0001739445false00017394452024-10-012024-10-01

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | | | | | | | | |

| Date of Report (Date of Earliest Event Reported): | | October 1, 2024 |

Arcosa, Inc.

__________________________________________

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | |

| Delaware | | 1-38494 | | 82-5339416 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | |

| 500 N. Akard Street, Suite 400 | | | | |

| Dallas, | Texas | | | | 75201 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code: (972) 942-6500

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | ACA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition of Assets.

On October 1, 2024, Arcosa, Inc., a Delaware corporation (“Arcosa”), completed the previously announced acquisition by East SM, LLC (formerly known as Arcosa MS9, LLC), a Delaware limited liability company and wholly owned subsidiary of Arcosa (“Purchaser”), of all of the issued and outstanding membership interests and certain identified assets, as applicable (together, the “Target”), of the entities set forth in the Purchase Agreement (as defined below) held by Stavola Holding Corporation, a New Jersey corporation, Stavola Holdings Pennsylvania LLC, a Delaware limited liability company, Stavola Trucking Company, Inc., a New Jersey corporation, Stavola Management Company, Inc., a New Jersey corporation, and Stavola Realty Company, a New Jersey general partnership (such transaction, the “Transaction”). The Transaction was completed pursuant to the Membership Interest and Asset Purchase Agreement, dated August 1, 2024 (the “Purchase Agreement”), by and among the Purchaser, Arcosa, the Target, and the other parties thereto.

The Target is an aggregates-led and vertically integrated construction materials company primarily serving the New York-New Jersey Metropolitan Statistical Area, with assets including a network of five hard rock natural aggregates quarries, twelve asphalt plants, and three recycled aggregates sites.

The purchase price paid by Arcosa at the closing of the Transaction was approximately $1.2 billion in cash, subject to customary purchase price adjustments, upon the terms and subject to the conditions set forth in the Purchase Agreement. The purchase price was funded through the previously announced completed offering of $600.0 million 6.875% senior unsecured notes due 2032 and the previously announced senior secured Term Loan B Facility due 2031 in an aggregate principal amount of $700.0 million (the “Term Loan”). In addition, Arcosa assumed in the Transaction certain customary liabilities and obligations of the Target.

The foregoing description of the Purchase Agreement and the Transaction contemplated thereby is qualified in its entirety by the full text of the Purchase Agreement, which will be filed as an exhibit to Arcosa’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024.

The Purchase Agreement will be included to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about Arcosa, Purchaser or any of their respective businesses, subsidiaries or affiliates. The representations, warranties and covenants contained in the Purchase Agreement (a) were made by the parties thereto only for purposes of that agreement and as of specific dates; (b) were made solely for the benefit of the parties to the Purchase Agreement; (c) may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Purchase Agreement (such disclosures include information that has been included in public disclosures, as well as additional non-public information); (d) may have been made for the purposes of allocating contractual risk between the parties to the Purchase Agreement instead of establishing these matters as facts; and (e) may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of Arcosa, Purchaser or any of their respective businesses, subsidiaries or affiliates. Additionally, the representations, warranties, covenants, conditions and other terms of the Purchase Agreement may be subject to subsequent waiver or modification. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in Arcosa’s public disclosures. The Purchase Agreement should not be read alone, but should instead be read in conjunction with the other information regarding the Target and Arcosa that is or will be contained in, or incorporated by reference into, the Forms 10-K, Forms 10-Q and other documents that are filed by Arcosa with the U.S. Securities and Exchange Commission (the “SEC”).

Item 2.03 Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above in Item 2.01, which describes the Transaction in connection with which Arcosa incurred a direct financial obligation, is hereby incorporated by reference into this Item 2.03.

