingent upon verification of a clinical benefit in

confirmatory trials.

VYONDYS 53 has met the full statutory standards for safety and

effectiveness and as such is not considered investigational or

experimental.

Important Safety Information for VYONDYS 53

CONTRAINDICATIONS: VYONDYS 53 is contraindicated in

patients with a serious hypersensitivity reaction to golodirsen or

to any of the inactive ingredients in VYONDYS 53. Anaphylaxis has

occurred in patients receiving VYONDYS 53.

WARNINGS AND PRECAUTIONS

Hypersensitivity Reactions: Hypersensitivity reactions,

including anaphylaxis, rash, pyrexia, pruritus, urticaria,

dermatitis, and skin exfoliation have occurred in VYONDYS

53-treated patients, some requiring treatment. If a

hypersensitivity reaction occurs, institute appropriate medical

treatment and consider slowing the infusion, interrupting, or

discontinuing the VYONDYS 53 therapy and monitor until the

condition resolves. VYONDYS 53 is contraindicated in patients with

a history of a serious hypersensitivity reaction to golodirsen or

to any of the inactive ingredients in VYONDYS 53.

Kidney Toxicity: Kidney toxicity was observed in animals

who received golodirsen. Although kidney toxicity was not observed

in the clinical studies with VYONDYS 53, the clinical experience

with VYONDYS 53 is limited, and kidney toxicity, including

potentially fatal glomerulonephritis, has been observed after

administration of some antisense oligonucleotides. Kidney function

should be monitored in patients taking VYONDYS 53. Because of the

effect of reduced skeletal muscle mass on creatinine measurements,

creatinine may not be a reliable measure of kidney function in DMD

patients. Serum cystatin C, urine dipstick, and urine protein-

to-creatinine ratio should be measured before starting VYONDYS 53.

Consider also measuring glomerular filtration rate using an

exogenous filtration marker before starting VYONDYS 53. During

treatment, monitor urine dipstick every month, and serum cystatin C

and urine protein-to- creatinine ratio every three months. Only

urine expected to be free of excreted VYONDYS 53 should be used for

monitoring of urine protein. Urine obtained on the day of VYONDYS

53 infusion prior to the infusion, or urine obtained at least 48

hours after the most recent infusion, may be used. Alternatively,

use a laboratory test that does not use the reagent pyrogallol red,

as this reagent has the potential to cross react with any VYONDYS

53 that is excreted in the urine and thus lead to a false positive

result for urine protein.

If a persistent increase in serum cystatin C or proteinuria is

detected, refer to a pediatric nephrologist for further

evaluation.

ADVERSE REACTIONS: Adverse reactions observed in at least

20% of treated patients and greater than placebo were (VYONDYS 53,

placebo): headache (41%, 10%), pyrexia (41%, 14%), fall (29%, 19%),

abdominal pain (27%, 10%), nasopharyngitis (27%, 14%), cough (27%,

19%), vomiting (27%, 19%), and nausea (20%, 10%).

Other adverse reactions that occurred at a frequency greater

than 5% of VYONDYS 53-treated patients and at a greater frequency

than placebo were: administration site pain, back pain, pain,

diarrhea, dizziness, ligament sprain, contusion, influenza,

oropharyngeal pain, rhinitis, skin abrasion, ear infection,

seasonal allergy, tachycardia, catheter site related reaction,

constipation, and fracture.

Other adverse events may occur.

To report SUSPECTED ADVERSE REACTIONS, contact Sarepta

Therapeutics, Inc. at 1-888-SAREPTA (1-888-727-3782) or FDA at

1-800-FDA-1088 or www.fda.gov/medwatch.

For further information, please see the full Prescribing

Information.

About AMONDYS 45

AMONDYS 45 (casimersen) uses Sarepta’s proprietary

phosphorodiamidate morpholino oligomer (PMO) chemistry and

exon-skipping technology to bind to exon 45 of dystrophin pre-mRNA,

resulting in exclusion, or “skipping,” of this exon during mRNA

processing in patients with genetic mutations that are amenable to

exon 45 skipping. Exon skipping is intended to allow for production

of an internally truncated dystrophin protein.

