false

--12-31

0001859007

0001859007

2023-11-30

2023-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 30, 2023

ZYVERSA

THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41184 |

|

86-2685744 |

| (State

or other jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 2200

N. Commerce Parkway, Suite 208 Weston, Florida |

|

33326 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(754)

231-1688

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

ZVSA |

|

The

Nasdaq Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

3.03 Material Modification to Rights of Security Holders.

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report is incorporated herein by

reference.

Item

5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

November 30, 2023, ZyVersa Therapeutics, Inc. (the “Company”) filed a certificate of amendment to the Company’s Second

Amended and Restated Certificate of Incorporation (the “Amendment”) with the Secretary of State of the State of Delaware

relating to a 1-for-35 reverse stock split (the “Reverse Stock Split”) of the outstanding shares of the Company’s common

stock (“Common Stock”). The Reverse Stock Split is expected to become effective om December 4, 2023 at 4:01 p.m., and the

Common Stock is expected to begin trading on The Nasdaq Global Market on a Reverse Stock Split-adjusted basis on December 5, 2023 at

market open. The Company’s stockholders previously approved the Reverse Stock Split and granted the board of directors the

authority to determine the exact split ratio and when to proceed with the Reverse Stock Split at the Company’s Annual Meeting

of Stockholders held on October 31, 2023 (the “Annual Meeting”). The Company’s board of directors subsequently approved

the Reverse Stock Split in the ratio of 1-for-35.

The

Amendment also increased, effective as of the filing of the Amendment with the Secretary of State of the State of Delaware, the authorized

number of shares of the Company’s capital stock from 111,000,000 to 251,000,000 and the number of authorized shares of Common Stock

from 110,000,000 to 250,000,000 (“Authorized Share Increase”).

The

par value and other terms of the Common Stock were not affected by the Reverse Stock Split or Authorized Share Increase. The Company’s

post-Reverse Stock Split Common Stock CUSIP number will be 98987D201.

A

copy of the Amendment is attached to this Current Report on Form 8-K as Exhibit 3.1 and is incorporated by reference herein.

Item

7.01. Regulation FD Disclosure.

The

Company issued a press release (the “Press Release”) on November 30, 2023 regarding the Reverse Stock Split and the

Authorized Share Increase, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information included

under this Item 7.01 (including Exhibit 99.1) is furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ZYVERSA

THERAPEUTICS, INC. |

| |

|

|

| November

30, 2023 |

By: |

/s/

Stephen Glover |

| |

Name: |

Stephen

Glover |

| |

Title: |

Chief

Executive Officer |

Exhibit

3.1

CERTIFICATE

OF AMENDMENT

OF

SECOND

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

ZYVERSA

THERAPEUTICS, INC.

(Pursuant

to Section 242 of the General Corporation Law of the State of Delaware)

ZyVersa

Therapeutics, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware

(the “Corporation”), does hereby certify as follows:

| 1. | That

a resolution was duly adopted by the Board of Directors of the Corporation pursuant to Section

242 of the General Corporation Law of the State of Delaware setting forth an amendment to

the Second Amended and Restated Certificate of Incorporation of the Corporation and declaring

said amendment to be advisable and that such amendment be submitted to the stockholders of

the Corporation for their consideration, as follows: |

RESOLVED:

That the first paragraph of Article IV of the Second Amended and Restated Certificate of Incorporation of the Corporation be and hereby

is deleted in its entirety and the following is inserted in lieu thereof:

“The

Corporation is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred

Stock.” The total number of shares of capital stock that the Corporation shall have authority to issue is 251,000,000. The total

number of shares of Common Stock that the Corporation is authorized to issue is 250,000,000, having a par value of $0.0001 per share,

and the total number of shares of Preferred Stock that the Corporation is authorized to issue is 1,000,000, having a par value of $0.0001

per share.