As previously disclosed, on August 15, 2024, Arcosa entered into Amendment No. 1 (the “Credit Facility Amendment”) to Arcosa’s existing Second Amended and Restated Credit Agreement dated as of August 23, 2023 (the “Existing Credit Agreement” and the Existing Credit Agreement as amended by the Credit Facility Amendment, the “Credit Agreement”), with the lenders party thereto and JPMorgan Chase Bank, N.A, as administrative agent. The Credit Facility Amendment amended the Existing Credit Agreement to, among other things: (1) provide for the Term Loan in an aggregate principal amount of $700.0 million; (2) increase the revolving commitments under the Credit Agreement from $600.0 million to $700.0 million (the existing revolving facility under the Credit Agreement as so increased, the “Revolving Credit Facility”); and (3) add substantially all of Arcosa’s and its subsidiary guarantors’ personal property (subject to certain exceptions) as collateral to secure the obligations under the Credit Agreement (together with cash management, hedging and other customary obligations owed to lenders and their affiliates).

On October 1, 2024, Arcosa funded the Term Loan in an aggregate principal amount of $700.0 million. The Term Loan: (a) requires quarterly principal amortization payments in an amount equal to 0.25% of the aggregate principal amount of the initial Term Loan, with the balance owed on the seventh anniversary of the initial funding of the Term Loan; (b) requires annual excess cash flow prepayments, initially requiring annual prepayments of 50% of excess cash flow, with step downs to 25% and 0% of excess cash flow when Arcosa’s consolidated secured net leverage ratio is less than or equal to 2.50 to 1.00 and 2.00 to 1.00, respectively; (c) requires other customary mandatory prepayments with the proceeds of certain asset sales and debt issuances; and (d) has a variable interest rate based, at Arcosa’s option, on the Secured Overnight Financing Rate (“SOFR”) plus 2.25% per annum, or an alternate base rate, plus 1.25% per annum. If Arcosa either (i) makes a prepayment of the loans under the Term Loan in connection with a repricing transaction or (ii) effects any amendment to the Credit Agreement resulting in a repricing transaction, in either case within six months after the initial funding of the Term Loan, Arcosa will pay a 1.0% premium on such prepaid amount or on the amount outstanding at the time such repricing transaction amendment becomes effective. Otherwise, the Term Loan may be prepaid, in full or in part, at any time without premium or penalty (other than customary SOFR-related breakage costs).

Pursuant to the Credit Facility Amendment, on October 1, 2024 the Revolving Credit Facility was amended such that: (a) the revolving commitments under the Credit Agreement increased from $600.0 million to $700.0 million; (b) the applicable margin for borrowings, letters of credit and the commitment fee rate are based on Arcosa’s consolidated net leverage ratio (permitting up to $150.0 million of unrestricted cash to be netted from the calculation thereof); (c) the margin for SOFR-based borrowings and the letter of credit rate ranges from 1.25% to 2.50% per annum; (d) the margin for base rate borrowings ranges from 0.25% to 1.50%; (e) a commitment fee accrues on the average daily unused portion of the Revolving Credit Facility at the rate of 0.20% to 0.45%; and (f) the maximum permitted leverage ratio under the Revolving Credit Facility includes a net debt concept (permitting up to $150.0 million of unrestricted cash to be netted from the calculation thereof), and such ratio shall be no greater than: 5.00 to 1.00 during the fourth quarter of 2024 and the next two fiscal quarters; 4.50 to 1.00 for the next following two fiscal quarters; and 4.00 to 1.00 for each fiscal quarter thereafter (provided, that this maximum permitted leverage ratio may, from time to time, be increased to 4.50 to 1.00 for up to four fiscal quarters if a material acquisition is entered into).

On October 1, 2024, after giving effect to the foregoing transactions, there were $700.0 million of outstanding term loans, approximately $140.0 million of outstanding revolving loans and approximately $0.7 million in letters of credit issued or borrowed, as applicable, under the Credit Agreement, leaving approximately $559.3 million of undrawn commitments available for revolving loans and letters of credit under the Revolving Credit Facility.

