false000152652000015265202024-02-142024-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 14, 2024

TRIPADVISOR, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-35362 |

80-0743202 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

400 1st Avenue Needham, MA 02494 |

(Address of Principal Executive Offices) (Zip Code) |

(781) 800-5000

Registrant’s Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock |

|

TRIP |

|

Nasdaq |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02. |

Results of Operations and Financial Condition. |

On February 14, 2024, Tripadvisor, Inc. issued a press release announcing its preliminary financial results for the quarter and year ended December 31, 2023. The full text of this press release is furnished as Exhibits 99.1 to this Current Report on Form 8-K.

Pursuant to General Instruction B.2. to Form 8-K, the information set forth in Items 2.02 and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall they be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

TRIPADVISOR, INC.

|

|

|

|

|

Date: February 14, 2024 |

|

By: |

/S/ MICHAEL NOONAN |

|

|

|

Michael Noonan |

|

|

|

Chief Financial Officer |

Exhibit 99.1

Tripadvisor Reports Fourth Quarter and Full Year 2023 Financial Results

NEEDHAM, MA, February 14, 2024 — Tripadvisor, Inc. (Nasdaq: TRIP) (“Tripadvisor” or the “Company”) today announced financial results for the fourth quarter and full year ended December 31, 2023.

•Revenue for the fourth quarter was $390 million, reflecting year-over-year growth of 10%. Revenue for the full year was $1,788 million, reflecting year-over-year growth of 20%.

•Net income for the fourth quarter was $32 million, or $0.22 diluted EPS. Net income for the full year was $10 million, or $0.08 diluted EPS.

•Non-GAAP net income for the fourth quarter was $55 million, or $0.38 diluted EPS. Non-GAAP net income for the full year was $186 million, or $1.29 diluted EPS.

•Adjusted EBITDA for the fourth quarter was $84 million, or 22% of revenue. Adjusted EBITDA for the full year was $334 million, or 19% of revenue.

“We are pleased with our fiscal 2023 results. On a consolidated basis, our $1.8 billion revenue was an all time high for Tripadvisor Group, reflecting annual growth of 20%. In addition to growing our revenue more than 10% higher than our previous peak, we have diversified our portfolio, with experiences now delivering more than 40% of our revenue, as we continue to drive our transformation at Tripadvisor, market leadership at Viator, and profitable growth at TheFork,” said Chief Executive Officer Matt Goldberg. “During the year we made significant progress executing on our strategic goals at each of our brands, positioning us to build momentum as we begin the new fiscal year and fortify the important position we hold in travel and experiences.”

“We exited the year with solid financial results, delivering fourth quarter revenue of $390 million, reflecting year-over-year growth of 10%. Adjusted EBITDA of $84 million, or 22% of revenue, came in better than expected due favorable channel mix and disciplined marketing spend,” said Chief Financial Officer Mike Noonan. “In 2024, we will continue to prioritize our segment strategies which focus on long-term growth and profitability.”

The Company renamed its Tripadvisor Core segment to “Brand Tripadvisor,” and its “Display and Platform” revenue stream within the Brand Tripadvisor segment, to “Media and Advertising.” These nomenclature changes had no impact on the composition of our segments, revenue streams, or on any current or historic financial information.

Fourth Quarter and Full Year 2023 Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

|

|

|

Year Ended December 31, |

|

|

|

|

(In millions, except percentages and per share amounts) |

|

2023 |

|

|

2022 |

|

|

% Change |

|

|

2023 |

|

|

2022 |

|

|

% Change |

|

Total Revenue |

|

$ |

390 |

|

|

$ |

354 |

|

|

|

10 |

% |

|

$ |

1,788 |

|

|

$ |

1,492 |

|

|

|

20 |

% |

Brand Tripadvisor (1) |

|

$ |

218 |

|

|

$ |

217 |

|

|

|

0 |

% |

|

$ |

1,031 |

|

|

$ |

966 |

|

|

|

7 |

% |

Viator |

|

$ |

161 |

|

|

$ |

127 |

|

|

|

27 |

% |

|

$ |

737 |

|

|

$ |

493 |

|

|

|

49 |

% |

TheFork |

|

$ |

39 |

|

|

$ |

33 |

|

|

|

18 |

% |

|

$ |

154 |

|

|

$ |

126 |

|

|

|

22 |

% |

Intersegment eliminations (1) |

|

$ |

(28 |

) |

|

$ |

(23 |

) |

|

|

22 |

% |

|

$ |

(134 |

) |

|

$ |

(93 |

) |

|

|

44 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net Income (Loss) |

|

$ |

32 |

|

|

$ |

(3 |

) |

|

n.m. |

|

|

$ |

10 |

|

|

$ |

20 |

|

|

|

(50 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Adjusted EBITDA (2) |

|

$ |

84 |

|

|

$ |

43 |

|

|

|

95 |

% |

|

$ |

334 |

|

|

$ |

295 |

|

|

|

13 |

% |

Brand Tripadvisor |

|

$ |

69 |

|

|

$ |

61 |

|

|

|

13 |

% |

|

$ |

348 |

|

|

$ |

345 |

|

|

|

1 |

% |

Viator |

|

$ |

15 |

|

|

$ |

(3 |

) |

|

n.m. |

|

|

$ |

— |

|

|

$ |

(11 |

) |

|

n.m. |

|

TheFork |

|

$ |

— |

|

|

$ |

(15 |

) |

|

n.m. |

|

|

$ |

(14 |

) |

|

$ |

(39 |

) |

|

|

(64 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Income (Loss) (2) |

|

$ |

55 |

|

|

$ |

10 |

|

|

|

450 |

% |

|

$ |

186 |

|

|

$ |

109 |

|

|

|

71 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings (Loss) per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP |

|

$ |

0.22 |

|

|

$ |

(0.02 |

) |

|

n.m. |

|

|

$ |

0.08 |

|

|

$ |

0.14 |

|

|

|

(43 |

)% |

Non-GAAP (2) |

|

$ |

0.38 |

|

|

$ |

0.07 |

|

|

|

443 |

% |

|

$ |

1.29 |

|

|

$ |

0.75 |

|

|

|

72 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow provided by (used in) operating activities |

|

$ |

(19 |

) |

|

$ |

(40 |

) |

|

|

(53 |

)% |

|

$ |

235 |

|

|

$ |

400 |

|

|

|

(41 |

)% |

Free cash flow (2) |

|

$ |

(35 |

) |

|

$ |

(55 |

) |

|

|

(36 |

)% |

|

$ |

172 |

|

|

$ |

344 |

|

|

|

(50 |

)% |

n.m. = not meaningful

(1)Brand Tripadvisor segment revenue figures shown in this table are gross of intersegment (intercompany) revenue, which is eliminated on a consolidated basis.

