UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULES 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Dated

December 09, 2024

Commission

File Number: 001-10086

VODAFONE GROUP

PUBLIC LIMITED COMPANY

(Translation

of registrant’s name into English)

VODAFONE

HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN,

ENGLAND

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F ✓

Form 40-F _

This

Report on Form 6-K contains a Stock Exchange Announcement dated 09

December 2024 entitled Update regarding Vodafone

Italy.

9 December 2024

|

|

|

Update regarding Vodafone Italy

|

On 15 March 2024, Vodafone Group Plc ("Vodafone") announced that it

had entered into a binding agreement to sell 100% of its Italian

operations ("Vodafone Italy") to Swisscom AG (the "Transaction").

Following the entry into force of the new UK Listing Rules (the

"UKLRs") on 29 July 2024, Vodafone released a further announcement

on 30 September 2024 containing certain additional

information.

Vodafone now sets out further information relating to the

Transaction in accordance with the new UKLRs.

Appendix 1: Financial information relating to Vodafone

Italy

The following historical financial information relating to Vodafone

Italy's performance has been extracted without material adjustment

from internal financial accounting records that underlie Vodafone

Group Plc's audited consolidated financial statements for the years

ended 31 March 2023 and 31 March 2024, and the unaudited condensed

financial statements for the six months ended 30 September 2024.

The audit reports in respect of these annual consolidated financial

statements were unqualified, and copies of those financial

statements are available on Vodafone's website and at its

registered address: Vodafone House, The Connection, Newbury,

Berkshire, RG14 2FN, England.

The historical financial information is unaudited, prepared on the

basis of Vodafone Group Plc accounting policies and presented

before the elimination of transactions between Vodafone Italy and

the remainder of the consolidated group.

EY LLP served as the auditor for Vodafone Group Plc during the

periods presented and subsequently up to the date of this

announcement.

Income Statement of Vodafone Italy for the years ended 31 March

2023, 31 March 2024 and the six months ended 30 September

2024:

|

|

Six

months ended

30

September 2024

|

Year

ended

31

March

2024

|

Year

ended

31

March

2023

|

|

|

€m

|

€m

|

€m

|

|

Revenue

|

2,249

|

4,668

|

4,809

|

|

Cost of

Sales

|

(879)

|

(3,527)

|

(3,619)

|

|

Gross

Profit

|

1,370

|

1,141

|

1,190

|

|

Selling

and distribution expenses

|

(114)

|

(244)

|

(238)

|

|

Administrative

expenses

|

(302)

|

(869)

|

(816)

|

|

Net

credit losses on financial assets

|

(26)

|

(51)

|

(66)

|

|

Operating

Profit / (Loss)

|

928

|

(23)

|

70

|

|

Financing

costs

|

(83)

|

(162)

|

(119)

|

|

Profit

/ (Loss) before taxation

|

845

|

(185)

|

(49)

|

|

Income

tax expense

|

(260)

|

23

|

10

|

|

Profit

/ (Loss) for the financial year from discontinued

operations

|

585

|

(162)

|

(39)

|

|

After

tax loss on the re-measurement of the disposal group

|

(739)

|

(83)

|

-

|

|

Loss

for the financial year from discontinued operations

|

(154)

|

(245)

|

(39)

|

Statement of Financial Position of Vodafone Italy as at 31 March

2024 and 30 September 2024:

