0000912093false00009120932024-12-132024-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 13, 2024

VIAVI SOLUTIONS INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

|

| | | | |

| Delaware | | 000-22874 | | 94-2579683 |

(State or other jurisdiction of incorporation or organization) | | (Commission file number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | |

|

| | |

1445 South Spectrum Blvd, Suite 102, Chandler, Arizona 85286 |

| (Address of principal executive offices and zip code) |

(408) 404-3600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of the exchange on which registered |

| Common Stock, $0.001 par value | | VIAV | | The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On December 13, 2024, Viavi Solutions Inc. (the “Company”) issued a press release announcing that it has signed a definitive agreement to acquire Inertial Labs, Inc. for initial consideration of $150 million at closing and up to $175 million of contingent consideration over four years. VIAVI intends to fund the transaction through cash on hand. The acquisition has been approved by the Board of Directors of each company and is expected to close during the first quarter of calendar year 2025, subject to certain regulatory approvals and customary closing conditions. A copy of the press release is furnished as Exhibit 99.1 and incorporated by reference in its entirety.

The information in this Item 7.01 of this Form 8-K, including Exhibit 99.1, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall they be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | Press release entitled “VIAVI Expands Market Reach with Strategic Acquisition of Inertial Labs” dated December 13, 2024 |

| 104 | | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | VIAVI SOLUTIONS INC. |

| | | |

| Date: December 13, 2024 | | | | By: | | /s/ Kevin Siebert |

| | | | Name: | | KEVIN SIEBERT |

| | | | Title: | | Senior Vice President, General Counsel and Secretary |

| | | | | | |

VIAVI Expands Market Reach with Strategic Acquisition of Inertial Labs

•Strategic acquisition extends VIAVI’s reach into aerospace, defense and industrial end markets

•Broadens VIAVI’s portfolio with highly complementary product offerings

•Accelerates entry into high growth applications such as autonomous air, land and sea systems

Chandler, Ariz., December 13, 2024 – Viavi Solutions Inc. (VIAVI) (NASDAQ: VIAV) today announced that it has signed a definitive agreement to acquire Inertial Labs, Inc. for initial consideration of $150 million at closing and up to $175 million of contingent consideration over four years. VIAVI intends to fund the transaction through cash on hand.

The acquisition is expected to add approximately $50 million to VIAVI’s Network and Service Enablement (NSE) annual revenue in calendar year 2025 and is expected to be accretive to EPS within 12 months of closing.

The acquisition has been approved by the Board of Directors of each company and is expected to close during the first quarter of calendar year 2025, subject to certain regulatory approvals and customary closing conditions.

Headquartered in Leesburg, Virginia, Inertial Labs is a leading developer, producer and supplier of high-performance orientation, positioning and navigation solutions for aerospace, defense and industrial applications. The company offers Inertial Measurement Units (IMU), Inertial Navigation Systems (INS), Assured Position Navigation and Timing (APNT), GNSS Tracking, LiDAR Scanning, Alternative Navigation (ALTNAV) and Visual Navigation solutions, which are highly complementary to VIAVI’s existing PNT and other aerospace and defense solutions.

Additionally, Inertial Labs’ solutions include enablement of utility inspection through LiDAR and photogrammetry algorithms, and smart system navigation for both airborne and autonomous ground vehicles to accelerate VIAVI’s entrance into industrial and autonomous delivery and transportation end markets.

“With a highly complementary product portfolio focused on alternate navigation solutions, this transaction supports VIAVI’s strategy to expand our presence in domestic and international aerospace and defense segments and accelerates our entry into autonomous air, land and sea systems in the military and industrial end markets,” said Oleg Khaykin, President and CEO of VIAVI.

“We are excited that our expertise, precision solutions and resources provide expansion opportunities for VIAVI in high growth markets and applications such as drone-based LiDAR and camera systems,” said Jamie Marraccini, President and CEO of Inertial Labs.

About VIAVI

VIAVI (NASDAQ: VIAV) is a global provider of network test, monitoring and assurance solutions for telecommunications, cloud, enterprises, first responders, military, aerospace and railway. VIAVI is also a leader in light management technologies for 3D sensing, anti-

counterfeiting, consumer electronics, industrial, automotive, government and aerospace applications. Learn more about VIAVI at www.viavisolutions.com. Follow us on VIAVI Perspectives, LinkedIn and YouTube.

About Inertial Labs

With over 20 years of industry experience, Inertial Labs is a leading designer, integrator, and manufacturer of cutting-edge Inertial Measurement Units (IMUs), GPS-Aided Inertial Navigation Systems (INSs) and Attitude & Heading Reference Systems (AHRSs). Our team leverages highly accurate and temperature calibrated MEMS gyroscopes and accelerometers to provide high performing inertial solutions across many applications. Solutions include Inertial Sensing, Assured Position Navigation and Timing (APNT), GNSS Tracking, LiDAR Scanning, Alternative Navigation (ALTNAV), Visual Navigation and Programmable Navigation Solutions.

Safe Harbor

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and is subject to the safe harbors created therein. The forward-looking statements include, but are not limited to, information regarding the ability of VIAVI and Inertial Labs to complete the acquisition, including the satisfaction of the conditions to the consummation of the acquisition, and the expected, estimated and anticipated impact of the transaction on VIAVI’s strategy and future financial results. These forward-looking statements involve risks and uncertainties that could cause VIAVI’s results to differ materially from management’s current expectations. Such risks and uncertainties include, but are not limited to, unforeseen changes in the strength of customers’ businesses and high growth markets; unforeseen changes in the demand for current and new products, technologies, and services; customer purchasing decisions and timing; unforeseen changes in future revenues, earnings and profitability of VIAVI or Inertial Labs; the risk that VIAVI is not able to realize the savings or benefits expected from integration of Inertial Labs; the risk that the required regulatory approvals for the proposed acquisition are not obtained, are delayed or are subject to conditions that are not anticipated; and those risks and uncertainties discussed in VIAVI’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on August 16, 2024 and Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November 1, 2024.

The forward-looking statements included in this release are valid only as of today’s date except where otherwise noted. Viavi Solutions Inc. undertakes no obligation to update these statements.

###

Media Inquiries:

| | | | | | | | |

Amit Malhotra pr@viavisolutions.com +1 202 341 8624 | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

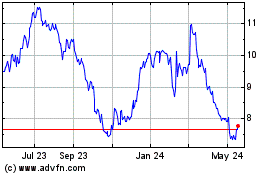

Viavi Solutions (NASDAQ:VIAV)

Historical Stock Chart

From Dec 2024 to Jan 2025

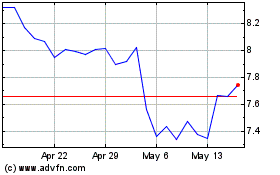

Viavi Solutions (NASDAQ:VIAV)

Historical Stock Chart

From Jan 2024 to Jan 2025