(2)“Total Adjusted EBITDA,” “Non-GAAP Net Income (Loss),” “Non-GAAP Diluted Earnings (Loss) per Share,” and “Free Cash Flow” are non-GAAP measures as defined by the U.S. Securities and Exchange Commission (the “SEC”). Please refer to “Non-GAAP Financial Measures” below for definitions and explanations of these non-GAAP financial measures, as well as tabular reconciliations to the most directly comparable GAAP financial measures.

Cost performance – Total costs and expenses were $359 million for the fourth quarter, a decrease of 2% year-over-year, and approximately $1.7 billion for the full year 2023, an increase of 19% year-over-year, driven primarily by the following:

•Cost of revenue was $36 million for the fourth quarter, or 9% of consolidated revenue, an increase of 20% year-over-year, compared to $30 million in the same period a year ago, or 8% of consolidated revenue. For the full year 2023, cost of revenue was $149 million, or 8% of consolidated revenue, an increase of 28% year-over-year, compared to $116 million in the same period a year ago, or 8% of consolidated revenue.

•Selling and marketing costs were $179 million for the fourth quarter, or 46% of consolidated revenue, a decrease of 8% year-over-year, compared to $194 million in the same period a year ago, or 55% of consolidated revenue. For the full year 2023, selling and marketing costs were $940 million, or 53% of consolidated revenue, an increase of 20% year-over-year, compared to $784 million in the same period a year ago, or 53% of consolidated revenue.

•Technology and content costs were $68 million for the fourth quarter, or 17% of consolidated revenue, an increase of 13% year-over-year, compared to $60 million in the same period a year ago, or 17% of consolidated revenue. For the full year 2023, technology and content costs were $273 million, or 15% of consolidated revenue, an increase of 23% year-over-year, compared to $222 million in the same period a year ago, or 15% of consolidated revenue.

•General and administrative costs were $47 million for the fourth quarter, or 12% of consolidated revenue, a decrease of 19% year-over-year, compared to $58 million in the same period a year ago, or 16% of consolidated revenue. For the fourth quarter, leverage in general and administrative as a percent of

consolidated revenue was driven primarily by the loss of approximately $8 million in Q4 2022 related to a targeted payment fraud scheme, which did not re-occur in 2023. For the full year 2023, general and administrative costs were $191 million, or 11% of revenue, an increase of 11% year-over-year, compared to $172 million in the same period a year ago, or 12% of consolidated revenue.

Cash & Liquidity – As of December 31, 2023, the Company had approximately $1.1 billion of cash and cash equivalents, an increase of $46 million from December 31, 2022. This increase was driven by positive operating cash flows for the full year, inclusive of an IRS audit settlement payment of $113 million during the second quarter of 2023 and related income tax refund of $49 million during the third quarter of 2023, both of which were previously disclosed in prior quarters. See “Income Taxes” discussion below.

Segment Highlights

Brand Tripadvisor

•Revenue for the fourth quarter was $218 million versus $217 million in the same period a year ago, flat year-over-year, and revenue for the full year was approximately $1.0 billion versus $966 million in the same period a year ago, reflecting year-over-year growth of 7%.

oBranded hotels revenue for the fourth quarter was $135 million, reflecting a year-over-year decline of 4%, and branded hotels revenue for the full year was $659 million, reflecting year-over-year growth of 1%. During the fourth quarter, the decline in branded hotels revenue was primarily a result of our European hotel meta offering. Within branded hotels, during the full year 2023, growth in the hotel B2B offering was mostly offset by declines in the hotel meta offering. Hotel meta performance, during the full year 2023, was impacted primarily by declines in Europe, which more than offset growth in Rest of World.

oMedia and advertising revenue for the fourth quarter was $35 million, reflecting year-over-year growth of 6%, and media and advertising revenue for the full year was $145 million, reflecting year-over-year growth of 12%.

oExperiences and dining revenue for the fourth quarter was $38 million, reflecting year-over-year growth of 12%, and experiences and dining revenue for the full year was $176 million, reflecting year-over-year growth of 31%.

oOther revenue for the fourth quarter was $10 million, flat year-over-year, and other revenue for the full year was $51 million, reflecting year-over-year decline of 2%.

•Adjusted EBITDA for the fourth quarter was $69 million, or 32% of revenue compared to adjusted EBITDA in the same period a year ago of $61 million, or 28% of revenue. Adjusted EBITDA for the full year was $348 million, or 34% of revenue compared to adjusted EBITDA in the same period a year ago of $345 million, or 36% of revenue. The improvement in adjusted EBITDA margin in the fourth quarter versus the same period a year ago was largely driven by lower sales and marketing and general and administrative expenses as a percent of revenue, which more than offset higher cost of revenue and higher technology and content as a percent of revenue. On an annual basis, year over year adjusted EBITDA margin declines were due primarily to increases in technology and content and cost of revenue as a percent of revenue.

Viator

•Revenue for the fourth quarter was $161 million, reflecting year-over-year growth of 27%, and revenue for the full year was $737 million, reflecting year-over-year growth of 49%. Excluding the impact of currency exchange rate fluctuations, we estimate year-over-year growth was 25% for the fourth quarter and 50% for the full year of 2023.

•Gross bookings value (GBV) was approximately $720 million during the fourth quarter, reflecting year-over-year growth of approximately 20%. GBV is reported at the time of booking and is gross of cancellations, whereas revenue is recorded at the time of the experience and is net of cancellations.

•Adjusted EBITDA for the fourth quarter was $15 million, or 9% of revenue compared to adjusted EBITDA loss in the same period a year ago of $3 million, or -2% of revenue. Adjusted EBITDA for the full year was $0 million, or 0% of revenue compared to adjusted EBITDA loss in the same period a year ago of $11 million, or -2% of revenue. Year-over-year improvement in adjusted EBITDA margin for the fourth quarter was primarily driven by lower sales and marketing costs as a percent of revenue, in

particular direct marketing costs. On an annual basis, improvement in adjusted EBITDA margin was driven primarily by lower sales and marketing costs as a percent of revenue.

