On April 5, 2024, Welsbach Technology Metals Acquisition Corp. (the

“Company” or “WTMA”) filed a Form 8-K announcing that the Company

has entered into a merger agreement (“Merger Agreement”) with

Evolution Metals LLC, a Delaware company (“EM”).

WTMA and EM aim to develop an alternative

secure, reliable global supply chain for critical minerals and

materials using proven technologies.

This supply chain includes beneficiation of

various oxides, carbonates and sulfates chemicals along with metals

and alloy powder refining, and manufacturing of both bonded and

sintered magnet products which are the essential ingredients for

both secondary cell batteries and rare earth permanent magnet value

chain that are critical for a greener, cleaner future, while

supporting the industrial base of the global economy. Additionally,

WTMA and EM also aims to establish a battery, e-scrap, and magnet

recycling in order to support the closed-loop economy.

WTMA and EM’s focus is on mid-stream and

down-stream to support the automotive, aerospace, and defense

industries while continuing to embrace a more sustainable future

through proven technologies, economical and efficient processing

integrated with state-of-the-art robotics and AI.

WTMA and EM’s business development objective is

to provide an alternative critical materials value chain while also

delivering AI-driven processing, manufacturing and customer

interfaces by converting traditional industry into an AI smart

factory and AI smart UI – all of which the incumbent critical

materials value chain lacks.

The capabilities of the combined company

represent a ten thousand ton plus, per annum, output material in

magnets and battery metals.

“The mid-stream and down-stream are critical

paths to supporting the automotive, aerospace and defense

industries, while continuing to embrace a more sustainable future”

says Frank Moon of EM. “We will continue to evolve proven

technologies for stable economic growth, supporting our

shareholders in a robust ever-developing technological world.”

The Transaction is intended to result in WTMAC’s

successor listed company owning 100% of the Target.

“We are confident and thrilled to be combining

WTMA with EM, and will be continuing to value our shareholders

interests first and foremost, which led us to a successful

agreement to proceed with EM,” says Daniel Mamadou, CEO of WTMAC.

“The world is full of minerals. Keeping the environment front

and center with economic and efficient processing is core to the

strategy of the surviving company. My partners and I are

excited to continue with the surviving company.”

"We are excited to join forces with WTMA to

revolutionize the critical materials value chain," says David

Wilcox, Managing Member of EM LLC. "Our combined expertise and

commitment to sustainable practices will drive the future of

critical minerals and materials supply, ensuring reliable and

efficient processing. This merger will not only benefit our

shareholders but also support the global push towards a greener,

cleaner future. We are dedicated to building an integrated critical

materials supply chain supported by advanced technologies,

including AI and robotics, to transform traditional industries into

smart, innovative solutions. Together, we will shape a more

sustainable and technologically advanced world."

Extension Proposal and Non-Redemption

Agreement

On May 29, 2024, the Company filed a definitive

proxy statement on Schedule 14A (“Proxy Statement”) for the

purposes of calling a special meeting of the Company’s stockholders

(the “Meeting”) to approve, among other proposals, an amendment to

the Company’s amended and restated certificate of incorporation to

extend the date by which it has to consummate an initial business

combination from June 30, 2024 to June 30, 2025 (the “Extension,”

such proposal, the “Extension Proposal”).

In connection with the Meeting, the Company and

Welsbach Acquisition Holdings LLC (the “Sponsor”) intend to enter

into non-redemption agreements (“Non-Redemption Agreements”) with

one or more unaffiliated third-party stockholders of the Company in

exchange for such stockholders agreeing to not redeem a

to-be-determined number of shares of common stock (“Non-Redeemed

Shares”) at the Meeting.

J.V.B. Financial Group, LLC, acting through its

Cohen & Company Capital Markets division (“CCM”) will act as

the Company’s financial advisor and lead capital markets

advisor.

In exchange for the foregoing commitment to the

Company to not redeem the Non-Redeemed Shares, WTMA and the Sponsor

will agree to cause the surviving entity of any future WTMA initial

business combination (“MergeCo”) to issue to such shareholders a

certain number of additional ordinary or common shares of MergeCo

immediately following the consummation of an initial business

combination, if they continue to hold such Non-Redeemed Shares

through the Special Stockholder Meeting. The Non-Redemption

Agreements, if entered into, are not expected to increase the

likelihood that the Extension Proposal is approved by the Company’s

stockholders, but are expected to increase the amount of funds that

remain in the Company’s trust account established in connection

with Company’s initial public offering following the Meeting. The

Company and the Sponsor may enter into additional, similar

non-redemption agreements in connection with the Meeting.

The Non-Redemption Agreements shall terminate on

the earlier of (i) the failure of the Company’s stockholders to

approve the Extension at the Meeting, (ii) the Company’s

determination not to proceed with the Extension, (iii) the

fulfillment of all obligations of parties to the Non-Redemption

Agreements, (iv) the liquidation or dissolution of the Company, (v)

the mutual written agreement of the parties or (vi) if the

applicable stockholder exercises its redemption rights with respect

to any Non-Redeemed Shares in connection with the Meeting and such

Non-Redeemed Shares are actually

redeemed. About

WTMACWTMAC is a blank check company formed for the purpose

of effecting a merger, capital stock exchange, asset acquisition,

stock purchase, reorganization or similar business combination with

one or more businesses. While WTMAC may pursue an acquisition in

any business industry or sector, it intends to concentrate its

efforts on targets in the technology metals and energy transition

materials industry. WTMAC is led by Chief Executive Officer Daniel

Mamadou and Chief Operating Officer Christopher Clower.