Effective

as of December 4, 2023 at 4:01 p.m. Eastern Time (the “Reverse Stock Split Effective Time”), a one-for-thirty-five (1:35)

reverse stock split of the Corporation’s Common Stock shall become effective, pursuant to which each thirty-five (35) shares of

Common Stock issued and outstanding and held of record by each stockholder of the Corporation or issued and held by the Corporation in

treasury immediately prior to the Reverse Stock Split Effective Time shall be reclassified and combined into one (1) validly issued,

fully paid and nonassessable share of Common Stock automatically and without any action by the holder thereof upon the Reverse Stock

Split Effective Time and shall represent one (1) share of Common Stock from and after the Reverse Stock Split Effective Time (such reclassification

and combination of shares, the “Reverse Stock Split”). If, upon aggregating all of the shares of Common Stock held by a holder

of Common Stock immediately following the Reverse Stock Split such holder would otherwise be entitled to a fractional share of Common

Stock, the Corporation shall issue to such holder an additional fraction of a share of Common Stock as is necessary to round the number

of shares of Common Stock held by such holder up to the nearest whole share, such that no person will hold fractional shares following

the Reverse Stock Split.

Each

stock certificate that, immediately prior to the Reverse Stock Split Effective Time, represented shares of Common Stock that were issued

and outstanding immediately prior to the Reverse Stock Split Effective Time shall, from and after the Reverse Stock Split Effective Time,

automatically and without the necessity of presenting the same for exchange, represent that number of whole shares of Common Stock after

the Reverse Stock Split Effective Time into which the shares formerly represented by such certificate have been reclassified (including

those fractional shares issued by the Corporation in connection with the Reverse Stock Split to round the number of shares held by such

holder at the Reverse Stock Split Effective Time up to the nearest whole share); provided, however, that each person of record holding

a certificate that represented shares of Common Stock that were issued and outstanding immediately prior to the Reverse Stock Split Effective

Time shall receive, upon surrender of such certificate, a new certificate evidencing and representing the number of whole shares of Common

Stock after the Reverse Stock Split Effective Time into which the shares of Common Stock formerly represented by such certificate shall

have been reclassified (including those fractional shares issued by the Corporation in connection with the Reverse Stock Split to round

the number of shares held by such holder at the Reverse Stock Split Effective Time up to the nearest whole share).”

| 2. | That,

at an annual meeting of stockholders of the Corporation, the aforesaid amendment was duly

adopted by the stockholders of the Corporation. |

| 3. | That

the aforesaid amendment was duly adopted in accordance with the applicable provisions of

Section 242 of the General Corporation Law of the State of Delaware. |

IN

WITNESS WHEREOF, this Certificate of Amendment has been executed by a duly authorized officer of the Corporation on this 30th

day of November, 2023.

| |

ZYVERSA

THERAPEUTICS, INC. |

| |

|

|

| |

By: |

/s/

Stephen Glover |

| |

|

|

| |

Name: |

Stephen

Glover |

| |

|

|

| |

Title:

|

Chief

Executive Officer |

Exhibit

99.1

ZyVersa

Therapeutics, Inc. Announces Reverse Stock Split and Increase in Authorized Shares of Common Stock

WESTON,

FL (November 30, 2023) - ZyVersa Therapeutics, Inc. (Nasdaq: ZVSA, or “ZyVersa” or the “Company”), a clinical

stage specialty biopharmaceutical company developing first-in-class drugs for treatment of renal and inflammatory diseases with high

unmet needs, announces that its board of directors has approved a 1-for-35 reverse stock split of the Company’s common stock. The

board of directors has also approved an increase in the Company’s authorized shares of capital stock. The Company’s stockholders

approved the reverse stock split and the increase in authorized capital stock at the Company’s Annual Meeting of Stockholders held

on October 31, 2023. The stockholders granted the board of directors the authority to determine the exact split ratio and when to proceed

with the reverse stock split.

The

reverse stock split will become effective on December 4, 2023 at 4:01 pm, Eastern Time, (“Effective Time”) and the Company’s

common stock is expected to begin trading on a reverse stock split-adjusted basis on The Nasdaq Global Market (“Nasdaq”)

on December 5, 2023 at market open under the existing ticker symbol, “ZVSA.” The reverse stock split is intended to increase

the price per share of the Company’s common stock to allow the Company to demonstrate compliance with the $1.00 minimum bid price

requirement for continued listing on Nasdaq, among other benefits.

As

of the Effective Time, every 35 shares of the Company’s issued and outstanding common stock will be combined into one share of

common stock. The par value per share of our common stock will remain unchanged at $0.0001. Proportional adjustments will be made to

the number of shares of common stock issuable upon the exercise of the Company’s equity awards, convertible securities and warrants,

as well as the applicable exercise price, and the number of shares authorized and reserved for issuance pursuant to the Company’s

equity incentive plans.