|

|

As

at

30

September

2024

|

As

at

31

March

2024

|

|

|

€m

|

€m

|

|

Goodwill

|

1,674

|

2,398

|

|

Other

Intangible Assets

|

3,416

|

3,331

|

|

Property, Plant and

Equipment

|

4,895

|

4,307

|

|

Deferred Tax

Assets

|

208

|

461

|

|

Trade

and Other receivables due > 1 year

|

143

|

167

|

|

Non-Current

Assets

|

10,336

|

10,664

|

|

|

|

|

|

Inventory

|

117

|

134

|

|

Taxation

Recoverable

|

76

|

77

|

|

Trade

and Other receivables due < 1 year

|

1,130

|

1,117

|

|

Cash

and Cash Equivalents

|

28

|

29

|

|

Current

Assets

|

1,351

|

1,357

|

|

Total

Assets held for sale

|

11,687

|

12,021

|

|

|

|

|

|

Long

Term Borrowings Total

|

1,387

|

1,509

|

|

Post

Employment Benefits- Liabilities

|

36

|

45

|

|

Provisions for

Liabilities and Charges due > 1 year

|

120

|

115

|

|

Trade

and other payables due > 1 year

|

92

|

120

|

|

Non-Current

Liabilities

|

1,635

|

1,789

|

|

|

|

|

|

Short

Term Borrowings Total

|

727

|

673

|

|

Taxation

Payable

|

12

|

12

|

|

Provisions due <

1 year

|

82

|

67

|

|

Trade

and other payables due < 1 year

|

1,440

|

1,723

|

|

Current

Liabilities

|

2,261

|

2,475

|

|

Total

Liabilities held for sale

|

3,896

|

4,264

|

|

|

|

|

|

Intercompany loans

due > 1 year

|

1,750

|

1,560

|

|

Other

intercompany

|

193

|

196

|

|

Net

Intercompany

|

1,943

|

1,751

|

|

|

|

|

|

Net

Assets

|

5,848

|

6,006

|

Appendix 2: Non-financial information relating to the

Transaction

1. Related party transactions

Details of the related party transactions that Vodafone has entered

into:

●

during

the financial year ended 31 March 2022 are set out in note 30 on

page 204 of the Company's 2022 Annual Report;

●

during

the financial year ended 31 March 2023 are set out in note 30 on

page 200 of the Company's 2023 Annual Report;

●

during

the financial year ended 31 March 2024 are set out in note 30 on

page 216 of the Company's 2024 Annual Report; and

●

during

the period from 1 April 2024 to 30 September 2024 are disclosed in

note 13 on page 46 of the Company's interim results for the half

year to 30 September 2024,

in each case, as incorporated by reference into this announcement.

Shareholders can access documents incorporated by reference

at https://investors.vodafone.com/performance/financial-results-and-presentations.

There have been no additional related party transactions by

Vodafone which are relevant to the Transaction during the period

between 30 September 2024, being the end of the last financial

period for which unaudited interim financial information of

Vodafone has been published, and the date of this

announcement.

2. Material contracts

A. Material contracts of the Retained Vodafone group

No contracts have been entered into by Vodafone or another member

of the Vodafone group, excluding Vodafone Italy (the "Retained

Vodafone Group") (not being contracts entered into in the ordinary

course of business): (i) within the period of two years immediately

preceding the date of this announcement that are, or may be,

material to the Retained Vodafone Group; or (ii) that contain any

provisions under which any member of the Retained Vodafone Group

has any obligation or entitlement that is, or may be, material to

the Retained Vodafone Group, save as disclosed below.

1. Revolving

Credit Facilities

(A) 2028 Revolving Credit Facility

Vodafone

has a USD 3,935,000,000 (as increased to USD 4,004,000,000)

syndicated revolving credit facility with Barclays Bank plc as

successor agent and certain financial institutions as lenders

originally entered into on 27 February 2015 and as amended pursuant

to an amendment agreement dated 10 March 2021, which matures on 10

March 2028.

The

facility supports Vodafone's commercial paper programmes and may be

used for general corporate purposes including

acquisitions.

Interest

is charged on loans drawn under the revolving credit facility at a

reference rate plus a margin of 0.375%. Interest periods vary based

on the loan drawn.

The

facilities agreement includes certain events of default that are

customary for facilities of this nature and which are subject to

standard grace periods and materiality thresholds, including,

without limitation, non-payment, breach of other obligations,

misrepresentation, cross default, insolvency-related matters and

cessation of business.

As

at the date of this announcement, no amount is outstanding under

the facility.

The

facility agreement is governed by English law.

(B) 2029 Revolving Credit Facility

Vodafone

has a EUR 3,840,000,000 (as increased to EUR 4,050,000,000)

syndicated revolving credit facility with Barclays Bank as agent

and certain financial institutions as lenders which it entered into

on 28 March 2014 and as amended by amendment and restatement

agreements dated 10 March 2021 and 8 February 2024, which matures

on 8 February 2031.

The

facility supports Vodafone's commercial paper programmes and may be

used for general corporate purposes including

acquisitions.

Interest

is charged on loans drawn under the revolving credit facility at a

reference rate plus a margin of 0.375%. Interest periods vary based

on the loan drawn.

The

facilities agreement includes certain events of default that are

customary for facilities of this nature and which are subject to

standard grace periods and materiality thresholds, including,

without limitation, non-payment, breach of other obligations,

misrepresentation, cross default, insolvency- related matters and

cessation of business.

As

at the date of this announcement, no amount is outstanding under

the facility.

The

facility agreement is governed by English law.

