Quarterly Cash Dividend Raised by 20.0% to $0.12 Per

Share

Tradeweb Markets Inc. (Nasdaq: TW), a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets, today reported financial results for the fourth quarter

and full year ended December 31, 2024.

$463.3 million quarterly revenues increased 25.2%

(25.5% on a constant currency basis) compared to prior year

period

$2.3 trillion average daily volume (“ADV”) for the

quarter, an increase of 36.7% compared to prior year period;

quarterly ADV records in U.S. government bonds, mortgages and

global repurchase agreements; record 7.9% share of fully

electronic U.S. high yield TRACE

$159.9 million net income and $181.2 million

adjusted net income for the quarter, increases of 54.2% and

19.2% respectively from prior year period

52.8% adjusted EBITDA margin and $244.7 million

adjusted EBITDA for the quarter, compared to 53.0% and $195.9

million respectively for prior year period

$0.66 diluted earnings per share (“Diluted EPS”) and

$0.76 adjusted diluted earnings per share for the

quarter

$0.12 per share quarterly cash dividend declared, a

20.0% per share increase from prior year period

Billy Hult, CEO of Tradeweb:

"2024 was a banner year for Tradeweb, marking our 25th

consecutive year of record annual revenues. This achievement

reflects our commitment to growing our geographical footprint,

entering new markets and client channels through organic and

inorganic collaborations, and consistently delivering value to our

clients. The year culminated with a strong fourth quarter, driven

in part by a favorable market environment that created additional

tailwinds for our global business. Our strong performance in the

fourth quarter was highlighted by ADV records across money markets

and rates, as well as record share of fully electronic U.S. high

yield TRACE.

We forged key partnerships in the fourth quarter, becoming the

first strategic partner to Goldman Sachs for its GS DAP technology

platform, and collaborating with the Tokyo Stock Exchange to

provide institutional investors with better access to liquidity in

Japanese ETFs. What’s more, we celebrated major milestones, such as

the 10-year anniversary of our U.S. Credit platform and five years

since the launch of portfolio trading in European Credit.

We also continued to strengthen our global reach, appointing

Enrico Bruni and Troy Dixon as Co-Heads of Global Markets in newly

created leadership roles. As we close this remarkable year, I am

energized by the opportunities ahead and look forward to

collaborating with our clients to reach new heights in 2025.”

SELECT FINANCIAL RESULTS

4Q24

4Q23

Change

Constant

Currency Change (1)

(dollars in thousands except per share

amounts)(Unaudited)

GAAP Financial Measures

Total revenue

$

463,344

$

370,000

25.2

%

25.5

%

Rates

$

240,192

$

191,743

25.3

%

25.8

%

Credit

$

113,572

$

104,267

8.9

%

9.1

%

Equities

$

28,749

$

26,056

10.3

%

10.6

%

Money Markets

$

44,258

$

16,606

166.5

%

165.5

%

Market Data

$

30,011

$

25,908

15.8

%

15.9

%

Other

$

6,562

$

5,420

21.1

%

21.0

%

Net income

$

159,942

$

103,741

54.2

%

Net income attributable to Tradeweb Markets Inc. (2)

$

142,210

$

89,314

59.2

%

Diluted EPS

$

0.66

$

0.42

57.1

%

Net income margin

34.5

%

28.0

%

+648

bps

Non-GAAP Financial Measures

Adjusted EBITDA (1)

$

244,743

$

195,943

24.9

%

25.0

%

Adjusted EBITDA margin (1)

52.8

%

53.0

%

-14

bps

-20

bps

Adjusted EBIT (1)

$

227,347

$

180,957

25.6

%

25.8

%

Adjusted EBIT margin (1)

49.1

%

48.9

%

+16

bps

+11

bps

Adjusted Net Income (1)

$

181,183

$

151,937

19.2

%

19.4

%

Adjusted Diluted EPS (1)

$

0.76

$

0.64

18.8

%

18.8

%

(1)

Adjusted EBITDA, Adjusted EBITDA

margin, Adjusted EBIT, Adjusted EBIT margin, Adjusted Net Income,

Adjusted Diluted EPS and constant currency change are non-GAAP

financial measures. See "Non-GAAP Financial Measures" below and the

attached schedules for additional information and reconciliations

of such non-GAAP financial measures.

(2)

Represents net income less net

income attributable to non-controlling interests.

ADV (US $bn)

(Unaudited)

Asset Class

Product

4Q24

4Q23

YoY

Rates

Cash

$

509

$

398

27.9

%

Derivatives

744

690

7.9

%

Total

1,253

1,087

15.2

%

Credit

Cash

15

14

3.2

%

Derivatives

13

10

27.9

%

Total

27

24

13.3

%

Equities

Cash

11

11

1.9

%

Derivatives

12

12

(1.4

)%

Total

24

24

0.1

%

Money Markets

Cash

988

541

82.5

%

Total

988

541

82.5

%

Total

$

2,292

$

1,677

36.7

%

DISCUSSION OF RESULTS: FOURTH QUARTER 2024

Rates – Revenues of $240.2 million in the fourth quarter

of 2024 increased 25.3% compared to prior year period (increased

25.8% on a constant currency basis). Rates ADV was up 15.2% from

prior year period, driven by record ADV in U.S. government bonds

and mortgages, as well as strong year-over-year growth in

swaps/swaptions < 1-year. The addition of r8fin continued to

contribute to wholesale volumes. European government bonds reported

a 18.6% ADV increase from prior year period, driven by increased

client adoption of our diverse trading protocols. Mortgages reached

record ADV, up 22.0% from prior year period, driven by strong

specified pool volumes and to-be-announced ("TBA") volumes, which

were largely supported by elevated roll trading activity.

