0001527541FALSE00015275412023-12-042023-12-040001527541us-gaap:CommonStockMember2023-12-042023-12-040001527541us-gaap:SeriesBPreferredStockMember2023-12-042023-12-040001527541us-gaap:SeriesDPreferredStockMember2023-12-042023-12-040001527541us-gaap:ConvertibleSubordinatedDebtMember2023-12-042023-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): December 4, 2023

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-35713 | | 45-2681082 |

(State or other jurisdiction

of incorporation or organization) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

2529 Virginia Beach Blvd. Virginia Beach, VA | | 23452 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (757) 627-9088

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | WHLR | | Nasdaq Capital Market |

| Series B Convertible Preferred Stock | | WHLRP | | Nasdaq Capital Market |

| Series D Cumulative Convertible Preferred Stock | | WHLRD | | Nasdaq Capital Market |

| 7.00% Subordinated Convertible Notes due 2031 | | WHLRL | | Nasdaq Capital Market |

Item 1.01. Entry into a Material Definitive Agreement

Item 8.01 of this Current Report on Form 8-K as to the redemptions by holders (collectively, the “Series D Preferred Holders”) of Wheeler Real Estate Investment Trust, Inc.’s (the “Company”) Series D Cumulative Convertible Preferred Stock (the “Series D Preferred Stock”) is incorporated herein by reference.

On December 4, 2023, the Company’s Board of Directors, under the terms of the Company’s charter (the “Charter”), created a Capital Stock Excepted Holder Limit of 55% and a Common Stock Excepted Holder Limit of 86% for each of Stilwell Activist Investments, L.P., Stilwell Activist Fund, L.P., Stilwell Value Partners VII, L.P., and Stillwell Associates, L.P. (collectively, the “Investors”). Joseph Stilwell, a member of the Company’s Board of Directors, is the managing member and owner of Stilwell Value LLC, which is the general partner of each of the Investors.

On December 5, 2023, the Company entered into an Excepted Holder Agreement with the Investors with respect to such limits. The Capital Stock Excepted Holder Limit provides that the Investors are exempted from the Charter’s aggregate stock ownership limit of not more than 9.8% in value of the aggregate of the outstanding shares of all classes of the Company's capital stock (as calculated under the definitions of “Aggregate Stock Ownership Limit” and “Beneficial Ownership” in the Charter) and are instead subject to the percentage limit established by the Board. The Common Stock Excepted Holder Limit provides that the Investors are exempted from the Charter’s common stock ownership limit of not more than 9.8% in value of the aggregate of the outstanding shares of the Company's Common Stock (as calculated under the definitions of “Common Stock Ownership Limit” and “Beneficial Ownership” in the Charter) and is instead subject to the percentage limit established by the Board. The Capital Stock Excepted Holder Limit and Common Stock Excepted Holder Limit will automatically terminate upon reduction of the Investors’ capital stock and Common Stock ownership below 9.8%, respectively.

In consideration of the grant of these Excepted Holder Limits, the Investors concurrently entered into a one-year letter agreement with the Company whereby each Investor agreed that it will not exercise its right to convert the Notes into shares of Common Stock to the extent that such conversion would result in such Investor, whether on its own or as part of a “group” within the meaning of Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), becoming the direct or indirect “beneficial owner”, as defined in Rule 13d-3 under the Exchange Act, of common equity of the Company representing 50% or more of the total voting power of all outstanding shares of common equity of the Company that is entitled to vote generally in the election of directors.

The foregoing description of the Excepted Holder Agreement and the letter agreement is qualified in its entirety by the full text of these agreements, which are attached hereto as Exhibits 10.1 and 10.2, respectively, and are incorporated by reference herein.

Item 3.03. Material Modifications to Rights of Security Holders

Adjustment to Conversion Price of 7.00% Subordinated Convertible Notes due 2031

Item 8.01 of this Current Report on Form 8-K as to the redemptions by the Series D Preferred Holders of the Series D Preferred Stock is incorporated herein by reference.

As of November 6, 2023, the Conversion Price for the Company’s 7.00% Subordinated Convertible Notes due 2031 (the “Notes”) was approximately $0.46 per share of the Company’s common stock, par value $0.01 (“Common Stock”) (approximately 54.05 shares of Common Stock for each $25.00 of principal amount of the Notes being converted).

For the December redemptions, the lowest price at which any Series D Preferred Stock was converted by a holder into

Common Stock was approximately $0.39.