AMONDYS 45 is indicated for the treatment of Duchenne muscular

dystrophy (DMD) in patients who have a confirmed mutation of the

DMD gene that is amenable to exon 45 skipping. This indication is

approved under accelerated approval based on an increase in

dystrophin production in skeletal muscle observed in patients

treated with AMONDYS 45. Continued approval for this indication may

be contingent upon verification of a clinical benefit in

confirmatory trials.

AMONDYS 45 has met the full statutory standards for safety and

effectiveness and as such is not considered investigational or

experimental.

Important Safety Information for AMONDYS 45

CONTRAINDICATIONS: AMONDYS 45 is contraindicated in

patients with a known serious hypersensitivity to casimersen or any

of the inactive ingredients in AMONDYS 45. Instances of

hypersensitivity including angioedema and anaphylaxis have

occurred.

WARNINGS AND PRECAUTIONS

Hypersensitivity: Hypersensitivity reactions, including

angioedema and anaphylaxis, have occurred in patients who were

treated with AMONDYS 45. If a hypersensitivity reaction occurs,

institute appropriate medical treatment, and consider slowing the

infusion, interrupting, or discontinuing the AMONDYS 45 infusion

and monitor until the condition resolves. AMONDYS 45 is

contraindicated in patients with known serious hypersensitivity to

casimersen or to any of the inactive ingredients in AMONDYS 45.

Kidney Toxicity: Kidney toxicity was observed in animals

who received casimersen. Although kidney toxicity was not observed

in the clinical studies with AMONDYS 45, kidney toxicity, including

potentially fatal glomerulonephritis, has been observed after

administration of some antisense oligonucleotides. Kidney function

should be monitored in patients taking AMONDYS 45. Because of the

effect of reduced skeletal muscle mass on creatinine measurements,

creatinine may not be a reliable measure of kidney function in DMD

patients. Serum cystatin C, urine dipstick, and urine

protein-to-creatinine ratio should be measured before starting

AMONDYS 45. Consider also measuring glomerular filtration rate

using an exogenous filtration marker before starting AMONDYS 45.

During treatment, monitor urine dipstick every month, and serum

cystatin C and urine protein-to-creatinine ratio (UPCR) every three

months. Only urine expected to be free of excreted AMONDYS 45

should be used for monitoring of urine protein. Urine obtained on

the day of AMONDYS 45 infusion prior to the infusion, or urine

obtained at least 48 hours after the most recent infusion, may be

used. Alternatively, use a laboratory test that does not use the

reagent pyrogallol red, as this reagent has the potential to cross

react with any AMONDYS 45 that is excreted in the urine and thus

lead to a false positive result for urine protein.

If a persistent increase in serum cystatin C or proteinuria is

detected, refer to a pediatric nephrologist for further

evaluation.

Adverse Reactions: Adverse reactions occurring in at

least 20% of patients treated with AMONDYS 45 and at least 5% more

frequently than in the placebo group were (AMONDYS 45, placebo):

upper respiratory infections (65%, 55%), cough (33%, 26%), pyrexia

(33%, 23%), headache (32%, 19%), arthralgia (21%, 10%), and

oropharyngeal pain (21%, 7%).

Other adverse reactions that occurred in at least 10% of

patients treated with AMONDYS 45 and at least 5% more frequently

than in the placebo group were: ear pain, nausea, ear infection,

post-traumatic pain, and dizziness and light-headedness.

Other adverse events may occur.

To report SUSPECTED ADVERSE REACTIONS, contact Sarepta

Therapeutics, Inc. at 1-888-SAREPTA (1-888-727-3782) or FDA at

1-800-FDA-1088 or www.fda.gov/medwatch.

For further information, please see the full Prescribing

Information.

About ELEVIDYS (delandistrogene moxeparvovec-rokl)

ELEVIDYS (delandistrogene moxeparvovec-rokl) is a single-dose,

adeno-associated virus (AAV)-based gene transfer therapy for

intravenous infusion designed to address the underlying genetic

cause of Duchenne muscular dystrophy – mutations or changes in the

DMD gene that result in the lack of dystrophin protein – through

the delivery of a transgene that codes for the targeted production

of ELEVIDYS micro-dystrophin in skeletal muscle.

ELEVIDYS is indicated for the treatment of Duchenne muscular

dystrophy (DMD) in individuals at least 4 years of age.