No

fractional shares will be issued as a result of the reverse stock split; rather, the Company will issue an additional fraction of a share

of common stock to round the number of shares to the nearest whole share, so no stockholder will hold fractional shares following the

reverse stock split.

The

Company’s transfer agent, Continental Stock & Trust Company, will serve as the exchange agent for the reverse stock split.

Registered stockholders holding pre-reverse stock split shares of common stock electronically in book-entry form are not required to

take any action to receive post-reverse stock split shares. Those stockholders who hold their shares in brokerage accounts or in “street

name” will have their positions automatically adjusted to reflect the reverse stock split, subject to each broker’s particular

processes, and will not be required to take any action in connection with the reverse stock split.

Likewise,

effective November 30, 2023, the Company amended its certificate of incorporation to increase the authorized number of shares of the

Company’s capital stock from 111,000,000 to 251,000,000 and the number of authorized shares of common stock from 110,000,000 to

250,000,000.

Additional

information about the reverse stock split and increase in authorized capital stock can be found in the Company’s definitive proxy

statement filed with the Securities and Exchange Commission on September 13, 2023, a copy of which is available at www.sec.gov.

About

ZyVersa Therapeutics

ZyVersa

(Nasdaq: ZVSA) is a clinical stage specialty biopharmaceutical company leveraging advanced, proprietary technologies to develop first-in-class

drugs for patients with renal and inflammatory diseases who have significant unmet medical needs. The Company is currently advancing

a therapeutic development pipeline with multiple programs built around its two proprietary technologies – Cholesterol Efflux Mediator™

VAR 200 for treatment of kidney diseases, and Inflammasome ASC Inhibitor IC 100, targeting damaging inflammation associated with numerous

CNS and other inflammatory diseases. For more information, please visit www.zyversa.com.

Cautionary

Statement Regarding Forward-Looking Statements

Certain

statements contained in this press release regarding matters that are not historical facts, are forward-looking statements within the

meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995.

These include statements regarding management’s intentions, plans, beliefs, expectations, or forecasts for the future, and, therefore,

you are cautioned not to place undue reliance on them. No forward-looking statement can be guaranteed, and actual results may differ

materially from those projected. ZyVersa Therapeutics, Inc (“ZyVersa”) uses words such as “anticipates,” “believes,”

“plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,”

“should,” “could,” “estimates,” “predicts,” “potential,” “continue,”

“guidance,” and similar expressions to identify these forward-looking statements that are intended to be covered by the safe-harbor

provisions. Such forward-looking statements are based on ZyVersa’s expectations and involve risks and uncertainties; consequently,

actual results may differ materially from those expressed or implied in the statements due to a number of factors, including the effect

that the reverse stock split may have on the price of ZyVersa’s common stock and ZyVersa’s ability to maintain its listing

on The Nasdaq Global Market.

New

factors emerge from time-to-time, and it is not possible for ZyVersa to predict all such factors, nor can ZyVersa assess the impact of

each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially

from those contained in any forward-looking statements. Forward-looking statements included in this press release are based on information

available to ZyVersa as of the date of this press release. ZyVersa disclaims any obligation to update such forward-looking statements

to reflect events or circumstances after the date of this press release, except as required by applicable law.

Corporate

and IR Contact:

Karen

Cashmere

Chief

Commercial Officer

kcashmere@zyversa.com

786-251-9641

Media

Contacts

Tiberend

Strategic Advisors, Inc.

Casey

McDonald

cmcdonald@tiberend.com

646-577-8520

Dave

Schemelia

dschemelia@tiberend.com

609-468-9325

v3.23.3

Cover

|

Nov. 30, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 30, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-41184

|

| Entity Registrant Name |

ZYVERSA

THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001859007

|

| Entity Tax Identification Number |

86-2685744

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2200

N. Commerce Parkway

|

| Entity Address, Address Line Two |

Suite 208

|

| Entity Address, City or Town |

Weston

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33326

|

| City Area Code |

(754)

|

| Local Phone Number |

231-1688

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

ZVSA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

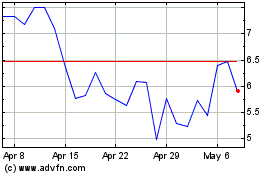

ZyVersa Therapeutics (NASDAQ:ZVSA)

Historical Stock Chart

From Apr 2024 to May 2024

ZyVersa Therapeutics (NASDAQ:ZVSA)

Historical Stock Chart

From May 2023 to May 2024