Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

14 November 2024 - 10:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULES 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Dated

November 14, 2024

Commission

File Number: 001-10086

VODAFONE GROUP

PUBLIC LIMITED COMPANY

(Translation

of registrant’s name into English)

VODAFONE

HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN,

ENGLAND

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F ✓

Form 40-F _

This

Report on Form 6-K contains a Stock Exchange Announcement dated 14

November 2024 entitled €500 MILLION SHARE BUYBACK PROGRAMME

TO COMMENCE.

14 November 2024

Vodafone Group Plc

€500 MILLION SHARE BUYBACK PROGRAMME TO COMMENCE

Vodafone Group Plc ("Vodafone") today announces that it will commence a share

repurchase programme of ordinary shares in the share capital of

Vodafone of US$0.20 20/21 each

(the "Ordinary

Shares") up to a maximum

consideration of €500 million (the

"Programme").

Vodafone announces that it has given a non-discretionary

instruction to Citigroup Global Markets Limited (Citi) in relation

to the purchase by Citi acting as riskless principal during the

period commencing on 14 November 2024 and ending no later than 3

February 2025, of Ordinary Shares for a target expense amount of no

greater than €500 million and the simultaneous on-sale of

such Ordinary Shares by Citi to Vodafone.

Any purchase of Ordinary Shares done in relation to this

announcement will be carried out on the London Stock Exchange and

Multilateral Trading Facilities, as defined by the Directive

2014/65/EU on markets in financial instruments (including the

delegated and implementing acts adopted under it) as implemented,

retained, amended, extended, re-enacted or otherwise given effect

in the United Kingdom from 1 January 2021 and as amended or

supplemented in the United Kingdom thereafter, and executed in

accordance with the Listing Rules and Vodafone's general authority

to make market purchases of Ordinary Shares granted by shareholders

at the 2024 Annual General Meeting ("2024 AGM") pursuant to which the Company is authorised to

repurchase up to 4,053,092,397 Ordinary

Shares. The sole purpose of the Programme is to reduce share

capital. Ordinary Shares acquired by Citi will be subsequently

repurchased by Vodafone, held as treasury shares and then either

cancelled or allocated to employee share awards as they fall

due.

The Ordinary Shares will be purchased in accordance with the price

and volume conditions set out in the Commission Delegated

Regulation (EU) 2016/1052 of 8 March 2016 supplementing Regulation

(EU) No 596/2014 of the European Parliament and of the Council with

regard to regulatory technical standards for the conditions

applicable to buyback programmes and stabilisation measures as

implemented, retained, amended, extended, re-enacted or otherwise

given effect in the United Kingdom from 1 January 2021 and as

amended or supplemented in the United Kingdom

thereafter.

Details of the authority granted at the 2024 AGM can be found

within the 2024 Notice of Meeting on our website.

|

For more information, please contact:

|

|

Investor Relations:

|

investors.vodafone.com

|

ir@vodafone.co.uk

|

Media Relations:

|

Vodafone.com/media/contact

|

GroupMedia@vodafone.com

|

|

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorised.

|

|

VODAFONE

GROUP

|

|

|

PUBLIC

LIMITED COMPANY

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date:

November 14, 2024

|

By: /s/ M D B

|

|

|

Name: Maaike de Bie

|

|

|

Title: Group General Counsel and Company Secretary

|

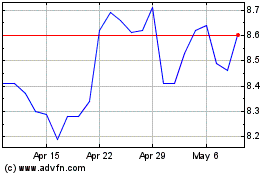

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Nov 2024 to Dec 2024

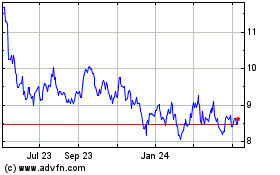

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Dec 2023 to Dec 2024