TheFork

•Revenue for the fourth quarter was $39 million, reflecting year-over-year growth of 18%, and revenue for the full year was $154 million, reflecting year-over-year growth of 22%. Excluding the impact of currency exchange rate fluctuations, we estimate year-over-year growth was 10% for the fourth quarter and 19% for the full year of 2023.

•Total number of bookings during the fourth quarter grew year-over-year by approximately 4%.

•Adjusted EBITDA for the fourth quarter was $0 million, or 0% of revenue compared to adjusted EBITDA loss in the same period a year ago of $15 million, or -45% of revenue. Adjusted EBITDA loss for the full year was $14 million, or -9% of revenue compared to adjusted EBITDA loss in the same period a year ago of $39 million, or -31% of revenue. The year-over-year improvement in adjusted EBITDA margin for the fourth quarter was driven primarily by lower sales and marketing and lower cost of revenue as a percent of revenue. On an annual basis, improvement in adjusted EBITDA margin was driven primarily by lower sales and marketing as a percent of revenue, which more than offset the year over year impact to adjusted EBITDA margin related to an $11 million fiscal year 2022 COVID government subsidies received, which was approximately 9% of revenue in 2022.

Restructuring and Related Reorganization Actions

During the third quarter of 2023, as disclosed in previous filings, the Company initiated restructuring and other related reorganization actions resulting in a pre-tax charge of $4 million and $22 million in the fourth quarter and full year of 2023, respectively. Our Brand Tripadvisor, Viator and TheFork segments incurred charges of $10 million, $3 million, and $9 million, respectively, during the full year of 2023, of which the Company paid $9 million of these costs and expects the majority of remaining unpaid costs will be disbursed by the Company during the first quarter of 2024. Included in these restructuring and other related reorganization costs were the previously announced cost savings initiatives in Brand Tripadvisor, as well as reorganization and related geographic relocation of certain capabilities in Viator, and strategy supporting cost-saving measures in TheFork. As noted on the last call, the actions taken in Brand Tripadvisor and TheFork reportable segments are expected to result in $35 million and $10 million, respectively, in annualized cost savings.

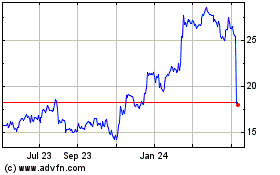

Share Repurchase Program

During the fourth quarter of 2023, the Company repurchased 1,324,524 shares of our common stock at an average price of $18.85 per share, exclusive of fees, commissions, and excise taxes, or $25 million in the aggregate under our existing share repurchase program authorized by the Board of Directors during the third quarter of 2023. During the full year 2023, the Company repurchased 6,049,253 shares of common stock at an average price of $16.51 per share, exclusive of fees, commissions, and excise taxes, or $100 million in the aggregate under then existing share repurchase programs authorized by the Board of Directors.

Income Taxes

As disclosed in previous filings, the Company received Notices of Proposed Adjustments (“NOPA”) from the IRS with respect to income tax returns for the years 2009, 2010 and 2011 filed by Expedia when Tripadvisor was part of Expedia Group’s consolidated income tax return. This assessment is related to certain transfer pricing arrangements with its foreign subsidiaries, and we requested competent authority assistance under the Mutual Agreement Procedure (“MAP”) for those years. In January 2023, the Company received a final notice from the IRS regarding a MAP settlement for the 2009 through 2011 tax years, which the Company accepted in February 2023. As a result, during the second quarter of 2023, the Company made a U.S. federal tax payment of $113 million to Expedia related to this IRS audit settlement pursuant to the Tax Sharing Agreement with Expedia. During the third quarter of 2023, we received a competent authority refund of $49 million associated with this IRS audit settlement. We anticipate the federal tax benefits, net of remaining state tax payments due, associated with this IRS audit settlement will be substantially settled during 2024, resulting in an estimated net cash inflow of $5 million to $10 million.

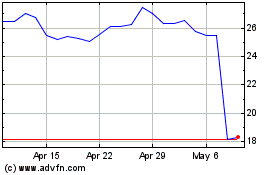

Separately, as disclosed in previous filings, the Company received a NOPA from the IRS with respect to income tax returns for the years 2014, 2015, and 2016. These proposed adjustments are related to certain transfer pricing arrangements with our foreign subsidiaries. In January 2024, we received notification of a MAP resolution agreement for these tax years, which the Company accepted in February 2024. We anticipate this will result in an estimated net cash outflow of $80 million to $130 million, inclusive of related interest expense, expected during 2024, and an increase to our worldwide income tax expense in an estimated range of $30 million to $60 million, expected during the first quarter of 2024. This estimated range takes into consideration competent authority relief, existing income tax reserves, transition tax regulations and estimated interest expense. This MAP resolution supersedes the NOPA for the 2014 through 2016 tax years from the IRS, described above. During the first quarter of 2024, we will review the impact of this settlement in relation to our transfer pricing income tax reserves for open tax years subsequent to 2016, and may result in adjustments, which could be material.

Conference Call

Tripadvisor will host a conference call tomorrow, February 15, 2024, at 8:30 a.m., Eastern Time, to discuss the Company’s fourth quarter and full year 2023 financial results, which may include forward looking information about Tripadvisor’s business. Investors and other interested parties may also go to the Investor Relations section of Tripadvisor’s website at http://ir.tripadvisor.com for a live webcast of the conference call. A replay of the conference call will be available on Tripadvisor’s website for three months.

SELECTED FINANCIAL INFORMATION

Tripadvisor, Inc.