2. Vodafone

Idea implementation agreement

On

20 March 2017, erstwhile Vodafone India Limited ("VIL"), erstwhile

Vodafone Mobile Services Limited, Idea Cellular Limited ("Idea"),

Vodafone International Holdings B.V. and certain VIL promoters and

Idea promoters entered into an implementation agreement pursuant to

which the Vodafone group and the Idea group agreed to combine their

mobile telecommunications businesses in India.

The

VIL promoters gave customary warranties for a transaction of this

nature, including as to capacity and title and received customary

warranties in return from Idea and the Idea promoters.

As

part of the implementation agreement (as amended), the parties

agreed a mechanism for payments between the Vodafone group and

Vodafone Idea Limited ("Vodafone Idea") pursuant to the difference

between the crystallisation of certain identified contingent

liabilities in relation to legal, regulatory, tax and other

matters, and refunds relating to Vodafone India and Idea. Cash

payments or cash receipts relating to these matters must have been

made or received by Vodafone Idea before any amount becomes due

from or owed to the Vodafone group. Any future payments by the

Vodafone group to Vodafone Idea as a result of this agreement would

only be made after satisfaction of this and other contractual

conditions.

The

Vodafone group's maximum potential exposure under this mechanism is

capped at INR 64 billion.

The

final liability calculation date under the contingent liability

adjustment mechanism is 30 June 2025 and no further cash payments

are considered probable from the Vodafone group as at 30 September

2024.

The

implementation agreement is governed by the laws of

India.

3. Vantage

Towers investment agreement and shareholders'

agreement

On

9 November 2022, Vodafone GmbH and Oak Consortium GmbH (formerly

SCUR-Alpha 1593 GmbH) (the "Investor"), an entity jointly

controlled by Global Infrastructure Management, LLC, KKR & Co.

Inc and other investors (the "Consortium"), entered into an

investment agreement establishing a co-controlled joint venture

(the "JV") for Vantage Towers, which at that date was listed on the

regulated market of the Frankfurt Stock Exchange (as amended on 22

March 2023).

Vodafone

GmbH contributed its shares in Vantage Towers by way of a capital

increase against new JV shares, while the Consortium agreed to

acquire shares in the JV for cash. Vodafone GmbH and the Investor

also agreed that the JV would make a voluntary takeover offer for

the listed Vantage Towers shares held by minority

shareholders.

Vodafone

GmbH gave customary warranties for a transaction of this nature,

including as to capacity and title.

On

23 March 2023, Vodafone GmbH, the Investor and Oak Holdings 1 GmbH

(the JV) entered into a shareholders' agreement relating to the JV.

Rights to appoint directors to the management board and to appoint

members to the shareholders' committee are tied to the percentage

of shares each of Vodafone GmbH and the Investor holds in the JV.

Vodafone GmbH and the Consortium agreed to a lock-up period of 3

years post-closing of the transaction, after which each shareholder

will be able to initiate a full or partial sale of its shareholding

in the JV, subject to a right of first offer in favour of the other

shareholder.

The

investment agreement and the shareholders' agreement are governed

by the laws of Germany.

4. Emirates

Telecommunications relationship agreement

On

11 May 2023, Vodafone entered into a relationship agreement with

Emirates Telecommunications Group Company PJSC ("e&"). Under

the terms of the agreement, subject to relevant regulatory

approvals, for so long as e& and its wholly-owned subsidiaries

beneficially own (a) at least 14.6% of Vodafone's outstanding

ordinary shares, e& is entitled to nominate the e& group

CEO to be appointed to the Vodafone Group Plc board as a

non-executive director; and (b) at least 20% of Vodafone's

outstanding ordinary shares, e& will be entitled to nominate a

further independent individual to the Vodafone Group Plc board as a

non-executive director. The e& directors are subject to annual

re-election by Vodafone's shareholders.

The

relationship agreement also sets out terms for the ongoing

relationship between e& and Vodafone in respect of

communications, corporate actions and voting.

Under

the terms of the agreement, e& is subject to a two-year lock-up

period and a standstill for the duration of the agreement (subject

to customary carve-outs and certain permitted

actions).

The

e& relationship is governed by English law.

5. Vodafone

UK and Three UK contribution agreement

On

14 June 2023, Vodafone, Brilliant Design (BVI) Limited (formerly

known as Brilliant Design Limited), CK Hutchison Group Telecom

Holdings Limited ("CKHGT"), CK Hutchison Holdings Limited, Vodafone

International Operations Limited and Vodafone UK Trading Holdings

Limited entered into a contribution agreement under which Vodafone

and CKHGT, a wholly owned subsidiary of CK Hutchison Holdings

Limited, agreed to combine their respective UK businesses, Vodafone

UK and Three UK.

