false 0001923840 0001923840 2024-01-04 2024-01-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 4, 2024

THIRD HARMONIC BIO, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-41498 |

|

83-4553503 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 1700 Montgomery Street, Suite 210 |

|

|

| San Francisco, California |

|

94111 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (209) 727-2457

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

THRD |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 4, 2024, Third Harmonic Bio, Inc. (the “Company”), announced the appointment of Christopher M. Murphy, age 40, as the Company’s Chief Financial and Business Officer and principal financial officer, effective as of January 4, 2024.

Prior to joining the Company, Mr. Murphy held positions of increasing responsibility at Horizon Therapeutics PLC (“Horizon”) from March 2014 to May 2020, serving most recently as Group Vice President, Commercial Operations and Analytics from June 2018 to May 2020, serving as Vice President of Business Development from March 2014 to November 2015, Group Vice President of Corporate Development from November 2015 to October 2017, Group Vice President of Operations, Inflammation Business Unit from October 2017 to June 2018, and most recently as Group Vice President, Commercial Operations and Analytics from June 2018 to May 2020. Prior to Horizon, Mr. Murphy held positions of increasing responsibility in the Life Sciences Investment Banking Group at JMP Securities LLC (“JMP”) from July 2008 to March 2014, serving most recently as a Director from February 2014 to March 2014. Prior to JMP, Mr. Murphy served as a Consultant in the Litigation and Investigation Group of Navigant Consulting, Inc. from July 2006 to June 2008. Mr. Murphy holds a B.B.A. in Finance from the University of Notre Dame.

There is no arrangement or understanding between Mr. Murphy and any other persons, pursuant to which Mr. Murphy was selected as an officer, no family relationships among any of the Company’s directors or executive officers and Mr. Murphy, and Mr. Murphy does not have any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

In connection with his appointment as Chief Financial and Business Officer, Mr. Murphy and the Company entered into an Offer Letter (the “Offer Letter”), which includes the following terms: (i) an initial annual base salary of $495,000 per year (the “Initial Base Salary”); (ii) an annual discretionary bonus of up to 40% of the Initial Base Salary; and (iii) an option to purchase 410,000 shares of the Company’s common stock, par value $0.0001 per share.

Mr. Murphy has also entered into the Company’s standard form of Indemnity Agreement and Change in Control and Severance Agreement. The forms of the Indemnity Agreement and Change in Control and Severance Agreement were previously filed by the Company as Exhibits 10.1 and 10.12, respectively, to the Company’s Registration Statement on Form S-1, filed with the SEC on September 8, 2022, and are incorporated by reference herein.

The foregoing descriptions of the Offer Letter, Indemnity Agreement and Change in Control and Severance Agreement are qualified in their entirety by reference to the full text of the Offer Letter, Indemnity Agreement and the Change in Control and Severance Agreement, respectively. The Offer Letter will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Item 7.01 Regulation FD Disclosure.

On January 4, 2024, the Company issued a press release announcing the appointment of Mr. Murphy as Chief Financial and Business Officer of the Company and providing a general business update. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The Company is furnishing its corporate presentation, which it intends to use in conferences and meetings. The full copy of the Company’s corporate presentation is filed as Exhibit 99.2 hereto. The corporate presentation will also be available on the Company’s website in the Investors & Media section at https://ir.thirdharmonicbio.com.

The information furnished in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1934, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

THIRD HARMONIC BIO, INC. |

|

|

|

|

| Date: January 4, 2024 |

|

|

|

By: |

|

/s/ Natalie Holles |

|

|

|

|

|

|

Natalie Holles Chief Executive Officer |

Exhibit 99.1

Third Harmonic Bio Appoints Christopher Murphy as Chief Financial and Business Officer and Provides Business Update

Chris brings extensive enterprise-level leadership experience in business development, commercial operations, and corporate strategy

IND-enabling toxicology studies of THB335 nearing completion; Pre-IND interaction with the U.S. FDA now complete

Program remains on track to file a U.S. IND

and initiate a Phase 1 study of THB335 during the first half of 2024

SAN FRANCISCO, CA, January 4, 2024 (GLOBE NEWSWIRE)

— Third Harmonic Bio, Inc. (Nasdaq: THRD), a biopharmaceutical company focused on advancing the next wave of medicine for inflammatory diseases, today announced the appointment of Christopher Murphy as Chief Financial and Business Officer.

