Vroom Announces Equity-for-Debt Recapitalization

13 November 2024 - 8:05AM

Business Wire

Positions the Company for Long-Term

Growth

Vroom, Inc. (Nasdaq: VRM), a leading automotive finance company

and an AI-powered analytics and digital services platform for

automotive retail, today announced that it has made the strategic

decision to enter into a Restructuring Support Agreement (RSA) with

holders of an overwhelming majority of its outstanding funded debt

and its largest stockholder. The parties to the RSA have agreed to

pursue a comprehensive transaction that will restructure Vroom,

Inc.’s outstanding funded debt, consisting of approximately $290

million of unsecured convertible senior notes due in 2026 (Notes),

into equity. Vroom, Inc. is the holding company of operating

subsidiaries including United Auto Credit Corporation (UACC),

CarStory, LLC (CarStory), and Vroom Automotive, LLC and does not

itself have operations.

- Vroom, Inc. intends to voluntarily file a prepackaged plan of

reorganization under Chapter 11 of the U.S. Bankruptcy Code in the

U.S. Bankruptcy Court for the Southern District of Texas. Vroom,

Inc.’s subsidiaries are not expected to be impacted by the

prepackaged Chapter 11 case and are expected to continue to operate

in the ordinary course. Vroom, Inc. anticipates emerging promptly

from the prepackaged Chapter 11 case at the end of 2024 or early

2025.

Pursuant to the transaction, the Notes will

be converted into new shares of common stock (New Common Stock)

and, upon consummation of the plan of reorganization, certain

classes of claims and interests will receive the following

treatment:

- Existing holders of Vroom, Inc. common stock will exchange each

existing share of common stock for one share of New Common Stock

and one warrant to purchase a share of New Common Stock. The

warrants will be exercisable for five years at a strike price of

$12.19 per share. The current common stockholders will own

approximately 7.06% of the New Common Stock following the execution

of the restructuring transactions, subject to dilution.

- Each holder of Notes will receive New Common Stock equal to 75%

of the face value of its Notes, assuming a per share value of $9.14

(the average daily market price of Vroom Inc.’s existing common

stock from September 23, 2024, the date on which the new Long-Term

Strategic Plan was released, to November 8, 2024, two business days

before the signing of the RSA based on current outstanding shares).

The holders of the unsecured Notes will own approximately 92.94% of

the New Common Stock as of consummation of the transactions, and

subject to dilution.

- Existing holders of options or restricted stock units will

receive new awards exchangeable into New Common Stock on the same

terms and conditions, and for the same number of units, applicable

to their existing awards in respect of the existing Vroom

stock.

- Trade creditors and all other general unsecured creditors are

expected to be paid in full in connection with the chapter 11 case.

Additionally, trade creditors of Vroom’s operating subsidiaries are

not expected to be impacted.

- Vroom does not anticipate that any creditors of the

consolidated enterprise will ultimately be affected other than the

holders of the unsecured Notes.

- Vroom intends to structure the prepackaged Chapter 11 case in a

manner that maximizes the ability to utilize a substantial portion

of its approximately $1.5 billion in federal tax net operating

losses after emerging from Chapter 11.

“Since winding down our ecommerce used automotive dealer

business, we have been focused on maximizing the value of our

remaining assets for our stakeholders. We believe eliminating our

unsecured Notes will significantly strengthen our balance sheet and

allow us to emerge without any long-term debt at Vroom, Inc., while

its subsidiary, UACC, will continue to be obligated to debt that is

related to asset-backed securitizations and their trust preferred

securities. Our team remains focused on executing our Long-Term

Strategic Plan,” said Tom Shortt, Chief Executive Officer of

Vroom.

“As an investor in the Company since 2022, we have seen Vroom

leadership consistently deliver on its commitments, and we are

excited to be a major stakeholder in the next chapter as they

implement their Long-Term Strategic Plan,” said Jason Mudrick,

Chief Investment Officer of Mudrick Capital Management, LP, which

was instrumental in the negotiations leading to the RSA.

As part of the case, Vroom, Inc. intends to file a number of

customary motions with the bankruptcy court that will allow the

continuation of normal business operations. Following court

approval and the completion of the anticipated prepackaged Chapter

11 case, reorganized Vroom, Inc. intends to use commercially

reasonable efforts to relist the New Common Stock for trading on

Nasdaq, the New York Stock Exchange, or a comparable nationally

recognized securities exchange following the consummation of the

plan of reorganization.