Vodafone

will have a 51.0% interest in the combined business ("MergeCo"),

with CKHGT holding the remaining 49.0%.

No

cash consideration will be paid under the agreement, with Vodafone

UK and Three UK contributing differential debt amounts at

completion of the transaction to achieve MergeCo ownership of

51:49. Vodafone UK will be contributed with £4.3 billion debt

and Three UK with £1.7 billion debt, subject to customary

completion adjustments.

Vodafone

Group Services Limited, a wholly-owned subsidiary of Vodafone, has

agreed to provide certain business, technology, IT and corporate

function services to MergeCo and its subsidiaries in the ordinary

and usual course of business in consideration for service

charges.

Under

the terms of the agreement, Vodafone International Operations

Limited provided certain customary indemnities for a transaction of

this nature to MergeCo in respect of pre-completion liabilities and

liabilities resulting from pre-completion actions in respect of

Vodafone UK. Vodafone International Operations Limited also gave

customary warranties for a transaction of this nature, including as

to capacity and title and MergeCo also received customary

indemnities and warranties from Brilliant Design (BVI)

Limited.

The

transaction is subject to anti-trust and regulatory clearances. As

at the date of this announcement, the transaction has received

clearances under the NSIA Act in the UK, the EU Merger Regulation

and from the UK's Competition and Markets Authority (the "CMA")

(subject to legally binding commitments relating to network

investment, retail pricing and wholesale pricing and contract

terms), the Egyptian Competition Authority and approval by CKHGT's

shareholders.

The

contribution agreement is governed by English law.

6. Vodafone

Italy sale and purchase agreement

On

15 March 2024, Vodafone Europe B.V., Swisscom Italia S.R.L.,

Vodafone and Swisscom AG entered into a sale and purchase agreement

for the sale of Vodafone's Italian operations.

The

consideration is €8 billion on a debt and cash free basis,

subject to customary closing adjustments.

The

transaction is subject to certain customary regulatory

approvals. As at the date of this announcement, the

transaction has received unconditional approval from the Presidency

of the Council of Ministers in Italy (Golden Power legislation),

the Swiss Competition Commission and the EU Commission,

Directorate-General for Competition, under the Foreign Subsidies

Regulation, Italian Authority for Communications (Autorità per

le Garanzie nelle Comunicazioni, AGCOM) but remains subject to

approval by the Italian Competition Authority (Autorità

Garante della Concorrenza e del Mercato) and authorisation under

Article 64 of the Legislative Decree no. 259/2003 with respect to

the transfer of the rights to use frequencies.

Vodafone

and Vodafone Europe B.V. gave customary warranties for a

transaction of this nature, including as to capacity and title and

received customary warranties in return from Swisscom Italia S.r.l.

and Swisscom AG.

The

sale and purchase agreement is governed by Italian

law.

B. Material contracts of Vodafone Italy

No contracts have been entered into by Vodafone Italy (not being

contracts entered into in the ordinary course of business): (i)

within the period of two years immediately preceding the date of

this announcement that are, or may be, material to Vodafone Italy;

or (ii) that contain any provisions under which Vodafone Italy has

any obligation or entitlement that is, or may be, material to

Vodafone Italy, save as disclosed below.

INWIT master services agreement

On

25 March 2020, Vodafone Italy and Infrastrutture Wireless Italiane

s.p.a. ("INWIT") entered into a master services agreement (the

"MSA") under which INWIT agreed to provide to Vodafone Italy, in

relation to the sites it operates: (i) use of the electromagnetic

space and related physical areas for the installation and

management of equipment for the use of Available Frequencies and

the supply of the related mobile network services; (ii) supply of

the power and air-conditioning systems, capable of ensuring the

correct power supply and functioning of the equipment even in the

event of a power failure; (iii) monitoring and security services;

(iv) management and maintenance services; (v) electricity supply

services; and (vi) measurement and monitoring services of the

physical and electromagnetic space.

The

MSA has a duration of eight years and automatically renews for

further periods of eight years unless terminated before the expiry

of that term.

The

fees paid by Vodafone Italy to INWIT in relation to the MSA are

adjusted each year by the rate of the consumer price index,

provided that this is positive.

The

MSA is governed by Italian law.