Credit – Revenues of $113.6 million in the fourth quarter

of 2024 increased 8.9% compared to prior year period (increased

9.1% on a constant currency basis). Credit ADV was up 13.3% from

prior year period, driven by strong activity in credit derivatives

and U.S. credit volumes, including record ADV in fully electronic

U.S. high yield credit. U.S. credit ADV was up 23.7% from prior

year period, reflecting continued client adoption across Tradeweb

products and protocols, including request-for-quote ("RFQ"),

Tradeweb AllTrade® and portfolio trading. European Credit ADV was

up 11.6% from prior year period, driven by robust activity across a

wide range of protocols including Tradeweb's Automated Intelligent

Execution tool ("AiEX"), Tradeweb AllTrade® and our unique dealer

selection tool, SNAP IOI. We reported 18.3% share of fully

electronic U.S. high grade TRACE, up 102 basis points (bps) from

prior year period, and a record 7.9% share of fully electronic U.S.

high yield TRACE, up 120 bps from prior year period.

Equities – Revenues of $28.7 million in the fourth

quarter of 2024 increased 10.3% compared to prior year period

(increased 10.6% on a constant currency basis). Equities ADV

remained relatively flat, up 0.1% from prior year period. Volumes

were driven by higher European ETF volumes and an increased number

of clients utilizing our RFQ offering.

Money Markets – Revenues of $44.3 million in the fourth

quarter of 2024 increased 166.5% compared to prior year period

(increased 165.5% on a constant currency basis). Money Markets ADV

was up 82.5% from prior year period, primarily driven by

contributions from the August 1, 2024 acquisition of ICD and record

ADV in global repurchase agreements, which was led by increased

client activity across the platform.

Market Data – Revenues of $30.0 million in the fourth

quarter of 2024 increased 15.8% compared to prior year period

(increased 15.9% on a constant currency basis). The increase was

derived primarily from increased LSEG market data fees from our

market data agreement that was amended effective as of November 1,

2023, as well as an increase in proprietary third party market data

revenue.

Other – Revenues of $6.6 million in the fourth quarter of

2024 increased 21.1% compared to prior year period (increased 21.0%

on a constant currency basis).

Operating Expenses of $274.8 million in the fourth

quarter of 2024 increased 20.3% compared to $228.4 million in the

prior year period, primarily due to an increase in employee

compensation and benefits as a result of increases in headcount to

support our continued growth and an increase in incentive

compensation expense tied to our financial performance, an increase

in depreciation and amortization expense primarily related to the

assets acquired in connection with the 2024 acquisitions of ICD and

r8fin and an increase in technology and communication expense due

to continued investment in our data strategy and infrastructure and

increased clearance and data fees driven primarily by higher

trading volumes from prior year period. Given the strong

environment to invest for long-term growth, during the fourth

quarter of 2024, we also accelerated certain discretionary

investments in marketing, consulting, digital assets and client

relationship development.

Adjusted Expenses of $236.0 million in the fourth quarter

of 2024 increased 24.8% (increased 25.2% on a constant currency

basis) compared to prior year period primarily due to an increase

in employee compensation and benefits as a result of increases in

headcount to support our continued growth and an increase in

incentive compensation expense tied to our financial performance

and an increase in technology and communication expense due to

continued investment in our data strategy and infrastructure and

increased clearance and data fees driven primarily by higher

trading volumes from prior year period. Given the strong

environment to invest for long-term growth, during the fourth

quarter of 2024, we also accelerated certain discretionary

investments in marketing, consulting, digital assets and client

relationship development. Please see "Non-GAAP Financial Measures"

below for additional information.

DISCUSSION OF RESULTS: FULL-YEAR 2024

Tradeweb recorded its 25th consecutive year of record annual

revenues for the year ended December 31, 2024, as total revenues

increased 29.0% (the same on a constant currency basis) to $1.7

billion compared to full year 2023. Revenue was driven by ADV of

more than $2.2 trillion and record ADV activity in each of the

following: U.S. government bonds, European government bonds,

swaps/swaptions ≥ 1-year and mortgages, as well as record ADV in

and share of fully electronic U.S. high grade credit. Net income

increased 35.9% to $570.0 million for the year ended December 31,

2024, compared to $419.5 million in 2023. Adjusted EBITDA margin

increased to 53.3% for the year ended December 31, 2024 compared to

52.4% in 2023, representing an increase of 91 bps from prior year

period (+80 bps on a constant currency basis). Diluted EPS

increased 36.3% from prior year period to $2.33 for the year ended

December 31, 2024. Adjusted Diluted EPS increased 29.2% from prior

year period to $2.92 for the year ended December 31, 2024.

RECENT HIGHLIGHTS

January 2025

- The U.S. Securities and Exchange Commission (SEC) approved the

registration of Tradeweb's swap execution facility, TW SEF LLC, as

a security-based swap execution facility (SBSEF) under the SEC's

new Regulation SE.

Fourth Quarter 2024

- Appointed Enrico Bruni and Troy Dixon to the newly-created

roles of Co-Heads of Global Markets, effective January 2025.

- Announced Tradeweb's collaboration with Tokyo Stock Exchange

("TSE") to offer institutional investors enhanced access to

liquidity in Japanese ETFs.

- Celebrated the 10-year anniversary of the launch of Tradeweb's

U.S. Credit platform and the five-year anniversary of the launch of

portfolio trading in European Credit.

- Announced that Tradeweb FTSE benchmark closing prices for U.S.

Treasuries, UK Gilts and European Government Bonds will be included

in FTSE Russell's premiere World Government Bond Index

("WGBI").

- Became the first strategic partner for Goldman Sachs' GS DAP

platform, introducing our trading and liquidity capabilities across

fixed income to help bring new commercial use cases to GS DAP.