Accordingly, pursuant to Section 14.02 (Optional Conversion) of the indenture governing the Notes, the Conversion Price for the Notes was further adjusted to approximately $0.21 per share of Common Stock (approximately 116.46 shares of Common Stock for each $25.00 of principal amount of the Notes being converted), representing a 45% discount to $0.39.

Item 8.01 Other Events

Results of December 2023 Series D Preferred Stock Redemptions

•The third monthly “Holder Redemption Date” occurred on December 5, 2023.

•The Company processed redemption requests from 35 Series D Preferred Holders, collectively redeeming 371,563 shares of Series D Preferred Stock for a redemption price of approximately $38.02 per share ($25.00 per share plus the amount of all accrued but unpaid dividends to and including the December 5, 2023 Holder Redemption Date) (the “Redemption Price”).

•The Company settled the Redemption Price in Common Stock.

•The volume weighted average of the closing sales price, as reported on the Nasdaq Capital Market, per share of Common Stock for the ten consecutive trading days immediately preceding, but not including, the December 5, 2023 Holder Redemption Date was approximately $0.39.

•Accordingly, the Company issued 36,194,825 shares of Common Stock (the “December 2023 Common Stock Issuance”) in settlement of an aggregate Redemption Price of approximately $14.1 million.

The December 2023 Common Stock Issuance was in the form of unregistered Common Stock. As previously disclosed, the significant declines and ongoing material fluctuations in the Company’s Common Stock price coupled with the unpredictable volume of monthly Series D Preferred Stock redemption requests have made it extremely challenging for the Company to plan for sufficient registered shares of Common Stock to meet the ongoing monthly redemption requests. Accordingly, the Company plans to issue unregistered shares of Common Stock to meet the ongoing monthly redemption requests until the Company has registered a sufficient number of shares of Common Stock to provide registered shares to cover the entirety of the remaining issue of Series D Preferred Stock. Efforts to register the necessary amount are underway. The Company similarly plans to register the unregistered shares issued in the December 2023 Common Stock Issuance and any unregistered shares issued in subsequent monthly Series D Preferred Stock redemption cycles.

Cumulative Series D Preferred Stock Redemption Information

•To date, the Company has processed 175 redemption requests, collectively redeeming 864,070 shares of Series D Preferred Stock.

•Accordingly, the Company has issued 52,788,687 shares of Common Stock in settlement of an aggregate Redemption Price of approximately $32.7 million.

•As of December 6, 2023, the Company had 53,769,787 shares of Common Stock and 2,515,876 shares of Series D Preferred Stock outstanding.

January 2023 Redemptions

•The deadline for the next monthly round of Series D Preferred Stock redemptions is December 25, 2023.

•The next monthly Holder Redemption Date will occur on January 5, 2024.

•Required redemption forms and a list of frequently asked questions can each be found on the Company’s website at https://ir.whlr.us/series-d/series-d-redemption.

Information contained on the Company’s website is not incorporated by reference into this Current Report on Form 8-K and should not be considered to be part of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | Excepted Holder Agreement, by and among Wheeler Real Estate Investment Trust, Inc., Stilwell Activist Investments, L.P., Stilwell Activist Fund, L.P., Stilwell Value Partners VII, L.P. and Stilwell Associates, L.P., dated as of December 5, 2023 |

| 10.2 | | Letter Agreement, by and among Wheeler Real Estate Investment Trust, Inc., Stilwell Activist Investments, L.P., Stilwell Activist Fund, L.P., Stilwell Value Partners VII, L.P. and Stilwell Associates, L.P., dated as of December 5, 2023 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Forward-Looking Statements.

This Current Report on Form 8-K includes forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “will,” “would” and “plans,” or the negative of such terms, or other comparable terminology, and include statements about the Company’s intention to register unregistered shares of Common Stock. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained herein due to many factors. These forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this Current Report on Form 8-K, and the Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein, or to reflect any change in our expectations with regard thereto or any other change in events, conditions or circumstances on which any such statement is based, except to the extent

otherwise required by applicable law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| WHEELER REAL ESTATE INVESTMENT TRUST, INC. |