3. Legal and arbitration proceedings

A. Significant litigation of the Retained Vodafone

group

Save as disclosed below, there are no governmental, legal or

arbitration proceedings (including any such proceedings which are

pending or threatened of which Vodafone is aware), during the

period covering the 12 months preceding the date of this

announcement, which may have, or have had in the recent past,

significant effects on the financial position or profitability of

the Retained Vodafone Group. The

proceedings disclosed below are those where the Vodafone group

considers that the likelihood of material future outflows of cash

or other resources is more than remote.

In all cases, determining the probability of successfully defending

a claim against the Retained Vodafone Group involves the

application of judgement as the outcome is inherently uncertain.

The determination of the value of any future outflows of cash or

other resources, and the timing of such outflows, involves the use

of estimates. The costs incurred in complex legal proceedings,

regardless of outcome, can be significant.

1. VISPL

tax claims

Vodafone

India Services Private Limited ("VISPL") is involved in a number of

tax cases. As at 30 September 2024, the total value of the claims

is approximately €468 million plus interest, and penalties of

up to 300% of the principal. Of the individual tax claims, the most

significant is for approximately €238 million (plus interest

of €672 million), which VISPL has been assessed as owing in

respect of: (i) the sale of an international call centre by VISPL

to Hutchison Telecommunications International Limited group

("HTIL"); and (ii) the acquisition of and/or the alleged transfer

of options held by VISPL in Vodafone India Limited. Item (i) is

subject to an indemnity by HTIL. Item (ii), which forms the largest

part of the potential claim, is not subject to any

indemnity.

A

stay of the tax demand was obtained following a deposit of INR

2,000 million (€22 million) being paid, and a corporate

guarantee being provided by Vodafone International Holdings BV

("VIHBV") for the balance of tax assessed. On 8 October 2015, the

Bombay High Court ruled in favour of VISPL in relation to the

options and the call centre sale. The Indian Tax Authority has

appealed to the Supreme Court of India. The appeal hearing has been

adjourned indefinitely. A claim in respect of the transfer pricing

margin charged for the international call centre of HTIL prior to

the 2007 transaction with Vodafone for HTIL assets in India has now

been settled. While there is some uncertainty as to the outcome of

the remaining tax cases involving VISPL, the Vodafone group

believes it has valid defences and does not consider it probable

that a financial outflow will be required to settle these

cases.

2. Netherlands

tax case

Vodafone

Europe BV ("VEBV") received assessments totalling €267

million of tax and interest from the Dutch tax authorities, who

challenged the application of the arm's length principle in

relation to various intra-group financing transactions. VEBV

entered into a guarantee for the full value of the assessments

issued. VEBV appealed against these assessments to the District

Court of the Hague where a hearing was held in March 2023. The

District Court issued its judgement in July 2023, upholding VEBV's

appeal in relation to the majority of issues and requiring the

Dutch tax authorities to significantly reduce its assessments. VEBV

and the Dutch tax authorities have since appealed the judgement.

The appeal hearing is currently scheduled to take place on 4

February 2025. The Vodafone group continues to believe it has

robust defences but has recorded a provision of €24 million

for tax and interest, reflecting its current view of the probable

financial outflow required to fully resolve the issue and has

reduced the guarantee to the same value.

3. Germany:

price increase class action

In

November 2023, the Verbraucherzentrale Bundesverband (Federation of

German Consumer Organisations) initiated a class action against

Vodafone Germany in the Hamm Higher Regional Court. Vodafone

Germany implemented price increases of €5 per month for fixed

lines services in 2023 in response to higher costs. The claim

alleges that terms regarding price increases in the consumer

contracts entered into by Vodafone Germany's customers up until

August 2023 are invalid under German civil law and seeks

reimbursement of the additional charges plus interest. Customers

must enter their details onto the register of collective actions on

the Federal Office of Justice website in order to participate in

the claim. The register opened on 23 April 2024. Whilst the

Vodafone group intends to defend the claim, it is not able to

determine the likelihood or estimate the amount of any possible

financial loss at this early stage of the proceedings.

4. Germany:

claims regarding transfer of data to credit

agencies

Individual

consumers are bringing claims against Vodafone Germany and/or the

other national network operators alleging that information was

passed to credit agencies up to February 2024 about contracts for

mobile services without consumer consent. The claims seek damages

of up to €5,000 per contract for GDPR (General Data

Protection Regulation) infringement. As at 15 November 2024,

Vodafone Germany had been notified of 482 claims filed in various

regional courts. The other national network operators are facing

similar claims. Vodafone Germany's position is that the transfer of

data about the existence of a consumer contract (and not about

payments in relation to the contract) to credit agencies is

standard practice and justified for the purposes of fraud

prevention. However, given the increasing volume of claims,

Vodafone Germany has stopped this activity. Although the outcome of

these claims is uncertain and consequently it is not possible to

estimate a potential financial loss, if any, at this stage, the

Vodafone group believes it has valid defences and that no present

obligation exists based on all available evidence.