- Recognized in numerous awards celebrating our company, as well

as our outstanding and diverse talent, including: America's Best

Companies 2025 (Forbes); European Women in Finance Awards,

Excellence in Trading Platforms - Alessandra Stagliano (Markets

Media); U.S. Women in Finance Awards, Rising Star - Bridget Silver

(Markets Media); U.S. Women in Finance Awards, CFO of the Year -

Sara Furber (Markets Media); 100 Most Influential Women in European

Finance - Nawel Khelil (Financial News); RFQ Platform of the Year,

ETF Stream Awards (ETF Stream)

CAPITAL MANAGEMENT

- $1.3 billion in cash and cash equivalents and an undrawn $500.0

million credit facility at December 31, 2024

- Cash capital expenditures and capitalized software development

in the fourth quarter 2024 of $38.0 million and $88.9 million in

full-year 2024

- Free cash flow for the year ended December 31, 2024 of $808.9

million, up 18.2% compared to prior year period. See “Non-GAAP

Financial Measures” for additional information

- During the year ended December 31, 2024, as part of its share

repurchase program, Tradeweb purchased a total of 478,915 shares of

Class A common stock, at an average price of $125.07, for purchases

totaling $59.9 million. During the fourth quarter of 2024, Tradeweb

purchased a total of 264,120 shares of Class A common stock, at an

average price of $132.11, for purchases totaling $34.9 million. As

of December 31, 2024, a total of $179.9 million remained available

for repurchase pursuant to the current share repurchase program

authorization

- $1.6 million in shares of Class A common stock were withheld in

the fourth quarter of 2024 and $48.0 million in shares of Class A

common stock were withheld in the full-year 2024 to satisfy tax

obligations related to the exercise of stock options and vesting of

restricted stock units and performance-based restricted stock units

held by employees

- The Board of Directors declared a quarterly cash dividend of

$0.12 per share of Class A common stock and Class B common stock, a

20.0% per share increase from prior year. This dividend will be

payable on March 17, 2025 to stockholders of record as of March 3,

2025

OTHER MATTERS

Full-Year 2025 Guidance*

- Adjusted Expenses: $970 - 1,030 million

- Acquisition and Refinitiv Transaction related depreciation and

amortization expense: $176 million

- Assumed non-GAAP tax rate: ~24.5% - 25.5%

- Cash capital expenditures and capitalized software development:

~ $99 - 109 million

- LSEG Market Data Contract Revenue: ~$90 million

LSEG Market Data Contract Revenue guidance is unchanged from the

prior quarter guidance.

*GAAP operating expenses and tax rate guidance are not provided

due to the inherent difficulty in quantifying certain amounts due

to a variety of factors including the unpredictability in the

movement of foreign currency rates. Expense guidance assumes an

average 2025 Sterling/US$ foreign exchange rate of 1.28.

CONFERENCE CALL

Tradeweb Markets will hold a conference call to discuss fourth

quarter and full year 2024 results starting at 9:30 AM EST today,

February 6, 2025. A live, audio webcast of the conference call

along with related presentation materials will be available at

https://investors.tradeweb.com/events-and-presentations.

- To join the call via audio webcast, click here:

https://edge.media-server.com/mmc/p/cw4zesjo/

- To join the call via phone, please register in advance here:

https://register.vevent.com/register/BI82aeb5b6b0af4127af700cf95f163d3b.

Registered participants will receive an email confirmation with a

unique PIN to access the conference call.

An archived recording of the call will be available afterward at

https://investors.tradeweb.com.

ABOUT TRADEWEB MARKETS

Tradeweb Markets Inc. (Nasdaq: TW) is a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets. Founded in 1996, Tradeweb provides access to markets, data

and analytics, electronic trading, straight-through-processing and

reporting for more than 50 products to clients in the

institutional, wholesale, retail and corporates markets. Advanced

technologies developed by Tradeweb enhance price discovery, order

execution and trade workflows while allowing for greater scale and

helping to reduce risks in client trading operations. Tradeweb

serves more than 3,000 clients in more than 85 countries. On

average, Tradeweb facilitated more than $2.2 trillion in notional

value traded per day over the past four fiscal quarters. For more

information, please go to www.tradeweb.com.

TRADEWEB MARKETS INC.

CONSOLIDATED STATEMENTS OF

INCOME

(UNAUDITED)

Quarter Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Revenues

(dollars in thousands, except

per share amounts)

Transaction fees and commissions

$

384,128

$

301,800

$

1,423,547

$

1,078,344

Subscription fees

55,026

47,489

206,659

183,972

LSEG market data fees

20,552

17,821

82,145

64,336

Other

3,638

2,890

13,598

11,567

Total revenue

463,344

370,000

1,725,949

1,338,219

Expenses

Employee compensation and benefits

152,206

125,872

592,690

460,305

Depreciation and amortization

62,854

47,500

219,999

185,350

Technology and communications

28,728

21,505

98,568

77,506

General and administrative

12,291

19,803

56,317

51,495

Professional fees

13,574

10,043

60,132

42,364

Occupancy

5,151

3,647

20,215

15,930

Total expenses

274,804

228,370

1,047,921

832,950

Operating income

188,540

141,630

678,028

505,269

Tax receivable agreement liability

adjustment

8,600

(9,517

)

7,730

(9,517

)

Interest income

14,803

20,952

74,037

67,397

Interest expense

(573

)

(667

)

(4,279

)

(2,047

)

Other income (loss), net

(1,124

)

(11,100

)

(1,114

)

(13,122

)

Income before taxes

210,246

141,298

754,402

547,980

Provision for income taxes

(50,304

)

(37,557

)

(184,439

)

(128,477

)

Net income

159,942

103,741

569,963

419,503

Less: Net income attributable to

non-controlling interests

17,732

14,427

68,456

54,637

Net income attributable to Tradeweb

Markets Inc.