| |

| By: | | /s/ M. Andrew Franklin |

| | Name: M. Andrew Franklin |

| | Title: Chief Executive Officer and President |

Dated: December 6, 2023

Execution Copy USActive 60131230.1 EXCEPTED HOLDER AGREEMENT This Excepted Holder Agreement (this “Agreement”) is made and entered into as of December 5, 2023, by and among Wheeler Real Estate Investment Trust, Inc., a Maryland corporation (the “Company”), Stilwell Activist Investments, L.P., a Delaware limited partnership, Stilwell Activist Fund, L.P., a Delaware limited partnership, Stilwell Value Partners VII, L.P., a Delaware limited partnership, and Stilwell Associates, L.P., a Delaware limited partnership (each an “Investor” and, collectively, the “Investors”). RECITALS A. Investors have delivered to the Company a duly completed Holder Redemption Notice and Ownership Statement. B. The Ownership Statement specifies the number of shares of Capital Stock and the number of Convertible Notes that Investors Actually and Constructively Own (as those terms are defined in the Instructions to the Ownership Statement). C. Pursuant to the Holder Redemption Notice, Investors desire the Company to redeem 207,713 shares of Series D Preferred Stock (the “Redeemed Preferred Stock”), and the Company has elected to redeem the Redeemed Preferred Stock for 20,233,821 shares of Common Stock. D. In order to maintain its qualification as a real estate investment trust (“REIT”), the Articles of Amendment and Restatement of the Company filed with the State Department of Assessments and Taxation of Maryland on August 5, 2016, as the same has to date been, and may in the future be, amended, restated, supplemented, and/or corrected (the “Charter”) limit the ability of any person to Beneficially Own or Constructively Own more than 9.8% of the Company’s Capital Stock (the “Aggregate Stock Ownership Limit”) or Common Stock (the “Common Stock Ownership Limit”, and together with the Aggregate Stock Ownership Limit, the “Ownership Limits”). E. Pursuant to Section 6.2.7 of the Charter, the Company’s Board of Directors (a) is permitted to exempt a Person from one or both Ownership Limits or establish an Excepted Holder Limit for such Person (which may apply with respect to one or more classes of Capital Stock), if the Board of Directors reasonably determines, including without limitation based on the representations, covenants and undertakings from such Person as are provided herein, that such exemption would not cause or permit the Company to fail to comply with certain requirements related to its qualification as a REIT, and (b) may impose such conditions or restrictions as it deems appropriate in connection with granting such exemption. F. Following the Transfer of Common Stock in redemption of the Redeemed Preferred Stock, Investors and certain direct and/or indirect equityholders of Investors would Beneficially Exhibit 10.1

-2- USActive 60131230.1 Own or Constructively Own an amount of Capital Stock in excess of the Ownership Limits described above. G. This Agreement provides for the establishment of an Excepted Holder Limit for Investors and their equityholders if certain conditions are satisfied, and Investors intend to satisfy such conditions by execution of this Agreement. NOW THEREFORE, in consideration of the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties, intending to be legally bound, hereby agree as follows: AGREEMENT 1. Representations of Investor. To induce the Company to enter into this Agreement, Investors represent and warrant to the Company as follows: 1.1. This Agreement has been duly executed and delivered by authorized representatives of Investors, and is a valid and binding obligation of Investors, enforceable in accordance with its terms; 1.2. The execution and delivery of this Agreement by Investors does not, and will not: (i) violate or conflict with any agreement, order, injunction, decree, or judgment to which Investors are a party or by which Investors are bound; or (ii) violate any law, rule or regulation applicable to Investors; 1.3. No consent, approval or authorization of, or designation, registration, declaration or filing with, any governmental entity or third Person is required on the part of Investors in connection with the execution or delivery of this Agreement; 1.4. The information provided by Investors in the Ownership Statement delivered to the Company was true, correct and complete. 1.5. To the knowledge of Investors, no Individual will be treated as Beneficially Owning more than 9.8% of the Company as a result of the transaction contemplated by this Agreement or otherwise (following such transaction) by reason of Investors’ Beneficial Ownership of Capital Stock of the Company; and 1.6. Investors have reviewed the list of the tenants of the Company and its subsidiaries previously provided to Investors (the “Tenant List”) and do not, individually or collectively, actually or Constructively Own 9.8% or more of any such tenant of the Company or its subsidiaries.