Advisors

Porter Hedges LLP is serving as bankruptcy counsel, Latham &

Watkins LLP is serving as special corporate counsel, Stout Risius

Ross, LLC is serving as financial advisor, and Verita Global is

serving as claims and noticing agent.

About Vroom (Nasdaq: VRM)

Vroom owns and operates United Auto Credit Corporation (UACC), a

leading automotive lender serving the independent and franchise

dealer market nationwide, and CarStory, a leader in AI-powered

analytics and digital services for automotive retail. Prior to

January 2024, Vroom also operated an end-to-end ecommerce platform

to buy and sell used vehicles. Pursuant to its previously announced

Value Maximization Plan, Vroom discontinued its ecommerce

operations and wound down its used vehicle dealership business.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including without limitation statements

regarding the anticipated prepackaged Chapter 11 case contemplated

by the RSA, the recapitalization of debt, their intended benefits,

their impact on our ongoing operations and operating subsidiaries,

our intention to list New Common Stock on a national securities

exchange, our expectations regarding UACC’s business, including

with respect to its securitizations, our ability to execute on our

Long-Term Strategic Plan, and the timing of any of the foregoing.

These statements are based on management’s current assumptions and

are neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Factors

that could cause actual results to differ materially from the

forward-looking statements in this press release include: we are

subject to risks and uncertainties associated with the anticipated

prepackaged Chapter 11 case; we may not be able to obtain

confirmation of the plan of reorganization contemplated by the RSA;

if the RSA is terminated, our ability to confirm and consummate the

plan of reorganization contemplated by the RSA could be materially

and adversely affected; the RSA is subject to significant

conditions and milestones that may be difficult for us to satisfy;

trading in our securities is highly speculative and poses

substantial risks; if the plan of reorganization contemplated by

the RSA becomes effective, the holders of our existing common stock

will be diluted; following the effectiveness of the plan of

reorganization contemplated by the RSA, certain holders of claims

or causes of action relating to the unsecured Notes, if they choose

to act together, will have the ability to significantly influence

all matters submitted to stockholders of the reorganized company

for approval; our business could suffer from a long and protracted

restructuring; as a result of the anticipated prepackaged Chapter

11 case, our historical financial information will not be

indicative of our future performance; we are subject to claims that

will not be discharged in the anticipated prepackaged Chapter 11

case, which could have a material adverse effect on our financial

condition and results of operations; the anticipated prepackaged

Chapter 11 case has consumed and is expected to continue to consume

a substantial portion of the time and attention of our management,

which may have an adverse effect on our business and results of

operations, and we may experience increased levels of employee

attrition; upon our emergence from bankruptcy, the composition of

our board of directors may change; the anticipated prepackaged

Chapter 11 case raises substantial doubt regarding our ability to

continue as a going concern; our indebtedness and liabilities could

limit the cash flow available for our operations, expose us to

risks that could materially adversely affect our business,

financial condition and results of operations and impair our

ability to satisfy our debt obligations; we may be unable to

satisfy a continued listing rule from Nasdaq, and if we are

delisted, we may not be able to satisfy an initial listing rule

from Nasdaq or another national securities exchange; our tax

attributes and future tax deductions may be reduced or

significantly limited as a result of the consummation of the plan

of reorganization contemplated by the RSA and any restructuring or

reorganization in connection therewith; there are risks associated

with the discontinuance of our ecommerce operations and wind-down

of our used vehicle dealership business; we may not generate

sufficient liquidity to operate our business; as well as the other

important risks and uncertainties identified under the heading

“Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2023, as updated by our Quarterly report on Form 10-Q

for the quarter ended September 30, 2024, which is available on our

Investor Relations website at ir.vroom.com and on the SEC website

at www.sec.gov. All forward-looking statements reflect our beliefs

and assumptions only as of the date of this press release. We

undertake no obligation to update forward-looking statements to

reflect future events or circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112947071/en/

Investor Relations: Vroom Jon Sandison

investors@vroom.com

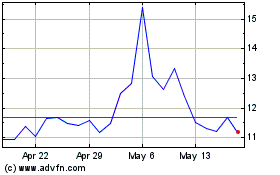

Vroom (NASDAQ:VRM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vroom (NASDAQ:VRM)

Historical Stock Chart

From Dec 2023 to Dec 2024