$

142,210

$

89,314

$

501,507

$

364,866

Earnings per share attributable to

Tradeweb Markets Inc. Class A and B common stockholders:

Basic

$

0.67

$

0.42

$

2.35

$

1.73

Diluted

$

0.66

$

0.42

$

2.33

$

1.71

Weighted average shares outstanding:

Basic

213,039,958

211,843,460

213,030,056

210,796,802

Diluted

215,043,352

213,833,001

214,924,763

212,668,808

TRADEWEB MARKETS INC.

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (UNAUDITED)

Reconciliation of Net Income to

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBIT and Adjusted

EBIT Margin

Quarter Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(dollars in thousands)

Net income

$

159,942

$

103,741

$

569,963

$

419,503

Merger and acquisition transaction and

integration costs (1)

1,071

1,631

22,823

8,042

Interest income

(14,803

)

(20,952

)

(74,037

)

(67,397

)

Interest expense

573

667

4,279

2,047

Depreciation and amortization

62,854

47,500

219,999

185,350

Stock-based compensation expense (2)

701

987

6,096

2,947

Provision for income taxes

50,304

37,557

184,439

128,477

Foreign exchange (gains) / losses (3)

(8,423

)

4,195

(6,326

)

(47

)

Tax receivable agreement liability

adjustment (4)

(8,600

)

9,517

(7,730

)

9,517

Other (income) loss, net

1,124

11,100

1,114

13,122

Adjusted EBITDA

$

244,743

$

195,943

$

920,620

$

701,561

Less: Depreciation and amortization

(62,854

)

(47,500

)

(219,999

)

(185,350

)

Add: D&A related to acquisitions and

the Refinitiv Transaction (5)

45,458

32,514

156,489

127,731

Adjusted EBIT

$

227,347

$

180,957

$

857,110

$

643,942

Net income margin (6)

34.5

%

28.0

%

33.0

%

31.3

%

Adjusted EBITDA margin (6)

52.8

%

53.0

%

53.3

%

52.4

%

Adjusted EBIT margin (6)

49.1

%

48.9

%

49.7

%

48.1

%

(1)

Represents incremental direct

costs associated with the acquisition and integration of completed

and potential mergers and acquisitions. These costs generally

include legal, consulting, advisory, due diligence, severance and

certain other transaction expenses and third party costs incurred

that directly relate to the acquisition transaction or its

integration.

(2)

Represents non-cash stock-based

compensation expense associated with the Special Option Award and

post-IPO options awarded in 2019 and payroll taxes associated with

the exercise of such options. During the quarter ended and year

ended December 31, 2024, this adjustment also includes none and

$2.7 million, respectively, of non-cash accelerated stock-based

compensation expense and related payroll taxes associated with our

former President and $0.6 million and $1.0 million, respectively,

of non-cash stock-based compensation expense and related payroll

taxes associated with RSAs and RSUs issued to help retain key ICD

employees during the integration of ICD.

(3)

Represents unrealized gain or

loss recognized on foreign currency forward contracts and foreign

exchange gain or loss from the revaluation of cash denominated in a

different currency than the entity’s functional currency.

(4)

Represents income recognized

during the applicable period due to changes in the tax receivable

agreement liability recorded in the consolidated statement of

financial condition as a result of, as applicable, changes in the

mix of earnings, tax legislation and tax rates in various

jurisdictions which impacted our tax savings.

(5)

Represents intangible asset and

acquired software amortization resulting from acquisitions and

intangible asset amortization and increased tangible asset and

capitalized software depreciation and amortization resulting from

the application of pushdown accounting to the Refinitiv Transaction

(where all assets were marked to fair value as of the closing date

of the Refinitiv Transaction).

(6)

Net income margin, Adjusted

EBITDA margin and Adjusted EBIT margin are defined as net income,

Adjusted EBITDA and Adjusted EBIT, respectively, divided by revenue

for the applicable period.

Reconciliation of Net Income to

Adjusted Net Income and Adjusted Diluted EPS

Quarter Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(dollars in thousands, except

per share amounts)

Earnings per diluted share

$

0.66

$

0.42

$

2.33

$

1.71

Net income attributable to Tradeweb

Markets Inc.

$

142,210

$

89,314

$

501,507

$

364,866

Net income attributable to non-controlling

interests (1)

17,732

14,427

68,456

54,637

Net income

159,942

103,741

569,963

419,503

Provision for income taxes

50,304

37,557

184,439

128,477

Merger and acquisition transaction and

integration costs (2)

1,071

1,631

22,823

8,042

D&A related to acquisitions and the

Refinitiv Transaction (3)

45,458

32,514

156,489

127,731

Stock-based compensation expense (4)

701

987

6,096

2,947

Foreign exchange (gains) / losses (5)

(8,423

)

4,195

(6,326

)

(47

)

Tax receivable agreement liability

adjustment (6)

(8,600

)

9,517

(7,730

)

9,517

Other (income) loss, net

1,124

11,100

1,114

13,122

Adjusted Net Income before income

taxes

241,577

201,242

926,868

709,292

Adjusted income taxes (7)

(60,394

)

(49,305

)

(231,717

)

(173,777

)

Adjusted Net Income

$

181,183

$

151,937

$

695,151

$

535,515

Adjusted Diluted EPS (8)

$

0.76

$

0.64

$

2.92

$

2.26

(1)

Represents the reallocation of

net income attributable to non-controlling interests from the

assumed exchange of all outstanding LLC Interests held by

non-controlling interests for shares of Class A or Class B common

stock.