Unaudited Condensed Consolidated Statements of Operations

(in millions, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

Year Ended |

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

Revenue |

|

$ |

390 |

|

|

$ |

354 |

|

|

$ |

1,788 |

|

|

$ |

1,492 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue (1) (exclusive of depreciation and amortization as shown separately below) |

|

|

36 |

|

|

|

30 |

|

|

|

149 |

|

|

|

116 |

|

Selling and marketing (1) |

|

|

179 |

|

|

|

194 |

|

|

|

940 |

|

|

|

784 |

|

Technology and content (1) |

|

|

68 |

|

|

|

60 |

|

|

|

273 |

|

|

|

222 |

|

General and administrative (1) |

|

|

47 |

|

|

|

58 |

|

|

|

191 |

|

|

|

172 |

|

Depreciation and amortization |

|

|

25 |

|

|

|

25 |

|

|

|

87 |

|

|

|

97 |

|

Restructuring and other related reorganization costs |

|

|

4 |

|

|

|

— |

|

|

|

22 |

|

|

|

— |

|

Total costs and expenses |

|

|

359 |

|

|

|

367 |

|

|

|

1,662 |

|

|

|

1,391 |

|

Operating income (loss) |

|

|

31 |

|

|

|

(13 |

) |

|

|

126 |

|

|

|

101 |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(11 |

) |

|

|

(10 |

) |

|

|

(44 |

) |

|

|

(44 |

) |

Interest income |

|

|

13 |

|

|

|

8 |

|

|

|

47 |

|

|

|

15 |

|

Other income (expense), net |

|

|

(1 |

) |

|

|

(1 |

) |

|

|

(4 |

) |

|

|

(5 |

) |

Total other income (expense), net |

|

|

1 |

|

|

|

(3 |

) |

|

|

(1 |

) |

|

|

(34 |

) |

Income (loss) before income taxes |

|

|

32 |

|

|

|

(16 |

) |

|

|

125 |

|

|

|

67 |

|

(Provision) benefit for income taxes |

|

|

— |

|

|

|

13 |

|

|

|

(115 |

) |

|

|

(47 |

) |

Net income (loss) |

|

$ |

32 |

|

|

$ |

(3 |

) |

|

$ |

10 |

|

|

$ |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.23 |

|

|

$ |

(0.02 |

) |

|

$ |

0.07 |

|

|

$ |

0.14 |

|

Diluted |

|

$ |

0.22 |

|

|

$ |

(0.02 |

) |

|

$ |

0.08 |

|

|

$ |

0.14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Numerator used to compute net income (loss) per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

32 |

|

|

$ |

(3 |

) |

|

$ |

10 |

|

|

$ |

20 |

|

Diluted |

|

$ |

32 |

|

|

$ |

(3 |

) |

|

$ |

11 |

|

|

$ |

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

138 |

|

|

|

141 |

|

|

|

139 |

|

|

|

140 |

|

Diluted |

|

|

143 |

|

|

|

141 |

|

|

|

145 |

|

|

|

146 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes stock-based compensation expense as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1 |

|

|

$ |

1 |

|

Selling and marketing |

|

$ |

4 |

|

|

$ |

3 |

|

|

$ |

16 |

|

|

$ |

12 |

|

Technology and content |

|

$ |

10 |

|

|

$ |

9 |

|

|

$ |

40 |

|

|

$ |

36 |

|

General and administrative |

|

$ |

10 |

|

|

$ |

11 |

|

|

$ |

39 |

|

|

$ |

39 |

|

Tripadvisor, Inc.

Unaudited Condensed Consolidated Balance Sheets

(in millions, except number of shares and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,067 |

|

|

$ |

1,021 |

|

Accounts receivable, net (allowance for expected credit losses of $21 and $28, respectively) |

|

|

192 |

|

|

|

205 |

|

Prepaid expenses and other current assets |

|

|

38 |

|

|

|

44 |

|

Total current assets |

|

|

1,297 |

|

|

|

1,270 |

|

Property and equipment, net of accumulated depreciation of $551 and $512, respectively |

|

|

191 |

|

|

|

194 |

|

Operating lease right-of-use assets |

|

|

15 |

|

|

|

27 |

|

Intangible assets, net of accumulated amortization of $208 and $198, respectively |

|

|

43 |

|

|

|

51 |

|

Goodwill |

|

|

829 |

|

|

|

822 |

|

Non-marketable investments |

|

|

32 |

|

|

|

34 |

|

Deferred income taxes, net |

|

|

86 |

|

|

|

78 |

|

Other long-term assets, net of allowance for credit losses of $10 and $10, respectively |

|

|

44 |

|

|

|

93 |

|

TOTAL ASSETS |

|

$ |

2,537 |

|

|

$ |

2,569 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

28 |

|

|

$ |

39 |

|

Deferred merchant payables |

|

|

237 |

|

|

|

203 |

|

Deferred revenue |

|

|

49 |

|

|

|

44 |

|

Accrued expenses and other current liabilities |

|

|

258 |

|

|

|

247 |

|

Total current liabilities |

|

|

572 |

|

|

|

533 |

|

Long-term debt |

|

|

839 |

|

|

|

836 |

|

Finance lease obligation, net of current portion |

|

|

51 |

|

|

|

58 |

|

Operating lease liabilities, net of current portion |

|

|

6 |

|

|

|

15 |

|

Deferred income taxes, net |

|

|

1 |

|

|

|

1 |

|

Other long-term liabilities |

|

|

197 |

|

|

|

265 |

|

Total Liabilities |

|

|

1,666 |

|

|

|

1,708 |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value |

|

|

— |

|

|

|

— |

|

Authorized shares: 100,000,000 |

|

|

|

|

|

|

Shares issued and outstanding: 0 and 0, respectively |

|

|

|

|

|

|

Common stock, $0.001 par value |

|

|

— |

|

|

|

— |

|

Authorized shares: 1,600,000,000 |

|

|

|

|

|

|

Shares issued: 149,775,361 and 146,891,538, respectively |

|

|

|

|

|

|

Shares outstanding: 124,881,494 and 128,046,924, respectively |

|

|

|

|

|

|

Class B common stock, $0.001 par value |

|

|

— |

|

|

|

— |

|

Authorized shares: 400,000,000 |

|

|

|

|

|

|

Shares issued and outstanding: 12,799,999 and 12,799,999, respectively |

|

|

|

|

|

|

Additional paid-in capital |

|

|

1,493 |

|

|

|

1,404 |

|

Retained earnings |

|

|

271 |

|

|

|

261 |

|

Accumulated other comprehensive income (loss) |

|

|

(71 |

) |

|

|

(82 |

) |

Treasury stock-common stock, at cost, 24,893,867 and 18,844,614 shares, respectively |