- For patients who are ambulatory and have a confirmed mutation

in the DMD gene

- For patients who are non-ambulatory and have a confirmed

mutation in the DMD gene.

The DMD indication in non-ambulatory patients is approved under

accelerated approval based on expression of ELEVIDYS

micro-dystrophin (noted hereafter as “micro-dystrophin”) in

skeletal muscle. Continued approval for this indication may be

contingent upon verification and description of clinical benefit in

a confirmatory trial(s).

IMPORTANT SAFETY INFORMATION

CONTRAINDICATION: ELEVIDYS is contraindicated in patients

with any deletion in exon 8 and/or exon 9 in the DMD gene.

WARNINGS AND PRECAUTIONS:

Infusion-related Reactions:

- Infusion-related reactions, including hypersensitivity

reactions and anaphylaxis, have occurred during or up to several

hours following ELEVIDYS administration. Closely monitor patients

during administration and for at least 3 hours after the end of

infusion. If symptoms of infusion-related reactions occur, slow, or

stop the infusion and give appropriate treatment. Once symptoms

resolve, the infusion may be restarted at a lower rate.

- ELEVIDYS should be administered in a setting where treatment

for infusion-related reactions is immediately available.

- Discontinue infusion for anaphylaxis.

Acute Serious Liver Injury:

- Acute serious liver injury has been observed with ELEVIDYS, and

administration may result in elevations of liver enzymes (such as

GGT, GLDH, ALT, AST) or total bilirubin, typically seen within 8

weeks.

- Patients with preexisting liver impairment, chronic hepatic

condition, or acute liver disease (e.g., acute hepatic viral

infection) may be at higher risk of acute serious liver injury.

Postpone ELEVIDYS administration in patients with acute liver

disease until resolved or controlled.

- Prior to ELEVIDYS administration, perform liver enzyme test and

monitor liver function (clinical exam, GGT, and total bilirubin)

weekly for the first 3 months following ELEVIDYS infusion. Continue

monitoring if clinically indicated, until results are unremarkable

(normal clinical exam, GGT, and total bilirubin levels return to

near baseline levels).

- Systemic corticosteroid treatment is recommended for patients

before and after ELEVIDYS infusion. Adjust corticosteroid regimen

when indicated. If acute serious liver injury is suspected,

consultation with a specialist is recommended.

Immune-mediated Myositis:

- In clinical trials, immune-mediated myositis has been observed

approximately 1 month following ELEVIDYS infusion in patients with

deletion mutations involving exon 8 and/or exon 9 in the DMD gene.

Symptoms of severe muscle weakness, including dysphagia, dyspnea,

and hypophonia, were observed.

- Limited data are available for ELEVIDYS treatment in patients

with mutations in the DMD gene in exons 1 to 17 and/or exons 59 to

71. Patients with deletions in these regions may be at risk for a

severe immune-mediated myositis reaction.

- Advise patients to contact a physician immediately if they

experience any unexplained increased muscle pain, tenderness, or

weakness, including dysphagia, dyspnea, or hypophonia, as these may

be symptoms of myositis. Consider additional immunomodulatory

treatment (immunosuppressants [e.g., calcineurin-inhibitor] in

addition to corticosteroids) based on patient’s clinical

presentation and medical history if these symptoms occur.

Myocarditis:

- Acute serious myocarditis and troponin-I elevations have been

observed following ELEVIDYS infusion in clinical trials.

- If a patient experiences myocarditis, those with pre-existing

left ventricle ejection fraction (LVEF) impairment may be at higher

risk of adverse outcomes. Monitor troponin-I before ELEVIDYS

infusion and weekly for the first month following infusion and

continue monitoring if clinically indicated. More frequent

monitoring may be warranted in the presence of cardiac symptoms,

such as chest pain or shortness of breath.

- Advise patients to contact a physician immediately if they

experience cardiac symptoms.

Preexisting Immunity against AAVrh74:

- In AAV-vector based gene therapies, preexisting anti-AAV

antibodies may impede transgene expression at desired therapeutic

levels. Following treatment with ELEVIDYS, all patients developed

anti-AAVrh74 antibodies.

- Perform baseline testing for presence of anti-AAVrh74 total

binding antibodies prior to ELEVIDYS administration.