(2)

Represents incremental direct

costs associated with the acquisition and integration of completed

and potential mergers and acquisitions. These costs generally

include legal, consulting, advisory, due diligence, severance and

certain other transaction expenses and third party costs incurred

that directly relate to the acquisition transaction or its

integration.

(3)

Represents intangible asset and

acquired software amortization resulting from acquisitions and

intangible asset amortization and increased tangible asset and

capitalized software depreciation and amortization resulting from

the application of pushdown accounting to the Refinitiv Transaction

(where all assets were marked to fair value as of the closing date

of the Refinitiv Transaction).

(4)

Represents non-cash stock-based

compensation expense associated with the Special Option Award and

post-IPO options awarded in 2019 and payroll taxes associated with

the exercise of such options. During the quarter ended and year

ended December 31, 2024, this adjustment also includes none and

$2.7 million, respectively, of non-cash accelerated stock-based

compensation expense and related payroll taxes associated with our

former President and $0.6 million and $1.0 million, respectively,

of non-cash stock-based compensation expense and related payroll

taxes associated with RSAs and RSUs issued to help retain key ICD

employees during the integration of ICD.

(5)

Represents unrealized gain or

loss recognized on foreign currency forward contracts and foreign

exchange gain or loss from the revaluation of cash denominated in a

different currency than the entity’s functional currency.

(6)

Represents income recognized

during the applicable period due to changes in the tax receivable

agreement liability recorded in the consolidated statement of

financial condition as a result of, as applicable, changes in the

mix of earnings, tax legislation and tax rates in various

jurisdictions which impacted our tax savings.

(7)

Represents corporate income taxes

at an assumed effective tax rate of 25.0% applied to Adjusted Net

Income before income taxes for the quarter and year ended December

31, 2024 and 24.5% for the quarter and year ended December 31,

2023.

(8)

For a summary of the calculation

of Adjusted Diluted EPS, see “Reconciliation of Diluted Weighted

Average Shares Outstanding to Adjusted Diluted Weighted Average

Shares Outstanding and Adjusted Diluted EPS” below.

The following table summarizes the calculation of Adjusted

Diluted EPS for the periods presented:

Reconciliation of Diluted Weighted

Average Shares Outstanding to Adjusted Diluted Weighted Average

Shares Outstanding and Adjusted Diluted EPS

Quarter Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Diluted weighted average shares of Class A

and Class B common stock outstanding

215,043,352

213,833,001

214,924,763

212,668,808

Weighted average of other participating

securities (1)

249,907

281,059

165,565

270,249

Assumed exchange of LLC Interests for

shares of Class A or Class B common stock (2)

23,073,616

23,079,809

23,076,373

23,902,379

Adjusted diluted weighted average shares

outstanding

238,366,875

237,193,869

238,166,701

236,841,436

Adjusted Net Income (in thousands)

$

181,183

$

151,937

$

695,151

$

535,515

Adjusted Diluted EPS

$

0.76

$

0.64

$

2.92

$

2.26

(1)

Represents the weighted average

of unvested stock awards and unsettled vested stock awards issued

to certain retired or terminated employees that are entitled to

non-forfeitable dividend equivalent rights and are considered

participating securities prior to being issued and outstanding

shares of common stock in accordance with the two-class method used

for purposes of calculating earnings per share.

(2)

Assumes the full exchange of the

weighted average of all outstanding LLC Interests held by

non-controlling interests for shares of Class A or Class B common

stock, resulting in the elimination of the non-controlling

interests and recognition of the net income attributable to

non-controlling interests.

Reconciliation of Operating Expenses to

Adjusted Expenses

Quarter Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(dollars in thousands)

Operating expenses

$

274,804

$

228,370

$

1,047,921

$

832,950

Merger and acquisition transaction and

integration costs (1)

(1,071

)

(1,631

)

(22,823

)

(8,042

)

D&A related to acquisitions and the

Refinitiv Transaction (2)

(45,458

)

(32,514

)

(156,489

)

(127,731

)

Stock-based compensation expense (3)

(701

)

(987

)

(6,096

)

(2,947

)

Foreign exchange gains / (losses) (4)

8,423

(4,195

)

6,326

47

Adjusted Expenses

$

235,997

$

189,043

$

868,839

$

694,277

(1)

Represents incremental direct

costs associated with the acquisition and integration of completed

and potential mergers and acquisitions. These costs generally

include legal, consulting, advisory, due diligence, severance and

certain other transaction expenses and third party costs incurred

that directly relate to the acquisition transaction or its

integration.

(2)

Represents intangible asset and

acquired software amortization resulting from acquisitions and

intangible asset amortization and increased tangible asset and

capitalized software depreciation and amortization resulting from

the application of pushdown accounting to the Refinitiv Transaction

(where all assets were marked to fair value as of the closing date

of the Refinitiv Transaction).

(3)

Represents non-cash stock-based

compensation expense associated with the Special Option Award and

post-IPO options awarded in 2019 and payroll taxes associated with

the exercise of such options. During the quarter ended and year

ended December 31, 2024, this adjustment also includes none and

$2.7 million, respectively, of non-cash accelerated stock-based

compensation expense and related payroll taxes associated with our

former President and $0.6 million and $1.0 million, respectively,

of non-cash stock-based compensation expense and related payroll

taxes associated with RSAs and RSUs issued to help retain key ICD

employees during the integration of ICD.

(4)

Represents unrealized gain or

loss recognized on foreign currency forward contracts and foreign

exchange gain or loss from the revaluation of cash denominated in a

different currency than the entity’s functional currency.