Chris brings extensive experience in business development, commercial operations, corporate strategy and investment banking in the biopharmaceutical industry to the company’s leadership team. In his role, Chris will be responsible for strategic

leadership and direction of the company’s finance, corporate strategy, and business development functions.

“We are very excited to welcome

Chris, a high-caliber enterprise leader with a clear track record of translating thoughtful corporate strategy into meaningful shareholder value,” said Natalie Holles, Chief Executive Officer at Third Harmonic Bio. “I look forward to

Chris’ thought partnership as we advance THB335 for the treatment of mast-cell mediated inflammatory diseases and evaluate opportunities to expand our work through strategic business development opportunities.”

Chris Murphy most recently served as a member of the leadership team that transformed Horizon Therapeutics PLC from a primary care-focused specialty

pharmaceutical company with a market capitalization of approximately $800 million to a fully integrated, highly profitable rare disease-focused biopharmaceutical company, which was acquired by Amgen Inc. for $28 billion in October 2023.

While at Horizon, he served in roles of increasing responsibility in business development and commercial operations. In business development, Chris was most recently Group Vice President, where he oversaw a number of strategic transactions and

integrations. In commercial operations, Chris most recently served as Group Vice President, overseeing market access, sales and marketing operations, and analytics across Horizon’s portfolio of medicines, including during the preparation and

initial launch of TEPEZZA® (teprotumumab-trbw) for the treatment of thyroid eye disease. Earlier in his career, Chris held positions of

increasing responsibility in the Life Sciences Investment Banking Group at JMP Securities LLC.

Third Harmonic Bio also provided a business update on its lead program, THB335, a potent, highly selective

oral small molecule KIT inhibitor in development for the treatment of chronic spontaneous urticaria and other mast-cell mediated inflammatory disorders. IND-enabling toxicology studies of THB335 are nearing

completion, and the company recently completed its pre-IND written correspondence with the U.S. FDA. The company is on track to file a U.S. IND and initiate a Phase 1

SAD/14-day MAD study of THB335 during the first half of 2024.

The company maintains a strong financial position

with cash and cash equivalents totaling $273.9 million as of September 30, 2023.

About Third Harmonic Bio, Inc.

Third Harmonic Bio is a biopharmaceutical company focused on advancing the next wave of medicine for inflammatory diseases through the development of novel

highly selective, small-molecule inhibitors of KIT, a cell surface receptor that serves as the master regulator of mast cell function and survival. Early clinical studies demonstrate that KIT inhibition has the potential to revolutionize the

treatment of a broad range of mast-cell-mediated inflammatory diseases, and that a titratable, oral, intracellular small molecule inhibitor may provide the optimal therapeutic profile against this target. Third Harmonic Bio’s lead product

candidate, THB335, is a titratable, oral, intracellular small molecule inhibitor expected to enter clinical trials during the first half of 2024. For more information, please visit the Third Harmonic Bio website:

www.thirdharmonicbio.com.

Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995, including, but not limited to, the roles and responsibilities of Chris Murphy, the timing of Third Harmonic Bio completing IND-enabling studies of THB335, the filing a U.S. IND application

for THB335, and the expected timing for clinical activities. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,”

“project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. These statements are subject

to numerous risks and uncertainties, including risks and uncertainties related to Third Harmonic Bio’s cash forecasts, ability to advance its product candidates, the receipt and timing of potential regulatory submissions, designations,

approvals and commercialization of product candidates, our ability to protect our intellectual property, the timing and results of preclinical and clinical trials, changes to laws or regulations, market conditions, geopolitical events, and further

impacts of pandemics or health epidemics, that could cause actual results to differ materially from what Third Harmonic Bio expects. Further information on potential risk factors that could affect Third Harmonic Bio’s business and its financial

results are

detailed under the heading “Risk Factors” included in Third Harmonic Bio’s Quarterly Report on Form 10-Q for the nine months ended

September 30, 2023, filed with the U.S. Securities and Exchange Commission (“SEC”) on November 9, 2023, and in Third Harmonic Bio’s other filings filed from time to time with the SEC. Third Harmonic Bio undertakes no

obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

TEPEZZA® is a registered trademark of Amgen Inc.

Investor & Media Contact:

Lori

Murray

lori.murray@thirdharmonicbio.com

Exhibit 99.2 On advancing the next wave of FOCUSED medicine for

inflammatory diseases JANUARY 2024 ©2024 THIRD HARMONIC BIO

Forward Looking Statements This presentation contains forward-looking

statements within the meaning of, and made pursuant to the safe harbor provisions of, the Private Securities Litigation Reform Act of 1995. Any statements made in this presentation that are not statements of historical fact, including statements

about our beliefs and expectations, are forward-looking statements and should be evaluated as such. Forward-looking statements include information concerning the anticipated profile, efficacy and target indications of THB335, the expected timing of

completing IND-toxicology studies for THB335, the expected development and timeline for clinical and non-clinical studies of THB335 candidate, and the expected timing of filing an IND application for THB335. These statements often include words such

as “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,”

“could,” “would,” “may,” “will,” “forecast” and other similar expressions. These forward-looking statements are contained throughout this presentation. We base these forward-looking

statements on our current expectations, plans and assumptions that we have made in light of our experience in the industry, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we

believe are appropriate under the circumstances at such time. As you read and consider this presentation, you should understand that these statements are not guarantees of future performance or results. The forward-looking statements are subject to

and involve risks, uncertainties and assumptions, and you should not place undue reliance on these forward-looking statements. Although we believe that these forward-looking statements are based on reasonable assumptions at the time they are made,

you should be aware that many factors could affect our actual results or results of operations and could cause actual results to differ materially from those expressed in the forward- looking statements. Factors that may materially affect such

forward-looking statements include: our limited operating history and that we have not completed any clinical trials beyond Phase 1 and have not had any product candidates approved for commercial sale; our significant net losses incurred since

inception and the likelihood of incurring additional losses for the foreseeable future; our need for substantial additional funding; the early stage of development of our programs and the possibility they may fail in development; our future

performance is substantially dependent on our ability to identify and develop future product candidates; legal and regulatory risks; and intellectual property-related risks, among others. Additional risks and uncertainties that could affect our

financial results and business are more fully described under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the three months ended September 30, 2023, filed with the SEC on November 9, 2023, and our other SEC

filings, which are available on the Investor & Media page of our website at https://ir.thirdharmonicbio.com/ and on the SEC’s website at www.sec.gov. These cautionary statements should not be construed by you to be exhaustive and are made

only as of the date of this presentation. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable law. This presentation

also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to

give undue weight to such estimates. In addition, projections, assumptions, and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. This

presentation shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such state or jurisdiction. 2

Recent Highlights Appointed Chris Murphy as Chief Financial and Business

Officer IND-enabling toxicology studies of THB335 nearing completion Completed Pre-IND interaction with the U.S. FDA On track to file a U.S. IND and initiate a Phase 1 study of THB335 during 1H’24 Strong financial position with cash and cash

equivalents totaling $273.9 million as of September 30, 2023 3

Third Harmonic Bio: Focused on KIT Inhibition to Treat Mast

Cell-Mediated Inflammatory Diseases LARGE ESTABLISHED KIT: A NOVEL, SELECTIVE MARKETS WITH HIGH CLINICALLY VALIDATED “PIPELINE-IN-A-TARGET” ORAL KIT UNMET NEED TARGET INHIBITORS POTENTIAL Mast Cell-Mediated Diseases Millions of patients

living Clinical validation of KIT Highly selective oral small Potential to be an attractive with severe mast cell-mediated as potentially transformative target for molecule with opportunity to treatment option for a range of diseases; high residual

need despite mast cell-mediated diseases optimize therapeutic index and dermal, airway and GI multiple approved products offer patient convenience over inflammatory diseases injectables 4

