Yotta Acquisition Corporation Announces the Separate Trading of its Common Stock, Warrants and Rights, Commencing June 27, 2022

25 June 2022 - 6:30AM

Yotta Acquisition Corporation (“YOTA”) announced today that,

commencing June 27, 2022, holders of the units sold in the

Company’s initial public offering completed on April 22, 2022 may

elect to separately trade the shares of common stock of YOTA, and

the warrants and rights included in such units on The Nasdaq Global

Market (“Nasdaq”).

The shares of common stock, warrants and rights

that are separated will trade on Nasdaq under the symbols “YOTA,”

“YOTAW” and “YOTAR,” respectively. Those units not separated will

continue to trade on Nasdaq under the symbol “YOTAU.” Holders of

units will need to have their brokers contact Continental Stock

Transfer & Trust Company, YOTA’s transfer agent, in order to

separate the units into shares of common stock, warrants and

rights.

The units were initially offered by YOTA in an

underwritten offering. Chardan acted as sole book-running manager

of the offering. A registration statement relating to these

securities was declared effective by the U.S. Securities and

Exchange Commission (the “SEC”) on April 19, 2022. The offering was

made only by means of a prospectus, copies of which may be obtained

by contacting Chardan, 17 State Street, 21st Floor, New York, New

York 10004, or by calling (646) 465-9001. Copies of the

registration statement can be accessed through the SEC’s website

at www.sec.gov.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Yotta Acquisition

Corporation

YOTA is led by founder Hui Chen (CEO). YOTA is a

blank check company formed for the purpose of effecting a merger,

share exchange, asset acquisition, stock purchase,

recapitalization, reorganization or similar business combination

with one or more businesses. Although there is no restriction or

limitation on what industry or geographic region its target

operates in, YOTA intends to focus on high technology, blockchain,

software and hardware, ecommerce, social media and other general

business industries globally. The proceeds of the offering will be

used to fund such business combination.

Cautionary Note Concerning

Forward-Looking Statements

This press release includes forward-looking

statements that involve risks and uncertainties. Forward looking

statements are statements that are not historical facts. Such

forward-looking statements, including the successful consummation

of YOTA’S initial public offering and search for an initial

business combination, are subject to risks and uncertainties, which

could cause actual results to differ from the forward-looking

statements. YOTA expressly disclaims any obligations or undertaking

to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in YOTA’S

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based.

YOTA Contact:Hui ChenChief Executive

OfficerYotta Acquisition Corporationhchen@yottaac.com

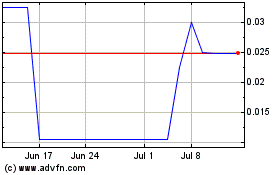

Yotta Acquisition (NASDAQ:YOTAW)

Historical Stock Chart

From Jan 2025 to Feb 2025

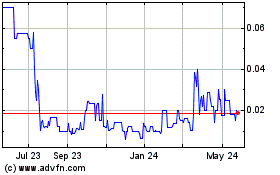

Yotta Acquisition (NASDAQ:YOTAW)

Historical Stock Chart

From Feb 2024 to Feb 2025