Year Ended December

31,

Reconciliation of Cash Flow from

Operating Activities to Free Cash Flow

2024

2023

(dollars in thousands)

Cash flow from operating activities

$

897,741

$

746,089

Less: Capitalization of software

development costs

(47,909

)

(43,235

)

Less: Purchases of furniture, equipment

and leasehold improvements

(40,960

)

(18,529

)

Free Cash Flow

$

808,872

$

684,325

TRADEWEB MARKETS INC.

BASIC AND DILUTED EPS CALCULATIONS

(UNAUDITED)

The following table summarizes the basic

and diluted earnings per share calculations for Tradeweb Markets

Inc.:

EPS: Net income attributable to

Tradeweb Markets Inc.

Quarter Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(dollars in thousands, except

per share amounts)

Numerator:

Net income attributable to Tradeweb

Markets Inc.

$

142,210

$

89,314

$

501,507

$

364,866

Less: Distributed and undistributed

earnings allocated to participating securities (1)

(167

)

(118

)

(389

)

(467

)

Net income attributable to outstanding

shares of Class A and Class B common stock - Basic and Diluted

$

142,043

$

89,196

$

501,118

$

364,399

Denominator:

Weighted average shares of Class A and

Class B common stock outstanding - Basic

213,039,958

211,843,460

213,030,056

210,796,802

Dilutive effect of PRSUs

661,696

691,150

589,171

458,343

Dilutive effect of options

303,253

877,866

428,926

1,150,159

Dilutive effect of RSUs and RSAs

561,703

394,812

415,957

257,076

Dilutive effect of PSUs

476,742

25,713

460,653

6,428

Weighted average shares of Class A and

Class B common stock outstanding - Diluted

215,043,352

213,833,001

214,924,763

212,668,808

Earnings per share - Basic

$

0.67

$

0.42

$

2.35

$

1.73

Earnings per share - Diluted

$

0.66

$

0.42

$

2.33

$

1.71

(1)

During the quarters ended

December 31, 2024 and 2023, there was a total of 249,907 and

281,059, respectively, and during the years ended December 31, 2024

and 2023, there was a total of 165,565 and 270,249, respectively,

weighted average unvested or unsettled vested stock awards that

were considered a participating security for purposes of

calculating earnings per share in accordance with the two-class

method.

TRADEWEB MARKETS INC.

REVENUES BY ASSET CLASS

(UNAUDITED)

Quarter Ended

Quarter Ended

Year Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Revenues

Variable

Fixed

Variable

Fixed

Variable

Fixed

Variable

Fixed

(dollars in thousands)

Rates

$

175,407

$

64,785

$

132,248

$

59,495

$

660,438

$

244,500

$

462,132

$

233,302

Credit

103,377

10,195

96,799

7,468

423,708

35,332

338,981

28,413

Equities

26,470

2,279

23,673

2,383

94,964

9,220

86,003

9,292

Money Markets

40,030

4,228

12,448

4,158

98,216

17,004

45,830

17,180

Market Data

89

29,922

108

25,800

457

117,563

268

93,806

Other

468

6,094

—

5,420

981

23,566

—

23,012

Total revenue

$

345,841

$

117,503

$

265,276

$

104,724

$

1,278,764

$

447,185

$

933,214

$

405,005

TRADEWEB MARKETS INC.

AVERAGE VARIABLE FEES PER MILLION

DOLLARS OF VOLUME (UNAUDITED)

Quarter Ended December

31,

YoY

2024

2023

% Change

Rates

$

2.23

$

1.95

14.5

%

Rates Cash

$

2.37

$

2.47

(4.2

)%

Rates Derivatives

$

2.14

$

1.66

29.1

%

Rates Derivatives (greater than 1

year)

$

3.65

$

2.36

54.6

%

Other Rates Derivatives (1)

$

0.23

$

0.21

9.4

%

Credit

$

60.36

$

64.64

(6.6

)%

Cash Credit (2)

$

148.07

$

168.34

(12.0

)%

Credit Derivatives, China Bonds and U.S.

Cash EP

$

7.98

$

7.90

1.0

%

Equities

$

17.56

$

15.97

9.9

%

Equities Cash

$

29.00

$

27.92

3.9

%

Equities Derivatives

$

7.07

$

5.38

31.4

%

Money Markets

$

0.57

$

0.37

54.8

%

Total

$

2.28

$

2.54

(10.4

)%

Total excluding Other Rates Derivatives

(3)

$

2.60

$

2.91

(10.7

)%

(1)

Includes Swaps/Swaptions of tenor

less than 1 year and Rates Futures.

(2)

The “Cash Credit” category

represents the “Credit” asset class excluding (1) Credit

Derivatives (2) China Bonds and (3) U.S. High Grade and High Yield

electronically processed (“EP”) activity.

(3)

Included to contextualize the

impact of short-tenored Swaps/Swaptions and Rates Futures on totals

for all periods presented.

TRADEWEB MARKETS INC.

AVERAGE DAILY VOLUME (UNAUDITED)

(1)

2024 Q4

2023 Q4

YoY

Asset Class

Product

ADV (USD mm)

Volume (USD mm)

ADV (USD mm)

Volume (USD mm)