5. Germany:

investigation by federal data protection

authority

In

2021, the BfDI (Federal Commissioner for Data Protection and

Freedom of Information) started an investigation into potential

breaches of the GDPR in relation to the systems used by Vodafone

Germany sales partners to manage customer data. Vodafone Germany is

working cooperatively with the authority to discuss the

circumstances giving rise to these issues and is currently

conducting settlement talks with the aim of reaching a constructive

resolution of the proceedings. Under the GDPR the authority has the

power to impose fines of up to 2% of the Vodafone group's annual

revenue from the preceding financial year. A provision immaterial

to the financial statements has been recorded.

6. Greece:

Papistas Holdings SA, Mobile Trade Stores (formerly Papistas SA)

and Athanasios and Loukia Papistas v Vodafone

Greece

In

October 2019, Mr. and Mrs. Papistas, and companies owned or

controlled by them, filed several claims against Vodafone Greece

with a total value of approximately €330 million for

purported damage caused by the alleged abuse of dominance and

wrongful termination of a franchise arrangement with a Papistas

company. Lawsuits which the Papistas claimants had previously

brought against Vodafone Greece, including one also citing Vodafone

and certain Directors and officers of Vodafone as defendants, were

either withdrawn or left dormant. Vodafone Greece filed a counter

claim and all claims were heard in February 2020. All of the

Papistas claims were rejected by the Athens Court of First Instance

because the stamp duty payments required to have the merits of the

case considered had not been made. Vodafone Greece's counter claim

was also rejected. The Papistas claimants and Vodafone Greece each

filed appeals. The appeal hearings took place on 23 February and 11

May 2023. Judgement has been received and the Court dismissed both

of the appeals because the stamp duty payments had again not been

made, except for one aspect of the proceedings which will be dealt

with at a further hearing in February 2025. Whether the Papistas

claimants will appeal the judgement is unknown as at the date of

this announcement. Vodafone Greece is continuing vigorously to

defend the claims and based on the progress of the litigation so

far the Vodafone group believes that it is highly unlikely that

there will be an adverse ruling. On this basis, the Vodafone group

does not expect the outcome of these claims to have a material

financial impact.

7. UK:

Phones 4U in Administration v Vodafone Limited, Vodafone Group Plc

and Others

In

December 2018, the administrators of former UK indirect seller,

Phones 4U, sued the three main UK mobile network operators

("MNOs"), including Vodafone UK, and their parent companies in the

English High Court. The administrators alleged collusion between

the MNOs to withdraw their business from Phones 4U thereby causing

its collapse. The judge ordered that there should be a split trial

between liability and damages. The first trial on liability took

place from May to July 2022. On 10 November 2023, the High Court

issued a judgement in Vodafone and Vodafone UK's favour and

rejected Phones 4U's allegations that the defendants were in breach

of competition law, consistent with Vodafone's previously stated

position that a present obligation does not exist. Phones 4U has

been granted permission to appeal the judgement from the Court of

Appeal. The appeal hearing will take place in May 2025. Vodafone

and Vodafone UK intend to vigorously defend the appeal and the

Vodafone group is not able to estimate any possible loss in the

event of an adverse judgement on appeal.

8. South

Africa: Kenneth Makate v Vodacom (Pty) Limited

Mr

Kenneth Makate, a former employee of Vodacom Pty Limited ("Vodacom

South Africa"), started legal proceedings in 2008 claiming

compensation for a business idea that led to the development of a

service known as "Please Call Me" ("PCM").

