false

0001559998

0001559998

2024-11-13

2024-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report:

November

13, 2024

Gaucho

Group Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40075 |

|

52-2158952 |

State

of

Incorporation |

|

Commission

File

Number |

|

IRS

Employer

Identification

No. |

1111

Lincoln Road, Suite 500

Miami,

FL 33139

Address

of principal executive offices

212-739-7700

Telephone

number, including area code

Former

name or former address if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communication pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communication

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communication

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock |

|

VINO |

|

The Nasdaq Stock Market

LLC |

Item

1.03 Bankruptcy or Receivership.

As

reported in Gaucho Group Holdings, Inc.’s (the “Company,” “we,” “us” or “our”)

Current Report on Form 8-K as filed with the Securities and Exchange Commission (the “SEC”) on November 12, 2024, the Company

filed a voluntary petition in the United States Bankruptcy Court for the Southern District of Florida seeking relief under Chapter 11

of Title 11 of the United States Code, case no. 24-21852 (the “Chapter 11 Reorganization”).

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

November 13, 2024, the Company, received a letter from the Listing Qualifications Department of the Nasdaq Stock Market (the “Staff”)

that the Staff has determined that the Company’s shares of common stock will be delisted from the Nasdaq Stock Market (“Nasdaq”)

in accordance with Nasdaq Listing Rules 5101, 5110(b) and IM-5101-1 as a result of the Chapter 11 Reorganization. Trading of the Company’s

common stock will be suspended at the opening of business on November 22, 2024 and a Form 25-NSE will be filed with the SEC, which will remove the Company’s securities from listing and registration on Nasdaq.

The Staff’s determination was based on the filing of the Chapter 11 Reorganization and public concerns raised by the filing; concerns

regarding the residual equity interest of the stockholders holding the existing listed common stock; and concerns about the Company’s

ability to sustain compliance with all requirements for continued listing on Nasdaq. The letter also indicates that the Company may appeal

Nasdaq’s determination pursuant to procedures set forth in Nasdaq Listing Rule 5800 Series. The Company does not intend to appeal

this determination.

The

Staff determination has no immediate effect on the Company’s Nasdaq listing and the Company’s common stock will continue

to trade on Nasdaq under the ticker symbol “VINO” until November 22, 2024. Thereafter, the Company anticipates that it will

be quoted on the over-the-counter market with the symbol “VINOQ”.

Item

7.01Regulation FD Disclosure.

Press

Release

On

November 13, 2024, the Company sent out a press release, announcing, among other things, the commencement of the Chapter 11 Reorganization.

A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

Nasdaq

Delisting Notice

The

information included in Item 3.01 is hereby incorporated by reference into this item.

The

information in this Item 7.01 of the Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing made

by the Company under the Securities Act of 1933, as amended, whether made before or after the date hereof, regardless of any general

incorporation language in such filing.

Cautionary

Statements Regarding Trading in the Company’s Securities

The

Company’s securityholders are cautioned that trading in the common stock during the pendency of the Chapter 11 Reorganization is

highly speculative and poses substantial risk. Trading prices for the common stock may bear little or no relationship to the actual recovery,

if any, by holders thereof in the Chapter 11 Reorganization. Accordingly, the Company urges extreme caution with respect to existing

and future investments in its common stock.

Item

8.01 Other Events

On

November 13, 2024, the Company sent out a press release announcing, among other things, the commencement of the Chapter 11 Reorganization.

The full text of the press release referenced herein is furnished hereto as Exhibit 99.1, and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized, on the 13th day of November 2024.

| |

Gaucho Group

Holdings, Inc. |

| |

|

|

| |

By: |

/s/Scott

L. Mathis |

| |

|

Scott L. Mathis, President

& CEO |

Exhibit

99.1

GAUCHO

HOLDINGS INITIATES CHAPTER 11 REORGANIZATION TO PROTECT CORE ASSETS

Strategic

Filing Aims to Protect Operational Continuity for the Benefit of Stockholders

MIAMI,

FL / November 13, 2024 / Gaucho Group Holdings, Inc. (NASDAQ:VINO), a company that includes a growing collection of e-commerce platforms

with a concentration on fine wines, luxury real estate, and leather goods and accessories (the “Company” or “Gaucho

Holdings”), today announced that it has filed a petition pursuant to Chapter 11 for a reorganization plan. This decision comes

as part of a strategic effort to protect the Company’s valuable assets, including Algodon Mansion and Algodon Wine Estates in Argentina,

and ensure continued operations while navigating current legal challenges.