- ELEVIDYS administration is not recommended in patients with

elevated anti-AAVrh74 total binding antibody titers greater than or

equal to 1:400.

Adverse Reactions:

- The most common adverse reactions (incidence ≥5%) reported in

clinical studies were vomiting, nausea, liver injury, pyrexia, and

thrombocytopenia.

Report negative side effects of prescription drugs to the FDA.

Visit www.fda.gov/medwatch or call 1-800-FDA-1088. You may also

report side effects to Sarepta Therapeutics at 1-888-SAREPTA

(1-888-727-3782).

For further information, please see the full Prescribing

Information.

About Sarepta Therapeutics

Sarepta is on an urgent mission: engineer precision genetic

medicine for rare diseases that devastate lives and cut futures

short. We hold leadership positions in Duchenne muscular dystrophy

(DMD) and limb-girdle muscular dystrophies (LGMDs), and we

currently have more than 40 programs in various stages of

development. Our vast pipeline is driven by our multi-platform

Precision Genetic Medicine Engine in gene therapy, RNA and gene

editing. For more information, please visit www.sarepta.com or

follow us on LinkedIn, X (formerly Twitter), Instagram and

Facebook.

Forward-Looking Statements

In order to provide Sarepta’s investors with an understanding of

its current results and future prospects, this press release

contains statements that are forward-looking. Any statements

contained in this press release that are not statements of

historical fact may be deemed to be forward-looking statements.

Words such as “believes,” “anticipates,” “plans,” “expects,”

“will,” “may,” “intends,” “prepares,” “looks,” “potential,”

“possible” and similar expressions are intended to identify

forward-looking statements. These forward-looking statements

include statements relating to our future operations, financial

performance and projections, business plans, market opportunities,

priorities and research and development programs and technologies;

the potential benefits of our technologies and scientific

approaches, including the potential benefits of SRP-9003; and

expected milestones and plans, including our expectation that by

mid-2025 we will have submitted a Biologics License Application for

one, and will be in clinical trials for two others, of our

Limb-girdle muscular dystrophy programs.

These forward-looking statements involve risks and

uncertainties, many of which are beyond Sarepta’s control. Actual

results could materially differ from those stated or implied by

these forward-looking statements as a result of such risks and

uncertainties. Known risk factors include the following: success in

preclinical and clinical trials, especially if based on a small

patient sample, does not ensure that later clinical trials will be

successful, and the results of future research may not be

consistent with past positive results or may fail to meet

regulatory approval requirements for the safety and efficacy of

product candidates; we may not be able to comply with all FDA

post-approval commitments and requirements with respect to our

products in a timely manner or at all; certain programs may never

advance in the clinic or may be discontinued for a number of

reasons, including regulators imposing a clinical hold and us

suspending or terminating clinical research or trials; if the

actual number of patients suffering from the diseases we aim to

treat is smaller than estimated, our revenue and ability to achieve

profitability may be adversely affected; we may not be able to

execute on our business plans, including meeting our expected or

planned regulatory milestones and timelines, research and clinical

development plans, and bringing our product candidates to market,

for various reasons, some of which may be outside of our control,

including possible limitations of company financial and other

resources, manufacturing limitations that may not be anticipated or

resolved for in a timely manner, and regulatory, court or agency

decisions, such as decisions by the United States Patent and

Trademark Office with respect to patents that cover our product

candidates; and those risks identified under the heading “Risk

Factors” in our most recent Annual Report on Form 10-K for the year

ended December 31, 2023, and our most recent Quarterly Report on

Form 10-Q filed with the Securities and Exchange Commission (SEC)

as well as other SEC filings made by the Company which you are

encouraged to review.

Internet Posting of Information

We routinely post information that may be important to investors

in the 'Investors' section of our website at www.sarepta.com. We

encourage investors and potential investors to consult our website

regularly for important information about us.

Sarepta Therapeutics, Inc.