-3- USActive 60131230.1 2. On-Going Covenants of Investor. Beginning on the date hereof, and during any period that an Excepted Holder Limit established pursuant to this Agreement remains in effect, Investors covenant and agrees as follows: 2.1. Assuming that all of the Redeemed Preferred Stock is redeemed in exchange for Common Stock, and subject to the adjustments set forth in this Section 2.1: 2.1.1. Investors will not, collectively, Beneficially Own more than fifty-five percent (55%) of the value of Capital Stock of the Company (such percentage, as the same may be adjusted from time to time in accordance with this Section 2.1, being the Excepted Holder Limit granted to Investors with respect to the Aggregate Stock Ownership Limit (the “Capital Stock Excepted Holder Limit”)); 2.1.2. Investors will not, collectively, Beneficially Own more than eighty-six percent (86%) (in value or number of shares, whichever is more restrictive) of the outstanding shares of Common Stock of the Company (such percentage, as the same may be adjusted from time to time in accordance with this Section 2.1, being the Excepted Holder Limit granted to Investors with respect to the Common Stock Ownership Limit (the “Common Stock Excepted Holder Limit” and, together with the Capital Stock Excepted Holder Limit, the “Investor Excepted Holder Limits”)); and 2.1.3. To the knowledge of Investors, no Individual will be treated as Beneficially Owning more than 9.8% (in value or in number of shares, whichever is more restrictive) of the outstanding shares of the Common Stock of the Company, or more than 9.8% (in value) of the aggregate of the Capital Stock of the Company as a result of Investors’ Beneficial Ownership of Capital Stock of the Company. If the Company redeems, repurchases or cancels shares of Capital Stock, the effect of which would be to cause Investors to exceed any Investor Excepted Holder Limit, such Investor Excepted Holder Limit shall, automatically and without need of any action on the part of the Company, its Board of Directors, or Investors, be increased so that the Investors’ then Beneficial Ownership is not in excess of the new applicable Investor Excepted Holder Limit; provided, that if such increase would cause any Investor to Constructively Own more than a 9.8% interest (within the meaning of Section 856(d)(2)(B) of the Code) in a tenant or would cause any Individual to Beneficially Own more than 9.8% (in value or in number of shares, whichever is more restrictive) of the outstanding shares of the Company’s Common Stock, or more than 9.8% (in value) of the aggregate of the Company’s Capital Stock, such Excepted Holder Limit shall be increased only to the extent it would not cause the Company to have such an ownership interest in a tenant and would not cause any Individual to Beneficially Own more than 9.8% of the Company’s Capital Stock. 2.2. Assuming that all of the Redeemed Preferred Stock is redeemed in exchange for Common Stock, Investors will not, individually or collectively, actually own or

-4- USActive 60131230.1 Constructively Own an interest in any tenant of the Company set forth on the Tenant List (as updated from time to time) that would cause the Company to Constructively Own more than a 9.8% interest (within the meaning of Section 856(d)(2)(B) of the Code) in such tenant. 2.3. Assuming that all of the Redeemed Preferred Stock is redeemed in exchange for Common Stock, Investors shall not, collectively, actually or Beneficially Own an amount of shares of the Company’s Capital Stock that would violate either Investor Excepted Holder Limit, and shall use their reasonable best efforts not to actually or Beneficially Own an amount of shares of the Company’s Capital Stock that would cause any Individual to be treated as Beneficially Owning 9.8% (in value or in number of shares, whichever is more restrictive) of the outstanding shares of the Company’s Common Stock, or more than 9.8% (in value) of the aggregate of the outstanding shares of all classes and series of the Company’s Capital Stock or that would cause the Company to become “closely held” within the meaning of Section 856(h) of the Code (without regard to whether the ownership interest is held during the last half of a taxable year) or otherwise cause the Company to fail to qualify as a REIT. 2.4. Investors agree that any violation, or attempted or purported violation, of Section 2.1, 2.2 or 2.3 of this Agreement (whether with respect to actual, Beneficial or Constructive Ownership by Investors or any Individual, and whether or not as a result of any Transfer), or any other action which is contrary to the restrictions contained in Article VI of the Charter, will automatically cause the shares of Capital Stock that otherwise would result in such violation to be transferred to a Trust in accordance with Sections 6.2.1(b) and 6.3 of the Charter, and such shares shall be subject to all the terms and limitations set forth in the Charter (without regard to any exception due to an Excepted Holder Agreement). 2.5. Each Investor shall promptly notify the Company in writing as soon as it becomes aware of any breach of Section 2.1, 2.2 or 2.3 of this Agreement. 2.6. Each Investor will maintain an accurate record of its investors for the purpose of monitoring the Beneficial and Constructive Ownership of the Company’s Capital Stock. No later than March 31 of each calendar year beginning in 2024 (but only for so long as Investors Beneficially Own or Constructively Own at least 9.8 percent (9.8%) of the Capital Stock or Common Stock of the Company), Investors shall deliver an updated Ownership Statement, listing Investors’ then-current actual and Beneficial Ownership of stock with detail sufficient for the Company to independently determine Investors’ then-current actual and Beneficial Ownership of Capital Stock. 2.7. Each Investor agrees to keep the Tenant List in strict confidence and shall not disclose it to any third parties without the Company’s prior written approval. 3. On-Going Covenants of the Company 3.1. Notwithstanding any provisions of the Charter to the contrary, the Company agrees that the Excepted Holder Limits granted by this Agreement shall not be revoked unless the