Each of the foregoing descriptions of the Term Loan and the Revolving Credit Facility does not purport to be complete and is qualified in its entirety by reference to the descriptions of the Term Loan and Revolving Credit Facility, as applicable, contained in the Credit Facility Amendment, which was filed as Exhibit 10.1 to Arcosa’s Current Report on Form 8-K, dated August 19, 2024, filed with the SEC on August 19, 2024.

Item 7.01 Regulation FD Disclosure.

On October 1, 2024, Arcosa issued a press release announcing the completion of the Transaction. A copy of this press release is furnished as Exhibit 99.1 to this report on Form 8-K.

The information in Item 7.01 of this report (including Exhibit 99.1) is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Exchange Act (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing. Additionally, the submission of this Item 7.01 is not an admission of the materiality of any information in this Item 7.01 that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired

The (i) audited combined and consolidated financial statements of Target and accompanying notes related thereto as of and for the year ended September 30, 2023 and (ii) unaudited consolidated financial statements of the Target for the nine months ended June 30, 2024 will be filed as an exhibit to an amendment to this Current Report on Form 8-K.

(b) Pro Forma Financial Information

The unaudited pro forma condensed combined financial statements of Arcosa and accompanying notes related thereto as of and for the period ended June 30, 2024 and the fiscal year ended December 31, 2023 will be filed as an exhibit to an amendment to this Current Report on Form 8-K.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| Arcosa, Inc. Press Release, dated October 1, 2024. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Arcosa, Inc. |

| (Registrant) |

| | |

| October 1, 2024 | By: | /s/ Gail M. Peck |

| | Name: Gail M. Peck |

| | Title: Chief Financial Officer |

News Release

FOR IMMEDIATE RELEASE

Arcosa, Inc. Announces Completion of Stavola Acquisition and Sale of Steel Components Business

–Transactions Advance Long-Term Strategy to Grow in Attractive Markets and Reduce Complexity and Cyclicality

DALLAS, Texas - ARCOSA, Inc. — October 1, 2024:

Arcosa, Inc. (NYSE: ACA) (“Arcosa” or the “Company”), a provider of infrastructure-related products and solutions, today announced it has completed the previously announced acquisition of the construction materials business of Stavola Holding Corporation and its affiliated entities (“Stavola”) for $1.2 billion.

Founded in 1948, Stavola is an aggregates-led and vertically integrated construction materials company primarily serving the New York-New Jersey Metropolitan Statistical Area (“MSA”) through its network of five hard rock natural aggregates quarries, twelve asphalt plants, and three recycled aggregates sites. For the last twelve months ended June 30, 2024 (“LTM”), Stavola generated revenues of $283 million and Adjusted EBITDA of $100 million, representing a 35% Adjusted EBITDA Margin. The aggregates business contributed 56% to Stavola’s LTM Adjusted EBITDA. The structure of the transaction is expected to create tax benefits attributable to Arcosa with a net present value of approximately $125 million.

The acquisition was funded with a $600 million 6.875% Senior Note issuance due 2032, which closed on August 26, 2024, and a pre-payable $700 million variable-rate senior secured Term Loan B Facility due 2031, which funded concurrently with the closing of the transaction. Excess debt proceeds will be used to pay down borrowings on our revolving credit facility.

Additionally, the Company completed the previously announced sale of its steel components business on August 16, 2024. For the quarter ended September 30, 2024, we estimate Adjusted EBITDA for the business will be a $1.0 million to $1.5 million loss, reflecting a partial period of ownership that was impacted by the deferral of certain product shipments and business interruption from actions necessary to complete the divestiture process.

Antonio Carrillo, President and Chief Executive Officer, commented, “We are pleased to announce the successful completion of the Stavola acquisition and the divestiture of our steel components business. These transactions significantly advance our strategy of growing in attractive markets while reducing the cyclicality and complexity of our overall portfolio. Stavola underscores our aggregates-led acquisition strategy, expanding our platform into the nation’s largest MSA with industry-leading financial attributes. Proforma for these transactions, our Construction Products segment represents nearly two-thirds of our Adjusted EBITDA, up from one-third at our spin-off, and our Adjusted EBITDA Margin increases more than 200 basis points.