Condensed Consolidated Statements of Income (Loss) (unaudited, in

thousands, except per share amounts)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

Revenues:

Products, net

$

429,771

$

309,322

$

1,149,803

$

779,805

Collaboration and other

37,401

22,495

93,764

66,750

Total revenues

467,172

331,817

1,243,567

846,555

Cost and expenses:

Cost of sales (excluding amortization of

in-licensed rights)

91,691

37,026

186,795

106,167

Research and development

224,483

194,301

604,569

681,870

Selling, general and administrative

128,200

120,893

393,999

350,171

Amortization of in-licensed rights

602

439

1,804

796

Total cost and expenses

444,976

352,659

1,187,167

1,139,004

Operating income (loss)

22,196

(20,842

)

56,400

(292,449

)

Other income (loss), net:

Other income (expense), net

11,810

(12,332

)

32,631

17,309

Gain from sale of Priority Review

Voucher

—

—

—

102,000

Loss on debt extinguishment

—

—

—

(387,329

)

Total other income (loss), net

11,810

(12,332

)

32,631

(268,020

)

Income (loss) before income tax

expense

34,006

(33,174

)

89,031

(560,469

)

Income tax expense

395

7,763

12,841

21,163

Net income (loss)

$

33,611

$

(40,937

)

$

76,190

$

(581,632

)

Earnings (loss) per share:

Basic

$

0.35

$

(0.46

)

$

0.80

$

(6.56

)

Diluted

$

0.34

$

(0.46

)

$

0.78

$

(6.56

)

Weighted average number of shares of

common stock used in computing earnings (loss) per share:

Basic

95,390

88,889

94,669

88,609

Diluted

100,448

88,889

99,572

88,609

Sarepta Therapeutics, Inc.

Reconciliation of GAAP Financial

Measures to Non-GAAP Financial Measures

(unaudited, in thousands, except

per share amounts)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP net income (loss)

$

33,611

$

(40,937

)

$

76,190

$

(581,632

)

Interest income, net

(13,415

)

(17,593

)

(43,156

)

(46,565

)

Depreciation and amortization expense*

9,204

10,489

25,465

32,229

Stock-based compensation expense

43,450

48,061

134,624

136,688

Change in fair value of derivatives

(1,535

)

2,000

8,565

1,200

Gain from sale of Priority Review

Voucher

—

—

—

(102,000

)

Loss on debt extinguishment

—

—

—

387,329

Impairment of strategic investments

—

27,500

—

27,821

Income tax effect of adjustments**

(4,300

)

1,992

(9,772

)

(1,197

)

Non-GAAP net income (loss)**

$

67,015

$

31,512

$

191,916

$

(146,127

)

GAAP net earnings (loss) per share -

diluted:

$

0.34

$

(0.46

)

$

0.78

$

(6.56

)

Add: impact of GAAP to Non-GAAP

adjustments

$

0.28

$

0.77

$

1.00

$

4.91

Non-GAAP net earnings (loss) per share -

diluted***

$

0.62

$

0.31

$

1.78

$

(1.65

)

Weighted average number of shares of

common stock used in computing diluted earnings (loss) per

share:****

GAAP

100,448

88,889

99,572

88,609

Non-GAAP

108,548

101,722

107,672

88,609

*Beginning in the fourth quarter of 2023,

depreciation and amortization excludes amortization of in-licensed

rights. Non-GAAP financial results for the three and nine months

ended September 30, 2023, have been updated to reflect this change

for comparability. **Beginning in the fourth quarter of 2023,

income tax (benefit) expense is no longer excluded from the

non-GAAP results. We have replaced this metric with income tax

effect of adjustments, which represents the estimated income tax

impact of each pre-tax non-GAAP adjustment based on the applicable

statutory income tax rate. Refer below for a reconciliation of

effective tax rates. Non-GAAP financial results for the three and

nine months ended September 30, 2023, have been updated to reflect

this change for comparability. ***Non-GAAP earnings per share is

calculated using diluted shares whereas non-GAAP net loss per share

is calculated using basic shares as all other instruments are

anti-dilutive. There was a $0.04 impact to the calculation of

non-GAAP net earnings per share as a result of the inclusion of

diluted shares for the three months ended September 30, 2023.

****The difference between the weighted average number of shares of

common stock used in computing diluted GAAP and non-GAAP earnings

per share for the three and nine months ended September 30, 2024,

is a result of the exclusion of the potential share settlement of

the 2027 Notes from the GAAP earnings per share as the inclusion of

such shares was anti-dilutive.