About EM LLCEM LLC is a mining,

refining and specialty chemicals company that it is committed to

establishing a secure and reliable supply chain for critical

minerals. Its strategy is to acquire and develop mining assets and

processing facilities to produce essential materials for industrial

uses including electric vehicles, electronics, environmental

technologies and aerospace and defense applications. EM aims to

support the creation of jobs, industry and manufacturing to promote

a greener future by providing bespoke solutions to support its

clients globally. EM LLC is led by Managing Member David

Wilcox.

Important Information and Where to Find

ItIf a legally binding definitive agreement with respect

to the proposed Transaction is executed, the parties intend to file

with the Securities and Exchange Commission (the “SEC”) a

registration statement relating to the Transaction. In addition,

WTMAC has filed a definitive proxy statement to be used at its

special meeting of stockholders to approve an extension of the time

in which it must complete an initial business combination or

liquidate the trust account that holds the proceeds of WTMAC’s

initial public offering (the “Extension”), which was mailed to

stockholders of WTMAC as of the record date established for voting

on the Extension. WTMAC’s stockholders and other interested persons

are advised to read the definitive proxy statement filed by WTMAC

in connection with the Extension and, when available the

preliminary proxy statements and the amendments thereto and the

definitive proxy statement relating to the proposed Transaction, as

these materials will contain important information about WTMAC,

Target, the proposed Transaction and the Extension. When available,

the definitive proxy statement and other relevant materials for the

proposed Transaction will be mailed to stockholders of WTMAC as of

a record date to be established for voting on the proposed

Transaction. Stockholders will also be able to obtain copies of the

above referenced documents and other documents filed with the SEC

in connection with the Extension and the proposed business

combination, without charge, once available, at the SEC’s web site

at www.sec.gov, or by directing a request to: Welsbach Technology

Metals Acquisition Corp., 4422 N. Ravenswood Ave #1025, Chicago,

Illinois 60640.

Participants in the

SolicitationWTMA and Target and each of their directors

and executive officers may be considered participants in the

solicitation of proxies with respect to the Extension and the

proposed Transaction under the rules of the SEC. Information about

the directors and executive officers of WTMAC and a description of

their interests in WTMAC and the Extension is contained in WTMA’s

Annual Report on Form 10-K for the year ended December 31, 2023,

which was filed with the SEC on April 16, 2024 (the “Annual

Report”) and the definitive proxy statement relating the

Extension.

Information about WTMAC’s directors and

executive officer’s interests in the Transaction, as well as

information about Target’s directors and executive officers and a

description of their interests in Target and the proposed

Transaction will be set forth in the proxy statement relating to

the proposed Transaction, when it is filed with the SEC. When

available, the above referenced documents can be obtained free of

charge from the sources indicated above.

No Offer or SolicitationThis

press release shall not constitute a solicitation of a proxy,

consent, or authorization with respect to any securities or in

respect of the Extension or the proposed Transaction. This press

release shall also not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any states or jurisdictions in which such

offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended, or an exemption therefrom.

Forward

Looking-StatementsCertain statements made in this press

release are “forward looking statements” within the meaning of the

“safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. When used in this press release, the

words “estimates,” “projected,” “expects,” “anticipates,”

“forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,”

“will,” “should,” “future,” “propose” and variations of these words

or similar expressions (or the negative versions of such words or

expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside WTMAC’s and Target’s control,

that could cause actual results or outcomes to differ materially

from those discussed in the forward-looking statements. Important

factors, among others, that may affect actual results or outcomes

include: the ability of WTMAC to enter into a definitive agreement

with respect to a business combination with Target within the time

provided in WTMAC’s second amended and restated certificate of

incorporation; WTMAC’s ability to obtain the Extension; WTMAC’s

ability to obtain the financing necessary to consummate the

potential Transaction; the performance of Target’s business; the

timing, success and cost of Target’s development activities;

assuming the definitive agreement is executed, the ability to

consummate the proposed Transaction, including risk that WTMAC’s

stockholder approval is not obtained; failure to realize the

anticipated benefits of the proposed Transaction, including as a

result of a delay in consummating the proposed Transaction; the

amount of redemption requests made by WTMAC’s stockholders and the

amount of funds remaining in WTMAC’s trust account after the

Extension and the vote to approve the proposed Transaction; WTMAC’s

and Target’s ability to satisfy the conditions to closing the

proposed Transaction, once documented in a definitive agreement;

and those factors discussed in the Annual Report under the heading

“Risk Factors,” and the other documents filed, or to be filed, by

WTMAC with the SEC. Neither WTMAC or Target undertake any

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Contact:

Daniel Mamadou, CEO, Welsbach Technology Metals Acquisition

Corp.daniel@welsbach.sg

David Wilcox, Managing Member, EM

LLCdavid.wilcox@evolution-metals.com

Welsbach Technology Meta... (NASDAQ:WTMAU)

Historical Stock Chart

From Jan 2025 to Feb 2025

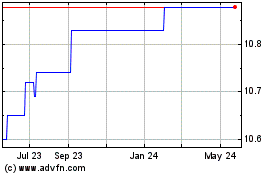

Welsbach Technology Meta... (NASDAQ:WTMAU)

Historical Stock Chart

From Feb 2024 to Feb 2025