Texas Capital ETF & Funds Management to Ring the Nasdaq Closing Bell

08 April 2024 - 11:00PM

WHAT:Texas Capital ETF & Funds Management

executives will join together at the Nasdaq MarketSite in New York

City on April 8, 2024, to celebrate the launch of the Texas Capital

Texas Small Cap Equity Index ETF (NASDAQ: TXSS) (the “Fund”).

Daniel Hoverman, head of Corporate & Investment Banking at

Texas Capital, and Ed Rosenberg, head of ETF & Funds

Management, will ring the Closing Bell following remarks for the

occasion.

The TXSS ETF tracks the performance of the Texas Capital Texas

Small Cap Equity Index, a sector GDP weighted and

market-capitalization weighted diversified index designed primarily

to reflect the performance of stocks in small-capitalization

companies headquartered in Texas. Key business sectors in the small

cap equity index include industrials, energy, consumer

discretionary, health care and real estate.

Additional details on the Fund can be found here.

WHERE:Nasdaq MarketSite4 Times SquareNew York,

NY 10036

WEBCAST:A live stream of the Nasdaq Closing

Bell will be available for viewing online at: Bell Ringing Ceremony

| MarketSite | Nasdaq

WHEN:Monday, April 8, 2024 – 3:45 p.m. to 4:00

p.m. ET

About Texas Capital Texas Capital Bancshares,

Inc. (NASDAQ: TCBI), a member of the Russell 2000® Index and

the S&P MidCap 400®, the parent company of Texas Capital Bank

d/b/a Texas Capital, is a full-service financial services firm that

delivers customized solutions to businesses, entrepreneurs and

individual customers. Founded in 1998, the institution is

headquartered in Dallas with offices in Austin, Houston, San

Antonio and Fort Worth, building a network of clients across the

country. With the ability to service clients through their entire

lifecycles, Texas Capital established commercial banking, consumer

banking, investment banking and wealth management capabilities. All

services are subject to applicable laws, regulations, and service

terms. Member FDIC. For more information, please

visit www.texascapital.com.

About NasdaqNasdaq (Nasdaq: NDAQ) is a global

technology company serving the capital markets and other

industries. Our diverse offering of data, analytics, software and

services enables clients to optimize and execute their business

vision with confidence. To learn more about the company, technology

solutions and career opportunities, visit us

at www.nasdaq.com.

DisclosuresInvestors should carefully

consider the investment objectives, risks and charges of the Fund

before investing. The prospectus contains this information and

other information about the Fund, and it should be read carefully

before investing. Investors can obtain a copy of the prospectus by

calling 844.TCB.ETFS (844.822.3837).

Texas Risk. Texas’ economy relies to a

significant extent on certain key industries, such as the oil and

gas industry (including drilling, production and refining),

chemicals production, technology and telecommunications equipment

manufacturing and international trade. Each of these industries has

from time to time suffered from economic downturns, and adverse

conditions in one or more of these industries could impair the

ability of issuers of Texas municipal securities to pay principal

or interest on their obligations.Investment and Market

Risk. As with all investments, an investment in the

Fund is subject to investment risk. Investors in the Fund could

lose money, including the possible loss of the entire principal

amount of an investment, over short or prolonged periods of

time. Geographic Concentration Risk. Because

the Fund and the Texas Capital Texas Equity Index (the “Index”)

will invest only in issuers headquartered in Texas, the Fund's

performance is expected to be closely tied to various factors such

as social, financial, economic and political conditions within that

region. Events that negatively affect that region may cause the

value of the Fund’s shares to decrease, in some cases

significantly. As a result, the Fund may be more volatile than more

geographically diverse funds.Index Tracking

Risk. There is no guarantee that the Fund will

achieve a high degree of correlation to the Index and therefore

achieve its investment objective. The Fund may have difficulty

achieving its investment objective due to fees, expenses (including

rebalancing expenses) and other transaction costs related to the

normal operation of the Fund. These costs that may be incurred by

the Fund are not incurred by the Index, which may make it more

difficult for the Fund to track the Index. New Adviser

Risk. Texas Capital Bank Private Wealth Advisors (the

“Adviser”) has not previously served as an adviser to a registered

mutual fund or ETF. As a result, there is no long-term track record

against which an investor may judge the Adviser and it is possible

the Adviser may not achieve the Fund’s intended investment

objective. New Fund Risk. The Fund is

new and may be at greater risk than larger funds of wider bid-ask

spreads for its shares, trading at a greater premium or discount to

net asset value, liquidation and/or a stop to trading. Any

resulting liquidation of the Fund could cause the Fund to incur

elevated transaction costs for the Fund and negative tax

consequences for its shareholders. Passive Investment

Risk. The Fund is not actively managed, and the

Adviser will not sell a security due to current or projected under

performance of a security, industry, or sector, unless that

security is removed from the Index by the Index provider, who is

unaffiliated with the Adviser. The Fund invests in securities

included in the Index regardless of the Adviser’s independent

analysis of the investment decision.

Shares are not individually redeemable and are issued

and redeemed at their net asset value only in large, specified

blocks of shares called creation units. Shares otherwise can be

bought and sold only through exchange trading at market price (not

NAV). Shares may trade at a premium or discount to their net asset

value in the secondary market. Brokerage commissions will reduce

returns.

Texas Capital Bank Wealth Management Services, Inc. d/b/a Texas

Capital Bank Private Wealth Advisors (“PWA”), a wholly owned

subsidiary of Texas Capital Bank and a Registered Investment

Advisor with the U.S. Securities and Exchange Commission (“SEC”),

serves as investment adviser to the Texas Capital Texas Equity

Index ETF and is paid a fee for its services. Shares of the Texas

Capital Texas Equity Index ETF are not deposits or obligations of,

or guaranteed or endorsed by, Texas Capital Bank or its affiliates.

The Texas Capital Texas Equity Index ETF is not insured by the FDIC

or any other government agency. The Texas Capital Texas Equity

Index ETF is distributed by Northern Lights Distributors, LLC,

member FINRA/SIPC, which is not affiliated with Texas Capital Bank

Private Wealth Advisors.

Not a Deposit. Not FDIC Insured. Not Guaranteed by the Bank. May

Lose Value. Not Insured by any Federal Government Agency.

INVESTOR CONTACT

Jocelyn Kukulka, 469.399.8544

investor.relations@texascapitalbank.com

MEDIA CONTACT

Julia Monter, 469.399.8425

Julia.monter@texascapitalbank.com

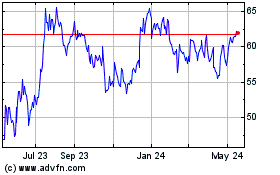

Texas Capital Bancshares (NASDAQ:TCBI)

Historical Stock Chart

From Oct 2024 to Nov 2024

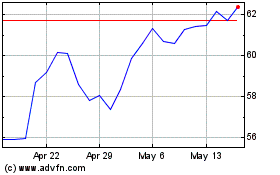

Texas Capital Bancshares (NASDAQ:TCBI)

Historical Stock Chart

From Nov 2023 to Nov 2024