|

|

(822 |

) |

|

|

(722 |

) |

Total Stockholders’ Equity |

|

|

871 |

|

|

|

861 |

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

2,537 |

|

|

$ |

2,569 |

|

Tripadvisor, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

Operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

32 |

|

|

$ |

(3 |

) |

|

$ |

10 |

|

|

$ |

20 |

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

25 |

|

|

|

25 |

|

|

|

87 |

|

|

|

97 |

|

Stock-based compensation expense |

|

|

24 |

|

|

|

23 |

|

|

|

96 |

|

|

|

88 |

|

Deferred income tax expense (benefit) |

|

|

(17 |

) |

|

|

(27 |

) |

|

|

(25 |

) |

|

|

(19 |

) |

Provision for expected credit losses |

|

|

1 |

|

|

|

3 |

|

|

|

6 |

|

|

|

6 |

|

Other, net |

|

|

4 |

|

|

|

1 |

|

|

|

9 |

|

|

|

7 |

|

Changes in operating assets and liabilities, net |

|

|

(88 |

) |

|

|

(62 |

) |

|

|

52 |

|

|

|

201 |

|

Net cash provided by (used in) operating activities |

|

|

(19 |

) |

|

|

(40 |

) |

|

|

235 |

|

|

|

400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures, including capitalized website development |

|

|

(16 |

) |

|

|

(15 |

) |

|

|

(63 |

) |

|

|

(56 |

) |

Other investing activities, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4 |

|

Net cash provided by (used in) investing activities |

|

|

(16 |

) |

|

|

(15 |

) |

|

|

(63 |

) |

|

|

(52 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase of common stock |

|

|

(25 |

) |

|

|

— |

|

|

|

(100 |

) |

|

|

— |

|

Payment of financing costs related to Credit Facility |

|

|

— |

|

|

|

— |

|

|

|

(3 |

) |

|

|

— |

|

Payment of withholding taxes on net share settlements of equity awards |

|

|

(3 |

) |

|

|

(2 |

) |

|

|

(17 |

) |

|

|

(20 |

) |

Payments of finance lease obligation and other financing activities, net |

|

|

(2 |

) |

|

|

(2 |

) |

|

|

(7 |

) |

|

|

(7 |

) |

Net cash provided by (used in) financing activities |

|

|

(30 |

) |

|

|

(4 |

) |

|

|

(127 |

) |

|

|

(27 |

) |

Effect of exchange rate changes on cash, cash

equivalents and restricted cash |

|

|

8 |

|

|

|

14 |

|

|

|

1 |

|

|

|

(23 |

) |

Net increase (decrease) in cash, cash equivalents and restricted cash |

|

|

(57 |

) |

|

|

(45 |

) |

|

|

46 |

|

|

|

298 |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

1,124 |

|

|

|

1,066 |

|

|

|

1,021 |

|

|

|

723 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

1,067 |

|

|

$ |

1,021 |

|

|

$ |

1,067 |

|

|

$ |

1,021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid (received) during the period for income taxes, net of refunds |

|

|

|

|

|

|

|

$ |

140 |

|

|

$ |

(40 |

) |

Cash paid during the period for interest |

|

|

|

|

|

|

|

$ |

39 |

|

|

$ |

40 |

|

Non-GAAP Financial Measures

To supplement our unaudited condensed consolidated financial statements, which are prepared and presented in accordance with accounting principles generally accepted in the United States (“GAAP”), we also report certain non-GAAP financial measures. A “non-GAAP financial measure” refers to a numerical measure of a company’s historical or future financial performance, financial position, or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP in such company’s financial statements. These non-GAAP financial measures are not prepared under a comprehensive set of accounting rules and, therefore, should only be reviewed alongside results reported under GAAP.

We may use the following non-GAAP measures: consolidated adjusted EBITDA (including forecasted consolidated adjusted EBITDA), consolidated adjusted EBITDA margin, non-GAAP net income (loss), non-GAAP net income (loss) per diluted earnings (loss) per share, free cash flow, non-GAAP revenue growth before foreign exchange effect (or “constant currency basis” revenue growth), as well as other measures.

The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP and should not be considered measures of Tripadvisor’s liquidity, except for free cash flow. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, these non-GAAP financial measures do not take into account the impact of certain expenses to our consolidated statements of operations. In addition, these measures may be different from non-GAAP financial measures used by other companies, even where similarly titled, limiting their usefulness for comparison purposes and therefore should not be used to compare Tripadvisor’s performance to that of other companies. We endeavor to compensate for the limitation of the non-GAAP financial measures presented by providing tabular reconciliations to the most directly comparable GAAP financial measure, definitions, limitations, and other related information about these non-GAAP financial measures. We do not reconcile consolidated adjusted EBITDA guidance to projected consolidated GAAP net income (loss) because GAAP net income (loss) or the reconciling items between consolidated adjusted EBITDA and GAAP net income (loss) are unavailable on a forward-looking basis, as a result of the uncertainty regarding, and the potential variability of, certain of these items. Accordingly, a reconciliation of the non-GAAP financial measure guidance to the corresponding GAAP measure is not available without unreasonable effort.

We believe these non-GAAP financial measures provide investors and analysts with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and/or allow for greater transparency with respect to key measures used by management to operate and analyze our business over different periods of time.

We define our non-GAAP financial measures as below:

Tripadvisor defines “Adjusted EBITDA” as net income (loss) plus: (1) provision (benefit) for income taxes; (2) other income (expense), net; (3) depreciation and amortization; (4) stock-based compensation and other stock-settled obligations; (5) goodwill, long-lived assets and intangible asset impairments; (6) legal reserves and settlements; (7) restructuring and other related reorganization costs; and (8) non-recurring expenses and income. These items are excluded from our Adjusted EBITDA measure because these items are non-cash in nature, or because the amount is unpredictable, not driven by core operating results and renders comparisons with prior periods and competitors less meaningful. The Company believes that excluding these amounts better enables management and investors to compare financial results between periods as these costs may vary independent of business performance.

Tripadvisor defines “Adjusted EBITDA margin” as Adjusted EBITDA divided by revenue.