“In August, we arranged attractive permanent financing for the acquisition, providing ample prepayment flexibility to reduce debt, consistent with our deleveraging strategy. As a near-term capital allocation priority, we anticipate deploying our strong free cash flow to return to our net leverage target of 2.0-2.5x within 18 months.”

Carrillo concluded, “We are excited to welcome Stavola and its experienced management team and look forward to the long-term strategic benefit and value creation this transaction will achieve for Arcosa’s shareholders.”

The Company plans to update its full year 2024 revenue and Adjusted EBITDA guidance for the completion of these transactions in connection with the release of its third quarter earnings.

About Arcosa

Arcosa, Inc., headquartered in Dallas, Texas, is a provider of infrastructure-related products and solutions with leading positions in construction, engineered structures, and transportation markets. Arcosa reports its financial results in three principal business segments: Construction Products, Engineered Structures, and Transportation Products. For more information, visit www.arcosa.com.

Cautionary Statements About Forward-Looking Information

Some statements in this release, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Arcosa’s estimates, expectations, beliefs, intentions or strategies for the future. Arcosa uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “outlook,” “strategy,” “plans,” “goal” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this release, and Arcosa expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, except as required by federal securities laws. Forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results to differ materially from historical experience or present expectations, including but not limited to, the intended use of offering proceeds, the contingencies related to the special mandatory redemption, the failure to successfully complete and integrate acquisitions, including the Transaction, or divest any business, or failure to achieve the expected benefits of acquisitions or divestitures; market conditions and customer demand for Arcosa’s business products and services; the cyclical nature of, and seasonal or weather impact on, the industries in which Arcosa competes; competition and other competitive factors; governmental and regulatory factors; changing technologies; availability of growth opportunities; market recovery; ability to improve margins; the impact of inflation and costs of materials; assumptions regarding achievements of the expected benefits from the Inflation Reduction Act; the delivery or satisfaction of any backlog or firm orders; the impact of pandemics on Arcosa’s business; and Arcosa’s ability to execute its long-term strategy, and such forward-looking statements are not guarantees of future performance. For further discussion of such risks and uncertainties, see “Risk Factors” and the “Forward-Looking Statements” section of “Management's Discussion and Analysis of Financial Condition and Results of Operations” in Arcosa's Form 10-K for the year ended December 31, 2023 and as may be revised and updated by Arcosa's Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

MEDIA CONTACT: media@arcosa.com

INVESTOR CONTACTS

| | | | | | | | |

| Erin Drabek | | David Gold |

| VP of Investor Relations | | ADVISIRY Partners |

| | |

| T 972.942.6500 | | T 212.661.2220 |

| InvestorResources@arcosa.com | David.Gold@advisiry.com |

v3.24.3

Cover Page and DEI Document

|

Oct. 01, 2024 |

| Document Information [Line Items] |

|

| Entity Central Index Key |

0001739445

|

| Title of 12(b) Security |

Common Stock ($0.01 par value)

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 01, 2024

|

| Entity Registrant Name |

Arcosa, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-38494

|

| Entity Tax Identification Number |

82-5339416

|

| Entity Address, Address Line One |

500 N. Akard Street, Suite 400

|

| Entity Address, City or Town |

Dallas,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| City Area Code |

972

|

| Local Phone Number |

942-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

ACA

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

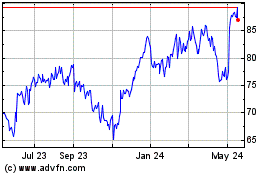

Arcosa (NYSE:ACA)

Historical Stock Chart

From Jan 2025 to Feb 2025

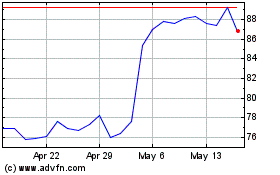

Arcosa (NYSE:ACA)

Historical Stock Chart

From Feb 2024 to Feb 2025