0001923840false00019238402023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 09, 2023 |

THIRD HARMONIC BIO, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41498 |

83-4553503 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1700 Montgomery Street, Suite 210 |

|

San Francisco, California |

|

94111 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (209) 727-2457 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

THRD |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, Third Harmonic Bio, Inc. (the “Company”) issued a press release reporting the Company’s financial results for the third quarter ended September 30, 2023. A copy of the Company’s press release is attached as Exhibit 99.1 to this report.

The information in this Item 2.02, including Exhibit 99.1 attached to this report, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 shall not be incorporated by reference into any other filing under the Exchange Act or under the Securities Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

THIRD HARMONIC BIO, INC. |

|

|

|

|

Date: |

November 9, 2023 |

By: |

/s/ Robert Ho |

|

|

|

Robert Ho

Chief Financial Officer |

Exhibit 99.1

Third Harmonic Bio Announces Third Quarter 2023 Financial Results

On track to file a U.S. Investigational New Drug (IND) application for THB335 and initiate clinical studies in 1H’24

Strong financial position with cash and cash equivalents totaling $273.9 million as of September 30, 2023

SAN FRANCISCO, CA, November 9, 2023 (GLOBE NEWSWIRE) -- Third Harmonic Bio, Inc. (Nasdaq: THRD), a biopharmaceutical company focused on advancing the next wave of medicine for inflammatory diseases, today announced financial results for the third quarter ended September 30, 2023.

“We continue to make important progress in advancing THB335, our orally available KIT inhibitor, towards clinical trials in the first half of 2024, which we believe has the potential to be a transformative treatment for chronic spontaneous urticaria and other mast cell-driven diseases,” said Natalie Holles, Chief Executive Officer of Third Harmonic Bio. “With the continued momentum of THB335 and our strong cash position, we are well-positioned for meaningful value creation in the next phase of our company’s growth.”

Recent Corporate Updates

•With IND-enabling studies continuing to progress, the company is on track to file a U.S. IND and initiate a Phase 1 SAD/14-day MAD study of THB335 to evaluate safety, pharmacokinetics and pharmacodynamics during the first half of 2024.

•Results from the truncated Phase 1b clinical trial of THB001 were presented at the European Academy of Dermatology and Venereology Annual Congress during a poster session: A Phase 1b, Open-label Study in Patients with Cold Urticaria (ColdU) Using THB001, an Orally Available, Potent and Highly Selective Small Molecule Inhibitor of Wild Type KIT Receptor Tyrosine Kinase.

•On October 31, 2023, Third Harmonic Bio announced the transition of Adrian S. Ray, Ph.D., from Chief Scientific Officer to Scientific Advisor effective November 1, 2023. In his new role, Dr. Ray will continue support the IND application for THB335, which is expected to be filed during the first half of 2024. Additionally, the company announced that Robert Ho, Chief Financial Officer, is departing the organization on November 10, 2023. The company has initiated executive searches for their successors.

•The company retains a strong financial position with cash and cash equivalents totaling $273.9 million as of September 30, 2023, and continues to be operated in a capital efficient manner.

Summary of Financial Results

Cash Position: Cash and cash equivalents totaled $273.9 million as of September 30, 2023. Based on the company’s current operating plan, Third Harmonic Bio believes that its existing cash and cash equivalents will be sufficient to fund its operating expenses and capital expenditure requirements through at least 2025.

R&D Expenses: Research and development (R&D) expenses increased to $6.0 million for the three months ended September 30, 2023, from $4.8 million for the same period in 2022. R&D expenses for the nine months ended September 30, 2023 increased to $18.0 million, from $15.1 million for the same period in 2022. The increases were primarily due to increases in discovery and development and personnel-related costs relating to the research and nonclinical development of THB335 and other next-generation discovery efforts.

G&A Expenses: General and administrative (G&A) expenses increased to $4.9 million for the three months ended September 30, 2023, from $3.8 million for the same period in 2022. G&A expenses for the nine months ended September 30, 2023 increased to $15.5 million, from $9.0 million for the same period in 2022. The increases were primarily attributable to increased costs associated with being a public company and personnel-related expenses.

Net Loss: Net loss for the three months ended September 30, 2023 decreased to $7.3 million from a net loss of $8.2 million for the same period in 2022. Net loss for the nine months ended September 30, 2023 was $24.0 million, compared to a net loss of $23.7 million for the same period in 2022. The increase for the nine months ended September 30, 2023 was primarily due to increases in R&D and public company costs, partially offset by increases in interest income.

About Third Harmonic Bio, Inc.