Adjusted EBITDA and Adjusted EBITDA margin are key operating performance measures used by our management and board of directors to understand and evaluate the financial performance of our business as a whole and our individual business segments, and on which internal budgets and forecasts are based and approved. In particular, the exclusion of certain expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons and

better enables management and investors to compare financial results between periods as these costs may vary independent of core business performance. Accordingly, we believe that Adjusted EBITDA and Adjusted EBITDA margin provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors and allows for a useful comparison of our performance with our historical results from prior periods.

Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results reported in accordance with GAAP. Because of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including net income (loss) and our other GAAP results.

Some of these limitations are:

•Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

•Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

•Adjusted EBITDA does not reflect the interest expense or cash requirements necessary to service interest or principal payments on our debt;

•Adjusted EBITDA does not consider the potentially dilutive impact of stock-based compensation or other stock-settled obligations;

•although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

•Adjusted EBITDA does not reflect certain income and expenses not directly tied to the ongoing core operations of our business, including, but not limited to, legal reserves and settlements, restructuring and other related reorganization costs;

•Adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us;

•Adjusted EBITDA is unaudited and does not conform to SEC Regulation S-X, and as a result such information may be presented differently in our future filings with the SEC; and

•other companies, including companies in our own industry, may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure.

Tripadvisor defines “non-GAAP net income (loss),” which was revised during the first quarter of 2023, as GAAP net income (loss) excluding: (1) stock-based compensation expense and other stock-settled obligations; (2) amortization of intangible assets; (3) goodwill, intangible asset, and other long-lived asset impairments; (4) legal reserves and settlements; (5) restructuring and other related reorganization costs; and (6) certain gains, losses, and other non-recurring income or expenses that we do not believe are indicative of our ongoing operating results. The non-GAAP adjustments described previously are reported on a pre-tax basis. The income tax effect on these non-GAAP adjustments is calculated based on the individual impact that these items had on our GAAP consolidated income tax expense (benefit) for the periods presented, in addition to non-recurring or infrequent discrete tax items (including significant adjustments related to (i) tax audit reserves/settlements; (ii) non-recurring or infrequent income tax reserves or adjustments; and (iii) the impact of one-time changes resulting from tax legislation or legislation that impacts tax, such as the CARES Act or the 2017 Tax Act, as examples). We believe non-GAAP net income (loss) is an operating performance measure that provides investors and analysts with useful supplemental information about the financial performance of our business, as it incorporates our unaudited condensed consolidated statement of operations, taking into account depreciation, which management believes is an ongoing cost of doing business, as well as other items which are not allocated to the operating businesses such as interest expense, interest income, income taxes, and foreign exchange gains and losses, but excluding the impact of certain expenses, infrequently occurring items and items not directly tied to the ongoing core operations of our businesses. Non-GAAP net income (loss) also enables comparison of financial results between periods where certain items may vary independent of business performance.

Tripadvisor defines “non-GAAP net income (loss) per diluted share,” or “non-GAAP diluted EPS,” as non-GAAP net income (loss) divided by GAAP diluted shares. We believe non-GAAP diluted EPS is useful to investors because it represents, on a per share basis, our unaudited condensed consolidated statement of operations, taking into account depreciation, which we believe is an ongoing cost of doing business, as well as other items which are not allocated to the operating businesses such as interest expense, interest income, income taxes and foreign exchange gains or losses, but excluding the effects of certain expenses not directly tied to the ongoing core operations of our businesses. Tripadvisor calculates non-GAAP diluted EPS using weighted average diluted shares prepared under GAAP.

Non-GAAP net income (loss) and non-GAAP diluted EPS have some of the same limitations as Adjusted EBITDA. In addition, non-GAAP net income (loss) does not include all items that affect our GAAP net income (loss) and GAAP diluted EPS for the period. Therefore, we think it is important to evaluate these measures along with our unaudited condensed consolidated statements of operations, which are prepared under GAAP.

Tripadvisor defines “free cash flow” as cash provided by (used in) operations less capital expenditures, which are purchases of property and equipment, including the capitalization of website development costs. We believe this financial measure can provide useful supplemental information to help investors better understand underlying cashflow trends in our business, as it represents the operating cash flow that our operating businesses generate, less capital expenditures but before taking into account other cash movements that are not directly tied to the ongoing core operations of our businesses, such as financing activities, foreign currency exchange rate impact on cash, or certain other investing activities. Free cash flow has certain limitations in that it does not represent the total increase or decrease in the cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. Therefore, it is important to evaluate free cash flow along with the unaudited condensed consolidated statements of cash flows, which are prepared under GAAP.

Tripadvisor calculates the estimated effects of foreign currency exchange rates on revenue to determine constant currency revenue growth, by translating actual revenue for the current three months and year ended using the comparable prior period foreign currency exchange rates. We believe this is a useful estimate that facilitates management's internal comparison to our historical performance because the effects of foreign currency exchange rate volatility is not indicative of our ongoing core operating results.

Pursuant to the requirements of Regulation G, we present reconciliations of these non-GAAP financial measures, described above, to the most directly comparable GAAP measures in the tables below.

Tripadvisor, Inc

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(in millions, except per share amounts and percentages)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 |

|

2023 |

|

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

FY* |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

FY* |

|

Reconciliation from GAAP Net Income (Loss) to Adjusted EBITDA (Non-GAAP): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net Income (Loss) |

$ |

(34 |

) |

$ |

31 |

|

$ |

25 |

|

$ |

(3 |

) |

$ |

20 |

|

$ |

(73 |

) |

$ |

24 |

|

$ |

27 |

|

$ |

32 |

|

$ |

10 |

|

Add: Provision (benefit) for income taxes |

|

1 |

|

|

22 |

|

|

37 |

|

|

(13 |

) |

|

47 |

|

|

58 |

|

|

20 |

|

|

37 |

|

|

- |

|

|

115 |

|

Add: Other expense (income), net |

|

13 |

|

|

10 |

|

|

8 |

|

|

3 |

|

|

34 |

|

|

1 |

|

|

- |

|

|

- |

|

|

(1 |

) |

|

1 |

|

Add: Restructuring and other related organization costs |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