ADV

Rates

Cash

$

508,863

$

31,654,127

$

397,946

$

24,713,727

27.87

%

U.S. Government Bonds

224,928

13,945,561

162,335

10,064,801

38.56

%

European Government Bonds

48,016

3,073,052

40,491

2,550,927

18.59

%

Mortgages

226,707

14,055,856

185,883

11,524,751

21.96

%

Other Government Bonds

9,211

579,657

9,236

573,248

(0.27

)%

Derivatives

744,189

46,916,987

689,543

43,033,453

7.92

%

Swaps/Swaptions ≥ 1Y

416,896

26,248,749

459,943

28,695,380

(9.36

)%

Swaps/Swaptions < 1Y

320,517

20,205,645

226,131

14,121,397

41.74

%

Futures

6,776

462,593

3,469

216,676

95.37

%

Total

1,253,052

78,571,114

1,087,489

67,747,180

15.22

%

Credit

Cash

14,751

919,420

14,291

882,253

3.22

%

U.S. High Grade - Fully

Electronic

6,481

401,793

5,134

318,320

26.22

%

U.S. High Grade - Electronically

Processed

3,116

193,168

2,500

154,994

24.63

%

U.S. High Yield - Fully

Electronic

794

49,248

642

39,825

23.66

%

U.S. High Yield - Electronically

Processed

219

13,598

300

18,620

(26.97

)%

European Credit

2,280

145,902

2,044

128,744

11.56

%

Municipal Bonds

421

26,113

454

28,175

(7.32

)%

Chinese Bonds

1,166

72,276

2,984

179,032

(60.93

)%

Other Credit Bonds

275

17,322

232

14,544

18.51

%

Derivatives

12,613

793,229

9,864

615,208

27.87

%

Swaps

12,613

793,229

9,864

615,208

27.87

%

Total

27,364

1,712,648

24,154

1,497,461

13.29

%

Equities

Cash

11,263

720,851

11,054

696,386

1.90

%

U.S. ETFs

8,103

518,579

8,308

523,379

(2.47

)%

European ETFs

3,161

202,272

2,746

173,007

15.09

%

Derivatives

12,295

786,854

12,474

785,845

(1.44

)%

Convertibles/Swaps/Options

8,906

570,007

8,495

535,199

4.84

%

Futures

3,388

216,847

3,979

250,646

(14.84

)%

Total

23,558

1,507,705

23,527

1,482,230

0.13

%

Money Markets

Cash

988,081

69,906,820

541,367

33,641,259

82.52

%

Repurchase Agreements (Repo)

687,695

42,873,437

524,267

32,578,498

31.17

%

Other Money Markets

300,386

27,033,383

17,100

1,062,761

1656.68

%

Total

988,081

69,906,820

541,367

33,641,259

82.52

%

ADV (USD mm)

Volume (USD mm)

ADV (USD mm)

Volume (USD mm)

YoY

Total

$

2,292,055

$

151,698,287

$

1,676,537

$

104,368,131

36.70

%

(1)

We acquired Yieldbroker, r8fin

and ICD on August 31, 2023, January 19, 2024 and August 1, 2024,

respectively. Total volume reported includes volumes from each

acquired business subsequent to the closing date of the applicable

acquisition.

To access historical traded volumes, go to

https://www.tradeweb.com/newsroom/monthly-activity-reports/.

BASIS OF PRESENTATION

Tradeweb Markets Inc. (unless the context otherwise requires,

together with its subsidiaries, referred to as “we,” “our,”

“Tradeweb,” “Tradeweb Markets” or the “Company”) closed its IPO on

April 8, 2019. As a result of certain reorganization transactions

(the “Reorganization Transactions”) completed in connection with

the IPO, on April 4, 2019, Tradeweb Markets Inc. became a holding

company whose principal assets consist of its direct and indirect

equity interest in Tradeweb Markets LLC (“TWM LLC”) and related

deferred tax assets. As the sole manager of TWM LLC, Tradeweb

Markets Inc. operates and controls all of the business and affairs

of TWM LLC and, through TWM LLC and its subsidiaries, conducts its

business. As a result of this control, and because Tradeweb Markets

Inc. has a substantial financial interest in TWM LLC, Tradeweb

Markets Inc. consolidates the financial results of TWM LLC and its

subsidiaries.

Numerical figures included in this release have been subject to

rounding adjustments and as a result totals may not be the

arithmetic aggregation of the amounts that precede them and figures

expressed as percentages may not total 100%.

Please refer to the Company's previously filed Quarterly Reports

on Form 10-Q and Annual Report on Form 10-K for capitalized terms

not otherwise defined herein.

UNAUDITED INTERIM AND FULL YEAR RESULTS

The interim and full year financial results presented herein for

the three months and the year ended December 31, 2024 and 2023 are

unaudited.

FORWARD-LOOKING STATEMENTS

This release contains forward-looking statements within the

meaning of the federal securities laws. Statements related to,

among other things, our guidance, including full-year 2025 guidance

and full-year 2025 revenue guidance related to the LSEG market data

license agreement, pending and completed acquisitions, future

performance, the industry and markets in which we operate, our

expectations, beliefs, plans, strategies, objectives, prospects and

assumptions and future events are forward-looking statements.

We have based these forward-looking statements on our current

expectations, assumptions, estimates and projections. While we

believe these expectations, assumptions, estimates and projections

are reasonable, such forward-looking statements are only

predictions and involve known and unknown risks and uncertainties,

many of which are beyond our control. These and other important

factors, including those discussed under the heading “Risk Factors”

in the documents of Tradeweb Markets Inc. on file with or furnished

to the SEC, may cause our actual results, performance or

achievements to differ materially from those expressed or implied

by these forward-looking statements. Given these risks and

uncertainties, you are cautioned not to place undue reliance on

such forward-looking statements. The forward-looking statements

contained in this release are not guarantees of future events or

performance and future events, our actual results of operations,

financial condition or liquidity, and the development of the

industry and markets in which we operate, may differ materially

from the forward-looking statements contained in this release. In

addition, even if future events, our results of operations,

financial condition, or liquidity, and events in the industry and

markets in which we operate, are consistent with the

forward-looking statements contained in this release, they may not

be predictive of events, results or developments in future periods.

