LPL Financial Holdings Inc. (Nasdaq: LPLA) (“LPL”) and Wintrust

Financial Corporation (Nasdaq: WTFC) today announced an agreement

to transition support of the wealth management business of Wintrust

Investments, LLC and certain private client business at Great Lakes

Advisors, LLC (collectively “Wintrust”), and their approximately 85

advisors and approximately $16 billion of brokerage and advisory

assets to the LPL Institution Services platform.*

Wintrust Investments, LLC is a broker-dealer and registered

investment advisor (“RIA”) with $13 billion of brokerage and

advisory assets that are expected to transfer to the LPL platform.

Great Lakes Advisors, LLC is an RIA with $17 billion in total

advisory assets; $3 billion of its private client advisory assets

are expected to transfer custody to the LPL platform.

“At Wintrust, our focus on outstanding client service has served

our customers well and has resulted in a formidable wealth

management operation,” said Tom Zidar, Chairman and Chief Executive

Officer at Wintrust Wealth Management. “We believe LPL is the right

partner to help us take our business to the next level. LPL’s

integrated advisor platform and ongoing investment in technology

will enable our advisors and portfolio managers to do even more for

our clients. We are excited about the strategic relationship with

LPL and the growth opportunities ahead of us.”

“Wintrust advisors offer deep expertise and exceptional personal

attention to their clients, and we are pleased to work with Great

Lakes Advisors to make their investment strategies more broadly

available to the full LPL advisor ecosystem,” said Christopher

Cassidy, SVP, Head of Institution Business Development at LPL

Financial. “Through this strategic relationship, LPL will enable

Wintrust advisors to further differentiate their offerings, as they

will have access to a cutting-edge platform that supports the

changing needs of their clients and their businesses. We look

forward to partnering with the team at Wintrust, growing our mutual

expertise and enhancing their ability to serve a marketplace with

an increasing demand for personalized financial advice.”

The transition is expected to be completed in the first quarter

of 2025, subject to receipt of regulatory approval and other

conditions.

Forward Looking StatementsCertain

of the statements included in this release, such as those regarding

the completion of the strategic relationship agreement; the

expected transition of assets associated therewith; and the

benefits anticipated therefrom, constitute forward-looking

statements within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Words such as “expects,” “believes,”

“anticipates,” “plans,” “assumes,” “estimates,” “projects,”

“intends,” “should,” “will,” “shall” or variations of such words

are generally part of forward-looking statements. Forward-looking

statements are made based on current expectations and beliefs

concerning future developments and their potential effects upon

Wintrust, LPL or both. In particular, no assurance can be provided

that the assets reported as serviced by financial advisors

affiliated with Wintrust will translate into assets serviced by

LPL, that advisors affiliated with Wintrust will transition

registration to LPL or that the benefits that are expected to

accrue to Wintrust, LPL and advisors as a result of the strategic

relationship agreement will materialize. These forward-looking

statements are not a guarantee of future performance and involve

risks and uncertainties, including economic, legislative,

regulatory, competitive and other factors, and there are certain

important factors that could cause actual results or the timing of

events to differ, possibly materially, from expectations or

estimates expressed or implied in such forward-looking statements.

Important factors that could cause or contribute to such

differences include: the failure of the parties to satisfy the

closing conditions applicable to the strategic relationship

agreement, including receiving regulatory approval, in a timely

manner or at all; difficulties or delays in transitioning advisors

affiliated with Wintrust, or in onboarding Wintrust’s clients and

businesses or transitioning their assets from Wintrust’s current

third-party custodian to LPL; the inability of LPL to sustain

revenue and earnings growth or to fully realize revenue or expense

synergies or the other expected benefits of the transaction, which

depend in part on LPL’s success in onboarding assets currently

served by Wintrust’s advisors; disruptions to Wintrust’s or LPL’s

businesses due to transaction-related uncertainty or other factors

making it more difficult to maintain relationships with financial

advisors and clients, employees, other business partners or

governmental entities; the inability of LPL or Wintrust to

implement onboarding plans; the choice by clients of

Wintrust-affiliated advisors not to open brokerage and/or advisory

accounts at LPL; changes in general economic and financial market

conditions, including retail investor sentiment; fluctuations in

the value of assets under custody; and the effects of competition

in the financial services industry, including competitors’ success

in recruiting Wintrust-affiliated advisors. Certain additional

important factors that could cause actual results or the timing of

events to differ, possibly materially, from expectations or

estimates expressed or implied in such forward-looking statements

can be found in the “Risk Factors” and “Forward Looking Statements”