Mast Cells are a Fulcrum of Inflammation Current therapeutic approaches

are mechanistically limited MANY ACTIVATORS MAST CELL MANY MEDIATORS IgE Antigen Receptor-binding agonists Pre-formed mediators Omalizumab IgE Histamine Anti-histamines Receptor Complement IL-4, IL-13 Dupilumab Neuropeptides TNF, GM-CSF

Degranulation Microbial products Proteases Cytokines Serotonin TSLP Heparin Tezepelumab Chemokines Newly synthesized Physical activators mediators Temperature Prostaglandins Pressure Leukotrienes Anti-leukotrienes Cytokines Histamines Chemokines

Cell-cell contact Neuropeptides PAF, free radicals Lymphocyte ligands OPTIMAL INTERVENTION POINT The Mast Cell Itself 5

KIT is the Master Regulator of Mast Cell Function and Survival

Intracellular small molecule approach to KIT inhibition offers multiple potential therapeutic advantages KIT SCF dimer • Master regulator of mast cell proliferation, migration, activation and survival KIT receptor • KIT inhibition drives

both mast cell inactivation Dimerization and depletion P P P P Small P P INTRACELLULAR SMALL MOLECULE P Molecule P INHIBITION • Potential for therapeutic index optimization Ras/Raf/Mek/Erk JAK2/STAT PLC�� PI3K/Akt Function,

Growth, Differentiation, Survival, Degranulation Chemotaxis, Cytokine Production • Patient and medical practice convenience • Avoids risk of MAb-mediated mast cell activation/anaphylaxis 6

Clinical results from first generation THB001 oral KIT inhibitor

7

First-Generation Product Candidate: THB001 Early results support the

potential of oral KIT inhibition and inform next-gen development THB001 PHASE 1 STUDY RESULTS: • THB001 demonstrated high potency and Rapid and dose-dependent drops in serum tryptase selectivity for KIT à mast cell depletion and disease

model efficacy in multiple nonclinical End of treatment studies 10% • Phase 1a 14-day healthy volunteer study completed -30% – Dose-dependent increases in THB001 plasma exposure and decreases in serum tryptase -70% – Mild decreases

in hematologic parameters and hair color change consistent with on-target effects of KIT -110% inhibition 0 5 10 15 20 Study Day • 14-day study results largely predictive of serum tryptase and hematologic effects seen in 12-week PBO 400mg BID

500mg QD FED study 200mg QD 200mg BID PBO = placebo; Mean percent change from baseline calculated using “0” for values <LLOQ (1.0 ) 8 Serum Tryptase (% Baseline)

1 THB001 Discontinued Phase 1b Chronic Inducible Urticaria Study

Overview Dose escalation study designed to interrogate potential for therapeutic index optimization DESIGN AND OBJECTIVES STUDY SCHEMATIC • 3 doses (1:1:1) of THB001 (total N=30) for 12 weeks • Pharmacokinetics and serum tryptase levels

THB001 200mg BID • Mean reduction in critical temperature threshold (CTT) Follow-up (n=10) 12 WEEKS TX 4 WEEKS STUDY DISPOSITION SRC • Enrolled 5 subjects in 200mg BID dose cohort before THB001 300mg BID SCREENING study discontinuation