Any forward-looking statement that we make in this release speaks

only as of the date of such statement. Except as required by law,

we do not undertake any obligation to update or revise, or to

publicly announce any update or revision to, any of the

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date of this release.

NON-GAAP FINANCIAL MEASURES

This release contains “non-GAAP financial measures,” including

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBIT, Adjusted

EBIT margin, Adjusted Net Income, Adjusted Net Income per diluted

share ("Adjusted Diluted EPS"), Adjusted Expenses, Free Cash Flow

and constant currency change, which are supplemental financial

measures that are not calculated and presented in accordance with

GAAP. We make use of non-GAAP financial measures in evaluating our

past results and future prospects. We present these non-GAAP

financial measures because we believe they assist investors and

analysts in comparing our operating performance across reporting

periods on a consistent basis by excluding items that we do not

believe are indicative of our core operating performance.

Management and our board of directors use Adjusted EBITDA,

Adjusted EBITDA margin, Adjusted EBIT and Adjusted EBIT margin to

assess our financial performance and believe they are helpful in

highlighting trends in our core operating performance, while other

measures can differ significantly depending on long-term strategic

decisions regarding capital structure, the tax jurisdictions in

which we operate and capital investments. Further, our executive

incentive compensation is based in part on components of Adjusted

EBITDA.

We use Adjusted Net Income and Adjusted Diluted EPS as

supplemental metrics to evaluate our business performance in a way

that also considers our ability to generate profit without the

impact of certain items. Each of the normal recurring adjustments

and other adjustments included in Adjusted Net Income and Adjusted

Diluted EPS help to provide management with a measure of our

operating performance over time by removing items that are not

related to day-to-day operations or are non-cash expenses.

We use Adjusted Expenses as a supplemental metric to evaluate

our underlying operating performance over time by removing items

that are not related to day-to-day operations or are non-cash

expenses.

We use Free Cash Flow to assess our liquidity in a way that

considers the amount of cash generated from our core operations

after non-acquisition related expenditures for capitalized software

development costs and furniture, equipment and leasehold

improvements.

We present certain changes on a “constant currency” basis. Since

our consolidated financial statements are presented in U.S.

dollars, we must translate non-U.S. dollar revenues and expenses

into U.S. dollars. Constant currency change, which is a non-GAAP

financial measure, is defined as change excluding the effects of

foreign currency fluctuations. Constant currency information is

calculated by translating the current period and prior period’s

results using the annual average exchange rates for the prior

period. We use constant currency change as a supplemental metric to

evaluate our underlying performance between periods by removing the

impact of foreign currency fluctuations. We present certain

constant currency change information because we believe it provides

investors and analysts a useful comparison of our results and

trends between periods. This information should be considered in

addition to, not as a substitute for, results reported in

accordance with GAAP.

See the attached schedules for reconciliations of the non-GAAP

financial measures contained in this release to their most

comparable GAAP financial measure. Non-GAAP financial measures have

limitations as analytical tools, and you should not consider these

non-GAAP financial measures in isolation or as alternatives to net

income attributable to Tradeweb Markets Inc., net income, net

income margin, earnings per share, operating income, operating

expenses, cash flow from operating activities or any other

financial measure prepared or derived in accordance with GAAP. You

are encouraged to evaluate each adjustment included in the

reconciliations. In addition, in evaluating Adjusted EBITDA,

Adjusted EBITDA margin, Adjusted EBIT, Adjusted EBIT margin,

Adjusted EBT, Adjusted Net Income, Adjusted Diluted EPS, Adjusted

Expenses and Free Cash Flow, you should be aware that in the

future, we may incur expenses similar to the adjustments in the

presentation of these non-GAAP financial measures.

Our presentation of non-GAAP financial measures should not be

construed as an inference that our future results will be

unaffected by unusual or non-recurring items. In addition, the

non-GAAP financial measures contained in this release may not be

comparable to similarly titled measures used by other companies in

our industry or across different industries.

MARKET AND INDUSTRY DATA

This release includes estimates regarding market and industry

data that we prepared based on our management’s knowledge and

experience in the markets in which we operate, together with

information obtained from various sources, including publicly

available information, industry reports and publications, surveys,

our clients, trade and business organizations and other contacts in

the markets in which we operate. In presenting this information, we

have made certain assumptions that we believe to be reasonable

based on such data and other similar sources and on our knowledge

of, and our experience to date in, the markets in which we operate.

While such information is believed to be reliable for the purposes

used herein, no representations are made as to the accuracy or

completeness thereof and we take no responsibility for such

information.

TRADEWEB SOCIAL MEDIA

Investors and others should note that Tradeweb announces

material financial and operational information using its investor

relations website, press releases, SEC filings and public

conference calls and webcasts. Information about Tradeweb, its

business and its results of operations may also be announced by

posts on the Company’s accounts on the following social media

channels: Instagram, LinkedIn and X. The information that we post

through these social media channels may be deemed material. As a

result, we encourage investors, the media, and others interested in

Tradeweb to monitor these social media channels in addition to

following our investor relations website, press releases, SEC

filings and public conference calls and webcasts. These social

media channels may be updated from time to time on our investor

relations website.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206827450/en/

Investor Relations Ashley Serrao + 1 646 430 6027

Ashley.Serrao@Tradeweb.com

Media Relations Daniel Noonan + 1 646 767 4677

Daniel.Noonan@Tradeweb.com

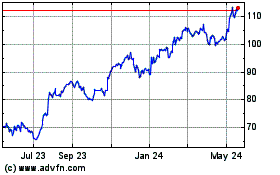

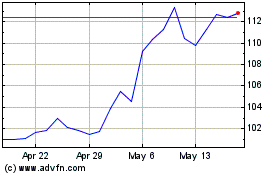

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Feb 2024 to Feb 2025