(in the case of Wintrust) or the “Risk Factors” and “Special Note

Regarding Forward-Looking Statements” (in the case of LPL) sections

included in each of Wintrust’s and LPL’s most recent Annual Report

on Form 10-K. Except as required by law, Wintrust and LPL do not

undertake to update any particular forward-looking statement

included in this document as a result of developments occurring

after the date of this press release.

About Wintrust Wintrust is a financial holding

company with assets of approximately $56 billion whose common stock

is traded on the NASDAQ Global Select Market. Built on the "HAVE IT

ALL" model, Wintrust offers sophisticated technology and resources

of a large bank while focusing on providing service-based community

banking to each and every customer. Wintrust operates fifteen

community bank subsidiaries, with over 170 banking locations

located in the greater Chicago and southern Wisconsin market areas.

Additionally, Wintrust operates various non-bank business units

including business units which provide commercial and life

insurance premium financing in the United States, a premium finance

company operating in Canada, a company providing short-term

accounts receivable financing and value-added out-sourced

administrative services to the temporary staffing services

industry, a business unit engaging primarily in the origination and

purchase of residential mortgages for sale into the secondary

market throughout the United States, and companies providing wealth

management services and qualified intermediary services for

tax-deferred exchanges.

About LPL FinancialLPL Financial Holdings Inc.

(Nasdaq: LPLA) was founded on the principle that LPL should work

for advisors and enterprises, and not the other way around. Today,

LPL is a leader in the markets we serve, serving more than 22,000

financial advisors, including advisors at approximately 1,100

enterprises and at approximately 570 registered investment advisor

firms nationwide. We are steadfast in our commitment to the

advisor-mediated model and the belief that Americans deserve access

to personalized guidance from a financial professional. At LPL,

independence means that advisors and enterprise leaders have the

freedom they deserve to choose the business model, services and

technology resources that allow them to run a thriving business.

They have the flexibility to do business their way. And they have

the freedom to manage their client relationships because they know

their clients best. Simply put, we take care of our advisors and

enterprises, so they can take care of their clients.

Securities and Advisory services are offered through LPL

Financial LLC (“LPL Financial”), a registered investment advisor.

Member FINRA/SIPC. LPL Financial and its affiliated companies

provide financial services only from the United States.

Throughout this communication, the terms “financial advisors”

and “advisors” are used to refer to registered representatives

and/or investment advisor representatives affiliated with LPL

Financial.

We routinely disclose information that may be important to

shareholders in the “Investor Relations” or “Press Releases”

section of our website.

*Value approximated based on asset and holding details provided

to LPL from year-end 2023.

Connect with Us!

https://twitter.com/lpl

https://www.linkedin.com/company/lpl-financial

https://www.facebook.com/LPLFinancialLLC

https://www.youtube.com/user/lplfinancialllc

LPL Contacts:Media

RelationsMedia.relations@LPLFinancial.com706-254-4100

Investor RelationsInvestor.relations@LPLFinancial.com

Wintrust Contacts:For general inquiries:David

A. Dykstra, Vice Chairman & Chief Operating Officer – Wintrust

Financial CorporationThomas P. Zidar, Chairman & Chief

Executive Officer – Wintrust Wealth

Management847-939-9000www.wintrust.com

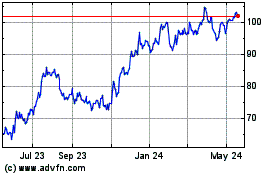

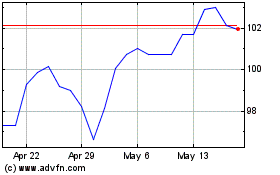

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jan 2024 to Jan 2025