Follow-up 4 Weeks (n=10) 12 WEEKS TX 4 WEEKS • 1 subject completed 12 weeks of treatment SRC • 2 subjects discontinued at week 8 due to drug-induced THB001 400mg BID liver injury (DILI) AEs Follow-up (n=10) 12 WEEKS TX 4 WEEKS • 2

remaining subjects were discontinued from study drug at weeks 3 and 4 and were followed for safety 1. CINDU SRC=safety review committee 9

THB001 in Phase 1b CINDU Study Safety Summary THB001 HEMATOLOGY

Hemoglobin and neutrophil count by subject over time Hemoglobin (g/dL) 16 • No serious or severe adverse events (AEs) ULN Baseline 15 • Two moderate AEs of transaminitis which resolved 14 13 at weeks 17 and 25 of follow-up LLN 12 •

All other AEs were mild 11 11 Neutrophils abs. (/cmm) – Overall profile consistent with on-target effects 8000 of KIT inhibition observed in the Phase 1a 7000 ULN 6000 study (e.g., hair color change) 5000 4000 – Hematologic profile

similar to Phase 1a and 3000 LLN 2000 trend toward stabilization of values observed as 1000 1000 expected -10 0 10 20 30 40 50 60 70 80 90 100 110 120 Study Day Baseline Treatment Post-Treatment Subject: Subject 1 Subject 2 Subject 3 Subject 4

Subject 5 10

Serum Tryptase µg/L THB001 Generated Responses at Lowest Planned

Dose in Phase 1b Study 4 of 5 subjects reached partial (n=2) or complete (n=2) Critical Temperature Threshold responses SUBJECT 1 >> SUBJECT 2>> SUBJECT 3>> SUBJECT 4 >> SUBJECT 5 >> PARTIAL RESPONSE PARTIAL RESPONSE NO

RESPONSE COMPLETE RESPONSE COMPLETE RESPONSE 7 6 23 5 18 4 3 13 2 8 1 3 0 Study Day 0 20 40 60 80 100 0 20 40 60 80 100 0 20 40 60 80 100 0 20 40 60 80 100 0 20 40 60 80 100 Baseline Treatment Post-Treatment • Rapid tryptase reduction: -83%

mean change from baseline by week 1 largely consistent with Phase 1a results • Strong correlation between serum tryptase reduction and clinical response consistent with other published urticaria clinical data • 4/5 patients achieved

clinical response despite early termination of study TempTest complete response ≤ 4°C Note: Negative TempTest results (complete response) are shown at 3° C. Serum Tryptase values below lower limit of quantification are shown at 0

µg/L. Empty circles indicate results post treatment. Serum lower limit of quantitation = 1 µg/L 11 TempTest °C

Understanding Hepatic Effects of THB001 Mechanistic understanding

allows for differentiation of next-generation candidate Conducted studies characterizing liver metabolism and phenotypic effects of THB001 Employed a comprehensive approach: • Assessed evidence for off-target biology liabilities •

Characterized liver metabolism and potential for formation of reactive metabolites • Identified phenotypic effects associated with THB001 in advanced hepatic testing systems Applied learnings to next-generation compound screening and candidate

selection 12

THB001 Shows Evidence for Formation of a Toxic Reactive Metabolite

Three findings from mechanistic studies provide potential basis for observed transaminitis 14 [ C] THB001 COVALENT PROTEIN ADDUCT FORMATION in Human Liver Microsomes • Studies identify major metabolite in human plasma which is formed via a

reactive intermediate – Metabolite present at higher levels in human plasma p<0.05 140 than in toxicology animal species 120 • Detected glutathione (GSH) conjugate metabolites 100 in human urine samples from Phase 1b study 80 –

Indicates potential to cause oxidative stress Literature 60 cut-off 1 • Measured high levels of protein adduct formation in vitro with radiolabeled THB001 40 20 – Indicates potential to irreversibly inhibit protein function and/or

trigger immune response 0 Diclofenac THB001 THB001+GSH THB001+ABT POSITIVE RELATIVE CYP CONTROL METABOLITE INHIBITOR SCAVENGER Values mean of n=2 or 3 independent donor pools each done in duplicate except ABT that is from a single donor pool. 1 ABT,