In

July 2014, the Gauteng High Court ("the High Court") ruled that Mr

Makate had proven the existence of a contract, but that Vodacom

South Africa was not bound by that contract because the responsible

director did not have authority to enter into such an agreement on

Vodacom South Africa's behalf. The High Court and Supreme Court of

Appeal ("the SCA") turned down Mr Makate's application for leave to

appeal in December 2014 and March 2015, respectively. In April

2016, the Constitutional Court of South Africa ("the Constitutional

Court") granted leave to appeal and upheld Mr Makate's appeal. It

found that Vodacom South Africa is bound by the agreement and

ordered the parties to negotiate, in good faith, and agree a

reasonable compensation amount payable to Mr Makate or, in the

event of a deadlock, for the matter to be referred to Vodacom

Group's Chief Executive Officer ("the CEO") to determine such

compensation amount. Mr Makate's application for the aforementioned

order to be varied from the determination of an amount to a

compensation model based on a share of revenue, was dismissed by

the Constitutional Court. In accordance with the Constitutional

Court order, and after negotiations failed, the CEO issued his

determination on 9 January 2019. However, the CEO's award of R47

million (€2.4 million) was rejected by Mr Makate, who

subsequently brought an application in the High Court for the

review of the CEO's determination and award. The High Court, in a

judgement delivered on 8 February 2022, set aside the CEO's

determination and ordered him to reassess the amount employing a

set of criteria which would have resulted in the payment of a

higher compensation amount, for the benefit of Mr Makate, than that

determined by the CEO. Vodacom South Africa appealed against the

judgement and the order of the High Court to the SCA. The SCA heard

the appeal on 9 May 2023 and its judgement was handed down on 6

February 2024. A majority of three judges, with a minority of two

judges dissenting, dismissed the appeal and ruled that Mr Makate is

entitled to be paid 5% - 7.5% of the total revenue of the PCM

product from March 2001 to the date of the judgement, plus

interest. On 27 February 2024, Vodacom South Africa applied for

leave to appeal the judgement and order of the SCA to the

Constitutional Court, resulting in the suspension of the operation

of the judgement and order of the SCA. On 26 August 2024, the

Constitutional Court issued a directive that it will hear Vodacom

South Africa's application for leave to appeal in tandem with its

appeal against the SCA judgement and order. The record of the

proceedings in the SCA, with relevant annotations, was filed in the

Constitutional Court on 26 September 2024. Vodacom South Africa, as

the applicant, filed its written arguments on 10 October 2024 and

Mr Makate filed his response on 18 October 2024. The matter was

heard by the Constitutional Court on 21 November 2024 and judgment

was reserved.

Vodacom

South Africa is challenging the SCA's judgement and order on

various grounds including, but not limited to the SCA ignoring the

evidence placed before it on the computation of the quantum of

compensation payable to Mr Makate, and the SCA issuing orders that

are incapable of implemented and enforced. The CEO's determination

in 2019 amounted to R47 million (€2.4 million). The minority

judgement of the SCA raised Mr Makate's compensation to an amount

payable of R186 million (€9.6 million). The value of the

compensation amount for Mr Makate, as per the SCA's majority

judgement and order, would at a minimum be R29 billion (€1.5

billion). Mr Makate, in his recent submissions to the

Constitutional Court, has stated that his request is for

compensation in the capital amount of R9.4 billion (€493

million), plus interest from 18 January 2019. Consequently, the

range of the possible compensation outcomes in this matter is very

wide. The amount ultimately payable to Mr Makate is uncertain and

will depend on the success of Vodacom South Africa's appeal against

the judgement and order of the SCA, on the merits of the case. The

Vodafone group is continuing to challenge the level of compensation

payable to Mr Makate and a provision immaterial to the financial

statements has been recorded.

9. UK:

Mr Justin Gutmann v Vodafone Limited and

Vodafone

In

November 2023, Mr Gutmann issued claims in the Competition Appeal

Tribunal seeking permission, as a proposed class representative, to

bring collective proceedings against the four UK MNOs and, in the

case of Vodafone Limited and EE Ltd, their respective parent

companies. Vodafone and Vodafone Limited are named defendants in

one of the claims with an alleged value of £1.4 billion

(approximately €1.6 billion), including interest. It is

alleged that Vodafone, Vodafone Limited and the other MNOs used

their alleged market dominance to overcharge customers after the

expiry of the minimum terms of certain mobile contracts (referred

to as a "loyalty penalty"). Taking into account all available

evidence at this stage, the Vodafone group's assessment is that the

allegations are without merit and it intends to defend the claim.

The Vodafone group is currently unable to estimate any possible

loss in regards to this issue but, while the outcome is uncertain,

the Vodafone group believes it is probable that no present

obligation exists.

B. Significant litigation of Vodafone Italy

Save as disclosed below, there are no governmental, legal or

arbitration proceedings (including any such proceedings which are

pending or threatened of which Vodafone is aware), during the

period covering the 12 months preceding the date of this

announcement, which may have, or have had in the recent past,

material effects on the financial position or profitability of

Vodafone Italy.