-5- USActive 60131230.1 Board of Directors determines based upon the written advice of counsel that such revocation is required for the preservation of the Company’s qualification as a REIT under the Code. 3.2. The Company agrees to keep the information in the Ownership Statement in strict confidence and shall not disclose it to any third parties without the Investors’ prior written approval; provided that the Company may disclose such information to its tax advisors, financial auditors or taxing authorities, under conditions of confidentiality, to the extent necessary to establish the Company’s status as a REIT. 4. Company’s Authorization of Agreement 4.1. Based on the above representations and agreements, the Company hereby grants to Investors and, and agrees that Investors shall have, an initial Capital Stock Excepted Holder Limit of fifty-five percent (55%) and an initial Common Stock Excepted Holder Limit of eighty-six percent (86%); provided, however, that such Investor Excepted Holder Limits shall be subject to adjustment as contemplated by Section 2.1 above. The Capital Stock Excepted Holder Limit and Common Stock Excepted Holder Limit granted hereunder are also granted to, and shall encompass, any direct and/or indirect equityholders of Investors previously identified by Investors to the extent of such equityholder’s Beneficial Ownership of Capital Stock or Common Stock solely by reason of such equityholder’s direct or indirect interest in Investors. 5. Additional Information 5.1. Investors and the Company agree that, in addition to the applicable provisions of the Charter, by which Investors would otherwise be bound as a holder of Capital Stock of the Company: 5.1.1. Investors shall provide the information described in Section 6.2.4 of the Charter in accordance with the provisions thereof; and 5.1.2. Investors will inform the Company of their direct or Constructive Ownership of a 9.8% or greater equity interest (within the meaning of Section 856(d)(2)(B) of the Code) in any tenant appearing on an updated Tenant List, provided to Investors by the Company, within 30 days of receipt of such updated Tenant List. 6. Miscellaneous 6.1. All capitalized terms not defined herein have the meaning ascribed to them in the Charter, except that “Constructively Owns” has the meaning ascribed to it in the Ownership Statement solely for the purposes of Recital B. 6.2. All questions concerning the construction, validity and interpretation of this Agreement shall be governed by and construed in accordance with the domestic laws of the State of Maryland, without giving effect to any choice of law or conflict of law provision

-6- USActive 60131230.1 (whether of the State of Maryland or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Maryland. 6.3. This Agreement may be signed by the parties in separate counterparts, each of which when so signed and delivered shall be an original, but all such counterparts shall together constitute one and the same instrument. 6.4. This Agreement shall automatically terminate, and Investors and their equityholders shall cease to be Excepted Holders as set forth herein and in the Charter, upon reduction of Investors’ Beneficial Ownership and Constructive Ownership to or below 9.8% of all outstanding Capital Stock or Common Stock of the Company. In the event of termination of this Agreement, Investors and their equityholders shall immediately become subject to all rules and restrictions regarding the ownership of the Company’s stock, including, without limitation, the limitations set forth in the Charter of the Company, and, for the avoidance of doubt, the establishment of a new Excepted Holder Limit for Investors (and any of their direct or indirect equityholders, as applicable) and the entry into a new Excepted Holder Agreement (in each case at the sole and absolute discretion of the Board of Directors of the Company pursuant to Section 6.2.7 of the Charter) shall be required before Investors may again Beneficially Own or Constructively Own Capital Stock or Common Stock of the Company in excess of any Ownership Limit. 6.5. Any provision of this Agreement may be amended or waived if in writing and signed by the Company and Investors. No failure or delay by any party in exercising any right, power or privilege hereunder shall operate as a waiver thereof nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any other right, power or privilege. The rights and remedies herein provided shall be cumulative and not exclusive of any rights or remedies provided by law. No provision of this Agreement is intended to confer upon any Person other than the parties hereto any rights or remedies hereunder. 6.6. The parties agree that irreparable damage would occur in the event that any of the provisions of this Agreement were not performed in accordance with their specific terms. It is accordingly agreed that the parties shall be entitled to specific performance of the terms hereof, this being in addition to any other remedy to which they are entitled at law or in equity. 6.7. This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersede all prior agreements and understandings, both oral and written, between the parties with respect to the subject matter hereof. [Remainder of page intentionally blank. Signature page follows.]