18 |

|

|

4 |

|

|

22 |

|

Add: Legal reserves and settlements |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Add: Other non-recurring expenses (income) (1) |

|

- |

|

|

- |

|

|

- |

|

|

8 |

|

|

8 |

|

|

3 |

|

|

- |

|

|

- |

|

|

- |

|

|

3 |

|

Add: Stock-based compensation expense |

|

22 |

|

|

21 |

|

|

22 |

|

|

23 |

|

|

88 |

|

|

23 |

|

|

25 |

|

|

24 |

|

|

24 |

|

|

96 |

|

Add: Depreciation and amortization (2) |

|

25 |

|

|

25 |

|

|

23 |

|

|

25 |

|

|

97 |

|

|

21 |

|

|

21 |

|

|

21 |

|

|

25 |

|

|

87 |

|

Adjusted EBITDA (Non-GAAP) |

$ |

27 |

|

$ |

109 |

|

$ |

115 |

|

$ |

43 |

|

$ |

295 |

|

$ |

33 |

|

$ |

90 |

|

$ |

127 |

|

$ |

84 |

|

$ |

334 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation from GAAP Net Income (Loss) to Non-GAAP Net Income (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net Income (Loss) |

$ |

(34 |

) |

$ |

31 |

|

$ |

25 |

|

$ |

(3 |

) |

$ |

20 |

|

$ |

(73 |

) |

$ |

24 |

|

$ |

27 |

|

$ |

32 |

|

$ |

10 |

|

Add: Stock-based compensation expense |

|

22 |

|

|

21 |

|

|

22 |

|

|

23 |

|

|

88 |

|

|

23 |

|

|

25 |

|

|

24 |

|

|

24 |

|

|

96 |

|

Add: Legal reserves and settlements |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Add: Restructuring and other related organization costs |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

18 |

|

|

4 |

|

|

22 |

|

Add: Other non-recurring expenses (income) (1) |

|

- |

|

|

- |

|

|

- |

|

|

8 |

|

|

8 |

|

|

3 |

|

|

- |

|

|

- |

|

|

- |

|

|

3 |

|

Add: Amortization of intangible assets |

|

3 |

|

|

3 |

|

|

3 |

|

|

4 |

|

|

13 |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

9 |

|

Add: (Gain)/Loss on investments |

|

(1 |

) |

|

(1 |

) |

|

(1 |

) |

|

(1 |

) |

|

(3 |

) |

|

(1 |

) |

|

(1 |

) |

|

(1 |

) |

|

(1 |

) |

|

(3 |

) |

Subtract: Income tax effect of Non-GAAP adjustments (3) |

|

3 |

|

|

- |

|

|

8 |

|

|

7 |

|

|

18 |

|

|

2 |

|

|

1 |

|

|

(4 |

) |

|

5 |

|

|

6 |

|

Subtract: Non-recurring or infrequent discrete tax items (4) |

|

- |

|

|

- |

|

|

(14 |

) |

|

14 |

|

|

- |

|

|

(55 |

) |

|

- |

|

|

- |

|

|

1 |

|

|

(55 |

) |

Non-GAAP Net Income (Loss) |

$ |

(13 |

) |

$ |

54 |

|

$ |

55 |

|

$ |

10 |

|

$ |

109 |

|

$ |

7 |

|

$ |

49 |

|

$ |

74 |

|

$ |

55 |

|

$ |

186 |

|

Interest expense on 2026 Senior Notes, net of tax (5) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1 |

|

Numerator used to compute Non-GAAP net income (loss) per diluted share |

$ |

(13 |

) |

$ |

54 |

|

$ |

55 |

|

$ |

10 |

|

$ |

110 |

|

$ |

7 |

|

$ |

49 |

|

$ |

74 |

|

$ |

55 |

|

$ |

187 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation from GAAP Earnings per Share (EPS) to Non-GAAP EPS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Diluted Shares Outstanding (6) |

|

139 |

|

|

145 |

|

|

146 |

|

|

146 |

|

|

146 |

|

|

147 |

|

|

145 |

|

|

143 |

|

|

143 |

|

|

145 |

|

GAAP Diluted Earnings (Loss) per Share |

$ |

(0.24 |

) |

$ |

0.21 |

|

$ |

0.17 |

|

$ |

(0.02 |

) |

$ |

0.14 |

|

$ |

(0.52 |

) |

$ |

0.17 |

|

$ |

0.19 |

|

$ |

0.22 |

|

$ |

0.08 |

|

Non-GAAP Diluted Earnings (Loss) per Share as Adjusted (7) |

$ |

(0.09 |

) |

$ |

0.37 |

|

$ |

0.38 |

|

$ |

0.07 |

|

$ |

0.75 |

|

$ |

0.05 |

|

$ |

0.34 |

|

$ |

0.52 |

|

$ |

0.38 |

|

$ |

1.29 |

|

Non-GAAP Diluted Earnings (Loss) per Share as Previously Reported |

$ |

(0.09 |

) |

$ |

0.37 |

|

$ |

0.28 |

|

$ |

0.16 |

|

$ |

0.75 |

|

n/a |

|

n/a |

|

n/a |

|

n/a |

|

n/a |

|

Non-GAAP Diluted Earnings (Loss) per Share - increase/(decrease) as result of revised definition |

$ |

(0.00 |

) |

$ |

0.00 |

|

$ |

0.10 |

|

$ |

(0.09 |

) |

$ |

0.00 |

|

n/a |

|

n/a |

|

n/a |

|

n/a |

|

n/a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Exchange Reconciliation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Total Revenue Growth |

|

113 |

% |

|

77 |

% |

|

51 |

% |

|

47 |

% |

|

65 |

% |

|

42 |

% |

|

18 |

% |

|

16 |

% |

|

10 |

% |

|

20 |

% |

Estimated effects of changes in foreign currency exchange rates |

|

(5 |

)% |

|

(10 |

)% |

|

(12 |

)% |

|

(11 |

)% |

|

(10 |

)% |

|

(4 |

)% |

|

(1 |

)% |

|

3 |

% |

|

2 |

% |

|

1 |

% |

Non-GAAP Total Revenue growth on a constant currency basis |

|

118 |

% |

|

87 |

% |

|

63 |

% |

|

58 |

% |

|

75 |

% |

|

46 |

% |

|

19 |

% |

|

13 |

% |

|

8 |

% |

|

19 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Total Brand Tripadvisor Segment Revenue |