Third Harmonic Bio is a biopharmaceutical company focused on advancing the next wave of medicine for inflammatory diseases through the development of novel highly selective, small-molecule inhibitors of KIT, a cell surface receptor that serves as the master regulator of mast cell function and survival. Early clinical studies demonstrate that KIT inhibition has the potential to revolutionize the treatment of a broad range of mast-cell-mediated inflammatory diseases, and that a titratable, oral, intracellular small molecule inhibitor may provide the optimal therapeutic profile against this target. Third Harmonic Bio’s lead product candidate, THB335, is a titratable, oral, intracellular small molecule inhibitor expected to enter clinical trials during the first half of 2024. For more information, please visit the Third Harmonic Bio website: www.thirdharmonicbio.com.

Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including, but not limited to, the timing of filing a U.S. IND application for THB335, the expected timing for clinical activities, and the sufficiency of the Company’s cash and cash equivalents to fund its operating expenses and capital expenditure requirements through at least 2025. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. These statements are subject to numerous risks and uncertainties, including risks and uncertainties related to Third Harmonic Bio’s cash forecasts, ability to advance its product candidates, the receipt and timing of potential regulatory submissions, designations, approvals and commercialization of product candidates, our ability to protect our intellectual property, the timing and results of preclinical and clinical trials, changes to laws or regulations, market conditions, geopolitical events, and further impacts of pandemics or health epidemics, that could cause actual results to differ materially from what Third Harmonic Bio expects. Further information on potential risk factors that could affect Third Harmonic Bio’s business and its financial results are detailed under the heading “Risk Factors” included in Third Harmonic Bio’s Quarterly Report on Form 10-Q for the nine months ended September 30, 2023, filed with the U.S. Securities and Exchange Commission (SEC) on November 9, 2023, and in Third Harmonic Bio’s other filings filed from time to time with the SEC. Third Harmonic Bio undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Investor & Media Contact:

Lori Murray

lori.murray@thirdharmonicbio.com

Exhibit 99.1

THIRD HARMONIC BIO, INC.

Condensed consolidated balance sheet data

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

2022 |

|

|

September 30,

2023 |

|

|

Assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

288,877 |

|

|

$ |

273,892 |

|

|

Other current assets |

|

|

3,958 |

|

|

|

2,837 |

|

|

Non-current assets |

|

|

5,840 |

|

|

|

5,521 |

|

|

Total assets |

|

$ |

298,675 |

|

|

$ |

282,250 |

|

|

Liabilities |

|

|

|

|

|

|

|

Current liabilities |

|

$ |

5,653 |

|

|

$ |

5,888 |

|

|

Non-current liabilities |

|

|

3,954 |

|

|

|

3,403 |

|

|

Total liabilities |

|

|

9,607 |

|

|

|

9,291 |

|

|

Stockholders' equity |

|

|

289,068 |

|

|

|

272,959 |

|

|

Total liabilities and stockholders' equity |

|

$ |

298,675 |

|

|

$ |

282,250 |

|

|

|

|

|

|

|

|

|

|

THIRD HARMONIC BIO, INC.

Condensed consolidated statements of operations

(Unaudited)

(In thousands of, except per share and share amounts)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

$ |

15,150 |

|

|

$ |

18,046 |

|

General and administrative |

|

|

9,008 |

|

|

|

15,503 |

|

Total operating expenses |

|

|

24,158 |

|

|

|

33,549 |

|

Loss from operations |

|

|

24,158 |

|

|

|

33,549 |

|

Other (income) expense, net |

|

|

(493 |

) |

|

|

(9,561 |

) |

Net loss |

|

$ |

23,665 |

|

|

$ |

23,988 |

|

|

|

|

|

|

|

|

Net loss per share of common stock, basic and diluted |

|

$ |

3.99 |

|

|

$ |

0.61 |

|

Weighted-average common stock outstanding, basic and diluted |

|

|

5,935,206 |

|

|

|

39,567,206 |

|

|

|

|

|

|

|

|

v3.23.3

Document And Entity Information

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

THIRD HARMONIC BIO, INC.

|

| Entity Central Index Key |

0001923840

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-41498

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

83-4553503

|

| Entity Address, Address Line One |

1700 Montgomery Street, Suite 210

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94111

|

| City Area Code |

(209)

|

| Local Phone Number |

727-2457

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

THRD

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

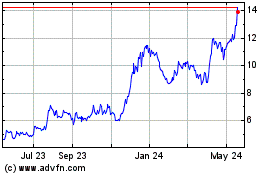

Third Harmonic Bio (NASDAQ:THRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

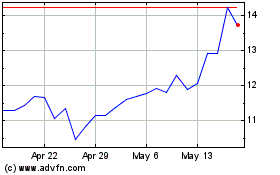

Third Harmonic Bio (NASDAQ:THRD)

Historical Stock Chart

From Apr 2023 to Apr 2024