USActive 60131230.1 IN WITNESS WHEREOF, the Company and Investors have caused this Agreement to be executed by their respective duly authorized officers as of the date first written above. WHEELER REAL ESTATE INVESTMENT TRUST, INC. By: /s/ M. Andrew Franklin Name: M. Andrew Franklin Title: Chief Executive Officer STILWELL ACTIVIST INVESTMENTS, L.P. By: /s/ Joseph Stilwell Name: Joseph Stilwell Title: Managing Member of the General Partner, Stilwell Value LLC STILWELL ACTIVIST FUND, L.P. By: /s/ Joseph Stilwell Name: Joseph Stilwell Title: Managing Member of the General Partner, Stilwell Value LLC STILWELL VALUE PARTNERS VII, L.P. By: /s/ Joseph Stilwell Name: Joseph Stilwell Title: Managing Member of the General Partner, Stilwell Value LLC [Signature page to Excepted Holder Agreement]

USActive 60131230.1 STILWELL ASSOCIATES, L.P. By: /s/ Joseph Stilwell Name: Joseph Stilwell Title: Managing Member of the General Partner, Stilwell Value LLC [Signature page to Excepted Holder Agreement]

Execution Copy 1 USActive 60131534.1 December 5, 2023 Stilwell Activist Investments, L.P. Stilwell Activist Fund, L.P. Stilwell Value Partners VII, L.P. Stilwell Associates, L.P. c/o Stilwell Value LLC 200 Calle del Santo Cristo Segundo Piso San Juan, Puerto Rico 00901 Ladies and Gentlemen: Reference is hereby made to that certain (1) Excepted Holder Agreement (the “Excepted Holder Agreement”) entered into concurrently herewith by and among Wheeler Real Estate Investment Trust, Inc., a Maryland corporation (the “Company”), Stilwell Activist Investments, L.P., a Delaware limited partnership, Stilwell Activist Fund, L.P., a Delaware limited partnership, Stilwell Value Partners VII, L.P., a Delaware limited partnership, and Stilwell Associates, L.P., a Delaware limited partnership (each an “Investor” and, collectively, the “Investors”), and (2) Indenture among the Company and Wilmington Savings Fund Society, FSB, as Trustee (the “Indenture”) governing the terms of the Company’s 7.00% Subordinated Convertible Notes due 2031 (the “Notes”). Capitalized terms not defined herein shall have the meanings assigned thereto (as applicable) in the Excepted Holder Agreement and the Indenture. In consideration of the Company entering into the Excepted Holder Agreement pursuant to which the Company granted Investor Excepted Holder Limits to the Investors, each Investor agrees that, notwithstanding anything to the contrary set forth in the Indenture, such Investor shall not exercise its right to convert the Notes into shares of Common Stock to the extent that such conversion would result in such Investor, whether on its own or as part of a “group” within the meaning of Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), becoming the direct or indirect “beneficial owner,” as defined in Rule 13d-3 under the Exchange Act, of common equity of the Company representing 50% or more of the total voting power of all outstanding shares of common equity of the Company that is entitled to vote generally in the election of directors (“Voting Stock”). The covenants contained in this paragraph shall apply to any transferees of the Notes that are affiliated with the Investors. The Company shall, upon receipt of any conversion notice tendered by any Investor pursuant to the terms of the Indenture, promptly notify such Investor by telephone and in writing (e-mail being sufficient for this purpose) of the number of shares of Common Stock outstanding (as of the date of the notification) and the number of shares of Common Stock that would be issuable to such Investor if the conversion requested in such conversion notice were effected in full, whereupon, notwithstanding anything to the contrary set forth in the Indenture, such Investor shall, within one business day of such Company notice to Investor, revoke all or part of its conversion notice to the extent that it is determined that the result thereof would be Investor’s direct or indirect “beneficial ownership” (whether on its own or as part of a “group” within the meaning of Section 13(d) of the Exchange Act) of 50% or more of the total voting power of all outstanding shares of Voting Stock. This Letter Agreement shall be governed by, and construed in accordance with, the laws of the State of Maryland, without giving effect to the conflicts of law provisions thereof. No party may assign its respective rights, interests or obligations hereunder without the prior written consent of the other parties. Exhibit 10.2