|

79 |

% |

|

49 |

% |

|

34 |

% |

|

34 |

% |

|

45 |

% |

|

28 |

% |

|

2 |

% |

|

2 |

% |

|

0 |

% |

|

7 |

% |

Estimated effects of changes in foreign currency exchange rates |

|

(2 |

)% |

|

(7 |

)% |

|

(9 |

)% |

|

(7 |

)% |

|

(7 |

)% |

|

(2 |

)% |

|

0 |

% |

|

3 |

% |

|

1 |

% |

|

1 |

% |

Non-GAAP Total Brand Tripadvisor segment revenue growth on a constant currency basis |

|

81 |

% |

|

56 |

% |

|

43 |

% |

|

41 |

% |

|

52 |

% |

|

30 |

% |

|

2 |

% |

|

(1 |

)% |

|

(1 |

)% |

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Total Viator Segment Revenue |

|

367 |

% |

|

240 |

% |

|

138 |

% |

|

115 |

% |

|

168 |

% |

|

105 |

% |

|

59 |

% |

|

41 |

% |

|

27 |

% |

|

49 |

% |

Estimated effects of changes in foreign currency exchange rates |

|

(6 |

)% |

|

(13 |

)% |

|

(16 |

)% |

|

(16 |

)% |

|

(15 |

)% |

|

(10 |

)% |

|

(2 |

)% |

|

2 |

% |

|

2 |

% |

|

(1 |

)% |

Non-GAAP Total Viator segment revenue growth on a constant currency basis |

|

373 |

% |

|

253 |

% |

|

154 |

% |

|

131 |

% |

|

183 |

% |

|

115 |

% |

|

61 |

% |

|

39 |

% |

|

25 |

% |

|

50 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Total TheFork Segment Revenue |

|

271 |

% |

|

78 |

% |

|

17 |

% |

|

10 |

% |

|

48 |

% |

|

35 |

% |

|

19 |

% |

|

20 |

% |

|

18 |

% |

|

22 |

% |

Estimated effects of changes in foreign currency exchange rates |

|

(48 |

)% |

|

(26 |

)% |

|

(14 |

)% |

|

(16 |

)% |

|

(19 |

)% |

|

(6 |

)% |

|

3 |

% |

|

6 |

% |

|

8 |

% |

|

3 |

% |

Non-GAAP Total TheFork segment revenue growth on a constant currency basis |

|

319 |

% |

|

104 |

% |

|

31 |

% |

|

26 |

% |

|

67 |

% |

|

41 |

% |

|

16 |

% |

|

14 |

% |

|

10 |

% |

|

19 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP Cash Flow from Operating Activities to Non-GAAP Free Cash Flow: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow provided by (used in) operations |

$ |

86 |

|

$ |

295 |

|

$ |

60 |

|

|

(40 |

) |

$ |

400 |

|

$ |

135 |

|

$ |

105 |

|

$ |

14 |

|

|

(19 |

) |

|

235 |

|

Subtract: Capital expenditures |

|

14 |

|

|

13 |

|

|

14 |

|

|

15 |

|

|

56 |

|

|

16 |

|

|

15 |

|

|

16 |

|

|

16 |

|

|

63 |

|

Free Cash Flow (Non-GAAP) |

$ |

72 |

|

$ |

282 |

|

$ |

46 |

|

$ |

(55 |

) |

$ |

344 |

|

$ |

119 |

|

$ |

90 |

|

$ |

(2 |

) |

$ |

(35 |

) |

$ |

172 |

|

Tripadvisor, Inc

Supplemental Financial Information

(in millions, except percentages)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 |

|

2023 |

|

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

FY* |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

FY* |

|

Segments - Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue |

$ |

262 |

|

$ |

417 |

|

$ |

459 |

|

$ |

354 |

|

$ |

1,492 |

|

$ |

371 |

|

$ |

494 |

|

$ |

533 |

|

$ |

390 |

|

$ |

1,788 |

|

Growth % (y/y) |

|

113 |

% |

|

77 |

% |

|

51 |

% |

|

47 |

% |

|

65 |

% |

|

42 |

% |

|

18 |

% |

|

16 |

% |

|

10 |

% |

|

20 |

% |

Brand Tripadvisor |

|

191 |

|

|

274 |

|

|

284 |

|

|

217 |

|

|

966 |

|

|

244 |

|

|

279 |

|

|

290 |

|

|

218 |

|

|

1,031 |

|

Growth % (y/y) |

|

79 |

% |

|

49 |

% |

|

34 |

% |

|

34 |

% |

|

45 |

% |

|

28 |

% |

|

2 |

% |

|

2 |

% |

|

0 |

% |

|

7 |

% |

Tripadvisor-branded hotels |

|

135 |

|

|

188 |

|

|

188 |

|

|

140 |

|

|

650 |

|

|

168 |

|

|

174 |

|

|

181 |

|

|

135 |

|

|

659 |

|

Growth % (y/y) |

|

82 |

% |

|

44 |

% |

|

31 |

% |

|

36 |

% |

|

44 |

% |

|

24 |

% |

|

(7 |

)% |

|

(4 |

)% |

|

(4 |

)% |

|

1 |

% |

Media and advertising |

|

26 |

|

|

37 |

|

|

33 |

|

|

33 |

|

|

130 |

|

|

30 |

|

|

42 |

|

|

38 |

|

|

35 |

|

|

145 |

|

Growth % (y/y) |

|

86 |

% |

|

42 |

% |

|

14 |

% |

|

14 |

% |

|

33 |

% |

|

15 |

% |

|

14 |

% |

|

15 |

% |

|

6 |

% |

|

12 |

% |

Tripadvisor experiences and dining (8) |

|

20 |

|

|

35 |

|

|

45 |

|

|

34 |

|

|

134 |

|

|

33 |

|

|

50 |

|

|

55 |

|

|

38 |

|

|

176 |

|

Growth % (y/y) |

|

67 |

% |

|

119 |

% |

|

96 |

% |

|

70 |

% |

|

91 |

% |

|

65 |

% |

|

43 |

% |

|

22 |

% |

|

12 |

% |

|

31 |

% |

Other |

|

10 |

|

|

14 |

|

|

18 |

|

|

10 |

|

|

52 |

|

|

13 |

|

|

13 |

|

|

16 |

|

|

10 |

|

|

51 |

|

Growth % (y/y) |

|

43 |

% |

|

27 |

% |

|

6 |

% |

|

0 |

% |