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

Total effective tax rate, GAAP

1.2

%

(23.4

)

%

14.4

%

(3.8

)

%

Less: impact of GAAP to Non-GAAP

adjustments

6.2

(16.7

)

(3.8

)

(24.4

)

Total effective tax rate, Non-GAAP

7.4

%

(40.1

)

%

10.6

%

(28.2

)

%

Sarepta Therapeutics, Inc.

Reconciliation of GAAP Financial Measures to Non-GAAP Financial

Measures (unaudited, in thousands)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP research and development expenses

$

224,483

$

194,301

$

604,569

$

681,870

Stock-based compensation expense

(18,034

)

(22,325

)

(54,113

)

(60,315

)

Depreciation and amortization expense

(6,664

)

(8,109

)

(18,692

)

(24,794

)

Non-GAAP research and development

expenses

$

199,785

$

163,867

$

531,764

$

596,761

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP selling, general and administrative

expenses

$

128,200

$

120,893

$

393,999

$

350,171

Stock-based compensation expense

(25,416

)

(25,736

)

(80,511

)

(76,373

)

Depreciation expense

(2,540

)

(2,380

)

(6,773

)

(7,435

)

Non-GAAP selling, general and

administrative expenses

$

100,244

$

92,777

$

306,715

$

266,363

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP operating income (loss)

$

22,196

$

(20,842

)

$

56,400

$

(292,449

)

Stock-based compensation expense

43,450

48,061

134,624

136,688

Depreciation and amortization expense

9,204

10,489

25,465

32,229

Non-GAAP operating income (loss)

$

74,850

$

37,708

$

216,489

$

(123,532

)

Sarepta Therapeutics, Inc.

Condensed Consolidated Balance Sheets (unaudited, in thousands,

except share and per share data)

As of September 30,

2024

As of December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

197,855

$

428,430

Short-term investments

1,000,534

1,247,820

Accounts receivable, net

434,524

400,327

Inventory

565,924

322,859

Manufacturing-related deposits and

prepaids

321,055

102,181

Other current assets

165,477

77,714

Total current assets

2,685,369

2,579,331

Property and equipment, net

305,788

227,154

Right of use assets

140,898

129,952

Non-current inventory

202,550

191,368

Non-current investments

181,770

—

Other non-current assets

83,559

136,771

Total assets

$

3,599,934

$

3,264,576

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

118,774

$

164,918

Accrued expenses

344,830

314,997

Deferred revenue, current portion

127,001

50,416

Current portion of long-term debt

91,595

105,483

Other current liabilities

17,289

17,845

Total current liabilities

699,489

653,659

Long-term debt

1,135,965

1,132,515

Lease liabilities, net of current

portion

170,009

140,965

Deferred revenue, net of current

portion

325,000

437,000

Contingent consideration

47,400

38,100

Other non-current liabilities

1,000

3,000

Total liabilities

2,378,863

2,405,239

Stockholders’ equity:

Preferred stock, $0.0001 par value,

3,333,333 shares authorized; none issued and outstanding

—

—

Common stock, $0.0001 par value,

198,000,000 shares authorized; 95,493,005 and 93,731,831 issued and

outstanding at September 30, 2024, and December 31, 2023,

respectively

10

9

Additional paid-in capital

5,588,839

5,304,623

Accumulated other comprehensive income,

net of tax

2,245

918

Accumulated deficit

(4,370,023

)

(4,446,213

)

Total stockholders’ equity

1,221,071

859,337

Total liabilities and stockholders’

equity

$

3,599,934

$

3,264,576

Source: Sarepta Therapeutics, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106393263/en/

Investor Contact: Ian Estepan, 617-274-4052

iestepan@sarepta.com

Media Contact: Tracy Sorrentino, 617-301-8566

tsorrentino@sarepta.com

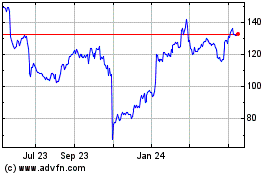

Sarepta Therapeutics (NASDAQ:SRPT)

Historical Stock Chart

From Oct 2024 to Nov 2024

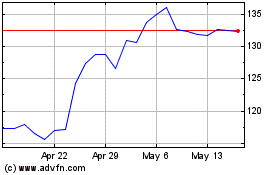

Sarepta Therapeutics (NASDAQ:SRPT)

Historical Stock Chart

From Nov 2023 to Nov 2024