Italy: Iliad v Vodafone Italy

In

July 2019, Iliad filed a claim for €500 million against

Vodafone Italy in the Civil Court of Milan. The claim alleges

anti-competitive behaviour in relation to customer portability and

certain advertising campaigns by Vodafone Italy. The main hearing

on the merits of the claim took place on 8 June 2021. On 17 April

2023, the Civil Court issued a judgement in Vodafone Italy's favour

and rejected Iliad's claim for damages in full. Iliad filed an

appeal before the Court of Appeal of Milan in June 2023. The appeal

process is ongoing. The Vodafone group is currently unable to

estimate any possible loss in this claim in the event of an adverse

judgement on appeal but, while the outcome is uncertain, the

Vodafone group believes it has valid defences and that it is

probable that no present obligation exists.

4. Significant change statement

On 14 November 2024, Vodafone announced that it will commence the

third tranche of a share repurchase programme of ordinary shares up

to a maximum consideration of €500 million ending no later

than 3 February 2025. On 5 December 2024, Vodafone announced

that the combination of Vodafone UK and Three UK had been approved

by the CMA. The approval is subject to legally binding

commitments relating to network investment, retail pricing and

wholesale pricing and contract terms. There have been no

other significant changes in the financial position of the Retained

Vodafone Group since 30 September 2024, the end of the last

financial period for which unaudited interim financial information

has been published.

There has been no significant change in the financial position of

Vodafone Italy since 30 September 2024, the end of the last

financial period for which unaudited interim financial information

has been published.

Notes

Information

that is itself incorporated by reference into the above documents

is not incorporated by reference into this document. It should be

noted that, except as set forth above, no other portion of the

above documents is incorporated by reference into this document and

those portions which are not specifically incorporated by reference

into this document are either not relevant for Shareholders or the

relevant information is included elsewhere in this

document.

Any statement contained in a document which is deemed to be

incorporated by reference herein shall be deemed to be modified or

superseded for the purpose of this document to the extent that a

statement contained herein (or in a later document which is

incorporated by reference herein) modifies or supersedes such

earlier statement (whether expressly, by implication or otherwise).

Any statement so modified or superseded shall not be deemed, except

as so modified or superseded, to constitute a part of this

document.

The contents of Vodafone's website or any hyperlinks accessible

from it do not form part of this document and investors should not

rely on them.

- ends -

|

For more information, please contact:

|

|

Investor Relations:

|

investors.vodafone.com

|

ir@vodafone.co.uk

|

Media Relations:

|

Vodafone.com/media/contact

|

GroupMedia@vodafone.com

|

|

Registered Office: Vodafone House, The Connection, Newbury,

Berkshire RG14 2FN, England. Registered in England No.

1833679

|

About Vodafone

Vodafone is a leading European and African telecoms company. We

provide mobile and fixed services to over 330 million customers in

15 countries (excludes Italy which is held as a discontinued

operation under Vodafone Group), partner with mobile networks in 45

more and have one of the world's largest IoT platforms. In Africa,

our financial technology businesses serve almost 83 million

customers across seven countries - managing more transactions than

any other provider.

Our purpose is to connect for a better future by using technology

to improve lives, businesses and help progress inclusive

sustainable societies. We are committed to reducing our

environmental impact to reach net zero emissions by

2040.

For more information, please visit www.vodafone.com follow

us on X at @VodafoneGroup or connect with us on LinkedIn

at www.linkedin.com/company/vodafone.

About Swisscom

Swisscom is the leading ICT company in Switzerland and, with

Fastweb, a leading challenger in Italy. The company offers mobile,

Internet and TV, as well as comprehensive IT and digital services

to private and business customers. Swisscom is listed on the Swiss

Stock Exchange and is 51% owned by the Swiss

Confederation.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorised.

|

|

VODAFONE

GROUP

|

|

|

PUBLIC

LIMITED COMPANY

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date:

December 09, 2024

|

By: /s/ M D B

|

|

|

Name: Maaike de Bie

|

|

|

Title: Group General Counsel and Company Secretary

|

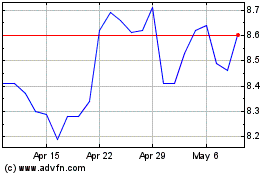

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Nov 2024 to Dec 2024

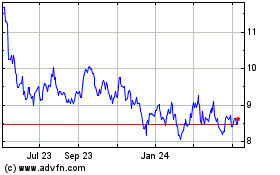

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Dec 2023 to Dec 2024