2 USActive 60131534.1 This Letter Agreement is not intended to confer benefits upon, or create any rights in favor of, any person or entity other than the parties hereto, except as expressly set forth herein. This Letter Agreement may be signed by the parties in separate counterparts, each of which when so signed and delivered shall be an original, but all such counterparts shall together constitute one and the same instrument. To be binding, any amendment, waiver or modification of this Letter Agreement must be effected by an instrument in writing signed by each of the parties hereto. This Letter Agreement shall terminate and be of no further force and effect as of December 5, 2024. The parties agree that irreparable damage would occur in the event that any of the provisions of this Letter Agreement were not performed in accordance with their specific terms. It is accordingly agreed that the parties shall be entitled to specific performance of the terms hereof, this being in addition to any other remedy to which they are entitled at law or in equity. [Remainder of page intentionally blank. Signature page follows.]

[Signature Page to Letter Agreement] USActive 60131534.1 This Letter Agreement (together with the Excepted Holder Agreement) constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements and understandings, both oral and written, between the parties with respect to the subject matter hereof. Very truly yours, WHEELER REAL ESTATE INVESTMENT TRUST, INC. By: /s/ M. Andrew Franklin____ Name: M. Andrew Franklin Title: Chief Executive Officer Accepted and agreed as of the date first written above: STILWELL ACTIVIST INVESTMENTS, L.P. By: /s/ Joseph Stilwell____ Name: Joseph Stilwell Title: Managing Member of the General Partner, Stilwell Value LLC STILWELL ACTIVIST FUND, L.P. By: /s/ Joseph Stilwell____ Name: Joseph Stilwell Title: Managing Member of the General Partner, Stilwell Value LLC STILWELL VALUE PARTNERS VII, L.P. By: /s/ Joseph Stilwell____ Name: Joseph Stilwell Title: Managing Member of the General Partner, Stilwell Value LLC STILWELL ASSOCIATES, L.P. By: /s/ Joseph Stilwell____ Name: Joseph Stilwell Title: Managing Member of the General Partner, Stilwell Value LLC

v3.23.3

Cover

|

Dec. 04, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 04, 2023

|

| Entity Registrant Name |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-35713

|

| Entity Tax Identification Number |

45-2681082

|

| Entity Address, Address Line One |

2529 Virginia Beach Blvd

|

| Entity Address, City or Town |

Virginia Beach

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23452

|

| City Area Code |

757

|

| Local Phone Number |

627-9088

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001527541

|

| Amendment Flag |

false

|

| Common Stock, $0.01 par value per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

WHLR

|

| Security Exchange Name |

NASDAQ

|

| Series B Convertible Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series B Convertible Preferred Stock

|

| Trading Symbol |

WHLRP

|

| Security Exchange Name |

NASDAQ

|

| Series D Cumulative Convertible Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series D Cumulative Convertible Preferred Stock

|

| Trading Symbol |

WHLRD

|

| Security Exchange Name |

NASDAQ

|

| 7.00% Subordinated Convertible Notes due 2031 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Subordinated Convertible Notes due 2031

|

| Trading Symbol |

WHLRL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_ConvertibleSubordinatedDebtMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

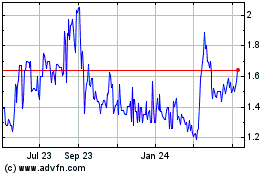

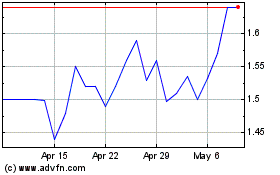

Wheeler Real Estate Inve... (NASDAQ:WHLRP)

Historical Stock Chart

From Apr 2024 to May 2024

Wheeler Real Estate Inve... (NASDAQ:WHLRP)

Historical Stock Chart

From May 2023 to May 2024