After

a thorough analysis of all potential options, Gaucho Holdings determined that filing for Chapter 11 reorganization would provide immediate

protection for its assets and support the Company’s goal of maintaining operations for the benefit of all stockholders. The Chapter

11 process enables the Company to challenge claims by creditors and, if deemed valid, establish a structured repayment plan over time

while continuing to operate its business. Gaucho Holdings has received a notice of delisting from NASDAQ and anticipates being quoted

on the over-the-counter market under the symbol “VINOQ.”

The

decision to pursue Chapter 11 reorganization comes at an opportune time, as Argentina enters a pivotal phase marked by promising economic

developments. A convergence of favorable factors—including the alignment of Argentina’s leadership philosophies with those

of the incoming U.S. administration—signals a renewed period of international cooperation and economic growth. Key drivers such

as the reintroduction of 30-year mortgages revitalizing the housing market, the successful tax amnesty program injecting significant

capital into the economy, and Argentina’s proactive stance as an early adopter of Bitcoin, enhancing financial flexibility and

investor confidence, position the country for robust growth. Gaucho Holdings views these trends as a strategic opportunity to bridge

the gap between its public market valuation and the significant intrinsic value of its real estate holdings. The Company is dedicated

to implementing strategic measures that preserve stockholder value and align its market capitalization with the true worth of its assets,

positioning it to benefit from Argentina’s upward economic trajectory.

Scott

Mathis, CEO and Founder of Gaucho Group Holdings, Inc., stated: “This decision was not made lightly, but it is a necessary step

to ensure that we protect the significant value we have built in our assets, especially at a time when Argentina’s economic climate

is showing marked improvement. Chapter 11 offers us the framework to navigate these challenges and continue driving value for our stockholders

while maintaining operational integrity.”

Since

the filing of the 8-K referred to and linked to below, as of the writing of this press release, the Company has already been informed

that the Chapter 11 reorganization petition filed on November 12, 2024 has had an immediate positive effect, resulting in the adjournment

of the pending sale of its assets. The full stockholder letter, which includes the Company’s position on the potential implications

of recent global developments, mortgage market growth, and strategic initiatives, can be viewed in an 8K filing available on the Company’s

website at: https://ir.gauchoholdings.com/sec-filings/all-sec-filings.

About

Gaucho Group Holdings, Inc.

For

more than ten years, Gaucho Group Holdings, Inc.’s (gauchoholdings.com) mission has been to source and develop opportunities in

Argentina’s undervalued luxury real estate and consumer marketplace. Our company has positioned itself to take advantage of the

continued and fast growth of global e-commerce across multiple market sectors, with the goal of becoming a leader in diversified luxury

goods and experiences in sought after lifestyle industries and retail landscapes. With a concentration on fine wines (algodonfinewines.com

& algodonwines.com.ar), hospitality (algodonhotels.com), and luxury real estate (algodonwineestates.com) associated with our proprietary

Algodon brand, as well as the leather goods, ready-to-wear and accessories of the fashion brand Gaucho – Buenos Aires® (gaucho.com),

these are the luxury brands in which Argentina finds its contemporary expression.

Cautionary

Note Regarding Forward-Looking Statements

The

information discussed in this press release includes “forward looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts,

included herein concerning, among other things, changes to exchange rates and their impact on the Company, planned capital expenditures,

future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, business strategy and other

plans and objectives for future operations, are forward looking statements. Although we believe that the expectations reflected in these

forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties and are not (and should not be

considered to be) guarantees of future performance. Refer to our risk factors set forth in our reports filed on Edgar. The Company disclaims

any obligation to update any forward-looking statement made here.

Media

Relations:

Gaucho

Group Holdings, Inc.

Rick Stear

Director of Marketing

212.739.7669

rstear@gauchoholdings.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

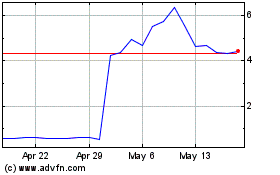

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Feb 2025 to Mar 2025

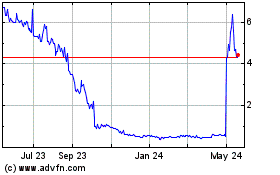

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Mar 2024 to Mar 2025