1-aminobenzotriazole. Published literature cut-off: Evans D.C. et al. Chem Res Toxicol 2004 13 Covalent Protein Adduct (pmol/mg equivalent)

Next generation oral KIT inhibitor THB335 14

THB335 Potent and Selective Small Molecule KIT Inhibitor Maintained

kinase inhibition profile to THB001 but lacking evidence for reactive metabolite formation COMPARISON OF KEY KINASE AND METABOLIC PATHWAY PARAMETERS THB335 KinomeScan THB001 THB335 467 Assays Tested 8 Interactions Mapped KIT IC 23 nM 9.5 nM 50

PDGFRa Selectivity >100-fold >100-fold Percent Control 0% CSF1R Selectivity 65-fold >100-fold KIT 0.1% 0.1-1% Off-target cell viability No effect at 3 µM 1-5% 5-10% Brain-to-plasma ratio 0.9 to 1.2 <0.1 10-35% > 35% Reactive

intermediate Yes No metabolite Glutathione adduct formation Yes No KinomeScan completed at 100 nM THB335 KIT and CSF1R IC determined by NanoBRET. PDGFR⍺ IC determined by homogeneous time resolved fluorescence (HTRF). Viability was assessed in

cell lines dependent on CSF1R and PDGFRβ, respectively. 50 50 15

THB335 Demonstrated Favorable Nonclinical Profile THB335 MAST CELL

DEPLETION THB335 PK IN NONCLINICAL MODEL 14-day non-GLP toxicology study (oral administration) Skin (Ear) Intestine (jejunum) Lung (pleural) 10000 p<0.001 p<0.001 p<0.001 70 300 100 60 250 1000 80 50 200 60 40 150 100 30 40 100 20 20 50

Bioavailability = 97% 10 10 0 0 0 0 4 8 12 16 20 24 Vehicle 60 200 Vehicle 60 200 Vehicle 60 200 Time (h) THB335 (mb/kg/day) THB335 (mb/kg/day) THB335 (mb/kg/day) Mean ± SD • Potent mast cell depletion across relevant tissue types •

Favorable nonclinical pharmacokinetic profile, including high oral bioavailability, metabolic stability and long circulating half-life • Improved solubility and lipophilicity compared to THB001 • No liver toxicity signal observed at high

multiples of anticipated clinical exposure in nonclinical models enabled by markedly improved solubility 16 2 Mast cells (per mm ) 2 Mast cells (per mm ) 2 Mast cells (per mm ) [Plasma] (ng/mL)

Third Harmonic Bio Next Steps Advancing THB335 back toward the clinic

with a longer-term view toward franchise expansion • THB335 U.S. IND filing and clinical trial initiation on track for 1H’24 • Targeting chronic spontaneous urticaria as initial clinical indication • Planned expansion into

additional mast-cell mediated inflammatory disorders at Phase 2 • Medicinal chemistry, next-generation efforts continuing to support pipeline-in-a-target potential • Selectively evaluating business development opportunities to expand

portfolio • Maintaining focused operational strategy • Cash and cash equivalents of $273.9M as of September 30, 2023 17

The next wave of medicine for ADVANCING inflammatory diseases

18

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

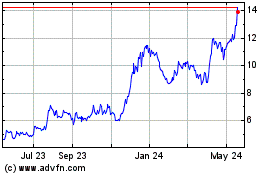

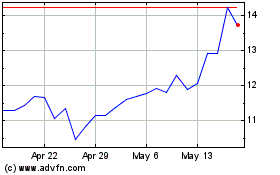

Third Harmonic Bio (NASDAQ:THRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Third Harmonic Bio (NASDAQ:THRD)

Historical Stock Chart

From Apr 2023 to Apr 2024